Dr. Nasser Saidi’s comments on Lebanon’s escalating economic-financial-fiscal crisis appeared in the article titled “Lebanon’s creditors adopt crash position as default risk worsens” published in the FT on 16th Nov 2019.

The full article can be accessed at: https://www.ft.com/content/11d008d6-07b5-11ea-a984-fbbacad9e7dd

Comments are posted below:

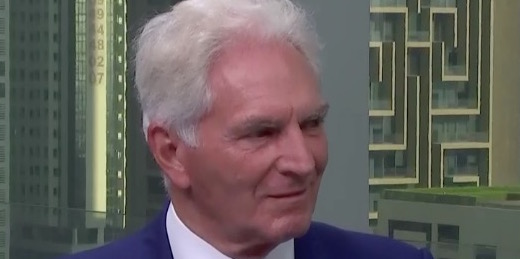

Nasser Saidi, a former BdL vice-governor and former economy and trade minister, said different approaches were needed to ease the debt servicing burden of Lebanon’s foreign currency and local currency debts.

Mr Saidi said that maturities on local debt could be extended and interest rates lowered, if BdL, local banks and pension funds were to agree with the measures. He added that multilateral development banks and foreign donors could offer guarantees on Lebanon’s foreign currency debt, lessening the pain for investors taking forced losses.

But he said that politicians need to act fast and appoint a government with technical skills to see through this difficult process. “The longer you take to . . . undertake a painful adjustment, the worse the problem becomes,” Mr Saidi said.

Mr Saidi said that maturities on local debt could be extended and interest rates lowered, if BdL, local banks and pension funds were to agree with the measures. He added that multilateral development banks and foreign donors could offer guarantees on Lebanon’s foreign currency debt, lessening the pain for investors taking forced losses.

But he said that politicians need to act fast and appoint a government with technical skills to see through this difficult process. “The longer you take to . . . undertake a painful adjustment, the worse the problem becomes,” Mr Saidi said.