Global Developments

- US Unemployment rate soared to 8.1% in Feb, the highest in 25 years, with 651000 jobs lost last month. Initial claims dipped back down to 639k from 670k last week. Despite the decline, the numbers still point toward a weak labour market. We expect unemployment to exceed 10% in 2009.

- US ISM Manufacturing Survey for Feb ticked up slightly, with improvement in production and modest signs of inventory correction. But there were sharp corrections in construction sector data, showing continuing decline.

- Analysta are forecasting US total loan and securities losses to amount to $3.6T, half of which accrue to the U.S. banking system, or $1.8T. Capitalization of FDIC banks is $1.4T, that of investment banks as of Q3 $110bn. If projected loan and securities losses materialize, the U.S. banking system is close to insolvency despite TARP 1 of $230bn and private capital of $200bn.

- Euroland’s manufacturing PMI is showing signs of stabilising. Germany and Spain, the weakest countries, seem to have stabilised tentatively while deterioration accelerated in France and Italy.

- Harmonised flash estimate for February’s Euroland inflation was marginally higher at 1.2% from Jan’s 1.1%.

- ECB projections for Eurozone growth significantly lowered from [-1.0% 0.0%] to a range of [-3.2% -2.2%] for 2009. Accordingly the ECB cut its policy rate by 50 bps to 1.50% and recommitted to providing unlimited liquidity at the policy rate until beyond the end of 2009.

- Bank of England cut interest rates 50bps to 0.5%, a new historical low.

- China’s Premier Wen Jiabao promised on Thursday to deliver 8% economic growth and record government spending this year. However, he failed to outline the new stimulus package many global investors had been expecting.

- Positive data from China included the continuing (3-month) rebound in Purchasing Managers Index (PMI), as export orders saw a large improvement.

- South Korean economic activity continued to weaken in January, driven by a further contraction in exports (-21.8% year on year) and investment weakness. Industrial output contracted by 25.6% from a year ago and weak durable goods demand led to decline in sales of consumption goods by 3.1%.

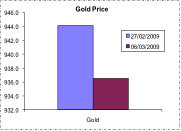

- South Korean CPI rebounded to 4.1% from a year ago in February (3.7% in January) – increase in headline inflation reflects in part an expiration of the gasoline tax relief and a spike in gold prices.

- Both India and Indonesia cut policy rates by 50bps each – India, for the 5th time since last October.

Regional Overview

- A recent IMF study put total GCC medium-term investment project investments at $ 2.193 trillion, with evidence of diversification (massive investments in petrochemicals and industry) in the UAE, while Oman and Bahrain were focused on attracting tourism.

- Saudi Arabia’s and Bahrain’s January money supply growth slowed to the lowest in two years, an early indicator of slowing inflation and slower growth in the region.

Market Intelligence on the UAE:

- The UAE Central bank is to set up a joint task force with banks in the country to tackle the credit crisis. The bankers also informed the Central Bank board that the recent measures to inject funds into the banking sector had a positive impact.

- Budgets in the UAE will move to a three-year term and will be based on a “zero-based” format, moving away from the current incremental budgeting.

- According to the Ministry of Economy, UAE topped GCC in foreign investment in 2008, with 60% of the foreign investment flowing into the GCC (valued at $20bn) coming into the UAE.

- Abu Dhabi Department of Finance (DoF) announced total foreign trade in 2008 for the emirate increased 37.5% year on year to Dh102.779 billion.

- Having completed the official (Article IV) annual review of the UAE economy, IMF has estimated that growth surged by around 13.9% in nominal terms and 6.1% in real terms in 2008. The oil sector grew by 24.2% to Dh305.5bn from Dh246bn a year ago, while the non-oil sector swelled by 8.4% to Dh495.5bn. Non publication by the authorities of the IMF’s Article IV will be badly perceived by the international financial markets and be viewed as lack of transparency.

- To boost the bank’s regulatory capital base and hence improve the capital adequacy ratio, Emirates NBD is planning to seek shareholder ratification to convert half of the deposits it received from the Ministry of Finance last year to Tier 2 capital. We estimate that UAE banks need to increase their capital base by some US$22 billion.

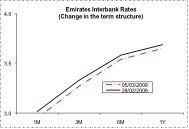

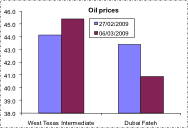

Market Snapshot as of 09/03/2009 at 14:00 (all % figures are weekly changes from 28/02/2009)

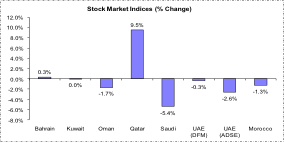

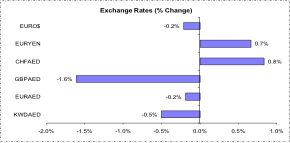

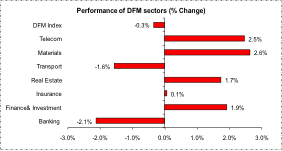

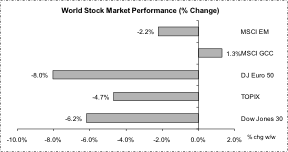

Stock markets in Asia and Europe were reeling Monday amid fresh concerns over the strength of the global banking industry as HSBC announced a 70% fall in profits and the U.S. government said it would pump $30 billion into ailing insurance giant AIG. US Stocks tumbled, driving the S&P 500 to its lowest level since 1996 (down 4.3% to 683) and the DJIA fell by 4.1% to 6,594, after Moody’s said it may cut JPMorgan’s credit rating and China quelled speculation the government will add to its stimulus plan. The situation has worsened with news about the near-bankruptcy of General Motors. The weak sentiment globally has rubbed off on the regional markets also; only Qatar has seen a positive change from last week. Oil rose above $45, gaining support from a weak dollar and OPEC meeting later this month. Gold prices have started to rise after falling earlier this week, as investors flocked to gold as a safe haven, on volatility in other assets.

Source: Reuters 3000Xtra, DIFC Economics.