This week’s “Weekly Insights” focuses on Women and Employment in the MENA region.

Markets

Stock markets in the US (S&P 500) and Europe (Stoxx 600) closed at record highs, as investors’ concerns about the impact of the coronavirus (COVID-19) eased. Even in China, stock markets are slowly recovering thanks to the various stimulus measures (more in the Bottomline section). Regional markets were mostly down, given the disappointing earnings season so far. The euro dropped to the weakest vis-à-vis the dollar in nearly 3 years while oil prices posted a weekly gain (the first since early-Jan), and gold prices closed near 7-year highs.

Global Developments

US/Americas:

- Inflation nudged up by 0.1% mom in Jan (Dec: 0.2%), thanks to a drop in energy prices. Core inflation edged up to 0.2% mom (0.1%) on higher rents and apparel prices, though in yoy terms core inflation stayed put at 2.3%.

- Retail sales increased by a modest 3% mom in Jan, from a downwardly revised 0.2% the month before. The rise was supported by an increase in auto sales

- Industrial production fell by 0.3% mom in Jan (Dec: -0.4%), with both manufacturing and utility outputs weak (-0.1% and -4%). Manufacturing was also hit by Boeing’s troubles.

- US posted a deficit of USD 33bn in Jan, compared to Dec’s USD 13.3bn deficit and a surplus USD 9bn in Jan 2018, in the latest monthly budget statement. Budget deficit looks on track to surpass USD 1trn for the first time since 2012, according to the Congressional Budget Office.

- Initial jobless claims increased by 2k to 205k in the week ende3d Feb 7, with the 4-week moving average remaining unchanged at 212k.

Europe:

- German Q4 growth was almost unchanged from previous quarter; in yoy terms, GDP grew by 0.3% yoy (Q2: 1.1%). At +0.6% yoy for the full year 2019, German GDP grew at the slowest pace since the region’s sovereign debt crisis.

- GDP in the wider Eurozone grew by 0.1% qoq and 0.9% yoy in Q4 (Q3: 0.3% qoq and 1.2% yoy); the bloc grew by 1.2% in 2019. The three biggest economies in Europe all stalled or shrank in Q4: France saw output contract by a modest 0.1% while Italy shrank 0.3%.

- Employment numbers have been encouraging: Germany has one of the lowest unemployment rates in the world while the latest data show that the number of employed people rose by 0.3% in the euro area in Q4 and by 0.2% in EU.

- Inflation in Germany increased to touch a 6-month high of 1.7% yoy in Jan (Dec: 1.5%), driven by increases in energy product prices (+5.2% yoy); in mom terms prices fell by 0.6%.

- EU industrial production (IP) dropped by 2.1% mom in Dec (Nov: flat), with sharp declines in Germany, France and Italy. IP was down 4.1% yoy – this is the weakest reading since the region’s sovereign debt crisis in 2012.

- Trade surplus in the EU widened to EUR 22.2bn in Dec (Nov: EUR 19.1bn). For the full year 2019, the Euro zone registered a EUR 225.7bn trade surplus: EU’s biggest trade surplus is with the US (EUR 152.6bn) while its biggest deficit is with China (EUR 163bn).

- UK Q4 GDP remained flat in qoq terms (Q3: 0.5%). In yoy terms, growth slowed to 1.1% yoy in Q4, following a 1.2% reading the quarter before.

- Industrial production in UK improved marginally, rising by 0.1% mom in Dec, following a 1.1% dip the month before. Manufacturing picked up by 0.3% mom (Nov: -1.6%). In yoy terms, IP and manufacturing dipped by -1.8% and -2.5% respectively.

Asia Pacific:

- China’s inflation increased by 5.4% yoy in Jan (Dec: 4.5%) – the highest since Oct 2011 – as the spread of the virus triggered buying of essential commodities (food prices were up 4.4% mom). Separately, the producer price index rose by 0.1% yoy from Dec’s 0.5% contraction.

- Japan’s current account surplus grew by 4.4% yoy to JPY 20.1trn, supported by an expansion in travel services (+9.1% to JPY 2.6trn). The surplus in current account last year was the first rise in 2 years although the goods trade surplus shrank for the 3rd year in a row (due to slowing export growth).

- Japan machine tool orders plummeted by 35.6% in Jan to JPY80.8bn, after losing in December 33.6%, as car-makers held off ordering.

- India industrial output dipped by 0.3% yoy in Dec (Nov: +1.8%), with manufacturing output falling by 1.2% (Nov: +2.7%) and electricity dropping by 0.1%. Separately, annual retail inflation rose to 7.59% yoy in Jan (Dec: 7.35%), partly by rising vegetable prices (+50% yoy).

- India’s trade deficit widened to USD 15.2bn in Jan (Dec: USD 11.3bn), as exports fell for the 6th consecutive month (-1.7%) and imports were down by 0.75%. During the first 10 months of the current fiscal year (Apr-Jan), exports have contracted by 1.9%, while imports shrank 8.1%, registering a trade deficit of USD 133.3bn.

- Singapore retail sales declined by 3.4% yoy and 1% mom in Dec (Nov: -4.2% yoy and 0% mom), on the back of falling motor vehicle sales. Excluding moto vehicles, retail sales nudged up by 0.1%. In 2019, retail sales declined by 2.8% yoy – the deepest contraction since 2013.

Bottom line: The Chinese government allocated CNY 71.8bn of fiscal funds to suppress the outbreak while Chinese asset managers have pledged capital of USD 350mn to support coronavirus-hit funds in a bid to boost investor confidence (in addition to the previous week’s PBoC stimulus). With expectations that globally, central banks and governments will intervene to support economic growth should the need arise, investors are pouring money across most asset classes amidst declining volatility indicators (https://tmsnrt.rs/2V1gWul).

Regional Developments

- GDP in Bahrain grew by 2.1% in 2019, supported by a 2.3% rise in the non-oil sector.

- Bahrain’s budget deficit narrowed by 24% yoy in 2019: as non-oil revenues increased by 63% alongside a decline in government spending by 3%, deficit declined to 4.7% of GDP in 2019 (2018: 6.3%). The primary budget deficit (i.e. excluding interest payments) fell 85% yoy, and the nation is aiming for a balanced budget by 2022.

- The head of Bahrain’s sovereign wealth fund called for greater de-regulation to attract FDI, citing the successful deregulation of the nation’s telecom sector in 2004: operators increased to 20 from one, resulting in a 50% drop in prices while employment increased by 17%.

- Egypt’s annual urban consumer inflation edged up to 7.2% in Jan (Dec: 7.1%) as prices of fruits and vegetables increased (+10.3% in Jan) as did transport (+16.3%); core inflation meanwhile increased to 2.7% (Dec: 2.4%).

- Egypt lowered its expectations for oil prices in the 2019-20 budget to USD 64 per barrel from USD 68, according to a report evaluating budget performance in H2 2019. Budget deficit during this period widened to EGP 236.7bn or 3.8% of GDP (Jul-Dec 2018: EGP 186.7bn or 3.6% of GDP). Total revenues edged up by 0.5% yoy to EGP 390.1bn, while tax and VAT revenues declined by 0.04% (to EGP 303.8bn) and 1.9% (to EGP 72.1bn) respectively.

- Egypt’s electricity subsidies were completely wiped out in H2 2019, down from EGP 7.992bn (USD 510mn) in the same period a year ago. Electricity prices were increased by an average of around 15% over the 2019-2020 fiscal year that began in Jul. Egypt slashed its spending on energy subsidies (excluding power) by 67.3% yoy to EGP 9.88bn in H2 2019.

- Egypt’s net government debt issues grew by 11.5% yoy to EGP 513bn (USD 32.74bn) in H1 of the 2019-20 fiscal year. Borrowing in H1 exceeded 70% of the target of EGP 725.156bn estimated in the budget.

- Gold reserves in Egypt increased by 3.7% mom to USD 3.424bn in Jan while foreign reserves nudged up by 0.08% mom to USD 45.456bn.

- Egypt’s central bank governor revealed ongoing talks with the IMF about technical assistance concerning structural reforms.

- Export of Egypt’s petroleum products rose by 4.54% to USD 4.9bn last year. LNG exports surged almost 2.5 times to USD 1.236bn.

- Egypt attracted EGP 1trn in foreign investments in planned and operated oil and gas projects, according to the sector’s minister, including USD 35bn during the last four years.

- Egypt’s official statistics agency disclosed that population crossed 100mn persons. Separately, unemployment rate fell to 8% in Q4 2019 vs 8.9% in the same period a year ago.

- US agreed to extend a waiver for Iraq to import energy supplies (including gas) from Iran. The latest extension will be for 120 days.

- Jordan launched 68 investment opportunities worth USD 4.5bn across various sectors; the tourism sector accounts for the largest share: investment volumes at USD 2bn from about 27 projects.

- Kuwait’s foreign reserves accelerated by 7.2% yoy to KWD 12.09bn (USD 39.9bn) in Dec. Money supply (M2) declined by 1.24% yoy and 0.24% mom to KWD 38.129bn while public debt instruments declined by 41.5% yoy and 4.61% mom to KWD 2.072bn at end-Dec 2019.

- Boursa Kuwait launched BK Main 50 Index, which represents the 50 most liquid securities in the main market. Constituents are to be reviewed annually based on average daily traded value; results will be announced on Jan’s second Sun and take effect on Feb’s second Sun.

- Lebanon has formally requested technical help from the IMF to draft a reform plan to support the economy. The IMF representative however stated that “Any decisions on debt are the authorities’, to be made in consultation with their own legal and financial advisers”.

- Lebanon’s finance minister stated that various options are being studied regarding the Mar 9 USD 1.2bn Eurobond payment, including whether to pay the debt. Capital Economics estimates a debt plan may involve up to a 70% haircut alongside a 50% drop in currency.

- Lebanon’s central bank set an interest rate cap of 4% on dollar bank deposits and a cap of 7.5% on Lebanese pound deposits, reported local media; these apply on deposits made or renewed from Feb 12.

- Lebanon’s flag carrier, MEA, which is 99% owned by the Central Bank, will not accept local currency any longer, only foreign currencies.

- Credit growth in Oman eased in 2019, rising by 3% yoy vs. 2018’s 6%. Among listed banks, steepest increase in lending came from the smaller banks: e.g. Ahlibank posted a 10% growth in net loans, advances and financing to OMR 2.45bn vs the largest Bank Muscat reporting a 0.7% decline to OMR 8.88bn.

- Cruise tourism in Oman surged by 43.6% yoy with the arrival of 283,488 tourists in 2019.

- Industrial production index in Saudi Arabia declined by 2.59% mom to 121.88 points. Declines were across the board, with mining and quarrying, manufacturing and electricity and gas supply down by 3%, 2% and 1.73% respectively.

- Saudi Arabia reduced crude supplies to some Asian buyers in Mar, after refiners reduced output.

- CEOs in Saudi Arabia are upbeat about the domestic economy while remaining concerned about global growth outlook, according to a KPMG survey of 50 CEOs.

- Saudi Arabia’s Public Investment Fund plans to have 1000 employees by end of this year, from 700 currently.

- The retail sector in Saudi Arabia currently employs more than 2mn persons, accounting for roughly one-fourth of the total workforce.

- Property prices in Saudi Arabia increased marginally by 0.5% yoy and 0.4% qoq in Q4 2019, according to Jadwa Investment. The report also stated that credit to the private sector rose by 7% yoy in Dec, posting the highest rise since Aug 2016.

- Tourists into Saudi Arabia are forecast to rise by 38% to 21.3mn by 2024 from 2019’s 15.5mn, driven by short city visits from GCC residents and business travelers, according to Colliers International.

- GCC nations rank highly in the 2020 Agility Emerging Markets Logistics Index: the list was topped by China and India, while UAE stood 3rd; Saudi Arabia (in 6th place), Qatar (7), Oman (14), Bahrain (15) and Kuwait (19) also rank favorably in the list.

- In a report titled “The state of the pre-seed startups in MENA” launched by Wamda and the STEP conference, it was disclosed that only 32% of startups are currently registered and within those 60% are either in UAE or Egypt.

UAE Focus

- Dubai’s non-oil private sector activity softened to 50.6 in Jan (Dec: 52.3) – the weakest since Feb 2016 – as output slowed (subdued by soft new business volumes) while construction, wholesale and retail sector PMIs fell below the 50-mark. Firms tried to boost sales through lowering output prices (for the 21st month in a row) while the rate of job losses was the strongest in the series’ 10-year history.

- Dubai Economy’s Business Registration and Licensing department issued a total of 4,076 new business licenses in Jan, creating about 10k+ new job vacancies. No comparative data were provided.

- Bloomberg reported that UAE’s biggest bank, First Abu Dhabi Bank, had terminated 100s of employees across multiple divisions. Separately, it was reported that Abu Dhabi Islamic Bank was planning to save ~AED 500mn (USD 136mn) by cutting jobs and closing branches.

- A CBRE report found that existing supply of residential real estate in Dubai stood at 608,500 units at end-2019, with an additional 127k units expected to be delivered by 2023.

- Dubai’s prime residential market witnessed transactions of over 1,454 villas and 16,522 apartments in 2019, according to statistics from Luxhabitat. The volume of such transactions grew by 22% to AED 42.3bn in 2019, while the average price per foot fell by 3.72%.

- UAE’s first floating solar power plant – a pilot facility with a capacity of just 80kW – will start producing electricity off the tiny resort island of Nurai “very soon”.

Weekly Insights on Women and Employment in the MENA region

Two news items inspire this week’s weekly insight: the FT’s feature on Middle East’s demographic dividend and the Global Women’s Forum being held in Dubai 16-17 Feb.

The young fast-growing population should have been the cornerstone of growth in the MENA region: it is the world’s second youngest region (behind sub-Saharan Africa) with close to 60% of the population under 30. However, low levels of growth, the lack of job creation and rising levels of unemployment has led to this being a curse rather than a boon (which ignited the Arab Spring back in 2011) and continues to fuel ongoing anti-government protests- from Algeria to Sudan, Lebanon to Iraq). The World Bank estimates that MENA needs to create a staggering 300mn plus jobs by 2050, and all this while the world is preparing for the 4th industrial revolution (a technological revolution including widespread use of AI) which is likely to displace and destroy medium and low skill jobs in the region.

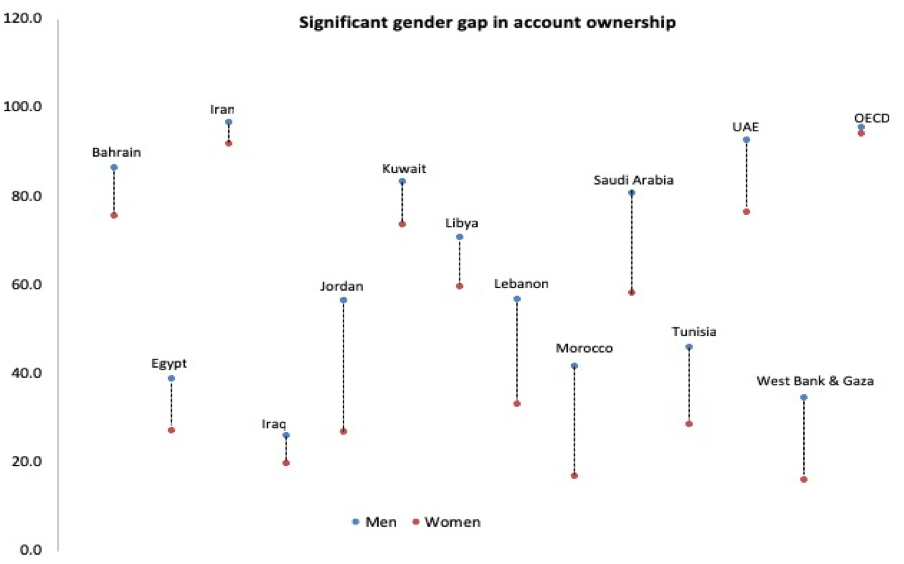

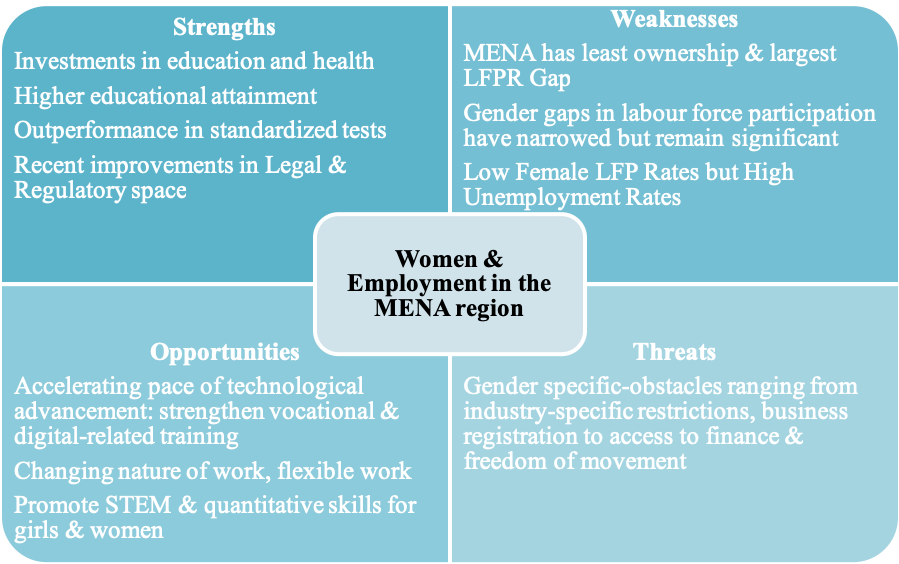

While the role of women in supporting economic development is not subject to dispute, women in the MENA region have been held back by various cultural and socio-economic barriers (the usual suspects of marriage, childcare and others like access to a bank account, ease of mobility, property rights, and so on). There has been significant progress on legal and regulatory barriers – the World Bank’s Women Business and the Law 2020 edition noted that the region was enacting the maximum number of reforms[1], though it remains the region with the lowest average score (49.6 vs the previous edition’s 44.9). The legal changes of course need to be accompanied by equal participation of women and men in the labour market and business, let alone politics. According to WEF’s Global Gender Gap 2020 report, gender parity will not be attained in the region for another 140 years!

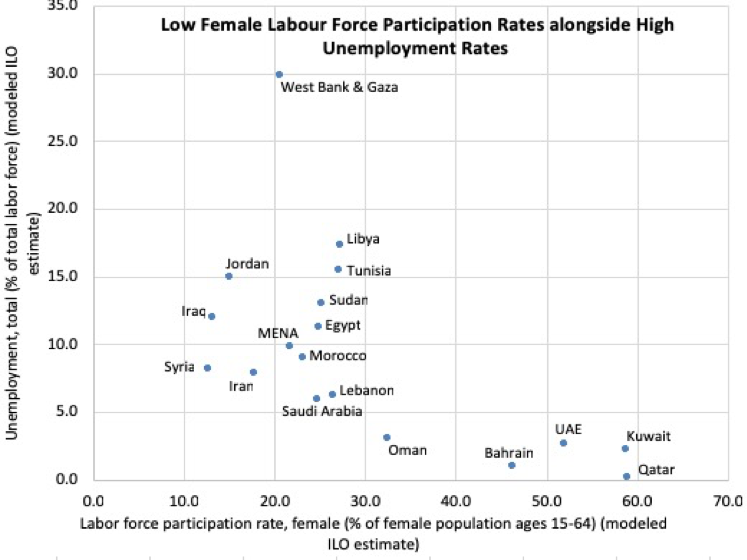

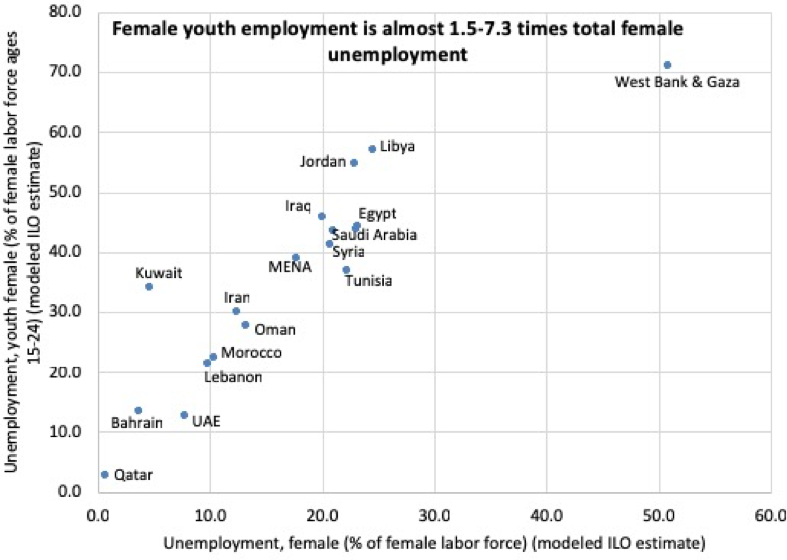

While labour force participation rates in MENA have improved over time, women have largely remained on the sidelines (in spite of their higher educational attainment and outperformance in standardized tests). The female labour force participation rate (FLFPR) has been rising, but still remains around 21.7% for the region – and low FLFPR coincides with higher female unemployment rates at an average of around 17.8% and closer to 40% for young women!

The region’s preference for public sector jobs – especially among women – however is not surprising, given the wide gender gaps in self-employment and entrepreneurial activity in the region. It is estimated that on average, self-employed females account for 30% of female employment in the region, rising to as high as 63% in Morocco (vs. 12.4% in the OECD). However, only one in ten self-employed women are employers, compared to one in four self-employed men; this is even lower in larger firms (OECD). Women representation is lacking even in pre-seeded start-ups, with women accounting for just a quarter of the founders (Wamda, STEP conference, 2020). This needs to change – especially as female-owned businesses tend to hire more women (25%) than their male counterparts do (22%).

How can the region progress? Economic growth and development do not necessarily lead to gender equality and empowerment of women. What the region needs is an affirmative action programme that actively promotes women and reverses marginalisation and discrimination. Alongside legal and regulatory changes, and reducing the costs of doing business, the region needs to support the move towards a more digitized economy (i.e. encouraging flexible work arrangements, strengthening vocational & digital-related training for women, promoting quantitative skills training, greater push towards STEM etc.). Last but not least, availability of timely data on factors that facilitate and discourage entry of women into the workforce would support policy making at a nation level. The bottom line is that investing in institutions and infrastructure for greater inclusiveness and participation will gradually lead to a change in ingrained cultural attitudes and to greater empowerment and economic integration of women.

Chart 1: Significant gender gap in account ownership

Note: The chart tracks account ownership at a financial institution or with a mobile-money-service provider as a % of population ages 15+ male vs female.

Source: World Bank data, Nasser Saidi & Associates.

Chart 2: Low Female Labour Force Participation Rates along with High Unemployment Rates

Source: ILOSTAT, Nasser Saidi & Associates.

Chart 3: Female youth employment is almost 1.5-7.3 times total female unemployment

Source: ILOSTAT, Nasser Saidi & Associates.

Table: A SWOT Analysis of Women & Employment in the MENA region

Source: Nasser Saidi & Associates.

Media Review

Sovereign investors pulled back from equities in fourth quarter

https://www.reuters.com/article/us-swf-investment-markets/sovereign-investors-pulled-back-from-equities-in-fourth-quarter-report-idUSKBN2071QC

Middle East’s demographic earthquake: the generation fuelling protests

https://www.ft.com/content/03274532-21ce-11ea-b8a1-584213ee7b2b

Dubai retailers being offered free space in some malls: Chalhoub Group

https://www.arabianbusiness.com/retail/439894-exclusive-dubai-retailers-being-offered-free-space-in-selected-malls-chalhoub-group

Foreign investors in row over Lebanese debt

https://www.ft.com/content/98a75182-4f24-11ea-95a0-43d18ec715f5

[1] Saudi Arabia, UAE, Bahrain, Jordan and Tunisia were among nations introducing maximum number of reforms supporting women.

Powered by: