“Weekly Insights” provides a pictorial representation of recent growth in the GCC region and main pain points.

Markets

Stock markets in the US continued their weekly gain streak for the second consecutive week in spite of weak macroeconomic numbers; plans were announced to gradually lift lockdowns (in China, Germany, Italy, Spain and some other parts of Europe); markets across Europe and Asia closed higher as well, also supported by reports of a hopeful experimental drug for Covid19. Regional markets remained under pressure, as oil prices continued their downward trend, and with IMF predicting an economic contraction this year across most major MENA countries. Among currencies, dollar edged up to a 10-day high on the euro, and the yen weakened against the dollar (FX year-to-date: tmsnrt.rs/2RBWI5E). Oil markets continued to remain under pressure on low demand (OPEC now sees a contraction of global demand of 6.9 million barrels per day), with prices dropping to an 18-year low on Fri. Gold prices fell.

Global Developments

US/Americas:

- Retail sales in the US plunged by 8.7% in Mar – the sharpest drop on record. Other than grocery sales which surged by 26.7%, most other categories saw massive declines: clothing and accessories sales dipped 26.8%, sporting goods were down 23.3% and electronics, appliances by 15.1%.

- Industrial production contracted by 5.4% mom in Mar – the steepest 1-month decline since Jan 1946 – with manufacturing declining by 6.3% and mining by 2%. Capacity utilization decreased by 4.3 ppts to 72.7% in Mar.

- Housing starts plunged 22.3% mom in Mar – the worst monthly decline since Mar 1984 – to a seasonally adjusted rate of 1.216mn units. The construction of single-family houses down by 17.5% mom, while apartment and condo starts were off 32.1%. The outlook doesn’t look promising either: there was also a 6.8% drop in permits to begin construction in Mar.

- Initial jobless claims touched 5.245mn in the week ended Apr 11 (from an upwardly revised 6.615mn the week before). This brings total claims in 4 weeks to 22.4mn, wiping out all job gains since Nov 2009 (22mn), and compares to the 8.7mn jobs lost during the financial crisis.

- The Federal Reserve’s balance sheet increased to a record USD 6.42trn last week, from just USD 4.29trn in the first week of Mar.

Europe:

- Inflation in Germany eased to 1.4% in Mar, down from the 1.7% reading in both Jan and Feb. Eurozone inflation slowed to 0.7% in Mar (Feb: 1.2%), largely due to the fall in energy prices (-4.5%) while food prices grew 2.4%. Core inflation eased to 1% from 1.2% in Feb.

- EU industrial production fell 1.3% yoy in Feb, thanks to a 3.1% decline in production of capital goods. IP declined by 1.9% in the eurozone.

Asia Pacific:

- China GDP declined by 6.8% yoy and 9.8% qoq in Q1: it is the first economic contraction reported since 1992 (when the official quarterly GDP records started).

- China exports fell by 6.6% yoy in Mar while imports were down by 0.9% bringing the trade surplus to USD 19.9bn (Feb: USD 18.55bn). China’s trade surplus with the US narrowed to USD 15.32bn in Mar from USD 25.37bn in Jan and Feb.

- Fixed asset investment in China declined by 16.1% yoy to CNY 8.41trn in Q1. Private investment decreased 18.8% to CNY 4.78trn and investment in high-tech industries dropped by 12.1% in Q1.

- FDI in China fell by 10.8% yoy to a total CNY 216.19bn (USD 31.2bn). Foreign investment in high-tech services surged 15.5% yoy, accounting for 29.9% of the service sector.

- China’s industrial production fell by 1.1% in Mar, bringing the Q1 value down by 8.4%. Retail spending dropped by 19% in Q1, with sales of consumer goods down by 15.8% in Mar, while online sales of physical goods rose 5.9%.

- Japan industrial production unexpectedly fell by 0.3% mom in Feb (Jan: +0.4%).

- The Reserve Bank of India cut the reverse repurchase rate by 25bps to 3.75% and announced it would inject INR 500bn (USD 6.5bn) in a new round of Targeted Long-Term Repo Operations. In addition, the apex bank extended the enhanced ways and means advance facility available to the administration to until Sep 30.

- India’s exports declined by a record 34.6% yoy in Mar (Feb: +2.9%, after falling for 6 months in a row) and imports dipped by 28.7%, thereby narrowing trade deficit to USD 9.8bn. For the full year 2019-20, exports contracted by 4.8% to USD 314.3bn while imports sank by 9.1% to USD 467.2bn, leaving a trade deficit of USD 152.9bn.

- India’s WPI inflation cooled to a four-month low of 1% in Mar (Feb: 2.26%) while food inflation fell to 4.91% (Feb: 7.79%). For the full year 2019-20, WPI inflation moderated to a 4-year low of 1% after sustained pickup since 2015-16.

Bottom line: The IMF, in its flagship World Economic Outlook report, forecast a global recession with growth falling by -3% this year (a downgrade of 6.3ppts from the Jan 20 estimates) – recording the worst downturn since the Great Depression. As fiscal and monetary stimulus packages continue to be rolled out globally, we expect inflation to tick up as strategic production is moved domestically from low-labour-cost developing nations, alongside wage inflation and unavoidable bankruptcies. The G20’s move to provide temporary debt relief to 76 of the poorest countries (from May 1) is a good move, though too small a gesture: a key question is whether private creditors will follow suit – over a quarter of the debt (USD 3bn over the next 8 months) is owed to them. Separately, ratings downgrades of countries and companies citing deterioration in credit quality given the impact of Covid19 is raising borrowing costs (adding to worries). In Europe, meanwhile, finance ministers are set to meet after the European Council’s meeting on Apr 23 to discuss the EU coronavirus rescue fund and “corona bonds”.

Regional Developments

- The IMF, in its latest Regional Economic Outlook, forecast a dip in economic growth to 3.3% this year in the MENA region, before rising to 4.2% in 2021. The GCC region will see a sharper decline in 2020, with growth falling by 2.7% from 0.6% in 2019.

- Non-oil exports from Egypt increased by 2% yoy to USD 6.728bn in Q1 this year while non-oil imports dropped by 24% yoy to USD 13.814bn.

- Remittances into Egypt grew by 33.3% yoy to USD 5.2bn in Jan this year, according to the central bank.

- Egypt’s tourism revenues are forecast to decline to USD 11bn in 2019-20, from previous estimates of USD 16bn. The calendar year 2019 had seen revenues touch a record USD 13bn.

- Jordan’s banks cut interest rates charged to SMEs and individuals by 1.5% from end-Apr, announced the Banking Association, following the central bank’s rate cut mid-Mar.

- The tourism ministry in Jordan waived the fees and fines for renewing licenses for 2020; in addition, JOD 10mn would be redirected to support local tourism activities and another JOD 5mn will be designated after the end of the crisis.

- Boursa Kuwait will postpone the date of listing its share on the stock market – it was tentatively scheduled for Apr 19th.

- Kuwait’s exports dropped by 14% yoy to KWD 4.6bn (USD 15bn) in Q4 2019 and imports were down by 1.1% to KWD 2.5bn, bringing surplus down by 26% yoy to KWD 2bn.

- About 250k low-paid expat workers have lost jobs in Kuwait following the Covid19 outbreak, reported Al Qabas daily quoting government sources.

- Lebanon’s banking associate disclosed that the Beirut Reference Rate was reduced to 5.75% for USD and to 7.75% for LBP, down from 9.35% for USD and 12.45% for LBP at the start of the year.

- Reuters reports that the Lebanese pound weakened to 3000 to the dollar on the country’s parallel market for the first time last Tues. The official peg stands at 1507.5.

- Oman’s finance ministry directed all ministries and civilian government units to reduce approved liquidity for development budgets by 10%, including review of salaries and benefits.

- The Supreme Committee in Oman issued directives to support private sector companies: includes reduction in expat visa renewal fees to OMR 201 from OMR 301 till Jun 2020 as well as negotiating reduction in wages and working hours with employees.

- Oman’s crude oil production picked up by 12.83% mom to 1.78mn barrels per day (bpd) in Mar. Crude exports in Mar was down 12.3% mom, averaging 738,348 bpd.

- Qatar set the official selling prices for its crude in May at wide discounts, reported Reuters: the Marine crude OSP was set at USD 7.10 a barrel, below the monthly average of Platts Oman and Dubai quotes.

- Saudi Arabia approved an additional set of measures to support the economy during the ongoing Covid19 outbreak: this includes SAR 50bn (USD 266mn) to accelerate payment of private sector dues, provide liquidity to several sectors and cover wages of those working in passenger transport while a further SAR 47bn was set aside for the health sector.

- Saudi Arabia’s bond sale to raise USD 7bn was heavily oversubscribed, with total orders amounting to more than USD 54bn.

- Saudi Arabia has extended the curfew measures to combat the Covid19 outbreak “until further notice” while SAMA has directed banks to extend the validity of expired ATM cards till Jun 2, 2020. Separately, at least 4 shopping malls in Saudi Arabia have granted a rent exemption to “eligible” tenants until these establishments reopen.

- Saudi Arabia is set to sell about 600k barrels of crude per day to the US in Apr – the highest volume in a year, reported Bloomberg. Separately, Reuters reported that some refiners in Asia were notified that Aramco would supply full contractual volumes of crude in May.

- Reuters reported that Saudi Aramco was in talks for a loan of about USD 10bn to finance its Sabic acquisition (70% stake).

- Unemployment rate in Saudi Arabia stood at 12% in Q4 2019, unchanged from the previous quarter. Unemployment among males was low at 4.9% (-0.8% from Q3) while female unemployment was unchanged at 30.8%.

- Online payments in Saudi Arabia surged by more than 400% in Q1 this year: number of online payments reached 7.3 million, valued at SAR 1.79bn (USD 475.81mn).

- G20 chair Saudi Arabia pledged USD 500mn to support global efforts to combat the spread of Covid-19.

- Investments into MENA-based start-ups dipped by 22% yoy to USD 277mn in Q1 this year, according to Magnitt’s 2020 MENA Venture Investment Report. The strong Jan-Feb fundraising start was dragged down by the Covid19 outbreak, resulting in a 67% drop in Mar.

UAE Focus

- Battling Covid-19’s impact: the ministry of economy reduced fees of 94 services including commercial registration services, trademarks, origin, and intellectual properties (businesses are estimated to save AED 113mn from the fee reduction); labour movement between the emirates has been banned; those with residency visas that expired in Mar can stay in the country legally till end of the year; the jobless can search for other opportunities and a visa transfer will be facilitated; waived/deferred rents for mall tenants (Majid Al Futtaim and Emaar malls); 3-month basic rent waivers to DIFC-based retailers from Apr-Jun; Dubai extended closure of all inbound tour operators, hotels, restaurants, venues and event organisers until further notice; the Ajman-DED announced a three-month renewal for trade licenses without lease contract.

- Since the UAE central bank launched the AED 256bn Targeted Economic Support Scheme on Mar 14, about AED 10bn was provided to banks with zero-interest funding while over AED 61bn was released given the lowered cash-reserve requirements. In a meeting with the banks’ CEOs, the central bank urged the disbursement of these funds to support private companies, SMEs and retail clients affected by the pandemic.

- UAE’s Federal Tax Authority extended the excise tax payment period: the extended payment period of Mar 1 to Apr 30 is due on May 17.

- The UAE central bank has postponed the Emiratisation target in the financial sector this year, while requesting banks not to terminate citizens’ jobs.

- Non-oil foreign trade of Abu Dhabi edged up by 0.5% yoy to AED 19.3bn in Jan 2020. Exports of non-oil commodities were up 0.4% to AED 5.49bn while imports accelerated by 5.8% to AED 10bn. Saudi Arabia, Chinas the US were top trade partners.

- Inflation in Dubai declined to 1.82% yoy in Mar, after a 6% dip in housing and utilities prices more than offset the 4.56% rise in food and beverages costs.

Weekly Insights: Outlook for economic growth in the GCC region and main pain points

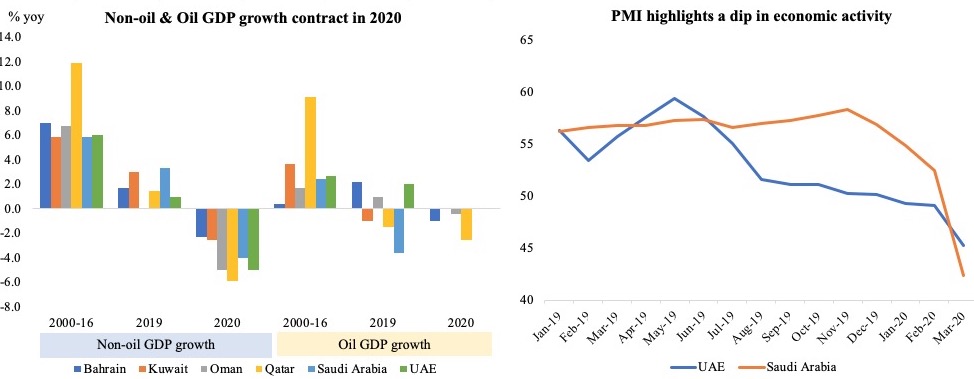

Economic growth in the GCC will decline by 2.7% this year, from growth of 0.6% in 2019 (Source: IMF), as the nations’ continue to suffer the economic impact from Covid19 (which has led to lockdowns and subsequent decline in economic activity) as well as lower oil prices (with spillover effects into the non-oil sector). The double whammy is expected to lead to a substantial decline in non-oil GDP growth (-4.3% from 2.4% growth last year). The PMI data for Q1 this year corroborates this upcoming dip. As nations closed borders, there has been significant decline in the operations of the non-oil sector, what with most GCC nations depending on the tourism and hospitality sector.

Fig 1. Decline in economic activity; PMI as a leading indicator

Source: IMF, IHS Markit, Nasser Saidi & Associates.

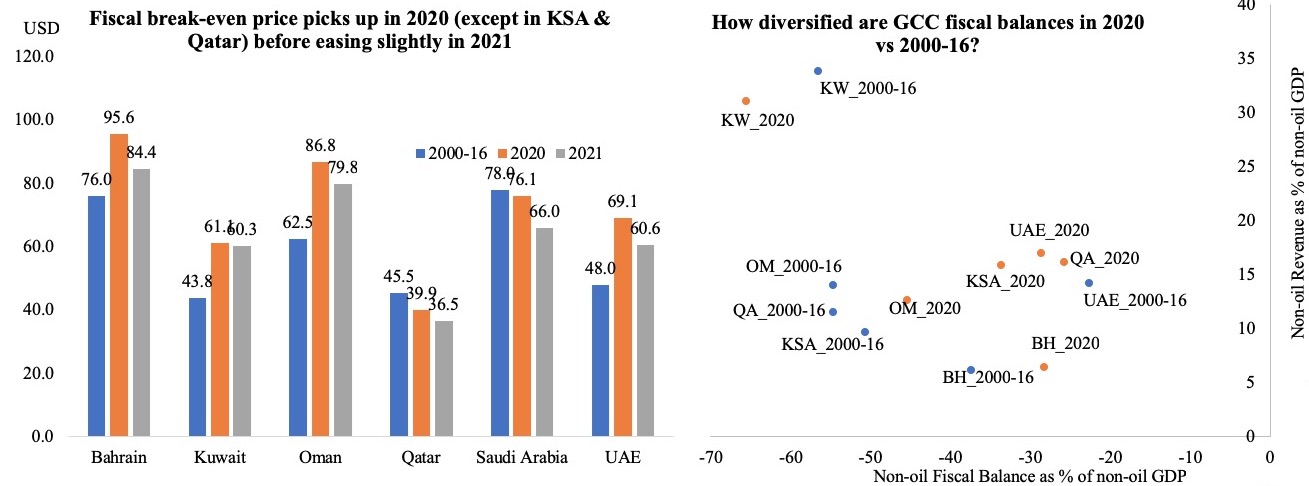

As oil prices decline, the major revenue stream of the GCC nations will dry up. Fiscal breakeven prices (i.e. oil price needed to maintain a balance budget) remains higher than the current oil price for all GCC nations. Though diversification efforts picked up after the 2014 decline in oil prices, there is still much room for improvement. The chart on the RHS (below) shows a scatterplot with non-oil fiscal balance (as % of non-oil GDP) on the X-axis and non-oil revenue as % of GDP on the Y-axis. Both Saudi Arabia and Qatar have successfully reduced their non-oil fiscal balance and increased non-oil revenues (when comparing the periods 2000-16 and this year). UAE has increased the share of non-oil revenue as % of GDP, though the non-oil fiscal deficit has widened further. Kuwait’s performance has suffered on both counts, witnessing both an increase in fiscal deficits and decline in non-oil revenues as a share of non-oil GDP during the periods of comparison.

Fig 2. Economic diversification efforts not significant enough to lift the GCC nations during the ongoing oil price slump

Source: IMF, Nasser Saidi & Associates.

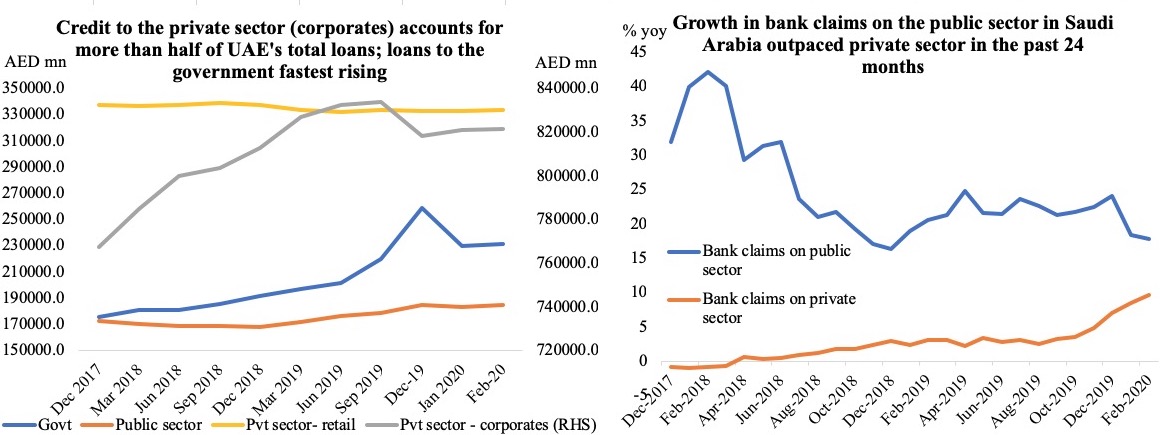

To reduce the impact from the ongoing Covid19 outbreak, all GCC nations have introduced stimulus packages – to the tune of more than 10% of combined GDP. However, with the central banks leading the efforts, is it sufficient to support the economy? We take the case of both UAE and Saudi Arabia, the largest GCC nations. It can be seen that growth of bank credit to the public sector is substantially higher than that to the private sector (corporates/ retail). As governments and central banks call for greater support to the SMEs and retail clients (who’ve felt the immediate effect of Covid19), can we expect the region’s banks to rise up to this situation, given their past behaviour? Governments will certainly need funds – we have seen the governments of Saudi Arabia, Abu Dhabi and Qatar tap the markets via bond issuances of USD 7bn, USD 7bn and USD 10bn each in the past two weeks. Will the banks extend a lending hand to the public sector & GREs or risk burning their hand lending to SMEs/ retail clients (future NPLs?)

Fig 3. In spite of the large stimulus packages rolled out by the GCC, private sector is likely to be crowded out by the public sector given banks’ focus on profitability, liquidity and potential NPLs in the future

Source: UAE central bank, SAMA, Nasser Saidi & Associates.

Media Review

IMF releases Economic Outlook reports

https://blogs.imf.org/2020/04/14/the-great-lockdown-worst-economic-downturn-since-the-great-depression/

https://www.imf.org/en/Publications/REO/MECA/Issues/2020/04/15/regional-economic-outlook-middle-east-central-asia-report

The Great Whiplash

https://www.project-syndicate.org/commentary/covid19-crisis-minimize-economic-whiplash-by-kaushik-basu-2020-04

Coronavirus in Conflict Zones: A Sobering Landscape – Carnegie Endowment for International Peace

https://carnegieendowment.org/2020/04/14/coronavirus-in-conflict-zones-sobering-landscape-pub-81518

Roundtable on Potential IMF Involvement in Lebanon, Lebanese Center for Policy Studies & Jadaliyya

https://www.jadaliyya.com/Details/40984

COVID-19: Good can also come out of a global scourge

https://gulfnews.com/business/analysis/covid-19-good-can-also-come-out-of-a-global-scourge-1.70954575

Powered by: