This week’s “Weekly Insights” is on the economic impact of Covid-19 on the Middle East & potential policy responses.

Markets

The Covid-19 outbreak continues to create havoc across capital markets: equity market sell-offs were rampant globally – European shares closed at near 7-month lows – except in China (where a two-year high was touched on Thursday, as investors expect more PBoC stimulus), while US Treasury prices rallied, with the yield on the benchmark 10-year government bonds dropping to a record low of 0.695%. Regional markets remained in the red, as Covid-19 cases increased, and travel restrictions were imposed. The dollar fell against a basket of currencies –worst week since 2016 – as traders bet further cuts following the emergency 50bps rate cut last week, while the flight to safe haven currencies JPY and CHF continued. Oil prices fell to a near 3-year low and posted biggest daily loss in more than 11 years on Fri after Russia rejected OPEC’s proposed steep production cuts. Gold posted the biggest weekly gain since Oct 2011.

Global Developments

US/Americas:

- The Fed cut its benchmark rate by half-point to a range of 1-1.25%, citing concerns about the impact of the coronavirus. The virus was mentioned in Fed’s Beige Book multiple times (the coronavirus 48 times and Covid-19 nine times) versus the term labor (51 times), employment (55) or wages (41).

- Non-farm payrolls increased by a higher than expected 273k in Feb, while the previous two readings were revised up by a total of 243k. The total employment level touched 158.8mn (near the Dec 2019 record) and unemployment rate was back to 3.5%. Average hourly earnings grew by 3% yoy while the average work week nudged up to 34.4 hours. Separately, ADP employment report showed a gain of 183k jobs in Feb, from a downwardly revised 209k in Jan.

- US ISM manufacturing PMI slowed to 50.1 in Feb (Jan: 50.9) while new orders fell to 49.8 from 52 the month before. The ISM non-manufacturing activity index increased to 57.3 in Feb – the highest level since Feb 2019 – from 55.5 in Jan; however, this reading diverges sharply from the Markit Services PMI, which fell to more than a six-year low in Feb.

- Factory orders declined by 0.5% mom in Jan (Dec: +1.9%); durable goods orders fell 0.2% while non-durable goods orders fell by a sharper 0.8%.

- US trade deficit narrowed by 6.7% mom to USD 45.3bn in Jan, as exports slipped by 0.4% and imports by a sharper 1.6% (imports of oil, autos and cell phones declined). Goods deficit with China slipped USD 2.1bn to USD 23.7bn.

- Initial jobless claims slipped by 3k to 216k at the week ended Feb 29, with the 4-week moving average rising by 3250 to 213k. Continuing claims increased by 7k to 1.73mn.

Europe:

- Eurozone inflation edged down to 1.2% in Feb (Jan: 1.4%), pulled down by energy prices (-0.3%) while core inflation (excluding food and energy prices) picked up to 1.2% (Jan: 1.1%).

- The producer price index in the eurozone declined by 0.5% yoy in Jan, slowing from Dec’s 0.6% dip; excluding energy prices, prices rose by 0.6% (Dec: +0.5%).

- Unemployment in the eurozone was stable at 7.4% in Jan, maintaining the lowest level seen since May 2008. EU 27 unemployment was unchanged at 6.6%, lowest since Jan 2000.

- German manufacturing PMI increased to a 13-month high of 48 in Feb (Jan: 45.3), with the decline in new orders easing to the softest in 17 months. Services PMI slipped to a 3-month low of 52.5 (Jan: 54.2) while composite PMI was down to 50.7 from Jan’s 51.2.

- EU manufacturing PMI rose to a one-year high of 49.2 in Feb (Jan: 47.9), with both output and new orders falling at slower rates. Composite PMI reached a 6-month high of 51.6 (Jan: 51.3), supported by stronger service sector activity (PMI edged up to 52.6 from 52.5).

- UK manufacturing PMI increased to 51.7 in Feb, lower than the flash reading of 51.9 but higher than Jan’s 50. The highest reading since Apr 2019 was supported by a 11-month high in new orders growth and a 9-month high business optimism. Services sector activity was slightly down to 53.2 from Jan’s 53.9 reading while the all-sector PMI rose to 53 (Jan: 52.8).

- German factory orders rebounded in Jan, gaining by 5.5% mom – the most in five years. Led by a recovery in foreign orders, the rise was attributed also to bulk orders and catch-up effects after the Dec holidays. Coronavirus related disruptions are likely in the months ahead.

- Retail sales in Germany recovered, rising by 0.9% mom and 1.8% yoy in Jan (Dec: -2% mom and +1.7% yoy). Separately, German new car sales fell 11% to 239,943 in Feb, with registrations from private buyers dropping by 16%.

- Eurozone retail sales gained by 0.6% mom and 1.7% yoy in Jan, thanks to spending on fuel (+1.9% mom) as well as on food and drinks (+0.7%).

Asia Pacific:

- China’s Caixin manufacturing PMI fell to a record low of 40.3 in Feb (Jan: 51.1), with new export orders slumping to its lowest point since Jan 2009. The Caixin services PMI almost halved to just 26.5 in Feb – the first drop below the 50-point margin – from 51.8 in Jan; it also reported the steepest decline in new work since Nov 2008. The composite PMI slowed to a record low of 27.5 in Feb (Jan: 51.9).

- China’s exports and imports plummeted in Jan-Feb, not unsurprising given the impact of the Chinese New Year holidays and ongoing coronavirus outbreak. Exports fell by 17.2% in Jan-Feb (Dec: +7.9%) while imports declined by 4% (Dec: +16.5%), bringing the balance to a deficit of USD 7.09bn (Jan-Feb 2019: surplus of USD 41.45bn).

- Foreign exchange reserves in China fell by USD 8.779bn to USD 3.107trn in Feb. The yuan fell 0.78% against the dollar in Feb, its first monthly drop since Aug.

- Japan’s manufacturing PMI declined to 47.8 in Feb, the lowest reading since May 2016. Composite PMI weakened to 47 in Feb (Jan: 50.1), with the decline the strongest since Apr 2014 (when consumption tax was increased to 8%). Services sector was massively hit on reduced tourism: services PMI dropped to 46.8 in Feb from Jan’s 51, also posting the steepest drop in demand for eight-and-a-half years.

- South Korea’s GDP grew by 2% yoy in 2019: though headline growth remained unchanged from the preliminary data released in Jan, facility investment, private consumption and investment in the construction sector were all revised up in Q4. Inflation eased to 1.1% yoy in Feb from Jan’s 1.5% on weakening demand and falling oil prices.

- South Korea’s manufacturing PMI dropped to a 4-month low of 48.7 from the previous month’s 49.8, with output contracting by the most since Jun 2015 as manufacturers closed their factories as a result of the Covid-19 outbreak.

- Singapore manufacturing PMI dipped to a record-low of 47 in Feb (Jan: 51.4) as the Covid-19 outbreak led to supply shortages and lower export demand; the decline in output was the steepest recorded since the survey began in 2012.

Bottom line: As Covid-19 spreads, with over 100k infected, rising number of cases and deaths outside of China, global growth rates are being slashed: OECD warns that the virus could halve global growth, while the IIF estimates growth at around 1% this year, far below 2019’s 2.6%. Global manufacturing slumped to 47.2 in Feb (Jan: 50.4) – its lowest level since May 2009, suffering its steepest contraction in over a decade as Covid-19 outbreak hits supply chains and demand. Lengthening of supplier lead times was a constant reference in PMIs across the globe as manufacturers adjust to the supply shock reverberating across the globe. Meanwhile, central bank meetings will be closely watched after the Bank of Canada and Fed’s 50bps move (US macro data is yet to show an impact from the virus) though the ECB and BoJ have limited room to manoeuver. While lower rates are unlikely to result in companies investing more (given current supply chain disruptions and weak demand), much more can be achieved by providing adequate fiscal support: with stimulus, governments can target spending where it is most needed (e.g. unemployment insurance, health spending, wage subsidies, tax reliefs).

Regional Developments

- The Fed’s 50bps cut was matched by Bahrain, Jordan, Qatar, Saudi Arabia and UAE, given the peg to the dollar; Kuwait lowered its discount rate to 2.5% from 2.75%. The cut is quite opportune and will support consumption spending and local investment at a time when Covid-19 is disrupting supply chains, trade and also tourism.

- Bahrain’s central bank issued a circular urging that banks and financing companies consider re-scheduling or granting deferrals on credit installments, given the ongoing coronavirus outbreak. With about 85 persons affected in the island nation, these institutions were also asked to reduce profit and interest rates, fees and commissions or other measures for customers affected by the outbreak.

- Bahrain-based Khaleeji Commercial Bank will vote on delisting from UAE’s Dubai Financial Market (DFM) at the ordinary general meeting to be held on 25th Mar. The bank is also listed on the Bahrain bourse.

- Bloomberg reported that Bahrain is working on a proposal to create a state-run fund into which it may transfer some of its oil and gas assets, to be followed by a sale of a stake in it.

- Bahrain’s imports surged by 20% yoy to BHD 445mn in Jan; China, US and Saudi Arabia were the largest source nations during the month. Non-oil exports declined by 5% to BHD 160mn; Saudi Arabia, UAE and India the biggest recipients of its products.

- Egypt’s PMI remained under-50 in Feb, with a reading of 47.1 stronger than the previous month’s 46. Though improvements were recorded in both output and new orders, at 46.2, it still remained in contractionary territory. Weak external demand meant that export orders were sub-50 for the fifth consecutive month (39.4 in Feb vs Jan’s 38.5).

- Net international reserves in Egypt increased by 0.12% mom to USD 45.509bn at end-Feb, according to the central bank.

- As part of a central bank initiative to support industrial projects, banks provided EGP 2.8bn in finances to about 115 beneficiaries. Funds were either to finance working capital or for machinery, equipment and production lines.

- The Central Bank of Egypt reached an agreement to settle non-performing loans worth EGP 50.9bn with 226 customers (as of 27 Feb). This follows an initiative launched in Dec 2019 to support defaulting factories with a debt less than EGP 10mn.

- Revenues from Egypt’s Suez Canal declined by 7.8% mom to USD 458.2mn in Feb; in yoy terms, however, revenues increased by 5.6%.

- Bilateral trade between Egypt and the US increased by 14.7% yoy to USD 8.64bn last year. Exports to the US accelerated by 27.1% to USD 3.153bn while imports grew by 8%.

- Unemployment in Egypt declined to 8% in Q4 last year vs 8.9% reported in Q4 2018. The workforce increased to 28.9mn persons from 28.4mn at end-2018, while labour force participation rates increased for the first time in 3 years (to 43.1 while female participation rose to 16.4% from 15.1%).

- Egypt’s government purchased EGP 3.639bn (USD 230mn) worth solar energy from the private sector during the period Feb 2018-Jan 2020.

- Kuwait’s real estate deals reached KWD 3.7bn (USD 12.08bn) in 2019: though the value was down by 1.5% yoy, number of transactions grew by 6.4% to 6765- the highest since 2016.

- Lebanon’s PM confirmed that the country would “suspend payment” on the Mar 9 USD 1.2bn Eurobond. The government will proceed to restructure its debt, and the PM assured that deposits in the banking sector would be protected “especially small depositors who represent more than 90% of total bank accounts”. From the speech, the three pillars to move forward include: total public debt restructuring (sovereign & BDL), banking sector restructuring (recapitalization & consolidation), social safety net, macro-fiscal-financial-structural reform program with multilateral funding (IMF led). What was missing was any reference to a funding package to support the reform phase.

- PMI in Lebanon improved slightly to 45.4 in Feb (Jan: 44.9); sentiment towards the 12-month business outlook fell to the weakest level in survey history, with political and economic instability the main cause for concern.

- Lebanon’s cabinet approved a draft law to lift banking secrecy, according to the Justice minister.

- After Lebanon’s financial prosecutor ordered asset freeze on 20 banks and those of their executives (without providing details of the specific charge or extent of the freeze), the state prosecutor overturned this order.

- Money supply (M2) in Oman grew by 2% yoy to OMR 17.8bn. Narrow money stock (M1) increased by 8.4% to OMR 5.3bn.

- Oman’s Ministry of Tourism disclosed that 96 hotels of various classifications are expected to open in the country by 2020-2021.

- Qatar PMI increased to 49.3 in Feb (Jan: 48.7), with the output index at an 11-month high alongside a rise in non-oil private sector employment.

- As Covid-19 cases across the MENA region increased, Saudi Arabia has temporarily halted all entry by land from the UAE, Bahrain and Kuwait (commercial trucks are the only exception). Entry is permitted only via the three international airports in Riyadh, Jeddah and Dammam. Furthermore, it suspended temporarily the Umrah pilgrimage and announced that the Grand Mosque in Makkah and the Prophet’s Mosque in Madinah will close an hour after the night prayer and open an hour before dawn prayers each day.

- PMI in Saudi Arabia slowed to 52.5 in Feb (Jan: 54.9), posting the lowest reading since Apr 2018. Respondents referred to “subdued demand” and the “need to offer price discounts to stimulate sales”. New orders contracted, falling to 49.3 in Feb (Jan’s 52.6 and Dec’s 64.1), for the first time since Apr 2018.

- Real GDP grew by 0.3% yoy in Saudi Arabia last year, lower than the government’s forecast of 0.9% and 2018’s 2.4%. Growth was supported by a 3.31% rise in the non-oil sector – the strongest since 2014 – as oil sector shrank by 3.65%. Within the non-oil sector, private sector grew by 3.78% and the government sector by 2.2%.

- Saudi Arabia launched an “instant visa” scheme to support entrepreneurship in the nation.

- Exports from Saudi Arabia declined by 10.4% yoy to SAR 1.05trn in 2019, with oil exports down by 14%, and alongside a 1.5% dip in imports to SAR 774.68bn.

- Banks in Saudi Arabia boosted investments in government bonds by 20.67% yoy and 0.8% mom to SAR 386.69bn by end-Jan.

- Retail loans in Saudi Arabia grew by 3.8% yoy to SAR 333.44bn in Q4 2019. Loans for reconstructing and renovating proprieties, at SAR 25.65bn, accounted for the largest share of retail loans (7.7% of the total), followed by car loans (6.9%) and consumer durables (3.7%).

- Real estate loans from banks and finance companies to Saudi citizens surged by 24.6% yoy and 7.7% qoq to SAR 317.27bn (USD 84.5bn) in Q4 2019.

- Total assets of Tadawul-listed banks grew by 11.98% yoy to SAR 2.445trn last year, with the National commercial Bank accounting for more than 1/5th of total assets.

- Consumption in Saudi Arabia increased by 8.1% yoy and 5.4% mom to SAR 84.59bn in Jan 2020. Point of sale transactions reached a record high of SAR 28.53bn in Jan (+33.4% yoy), with number of transactions surging by 75% yoy to 186.14mn.

- More Cabinet reshuffle in Saudi Arabia: two weeks after the ex-energy minister was brought back as investment chief, the current minister of finance has been tasked with overseeing the economy and planning ministry as well. The former minister of economy and planning has been appointed as adviser at the royal court at the rank of minister.

- Artificial intelligence is expected to contribute an estimated SAR 500bn (USD 133bn) to GDP by 2030, according to the Saudi Data and Artificial Intelligence Authority. It was also revealed that ~70% of 96 strategic goals under Vision 2030 are closely related to data and AI.

- A decision to Saudize 70% of 9 key sectors within retail and wholesale outlets will be effective Aug 20, 2020.

- Total number of private and public sector employees in Saudi Arabia declined by 0.57% qoq to 8.47mn in Q3 2019, with expats accounting for 77.4% of total (-0.8% to 6.55mn).

UAE Focus

- UAE PMI continued to slip to 49.1 in Feb (Jan: 49.3) and the lowest since Aug 2009, with declines across output, new orders and employment. Output levels contracted for the first time in over ten years, after stagnating in Jan.

- UAE’s Minister of State for Financial Affairs disclosed that it would take 3-5 years to collect data for the assessment of VAT’s impact on UAE GDP.

- The number of economic licenses issued in the UAE grew by 0.34% mom to 678,573 in Feb, according to the National Economic Register maintained by the Ministry of Economy. Abu Dhabi and Dubai together accounted for 68.6% of all licenses issued in Feb.

- According to a member of the Federal National Council, unemployment rate has reached ~13% among Emiratis, with ~40k youths out of 300k eligible workers active job seekers.

- UAE will allow full foreign ownership in 122 economic activities in the industrial, agricultural and services sectors. This includes about 51 activities in the industrial sector (e.g. manufacturing food and drinks products and aircraft repair), 52 activities in services sector (e.g. scientific R&D) and 19 activities in agriculture (e.g. cultivation of grains).

- A Property finder report states that some 48,500 units will be added to the Dubai real estate market by Sep 2020.

- As the Covid-19 cases touch 45 in the UAE, a decision was taken to close schools/ colleges/ universities for 4 weeks (bringing forward the spring break which was scheduled for end-Mar, followed by 2 weeks of online/ distance learning). This should ideally be supported by allowing for either flexi-times or better still “working from home” if possible. While the government allowed flexible work hours for its female employees with nursery-going kids during nursery closures, this practice should ideally be applied across the board in the private sector as well. Not only would this move lower contagion but could also be applied (if successful!) as a long-term policy for better work-life balance and improved overall happiness.

Weekly Insight on the economic impact of Covid-19 on the Middle East & potential policy responses

Since the Covid-19 outbreak surfaced two months ago, it has spread outside China and affected more than 100k persons globally. With the virus spreading faster globally – with Italy and Iran other major epicenters – in addition to lives lost, there is both a supply and demand shock. The supply shock will result from factory closures, supply chain disruptions, higher price of disrupted raw materials supply, along with tightening of credit, while weaker economic growth implies lower consumer spending (given workplace closures, quarantines), slowdown in aggregate demand and firms’ investment delays amidst higher uncertainty. The exact size of the shocks depends on the geographical spread, duration and intensity of the contagion. It is clear, however that (i) GDP growth will be lower than an already slow 2019; (ii) domestic demand will remain weak; (iii) inflation will be affected by an increase in inputs costs and goods prices and weaker demand will likely lower prices on retail spending and energy.

Initial reports suggest a slow resumption of production activity across China: The South China Morning Post reported yesterday that as of Tuesday, 45% of China’s small businesses, which account for 60% of GDP and 80% of employment, had reopened. However, the key is whether production and export capacity have been fully restored. The disruption has spilled over to many Asian countries – as evidenced by PMI readings – where the supply chain linkages are very strong. Taiwan dropped below 50, Vietnam fell to a more than 6-year low of 49 (highly dependent on China and South Korea for electronics components), while only Indonesia and Philippines reported an increase in PMI – at 51.9 and 52.3 in Feb respectively (highlighting their relatively lower exposure to China’s global supply chain and focus on food production).

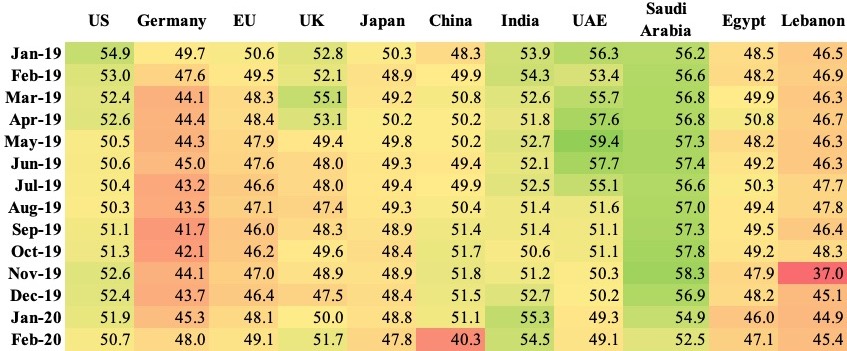

Fig. 1. Heatmap of Manufacturing/ Non-oil sector PMIs – the Covid-19 effect

Source: Refinitiv Datastream, Nasser Saidi & Associates.

Closer home, the PMI data continue to show signs of a slowdown: Middle East nations are not that integrated with the global supply chain and linkages with China remain lesser compared to Asian counterparts. However, the camel in the room remains oil: the most direct impact of a Chinese and global slowdown is from the demand for oil. OPEC already slashed its growth in global oil demand this year to 480k barrels per day (bpd) versus expectations of 1.1mn bpd growth in Dec (given the supply overhangs, OPEC recommended a massive production cut in Q2). This will affect the oil exporters – for most of whom fiscal break-evens are substantially higher than the current Brent oil price of USD 45 per barrel: as per the IMF’s Fall 2019 estimate, Iran’s is as high as US$194.6 while the UAE and Saudi Arabia’s estimates are at US$ 70 and US$ 83.6 respectively. Furthermore, spillover effects have been visible in travel and hospitality (airlines and hotels are requesting staff to go on unpaid leave, hotels rates are being cut to off-peak rates), tourism (including MICE, given the number of cancellations/ rescheduling of major events), entertainment and leisure activities (movie theatres, theme parks and the like) and retail (though anecdotal evidence suggests an uptick in e-commerce activity).

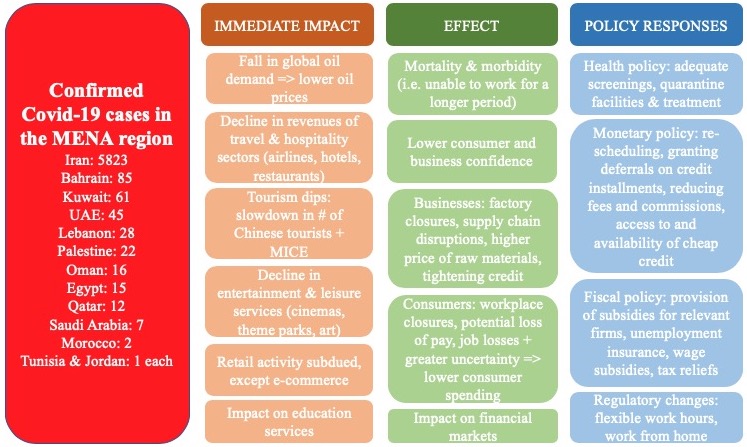

Fig. 2. Impact of Covid-19 on the MENA region & Potential Policy Responses

Source: Nasser Saidi & Associates. Covid-19 cases as of 8 Mar 2020 (reported by Johns Hopkins CSSE)

Major countries like Saudi Arabia and the UAE have been proactively fighting the spread of the virus with measures in place like closure of school/ universities as well as cancellation of large events (ranging from concerts to global events like Art Dubai). Saudi Arabia, being home to the Holy Mosques, announced temporary bans on the Umrah pilgrimages and that mosques would remain closed between the night and dawn prayers. With religious tourism one of the main sources of non-oil revenue for Saudi Arabia, this closure will have a significant bearing on economic growth: it would be much more prominent should such temporary bans/ restrictions be enforced when the Hajj season begins. The bottom line is that the GCC countries will suffer directly from the lower price of oil and from lower tourism and trade spillover effects.

Central banks, in spite of the peg to the dollar and lack of independence to conduct effective monetary policy, have been issuing effective guidelines to banks and financial institutions including advice to consider re-scheduling or granting deferrals on credit installments and/or reducing fees and commissions. If the outbreak persists, additional measures may include facilitating access to and availability of cheaper credit (especially for SMEs) and a case-by-case review of NPLs and/or defaults during the period.

The bottom line is that faced with a real supply shock and linked demand shock, fiscal policy stimulus is more likely to have a lasting impact to tackle the spillovers from the virus outbreak (e.g. subsidies for its international airlines) rather than monetary policy measures. This is a policy conundrum for the oil exporters of the region at a time when oil prices are also south-bound, unless the sovereign wealth funds are solicited to support, given the extraordinary circumstances.

Media Review

Lebanon’s Economy: To Avoid an Implosion

https://finance.yahoo.com/news/lebanon-economy-avoid-implosion-050529367.html

America Punished Elizabeth Warren for Her Competence

https://www.theatlantic.com/culture/archive/2020/03/america-punished-elizabeth-warren-her-competence/607531/

To Take on the Coronavirus, Go Medieval on It – The New York Times

https://www.nytimes.com/2020/02/28/sunday-review/coronavirus-quarantine.html

UK-listed companies face compulsory climate disclosures

https://www.ft.com/content/de915fb4-5f9e-11ea-b0ab-339c2307bcd4

Female work force participation is key to the Middle East’s economic development

https://www.thenational.ae/business/comment/female-work-force-participation-is-key-to-the-middle-east-s-economic-development-1.987027

Powered by: