Global Developments

- The stimulus package proposed by the US government is still being mulled over with skepticism by

Market Intelligence on the UAE:

- The Dubai government issued bond for USD 20 bn of which USD10bn have been subscribe by the UAE Central Bank, in a move widely interpreted as a support by the federal government to the Dubai government. As a consequence markets and sentiment rallied.

Market Snapshot as of 22/02/2009 at 14:30 (all % figures are weekly changes from 15/02/2009)

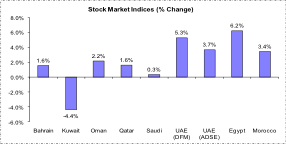

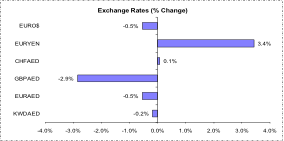

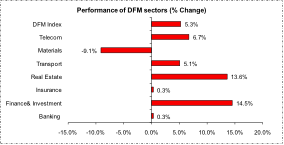

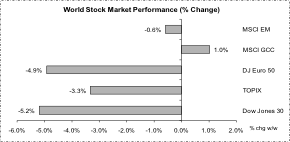

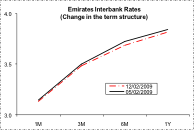

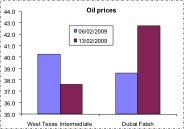

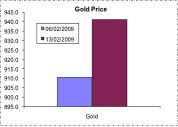

Stock markets in developed countries fell sharply on continued disappointment for the US stimulus package and concerns over Japanese banking sector. Emerging markets fared even worse. GCC markets fared somewhat better, but still with negative signs. DFM displayed a good performance with a broad based recovery led financials. In FX markets the yen was weak, but other currencies remained broadly within range. WTI gained some lost ground, but the Fateh dropped to around $40 p/b. The uncertain economic outlook is favoring gold whose price is close to 1000US$ per ounce. Eibor rates have eased significantly at the front end to near 3.0%, although the longer end remained unchanged.

Source: Reuters 3000Xtra, DIFC Economics.