The article titled “A six-point plan to rebuild Lebanon’s economy” appeared in The National’s online edition on 5th January, 2020 and is posted below. Click here to access the original article.

A six-point plan to rebuild Lebanon’s economy

Debt needs to be re-profiled, banks require a bail-in and peg to the US dollar should be abandoned

As I write this column, Lebanon is in turmoil, trying to form a government, while the economy is going through its worst crisis since its 1975-1990 Civil War. Several weeks of unjustified, panic-inducing bank closures, compounded by the imposition of de facto, illegal, capital controls, payment restrictions and foreign exchange limitations led to a liquidity crunch, a payments and credit crisis, undermining confidence in the banking sector.

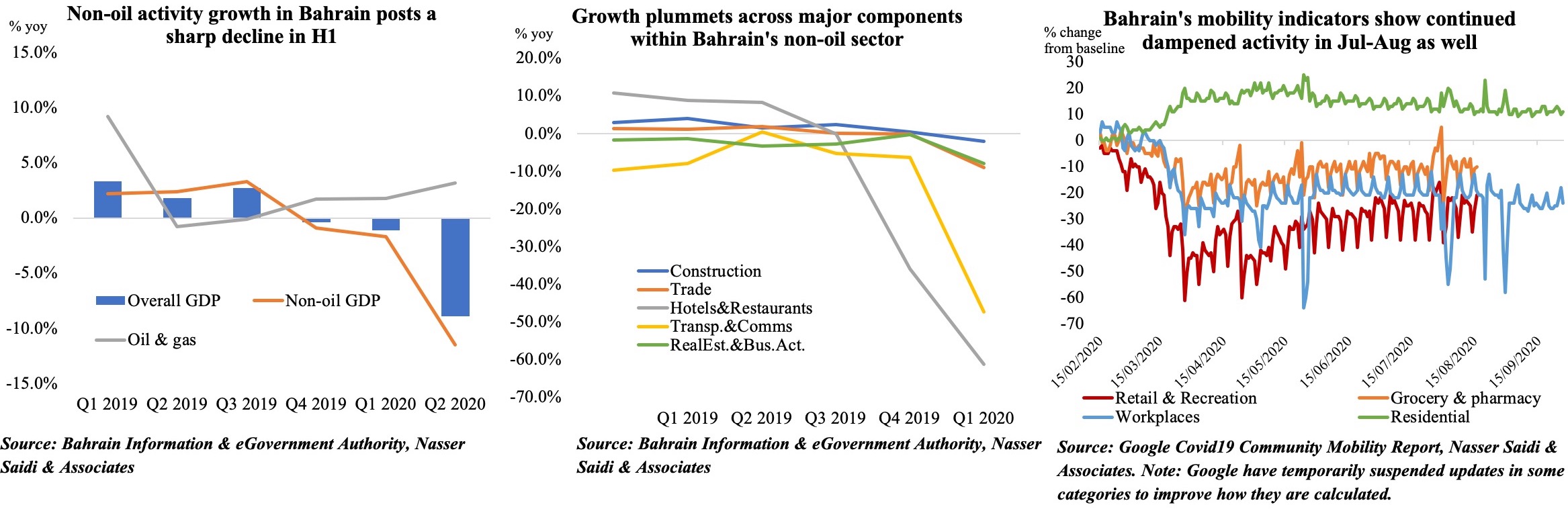

In turn, these measures are generating a sharp contraction in economic activity and domestic and international trade. There is an emergence of a parallel market where the Lebanese pound has depreciated by about 30 per cent; a jump in price inflation; business closures and bankruptcies; growing unemployment and rampant poverty. The rapid deterioration of economic conditions has worsened public finances, with the minister of finance saying on Twitter that revenues are down 40 per cent, suggesting a likely budget deficit of 15 per cent for 2019 – double the government’s target of 7.6 per cent of GDP.

Lebanon is suffering from decades of corruption, unsustainable economic policies and incompetent public management. Persistent budget and current account deficits, with unsustainable Ponzi-like financing by the central bank, resulted in a sovereign debt-to-GDP ratio exceeding 155 per cent.

Not surprisingly, the price of Lebanese eurobonds have recently plummeted to historic lows, with rating agencies downgrading Lebanon’s sovereign and bank debt to junk territory, while credit default swap rates – the cost of insuring against default – have shot up to 2,500, second only to Argentina.

Without rapid, corrective, policy measures, the outlook is of economic depression, growing unemployment and a sharp fall in consumption, investment and trade.

With the Banque du Liban printing money to finance the budget, the Lebanese pound will continuously depreciate on the parallel market, resulting in rapidly accelerating inflation and a decline in real wages, along with a sharply growing budget deficit due to falling revenues. As a result, financial pressures on the banking system will increase, with a scenario of increasing ad hoc controls on economic activity, imports and payments, and resulting market distortions.

Lebanon’s politicians have irresponsibly aggravated the economic and financial crisis by delaying the formation of a new government. What needs to be done to address the interlinked currency, banking, fiscal, financial and economic crises, and rebuild confidence in the banking and financial sector?

1. Form a credible, independent new government

Rapidly empower a government of competent, experienced and politically-independent members that are able to confront and hold accountable an entrenched kleptocracy and its associated policymakers. The policy imperative is to develop and implement a comprehensive, multi-year macroeconomic reform plan, including deep structural measures.

A credible and effective government will have to implement unpopular economic reforms and approach the international community for a financial package in order to avoid an extended, deep and painful recession which will be accompanied by social and political unrest.

2. Tackle subsidies and other inefficiencies

The new government should undertake a swift, comprehensive and front-loaded fiscal reform. These should sustainably reduce the fiscal deficit by cutting wasteful expenditure and subsidies, increase electricity and petrol prices to international levels, combat tax evasion and overhaul the public pension system. They should also reform and resize the public sector and implement structural reforms, starting with the massively inefficient energy sector.

Other state-owned assets and government-related enterprises, such as the Middle East Airlines, casino, airport, ports and telecoms can either be sold or managed as independent, efficient, profitable private sector enterprises.

3. Restructure public debts

Public debt (including central bank debt) will have to be restructured. Domestic Lebanese pound debt is entirely held by the Banque du Liban and local banks. A re-profiling would repackage debt maturing over 2020–2023 into new debt at 1 per cent, maturing in five-to-10 years.

Similarly, foreign currency debt should be restructured into longer maturities of 10 to 15 years, with a guarantee from a new Paris V Fund (see below), which would drastically lower interest rates.

The suggested debt re-profiling would reduce it to sustainable levels, radically cut the enormous debt service costs now exceeding 10 percent of GDP and would create fiscal space during the adjustment period.

4. Reform the country’s banks

About 70 per cent of bank assets are invested in sovereign and central bank debt. The debt restructure implies a major loss for the banks. To compensate for these losses, a bail-in by the banks and their shareholders is required, a large recapitalisation and equity injection, of the order of some $20 billion (Dh73.45bn), including a sale of assets and investments.

The banks have been major beneficiaries of a bail out and so-called “financial engineering” operations by the BDL generating high profits, have substantial reserves and assets, as well as deep pocketed-shareholders to enable a recapitalisation and restructuring. A consolidation of the banking system will be required to restore its soundness and financial stability and the ability to support economic recovery.

5. Scrap the dollar peg

Lebanon’s overvalued exchange rate acts as a tax on exports, subsidises imports and worsens the large current account deficit. To support the overvalued peg, Banque du Liban has borrowed massively from the domestic banks creating a domestic liquidity squeeze, and kept interest rates high to attract capital inflows and remittances. These policies have crowded out the private sector, depressed economic growth and increased the cost of public borrowing, aggravating the budget deficit and increasing debt levels. Lebanon needs to change its monetary policy and move to a managed flexible exchange rate regime. This starts with admitting the failure of the pegged regime and recognising the de facto devalued parallel market rate.

6. Enter into an IMF programme

To underpin the deep reforms, Lebanon will require an Economic Stabilisation and Liquidity Fund, of some $20bn to $25bn, as part of a Paris V reform framework. To be credible, the policy framework should be an IMF programme, with requisite policy conditions, in order to attract multilateral funding from international financial institutions and CEDRE participants, including the EU and the GCC countries. Importantly, the programme should include a targeted Social Safety Net (via cash transfers, unemployment insurance and other methods) to provide support during the reform process and aim at lowering inequality and reducing poverty in the medium term.

The ongoing October 17 protests and revolt are a historical opportunity for Lebanon to undertake deep political and economic reforms to avoid a lost decade of economic depression, social misery, growing poverty and massive migration. The livelihood of several generations is at stake. It is time to build a Third Republic.