Global Developments

- The Inauguration of President Obama sparked optimism, but the US stimulus package still needs to be approved and the delay is seriously hitting the hopes of a recovery by year’s end.

- Global equities were markedly down as economic data continue to disappoint. Markets are likely to remain nervous, as the gloom from both macro data and corporate earnings persists.

- In bond markets G3 public debt yields are increasing, since huge fiscal deficits are becoming a concern, as governments talk of “bold” (i.e., large) fiscal expansion plans.

- Korea’s GDP fell 5.6%q/q, saar in Q4 and 3.4%yoy.

- Japan export fell again sharply in December -35% yoy, while consumer sentiment deteriorated further to 26.2 from 28.4; all components of the confidence survey worsened but employment was particularly bad, falling from 21.1 to 15.4.

- China GDP grew by 6.8% in Q4 2008 a worse than expected results that brings average growth in 2008 down to 9%, from 13% in 2007. The Head of the Statistical Bureau argued that the situation has improved given that industrial production grew 5.7% yoy in December up from 5.4% in November.

- Singapore output fell by 3.7%yoy in Q4 with industrial production recording a 13.5%yoy slump in December.

- In the U.K. Q4 GDP recorded a decline of 1.5%qoq, (-1.8%yoy), much worse than expected; when seasonally adjusted the decline was a staggering 5.9%qoq. Inflation remained high at 3.1% yoy in December, and unemployment rose to 6.1% from 5.7% a month earlier.

- US Weekly jobless claims jumped to 589k in the week to Jan 17. The 4-week average was 519k, the same as in mid-November.

- The European Central Bank warned in its Monthly Bulletin that the crisis could be deeper and more prolonged than previously expected.

- The Euro area flash PMI report for January (for both manufacturing and services) rose in January versus December, still very depressed (manufacturing 34.5 versus 33.9 in December; services 42.5 versus 42.1 in December), but at least one rare sign of stabilization.

- Spain unemployment rose to 13.9% in Q3 up from 11.3% in Q2.

- Brazil’s central bank cut rates aggressively by 100bp, to 12.75%.

Market Intelligence on the UAE:

- Standard Chartered economists estimate that UAE growth in 2009 will slow down to 0.5%, with inflation at 2.5%. They also pointed out that “the central bank lacks the necessary tools (such as a fully functioning repo window on a business-as-usual basis) to manage liquidity effectively” and this among other things keep the cost of capital for businesses excessively high.

- The Department of Naturalization and Residency Dubai (DNRD) declined to comment on the figure relative to net residence visa issued, stating that every ministerial department had its own figures and talks were ongoing in order to determine the right number. Reports of average daily visa cancellations in the order of 1500 with peaks of 2000 are stirring worries. Further job cuts are reported in all sectors, with even prominent names like Istithmar and Tatweer downsizing their payroll.

- Meanwhile, Abu Dhabi’s continues to receive between 400 and 1,000 new visa applications every day, according to a senior officer at the Residency and Naturalization Department, while the number of cancellations remained stable, averaging between 50 and 200 a day.

- The UAE central bank governor instructed banks not to sell assets in order to stem the markets’ fall.

- Dubai’s corporate refinancing requirements in 2009 are expected to touch $15 billion (Dh55 billion), according to credit rating agency Moody’s.

- There is increasing evidence that businesses are refusing to pay their loans in order to force banks to reschedule payments and reduce interest rates.

Markets Overview Jan. 25th 2009

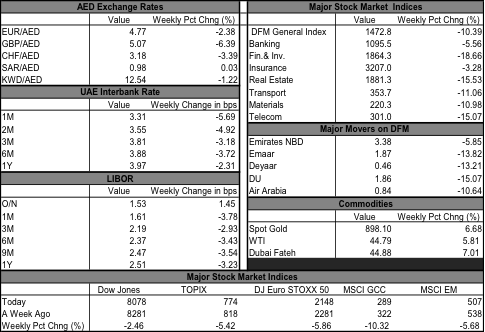

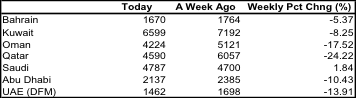

A series of bad news and growing concerns on corporate earnings marked another negative week for stock markets, both in developed and emerging markets. Across the Gulf all markets, with the exception of KSA recorded again heavy losses despite the gains in oil prices. The euro fell on bad economic data and lingering concerns about the public debt of some EMU countries. On the positive side interbank rates in the UAE are continuing their descent in the wake of lower Libor rates and the rate cut by the central bank.

Updated from Reuters 3000Xtra, 8:45am