Global Developments

- The US Fed cut its rates to a range 0-0.25% to fight the incumbent crisis (all economic data from industrial production to housing markets and surveys fell sharply during the week) and the threat of deflation highlighted by falling consumer prices (-1.7%mom). This move was not followed by all GCC countries as Kuwait and Oman’s central banks cut rates, KSA cut before the Fed, but central banks in Bahrain, the United Arab Emirates and Qatar remained on hold.

- Oil prices have fallen below at some point below 35USD p/b. OPEC oil basket is today around 40 USD p/b despite the decision to cut supply by a larger-than-expected 2.2 m/b a day.

- The first step in the bail out of the US car industry cost 17bn USD but guarantees survival only for a few weeks to GM and Chrysler. The total cost might amount to 125bn USD but will be left to Obama’s decision.

- Meanwhile the incoming US administration has increased the scope of the stimulus package in an effort to create 3 million jobs, up from 2.2 million in the original plan.

- The Bank of Japan cut its rate to 0.1% in response to a worsening outlook (Highlighted by a large drop in the Tankan business survey) and announced a full-fledged quantitative easing policy with purchases of government bonds and commercial paper.

- In Europe the economic data are worsening: France business confidence sank to the lowest level ever, the German IFO lost another three points to 82.6, its worst level since 1982. The German government remains hostile to a major stimulus package financed by public debt.

- China Industrial production slowed to 5.4%yoy in November.

Market Intelligence on the UAE:

- Dubai has announced that it will seek a rating by mid 2009, while concerns on debt roll over have proven unfounded: all such operations by public and private entities have been completed successfully. Citibank announced that it has arranged credits to Dubai for 8 bn USD this year.

- However the ratings of several banks and a number of Dubai Inc. firms have been revised down due to worsening economic outlook and fragile conditions on financial markets.

- Mixed news from the real estate market: further job cuts might come from Arabtec (5000 units) and Tatweer. On the other hand plans at Sport City will be completed and in the controversial Dubai Lagoon the first 8 buildings are due for delivery in March 2009.

- A survey by HSBC Holdings recorded a 4% rise in quoted real estate prices in the UAE in November, but prices fell 4% in Dubai. The survey remarked that the market might have reached a tipping point as bank credit has dried up. In fact, transactions in real estate have declined, which makes aggregate price signal less relevant to judge the overall situation. In the second week of December in freehold areas were recorded 418 sales transactions, of which 383 were for apartments for a total of 295.37 million and 35 for villas at a total of Dh175.53 million. This relatively healthy figure might be due to a backlog of purchases, but might not necessarily point to a positive outlook.

- ADIA might have suffered a loss in the order of a few hundred million USD as a result of the Mardoff scam.

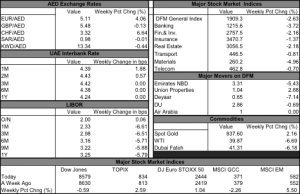

Market Overview (updated Dec 21st, 9:30am)

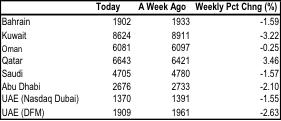

GCC equity markets continued to fall last week notwithstanding some regained stability worldwide (with Emerging Markets gaining 5.5%). As a result of central bank easing, Libor has fallen sharply, but in the UAE interbank rates have actually gone up or remained stable. In exchange markets the euro has climbed against the dollar as result of the Fed move and worse than expected deterioration in economic conditions.