This week’s “Weekly Insights” compiles the latest responses from GCC nations to tackle the ongoing Covid19 outbreak. The plunge in oil price is adding fuel to the fire! Read our take on the state of fiscal balances in the near- to medium-term.

Markets

Central banks across the globe announced measures to support markets as more and more countries started to embrace shutdowns/ social distancing and stay-at-home policies. Though US stocks partially rebounded from Monday’s historic sell-off, the S&P still posted a weekly decline of around 15%. Early gains or rebounds across global markets after stimulus announcements remained short-lived after imminent global economic slowdown (at least in this quarter and next) dampened spirits. Regional markets remained mostly in the red (except Qatar) – stimulus announcements notwithstanding – as it battled the effects of both the Covid19 outbreak, global financial contagion, and falling oil prices. Emerging market currencies continued in a rut on a stronger dollar (tmsnrt.rs/2egbfVh); following the surprise BoE rate cut, the GBP sank to the lowest since 1985; euro stayed near a three-year low, also recording the steepest weekly decline since mid-2015. Oil markets were extremely volatile and fell for the 4th consecutive week, with prices closing at less than half their price in Jan (Brent crude briefly moved above USD 30 mark on Fri); in spite of Fri’s rally, gold price dipped in weekly terms.

Global Developments

US/Americas:

- US Fed lowered interest rate to near zero (by a total of 1.5 ppts since Mar 3), lowered the discount rate (to 0.25% from 1.75%, lower than during the Great Recession of 2007-2009), opened dollar swap lines and stepped up asset purchases (buy at least USD 500bn in Treasury securities and USD 200bn in mortgage-backed securities over “the coming months”).

- Industrial production in the US rose by 0.6% mom in Feb (Jan: -0.5%) while manufacturing rose by just 0.1% after a downwardly revised fall by 0.2%. Capacity utilization improved to 77% from 76.6% the month before.

- US retail sales dropped by 0.5% mom in Feb (Jan: 0.6%) – the biggest drop since Dec 2018; excluding autos, retail sales fell by 0.4%.

- Building permits declined by 5.5% to 1.464mn in Feb; housing starts fell by 1.5% to 1.599mn. Existing home sales increased to 5.77mn in Feb, rising by 6.5% mom, following a 1.3% dip the month before.

- The New York Fed’s Empire State business conditions index fell in Mar to its lowest level since 2009: down 34 points to -21.5. Separately, the Philadelphia Fed Factory Index plunged to -12.7 in Mar (Feb: 36.4), the biggest one-month decline in the survey’s history.

- Initial jobless claims increased to 281k in the week ended Mar 13 while the 4-week average increased to 232.25k. Expect a massive increase in the coming weeks.

Europe:

- The ECB launched a new asset purchase programme to support the region during the ongoing Covid19 outbreak. The EUR 750bn Pandemic Emergency Purchase Programme (PEPP) will extend until the end of 2020.

- The ZEW survey showed a plunge in German economic sentiment to -49.5 in Mar (Feb: +8.7) – the largest drop since the survey started in Dec 1991 – while the current situation reading dropped to -43.1 (Feb: -15.7). The EU ZEW economic sentiment dropped to -49.5 in Mar (Feb: 10.4) – the lowest since Dc 2011.

- German producer price index declined by 0.4% mom in Feb, partially reversing Jan’s 0.8% rise.

- The Bank of England delivered a second emergency rate cut, leaving interest rates at 0.1%, while also ramping up its bond-buying program (to GBP 645bn from GBP 435bn).

- UK ILO unemployment rate edged up to 3.9% in the 3 months to Jan from the previous reading of 3.8%. The number of people out of work rose by 63k to 1.34mn – the biggest increase since late 2011; number of employed people rose by 184k to a record high 32.99mn.

- Wage growth in the UK picked up, with average earnings including bonus rising by 3.1% yoy (Dec: 2.9%).

Asia Pacific:

- Covid19 hits China’s economy hard in Jan-Feb: fixed asset investment plunged by 24.5% yoy in Jan-Feb (Jan: +5.4%) to CNY 3.3trn (USD 471bn); industrial production tumbled by 13.5% yoy in Jan-Feb (Jan: 6.9%) – the sharpest drop in 30 years; retail sales dropped by 20.5% yoy (Jan: +8%). Meanwhile, the PBoC left its benchmark loan prime rates unchanged at 4.05% (following the previous week’s cut in required reserve ratio).

- The Bank of Japan, at its latest policy meeting, left rates untouched while deciding to pump more liquidity: this includes starting a new loan program for companies, boosting exchange-trade fund purchases, and conducting swap operations. The BoJ purchased JPY 1.3trn (USD 12bn) of government bonds on Thursday to curb rising long-term yields.

- Japan machinery orders rebounded by 2.9% mom in Jan (Dec: -11.9%) – but this uptick in data is prior to the spread of Covid19 globally. Industrial production in Japan rose by 1% mom in Jan, with shipments rising by 0.6% and inventories declining by 1.6%; in yoy terms, industrial output slipped by 2.3% yoy in Jan (Dec: -2.5%).

- Japan trade balance reported a surplus of JPY 1.1trn in Feb (Jan: JPY 1.3trn deficit) – its largest since Sep 2007 – as imports plunged by 14% yoy and exports slipped for the 15th consecutive month (-1%). Imports from China fell at the fastest pace since 1986 (-47.1%).

- Core inflation in Japan eased further to 0.6% yoy in Feb (Jan: 0.8%) as energy prices fell; the core-core price index (excluding energy prices in addition to food) rose 0.6%.

- Japan’s all industry activity edged up by 0.8% mom in Jan (Dec: -0.1%), thanks to an uptick in construction output and tertiary industry activity.

- Other central bank activity: The Bank of Korea cut the benchmark rate by 50bps to a record low of 0.75% in a bid to support the plunging stock market. The Bank of Thailand decided at an emergency meeting to cut its key interest rate to 0.75%, a historical low.

Bottom line: Italy’s death toll from Covid19 has already surpassed that of China (toll continues to surge in Italy and Spain with Sat the worst day for mortalities); China meanwhile has reported no new cases of the coronavirus for the 1st time since the outbreak began. As the pandemic continues to grow amid calls for social distancing and “flattening the curve”, the ILO projects that the pandemic could cause about 25mn job cuts. Data from China for Jan-Feb shows how drastic the economic impact of the outbreak is and given its widespread transmission across the globe, the recovery stage is far afield: even as China recovers (given recent resumption of work, government’s plans for “new infrastructure” might drive investment etc.), global demand would remain dented and global supply chains would still be broken. Plus, the questions remain on the extent of the spread of Covid19 to India, Latin America and Africa, and whether the infections will re-emerge as virus-related restrictions are eased. Central banks in the US, Canada, UK, Australia, South Korea, Taiwan, Norway and Brazil have all cut rates in March (some twice), while the ECB and Bank of Japan have expanded their quantitative easing as their interest rates were already in negative territory. Last, but not the least, corporate borrowing costs are soaring (https://on.ft.com/2UbBTl6).

Regional Developments

- Central banks in the region cut interest rates following the Fed cut to near zero, given the peg to the dollar. Kuwait’s central bank cut its deposit rate by 100 bps to 1.5%, its lowest ever; in Saudi Arabia the repo and reverse repo were lowered by 75bps; UAE lowered the interest rate on 1-week certificate of deposit by 75bps and other rates by 50bps. The Qatar Central Bank also cut the main interest rates by 50bps.

- All GCC nations have introduced stimulus packages to support their economies through the Covid19 outbreak. Our weekly insights section compiles the latest responses.

- Bahrain’s economic stimulus package worth BHD 4.3bn (USD 11.3bn) has 8 initiatives including a doubling of the Liquidity Fund to BHD 200mn, a waiver on utilities bills for 3 months, delay of loan installments for 6 months (not a blanket waiver, but for those impacted by the outbreak), exempting tourism fees for 3 months and supporting wages of Bahrainis in the private sector among others.

- Bahraini nationals can delay payments of loan installments by 6 months, according to the central bank: this covers credit cards but does not include inter-bank deposits or borrowings. The waiver (applicable from Mar) is without fees, compound interest or increase in the profit or interest rate.

- In a bid to meet emergency expenses, Bahrain’s finance minister has been authorized to withdraw directly from the public account, without exceeding 5% of total appropriations for the current fiscal year’s budget.

- Electronic fund transfers in Bahrain surged by 82% yoy in 2019: with 300k registered users and over 2,300 merchants, the electronic payment solution BenefitPay reported overall transactions of 6mn by end-2019.

- Egypt’s central bank lowered interest rates by 300bps at an unscheduled meeting: it cut the overnight deposit rate, overnight lending rate, and the rate of the main operation by 300bps to 9.25%, 10.25% and 9.75%, respectively. The discount rate was also lowered by 300bps to 9.75%. The apex bank also announced that all debt payments for institutions and individuals will be delayed for six months, including loans for consumption, personal mortgage loans. Banks were asked to raise daily transaction limits on credit cards, as well as cancel fees and commissions applied at points of sale and ATMs.

- Egypt central bank’s new initiative for non-performing loans (effective until Mar 31, 2021): the bank will cancel around EGP 10bn in debt owed to banks by 940k customers. The decision includes all NPLs whether the debtors are facing legal procedures or not. (The CBE circular – in Arabic – https://bit.ly/3dktjbp)

- In response to the covid19 outbreak, Egypt announced the closure of all cafes, malls and sporting clubs in the evenings (from 7pm to 6am) until Mar 31. In addition, there is a flight ban in place (from Mar 19th, except for outward-bound flights needed by foreign tourists) and a nation-wide school shutdown for 2 weeks.

- To support the economy during the outbreak, Egypt gave a 3-month grace period for real estate tax payment for factories and tourism facilities, reduced the price of natural gas and electricity for the industrial sector, lowered stamp taxes on transactions on the stock exchange, reduced taxes on dividends from listed companies and exempted non-residents capital gains taxes on bourse transactions. It is estimated the tourism sector will incur losses of up to USD 1bn monthly given suspension of flights (and subsequent loss in revenues) while exports are likely to drop by 25% this year.

- Egypt recorded a primary surplus of EGP 38bn in Jul 2019-Feb 2020, representing 0.6% of GDP (vs EGP 28.5bn or 0.5% of GDP in the same period a year ago). The overall budget deficit remained unchanged at 4.9% of GDP during the 8-month period.

- Egypt raised income tax exemption cap for employees to EGP 15k from EGP 8k; the government will introduce a new tax bracket of 2.5% on those earning less than EGP 35k annually, down from 10%.

- Egypt will allocate EGP 1bn (USD 63mn) in export subsidy arrears to be paid in Mar and Apr, as part of a previously announced programme. Additionally, a cash payment of 10% will be done in Jun to support exporters, revealed the PM.

- Egypt increased its holdings of US Treasuries by 4% yoy and 0.5% mom to USD 2.192bn in Jan. Overall GCC investments in Treasures picked up by 0.59% mom to USD 278.912bn.

- Remittances into Egypt grew by 5.1% yoy to USD 26.8bn in 2019 (2018: 3.1%), reported the central bank.

- Textile exports from Egypt declined by 0.4% yoy to USD 257mn in Jan: exports of ready-made garments fell by 3% while exports of home furnishing and textiles rose by 9% and 2%.

- Women beneficiaries in Egypt received a total of EGP 242bn (USD 15bn) during Jul 2018-Dec 2019, disclosed the minister of planning and economic development. She also stated that women accounted for 5% of total micro- and small funding at a total value of EGP 3.8bn.

- Jordan, in an attempt to contain the spread of Covid19, has suspended work in the public and private sectors for two weeks as well as closed banks (till Mar 31).

- The Central Bank of Kuwait issued KWD 290mn (USD 943.39mn) worth of bonds and related tawarruq.

- In addition to the economic and financial stimulus measures, schools and colleges in Kuwait will remain suspended till Aug 3.

- Fitch downgraded Lebanon’s long-term foreign-currency IDR to “RD” from “C”.

- Lebanon declared a medical state of emergency last Sun, also ordering closure of borders, ports and airport from Mar 18-29.

- Oman’s central bank announced that it would provide OMR 8bn (USD 20bn) in extra liquidity to banks as part of measures aimed at supporting the economy. This includes reducing banking fees, lower capital conservation buffers, a deferment of loan instalments / interest / profit for affected borrowers, particularly SMEs (with immediate effect for the next 6 months) as well as increase lending ratios for various economic sectors. In addition, other measures including tourism and municipality tax breaks, free government storage facilities and postponement of credit instalment payments were also announced.

- Oman, in light of its Covid19 response, will review budget every three months. The finance ministry slashed the approved budgets of civil, military and security agencies by 5% this year. Furthermore, the ministry specified that no further funding would be provided if ministries did not stick to the revised budgets.

- The Capital Market Authority in Oman ordered joint-stock companies and investment funds to suspend holding ordinary general assemblies until further notice.

- Hotel revenues in Oman dropped by 9.2% yoy to OMR 20.64mn (USD 53.4mn) in Jan. Occupancy rates were down by 10.4% to 55.9% (vs 62.5% in Jan 2019).

- Qatar announced a USD 23.3bn stimulus package to combat the economic impact from the Covid19 epidemic: this includes QAR 75bn (USD 20.6bn) to provide financial and economic incentives for the private sector in addition to directing govt funds to increase investments in the stock exchange by QAR 10bn (USD 2.75bn). Qatar Development Bank will also postpone installments for all borrowers for 6 months.

- Saudi Arabia will roll out SAR 120bn worth measures to support the private sector. This includes exemptions and postponement of some government dues, postponing payments of VAT, excise tax, income tax, Zakat declaration and payments due for a period of 3 months, and postponing the collection of customs duties on imports among others.

- Saudi Arabia will cut SAR 50bn (USD 13.32bn) from the 2020 budget – representing less than 5% – in areas with the least social and economic impact, according to the finance minister.

- Saudi Arabia’s Ministry of Human Resources and Social Development announced 7 private sector initiatives to reduce the burdens related to manpower, to be in force till the virus disappears. This includes lifting the halts on wage protection (in the current phase), on non-payment of fines, fines pertaining to recruitment of workers and the like.

- Saudi Arabia suspended work for most private sector for 15 days and have called for work-from-home policies. This is in addition to previous moves suspending attendance for employees in government agencies (including at the central bank and banks), closing mosques, schools, restaurants, coffee shops and malls; entry and prayer in the outer courtyards of Two Holy Mosques in Makkah and Madinah has been suspended.

- SAMA issued a series of measures for banks and financial institutions in the backdrop of Covid19: it will suspend freezes on client bank accounts for 30 days in specific situations (in case of not completing KYC, expiry of identification documents etc.) and increase purchase limits; in addition, business continuity plans had been activated.

- Saudi Arabia’s crude exports fell to 7.29mn barrels per day (bpd) in Jan from Dec’s 7.37mn bpd while production touched 9.748mn bpd in Jan.

- Saudi Arabia’s energy ministry confirmed that Aramco would be supplying crude oil at a record 12.3mn barrel per day (bpd) in the coming months, with oil exports to top 10mn bpd from May (another record high).

- Aramco’s CFO, during a conference call, stated that the company has “massive capacity” to borrow, but that it does not need additional debt. Aramco had previously confirmed that it was “very comfortable” with a price of USD 30 per barrel.

- Saudi Arabia detained 298 public officials on crimes (bribery, embezzlement and abuse of power) to the tune of SAR 379mn (USD 101mn). While no further details were provided on the cases, it was disclosed that the detained included persons from the defense ministry, judges and university officials.

UAE Focus

- Abu Dhabi announced an economic stimulus package, fast tracking the implementation of Ghadan 21 initiatives. It also includes utilities subsidies (AED 5bn), free road tolls till end-2020, exemption of all commercial and industrial activities from Tawtheeq fees, exemption of individual and commercial real estate registration fees this year, suspension of bid bonds, settling all approved government payables and invoices within 15 working days, waiving all current commercial and industrial penalties, and reducing industrial land leasing fees by 25% for new contracts among others.

- The UAE has restricted entry to all except UAE nationals – but including valid residence visa holders – for 2 weeks from noon Thursday. Additionally, the issuance of all types of labour permits has been suspended (including for drivers and domestic workers) effective Mar 19 until further notice – this exempts intra-corporate transfer & Expo 2020 Dubai permits.

- UAE’s Emirates Airlines announced the suspension of all passenger flights by March 25, but will retain its cargo operations.

- Given the ongoing measures to contain the spread of Covid19 globally, the Expo 2020 Dubai convened a virtual steering committee with the representatives of the countries taking part (in the Expo, in 7 months’ time) and assured that “all sensible precautions” will be taken “to manage and mitigate risk to all those involved”. Work is still continuing at the event site.

- Assets of the UAE central bank increased by 10.3% yoy to AED 457bn at end-Feb, driven by a rally in cash and bank balances. Deposits at the central bank increased by 24.3% yoy to AED 143.4bn.

- The UAE Federal Tax Authority reported increased compliance and a 21% hike in value of tax returns in 2019; the number of businesses registered increased by 7% to 320,440. Bottom of Form

- Inflation in Dubai declined by 1.2% in Feb, driven by the decrease in utilities prices (-5.21%), clothing and footwear (-3.21%) while food and beverages went up by 2.38%.

- Dubai Airport Freezone Authority (DAFZA) reported a 12.6% yoy increase in foreign trade to AED 164bn (USD 45bn), thanks to a 15.8% rise in imports (to AED 72.4bn). India was DAFZA’s biggest trade partner in 2019 with its share at AED 30bn or 18.3% of total.

- Various companies in the UAE have rolled out measures to support businesses (non-exhaustive list): ADCB announced deferring of loan payments and waiving interest for up to 6 months for customers subject to “an appropriate level of scrutiny”; mall operators announced reduced mall timings; Al-Futtaim Group set up a fund of AED 100mn to help ease financial burden; district colling firm Empower announced 10% discount on bills; Dubai Holding rolled out an AED 1bn relief package while Alder Properties will ease/ review rentals, waive fees, and review school fees;

- As the UAE schools roll out distance learning, families with no home internet services will be supported with the provision of free data by the telecom providers.

- Property transactions in Dubai accelerated by 12% and 33% yoy in Jan & Feb 2020; in Feb, there were a total 4356 sales transactions with a value of AED 9.4bn.

- Occupancy levels in Dubai hotels plunged by almost 30% yoy in the first week of Mar, according to STR. The average daily rate (ADR) dropped 20.4% to AED 498.13, while revenue per room (RevPar) fell 42.9% to AED301.68.

- The UAE maintained the top ranking among the Arab nations for the sixth consecutive year, in the World Happiness Report 2020. The report can be accessed at: https://worldhappiness.report/ed/2020/

Weekly Insights: GCC responses to tackle the ongoing Covid19 outbreak amid falling oil prices

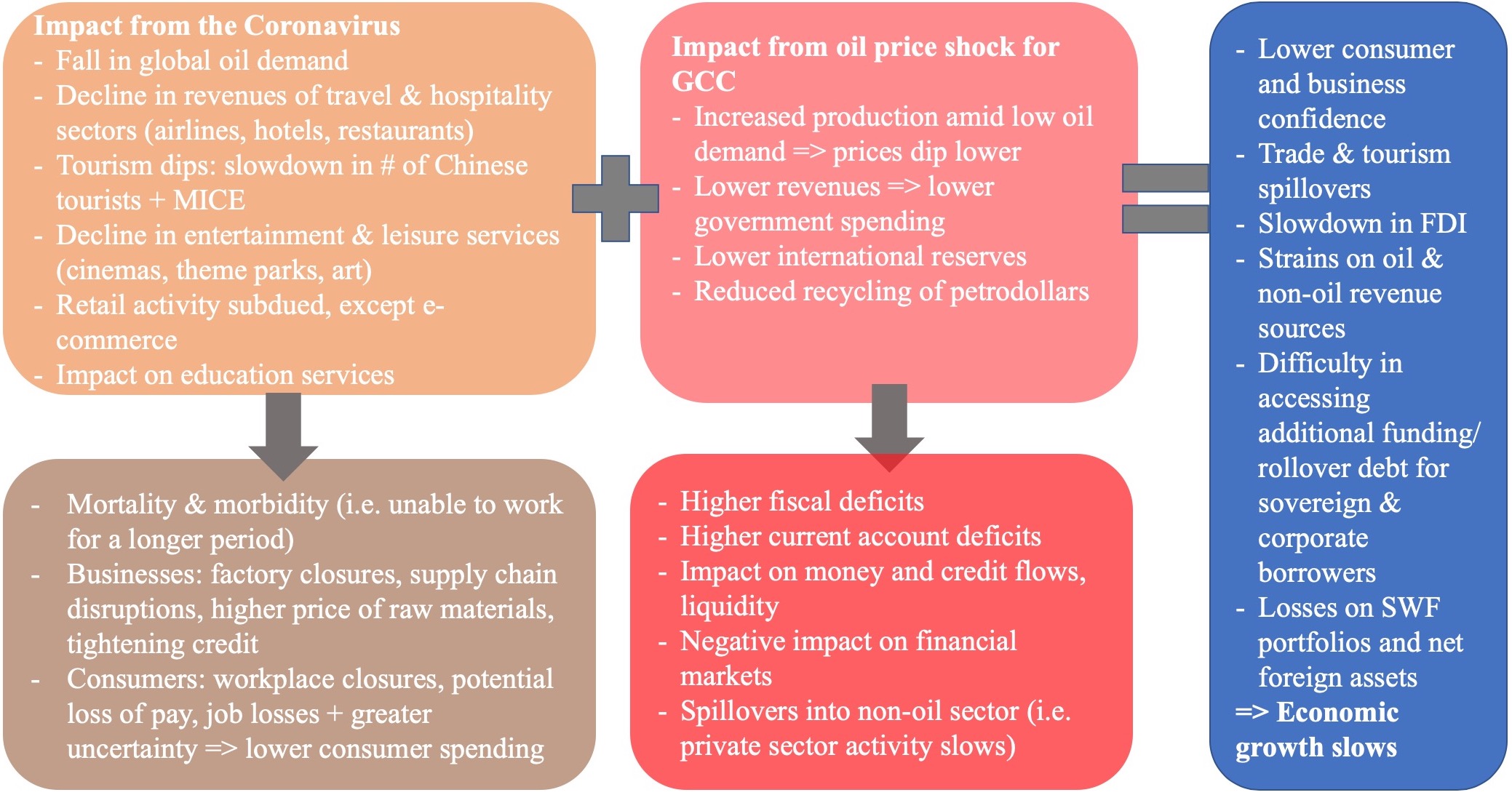

As the GCC nations roll out various economic, financial, health and travel-related initiatives, we have compiled a country-by-country list (below). We end it by reiterating a previously-shared graphic on how lower oil prices will affect the GCC nations in the backdrop of Covid-19 related slowdown. To provide a recent comparison, the OPEC lost a collective USD 450bn in oil revenues in 2014-16 (when the prices dipped by around 70% from $100+ to under $40). We expect fiscal deficits to soar to 10-12% of GDP this year, representing some USD 150-170bn in additional required financing.

The GCC will suffer a negative wealth effect (losses on SWF portfolios and net foreign assets), and with bulging deficits and the prospects of low oil prices, will find access to markets both more difficult and more expensive. Sovereign and corporate borrowers and bond issuers will find it increasingly difficult to rollover debt or access additional funding, given a debt overhang of USD 500bn.

Table: GCC’s responses to the Covid19 outbreak

| Bahrain | |

| Economic & Financial | Health & travel-related |

|

BHD 4.3bn stimulus package: – Doubling the Liquidity Fund to BHD 200mn – Waiver on utilities bills for 3 months; – Delay in loans installments for 6 months – Supporting wages of citizens in pvt sector Central bank moves: – Banned lenders from freezing customers’ accounts in case of lost jobs or retirement – Cut overnight lending rate to 2.45% from 4% to ensure “smooth functioning of the money markets” (before Fed moves) Parliament: – Approved measures like reduction of commercial registration fees as well as labour & utility charges for 6 months Cabinet authorised the finance minister to directly withdraw funds with a 5% ceiling from the public account |

– Closure of educational institutes – Limiting social gathering of more than 150 individuals – Closure of movie theatres – Testing all incoming passengers; mandatory 14-day self-isolation – Ban on travel to some countries; cancellation of flights to infected areas

|

| Kuwait | |

| Economic & Financial | Health & travel-related |

|

Central bank: – Reduced the discount rate to 1.5% (from 2.5%) a record-low – Set up a KWD 10mn (USD 33mn) fund, to be financed by Kuwaiti banks – Suspended fees on point of sales devices and ATM withdrawals + increased the limit for contactless payments to KWD 25 from KWD 10 |

– Kuwait declared a public holiday from Mar 12-26 – Halted ALL commercial passenger flights – Closed schools, shopping centres, cinemas, wedding halls & children’s entertainment – MoH imposes mandatory corona testing for all expats who returned to the country since Feb 27, taking place on a district by district basis |

| Oman | |

| Economic & Financial | Health & travel-related |

|

CB announces a $20bn incentive package – Repo rate cut by 75bps to 0.5%; – Reduce Capital Conservation Buffers for banks to 1.25% from 2.5%; – Lending Ratio / Financing Ratio for lenders increased to 92.5% up from 87.5% – Accept all requests for deferment of loan instalments / interest / profit for affected borrowers, particularly SMEs, with immediate effect for the next 6 months – Reduce existing fees related to banking services + avoid introducing new fees Finance ministry slashed approved budgets of civil, military and security agencies by 5% Other measures include tourism & municipality tax breaks, free government storage facilities and postponement of credit instalment payments |

– Oman has closed its borders: only Omanis can enter – Mandatory 14-day quarantine for those entering – Suspend issuance of tourist visas from Mar 15 for 30 days – Will not allow cruise ships to dock at its ports during this period – Schools closed; all public parks closed, public gathering prohibited, Friday prayers at mosques suspended |

| Qatar | |

| Economic & Financial | Health & travel-related |

|

A $23.3bn stimulus package – QAR 75bn ($20.6bn) to provide financial + economic incentives for private sector – CB to put in place an appropriate mechanism to encourage banks to postpone loan installments and obligations of the private sector with a grace period of 6 months – Qatar Development Bank to postpone installments for all borrowers for 6 months – Directing govt funds to increase investments in the stock exchange by QAR 10bn ($2.75bn) – Exempting food & medical goods from customs duties for 6 months – Utilities bill exemption for SMEs, affected sectors; rent exemption for 6 months |

– All international flights suspended for 2 weeks from Mar 18; cargo aircraft, transit flights exempt – Travel ban on all travelers except Qatari nationals – Educational institutions closed – High risk employees + those above 55 years + pregnant women can work remotely – Public transport modes have been stopped for 14 days – 6 tonnes of aid sent to Iran (medical equipment & supplies) |

| Saudi Arabia | |

| Economic & Financial | Health & travel-related |

|

– SAR 120bn worth measures to support the pvt sector including postponement of VAT/ excise/ income tax/ Zakat payments, exemptions of govt dues etc – SAMA’s SAR 50bn stimulus package: financing support for SMEs (including deferred loan payments, concessional loans) and coverage of points of sale & e-commerce fees – Initiatives to reduce private sector’s burdens related to manpower: e.g. lifting halts on non-payment of fines, fines related to workers recruitment etc. – Saudi Arabia will cut SAR 50bn (USD 13.32bn or less than 5%) of the 2020 budget – Land borders with UAE, KW, Bahrain closed except for commercial trucks; shipping services suspended from 50 countries; cargo traffic not affected |

– All international flights suspended for 2 weeks; travel ban on passengers from Bahrain, Oman, UAE, Kuwait, Lebanon, Syria, Iraq, Egypt, France, Germany, Turkey, Spain, South Korea, Egypt, Italy – Temporarily suspends private-sector work & govt work for 15 days; banks will also remain closed – Closed eateries, malls – Umrah pilgrimages to Mecca & Medina are under a temporary ban – Suspended entry & prayer in the outer courtyards of Two Holy Mosques in Makkah and Madinah – Capital Markets Authority urged shareholders & invested in listed companies to vote electronically in upcoming meetings |

| United Arab Emirates | |

| Economic & Financial | Health & travel-related |

|

Central bank: – AED100bn stimulus to facilitate temporary relief on private sector loans & promote SME lending; support also the real estate sector – Banks expected to reschedule loans contracts, grant deferrals on monthly loan payments + reduce fees and commissions Dubai: AED 1.5bn stimulus package to support businesses affected by Covid19 including 10% reduction in utilities bills Abu Dhabi: AED 5bn in utilities subsidies; free road tolls till end-2020, 20% rebate on rental values for restaurants + tourism & entertainment sectors (+ faster implementation of Ghadan-21 initiatives) |

– Suspends entry for residents overseas for 2 weeks; temporary stop to issuing all new visas – From Mar 17, Emirates suspended flights to 35 global destinations. No wider closure – ‘Remote work’ system for UAE public sector employees for 2 weeks – Cancels public prayers at mosques, churches for 4 weeks; closed: public parks, theme parks, cinemas, gyms – Supporting others: – Sends 2 batches critical medical aid to Iran in Mar – Flew 215 people from different countries out of Wuhan to Abu Dhabi’s Emirates Humanitarian City |

Fig. Impact of Covid19 & lower oil prices on the GCC

Source: Nasser Saidi & Associates.

Media Review

What’s the Fed doing in response to the COVID-19 crisis? What more could it do?

https://www.brookings.edu/blog/up-front/2020/03/20/whats-the-fed-doing-in-response-to-the-covid-19-crisis-what-more-could-it-do/

Blunting the Impact and Hard Choices: Early Lessons from China

https://blogs.imf.org/2020/03/20/blunting-the-impact-and-hard-choices-early-lessons-from-china/

Key oil freight rates retreat from Saudi-led bookings spike

https://www.reuters.com/article/us-global-oil-shipping/oil-tanker-rates-fall-but-storage-demand-stays-firm-sources-idUSKBN21616X

Did the number of confirmed cases rise faster in China, Italy, South Korea, or the US? Trajectories since the 100th confirmed case

https://ourworldindata.org/coronavirus#trajectories-since-the-100th-confirmed-case

Why coronavirus could hit Iran harder than US sanctions (FT – subscription only)

https://www.ft.com/content/ba417ace-6474-11ea-b3f3-fe4680ea68b5

Powered by: