Global Developments

- The stimulus package proposed by the US government triggered a resounding negative reaction on the markets: Wall Street displayed the worst weekly decline since November. The plan addresses unconvincingly two of the three main issues: (1) toxic assets and (2) u

Market Intelligence on the UAE:

- Dubai’s biggest government-linked holding companies unveiled a major restructuring, consolidating operations to cut costs as the global downturn hit at the core of the emirate’s financial and property sectors.

- The UAE and Vietnam signed a trade pact aimed at boosting their economic relations.

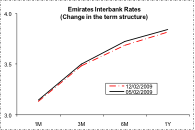

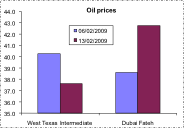

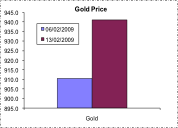

Market Snapshot as of 15/02/2009 at 8:30 (all % figures are weekly changes from 05/02/2009)

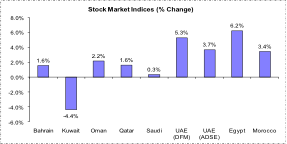

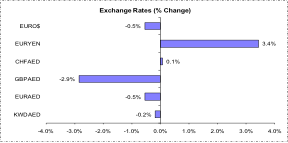

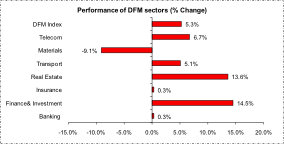

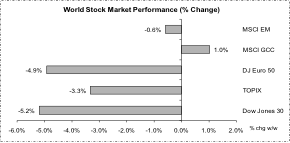

Stock markets in developed countries fell sharply on disappointment for the US stimulus package and further bad news from the banking sector. Emerging markets fared much better on signs that China’s economy is regaining some traction. Most regional markets were in the green territory except Kuwait, despite the government stimulus plan. DFM saw a broad based recovery led by the construction sector. In FX markets the yen and the pound were weak on the wake of negative data. International oil prices dropped sharply due to downward revisions of future demand forecasts by the EIA, nevertheless the Dubai Fateh gained. The uncertain economic outlook propelled the gold price above the key resistance point of 931US$ per ounce, opening the way for a test of 1000US$ per ounce.

Source: Reuters 3000Xtra, DIFC Economics.