This week’s “Weekly Insights” is a pictorial representation of the week’s key macroeconomic data releases.

Markets

Another negative week for markets as Covid-19 cases cross the million-mark, with US, Italy and Spain recording the maximum confirmed cases and deaths. Weak macro data in the US (non-farm payrolls, unemployment) and EU (PMIs/ business activity) led to sharp declines in the stock markets as well. Hopes of an oil ceasefire between Saudi Arabia and Russia led to an increase in the oil price (20%+ on Thurs), ending the week higher after 5 consecutive weeks of declines while also supporting stock market movements (benefiting Saudi’s Tadawul). Other regional markets ended in the red as the impact of Covid19 became more widespread given lockdowns across many nations (and districts). The dollar gained during the week as evidence became stronger that the global economy was headed for a recession in H1, while the euro declined by close to 3%. Gold prices closed slightly higher versus the week before.

Global Developments

US/Americas:

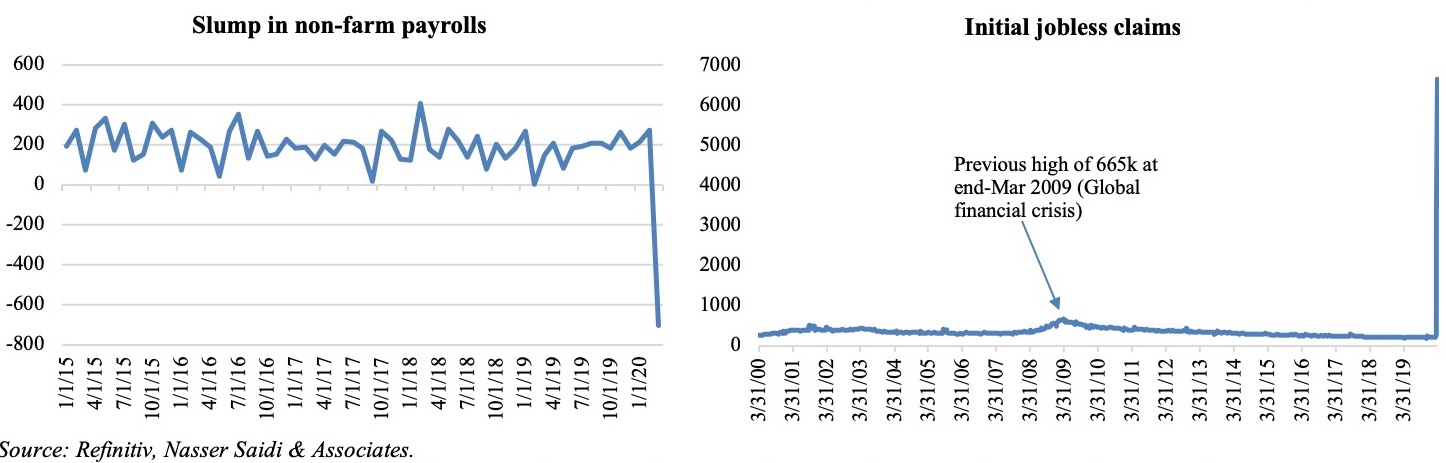

- Initial jobless claims soared to a historical record 6.65mn the week ending Mar 28 (from an upwardly revised 3.34mn the week before). This points to an unemployment rate of around 10% versus the official 3.5% rate in Feb (a 50-year low).

- Non-farm payrolls tumbled by 701k in Mar (Feb: +275k) – the first decline since Sep 2010, and largest drop in magnitude since Mar 2009. The survey numbers are based on data from Mid-Mar, before the record high jobless claims began to show up. Unemployment rate increased to 4.4% (Feb: 3.5%) – the highest level since Aug 2017.

- Factory orders remained unchanged in Feb, following a 0.5% decrease un Jan. Orders for non-defense capital goods excluding aircraft (a proxy for business spending) fell 0.9% in Feb while shipments of core capital goods were down by 0.8%.

- Pending home sales increased by 2.4% mom and 9.4% yoy in Feb (Jan: 5.7% yoy). S&P Case Shiller home price indices advanced by 3.1% yoy in Jan from 2.8% the month before. However, these figures are likely to crash in the months ahead given the covid-19 outbreak.

- US Chicago PMI slipped to 47.8 in Mar (Feb: 49), its 9th consecutive below-50 reading.

- ADP employment report showed that private sector employment decreased by 27k in Mar (Feb: -183k). The data needs to be taken with caution as it covers records only through the 12th of the month.

- ISM manufacturing PMI fell to a reading of 49.1 in Mar (Feb: 50.1), with the new orders and employment plunging to 11-year lows alongside declines in production. ISM non-manufacturing PMI slowed to a 3.5 year low of 52.5 in Mar (Feb: 57.3).

- US trade deficit narrowed to USD 39.9bn in Feb (Jan: USD 45.5bn), the lowest level since Sep 2016. Goods trade deficit with China dropped to USD 16bn – the lowest since Mar 2009.

Europe:

- Manufacturing PMI in Germany edged down to 45.4 in Mar (Feb: 45.7); in the UK, PMI eased to 47.8 from 48 the month before. Eurozone manufacturing PMI slipped to 47.8 in Mar (Feb: 48).

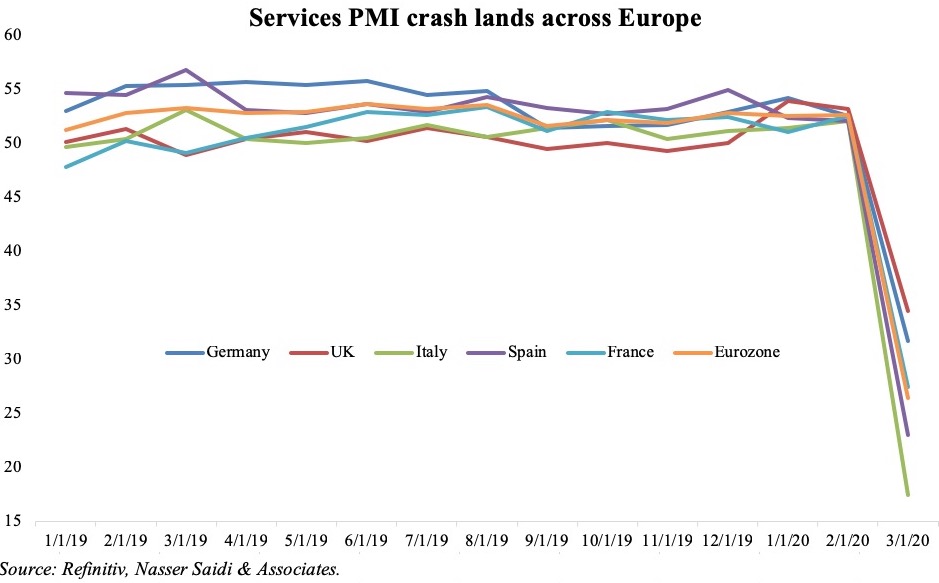

- Service sector activity plummeted across Europe: Germany, France and Spain touched record-low PMI readings while in Italy it plunged to 17.4. The Eurozone composite PMI dropped to 29.7 in Mar – the lowest in the survey’s history.

- CPI in Germany eased to 1.3% yoy in Mar (Feb: 1.7%) as energy prices dipped. In the wider eurozone, inflation fell to 0.7% yoy in Mar (Feb: 1.2%) while core inflation also slowed to 1% from 1.2%. Energy prices were down by 4.3% but unprocessed food prices increased by 3.5% as bulk buying increased.

- Unemployment rate in Germany remained unchanged at 5.3% in Feb: but since the data were collected before Mar 12, the impact of the coronavirus is unlikely to have been captured. Separately, it was reported that 470k companies had applied for funding under the short-time work scheme (“Kurzarbeit) – versus 1300 applications a month on average before -wherein the state replaces a large part of the lost income.

- Retail sales in Germany increased by 1.2% mom and 6.4% yoy in Feb (Jan: 1% mom & 2.1% yoy) after households stocked up ahead of restrictions on going out. Revenues of online and delivery services grew by 11% yoy and non-food sales were up by 5.6%.

- Retail sales in the EU increased by 0.9% mom and 3% yoy in Feb as consumers stockpiled food (+2.4%) and on higher online spending (+5.6%).

- UK’s final GDP estimates reveal a 1.1% yoy growth in Q4, remaining flat in qoq terms. Total business investment declined by 0.5% qoq (Q3: -1%).

Asia Pacific:

- The People’s Bank of China unexpectedly cut the 7-day reverse repo to 2.2% from 2.4%, injecting CNY 50bn into the interbank market. This move came after the withdrawal of CNY 33bn of liquidity on the day before (28 Mar).

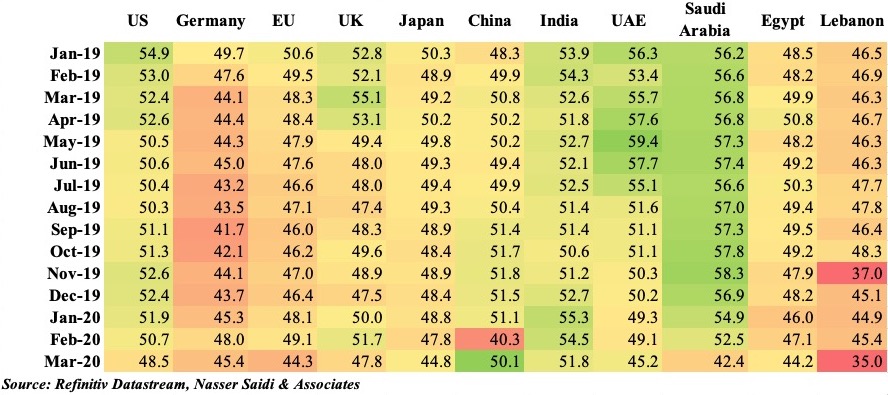

- Some PMI relief in China’s Mar reading after the dip in Feb: NBS manufacturing PMI increased, rising to 52 (Feb: 35.7), thanks to an improvement in new orders supported by domestic demand. Non-manufacturing PMI improved to 52.3 from Feb’s 29.6, largely due to increases in business activity and expectations to above 50 while others like new orders, prices, and employment remained sub-50.

- China’s Caixin manufacturing PMI rebounded to 50.1 in Mar (Feb: 40.3) though Caixin services PMI stayed below-50, clocking in at 43 in Mar (Feb: 26.5).

- Japan’s Tankan large manufacturing index decreased to -8 in Q1 (Q4: 0) – the first negative reading in 7 years – while the outlook fell further to -11 from 0 the month before.

- Japan’s final manufacturing PMI reading fell to a seasonally adjusted 44.8 in Mar (Feb: 47.8), its lowest since Apr 2009. Services PMI tumbled to 33.8 (Feb: 46.8), the lowest since Feb 2009, while the composite PMI was down to 36.2 (Feb: 47), the lowest since Mar 2009.

- Industrial production in Japan fell by 4.7% yoy in Feb (Jan: -2.3%); in mom terms, it advanced by 0.4% following a 1% growth the month before. The METI revised its assessment of industrial production, stating that it fluctuates indecisively but has weakened.

- Japan’s unemployment rate stayed unchanged at 2.4%. Retail trade grew by 1.7% yoy in Feb compared to a 0.4% dip in Jan though in mom terms growth slowed to 0.6% following a 1.5% rise in Jan.

- Korea’s industrial output declined by 3.5% mom in Feb – the sharpest decline since Feb 2011. Production in the mining, manufacturing, gas and electricity industries also fell 3.8%, recording the sharpest fall since Dec 2008.

- Singapore retail sales declined at the fastest (mom) pace in 12 years, recording a dip of 8.9% mom and 8.6% yoy in Feb, as the coronavirus impact tourism and hospitality sectors. Excluding motor vehicles, retail sales fell by a larger 10.2% yoy.

Bottom line: As macroeconomic data continue its disappointing run across much of Europe and the US, countries and central banks are simultaneously rolling out unprecedented stimulus packages to counter the impact of the Covid19 outbreak. Though the banking sector has been tasked with supporting SMEs during these troubled times, it remains to be seen if these monies eventually filter out to those in need (additional input on Gulf banks in the Media Review section). China’s latest PMI readings seem to be very positive – but remember that not all businesses in China have returned to normal capacity, global demand is still weakening, and supply chain links are still broken. Global PMI fell by a new record of 6.7 points to 39.4 (the lowest since Feb 2009) while the service sector’s decline was the steepest in 22 years. Meanwhile the oil price war continues to splutter after some positive moves towards end of last week. The IMF also warned that the economic impact of the Covid19 pandemic would be worse than the 2008 financial crisis.

Regional Developments

- The oil war heats up again: last week saw Trump claim that he had negotiated a ceasefire between Saudi Arabia and Russia, which would lead to a drop in production. This was followed by Saudi Arabia’s state media reporting that an emergency meeting had been called to discuss a fair oil arrangement. However, tempers have since flared with Russia accusing Saudi Arabia of pressuring the US shale industry and Saudi’s foreign minister rejecting this contention – OPEC sources believe that the virtual meeting scheduled for Apr 6th will likely be delayed.

- Bahrain’s exports increased by 11% yoy to BHD 196mn in Feb, with Saudi Arabia, UAE and US the top destinations. The top 10 trading partners accounted for 85% of the total exports.

- The Ministry of Finance disclosed that Bahrain had paid back USD 1.25bn in bonds that matured on Mar 31.

- Expat workers in Bahrain’s private sector declined by 0.8% yoy to 498k last year while the number of Bahrainis in the private sector inched up by 1.5% to 106k.

- Bahrain’s judicial system has launched electronic procedures and become operational online: this allows for the electronic filing of cases, submission of defence statements, pleadings and applications to the courts during all stages of the case, including issuance of judgements.

- Egypt’s central bank imposed temporary limits on daily withdrawals and deposits amid the spread of coronavirus. The apex bank called for the use of electronic transfers and e-payments as the daily limits were capped at EGP 10k (USD 640) for individuals and EGP 50k for companies. Banks also cancelled fees on transfers and e-payment methods. Separately, there were over 5mn beneficiaries of the CBE initiative to postpone loan installment payments, as per a central bank source.

- The Central Bank of Egypt left policy rates unchanged at the latest meeting, following a 3% cut at an unscheduled meeting in mid-Mar. The overnight lending rate stands at 10.25% and the overnight deposit rate at 9.25%.

- Egypt’s non-oil sector PMI declined to 44.2 in Mar (Feb: 47.1) – the quickest fall since Jan 2017 – as the outbreak affect the tourism and hospitality sectors. Output fell the most in over three years, new orders shrank, and export sales declined at the fastest rate in over seven years.

- Money supply in Egypt increased by 13.96% yoy to EGP 4.2trn (USD 267.69bn) in Feb. Foreign reserves edged up by 0.13% mom to USD 45.51bn in Feb.

- Egypt’s balance of payments surplus touched USD 410mn in Jul-Dec (H1 FY 2019-2020) and can be compared to a deficit of USD 1.8bn in the same period a year ago. Current account deficit narrowed by 13.6% yoy to USD 4.6bn during the period, thanks to a decline in non-oil trade deficit. Tourism receipts during the period grew by 6.8% yoy to USD 7.25bn while remittances were up 13.5% to USD 13.68bn.

- FDI into Egypt declined by 5.8% to USD 2.61nm in Q4 2019 while net portfolio investment surged to USD 2.26bn from -USD 2.65bn in Q4 2018.

- Egypt’s revenues are expected to rise to EGP 1.3trn (USD 82bn) in the fiscal year 2020-21, and with spending estimated to increase 9% yoy to EGP 1.71trn, the nation is looking at a deficit of 6.3% of GDP (vs a target of 7.2% in the current budget).

- Egypt’s finance ministry plans to issue T-bills and bonds worth EGP 610bn (USD 38.74) in the 3 months starting Apr 1, to finance the budget deficit (estimated to touch EGP 445.1bn by end FY 2019-20).

- Mortgage finance in Egypt surged by 46.6% yoy to EGP 168.5mn in Jan, according to the Financial Regulatory Authority.

- Egypt welcomed 13.1mn tourists in 2019, up from 11.3 and 8.3mn respectively in 2018 and 2017. Revenues increased by 12.5% yoy to a record high of USD 13.03bn, versus the previous peak of USD 12.5bn touched in 2010 (from 14.7mn tourists). The tourism sector is estimated to lose between USD 2.5-3bn by mid-Apr, a month since international flights were suspended.

- Nearly 1.7mn SMEs in Egypt employ around 5.8mn persons and operate with EGP 77.1bn (USD 4.9bn) capital, revealed the Chairman of the Central Agency for Public Mobilization and Statistics.

- Jordan imported about 310k barrels of oil from Iraq in Mar, according to the former’s energy minister, with a daily average of 10k barrels a day.

- To support businesses impacted by Covid-19 outbreak, the central bank of Jordan launched a JOD 500mn (USD 704.5mn) soft financing programme for SMEs, with the Jordan Loan Guarantee Corporation acting as guarantor. With a one-year grace period, the interest rate of the loans is less than 3.5% while the loan guarantee level is 85% (higher than 70% normally).

- Jordan observed a 24-hour lockdown on Thursday, with closure of permitted commercial stores and a ban on movement of people.

- Kuwait’s central bank’s stimulus package to support SMEs and key sectors from the Covid19 outbreak included a cut in capital adequacy requirements by 2.5% and easing the risk weighting for SMEs to 25% from 75%. This is in additional to an earlier move during the week to provide soft long-term loans from local banks and postpone loan repayments by 3 months. Government agencies were also directed to pay obligations to the private sector as soon as possible.

- Moody’s placed Kuwait’s Aa2 rating on review for a downgrade, citing a “significant” decline in government revenues in line with the sharp fall in oil prices.

- Kuwait’s oil exports to Japan fell by 8% yoy in Feb to 7.5mn barrels or 259k barrels per day.

- Lebanon’s central bank announced the launch of a foreign exchange unit to centralise the parallel exchange rate. The pound has traded around 2,800 pounds to the dollar in the parallel market, nearly 50% weaker than the official peg of 1,507.5 (in place since 1997).

- Lebanon will allow deposits of USD 3k or less to be withdrawn in Lebanese pounds at the “market” rate, as per a central bank circular. Though the market rate was not defined initially, another statement detailed that the scheme would run for three months and that the rate would be set daily via an electronic platform including local lenders, the central bank and exchange bureaus.

- PMI in Lebanon slipped to 35.0 in Mar from a reading of 45.5 in Feb, recording the sharpest deterioration in business conditions; new orders and output sub-indices fell to historic lows.

- The World Bank approved a USD 40mn loan to Lebanon to support its fight against the spread of Covid19. The loan will support 3 main areas of “surveillance and case detection, case management and protection of health workers, multisectoral response to support multisectoral activities”.

- Oman’s ruler issued a decree to set up a new tax administration system.

- Moody’s placed the Ba2 issuer rating of the government of Oman under review for a downgrade, citing “increased external vulnerability and government liquidity risks”.

- Bloomberg reported that Qatar had hired banks to raise more than USD 5bn in bonds to support its finances (given the double whammy of lower oil prices and the spread of Covid19) as early as this week.

- Qatar government has instructed private sector companies to have 80% of their staff work from home, effective Thurs (Apr 2) for an initial 2 weeks. The working day will be reduced to six hours, from 7:00 a.m. to 1:00 p.m., excluding grocery stores, pharmacies and restaurants.

- The chief executive of Qatar Airways disclosed to Reuters that though the airline remains operational (it expects to operate around 1800 flights over 2 weeks), it would “eventually” reach out to the government “for equity” injection.

- Saudi Arabia’s non-oil sector activity posted the biggest drop in the PMI survey’s history when it fell to 42.4 in Mar from 52.5 in Feb; this is also the first time the index is below the 50-mark.

- The King ordered Saudi Arabia’s government to pay 60% of salaries of Saudi employees working in the private sector for 3 months, estimated to amount to SAR 9bn (USD 2.39bn).

- Saudi Arabia imposed a 24-hour curfew from Thurs (Apr 2) in Mecca and Medina “until further notice” while making exceptions for workers to leave their homes for approved jobs. A curfew was imposed also in Dammam, Taif and Qatif starting Fri 3pm till further notice.

- Saudi Arabia’s minister for Hajj and Umrah asked Muslims to put Hajj plans on hold until there is more clarity about the spread of Covid19. The Hajj, which has been cancelled only 40 times in history, is a major source of non-oil revenue and supports non-oil sector activity.

- In a bid to support companies affected by the outbreak, Saudi Arabia’s central bank has asked that banks agree to restructure financing for customers without extra fees and provide financing needed by private sector customers who were made redundant during this time.

- Saudi Arabia’s Ministry of Human Resources and Social Development allocated SAR 17bn (USD 4.5bn) to deal with the economic impact and job losses from the Covid19 crisis. Under new rules, expat workers whose residency permits expire before Jun 30 will be exempt from financial fees and their permits extended for three months.

- Saudi Arabia approved (either direct or indirect) IPO stock listings of government assets planned for privatisation in Tadawul. According to the statement, indirect IPOs for assets would be done via setting up companies that own the government stakes in these projects.

- Saudi Arabia’s FDI grew by 1.97% yoy to SAR 885.62bn (USD 236.17bn) last year, as per SAMA data; net FDI increased by 12.87% to SAR 17.1bn in 2019.

- Banks in Saudi Arabia raised investments in government issued bonds by 20.7% yoy to SAR 400.2bn (USD 106.72bn) in Feb 2020.

- Saudi Arabia pumped more than 12mn barrels of oil for the first time in its history. It was also reported earlier in the week that plans were on to increase its crude oil exports by about 600k barrels per day (bpd), taking the total to 10.6mn bpd, starting from May.

- Saudi energy firms pledged SAR 525mn (USD 140mn) – of which Aramco contributed SAR 200mn – in the fight against the covid19 outbreak.

- The electricity grids of Egypt and Sudan were officially connected last week, with an initial capacity of 60 megawatts.

- ESCWA estimates that an additional 8.3mn persons would fall into poverty in the Arab region. This could also raise the number of unnourished persons by some 2mn. The report: https://www.unescwa.org/sites/www.unescwa.org/files/en_20-00119_covid-19_poverty.pdf

UAE Focus

- The UAE initiated an indefinite lockdown/ national sterilization drive starting Apr 5. While metro and tram services have been suspended, public buses and taxis will remain available (with the latter slashing rates by 50%). Dubai imposed a 2-week 24-hour lockdown following a shutdown initiated earlier in the densely-populated Al Ras district. UAE also extended schools’ closure till end of the academic year (Jun).

- The UAE central bank announced new measures to ease financial and liquidity requirements: this includes a 50% reduction in reserve requirements for demand deposits to 7% (releasing ~ USD 16.6bn in liquidity) in addition to allowing banks to defer payments of loans until end-2020.

- UAE PMI slipped to 45.2 in Mar (Feb: 49.1) – the biggest decline ever – and employment in the non-oil private sector contracted at the quickest rate ever.

- The value of UAE’s non-oil trade increased by 3.3% yoy to AED 786bn in H1 2019. Re-exports increased by 3% yoy to AED 226.2bn while imports grew by 1.4% to AED 44bn.

- The UAE announced the appointment of a new central bank governor Abdulhamid Saeed replacing the previous governor whose tenure began in 2014.

- Dubai Expo organisers have officially proposed 1st Oct 2021 as the new starting date for the 6-month long event. BIE is set to decide on it at the next meeting to be held on Apr 21.

- Dubai government revealed its commitment to inject liquidity into Emirates airlines.

- Abu Dhabi has been ranked the most livable city in the Arab world, followed by Dubai, according to the EIU’s Global Liveability Index.

Weekly Insights: Charts of the Week

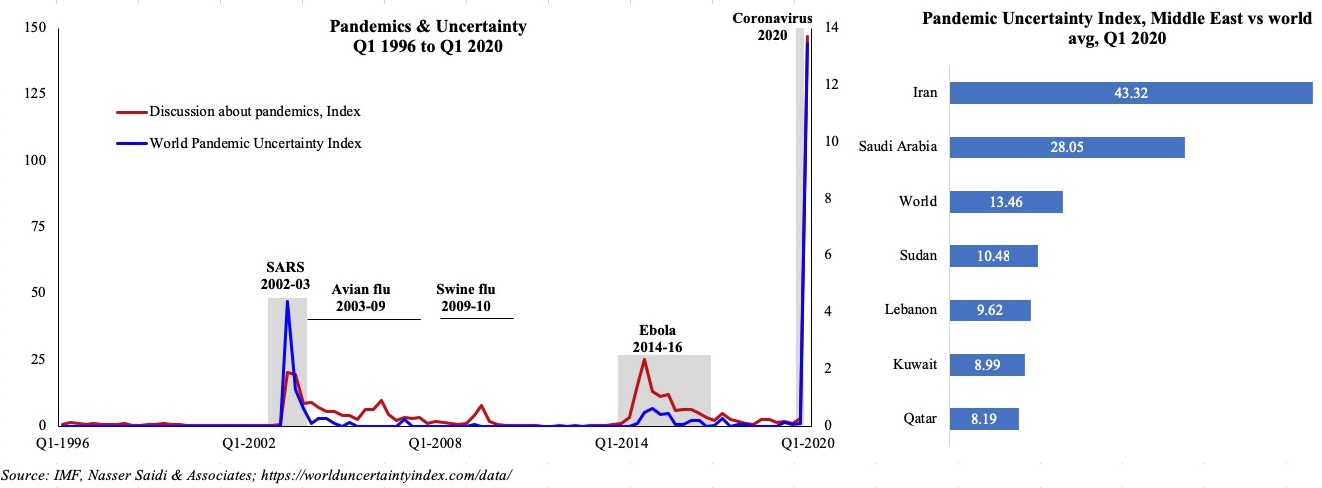

- World Pandemic Uncertainty Index: the current Covid19 outbreak is 3X the size of the uncertainty during the 2002-03 SARS epidemic & ~20X the size during the Ebola outbreak.

- US non-farm payrolls dips and unemployment rate rises but brace for further declines as the timing of data collection was prior to the drastic rise in past 2 weeks. Initial jobless claims have risen over 10mn over past two weeks, likely to push unemployment rate closer to 10%.

- Manufacturing PMIs deteriorated everywhere except in China

4. Services PMIs collapse across Europe

Media Review

Gulf banks put brakes on lending as dollar liquidity crunch looms

https://www.reuters.com/article/us-health-coronavirus-gulf-banks/gulf-banks-put-brakes-on-lending-as-dollar-liquidity-crunch-looms-idUSKBN21J5HR

Oil row rumbles on as crisis talks are postponed

https://www.arabnews.com/node/1653346/business-economy

Option-Based Credit Spreads Signal a Recession, but the US Stimulus Will Soften the Blow

https://promarket.org/option-based-credit-spreads-signal-a-recession-but-the-us-stimulus-will-soften-the-blow/

Global Uncertainty Related to Coronavirus at Record High

https://blogs.imf.org/2020/04/04/global-uncertainty-related-to-coronavirus-at-record-high

Powered by: