“Weekly Insights” focuses on how the GCC nations are financing their stimulus packages. The chart of the week is Google’s Mobility Report on a few selected MENA nations.

Markets

Stock markets gained as stimulus packages continue to be announced out across the globe and on hopes that lockdowns would curb the spread of Covid19: Wall Street rallied, European markets were up for a 4th straight day on Thursday and the MSCI all-country index was at the highest since mid-Mar. Volatility in financial markets (the VIX index) was close to its lowest levels since Oct (tmsnrt.rs/2DaIljM). Regional markets were higher last week (except Bahrain and Kuwait): expectations of an OPEC+ deal boosted oil exporters’ markets, while government bonds sales in Qatar and Abu Dhabi also supported market sentiment. The dollar remained soft while emerging market currencies gained (tmsnrt.rs/2egbfVh). Over the weekend, the OPEC+ committed to cut 9.7mn barrels a day from global supply – the biggest supply reduction on record- also facing the largest demand fall on record; markets were closed on Fri for Easter, but oil prices had risen in anticipation of the deal and were near $30 a barrel on Thursday. Gold price meanwhile hit a 1-month peak.

Global Developments

US/Americas:

- The Fed will provide up to USD 2.3trn in loans (including the Payroll Protection Program) to support local governments and small and mid-sized businesses. Plans include buying corporate bonds (both at an investment-grade level and high-yield, or junk, bonds), targeting USD 850bn through the expansion of three existing credit facilities (a move backed by USD 85bn in protection from the Treasury) as well as Main Street loans (to support up to USD 600bn in loans tied to SMEs).

- US producer price index slipped by 0.2% mom in Mar (Feb: -0.6%) and core PPI fell by 0.2% – the largest decline since Oct 2015 – and compares to a 0.1% dip in Feb. In yoy terms, PPI nudged up by 0.7% yoy in Mar (Feb: 1.3%) while core PPI (excluding food and energy) rose by 1.0% (Feb: 1.4%).

- Michigan consumer sentiment index sank to a 9-year low of 71 in Apr (Mar: 89.1), led by the current-conditions index, which plummeted by 31.3 points – nearly double the record decline of 16.6 points set in Oct 2008.

- US consumer prices dipped in Mar: CPI fell by 0.4% mom, posting the biggest drop since Jan 2015, following a 0.1% gain in Feb. Gasoline prices fell, as did hotel accommodation, apparel and airline ticket prices. Excluding food and energy, CPI fell by 0.1% mom – the first drop since Jan 2010.

- The US budget deficit widened by 8% yoy to USD 743.6trn in fiscal H1 (i.e. Oct 2019-Mar 2020), as receipts and spending increased by 6% and 7% respectively. The stimulus measures passed late-Mar will feature in Apr’s budget.

- Initial jobless claims climbed to a record 6.61mn at the week ending Apr 3 (from an downwardly revised 6.87mn the week before). The 4-week average increased to 4.27mn from 2.67mn the week before.

Europe:

- Finance ministers from the Eurozone agreed to an emergency rescue package to the tune of EUR 500bn: this includes revised credit lines from the European Stability Mechanism (EUR 240bn available for indebted nations to use for financing of direct or indirect healthcare), a boost to the lending capacity of the European Investment Bank, a new EUR 100bn unemployment insurance scheme and a “temporary, targeted” recovery fund to support a post-lockdown economic rebound.

- Germany’s exports increased by 1.3% mom and imports declined by 1.6% mom, widening the trade surplus to EUR 21.6bn (Jan: EUR 18.7bn). Trade with China slowed: exports to China fell by 8.9% yoy, while imports from China dropped by 12.0%. Separately, current account surplus also widened to EUR 23.7bn from the previous month’s EUR 16.8bn.

- German factory orders fell by 1.4% mom in Feb (Jan: +4.8%), with a sharp fall in foreign orders. Separately, industrial production in Germany edged up by 0.3% mom in Feb, thanks to a 1.8% increase in the production of consumer goods but a 0.3% decline in capital goods. In yoy terms, it slipped by 1.2% yoy in Feb (Jan: -0.9%). The Economy Ministry expects major falls in orders for Mar and Apr and sharp drops in production in both Q1 and Q2.

- UK’s industrial production dropped by 2.8% yoy in Feb, after falling -2.9% in Jan. Manufacturing fell by 3.9% (Jan: -3.7%).

- UK goods trade balance widened to GBP 11.487bn in Feb (Jan: GBP 5.759bn deficit). Overall trade balance (including services) posted a surplus GBP 1.4bn in Dec-Feb – for the first time in more than 20 years of records.

- GDP in the UK fell 0.1% in Dec-Feb (Jan: 0.1%); in Feb, the services sector posted 0% growth, manufacturing bounced growing by 0.5%, while construction dropped by 1.7%.

Asia Pacific:

- Inflation in China fell by 1.2% mom in Mar (Feb: 0.8%); in yoy terms, prices were up 4.3% yoy, declining from Feb’s 5.2% gain. Producer price index fell 1.5% yoy in Mar (Feb: -0.4%).

- China new yuan loans surged by CNY 1.29trn to CNY 1trn (USD 988bn) in Q1. Money supply grew by 10.1% yoy by end-Mar, after rising 8.8% in Feb. Aggregate financing increased by 11.5% yoy to CNY 262.24trn in Mar. Foreign exchange reserves in China declined to USD 3.061trn in Mar from Feb’s USD 3.107trn.

- Japan announced a USD 1trn stimulus package – equivalent of 20% of GDP – that includes JPY 39.5trn (USD 363bn) in direct fiscal spending. This fiscal stimulus is much higher than the USD 670bn emergency spending after the 2008-09 crisis. The government also declared a state of emergency for Tokyo and other urban areas.

- Core machinery orders in Japan unexpectedly rose by 2.3% mom in Feb following Jan’s 2.3% gain.

- Japan’s overall household spending fell by 0.3% yoy to JPY 270k (USD 2.5k) in Feb (Jan: -3.9%). Though spending on masks and other healthcare products rose more than 40%, and toilet paper by 47%, this was more than offset by the decline in spending on domestic package tours, movies as well as rail fare.

- Real wages in Japan increased by 0.5% mom in Feb, following a downwardly revised 0.4%.

- India’s industrial output increased to a 7-month high in Feb, rising by 4.5% yoy (Jan: 2.1%); manufacturing edged up by 3.2% (Jan: 1.6%).

Bottom line: Though US passed Italy with the highest number of Covid19 related deaths globally, there was some optimism as the rate of contagion of the pandemic eased (lockdowns seem to be working, as numbers in Italy and Spain ease; India plans to extend the nation-wide lockdown for 2 more weeks; Chinese authorities lifted a lockdown imposed in late Jan on Wuhan, the initial epicenter of the outbreak). However, with much of the world struggling with the pandemic still, export orders for Chinese manufacturers are sinking, raising fears about a second wave of demand shock. WTO’s forecasts trade to plummet by 13-32% in 2020 alongside a steeper decline in sectors with complex value chains (e.g. electronics, automotive products), reflecting the consequences of the ongoing shock, while potential slow recovery is expected next year (but dependent on the duration of the outbreak and policy effectiveness afterwards).

Regional Developments

- The World Bank lowered MENA growth forecasts: it expects GDP to decline by 1.1% this year (versus the previous forecast of a 2.6% rise). MENA economies will face USD 116bn in costs from the impact of both Covid19 and lower oil prices. Access the full report at https://openknowledge.worldbank.org/bitstream/handle/10986/33475/9781464815614.pdf

- As part of the overall stimulus package, Bahrain’s labour ministry disclosed plans to spend USD 570mn in payment of salaries of around 100k employees in the private sector during Apr-Jun; in addition, utilities bill payments will be covered for all citizens and Bahraini businesses.

- Bahrain will not collect rents and allowance from all tenants of municipal properties for three months starting from Apr, as part of relief measures launched after the Covid19 outbreak.

- Money supply in Bahrain increased by 7% yoy to BHD 13.8bn in Feb while retail banks’ outstanding loans and credit facilities inched up by 2.1% to BHD 9.8bn. The total outstanding balance of public debt instruments edged up by 4.3% to BHD 12bn.

- Aggregate balance sheet of wholesale and retail banks in Bahrain increased by 4.6% yoy to USD 204.9bn at end of 2019, with the former accounting for 54.1% of total assets, according to the central bank’s annual report for 2019.

- Bahrain will allow passengers to transit through the international airport, though entry into the country will be limited only to citizens.

- Egypt expects economic growth to slow to 4.5% in Q3 and to 1% in the last quarter of the fiscal year 2019-2020 (till Jun), revealed the planning minister. During the 2019-2020 year, annual growth is expected at 4.2% instead of 5.6% previously.

- Annual urban inflation in Egypt fell to 5.1% yoy in Mar (Feb: 5.3%) – the lowest level since Nov. Core inflation stood at 1.89% yoy in Mar (Feb: 1.9%).

- Net international reserves in Egypt dropped to USD 40bn in Mar – sufficient to cover 8 months of commodity imports – down from USD 45.5bn in Feb. About 5.4bn of reserves were used to cover imports of strategic goods, payment of international obligations related to external debt and to bridge the gap caused by the decline in FDI and portfolio investments.

- Egypt’s cabinet approved a six-month rescheduling and deferral plan on utility payments for tourist firms and private airlines. Additional support for tourism sector: a 6-month exemption from real estate taxes and all dues owed by such firms will be postponed for 3 months without penalties. The Central Bank of Egypt’s EGP 50bn financing initiative to support local tourism includes loans with a declining 8% interest as well as credit facilities with a maximum two-year repayment period.

- Free zones in Egypt are allowed to offer 50% of their production in the local market during a 6-month period starting Apr. Additionally, industrial projects at free zones can also offer 20% of their stock, including raw materials.

- Egypt’s ministers are taking a 20% pay cut for 3 months, with the funds being directed to support informal labourers during the Covid19 pandemic.

- About 13 industrial complexes in Egypt will receive EGP 5bn in funding – allotted for linking utilities – during the fiscal year 2020-21, according to the planning minister.

- Egypt plans to disburse 30% of due export subsidies with a minimum limit of EGP 5mn owed by the Export Development Fund.

- To support medium-sized firms’ access subsidized loans, the Central Bank of Egypt cancelled the EGP 1bn annual sales cap requirement to qualify for the EGP 100bn initiative aimed to support industrial, agricultural, and aquaculture production companies.

- Iraq’s president named intelligence chief Mustafa al-Kadhimi as prime minister-designate on Thursday, the third person nominated to lead the country in just 10 weeks.

- MSCI announced that it would postpone the entry of Kuwait’s listed companies into its emerging markets index from May given the ongoing Covid19 outbreak.

- Inflation in Kuwait increased by 1.67% yoy and 0.9% mom in Feb; excluding food and housing services, inflation increased by 1.39% yoy and 2.94% respectively.

- Fitch affirmed Kuwait’s long-term foreign-currency issuer default rating at AA with a stable outlook, citing the nation’s strong fiscal and external balance sheets

- Kuwait’s parliament called on the government to rewrite the public debt law in light of the ongoing Covid19 outbreak.

- Lebanon’s draft financial restructuring plan – still being discussed by the Cabinet – estimates the need for external financing to the tune of USD 10-15bn over the next five years. While international holders of the Eurobonds remain supportive of the proposal, a letter from an adviser to the Association of Banks in Lebanon words it strongly by stating the need to “protect the health of the banking sector and, more importantly, depositor monies”.

- Moody’s changed its outlook on Lebanon’s banking system to negative. It expects Lebanon’s banks to face major losses given its “heavy exposure to the sovereign”, and a high probability of funding and liquidity pressure with very low prospects of government support.

- Lebanon’s PM pledged to audit the central bank’s accounts to show transparency after launching debt restructuring talks with creditors.

- Oman has banned movement into and out of the governorate of Muscat from Apr 10-22.

- Oman’s health minister disclosed that Covid-19 tests and treatments will be done for free for all communities, including expats.

- Qatar’s GDP fell by 0.6% yoy (and 1.4% qoq) in Q4 2019, largely due to a 3.4% yoy decline in mining and quarrying while non-oil sector grew by 2% yoy (and 0.3% qoq).

- Qatar raised USD 10bn in a three-tranche bond, attracting around USD 45bn in orders; it still ended up offering some 40bps over its existing curve. According to the bond prospectus, the government has been asked to postpone USD 8.2bn worth of unawarded contracts on capital expenditure projects, given the ongoing pandemic.

- Saudi Arabia’s industrial production index declined by 5.72% yoy in Feb (Jan: -6.68%), thanks to dips in mining and quarrying (-3.38%) and manufacturing (-12.7%).

- SAMA’s new licensing rules introduced two new financing activities – digital finance intermediation and collection of financing agencies’ debts; paid-up capital required for these activities are set at SAR 2mn and SAR 10mn respectively.

- Fitch affirmed Saudi Arabia’s long-term foreign-currency issuer default rating at A with a stable outlook, though pointing to the nation’s weakening fiscal and external balance sheets.

- Saudi Arabia’s private sector has been permitted to cut employees’ wages and working hours, but only with the employees’ consent.

- Saudi Arabia cut domestic fuel prices: gasoline 91 will be priced at SAR 1.31 per liter from SAR 1.55 in the previous month, while gasoline 95 will be SR1.47 per liter from SR2.05.

- Saudi Arabia’s Social Development Bank launched a SAR 2bn (USD 530mn) “healthcare portfolio” to support established and new SMEs in the healthcare sector, offering financing solutions and flexible funding.

UAE Focus

- Abu Dhabi sold USD 7bn in bonds, receiving USD 44bn in orders for the debt sale. Sold in 3 tranches, it offered an interest rate equivalent to 220 bps over US Treasuries for USD 2bn in five-year bonds, 240 bps over the same benchmark for USD 2bn 10-year bonds and 4.1% for USD 3bn 30-year notes. This corresponds to about 30bps over its existing curve.

- The government of Dubai issued a Sukuk for the first time in four years: the AED 1bn (USD 272mn) eight-year sukuk at 4.7125% is in the form of a private placement and has been sold to the emirate’s banks.

- Dubai non-oil sector PMI fell to the lowest-ever reading of 45.5 in Mar (Feb: 50.1), with the employment sub-index dropping to 44.8 from 50.4 in Feb.

- Abu Dhabi nominal GDP grew by 4.6% yoy to AED 620bn (USD 169bn) during Jan-Sep 2019.

- Dubai government extended the closure of all non-essential commercial activities till April 18. Separately, Dubai’s department of finance has asked government agencies to cut administrative and general expenses by at least 20%, halt new hiring and also to postpone all construction projects that have not begun.

- Ajman’s Crown Prince announced initiatives to support firms affected by the Covid19 outbreak. For the trade and customs sectors, support includes paying customs duties with easy payments within 90 days, extending the free period for storing containers to 20 days from 10, and reducing container insurance fees by 50% for each container until end-Jun 2020. In the tourism sector, registration fees are exempt, payment of fines are postponed, and penalties are cancelled for tourism firms and hotels. For the real estate sector, initiatives include cancelling administrative fines for every violation of real estate registration renewal.

- The Dubai Financial Supervisory Authority (DFSA) announced relief measures for DIFC-based regulated firms: for new firms, there will be a 50% reduction in application fees for the remainder of 2020 and flexibility in requirements for permanent premises and for domestic funds, there will be a waiver of registration fees for the remainder of 2020. For existing firms, extension for filing returns and reports, flexibility in meeting Authorised Individual obligations, temporary relief from capital requirements for firms which do not hold or control Client Assets or hold Insurance Monies and a waiver of listing fees for new SME issuers in the DIFC for the remainder of 2020 (among others). The complete list is available at: https://www.dfsa.ae/MediaRelease/News/DFSA-Provides-Relief-Measures-for-DIFC-Firms

- Real estate transactions in Dubai grew by 10% yoy to 10,243 in Q1 this year. In the month of Mar, there were 3124 transactions to the tune of AED 6.99bn; this month also saw the highest number of mortgage registrations (+24.8% yoy to 1209) since Oct 2019.

- UAE’s banks have revealed their exposure to the hospital group NMC Health which recently revised its debt position to USD 6.6bn: ADCB (USD 981mn), Emirates NBD (AED 747.3mn including AED 676.5mn linked to Emirates Islamic Bank), Dubai Islamic Bank (USD 425mn) and Noor bank (USD 116mn).

- Emirates Airlines is looking to raise billions in loans from local and international banks, reported Bloomberg, after being promised Dubai government support the week before.

Weekly Insights: How are GCC nations financing the stimulus packages?

As the Covid19 pandemic continues to affect the GCC, imposing curfews and restrictions on movement has become the norm, alongside various levels of stimulus packages being rolled out to support the economies. The packages have a few measures in common – rate cuts, liquidity enhancing measures, deferring of loans/ credit card payments as well as support for SMEs and affected sectors (specifically trade, tourism and hospitality). Overall stimulus measures in the GCC have crossed over 10% of 2019 GDP and with the sharp dip in oil prices (and subsequent decline in revenues), options to finance this spending are via (a) spending cuts; (b) drawdown international reserves at the central banks; (c) support from SWFs; and/or (d) borrowing from international/ regional markets. However, with additional liquidity in the market, will banks be willing to lend to the public sector in need of funds or the private sector (with a higher risk of rising NPLs in the medium term)? There remains a significant risk of crowding out lending to the private sector.

Among the four options mentioned above, spending cuts have been common – from Oman slashing government companies approved expenditures by10% for 2020 to Saudi Arabia’s reducing 2020 budget by less than 5% or more recently Dubai asking its government agencies to cut administrative and general expenses by at least 20%. In addition, governments have also responded by cutting (mostly capital) spending (latest being Dubai and Qatar) magnifying the negative effect on the non-oil sector.

During the past week, Qatar and Abu Dhabi have tapped the market (option d) via bond sales – both offered at some 30-40bps above the existing curve – while the Dubai government raised AED 1bn from a private placement of a sukuk. Support from the central bank will likely be evident in the next few data releases: Egypt has already witnessed this. As for support from sovereign wealth funds, given lack of transparent data, it will be difficult to gauge the actual value, but their optimal role would be to: (a) tap into investments abroad (starting with sale of money market instruments like T-bills); (b) re-assess long-term investment strategies to play a larger role domestically in supporting local industries, innovation and developing digital assets.

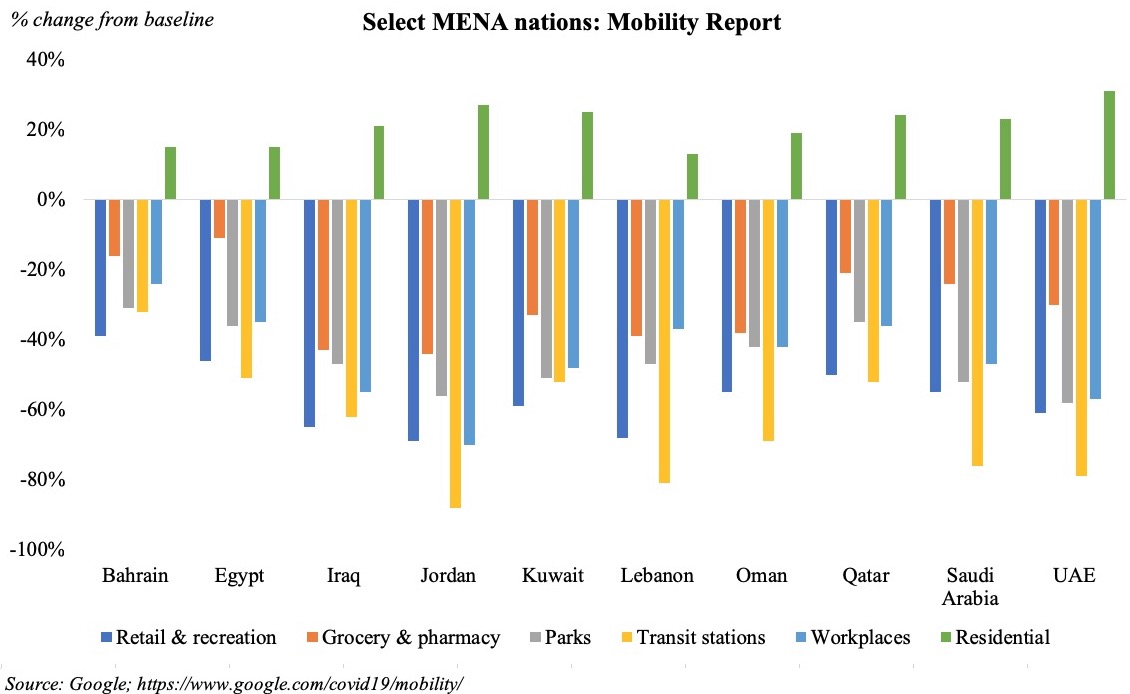

Chart of the Week – MENA Mobility Report

Most hit segments in the GCC are transport, followed by retail and recreation (except in Bahrain where the places are swapped). In Jordan and Lebanon, transport has declined by a substantial 88% and 81% respectively. With remote working practices encouraged across the MENA region, workplaces have taken an extreme hit in Jordan (-70%), UAE (-57%) and Iraq (-55%) compared to baseline levels.

With most GCC nations in lockdowns after Apr 5th, these numbers are likely to further dip in the next iteration of the data.

Notes: The reports show trends over several weeks with the most recent data representing approximately around Apr 5th. The baseline is the median value, for the corresponding day of the week, during the 5-week period Jan 3–Feb 6, 2020. Only data from users who have turned on the Location History setting will be used to create the reports. Currently, this setting is turned off by default.

Media Review

Covid-19 related articles on Project Syndicate

https://www.project-syndicate.org/commentary/west-must-learn-covid19-control-from-east-asia-by-jeffrey-d-sachs-2020-04

https://www.project-syndicate.org/commentary/mapping-covid19-global-recession-worst-in-150-years-by-kenneth-rogoff-2020-04

https://www.project-syndicate.org/commentary/will-covid19-remake-the-world-by-dani-rodrik-2020-04

How a “digital dollar” might work, thanks to coronavirus

https://www.technologyreview.com/2020/03/26/950277/we-just-glimpsed-how-a-digital-dollar-might-work-thanks-to-coronavirus

An unprecedented plunge in oil demand will turn the industry upside down

https://www.economist.com/briefing/2020/04/08/an-unprecedented-plunge-in-oil-demand-will-turn-the-industry-upside-down

The shape of economic recovery

China: https://www.ft.com/content/50ea1a73-f2e5-493d-a468-0b6111c3a2ef

https://t.co/YdwohmPRfh

Powered by: