This week’s “Weekly Insights” is on the ongoing oil price war, lower oil prices and its economic impact on the Middle East amid the Covid19 epidemic.

Markets

Friday saw global financial markets suffer their worst day since 1987’s Black Monday: the MSCI all-country world index entered bear market territory (https://tmsnrt.rs/39UsofJ) while world markets lost nearly USD 18trn from Feb’s peak (https://tmsnrt.rs/2TRkFti). The VIX volatility index and corresponding measure of volatility for the Euro Stoxx 50 hit their highest since the 2008 financial crisis. Equity markets in the region closed in the red last week, with GCC investors losing more than AED 150bn on Sun (when markets opened after the failure of OPEC+ talks on production cuts). As safe haven currencies, the JPY and CHF strengthened (https://tmsnrt.rs/2xGgs35), the Indian rupee touched a record low, and other emerging market currencies like the Indonesian rupiah, Thai baht and South Korean won lost ground as well. Oil prices continued to decline on news of higher production plans from UAE and Saudi Arabia while the gold price ended the week with a loss of 8.6%, the most since Mar 1983.

Global Developments

US/Americas:

- Trump declared a “national emergency”, and stimulus measures announced include access to free testing, food aid, as well as extending sick leave benefits to vulnerable persons. Travel bans were extended to the UK and Ireland in addition to the 26 European Separately, the New York Fed raised the size of repo operations, and vowed to inject around $1.5trn to address “highly unusual disruptions”.

- Inflation in the US unexpectedly edged up by 0.1% mom in Feb, matching Jan’s gain. In yoy terms, inflation eased to 2.3% yoy in Feb from Jan’s 2.5%. Core inflation edged up to 2.4% yoy (Jan: 2.3%). Producer prices fell by 0.6% mom in Feb (Jan: 0.5%), the biggest decline since Jan 2015. Wholesale energy prices were down by 3.6% (Jan: -0.7%), thanks to a 6.5% dip in gasoline prices.

- US monthly budget deficit surged to a record USD 235bn in Feb from USD 33bn the month ago. In the first five months of the fiscal year, deficit has widened by 15% yoy to USD 625bn.

- Initial jobless claims eased to 211k in the week ended Mar 6 from 215k the week before, showing no signs yet of any impact from the Covid19 outbreak. The 4-week moving average increased by 1,250 to 214k.

Europe:

- The EU Commission latest forecast is that GDP will likely shrink by around 1% in 2020. Spain declared a 15-day state of emergency and locked down 46mn people to contain the surge in Covid19 cases, while France closed non-essential public places. As UK’s death toll doubled in 24 hours and confirmed cases surged, UK’s strategy of delaying restrictions (to achieve “herd immunity”) is likely to be replaced by new measures including ban of mass gatherings.

- Norway’s central bank cut its key interest rate to 1% from 1.5% last Friday, in a surprise announcement (the bank meets on monetary policy on March 19th). This followed the Bank of England’s emergency rate cut by 50bps to 0.25%. The ECB meanwhile left its main interest rate unchanged at -0.5%.

- Eurozone GDP weakened to 0.1% qoq and 1% yoy in Q4 (Q3: 0.1% qoq and 1% yoy), leaving the full year growth at 1.0%. Germany’s growth flatlined as GDP slumped from 0.2% to 0% in Q4 (2019: 0.6% yoy, the worst since 2013) while France, Italy, Finland and Greece contracted. Gross fixed capital formation contributed 0.9 ppts to GDP and household and government spending each 0.1 points. Separately, employment in the eurozone grew by 1.1% yoy and 0.3% qoq in Q4.

- German exports were flat in Jan (Dec: +0.2% mom) while imports edged up by 0.5% mom; trade surplus fell to EUR 18.5bn from EUR 19bn the month before. German exports to China fell by 6.5% yoy while imports were down by just 0.5%, though neither were linked to the Covid19 epidemic.

