Global Developments

- Financial markets have been relatively calm due to the festive period and low volumes. This consolidation together with subdued volatility seems to indicate a willingness to look beyond the most dreadful quarter in decades and focus on the future outlook.

- The most recent economic data releases are still dismal, as they refer to the past two or three months.

- Monetary policy

Market Intelligence on the UAE:

- According to a report by Credit Suisse, the UAE’s banks have the highest exposure to the real estate sector among regional peers. The report reveals that UAE banks have the highest funding gap in the region, with their average loan-to-deposit ratio being 122.8% against the central bank ceiling of 100%. Abu Dhabi Commercial Bank has the highest loan-to deposit ratio of 147.2% followed by Emirates NBD at 121.8%.

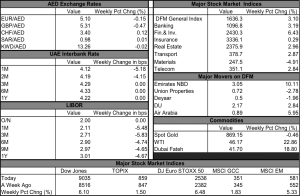

Markets Overview Jan. 11th 2009

Updated 845am from Reuters 3000Xtra