Global Developments

- Financial markets have been relatively calm due to the festive mood and low volumes. This consolidation together with subdued volatility seems to indicate a willingness to look beyond the most dreadful quarter in decades and focus on the next developments.

- A quiet week in major markets due to the holiday season in Western countries. In general stock markets are in a consolidation pattern waiting to fathom the policy which will emerge after the new US President takes office. Global equity markets, although on a weak tone, have become much less volatile as December has progressed. This stability however is not yet forming the basis for any sustained rebound especially in the emerging markets, including the GCC.

- The festive mood has not reduced the flow of bad news: in Euroland data recorded another plunge with manufacturing orders falling 4.5%mom and Belgian business confidence (widely seen as a leading indicator for the entire continent) falling to -36.5 a record low worse than the 1982 recession. Convention al forecast models point to a drop of GDP in Euroland of -0.7%qoq. Reluctance by Germany to provide a robust fiscal boost is sapping the prospect for a solid rebound anytime before well into 2010.

- In the US final GDP data confirmed the preliminary estimates of a 0.5%qoq drop in Q3. Existing homes sales and new home sales fell by 8.6%mom and 2.9%mom. House sales are fast approaching the lowest level of all times in the early 1980s.

- China cut rates late on Dec. 22nd, with the 1-year lending rate falling 27bp, to 5.31%. Rate cuts in China now total 216 basis points since mid-September

- Japan industrial production slumped 8% m/m in November, the worst result since the index started in 1953. Japan reported also very weak November exports (down 13.5%m/m sa) which have fallen by 22.5% from their July peak. Import values were down 11.2%m/m (sa) in November.

Market Intelligence on the UAE:

- Stock markets are still falling sharply in the UAE, amid low volumes, as a result of uncertain prospects, lower oil prices and lack of good news. Interbank rates are easing as a result of the announced dollar-dirham swap facility set up by the Central Bank.

- Dubai home rents are decreasing according to anecdotal evidence from real estate professionals. The most hits area the upscale locations on the Palm and Burj Dubai with declines in the order of 30%-40% (to levels which prevailed at the beginning of 2008). On the contrary mid-income locations such as International City are still holding up well.

- The property market continues to be severely affected by the reluctance of banks to extend loans and pockets of oversupply in upscale units. Investors have declined sharply while demand is mainly composed of perspective end-users, who however find it difficult to obtain mortgages.

- Consolidation among developers and construction companies is likely in the near future according to the Director of the Department of Finance, while reports that thousands of construction workers are asking for visa cancellation and that some construction companies are not being paid is fueling tension and uncertainty.

- The EU-GCC FTA negotiations were halted. Resumption is unlikely in the near future.

- Fiscal Budgets in GCC countries will not be trimmed much in order to stem the effects of the crisis despite drop in oil revenues.

- The UAE Cabinet has approved the new organizational structure of the Ministry of Economy (MoE) which will encompass 4 departments: economic policies, commercial policies, industrial affairs and corporate & support services affairs.

- A summit of GCC Heads of States convenes in Muscat today to take key decisions on the GCC monetary union.

Market Overview (updated Dec 29th 8:30am)

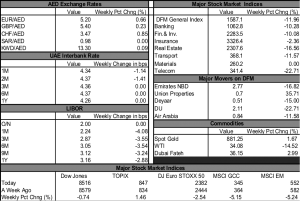

Stock markets are still falling sharply in the UAE, amid low volumes, as a result of uncertain prospects, lower oil prices and lack of good news. Interbank rates are easing as a result of the announced dollar-dirham swap facility set up by the Central Bank. In other GCC countries equities have rebounded slightly on the back of rumors that governments are stepping in to sustain prices. Exchange rates are stable, but oil prices have remained generally weak drifting down towards 35 USD p/b. Subdued activity will prevail throughout the first week of the new year.

GCC Stock Markets

|

Today |

A Week Ago |

Weekly Pct Chng (%) |

|

| Bahrain |

1824 |

1861 |

-1.99 |

| Kuwait |

8043 |

8394 |

-4.18 |

| Oman |

5212 |

5942 |

-12.29 |

| Qatar |

6715 |

6665 |

0.75 |

| Saudi |

4687 |

4774 |

-1.83 |

| Abu Dhabi |

2282 |

2576 |

-11.43 |

| UAE (Nasdaq Dubai) |

1156 |

1370 |

-15.61 |

| UAE (DFM) |

1587 |

1803 |

-11.96 |