Global Developments

- The US government has unveiled another bank bailout plan. Market participants have lost count of how many plans have been already presented, but essentially they all look similar to the one presented in November 2008 under the Bush Administration. Instead of fresh thinking the Geithner-Bernanke team persists in an approach that markets and logics find difficult to appreciate. As Nobel laureate Krugman has pointed out: investors, like hedge funds and private equity funds, have refused to pay more than about 30 cents on the dollar for many bundles of mortgages, even if most of the borrowers are still current. But banks holding those mortgages, not wanting to book huge losses on their holdings, have often refused to sell for less than 60 cents on the dollar. The Treasury hopes to bridge this gap with public money.

- Meanwhile the US economy, as quickly pointed out by President Obama, is showing sketchy signs of improvement: durable goods orders rose by 3.6% boosted by defense orders, new home sales in February bounced back from a January record low, increasing 4.7% annual rate and existing home sales jumped 5.1%.

- US fourth quarter GDP (for 2008) was revised downward slightly, to -6.3% from -6.2%. The composition of GDP showed a steeper decline in nonresidential construction, from -5.9% to -9.4% while trade contributed a bit more from a pullback in imports than any increase in exports.

- US Personal Consumption Expenditure (PCE) core price index indicates a small gain in real spending in the first quarter – revised numbers for real consumption in January showed a jump by 0.7%, with February registering a 0.2% decline. The core PCE price index for February increased by 0.24% (month on month) and the overall PCE index by 0.35%.

- Belgian manufacturing index, a leading indicator for the whole euro area, rose to -33 from a very depressed -36 a month ago. Despite the improvement the current level is consistent with a 2.0% drop in Euroland’s GDP.

- Japan exports plunged by half in February on the year the worst dive ever, with cars export dropping 70%.

- Oil inventories rose 2.8m barrels higher in the week ended March 20, with crude stocks up by 3.3m barrels.

Regional Developments

- Bahrain is finalising a $500 million Islamic bond and will see economic growth halve to around 3% this year, according to the central bank governor.

- Kuwait’s government has approved the USD 5.2bn stimulus package despite the dissolution of Parliament last week. The Central Bank estimates that GDP could contract by 1% this year.

- Qatar government has purchased up to QAR 6.5bn in Qatari companies’ stocks owned by local banks in an attempt to prop up the market and recapitalize the banks.

- Nasser al Kaud, deputy assistant general for economic affairs at the GCC Secretariat has declared to Financial Times that the Gulf Monetary Union cannot be completed by Jan 1 2010, contradicting a commitment made by Heads of States in their last summit in Muscat three months ago. GCC Secretary General Al Attiyah however later reiterated that the 2010 deadline is still valid.

- The common central bank planned for the GCC will target price stability but not a specific inflation rate, as per a statement made by the head of the monetary union unit at the GCC General-Secretariat.

Market Intelligence on the UAE:

- The UAE economy has reported a growth rate of 7.4% in 2008. Data released by the Central Statistics Department announced 2008 GDP at fixed prices came to AED 535.60bn. Additionally, trade surplus of the UAE grew by 23.8% (year-on-year) to AED 184.1 billion in 2008.

- Dubai projects economic growth of 2% for 2009, as cited in an Executive Council meeting attended by the Dubai ruler (Source: Reuters).

- Abu Dhabi-based First Gulf Bank has paid off a three-year syndicated term loan facility worth USD 750mn which matured on March 16, according to a public statement from the bank.

- The Dubai Electricity and Water Authority (DEWA) is completing the refinancing of its USD 2.2bn islamic loan maturing next month. DEWA has announced its plan to invest AED 13bn in new projects this year, in line with their spending plan of AED 75bn to facilitate UAE’s future economic growth.

- Standard & Poor’s Ratings Services and Fitch have assigned a ‘AA’ long-term senior unsecured debt rating to the Abu Dhabi’s upcoming USD 10bn global medium-term note program.

- Abu Dhabi’s Aabar has acquired a 9% stake in Daimler reviving the activism of sovereign wealth entities in high profile international deals.

- UAE national banks boosted their combined net earnings by 6.2% in 2008, to around AED 19.92bn.

Market Snapshot as of 29/03/2009 at 14:30 (all % figures are weekly changes from 22/03/2009)

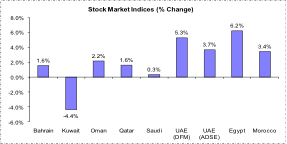

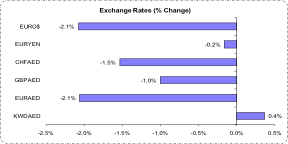

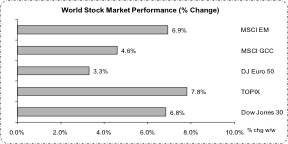

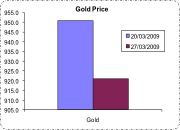

Stock markets worldwide were positively influenced by the new US plan for the banking sector. Optimism in the global financial markets was reflected in the positive sentiment in the Gulf markets last week, with the Qatar bourse performing the best of the lot – also due to the promised government support. The dollar fluctuated given Geithner’s remarks on the dollar after China commented about a new reserve currency to replace the greenback – the USD gained against the Yen, but remained a shade weaker against emerging market Asia. Oil prices have registered gains on news of better than expected economic data from the US and the Chinese economy. Gold prices are still strong when compared to the prices last year, but looks likely to lose its stand as an alternative investment with dollar strength.

Source: Reuters 3000Xtra, DIFC Economics.