“Weekly Insights” is a collection of macroeconomic charts of recent regional macro data.

Markets

Stock markets gathered steam last week, hitting weekly highs on Fri, rallying in spite of weak macro data across the board and Covid19 cases crossing the 4mn mark. There is a growing disconnect between equity markets and the deep recession of real economic activity in the US, Europe and globally. The resumption of trade negotiations between US and China resulted in some renewed optimism, that was also reflected in Asian markets. Regional markets mostly ended in the red last week. Among currencies, dollar gained versus the euro and swiss franc. Oil prices edged up, posting a second week of gains, on output cuts and hopes that ease in COVID19 restrictions will slowly revive demand, while gold price hovered near a 2-week high.

Global Developments

US/Americas:

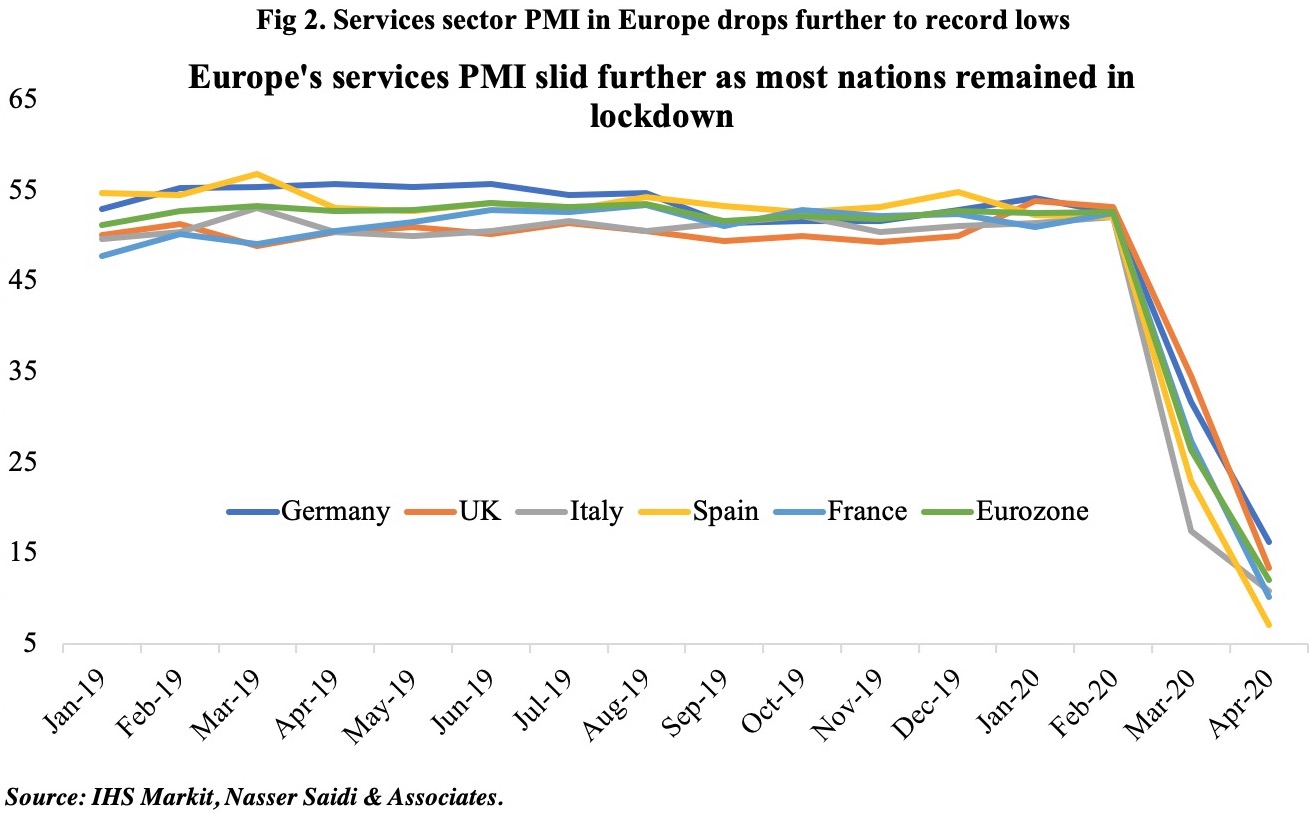

- US non-farm payrolls plunged by 20.5mn in Apr (from a downwardly revised 870k in Mar) and the unemployment rate more than tripled to 14.7% – both post- World War II records. Average hourly earnings rose 4.7% mom and 7.9% yoy, skewed higher given the disappearance of low-wage workers from the payrolls. Leisure and hospitality employers laid off 7.65mn persons, manufacturers 1.33mn and retailers 2.1mn.

- Private payrolls in the US dropped by a record 20.2mn in Apr from a downwardly revised 149k jobs in Mar (the first decline since Sep 2017). The leisure/hospitality sector, with 8.61mn jobs lost, accounted for 40% of private sector job losses.

- Initial jobless claims continue to rise, it hit 3.169mn in the week ended May 2, bringing the 7-week total to 33.5mn.

- Factory orders posted a record drop, declining by 10.3% mom in Mar (Feb: -0.1%), after transportation equipment orders plunged 41.3% after increasing 4.6% in the prior month. Orders for non-defense capital goods excluding aircraft dipped 0.1% in Mar.

- Trade deficit in the US widened to USD 44.4bn in Mar (Feb: USD 39.8bn), as exports dropped a record 9.6% to USD 187.7bn – the lowest since Nov 2016 and imports fell by 6.2%. Goods trade deficit with China decreased by USD 4.2bn to USD 11.8bn, a 16-year low.

- Markit services PMI was revised lower by 0.3 points to 26.7 in Apr, recording the steepest fall in activity since the series initiated in Oct 2009. Composite PMI also slipped to 27 from 27.4 the month before.

- ISM non-manufacturing PMI slipped to an 11-year low of 41.8 in Apr (Mar: 52.5), with new orders sub-index plunging to 32.9 (a level last seen in Dec 2008) and the employment sub-index slowing to 30 from 47 the month before.

- Non-farm productivity fell by 2.5% qoq in Q1 (Q4: +1.2%): this is the largest decline in output since Q1 2009 and the largest decline in hours worked since Q3 2009.

Europe:

- The final German Markit manufacturing PMI clocked in at 34.5 in Apr – the lowest since Mar 2009 – up from the flash estimate of 34.4, but below Mar’s 45.4. Composite PMI edged up to 17.4 from the preliminary 17.1, but much lower than Mar’s 35, after services PMI inched up to 16.2 from Mar’s 31.7 and an initial estimate of 15.9.

- EU manufacturing PMI slipped to 33.4 in Apr (initial estimate: 33.6; Mar: 44.5) – the steepest month of contraction ever; services PMI grew slightly to 12 from the preliminary reading of 11.7 and 26.4 the month before, thereby helping the composite PMI to record 13.6 – the lowest since the series began (initial estimate: 13.5; Mar: 29.7).

- German factory orders plummeted by 15.6% mom and 16% yoy in Mar. Both domestic and foreign demand declined: from within Germany, orders were down by 14.8%, from elsewhere in the eurozone orders were off 17.9% while orders from other countries dropped by 15%. Orders for investment goods (e.g. factory machinery) declined steeply by -22.6%.

- Industrial production in Germany declined by 9.2% mom and 11.6% yoy in Mar; production contracted for intermediate goods (-7.4%), consumer goods (-7.5%), capital goods (-16.5%), and energy (-6.4%) while by industry, automotive collapsed by 31.1%.

- German exports posted a record decline of 11.8% mom to EUR 108.9bn (USD 117.9bn) in Mar. In yoy terms, exports declined by 7.9% while imports were down 4.5% to EUR 91.6bn.

- Retail sales in the euro area declined by 11.2% mom and 9.2% yoy in Mar, with volume of retail trade for non-food products down the most (- 23.1%) followed by automotive fuels (-20.8%).

- The Bank of England warned that the UK is heading towards its sharpest recession ever, forecasting a 14% dip this year (based on the lockdown being phased out in Jun-Sep). Though the bank left interest rates unchanged at a record low 0.1%, two of the 9 committee members voted to increase the latest round of QE by GBP 100bn to GBP 300bn.

Asia Pacific:

- China Caixin services PMI improved to 44.4 in Apr (Mar: 43), though below-50 for the third month running, with the employment sub-index fell below the 50-mark for the first time.

- Exports from China increased by 8.2% yoy in Apr (Mar: -3.5%) while imports were down by 10.2% (Mar: 2.4%). This widened the trade surplus to USD 45.34bn in Apr (Mar: USD 19.93bn). Exports were supported by stronger demand from south-east Asia (+3.9% increase in purchases during Jan-Apr 2020) while trade with the EU and US continue to decline (-6.6% and -15.9% yoy in Apr).

- Japan household spending plunged to a 5-year low in Mar: average spending was down by 6% yoy (Mar: -0.3%). Inflation-adjusted real wages fell in Mar as overtime pay declined 4.1% yoy, posting the fastest pace on record. While gaming consoles purchases more than doubled, spending on package tours and hotel accommodation tumbled by 83% and 55% respectively.

- India’s manufacturing PMI hit a record low of 27.4 in Apr (Mar: 51.8), with record contractions in output, new orders and employment. Services PMI plunged to 5.4 in Apr (Mar: 49.3), with the sub-index measuring foreign demand for services down to an unprecedented 0. The composite PMI fell to an all-time low of 7.2 last month (Mar: 50.6).

- India’s unemployment rate climbed to a staggering 27.1% in the week ended 3 May, according to the private research agency Centre for Monitoring the Indian Economy with some 121.5mn Indians having lost their jobs in Apr.

- Singapore’s PMI shrank for the 3rd consecutive month, declining to an 11-year low of 44.7 in Apr (Mar: 45.4). All key sub-indices posted sharper contractions: the imports index, with a reading of 45.5 was the lowest since Oct 2012, and the electronics sector sub-index was down to 42.8 – the lowest since Dec 2008.

- Retail sales in Singapore sank by 13.3% yoy in Mar (Feb: -8.4% yoy), the worst drop since Sep 1998. While super markets and hypermarkets gained 35.9% yoy, sales losses were reported across wearing apparel and footwear (-41.6%), food and alcohol (-41%), department stores (-38.6%), watches and jewellery (-34.4%) and petrol stations (-10.5%) among others.

Bottom line: Macroeconomic data remains weak, and given that Covid19 infections are still widespread, a gradual ease in restrictions is unlikely to return business activity to pre-Covid19 levels: expect a longer path to economic recovery, more an extended U-shaped, than a previously touted V-shaped recovery. Last week saw the release of disappointing PMIs across the globe: global manufacturing PMI slumped to the lowest level since financial crisis of 2008-09, with output and new orders down to near-record lows while employment fell at the quickest pace in almost 11 years. Though business sentiment remains low, as nations slowly ease restrictions, look for signs of how fast global supply chains recover (will order volumes increase – both domestic and international?).

Regional Developments

- Bahrain sold a USD 2bn dual-tranche bond issuance, after receiving more than USD 11bn in combined orders. The investor presentation revealed that the nation expects a budget deficit of 4% of GDP this year, down from 4.7% last year – highly unlikely given the triple whammy from Covid19 effects alongside lower oil prices and financial market.

- Bahrain’s shops and industrial enterprises opened last Thurs while restaurants remain closed still for dine-in customers.

- MPs in Bahrain approved 6 proposals: includes lower fuel prices, support for travel agencies and tour operators, as well as expedited receipt of financial support to unemployed Bahrainis among others.

- Egypt’s PMI plunged to a historic low of 29.7 in Apr (Mar: 44.2), with new orders down to 14.1 (Mar: 40.2) while purchasing slipped to 21 (Mar: 39.5). As business expectations remain strong, the employment sub-index inched down to just 46.1 from 47 the month before.

- GDP growth is forecast at 3.5% in Egypt in the fiscal year 2020-21 which starts in Jul, according to the planning minister. However, should Covid19 crisis continue to Dec, growth is likely to slow to 2%. Growth in this fiscal year is likely to touch only 4.2% vs expectations of 5.6%. Separately, the nation’s requests to the IMF for a Rapid Financing Instrument and its Stand-By Arrangement will be considered on Mon (May 11th).

- Budget deficit in Egypt will likely rise to 7.8% of GDP this fiscal year 2020-21, if Covid19 crisis continues till Dec this year, according to the finance minister. This compares to the forecast of 6.3% deficit made previously in Mar. Separately, private sector investments are likely to decline by 30% in the fiscal year 2020-21 should the Covid19 outbreak last till Dec this year, according to the planning minister.

- Egypt’s foreign reserves declined by 7.66% mom to USD 37.037bn at end-Apr (Mar: -12% mom). The central bank disclosed it had drawn on reserves to cover imports of strategic goods, as well as repay a USD 1bn Eurobond and meet USD 600mn in other external obligations.

- Local currency deposits in Egypt continued to rise for the 13th consecutive month: it inched up by 1.67% mom to EGP 3.089trn in Mar. Foreign currency deposits rose for the first time in 10 months, up 1.8% mom to EGP 639.131bn.

- Trade deficit in Egypt narrowed by 51.4% yoy to USD 1.95bn in Feb; exports increased by 3.3% to USD 2.69bn while imports declined by 29.9% thanks to drops in imports of iron ore and steel as well as wheat, petroleum products and plastics.

- Egypt’s Suez Canal revenues increased by 2.03% yoy to USD 1.907bn in Jan-Apr 2020. Separately, the Suez Canal Authority announced a reduction in fees (between 60-75%) for all container ships crossing the Canal effective May 1st till Jun 30th.

- The Labour Emergency Fund in Egypt disbursed EGP 7.7mn to about 7500 tourism sector employees in 70 firms, according to the ministry of manpower. Earlier, EGP 75mn was provided to 56,280 persons from 275 firms. Under consideration now are a further 3525 firms.

- Egypt signed agreements to settle overdue export subsidies with 41 firms: each company will receive 30% of the subsidies owed by the Export Development Fund or a minimum EGP 5mn before end-Jun. The government has paid EGP 2.133bn in overdue subsidies in Jan-Apr.

- Egypt’s Exchange raised USD 2.2bn for 23 IPOs over 2010-19, accounting for 60% of total IPO proceeds among all North African exchanges, as per a PwC report.

- Jordan expects economic growth to contract by around 3% this year, given the impact of Covid19. Government revenue declined by JOD 610mn (USD 860mn) in just Apr this year, according to the finance minister. Most businesses have been allowed to open as of Wed last week after a nearly 2-month lockdown.

- Jordan imported approximately 324k barrels of oil via 1,114 tankers from Iraq in Apr, at an average of 11k barrels per day (bpd), disclosed Jordan’s energy minister. During the Sep 2019-Apr 2020 period, Jordan received 2.24mn barrels at an average 10k bpd.

- Kuwait has imposed a “total curfew” from 4pm Sun (May 10) till May 30th: public sector will work remotely while private sector activity will remain suspended (except vital sectors).

- All educational institutions in Kuwait will reopen on 4th Aug as per the cabinet’s decision. There is no intention to cancel the academic year, though an evaluation of conditions will be submitted to the government in mid-Jul.

- Kuwait’s central bank issued KWD 240mn worth of bonds and related tawarruq, with a 1.25% return rate. The issue was oversubscribed by 11.36 times.

- Foreign exchange reserves in Kuwait declined by 1.89% mom to KWD 12.19bn (USD 39.488bn) in Mar.

- The partial curfews in Kuwait resulted in a 60% decline in gasoline usage, allowing for cancellation/reduction of gasoline imports from abroad, amounting to ~1.4mn litres per day.

- Lebanon’s finance minister disclosed that the move to a flexible exchange rate will be in a “coming phase”, in a “gradual and studied way”, and that the currency peg will continue to operate for now.

- The BLOM Lebanon PMI fell to 30.9 in Apr from Mar’s 35, given substantial declines in output and exports. Businesses also remained “severely pessimistic” on the 12-month outlook.

- The Association of Banks in Lebanon is working on a financial rescue plan that would preserve some of their capital, after having expressed criticism of the government plan. This is expected to be released by this week.

- Though Lebanon has eased some restrictions last week, it formally extended its Covid19 lockdown for a further 2 weeks on Tues.

- Oman’s production and imports of natural gas inched up by 1.7% yoy to 11.04 billion cubic meters at end-Mar 2020.

- The ownership of Manah Power – the first privately procured Independent Power Project in Oman and the wider Middle East region at the time – was transferred to the government on May 1st this year.

- Qatar Airways expects to reopen routes this month, as air travel restrictions are eased across the globe: it hopes to fly to 52 destinations by end-May and up to 80 in Jun (compared to 165 total destinations previously). Separately Reuters reported that the airline is in talks with banks to secure billions in loans.

- Saudi Arabia’s non-oil PMI edged up to 44.4 in Apr, though below the 50-mark, from Mar’s 42.4, thanks to slower reductions in new work. Output hit a record low (37.5 in Apr, from Mar’s 37.9); new export orders and employment dropped at the fastest pace since the survey began in Aug 2009.

- SAMA reiterated its commitment to the dollar peg in a recent statement, also disclosing that its forex reserves are sufficient to cover 43% of its imports and 88% of broad money (M3).

- The Saudi Ministry of Labour and Social Development will allow private businesses (affected by Covid19) to reduce working hours and permit wages to be reduced by not more than 40% of total salary for the next 6 months. Firms cannot reduce wages without reducing working hours while employees do not have the right to object the reduction so long as it does not exceed 40%.

- New measures to support the industrial and mining sector in Saudi Arabia includes facilitating the settlement of private sector dues, developing new products to support working capital, reducing ministry fees and automatic renewal of various licenses among others.

- Saudi Arabia’s trade with GCC members declined by 4% yoy to SAR 7.8bn (USD 2.08bn) in Feb this year, with non-oil exports down by 1.7% to USD 970mn. UAE accounted for 66% of the total KSA-GCC trade exchange (SAR 5.14bn).

- Saudi Aramco raised its prices for June supply of crude after 2 months of low levels: the increases ranged from USD 1 per barrel for crude for American markets to upwards of USD 6 a barrel for crude bound for European and Mediterranean trading zones.

- Ahead of the OPEC+ deal coming into effect, oil production in the UAE, Saudi Arabia and Kuwait surged to new highs in Apr. Combined, their production touched 30.79mn barrels per day (bpd) in Apr – this offset losses by other producers like Iraq, Angola and Iran.

UAE Focus

- UAE’s non-oil PMI fell further to 44.1 in Apr (Mar: 45.2), with both output and new export orders fell to record lows of 39.9 (Mar: 47.2) and 35.2 (44.3) respectively. Business expectations for the year ahead weakened to a 32-month low.

- The UAE central bank estimates that GDP grew by 1.7% in 2019, with the non-oil sector up by 1% alongside a 3.4% rise in the oil sector.

- Non-oil foreign trade in Abu Dhabi grew by 3.6% yoy to AED 37.1bn in Jan-Feb this year; imports grew by 20.8% to AED 9.26bn in Feb while re-exports dropped by 11.2% to AED 4.01bn.

- Dubai’s external trade touched AED 323bn in Q1: exports grew by 2% yoy to AED 43bn while imports and re-exports clocked in at AED 189bn and AED 92bn respectively.

- With no unemployment data publicly available in the UAE, one of the proxies to use could be the number of expats seeking repatriation. In the first flights back to India, about 25% of the close to 200k persons disclosed job losses as the reason for retuning. Many companies in Covid19 affected sectors have been announcing job cuts including real estate developers, airlines, and more recently Careem laying off of 31% of its workforce and Air Arabia 57 persons (out of a total ~1k persons).

- Sharjah Entrepreneurship Centre pledged USD 1mn solidarity funds to help startups; the fund will be distributed through equity-free grants and commissioned projects.

- Dubai South Free zone announced a set of relief measures: this includes a 20% reduction on license fees renewals, waiver of 1st year license fees for new clients in the aviation, logistics and e-commerce sectors, lease deferrals and flexibility in settling rental fees among others.

- The postponement of Dubai Expo – to run from Oct 1, 2021 for 6 months – has been approved by the 2/3-rds of the BIE member states.

- In a letter to the authorities, UAE’s major restauranteurs (which account for over 50% of persons working in the F&B sector) disclosed losses amounting close to AED 1bn a month in staff salaries, housing and operational costs (excluding rents which could go as high as AED 1bn a year) while predicting recovery no earlier than Q1 2021. The establishments have requested relief measures including on loan repayments, automatic license renewals and payment of municipality tax among others.

- The Federal Authority for Government Human Resources disclosed that remote work systems could be in place post-pandemic as well.

Weekly Insights: Charts of the week

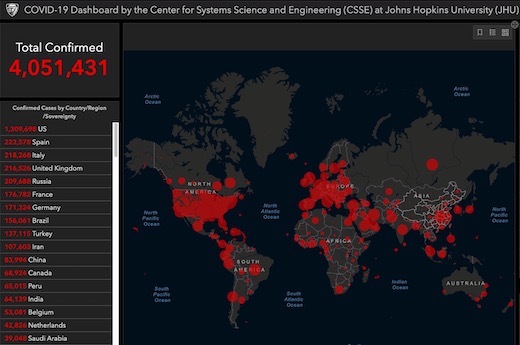

Fig 1. Heatmap of manufacturing/ non-oil sector PMIs

PMIs have declined as a result of dips across output, new export orders and employment. With trade flows slowing across the globe, supply chains have taken a hit and delivery delays have become the new normal along with delays in payment of invoices. Average payment terms increased to 37.4 days in Q1 2020, from 2019’s average 36.7 days, as per Tradeshift data. With the lack of orders during the lockdown, this situation will only worsen in the coming months.

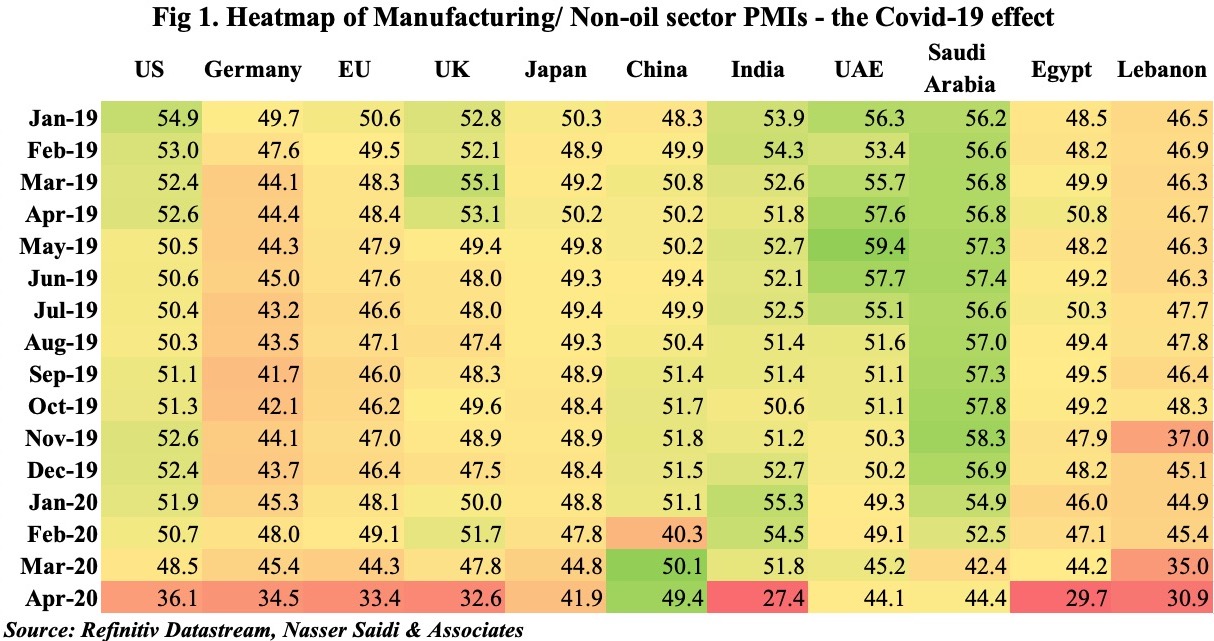

Fig 2. Services sector PMI in Europe drops further to record lows

Other than in Sweden (which is following a herd immunity policy with no lockdowns), most European nations had seen a near shutdown of its major services industries in Apr. Restrictions have been eased in the past weeks, with France set to ease rules from May 11th. The Google Mobility reports indicate that trips to workplaces continue to remain 40-60% below pre-crisis levels while trips for retail and recreation have fallen by more than 80% in many. As long as no vaccine is announced, we believe that a return to pre-Covid19 levels will take time as health concerns are likely to outweigh the policy responses to kickstart the economy (like availability of interest rate loans and/or tax rebates or mortgage refinancing options).

Fig 3. The number of unemployed continues to surge in the US

More than 33 million persons have filed for unemployment since mid-Mar and jobless rate has more than tripled to 14.7% in Apr. Payrolls data show leisure and hospitality hit hard with around 7.7mn job losses while retailers cut 2.1mn jobs. With no coordinated national policy to fight the Covid19 outbreak, politics continues to play havoc as stimulus packages are left undecided upon (given the fiscal price) and local/ county/state are clashing on decision to ease restrictions and reopen for business. Macroeconomic data meanwhile continue to remain weak.

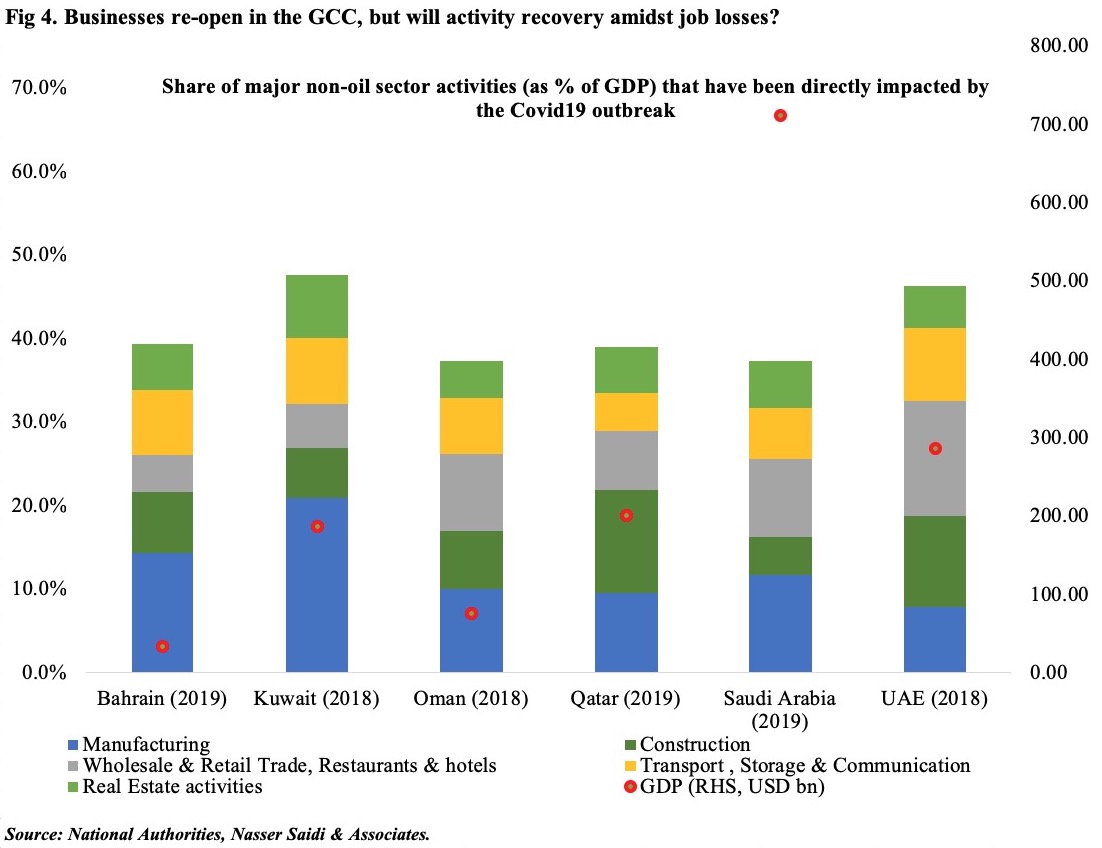

Fig 4. Businesses re-open in the GCC, but will activity recovery amidst job losses?

The contribution of the non-oil sector to GDP remains relatively smaller to the oil sector in the GCC. Among the non-oil sector, the share of manufacturing, construction and real estate, wholesale and retail trade, along with transport and communication together account for around 40% of total GDP – all sectors directly impacted by Covid19. Even as businesses open (albeit at lower capacity with low footfalls), anecdotal evidence suggests that shops and restaurants within malls are losing money by remaining open. Furthermore, job losses are adding up (repatriation flight numbers as a proxy) as are reports of closures of small businesses (e.g. restaurants, tour operators). Given that most visas are still linked to jobs in the region (in spite of select few in the UAE and Saudi Arabia), a job loss essentially implies that a family moves back to their homeland, resulting in loss of income for real estate (housing), retail (food, clothing etc.) as well as education (schools, colleges) among other sectors – essentially a multiplier effect on the overall economy.

Media Review

The Market Keeps Distancing itself from the Economy

https://www.bloomberg.com/opinion/articles/2020-05-07/weekly-jobless-claims-highlight-market-economy-decoupling

The world’s food system has so far weathered the challenge of covid-19

https://www.economist.com/briefing/2020/05/09/the-worlds-food-system-has-so-far-weathered-the-challenge-of-covid-19

US and China: edging towards a new type of cold war?

https://www.ft.com/content/fe59abf8-cbb8-4931-b224-56030586fb9a

Have real-time data helped us address the crisis? | Chicago Booth Review

https://review.chicagobooth.edu/economics/2020/video/have-real-time-data-helped-us-address-crisis

Gulf debt market shows signs of recovery as issuers line up

https://www.reuters.com/article/mideast-debt/mideast-debt-gulf-debt-market-shows-signs-of-recovery-as-issuers-line-up-idUSL4N2CN2L6

GCC faces expat exodus

https://www.reuters.com/article/us-health-coronavirus-gulf-jobs/whats-the-point-of-staying-gulf-faces-expatriate-exodus-idUSKBN22J1WL

https://www.nytimes.com/2020/05/09/world/middleeast/virus-forces-persian-gulf-states-to-reckon-with-migrant-labor.html

Powered by: