Global Developments

- A relatively strong retail sales report for February from the US last week – total sales were down by 0.1%, but ex autos sales increased by 0.7%. However initial jobless claims rebounded and continuing claims pushed higher. Univ. of Michigan consumer sentiment (provisional) ticked upwards in March to 56.6 (Prev: 56.3).

- Euro area retail sales volumes in January were flat relative to December and were down just 1.4%, relative to the fourth quarter.

- In Germany the volume of total manufacturing orders plunged 8% month-on-month in January 2009, with capital goods orders down 9.1%.

- Japan’s current account moved into deficit at Japanese Yen (JPY) -172.8 bn in January, for the first time since January 1996. Net investment income (JPY15.8 trn), which made up 97% of the current account surplus in 2008, declined 31.5% year on year to JPY992.4 bn in January from JPY1.4 trn in Jan08.

- Weak domestic and external demand were reflected in the revised Q4 Japan GDP (-12.1% quarter on quarter annualized), similar to the preliminary release (-12.7%).

- Japanese core machinery orders also fell 3.2% month on month but these numbers are in contrast to Chinese fixed asset investment data, jointly released for Jan-Feb 2009, posted a 26.5% year on year gain, broadly in line with the fourth quarter 2008 average.

- China’s inflation came in at -1.6% year-on-year in February (Jan: +1.0%). This sudden drop is due to base effects largely due to a shift in Chinese New Year (CNY) (last year in Jan, this year early Feb). Another indicator affected by CNY was export growth – which fell significantly by 25.7% year on year in Feb09 (Jan: -17.5%), while imports decline rate slowed (Feb: -24.1%; Jan09: -43.1%).

Regional Overview

- Kuwait overnight money market rates have fallen to around 0.25% and the interbank markets are flush with liquidity. This prompted Kuwait’s central bank to issue 107 million dinars of one-year Treasury bonds (carrying a coupon of 2.25%) and six-month treasury bills with a yield of 2.125% on Wednesday to drain liquidity.

- The Kuwaiti government will guarantee 50% of a maximum of 4 billion Kuwaiti dinars ($13.56 billion) bank loans to local companies in a wide range of sectors such as farming, industry, trade, construction, oil, petrochemicals, and services.

- The Central Bank of Oman reported a surge in 2008 budget surplus to Omani Rial (OMR) 1.58 billion, from strong oil prices and higher crude output. A breakdown showed a deficit of around OMR399 million in Dec from a 42% month-on-month increase in spending in Dec and revenues contracted by 73% in the same period.

- Qatar’s economy grew 7.8% at current prices in the fourth quarter to 83.2 billion riyals, down from a more than 60% surge in the third quarter. The economy expanded 44% to 372.38 billion riyals at current prices for the full year 2008. Qatar’s government announced on Monday that it would buy the investment portfolios of seven banks with help from the Qatar Central Bank by the end of the month. This sent the Qatar stock market up 8.9%, bolstering overall confidence.

- Saudi Arabia’s annual inflation fell to 6.9% in February from 7.9% in January, according to the Central Department of Statistics.

Market Intelligence on the UAE:

- Funds from an emergency $10 billion programme to assist Dubai’s debt-strapped companies will flow to businesses within two weeks in the form of loans or through banks, according to Nasser al-Shaikh, head of Dubai’s finance department.

- Loans at United Arab Emirates’ (UAE) banks exceeded customer deposits by 110 billion dirhams ($29.95 billion) and the government was looking for a way to bridge the gap, as per a statement by the UAE central bank’s governor. “The current situation requires a stimulus plan for banks and the economy in view of this ‘gap’ which could be bridged in collaboration with the Ministry of Finance,” said Sultan Nasser al-Suweidi, the Central Bank governor.

- According to the Director-General of the Dubai Naturalisation and Residency Department (DNRD), the DNRD has cancelled the residency visas of about 44,000 people during February and issued more than 66,000 residency visas in the same month.

- Inflation in the United Arab Emirates is expected to fall to between 5 to 8% this year according to the Economy Minister Sultan bin Saeed al-Mansouri. (Source: Reuters)

- The merger of the Real Estate Bank and the Emirates Industrial Bank – to form Emirates Development Bank – is estimated to have Dhs 10 billion in capital and is expected to provide credit to the small and medium size enterprises.

- A draft law on credit information – to regulate bank loans provision- has been approved by the Federal National Council. It calls for the establishment of a company (affiliated to the Central Bank) to collect, file, analyse, classify, use and exchange credit information and reports.

- Transparency scores of four of the 11 sovereign wealth funds (SWFs) from the Gulf region improved, as per the Linaburg-Maduell Transparency Index created by the Sovereign Wealth Fund Institute. Abu Dhabi’s Mubadala and Bahrain’s Mumtalakat shared the top slots from the region, ranking 13 and 14 among the 45 SWFs tracked.

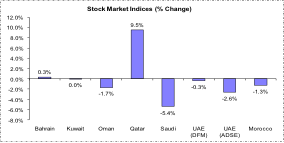

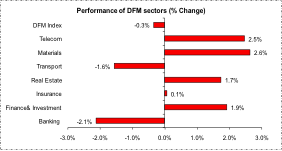

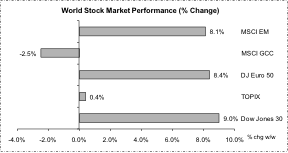

Market Snapshot as of 15/03/2009 at 14:00 (all % figures are weekly changes from 08/02/2009)

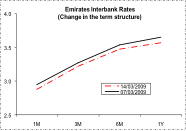

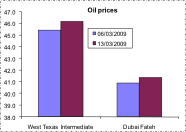

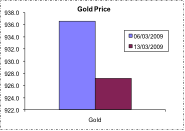

Friday proved good for the markets globally – the rally continues on the back of announcements made by Citigroup, Bank of America and JP Morgan about earnings in Jan&Feb, improvement in US data – but the recent rebounds in most indices have generally brought them back to where they were a couple of weeks ago (i.e., the end of February). In the regional markets, (update after 2pm). Emirates interbank rate has continued its decline, closing its gap with the policy rate. Though improving from last week, oil price fell toward $46 a barrel as bearish forecasts for demand outweighed the potential for production cuts agreement when the OPEC meets today.

Source: Reuters 3000Xtra, DIFC Economics.