“Weekly Insights” is a collection of macroeconomic charts of recent regional macro data.

Markets

Stock markets declined across the globe on Fri after having a strong positive week earlier, thanks weak economic data in addition to Trump’s latest attack on China about its role in the origin and spread of Covid19 as well as weaker-than-expected earnings (all leading to negative sentiment). In the region, a recovery in oil prices helped markets to close in the green. Among currencies, the RMB weakened to its lowest level since early Apr against the dollar (on Trump threats) while the euro stabilized against the dollar and the riskier Aussie dollar reached a 7-week high on Thurs. Oil markets remained volatile through the week, but stabilized on Fri. Gold prices were down 1.6% this week, posting their biggest weekly loss since mid-Mar.

Global Developments

US/Americas:

- US GDP declined by 4.8% in Q1 – the fastest pace since the 8.4% dip recorded at end Great of 2008 – from the 2.1% pickup the quarter before. The drop was driven by a sharp 7.6% drop in personal consumption (the biggest fall since 1980). Core PCE increased by 1.8% qoq in Q2 (Q1: 1.3%).

- The Fed left interest rates unchanged at its latest meeting, while warning of lasting “medium-term” economic damage and committed to using “full range of tools” to help the economy. Separately, it expanded its “Main Street Lending Facility” to companies with up to 15k employees and USD 5bn in revenue versus the initial program (with 10k workers and USD 2.5bn in revenue) announced on Apr 9.

- Personal income fell by 2% in Mar (most since Jan 2013) while savings rate rose to its highest level in 39 years (13.1% in Mar from Feb’s 8%).

- The personal consumption expenditures (PCE) price index excluding food and energy dipped by 0.1% in Mar – the weakest since Mar 2017 and down from the 0.2% reading in Feb. Core PCE increased to 1.7% from Feb’s 1.8%.

- The goods trade deficit widened further to USD 64.22bn in Mar from the previous month’s USD 59.89bn. Goods imports dropped by 2.4% to USD 191.9bn (Feb: -2.5%) while exports sank at a faster 6.7% to USD 127.6bn.

- The S&P Case Shiller home price indices increased by 3.5% yoy in Feb (Jan: 3.1%), ahead of the pandemic.

- The Richmond Fed manufacturing index crashed to -53 in Apr from Mar’s +2 reading, with new orders at record lows (-42 vs -8 in the month before).

- Pending home sales plunged by 20.8% mom in Mar (Feb: 2.3%); the average rate on the 30-year fixed mortgage fell to a new low of 3.43% last week.

- US ISM manufacturing PMI fell to 41.5 in Apr (Mar: 49.1), with new orders dropping 15.1 points to 27.1 (biggest monthly drop since 1951) and employment index decreasing 16.3 points to 27.5 (lowest level since 1949 and the largest mom drop since the series began in 1948).

- Markit manufacturing PMI dropped to 36.1 in Apr, down from the flash reading of 36.9 and Mar’s 48.5.

- Initial jobless claims totaled 3.839mn in the week ended Apr 25, down from 4.442mn in the previous week). Claims since 21st Mar add up to 30.3mn, equivalent to almost 20% of the workforce; at least 10mn people who have filed claims haven’t yet received the benefits.

Europe:

- GDP in the eurozone shrank by 3.8% qoq in Q1 – the largest drop since the series started in 1995. Quarterly contractions were also reported in France (-5.8% qoq from Q4’s -0.1%), Italy (-4.7% qoq vs -0.3% in Q4) and Spain (-5.2% qoq), with the former two entering recession.

- The ECB held interest rates steady, while expanding its programme to lend to banks at rates as low as -1%. The apex bank expects the economy to shrink between 5-12% this year, depending on the success of containment measures, with forecasts of returning to pre-Covid19 levels as late as 2022.

- Inflation in the eurozone fell to 0.4% in Apr – the lowest level of price growth in almost 4 years – following Mar’s 0.7%, dragged down by energy prices.

- Unemployment rate in the EU edged up to 6.6% in Mar (Feb: 6.5%) while in the euro area it inched up to 7.4% from 7.3% the month before. About 14mn persons were unemployed in the EU27 as of Mar, including 12.16mn in the euro area.

- The Economic Sentiment Indicator in the Euro area slipped to 67 from 94.2 in Mar; the indicator fell the most in Netherlands (down by 32.6 points from Mar) while confidence among services sector companies fell 32.7 points to its lowest-ever level.

- German inflation eased to 0.8% yoy in Apr (Mar: 1.3%) – the lowest reading since Nov 2016 – thanks to the fall in energy prices (-5.8%) while food prices increased (+4.8%).

- German unemployment rate increased to a 3-year high of 5.8% in Apr (Mar: 5.1%) as jobless numbers rose by 308k to 2.64m in Apr. Separately, about 10mn persons have registered to have part of their wages paid by the state (after being sent home or working reduced hours).

- Retail sales in Germany declined by 5.6% mom in Mar after clocking in a 0.8% gain in Feb – this was the fastest drop in more than a decade.

- Fitch downgraded Italy’s credit rating to ‘BBB-‘ from ‘BBB’, just one level above its junk rating, on the sovereign’s fiscal position amid the adverse impact from the pandemic.

- UK’s Markit manufacturing PMI plunged to a near 30-year low of 32.6 in Apr, as output, new orders and employment dip at record rates.

Asia Pacific:

- China’s NBS manufacturing PMI eased to 50.8 in Apr from 52 the month before, thanks to a slowdown in output and new orders. The Caixin manufacturing PMI slipped to 49.4 in Apr (Mar: 50.1): total new orders fell for the 3rd consecutive month on sluggish demand, while output sub-index stayed above 50 as work resumed albeit slowly. The plunge in export orders was consistent in both PMIs: NBS export orders slumped to 33.5 from 46.4 the month before while in the latter it dropped to 33.7.

- China’s non-manufacturing PMI inched up to 53.2 in Apr from 52.3 in Mar: as restrictions were eased, new businesses grew for the first time in 3 months (52.1 from Mar’s 49.2) and employment fell at a softer pace (48.6 vs 47.7).

- The Bank of Japan left policy rates unchanged, but expanded stimulus: the governor stated that the Bank would buy JGBs “as much as necessary” “without setting an upper limit”, while stressing that it was not a permanent measure. Furthermore, the BoJ will also nearly triple the amount of corporate bonds and commercial paper that it can purchase and it eased collateral rules as well to support SMEs.

- Japan approved a JPY 25.69trn (USD 241bn) supplementary budget, including cash payouts of JPY 100k for all individuals (also for foreign nationals registered as residents) as well as JPY 3.8trn for SMEs to secure cash to stay afloat and JPY 2.3trn for those companies and solo proprietors experiencing severe financial losses.

- The headline Jibun Bank Japan Manufacturing PMI declined to an 11-year low of 41.9 in Apr (Mar: 44.8), with clear evidence of supply chain disruptions. It was recorded that staffing numbers fell at the fastest pace since mid-2009 amid reports of restructuring.

- Tokyo inflation gained 0.2% yoy in Apr, down from 0.4% in Mar. Core CPI sank 0.1%. Annual prices increased for food, housing, furniture, clothing and costs were down for fuel, communications and education.

- Japan unemployment rate inched up to a 1-year high of 2.5% in Mar from 2.4% previously. The number of unemployed people increased by 60k persons or 3.6% mom to 1.72mn in Mar. Separately, job availability slipped to a more than three-year low.

- Retail trade in Japan declined by 4.6% yoy in Mar (Feb: 1.6%), as demand for general merchandise and clothing fell.

- Industrial production in Japan declined by 3.7% mom and 5.2% yoy in Mar – the sharpest fall in production since Oct 2019 – following a 0.3% mom and 5.7% yoy dip the month before.

- The Reserve Bank of India announced a special liquidity window for mutual funds worth INR 500bn. This followed the abrupt winding up of 6 debt schemes of Franklin Templeton Mutual Fund; the scheme will be open till May 11 or up to utilisation of the allocated amount, whichever is earlier.

- Unemployment rate in Singapore increased to 2.4% in Q1 from 2.3% the previous quarter. In comparison, during SARS, overall unemployment rate was 4.8% in Sep 2003 and during the global financial crisis, it was 3.3% in Sep 2009.

- India extended its nationwide lockdown by another 2 weeks, highlighting red, green and orange zones, with the former considered as hotspots. In Japan, the PM is expected to decide on Monday (May 4th) regarding a 1-month extension of the nationwide state of emergency declared over the Covid19 outbreak.

Bottom line: Major central banks met last week, and more stimulus was doled out, as expected. As several nations in the EU get ready to reopen their economies in a phased manner, it is worthwhile to keep in mind China’s experience so far: though businesses have resumed operations and production is back on track, external and even domestic demand hasn’t picked up in tandem meaning that inventories are piling up. Meanwhile, the longer the duration of the outbreak elsewhere, the higher the number of job losses and business bankruptcies, and slower the economic growth (US and EU have already shown recessionary patterns). Separately, the current credit extensions will prevent a debt crisis now, but be prepared for this to re-surface in a few years’ time.

Regional Developments

- Bahrain’s central bank issued bonds worth BHD 300mn (USD 793.5mn) with direct subscription via the primary market on behalf of the government. The bonds can be traded once listed on the Bourse (expected May 17th).

- MPs in Bahrain approved eight Covid19 related motions: this ranged from setting lower rates for internet usage (as stay at home policies took effect and schools went online) to letting Tamkeen extend by two weeks its deadline for SMEs to register for financial support (while also expanding the beneficiaries’ list) and also to exempting businesses from Commercial Registration fees and postponing fines for 3 months.

- As people stayed at home given the Covid19 outbreak, traffic on roads, markets, malls and residential areas in Bahrain dropped by about 90% in the morning and 85% in the evening.

- Money supply (M2) in Egypt accelerated by 14.82% yoy in Mar to EGP 4.28trn (USD 272.6bn) at end-Mar.

- Foreign assets of Egypt’s banks dived by 45% mom to EGP 196.66bn at end-Mar while foreign liabilities climbed to EGP 251.36bn from EGP 235.77bn the month before.

- Egypt requested a new financial package from the IMF for 1 year: negotiations are underway, with a COVID-19 Rapid Financing Instrument likely to be received within the next few weeks. The PM promised that the financial package would involve only structural reforms and that it would not raise prices of goods and services. Separately, the World Bank approved Egypt’s request to increase funding to USD 400mn: this loan will be used to support healthcare infrastructure and provide health insurance for the needy.

- In the light of job losses during the Covid-19 outbreak, Egypt will reassess its aim to reduce unemployment rate by 1-1.5% to 6.3% by 2020. The latest data show unemployment rate at 8% in Q4 2019.

- Jordan’s finance minister disclosed that JOD 500mn had been pumped into the economy as stimulus measures this year; the ministry also disclosed that its financial dues to the private sector amounting to JOD 150mn would be disbursed in Apr-May this year.

- The World Bank approved a USD 20mn project to support Jordan’s response to the Covid19 outbreak. The project will provide support to enhance case detection, testing, recording and reporting, as well as contact tracing, risk assessment and clinical care management.

- Jordan extended the suspension of work for ministries and public departments (excluding vital public sectors) until the end of Ramadan.

- Kuwait’s central bank offered bonds and related tawarruq at a total value of KWD 200mn, with a 1.25% return rate. The bonds have a 3-month maturity period.

- After all commercial flights were halted on Mar 13th, Kuwait’s Jazeera Airlines laid off one third of its staff, revealed the company’s chairman. He clarified that the company is not seeking state aid as it can dip into its reserves to pass through the Covid19 phase.

- Lebanon signed a request for assistance from the IMF on Friday, with the amount depending on negotiations: the economic rescue plan approved by the Diab government rests on covering financial sector losses (to the tune of USD 70bn) partly by a bank shareholder bail-in and cash from large depositors. The banking sector has already stated that it was not consulted on the plan and could in “no way” endorse it.

- Lebanese banks set an exchange rate of LBP 3000 per dollar for withdrawals from USD accounts last week, reported Reuters. This compares to the official pegged rate of LBP 1507.5.

- Oman’s finance ministry called for “urgently replacing” expatriates in state companies with citizens, as part of the “Omanisation” policy. About 53,332 expats work in Oman’s government sector.

- Crude oil production in Oman stood at 90.84mn barrels at end-Mar: daily average crude oil production increased to 998.3 barrels at end-Mar vs 970.5 barrels in Mar 2019; exports of crude oil declined by 3.9% yoy to 69.77mn barrels in Mar; average price edged up by 5.6% to USD 64.4 per barrel in Mar. China, India and Japan were the top oil export destinations, importing 61.26mn, 2.94mn and 608.2k barrels of crude respectively.

- Electricity generation in Oman declined by 4.9% yoy in Jan-Feb this year to 3,966MW while water production was up by 5.5% to 54.97mn cubic metres.

- Saudi Arabia’s reserves plummeted in Mar: net foreign assets declined by more than USD 27bn or 5% mom to USD 464bn in Mar, the lowest since 2011. According to SAMA, the central bank, the government’s current account shrank by 45% mom to under SAR 40bn in Mar while SAMA’s bills and repurchase agreements fell by more than one-third to SAR 62bn (reflecting dollar liquidity injected into the banking system).

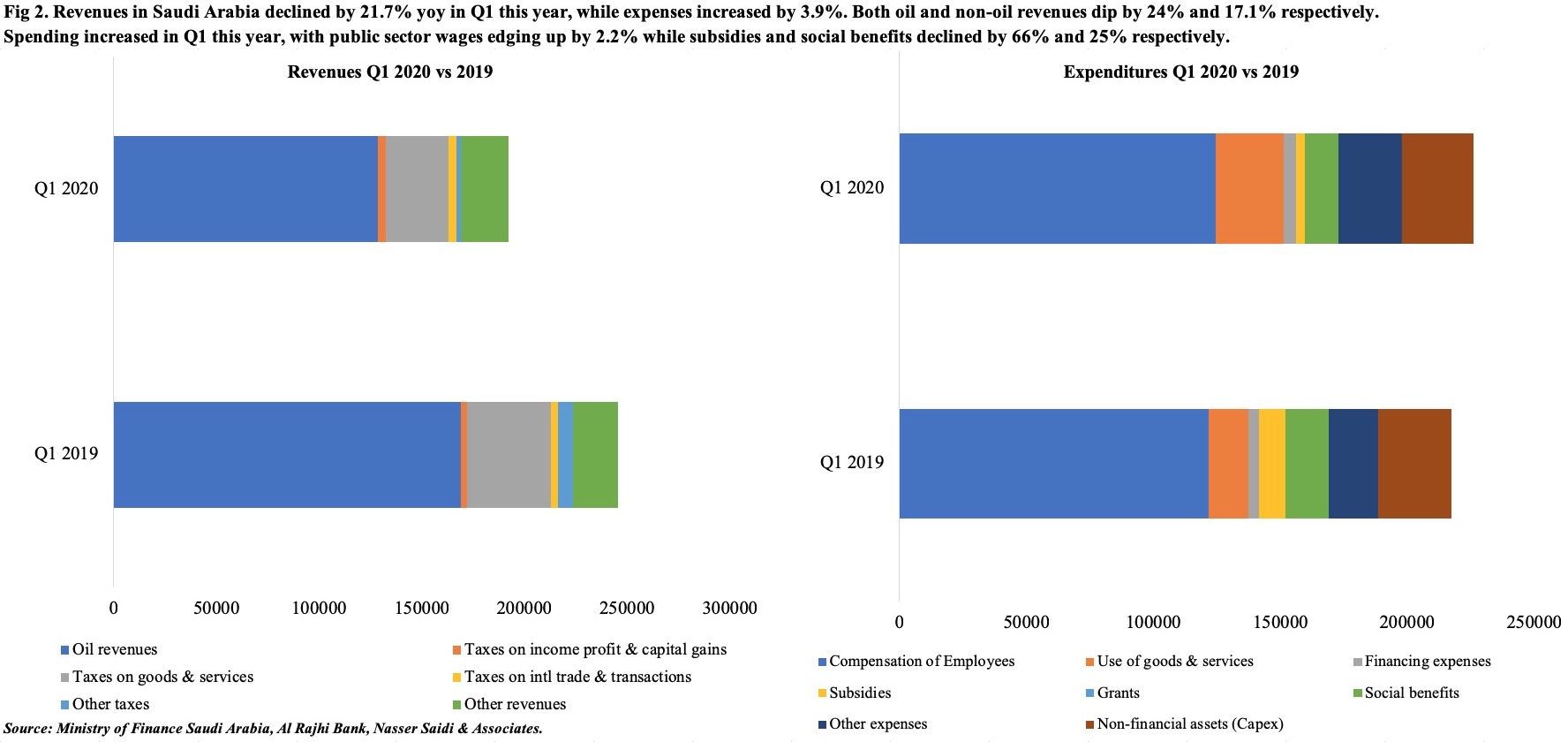

- Saudi Arabia posted a budget deficit of SAR 34.1bn in Q1, covered by both external and domestic borrowing. The government spent SAR 226.2bn in Q1 (+4%) while revenues hit SAR 192.1bn (-21.7%). Oil revenue declined by 24% yoy to SAR 128.8 while non-oil revenues were down by 17%. On the spending side, public sector wages were up by 2.2%, and “use of goods and services” up by 74.5% while social benefits dipped by 24.7%.

- The Social Development Bank in Saudi Arabia announced a SAR 9bn (USD 2.4bn) package to support small businesses and entrepreneurs with financing. The bank also offers a 6-month grace period to repay instalments.

- Saudi Arabia’s outlook was cut to negative from stable by Moody’s, citing fiscal risks from the steep decline in oil prices. The company kept the sovereign at A1, its fifth-highest grade.

- The General Organization for Social Insurance in Saudi Arabia disbursed nearly SAR 2.2bn for over 40k citizens working in the private sector and negatively impacted by Covid19. Separately, the Human Resources Development Fund stated that private sector enterprises registered more than 51k citizens in the “employment subsidy” initiative (which supports monthly salaries of citizens in the private sector by up to 50% over the course of 2 years).

- Tadawul approved the listing of SAR 5.55bn (USD 1.48bn) worth of debt instruments.

- Expat remittances from Saudi Arabia increased by 8.7% yoy to SAR 12.2bn in Mar 2020. In Q1, remittances were up 6% to SAR 33.855bn.

- Saudi Arabia’s tourism minister, in an interview with Reuters, stated that he anticipates a 35-45% decline in revenues this year.

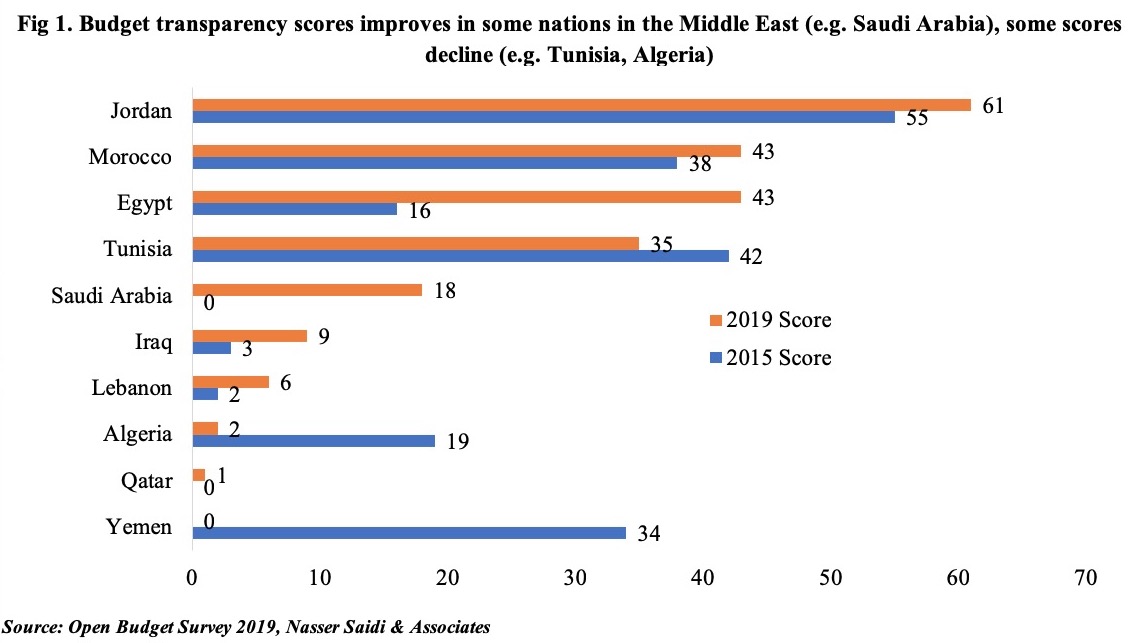

- Saudi Arabia improved its Open Budget Index ranking, jumping up 18 ranks and improving its score to 18 from 1 point in the last edition.

- OPEC oil output jumped to a 13-month high of 30.25mn barrels per day (bpd) in Apr. The biggest increase in supply was from Saudi Arabia which pumped a record 11.3mn bpd.

UAE Focus

- Abu Dhabi announced that the government plans to allocate 15% of its government procurement spending and contracts to SMEs.

- Dubai hopes to welcome tourists by beginning of July, disclosed Dubai’s DTCM director-General in an interview with Bloomberg.

- A joint statement by Emirates President and the CEO of Etihad Airways warns that passenger demand is unlikely to return to pre-crisis levels until 2023.

- S&P lowered the outlook to negative from stable for Sharjah and Ras al Khaimah, citing financial risks from lower oil prices and the impact of Covid19.

- Moody’s lowered DEWA’s rating to Baa2, two levels above junk, citing “risks of sustained large transfers to the government” and also highlighting a potential decline in expat population.

- UAE’s Abu Dhabi Power Corp’s plan to build the 2-gigawatt solar project, one of the world’s largest, received the world’s lowest tariff. The tariff set at USD 1.35/kWh on a Levelized Electricity Cost basis is approximately 44% lower than the tariff set on the ‘Noor Abu Dhabi’ project 3 years ago (a world record tariff-setter at the time).

Weekly Insights: Charts of the week

Fig 1. Budget Transparency in the Middle East

Fig 2. Fiscal deficit recorded in Q1 2020 in Saudi Arabia

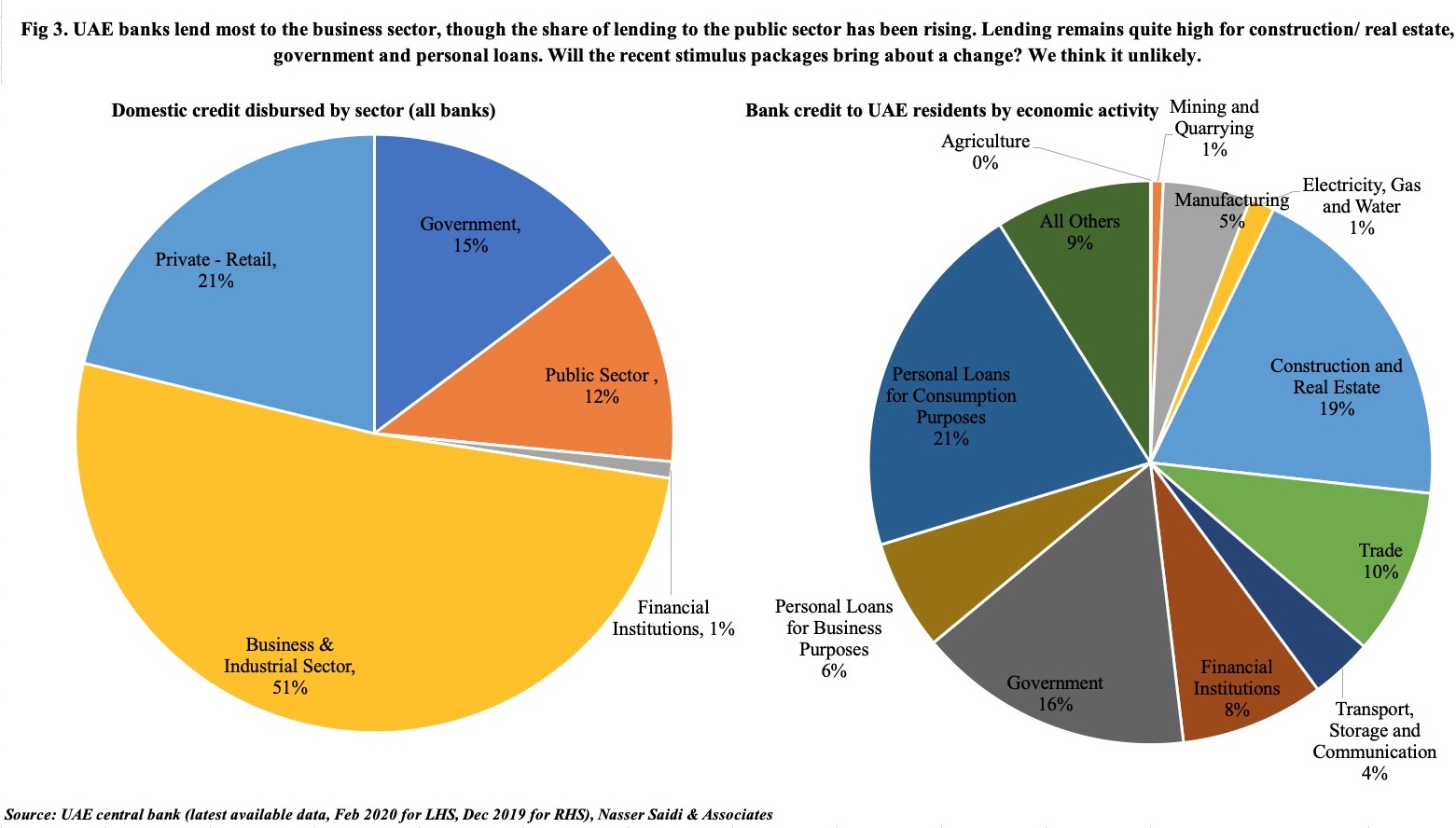

Fig 3. UAE banks’ lending activity

Media Review

How to avoid a W-shaped recession?

https://www.project-syndicate.org/commentary/covid-19-response-premature-withdrawal-w-shaped-recession-by-jeffrey-frankel-2020-05

Which emerging markets are in most financial peril?

https://www.economist.com/briefing/2020/05/02/which-emerging-markets-are-in-most-financial-peril

Al Arabiya’s interview with Saudi Arabia’s finance minister: full transcript

https://english.alarabiya.net/en/coronavirus/2020/05/02/Full-transcript-of-Al-Arabiya-s-interview-with-Saudi-Arabia-s-Finance-Minister.html

Citigroup Sees Asset Sales Boosting $47 billion Gulf Debt Binge

https://www.bloomberg.com/news/articles/2020-04-26/citigroup-sees-asset-sales-boosting-47-billion-gulf-debt-binge

Trumplomacy: What’s behind new US strategy on China?

https://www.bbc.co.uk/news/world-us-canada-52506073

Powered by: