Global Developments

- With Obama back from the European trip the focus shifts to the domestic front where data remain weak: initial jobless claims fell by 20k for the first week of April, but this only brought it back into the 650k range they had been in for several weeks ago.

- Euroland retail sales declined again in March by [2.4%] on an annual basis. Additionally, revised fourth quarter 2008 GDP numbers point to a dismal -1.5% quarter-on-quarter growth (the biggest contraction since 1995), with all components, except stockbuilding down, exports plummeting 7.3%qoq and capital expenditure (-4.0% qoq). The large build-up of inventories suggests lower production in first quarter of 2009.

- German Manufacturing Orders remain in recession territory in spite of the Purchasing Managers Index (PMI) signaling a stabilization in orders. Manufacturing orders in Feb were down 3.7% month-on-month (-6.7% in Jan).

- Japan on Friday announced a third stimulus package on Friday, of $150 billion – bringing the total amount of “new spending” to around 5% of GDP, also increasing Japan’s public debt (OECD forecast: 197% of GDP).

- Japan machinery orders (private sector excluding shipping and electric power) posted their first increase in five months in February, rising 1.4% month-on-month (Jan: -3.2%). However, external orders (indicator for capital goods exports) were still showing a decline.

- China’s March trade data reported a stabilization and modest rise in exports – exports were $90.3 billion, down 17% year-on-year (the Jan-Feb09 average had been -21.6%). The trade surplus for Q1 as a whole ($62.3 billion) was up 53% from a year earlier.

- Taiwan’s March exports came in at -35.7% year-on-year (compared to -37.2% averaged in Jan-Feb09). A breakdown by country showed that the improvement in exports was mainly contributed by demand from China (-37.6% in Mar09, vs. -44.4% in Jan-Feb09) – in one of the initial signs of a possible turnaround.

Regional Developments

- Merger and Acquisition activity in the GCC shrank by 55% to USD6.5bn in 2008 according to the Global Investment House. The largest operations were in telecommunication. Most of the decline took place in Q4.

- The GCC Heads of state are due to decide the location of the Gulf Central Bank in May according to the Head of Oman Central Bank.

- KSA has spent an estimated $400bn of SAMA foreign currency reserves to sustain its economy and its banking system in Q1 2009 according to economists analyzing the SAMA balance sheet. The effects are already visible in the banks’ profits for the first two months of 2009 which totaled SR 6bn form a SR 95ml in December.

- The proposals for building Saudi Arabia’s North-South Railway have been reaffirmed with the Saudi Binladin Group earning the SAR 1.7billion contract along with the French defence group Thales to build signaling, ticketing, communications and security systems for the planned 2300km railroad.

- Kuwait’s Central Bank issued a fifth tranche this year of $275ml of one year treasury bonds. It was oversubscribed by almost eight times according to the central bank.

Market Intelligence on the UAE:

- Dubai Fly, the low cost airline is due to start operations on June 1st with two Boeing serving Beirut and Amman.

- Abu Dhabi government aims to issue an additional $7bn in bonds over the next two years according to Hamad Al Suwaidi, undersecretary at the Department of Finance.

- Abu Dhabi will be investing nearly $10bn into expanding its gas output capacity inspite of other similar projects being shelved in the GCC. This investment is expected to triple the output of Gasco (Abu Dhabi Gas Industries Company) within five years.

- Dubai jobless rate for 2008 came in lower than the UAE average at 2.4% (2007: 3.45%). However, this indicator is trivial given that (a) expatriates who are unemployed have to leave the country within 30 days and (b) those employees that are fired are no longer counted in the workforce.

- Dubai Cotton Exchange is planning to start operations on the third week of April.

- Reclamation work was completed at man-made Al Rajan Island in Ras al Khaimah according to the developer.

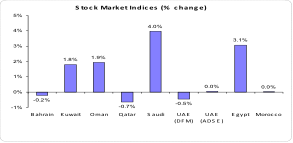

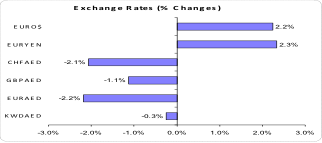

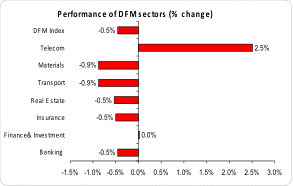

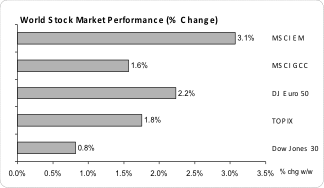

Market Snapshot as of 12/04/2009 at 14:30 (all % figures are weekly changes from 05/04/2009)

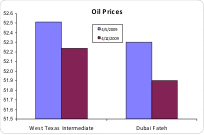

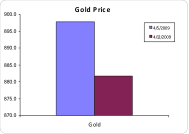

Optimism is evident in most global stock markets – with most global markets moving to (or towards) multi-month highs. Asian stocks climbed for a fifth week, the longest streak of gains since February 2007 after Japan’s third and biggest stimulus package announcement. Oil and gold prices have both declined over the past with, with gold losing its stand as an alternative ‘safe’ investment.

Source: Bloomberg, DIFC Economics.