Global Developments

- Global equities were again hit by a series of bad economic news particularly from the US: US consumer and producer inflation fell by 0.7%mom and 1.9%mom respectively; retail sales plunged 2.7%mom; industrial production fell sharply again by 2.0% mom and initial jobless claim recorded another dismal figure: 524,000 in a single week.

- The banking sector, despite massive government support worldwide, is still in the midst of a profound crisis: huge losses were reported by Merril Lynch (US$21.5 bn), Citigroup (US$ 8.3 bn) and Deutsche Bank (€ 4.8bn). Barcalys shares fell 25% to less than one pound as investor fear that new injections of capital will be necessary; Commerzbank shares lost more than 30% in a week.

- The European Central Bank cut again its main rate to 2%, an all time low, amid concerns, reinforced by the EU Commission forecasts, that the eurozone is in a worse than expected recession.

- German GDP rose only 1.3% in 2008. Industrial Production in the euro area declined 7.7% yoy, the steepest drop since data started to be recorded in 1990.

- S&P downgraded Greece credit rating hinting that the same could happen to Ireland, Portugal and Spain.

- Japan core machine orders dropped by 16.2% an all time negative record while its current account balance shrank by 55.3%yoy in November.

- Chinese exports fell by 2.8% and imports by 21.3% in December, another sign that the recession is hitting also large emerging markets.

- Oil was generally weak with a widening difference between the two major benchmarks: the WTI fluctuated around 35 $/b while the Brent remained between 45 and 50 $/b.

Market Intelligence on the UAE:

- In Dubai more than 200,000 new visas were issued in November and December 2008 while visa cancellations are far lees according to the Dubai Naturalization and Residency Department.

- Residential property prices in Dubai dropped 8 per cent in the fourth quarter of last year, the first quarterly decline since foreign ownership became legal in 2002, according to Colliers International. The report also stated that the numbers of sales dropped 45 per cent in the last quarter of 2008.

- Moody’s yesterday issued its first negative outlook on UAE banks since it began reviewing them a decade ago.

- Analysts are concerned that loans to small-scale private developers may pose the single largest threat to the health of the banks, which may suffer in a prolonged property market correction

- Nakheel has suspended the project to build the tallest skyscraper in the world.

- Abu Dhabi officials have drafted five laws to establish safeguards for property investors: a strata law, defining the roles of property owners in multiple-occupancy developments; a trust-account law similar to Dubai’s escrow requirements; a law establishing a regulator; a mortgage law to protect financiers; and a law to ensure that developers have acquired titles and permits before selling properties to the public.

Markets Overview Jan. 18th 2009

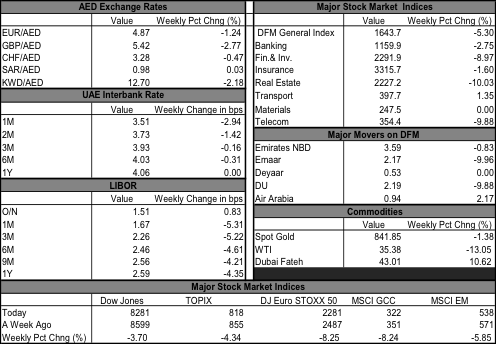

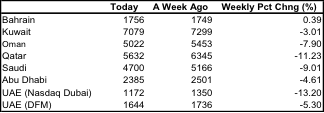

A negative week for world stock markets both in developed and emerging markets which ended the stabilization phase started at the beginning of 2009. Economic conditions worldwide remain weak and a turn around is not in sight. Across the Gulf all markets, with the exception of Bahrain recorded heavy losses. The euro fell on concerns about the public debt sustainability of some EMU members and oil prices remained under pressure. Interbank rates in the UAE are continuing their normalization process in the wake of lower Libor rates.