Global Developments

- U.S. GDP contracted at a 3.8% (saar) clip in Q4, with real consumer spending falling 3.5% (saar), much better than expected with real consumption holding up better than expected.

- US consumer confidence dropped to an all-time new low in Jan09 – to 37.7 from 38.6, contrary to market expectations of a slight improvement.

- The US Federal Reserve FOMC in its statement stated that the Fed “is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets.” This is a step closer than studying the option, but underscores that the ultimate objective is lower private-sector interest rates. Ultimately there was no major change in the monetary policy stance.

- US House of Representatives passed Obama’s economic stimulus package.

- Ifo (Germany) business climate index went up slightly, rising to 83 points in January from 82.7 in December. Export-oriented manufacturers still predict a “very unfavorable” environment, as the manufacturing sector confidence fell to minus 40.1 in January from minus 39.9 in December.

- German unemployment, which had been falling for most of 2008, spiked up in January, rising 56k (following 33k in December).

- Euroland’s harmonised inflation flash estimate for Jan was lower than expected, at 1.1% y/y from 1.6% in December – the surprisingly low inflation points to core prices falling faster.

- More weak data from Japan and Korea – industrial production for Dec08 – both falling 9.6% m/m.

- The IMF updated regional growth forecasts last Wednesday. The revised estimates reveals world economic growth slowing to 0.5% in 2009 while economic growth in the Middle East is forecast to cool to 3.9% (from 6.1% in 2008).

Market Intelligence on the UAE:

- According to DED officials, Dubai’s Preliminary GDP estimate for 2008 is up by between 13% and 16% in nominal terms and 6-8% in real terms. Wholesale and retail sectors, at 37% of the GDP, were the biggest contributors – followed by real estate and manufacturing each at 10% of GDP.

- The Central Bank, in order to scrutinize asset quality, has asked banks not to publish their audited annual accounts until the CB gives its approval. Additionally, banks have been asked to provide a detailed assessment of every loan above 10 million dirhams.

- An IMF official was quoted saying that growth in the Gulf states would reduce from 7% in 2008 to 5.1% in 2009. The IMF official update for the Middle East will be announced on Feb 3.

- Data released by the Dubai Chamber of Commerce has reported a 42% increase in export and re-export, with the total value rising to AED 240billion in 2008.

- According to the UAE Ministry of Economy annual investments in UAE’s industrial sector rose 6% to AED 77 bn in 2008 from AED 72.60 bn in 2007. The number of industrial units in the UAE grew to 4,219 from 3,852 in 2007.

- DP World is putting all its expansion plans on hold and freezing new recruitment after the declining performance of the global shipping sector and uncertain 2009 growth. (Source: Emirates Business 24/7)

- Decline in profits reported by two of Abu Dhabi’s largest property developers – Sorouh real estate and Aldar properties – underscore the hit on the real estate sector, as an effect of the global credit crisis. (Source: The National)

- According to RERA, the number of property developers registered in Dubai has fallen by 40% in two months. This resulted from two main factors – one, as part of a “clean-up” because certain agencies were unlikely to start their projects and two, due to liquidity worries. Also, a new system is in the pipeline that would rank the developers according to financial stability and market experience. (Source: The National)

- Central bank has announced that they will collect debit card statistics from banks monthly. Banks should classify the statistics according to purchases inside the country, by both nationals and expatriates, as well as purchases of debit cards outside the country. (Source: Emirates Business 24/7)

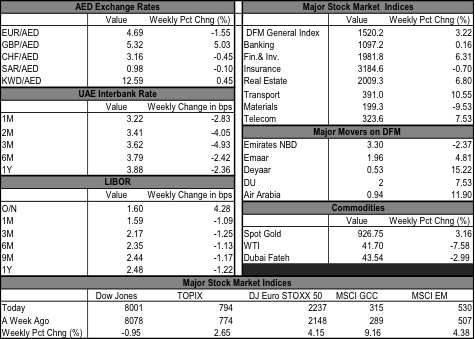

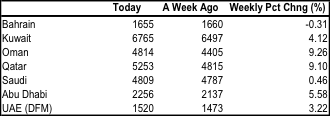

Markets Overview Feb 1st 2009

The markets, both developed and emerging, have stabilized and improved given the better-than-expected earnings season. Across the Gulf all markets closed in the green, with the exception of Bahrain which was slightly down, at -0.3%. Crude oil prices remain under pressure with weakening oil demand, while spot gold prices continued to rise (an alternative safe haven for investment). Interbank rates in the UAE are continuing their fall given the lower Libor rates.