Global Developments

- The IIF warns that after one of the most disastrous quarter for the world economy in the next few months other areas of strain will emerge extending the contagion from the financial sector to the real economy through weaker employment and capital spending; more credit deterioration, in new areas such as credit cards; and reckless push from economic policies.

- The industrial data over the last week has been encouraging. The ISM, Ifo, UK and Euroland PMI, Chinese PMIs were all higher (albeit by not much). Services sector surveys in Euroland and the US also have stabilized, although at levels that still signal recession.

Market Intelligence on the UAE:

- Nearly 53% of the UAE’s development portfolio, worth a combined $582bn, has been suspended according to Dubai-based market research firm Proleads. Projects worth $698bn are still in operation out of a $1.3 trillion-strong industry.

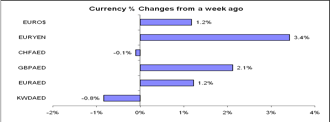

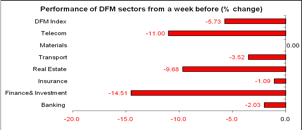

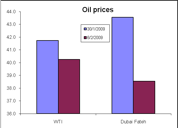

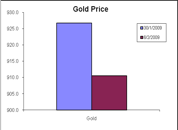

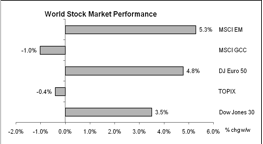

Market Snapshot (as of 07/02/2009 from 30/01/2009) at 8:30am

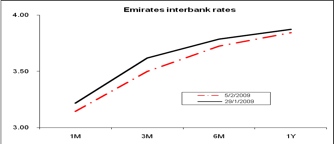

Fears over prospects in banking and property sectors kept markets in the region mostly down, with the exception of Kuwait and Saudi Arabia. Morgan Stanley’s report which stated that “UAE property prices have fallen off a cliff” led to a decline in the real estate sector – down 9.7% in DFM over the past week. Interbank rates continued to decline alongside the fall in LIBOR. Oil prices continued their slide, down 3.6% week on week, with oil falling below 40 dollars a barrel ; spot gold prices also fell 1.7%, down to 910.6 (as of 6th Feb 09).

Source: Reuters 3000Xtra, DIFC Economics.