“Weekly Insights” this week is a collection of charts based on recent macro and market data.

Markets

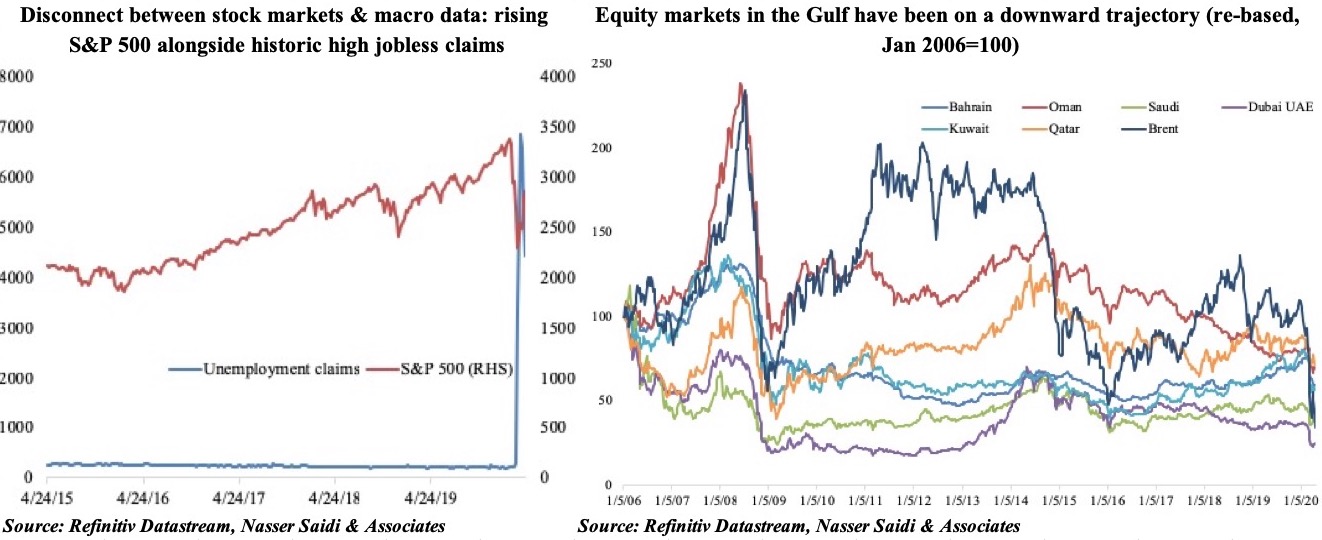

Stock markets declined last week: the MSCI All country world index posted its worst weekly performance since Mar; the pan-European STOXX 600 index ended its 2-week winning streak and reported weekly loss; the S&P ended the week down 12.2% for the year. While there has been a disconnect (for some time) between macro data releases and stock market movements, this week’s news dashed hopes of an early vaccine or treatment of COVID-19 (that Gilead’s antiviral drug remdesivir had failed in its first clinical trial) affected markets negatively. Regional markets remained in the red for the week though recovering towards end of the week thanks to some better-than-expected Q1 earnings. The dollar rallied and closed about 0.5% higher vis-à-vis the euro – the biggest weekly rise in 3 weeks. Oil prices had a troublesome week – with WTI going below zero due to storage bottlenecks and Brent remaining volatile – while the gold price touched a fresh 7.5-year highs.

Global Developments

US/Americas:

- A new USD 484bn stimulus was passed by the US Congress last week, which includes additional funding for small businesses Paycheck Protection Program, as well as funding for hospitals (USD 75bn) and expanding testing (USD 25bn). This move brings the total federal spending to combat the outbreak up to USD 3trn. Separately, the USD 349bn allocated to the Paycheck Protection Program last month ran out after just 13 days.

- Chicago Fed National Activity Index fell to -4.19 in Mar – the lowest level since the financial crisis – from a downwardly revised 0.06 the month before.

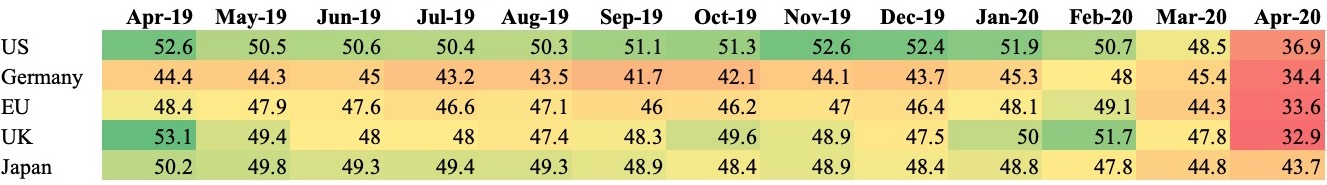

- US Markit manufacturing and services PMI declined in Apr to a 11-year low of 36.9 (Mar: 48.5) and a new series-low of 27 (39.8) respectively. Composite PMI declined to 27.4 Apr (Mar: 40.9), with output contracting at the fastest pace in survey history.

- Existing home sales declined by 8.5% mom – the largest decline since Nov 2015 – to 5.27mn units in Mar. The median existing house price increased 8.0% yoy to USD 280,600 in Mar. New home sales dived by 15.4% mom in Mar to 627k, after falling by 4.6% in Feb.

- Housing price index increased by 0.7% mom in Feb (Jan: 0.5%); these transactions still do not reflect the impact from the Covid19 outbreak.

- US durable goods tumbled by 14.4% mom in Mar (Feb: 1.1%), largely due to a 41% collapse in demand for transportation equipment (demand for civilian aircraft slipped 295.7%). Non-defense capital goods (excluding aircraft) edged up by 0.1% after the 0.8% in Feb.

- Initial jobless claims touched 4.427mn in the week ended Apr 11 (from 5.237mn the week before). The 4-week moving average increased to 5.787mn from 5.507mn the week before; the claims since mid-Mar reached 26.4mn, more than 15% of the US workforce.

Europe:

- Europe’s leaders agreed to build a trillion-euro emergency fund to help recover from the Covid19 outbreak, though details about the stimulus will be disclosed only over the summer. Separately, Germany’s cabinet agreed additional funding to the tune of EUR 10bn.

- German ZEW economic sentiment improved to 28.2 in Apr (Mar: -49.5) while the current situation indicator worsened dramatically, slipping to -91.5 from -43.1 in Mar. The ZEW reading for EU’s economic sentiment improved as well, rising to 25.2 from Mar’s -49.5.

- German Markit manufacturing PMI fell to 34.4 in Apr (Mar: 45.4), the lowest reading since Mar 2009, as new orders and output dropped. Services PMI slipped to a record low of 15.9 from the previous month’s 31.7, causing the composite PMI to also plummet to 17.1 (the lowest reading on record versus a low of 36.3 during the financial crisis) from Mar’s 35.

- EU Markit manufacturing PMI slipped to 33.6 in Apr from 44.5 in Mar, with the output index dipping to 18.4 (Mar: 38.5). As services PMI slowed to a record low of 11.7 (26.4), given the enforced shutdowns, the composite index also slumped to a record-low of 13.5 (Mar: 29.7). The composite flash PMI output indices hit all-time lows of 17.1 and 11.2 respectively in Germany and France (down from 35.0 and 28.9 in Mar), while the rest of the region saw the composite PMI slide from 25.0 to 11.5.

- German Ifo business climate fell to 74.3 in Apr (Mar: 85.9), the lowest level on record and the steepest monthly decline. The current assessment dropped to 79.5 from the previous month’s 92.9.

- German producer price index declined for the second consecutive month in Mar, down by 0.8% mom (Feb: -0.4%).

- Record declines across UK’s Markit PMIs: manufacturing declined to 32.9 in Apr (Mar: 47.8) while services PMI plummeted to 12.3 (34.5). Around 81% of UK service providers and 75% of manufacturing companies reported a fall in business activity during Apr.

- UK ILO unemployment rate edged up to 4% for the 3 months to Feb from 3.9% in the month prior. Seven out of 10 UK firms have furloughed staff, according to a British Chamber of Commerce survey. Average earnings excluding bonus fell to 2.9% in the 3 months to Feb following the previous month’s 3%.

- UK inflation eased to 1.5% in Mar (Feb: 1.7%), thanks to falls in the price of clothing and fuel. PPI declined by 2.9% mom in Mar (Feb: -0.2%) while retail price index slipped to 0.2% (0.5%).

- Retail sales in the UK slipped by 5.1% mom in Mar (Feb: -0.3%), with food stores and non-store retailing the only sectors to show growth. Online sales as a proportion of all retailing grew to a record high of 22.3%.

Asia Pacific:

- China’s PBoC cut the interest rate on its targeted medium-term lending facility (TMLF): the 1-year interest rate on the TMLF was lowered by 20bps to 2.95% from 3.15% previously. It disclosed an injection of CNY 56.1bn (USD 7.93bn) into the economy on Friday, when a batch of CNY 267.4bn of TMLF loans was due to expire. Earlier in the week, the benchmark lending rate was lowered (for the 2nd time this year) to 3.85% from 4.05%.

- Japan trade data revealed that exports slumped by 11.7% yoy in Mar – the fastest rate since 2011 – and imports were down by 5%, sinking the trade balance by 99% to a surplus JPY 4.9bn (USD 45.47mn). Exports to China, Japan’s largest trading partner, fell 8.7% in the year to Mar, reflecting a slump in items such as car parts, organic compounds and chip-making machinery.

- Japan’s leading economic index edged up to 91.7 in Feb versus Jan’s 90.7 and the initial estimate of 82.1. The coincident index that reflects the current economic activity fell to 95.5 in Feb from 95.7 in the previous month.

- Japan all industry activity index fell by 0.6% in Feb, the first decline since Oct, and offsetting Jan’s 0.6% rise.

- Inflation in Japan eased in Mar, with the core CPI (excluding food) growing at 0.4% (from Feb’s 0.6%). Gasoline prices inched up only by 0.4% in Mar after Feb’s 4.8% gain.

- Korea Q1 GDP contracted by 1.4% qoq – the fastest pace since 2008 – from Q4’s 1.3%. Private consumption shrank 6.4%, posting the worst reading since a 13.8% contraction in Q1 1998. In yoy terms, the reading was 1.3% in Q1, slowing from Q4’s 2.3% growth.

- Industrial production in Singapore increased by 21.7% mom in Mar, reversing Feb’s 22.1% plunge. Manufacturing output grew by 16.5% yoy in Mar, supported by a surge in pharma output (+126.6% yoy) and a low base in 2019. Excluding biomedical manufacturing (which grew by 91.4% yoy), factory output was unchanged.

- Inflation in Singapore was flat in Mar (Feb: 0.3%) while core inflation fell deeper to -0.2% yoy (Feb: -0.1%). Inflation is likely to remain subdued going forward.

Bottom line: While the global death toll from Covid19 crossed 200k, some nations are seeing a “flattening” of the curve and are considering easing restrictions in phases: lessons can be absorbed from “successful” Asian nations. Latest PMI readings point to the sharp downturn in the services sector vis-à-vis manufacturing. There is no consensus on the shape of economic recovery, especially as it will depend on how quickly restrictions are eased and also given WHO’s warnings a potential second wave. Also worrisome is emerging markets debt: around USD 5.5trn is coming due this year, with a sizable percentage held by investors in the industrialized world. Meanwhile, this week’s calendar is heavy with central bank meetings as countries come to terms with the significant economic impact of the Covid19 outbreak: the focus now needs to be on the path to economic recovery, especially as the narrative is changing towards calls for greater nationalization and deglobalisation.

Regional Developments

- Bahrain will reduce government agencies spending by 30% amid the Covid19 outbreak. The government also plans to reschedule some construction and consulting projects to keep spending in check.

- The value of Bahrain-origin exports decreased by 1% yoy to BHD 579mn (USD 1.53bn) during Q1 2020. Imports were up by 8% to BHD 1.244bn during the same period, resulting in a widening of the trade deficit by 17% to BHD 438mn.

- Bahrain secured a loan of about USD 1bn from a group of local and international banks to repay USD 1.25bn in bonds that matured on Mar 31, reported Reuters.

- Egypt will cut spending on fuel subsidies by 47% yoy in the 2020-21 budget to EGP 28.193bn (USD 1.8bn). The draft budget also plans an increase in net debt issuance by 19.7% to EGP 974.482bn. Furthermore, the introduction of new steel and cement production licenses is expected to add EGP 620mn in revenue in the next fiscal.

- Macroeconomic investments in Egypt are expected to decline by 11.9% yoy to EGP 740bn in the fiscal year 2020-21; of this, EGP 595bn has been allocated to public investments.

- Egypt’s manufacturing index (excluding oil) fell by 0.4% mom to 117.96 in Jan.

- Revenues from VAT in Egypt edged up by 0.22% yoy to EGP 191.25bn during Jul 2019-Jan 2020. Sales tax revenue picked up by 0.8% to EGP 85.17bn while overall tax revenues grew by 29.1% to EGP 473.42bn during the 7-month period.

- Egypt approved new income tax facilities for 10 sectors affected by the Covid19 outbreak (including aviation, tourism, hospitality and export companies): payment of 2019 income taxes can be done in installments till 30 Jun without any charges for payment delays.

- Tax and non-tax proceeds from the Suez Canal in Egypt weakened by 4.7% yoy to EGP 35.91bn in the period Jul 2019-Jan 2020.

- Egypt’s banks reported a total net profit of EGP 83.18bn last year, with the five largest banks accounting for just over 50% of total profits.

- Jordan eased lockdown measures in three southern governorates with no Covid19 confirmed cases, allowing for some commercial establishments to reopen alongside construction works. Plans are also underway to restart investment sectors in free zones after getting the required approvals.

- Kuwait has extended partial curfew for 16 hours a day, given the ongoing Covid19 outbreak, and a national holiday has been declared until May 28th.

- Kuwait’s foreign reserves grew by 8.57% yoy and 1.22% mom to KWD 12.42bn (USD 39.96bn) in Feb 2020. Additionally, the book value of gold reserve amounted to KWD 31.7mn.

- The central bank of Kuwait offered bonds and related tawarruq at a total value of KWD 240mn, with a 1.25% rate of return and a 3-month maturity period.

- Kuwait’s oil minister disclosed that the nation had already begun to reduce oil supply to the international market, prior to the agreement which comes into effect May 1st.

- It is estimated that financial support needed by SMEs in Kuwait is about KWD 500mn. The National Fund for Small and Medium Enterprise Development will provide 80% of SMEs’ funding needs at no interest for up to three years, while banks will finance 20% at a maximum 2.5% interest rate, with the state supporting companies in paying the interest for 3 years.

- Kuwait’s central bank has asked banks to postpone amounts due from Covid19 affected customers for six months without applying any penalties (extending the previous 3-month postponement directive).

- Lebanon’s PM rebuked the central bank governor, questioning the slump of the Lebanese pound (slid 15% further last week) and accelerated losses at the central bank.

- Earlier last week, the central bank set an exchange rate for wire transfers of LBP 3625 per dollar (58% weaker than the official peg of 1507.5) – a rate accessible only to importers of vital goods. The apex bank also stated that depositors with dollar accounts would be paid cash in pounds, also at a “market rate”, within each bank’s withdrawal limits.

- Oman’s central bank has asked banks and financial institutions to freeze repayments of personal and housing loans for three months, effective from May.

- The recent cuts in Oman – ministries’ development and operational budgets by 10% each and 5% reduction in allocation to government agencies –reduced the state budget by OMR 500mn (USD 1.3bn).

- Saudi Arabia’s finance minister disclosed that the government is considering more measures to reduce spending amid the Covid19 outbreak.

- The Saudi Arabian Monetary Authority directed banks to delay installment payments for 3 months for all citizens.

- The Saudi King approved performing shortened Tarawih prayers without public attendance in the two holy mosques.

- Saudi Arabia’s crude oil exports fell to 7.278mn barrels per day (bpd) in Feb from Jan’s 7.294mn bpd. Production however inched up to 9.784mn bpd in Feb from Jan’s 9.748mn bpd.

- Inflation in Saudi Arabia inched up by 1.5% yoy in Mar (Feb: 1.2%) – the highest increase since Dec 2018. Food and beverages and transport costs grew by 3.9% and 3.7% respectively.

- The head of PIF disclosed that the fund was looking into investment opportunities in aviation, oil and gas as well as entertainment once the COVID outbreak passes.

- Saudi Arabia’s finance ministry disclosed raising SAR 5.55bn (USD 1.48bn) in sukuk.

- The Saudi real estate price index inched up by 1.2% yoy in Q1, driven mainly by prices of residential properties (+2.1%), while the prices of commercial and agricultural real estate decreased by 0.5% and 0.2%.

- Saudi Arabia’s tourism sector is estimated to witness a 35-45% dip in revenues, according to the tourism minister; also depends on how fast the nation will be able to reopen post-Covid.

- Colliers projects that the MENA hotel sector will benefit from tourism initiatives once recovery begins in Q4 this year. Faster recovery is forecast for UAE and Saudi Arabia.

- IATA warns that 1.2 aviation jobs are at risk across the region (up from estimates of 900k), with revenue losses at USD 24bn and USD 66bn loss in GDP, given Covid19 related disruptions. More than 378k employees in UAE’s aviation industry are at risk of unemployment or income losses while Saudi Arabia is looking at an estimated 287k jobs.

UAE Focus

- The UAE partially lifted some lockdown measures across the emirates from Apr 24: this includes opening of shopping malls (no more than 30% of total capacity) while following social distancing guidelines; entertainment venues (cinemas) and tourist attractions will remain closed; offices have to limit employees on its premises to 30% of workforce; metro will be re-opened in phases, buses will run limited services and all such services reassessed within a week based on demand. Public gatherings are still not allowed though move permits are not required to travel outside from 6am to 10pm.

- UAE banks’ reserve requirements grew by 7.7% yoy to AED132.6bn during Q1 2020, according to the central bank. Money supply (M2) in the UAE increased by 2% yoy to AED 1454.9bn (USD 396.2bn) in Mar.

- The UAE central bank has extended the duration of the Targeted Economic Support Scheme (TESS) for affected retail and corporate customers till end-Dec 2020. It was also disclosed that UAE banks have tapped 60% of the TESS facility (AED 30bn of the AED 50bn allocation), and utilisation had doubled within a week.

- UAE has extended the deadline for submitting VAT returns to May 28, 2020 for the tax period ending Mar 2020. This does not affect any other tax periods where the deadline for filing tax returns and settling of payable taxes does not fall in Apr 2020.

- Inflation in the UAE decreased to 1.6% yoy in Mar, driven down by prices of recreation and culture (-9.89%) as well as housing and utilities (-4.08%). Meanwhile, food and beverage prices were up by 3.95% and tobacco prices by 6.43%.

- The BIE Executive Committee recommends postponing Expo 2020 Dubai to 1 Oct 2021. Since changing of dates needs the support of 2/3-rds majority of member states, voting will be carried out remotely between 24 April to 29 May. The name Expo 2020 Dubai will be retained.

- Emirates airlines are planning to keep its passenger flights grounded until Jul at the earliest (reservations currently reopen from Jul 1st). Etihad airlines however are planning to resume regular passenger flights from May 16th, though a spokesperson has clarified that “this situation may change”.

- Dubai Airports unveiled measures to support its tenants, concessionaries and aviation partners during the impacted period Mar 1-May 31, including a waiver of 100% of minimum guarantees or equivalent fees.

- DP World announced that it had handled 17.2mn TEU (twenty-foot equivalent units) shipping containers in Q1 this year, with gross container volume falling by 1.7% yoy on a reported basis but up 0.3% on a like-for-like basis. The chief executive warned that the real impact of Covid19 would be visible only from Q2.

Weekly Insights: Charts of the week

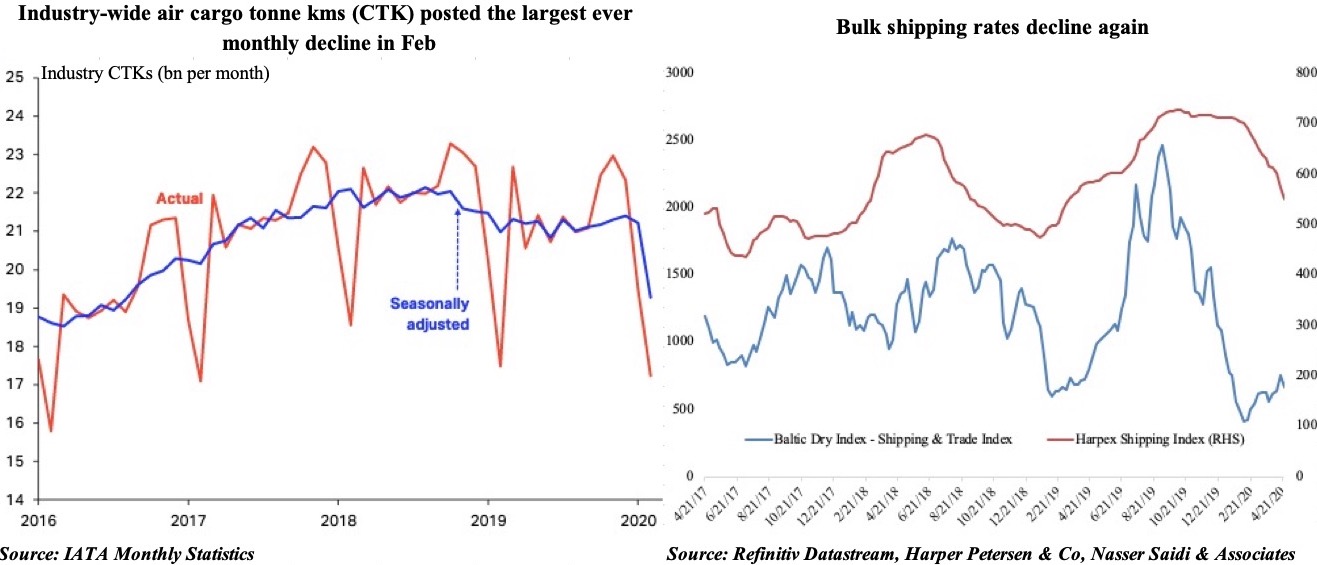

The flash PMI readings clocked in multi-year lows across the US and Europe. Along with the decline in export orders component within the PMIs, the fall in shipping indices (Baltic Dry Index, Harpex Shipping Index) and air cargo volumes as well (proxy indicators of global trade) imply a downturn in trade numbers in the next coming months.

Fig 1. Heatmap of Manufacturing PMIs – the Covid-19 effect

Source: Refinitiv Datastream, Nasser Saidi & Associates.

Fig 2. Proxy indicators for global trade

There has been a chasm between stock market performance and disappointing macro data for a few weeks now. Though the rollout of stimulus measures seem to have calmed investors initially, the question of how economies will recover (and its duration) is likely to lead to a change in market behaviour. Two instances this week – failure of a potential drug for Covid19 and lack of a detailed plan regarding the EU’s emergency fund – triggered sharp declines. Meanwhile in the region, GCC equity markets show no respite.

Fig 3. Equity market movements

Media Review

Will American shale oil rise again?

https://www.ft.com/content/2d129e4a-860b-11ea-b872-8db45d5f6714

Developing world economies hit hard by coronavirus

https://www.bbc.com/news/business-52352395

A deglobalisation trend?

https://www.piie.com/blogs/realtime-economic-issues-watch/pandemic-adds-momentum-deglobalization-trend

New Zealand’s Prime Minister May Be the Most Effective Leader on the Planet

https://amp.theatlantic.com/amp/article/610237/

What next for countries that are nearly covid-free?

https://www.economist.com/asia/2020/04/23/what-next-for-countries-that-are-nearly-covid-free

Can cannabis legalization rescue Lebanon’s ailing economy?

https://www.arabnews.com/node/1663936/middle-east

Powered by: