Global Developments

- The G20 meeting in London was a rare moment of international cohesion on the measures to tackle the crisis among which 1) trebling of IMF resources to $750 bn, additional funds for $250 bn to support trade finance and $ 100 bn for development banks; 2) establishing a new Financial Stability Board (FSB) with enhanced powers to provide early warnings of financial and macroeconomic instability and reshape financial markets regulations; 3) clamping down on tax havens.

- The $1.1 tr stimulus is indeed much needed: OECD has downgraded global growth forecast (-4.3% in 2009).

- The U.S., Euro area and U.K. PMIs rose somewhat (although remain very weak and still signal contraction in output). On the contrary Chinese PMI (private sector, from CLSA) fell, to 44.8 (from 45.1 last month). The Bank of Japan’s Tankan survey was very weak, with the large manufacturers’ diffusion index falling a massive 22 points, to -58. The best performer was India whose PMI at 49.5 is close to enter recovery territory.

- US Payroll data showed that 663,00 jobs were lost in March, with another 86,000 in downward revisions sharpening the declines already reported.

- President’s Obama took a tough stance towards the auto industry. His plan gives GM another 60 days, and Chrysler 30 days, to extract more concessions from creditors and workers, or face the prospect of a bankruptcy judge forcing these concessions. The ousting of top managers and the merging between Chrysler and Fiat is a reminder that no solution is ruled out from now on.

- The ECB is still hawkish: it cut its reference rate by 0.25% to 1.25% against expectations of 0.5%.

- German March labour report showed another 69k rise in unemployment, with the rate up to 8.1%.

- Japan unemployment rate increased to . The government has swiftly announced an additional stimulus plan after the first tax cuts and new spending for 2% of GDP.

- Korean industrial production rebounded sharply in February up 6.8%m/m. Also Korean trade continues to show some signs of stabilization: exports rose in March (nsa basis), to their highest level since November.

Regional Developments

- Qatar is projecting a slight budget deficit for the next fiscal year starting on April 1according to the Qatar Advisory Council.

- KIA will provide consistent funds to recapitalize the bank and other companies in Kuwait according to the Central Bank Governor.

- Global Sukuk issuance fell 37% to USD1.8bn in Q1 2009 compared to the same period in 2008 (Zawya)

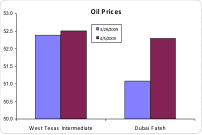

- Two projects which would have boosted Saudi Arabia’s daily oil production capacity beyond 12.5 ml barrels face delays, suggesting KSA is not rushing to add capacity as demand slumps

Market Intelligence on the UAE:

- Abu Dhabi’s USD 3bn bond issue – in one five-year tranche of $1.5bn, and a second tranche of $1.5bn with a tenure of 10 years – was oversubscribed more than two times as investors offered to buy about $7bn of the bonds. This appetite shows the positive investor sentiment in the region and could prove to be the final push for the development of a regional fixed income market to create liquidity.

- Two Abu Dhabi-based banks First Gulf Bank and Abu Dhabi Islamic Bank have secured a total Dh6.7 billion in fresh capital from the emirate’s government.

- Al Ghurair Group has signed a $347.2 million Islamic facility – structured in Ijara and Musharaka involving a sale and lease-back of the asset owned by the client – with a group of financial institutions, the largest to a private entity this year.

- Moody’s dropped by one notch its rating for Emaar to Baa1 from A3, just two points shy of “junk” status. It cut the rating for Dubai Holding Commercial Operations Group to A2 from A1. Moody’s said its negative outlook highlights Dubai’s vulnerability in the current global economy, given its reliance on volatile industries such as real estate, trade, financial services and tourism. It also cited Dubai’s swelling debt and refinancing constraints.

- The GCC Central Bank governors are set to meet in Muscat (April 6-7) as part of their twice-yearly meeting. The agenda includes the location of the Gulf Central bank and an alternative timetable for the single currency.

- Dubai’s DLD has announced a new amendment to Law 13 on Real Estate which is intended to clarify the rules on the termination of off-plan contract. A circular on Art. 11 of the Law issued in August had sparked controversy and contributed to the downfall in the real estate sector by sapping investors’ confidence.

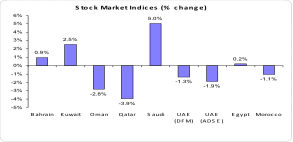

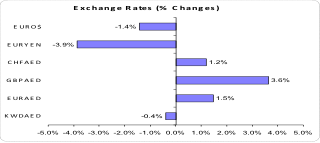

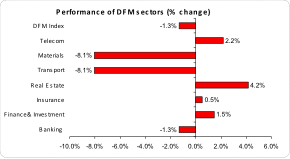

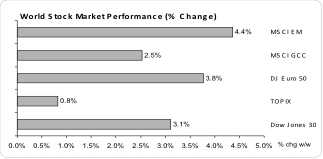

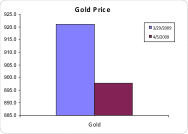

Market Snapshot as of 05/04/2009 at 14:30 (all % figures are weekly changes from 29/03/2009)

Source: Bloomberg, DIFC Economics.