- Inflation in Germany remained unchanged at 1.7% yoy and 0.4% mom in Feb.

- In Germany, industrial production expanded by 3% mom in Jan (Dec: -2.2%), supported by the construction (4.7%) and energy sector (+0.2%). Industrial production in the EU rebounded by 2.3% mom in Jan (Dec: -1.8%) – its first increase since Aug; French factory output increased by 1.2% mom while Italian manufacturing clocked in a 3.7% rise.

- GDP growth in the UK remained flat in Jan versus Dec’s expansion by 0.3% mom.

- The UK’s latest budget outlined GBP 30bn of extra spending – including an extra GBP 7bn to support workers and businesses affected by the coronavirus and at least GBP 5bn to help the NHS cope with the outbreak. The spending is being largely paid for with a big increase in government borrowing. Public borrowing is already forecast to climb to a six-year high by 2022 without taking into account these additional spending measures.

- Industrial production in the UK fell by 0.1% mom and 2.9% yoy in Jan (Dec: +0.1% mom and -1.8% yoy) while manufacturing production edged up by 0.2% mom (Dec: 0.3%)

- UK’s trade surplus fell to GBP 4.212bn in Jan (Dec: USD 6.279bn). Goods trade deficit widened to GBP 3.72bn from 1.418bn the month before.

Asia Pacific:

- China’s inflation remained high in Feb, registering 8% mom and 5.2% yoy (Jan: 1.4% mom and 5.4% yoy), with supply chain disruptions driving up food prices (+21.9% yoy). Producer price index dropped by 0.4% yoy in Feb (Jan: 0.1%).

- China new loans slowed to CNY 905.7bn (USD 130bn) in Feb, down from a record CNY 3.34trn in Jan; both household and corporate loans dropped to CNY 413.3bn and CNY 1.13trn (Jan: CNY 634.1bn and CNY 2.86trn). Money supply grew by 8.8% yoy in Feb (Jan: 8.4%) while growth of outstanding total social financing, a broad measure of credit and liquidity, was 10.7% in Feb, unchanged from Jan.

- FDI into China dipped by 8.6% yoy to CNY 134.4bn (USD 19.2bn) in Jan-Feb; it plunged by 25.6% in Feb, after a 4% gain in Jan.

- Japan’s (revised) GDP shrank by 1.8% qoq and 7.1% yoy in Q4 (Q3: -1.6% qoq and -6.3% yoy), largely due to 4.6% drop in business investment (the sharpest fall in Q1 2009) and a 2.8% dip in private consumption.

- Japan’s 67th consecutive month of current account surplus touched JPY 612.3bn (USD 5.89bn), up 6.6% yoy in Jan; deficit in goods trade widened by 1.6% yoy to JPY 985.1bn.

- India’s industrial production grew by 2% yoy in Jan (Dec: 0.5%) – the fastest in 6 months – while manufacturing rebounded by 1.5% after falling by 0.7% the month before; production of capital goods shrank by 4.3% in Jan.

- India’s exports grew (for the first time in 7 months) by 2.91% yoy to USD 27.65bn in Feb while imports were up by 2.48% to USD 37.5bn, bringing trade deficit to USD 9.85bn.

Bottom line: Stock markets around the world continued to experience deep falls; central banks announced interest rate cuts and launched new liquidity measures (including Japan, Australia, US and Norway while UK eased trading rules on fixed-income ETFs, Italian and Spanish regulators banned short selling, and Sweden cut countercyclical capital buffers to zero) to stem selling. Stimulus measures across the globe include ECB’s measures to support bank lending & expanding its asset purchase program, EU vowing to relax its fiscal spending rules, the EU Commission’s EUR 37bn “Corona Investment Fund” to help businesses, healthcare systems and sectors in need, US’s access to free testing, food aid, extending sick leave benefits, as well as Indonesia and Thailand’s stimulus packages of USD 8.1bn (in addition to a previous USD 745mn package) and THB 400bn (USD 12.7bn) respectively. To curb Covid19 outbreaks, travel bans have also been implemented across many nations in addition to cancellation of visas. New cases are now rising faster outside China than within, and indicators point to an initial phase of recovery in China (https://bit.ly/2Qd2BYk).

Regional Developments

- The oil war heats up: after initially announcing plans to increase oil production to 12.3mn barrels per day (bpd) in Apr, Saudi Aramco later announced plans to raise capacity to 13mn bpd. UAE will follow Saudi Arabia in increasing its oil output to a record high of more than 4mn bpd in April. Together Riyadh and Abu Dhabi will add a combined 3.6mn bpd of extra oil in Apr. Russian oil firms might boost output by up to 300k bpd and could increase it by as much as 500k bpd.

- GCC nations have introduced measures to combat Covid19: this includes cancellation of flights to infected areas, asking individuals returning from countries with high cases to self-isolate for 14 days as well as suspending issuance of new visas in addition to closing schools.

- Bahrain central bank cut its overnight lending rate to 2.45% from 4% to ensure “smooth functioning of the money markets”, while also assuring “further necessary actions” if required.

- To support businesses during the Covid19 outbreak, MPs in Bahrain approved measures including reduction of commercial registration fees as well as labour and utility charges for 6 months; this proposal has been forwarded to the Cabinet for approval. Furthermore, the central bank asked banks to not freeze customers’ accounts in case of job loss or retirement.

- Women account for 29% of total investors at Bahrain Bourse, revealed the COO, the value of shares held by them is currently BHD 580mn.

- Inflation in Egypt declined to 4.9% in Feb (Jan: 6.8%), driven by a dip in vegetable prices (-5.4%); urban consumer inflation fell to 5.3% yoy in Feb (Jan: 7.2%).

- Manufacturing index in Egypt (excluding crude oil and petroleum) fell 6% mom to 132.8 points in Dec 2019.

- The Sovereign Fund of Egypt aims to acquire assets worth EGP 70-80bn in the coming years and plans to get returns from investments after five years in operation, according to the CEO.

- Kuwait declared a public holiday from Mar 12-26, halted all commercial passenger flights, closed schools, shopping centres, cinemas, wedding halls and children’s entertainment centres to slow the spread of the disease. The central bank announced the set up a KWD 10mn (USD 33mn) fund – to be financed by Kuwaiti banks – for disbursement by the Cabinet on urgent and necessary needs. Further, it suspended fees on point of sales devices and ATM withdrawals and increased the limit for contactless payments to KWD 25 (USD 81.44) from KWD 10, while announcing that it remains ready to support the financial sector further.

- Money supply (M2) in Kuwait declined – for the 3rd consecutive month – by 1.4% yoy to KWD 38.05bn (USD 125bn) in Jan. Foreign reserves increased by 7.6% yoy and 1.5% mom to KWD 12.27bn (USD 40.31bn) by end-Jan.

- Kuwait posted a budget deficit of KWD 1.825bn (USD 5.9bn) in Apr 2019-Feb 2020, after transfers to the Future Generations Fund’s reserve. This compares to a surplus KWD 1.193bn recorded in the same period a year ago. Total revenues were down by 14.52% yoy during this period while expenditures surged by 8.17%.

- Non-oil exports from Kuwait decreased by 29% yoy to KWD 12.64mn in Feb. Jordan was the biggest importer of Kuwaiti goods, followed by Iraq, Egypt, and Yemen.

- Lebanon’s plan to address the financial and economic crisis will be ready “in weeks” and will meet IMF recommendations, according to the finance minister. He also stated that the LBP’s official exchange rate would be maintained for the “foreseeable future”.

- S&P downgraded Lebanon’s foreign currency ratings to “selective default”, citing low foreign currency reserves, and warned that debt restructurings could become complicated. Fitch Ratings downgraded Lebanon’s long-term foreign-currency issuer default rating to “C” from “CC”.

- Oman is in talks with banks to raise around USD 2bn in loans, to manage its rising fiscal deficit as oil prices plunge. A deficit of OMR 2.5bn (USD 6.49bn), or 8% of GDP, is projected this year; foreign and domestic borrowing is expected to cover about 80% of that amount.

- Moody’s downgraded the government of Oman’s issuer rating to Ba2 with a stable outlook. Further, the ratings agency downgraded the long-term local and foreign currency deposit ratings of five Omani banks citing the government’s weak fiscal capacity and weak standalone credit profiles of some banks.

- Hotel revenues in Oman fell by 9.2% yoy to OMR 20.64mn at end-Jan 2020, with occupancy rates declining by 10.4% to 55.9% and number of hotel guests down by 1.4% to 144,270.

- Oman, in a bid to contain the spread of Covid19, announced that it would suspend the issuance of tourist visas from Mar 15 for 30 days and would not allow cruise ships to dock at its ports during this period.

- Saudi Arabia announced a SAR 50bn stimulus package to support the private sector: among the measures by SAMA are financing support for SMEs (including deferred loan payments, concessional loans) and coverage of points of sale and e-commerce fees.

- Saudi Arabia’s finance ministry has instructed various government agencies to submit proposals to reduce 20-30% in their 2020 budget. This will likely take the shape of postponed projects and delays in awarding contracts among others.

- Reuters reported that Saudi Arabia approved incremental supplies for its top Indian and Chinese customers, including Bharat Petroleum, Reliance Industries, at least one Chinese state refiner, and privately held Zhejiang Rongsheng Holding Group while rejecting at least 3 other Asian refiners – one Korean, one Taiwanese and one Chinese – requests for extra barrels on top of their long-term supply deals.

- In addition to closing schools and universities, Saudi Arabia suspended travel to 9 countries – UAE, Kuwait, Bahrain, Lebanon, Syria, South Korea, Egypt, Italy and Iraq – for its citizens and residents to limit the spread of Covid19. The Capital Markets Authority urged shareholders and invested in listed companies to vote electronically in upcoming meetings.

- Net foreign assets held by Saudi banks declined – for the 3rd month in a row – by 51% yoy and 19.1% mom to SAR 57bn. The value of foreign assets held by banks increased by 6.87% yoy to SAR 240.68bn.

- Saudi Arabia’s industrial production index fell by 6.68% yoy in Jan, weighed down by a 4.74% decline in mining and quarrying activity.

- Saudi Arabia will provide USD 10mn to the World Health Organisation to support its efforts in combating the spread of Covid19.

UAE Focus

- The UAE central banked announced a stimulus package worth AED 100bn to support the economy amidst Covid19: the Targeted Economic Support Scheme includes AED 50bn from central bank funds through collateralised loans at zero cost to all banks in the UAE and AED 50bn funds freed up from banks’ capital buffers (as banks will be allowed to tap into a maximum of 60% of the capital buffer). To support financing for SMEs, the amount of capital banks must hold for loans to SMEs has been reduced by 15 to 25%. To support the real estate sector, the loan-to-value for first time home buyers has been increased by 5 ppts and the maximum exposure banks can have to the real estate sector will be allowed to rise to 30% from current 20% (but banks will need to hold more capital).

- Dubai announced a AED 1.5bn stimulus package to support businesses: this includes a freeze on the 2.5% market fees levied on all facilities operating in Dubai, a refund of 20% on the custom fees imposed on imported products sold locally in Dubai markets, fees imposed on submitting customs documents of companies will be reduced by 90%, ability to renew commercial licenses without mandatory renewal of lease contracts, reduction of municipality fees imposed on sales at hotels to 3.5% (from 7%) as well as a 10% reduction in utility bills for a period of three months (among others).

- UAE announced ‘remote work’ system for public sector employees for two weeks; this follows similar announcements from the Dubai and Abu Dhabi governments. The UAE will temporarily stop issuing new visas from Mar 17th.

- Dubai PMI declined to a 4-year low of 50.1 in Feb (Jan: 50.6) as a result of weaker sales, slowing demand and lower inventories. New orders decreased for the first time since Feb 2016, confidence for future activity dropped to a 31-month low and stocks of purchases fell to the greatest extent since Oct 2010.

- Abu Dhabi’s non-oil foreign trade increased by 7.7% yoy to AED 30.9bn (USD 8.41bn) in Q4 2019 while the value of imports grew by 1.5% to AED 28bn.

- Dubai’s Department of Economic Development (DED) announced the issuance of 4,459 new licenses in Feb 2020, creating 11,877 jobs. Real estate, leasing and business services accounted for 50% of the economic activities licensed during the month.

- The Dubai International Financial Centre (DIFC) announced a 14% yoy increase in its number of firms to 2437 in 2019, with 727 active financial firms (29.8% of total). The total workforce in the Centre grew by 9% yoy to 25,600. Banking assets booked in DIFC grew by 13% yoy to USD 178bn, with an additional USD 99bn of lending arranged by DIFC firms.

- Dubai Jebel Ali Free Zone’s (Jafza) registration, licensing and related administrative fees have been reduced by 50-70%, announced DP World. Furthermore, a host of online services would also be offered free of cost.

Weekly Insights: Middle East – adjusting to lower oil prices amid the Covid19 epidemic

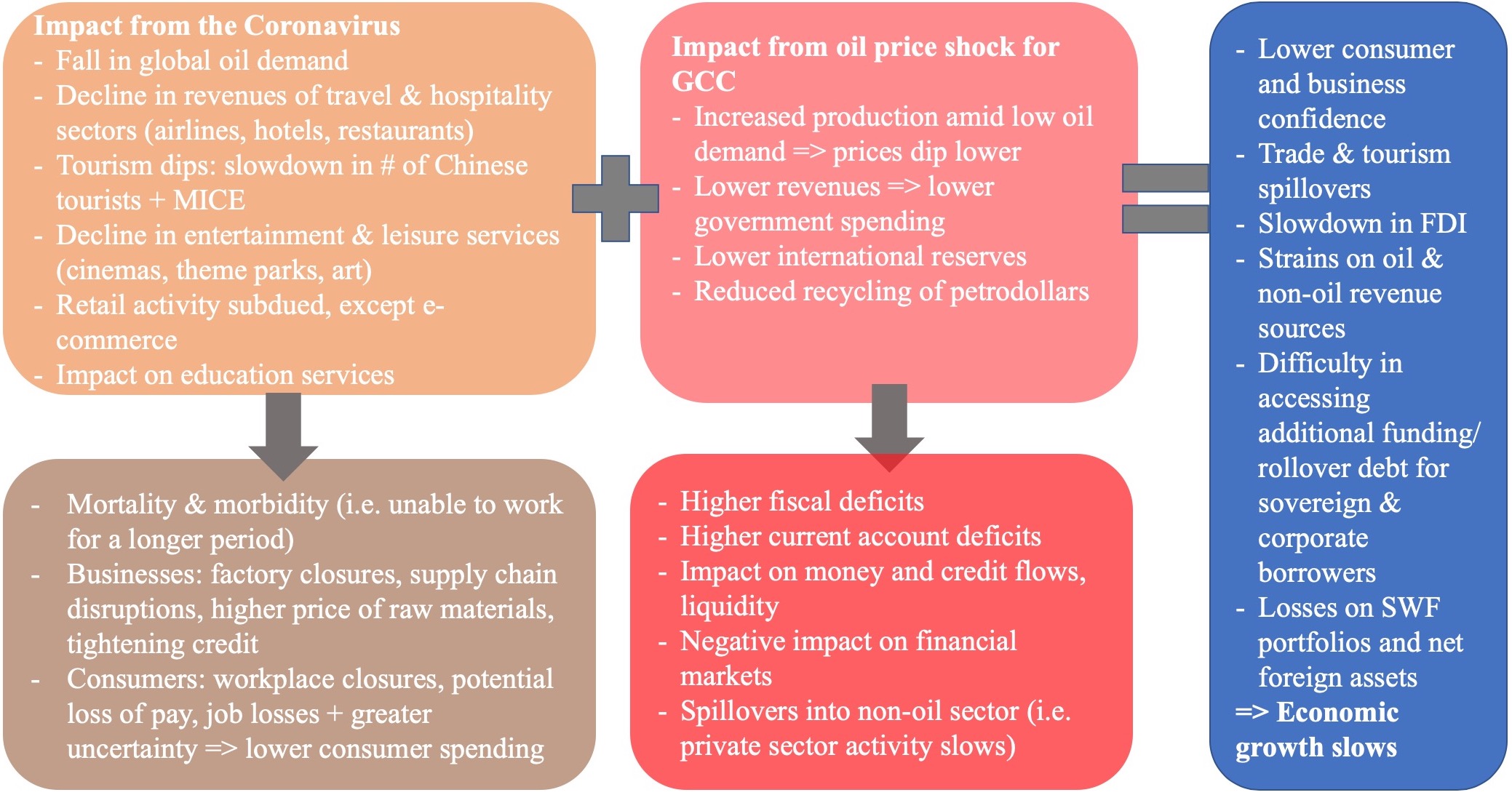

A double-edged sword: the Middle East has to adjust to the ongoing oil price war in addition to providing adequate stimulus to support their domestic economies taking a hit from Covid19 while also rolling out measures to curb its spread. The crash of oil prices, sharp fall in global growth and Covid19 effects will put severe strains on both oil and non-oil revenue sources in the Middle East (including VAT, real estate fees, tourism and trade).

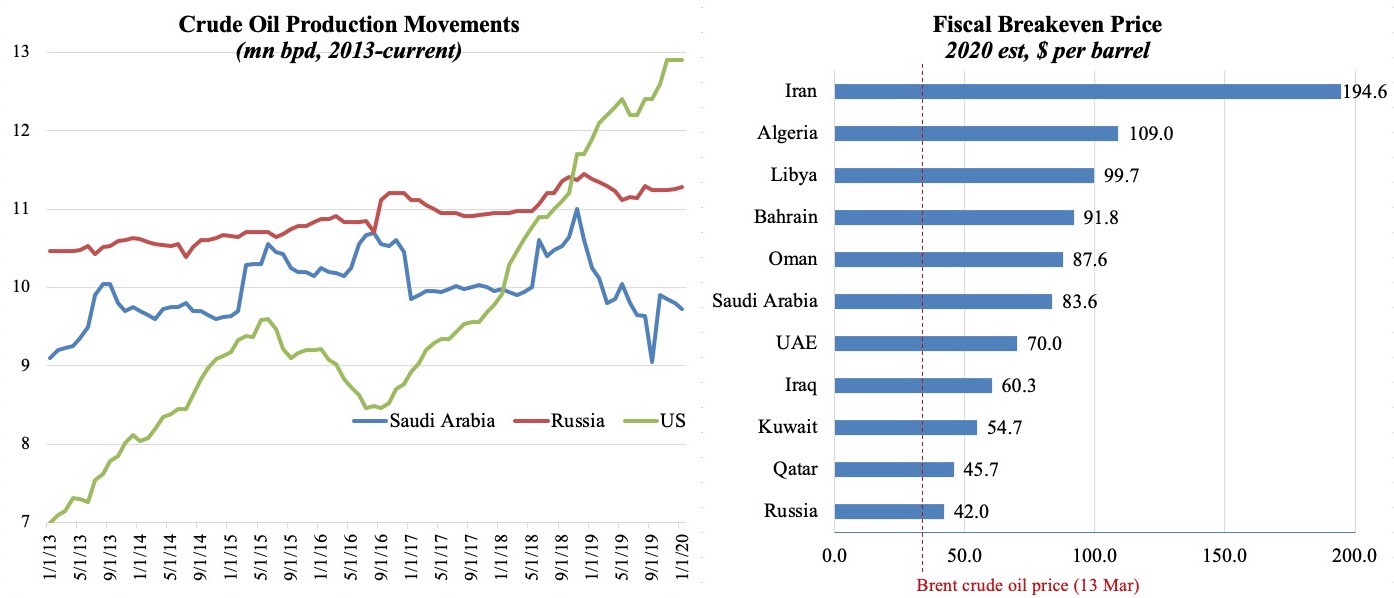

The How, Why and When? At the OPEC+ meeting on Mar5-6, Russia and Saudi Arabia sparred over the extent of production cuts in the backdrop of lower global oil demand due to the spread of Covid19. OPEC had already slashed its expected growth in global oil demand this year, recommending a massive production cut in Q2 in order to maintain prices. The disagreement flared into an outright price war, with Saudi Arabia announcing discounts (of as high as USD 8) to northwest Europe and other big consumers of Russian oil alongside an increase in oil production to 12.3mn bpd (versus the current 9.7mn bpd). Russia was not far behind in announcing that it could add between 300-500k to raise output to 11.2mn bpd. Later, Aramco confirmed that Apr output levels would reach 13mn barrels per day and the UAE also announced a ramp up in its oil production. This is likely to bring about a shift in the market share of top crude oil producers (Saudi, UAE): shale oil had flooded the market during the OPEC+ production cuts phase (resulting in US becoming the largest oil-producing country) though at current prices, shale oil producers face a potential collapse (via production cuts, layoffs and/or bankruptcies) given their higher production costs.

What next? The price of Brent crude plunged by 24%, to USD 34 a barrel, on Mar 9th, posting its steepest one-day drop in nearly 30 years; oil is down by about 50% since the start of the year. While Saudi Arabia has the capacity to increase production, various other players in the region will be hard-hit, especially Oman and Bahrain in the GCC with their high breakeven oil prices, rising fiscal deficits and debt. For the oil exporters, not only would lower oil price mean lower revenues and potential higher fiscal deficits, but it will also result in spillovers into the non-oil sector (which is already negatively affected by the Covid19 outbreak). In addition to a debt overhang of around USD 500bn in the GCC, it will also be increasingly difficult for sovereigns to finance their deficits through borrowing as access to markets will become more difficult and expensive. Last, but not least, there will be a negative impact from financial markets: domestic equity markets have already taken a hit (with GCC investors having lost more than AED 150bn last Sun) while the sovereign wealth fund portfolios would also be negatively affected given the stock market collapse globally.

Fig. 1. In search of higher market share (crude oil production, LHS) even as fiscal breakeven prices remain high in the still oil-dependent economies (RHS)

Source: Refinitiv, Nasser Saidi & Associates.

Fig. 2. Impact of Covid19 & lower oil prices on the GCC

Source: Nasser Saidi & Associates.

Media Review

How canceled events and self-quarantines save lives, in one chart: “Flattening the curve”

https://www.vox.com/2020/3/10/21171481/coronavirus-us-cases-quarantine-cancellation

https://voxeu.org/article/it-s-not-exponential-economist-s-view-epidemiological-curve

Coronanomics 101

https://www.project-syndicate.org/commentary/limits-macroeconomic-tools-coronavirus-pandemic-by-barry-eichengreen-2020-03

The Pandemic Stress Test

https://www.project-syndicate.org/commentary/covid19-economic-weaknesses-by-raghuram-rajan-2020-03

Lebanon Banks Set for Shake-Out Under Sovereign Debt Revamp – The New York Times

https://www.nytimes.com/reuters/2020/03/12/business/12reuters-lebanon-crisis-banks.html

Top jobs for women in Mideast set to double but challenges remain

https://www.arabnews.com/node/1638311/business-economy

Powered by: