Dr. Nasser Saidi’s interview with Bonds & Loans, published in Apr 2019, titled “China-US Tensions, War with Iran Dominate Medium-Term GCC Risk Landscape” is posted below. The original can be accessed here.

Despite a positive macro outlook, a blend of rapidly rising regional tensions and an evolving trade dispute between China and the US will weigh more heavily than previously thought on the GCC’s economic prospects in the medium term, argues Dr. Nasser Saidi, Founder and President of Nasser Saidi & Associates and Lebanon’s former Minister of Economy.

Bonds & Loans speaks with Dr. Saidi about the regional economic outlook, progress on fiscal reforms in the region, structural shifts in the Middle East’s political dynamic, and how to avoid the pitfalls of state-led development as currently practiced.

Bonds & Loans: What do you see as the top risks facing GCC markets in 2019?

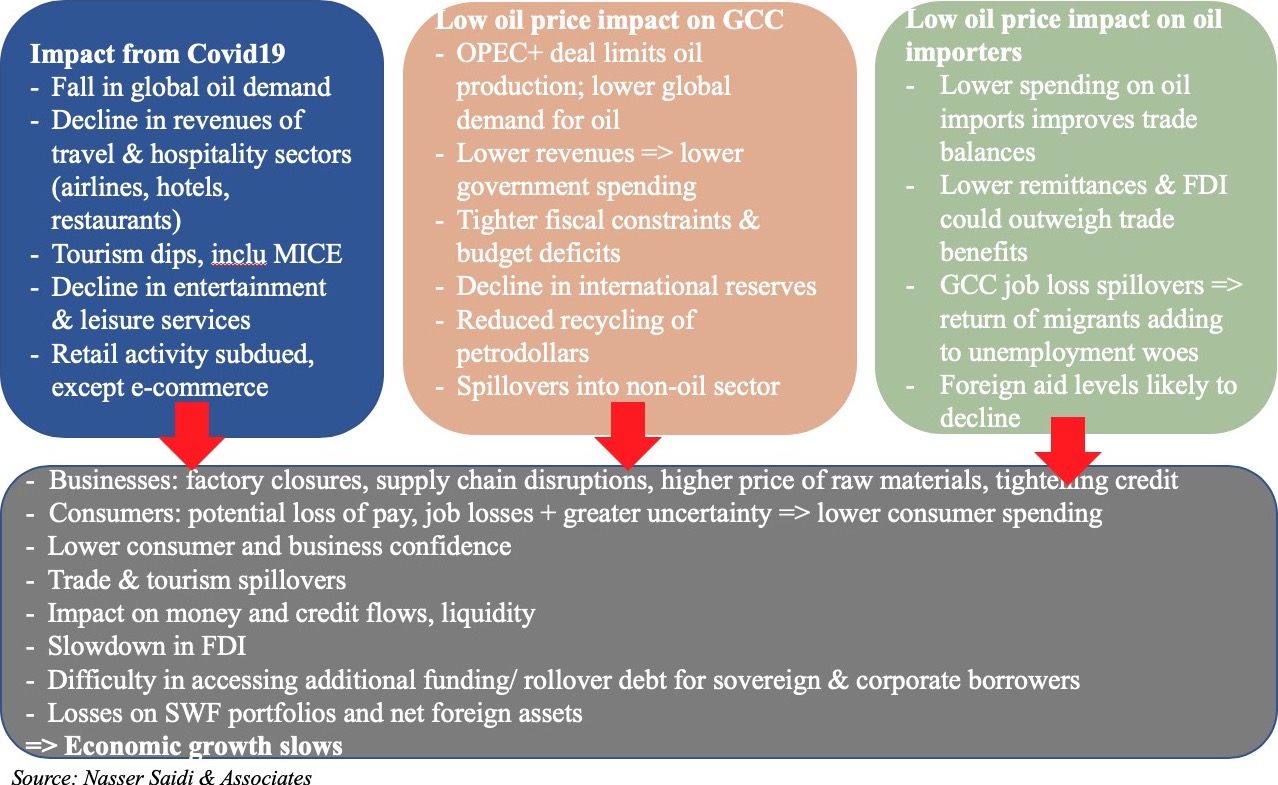

Nasser Saidi: The first major risk is the oil price. The second relates to spill-overs of international political and economic tensions. The third is climate change.

Oil prices and revenues continue to dominate the macroeconomic risk paradigm in the region, dominating trade, current accounts, and gross output. Despite reform efforts over the past few years, we have yet to see substantial progress on making the GCC less vulnerable to oil price volatility, or on diversification more broadly. Oil prices over the next two years, which we anticipate will hover between the USD55 and USD60 per barrel bracket, subject to added geopolitical risk, remain substantially below breakeven points, which will continue to weigh on the region’s current account deficits. This means that many of the GCC countries will have to continue with fiscal adjustments to address their sustainability, while drawing from new and existing funding sources to make up the difference.

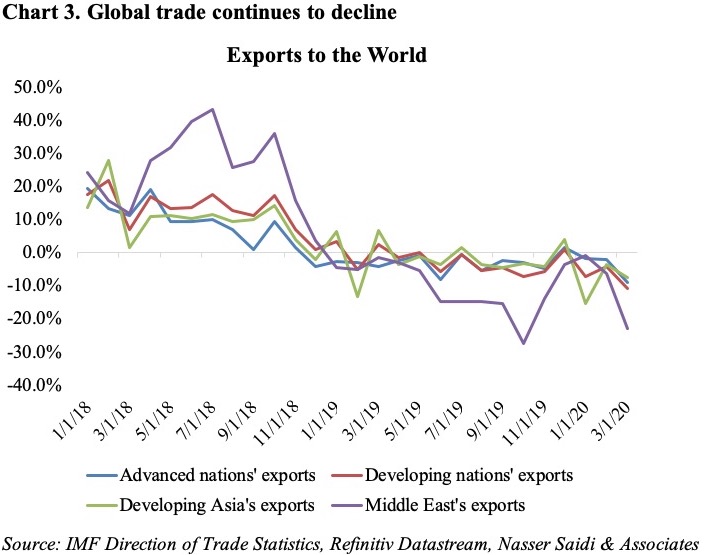

Spill-overs from global economic tensions – and here specifically, the economic standoff between the US and China – is also a significant risk. This isn’t just about trade, it seems, but rather increasing confrontation at multiple levels: trade; China’s role on the global stage; technology; intellectual property; market access. More fundamentally, it’s about economic regime change in China, the world’s second largest economy. As China forges ahead with its larger strategic objectives, it is becoming a globalist on a scale yet to be seen.

The main reason why economic warfare between the US and China is important for the GCC is that it could weigh on GCC integration with Asian supply chains. Asia currently accounts for a substantial portion of commodities demand, and China is now the largest importer of GCC oil and gas, so any reduction of the growth rate in China – coupled with the fact that the US is looking to increase production and shipments of shale oil – will have a negative effect on global oil demand.

Finally, climate change is a huge risk. Extreme weather events are increasing, especially in this part of the world, and insurers – as well as investors and the banks – have significantly under-priced climate risk. We could end up having a Minsky moment as a result: once the industry reckons with the scale of its exposure to the fossil fuels industry, we could see an acute and substantial drop in the value of assets exposed to climate risk. This is a social as well as financial risk, but it is largely only viewed as a social risk at present. That is starting to change, particularly in Europe, but it needs to shift much more quickly.

Other global macro risk factors relate to the massive build-up of household and corporate debt on the horizon blended with a tightening liquidity environment, and the uncertain interest rate trajectory in the US. In emerging markets, this is compounded by the fact that a sizeable portion of that debt is denominated in foreign hard currencies, and rising maturities over the next three years.

Bonds & Loans: A significant portion of your presentation at last year’s Bonds, Loans & Sukuk Middle East conference focused on political shifts emerging across the wider Middle East. How have some of those shifts played out? Do you see geopolitical risk rising or falling?

Nasser Saidi: You still have wars ongoing in Syria and Yemen. In Syria, to an extent, we are seeing a lower level of violence, but self-congratulatory statements about defeating ISIS are blatantly misplaced; rebel and national armed forces may have temporarily vanquished the group militarily, but all of the conditions that led to the formation and growth of ISIS – high levels of unemployment, poverty, disengagement with the state, lack of viable economic prospects – continue to persist. These conditions will not change unless global powers start seriously re-considering how they approach post-violence reconstruction in places like Iraq, Syria, Yemen, and Libya among other places.

A failure to address these conditions could likely lead to another boiling over of discontent, particularly among the region’s youth. Best estimates for growth in most countries in the Middle East don’t exceed 2.2%, which barely covers population growth in many of them – so what this means is a decline in real income per capita.

Added to this are rising geopolitical tensions linked to the spat between China and the US, particularly around the Belt and Road Initiative, which the GCC countries – particularly the UAE and Oman – are investing heavily into. This is to further integrate the Middle East into China’s global logistics and trade infrastructure. But it’s unclear whether that will come at the cost of relations with the US. That the GCC no longer talks as one coherent bloc of countries compounds this risk, and diminishes the region’s capacity to negotiate at the global level.

Finally, I am increasingly concerned that we may see armed confrontation with Iran. If you listen to the rhetoric of the top brass in the US, and their diplomatic activities within the Middle East, they seem to be setting the stage for war with Iran – not dissimilar to the build-up seen before the first gulf war with Iraq. Any armed confrontation would of course have dire implications for global oil prices, and the region more specifically.

Bonds & Loans: As the largest economy in the region, many look to Saudi Arabia for a sense of the trajectory many of the region’s economies are on, particularly in terms of reform. How would you assess GCC states’ progress on diversifying their economies away from oil?

Nasser Saidi: This is one of the biggest challenges facing the region. It has become quite obvious since the collapse in oil prices that this is not cyclical, but structural, which means the region’s governments need to target diversification in three major ways: trade diversification, in the sense that these countries need to ween themselves off their overreliance on oil exports; production diversification, so moving away from oil to non-oil activities and services; and government revenue diversification.

Saudi Arabia is the biggest economy in the Arab world, followed by the UAE. What happens in Saudi Arabia is important because of its size, and the economic benefits that its neighbours enjoy through trade. But it’s also to some extent a litmus test on the success of reforms in the region. What has been proposed in Saudi Arabia, in terms of modernisation efforts included in the National Transformation Plan and Vision 2030, is really the mother of all reform efforts in the region, and all the countries in the GCC need the country to succeed in this endeavour. Failure will invite a backlash from more conservative segments of leadership, and potentially, large pools of the population, but it will also weigh on the development of neighbouring economies as they depend heavily on the opening of the Saudi economy to boost their prospects.

Bonds & Loans: There continues to be significant optimism around Egypt’s economic prospects, but some of its fundamentals – like youth unemployment, and productivity – are worrying. Do you think the country can achieve its ambitions without a fairly radical shift away from how the economy is managed?

Nasser Saidi: It’s an important point, but we should also pay heed to what has been achieved so far. The IMF, and its regional peers like the UAE, Saudi Arabia, and Kuwait, have lent substantial support to the country – in large part because the country is too big to fail. We’ve seen a rise in interest rates and greater monetary policy freedom, with inflation trending down towards 8.5% from peaks in excess of close to 30% in 2017. We’ve seen a partial reform of fuel subsidies, price adjustments in the power sector, and a decline in recorded unemployment over the past couple of years, with some facilitation by Egypt’s neighbours of youth participation in their labour markets.

The country needs to reconsider its state-led development strategy, which means PPPs and privatisation need to move further up the policy agenda. But it comes with a warning. Under Mubarak, the beneficiaries of privatisation largely included the coteries around the leader – including his family. There was no trickle-down, in other words, and that issue still remains; addressing this would also help address unemployment. What this also means is that the country needs to achieve a transformation away from strong dependence on agriculture and the Nile, which remains its lifeline. This can be achieved through the dispersion and increased use of technologies and modern techniques in the agricultural sector to raise productivity and reduce dependence on dwindling water supplies, as we are seeing increasing desertification. More broadly, the industrialisation strategy undertaken by Egypt – which has been largely military or state-led – cannot be the future; this applies as well to the GCC governments, which also need to foster a more vibrant and prominent private sector.

Economic reforms – like the removal of subsidies, increasing cost recovery through public services – require a new social contract. We have the beginnings of one, but it’s not there yet.

More crucial is the issue of overall governance. What you effectively have is a government within a government. President Sisi has consolidated power and is looking for a renewal of his mandate, not unlike Ergodan in Turkey, and there is a high level of concentration of power; parliament in Egypt has largely become a Potemkin parliament. The question of inclusiveness – politically, economically, socially – looms large.

Bonds & Loans: The UAE economy has undergone a significant transformation over the past decade. Can the country continue to thrive if it does not adjust to shifting demographics on the ground via the changing nature of labour migration?

Nasser Saidi: The situation in the UAE is different to that of Saudi Arabia and its neighbours in the sense that it is much more diversified. Dubai contributes about 40% of the UAE’s GDP, if you include the Emirate’s free zones – where a range of multinational private corporates operates. It has been able to secure significant foreign investment, much more FDI than others in the region. This is due to the quality of core infrastructure and logistics hubs, rule of law, and free zones.

For a long period, the country attracted a great deal of low-skilled, low-cost labour to build that infrastructure. Much of that infrastructure has now been achieved, which means moving onto the next phase: modernisation and digitalisation of the economy. But it will take a long time before modern sectors emerge as strong contributors to GDP, as well as human capital; that labour needs a viable pathway to remaining in the UAE for the long-term.

There have been a number of reforms addressing this. There is a 10-year residency visa for export specialists; 100% foreign ownership is now allowed in non-strategic sectors of the economy; there is the prospect of allowing companies operating in free zones to secure dual licenses that allow them to operate both onshore and in free zones. This is the beginning of a much longer-term liberalisation effort that will foster long-term residents.

But over the long-term, the country may do well to move towards the Swiss model. If you look back at Switzerland’s history, and the development of its infrastructure, it was largely developed at a time when the country was overwhelmingly agrarian by nature. It has turned itself into a strong services hub for Europe and the rest of the World by strategically investing in key sectors, but it also reformed the way in which expat workers could obtain long-term residency and, eventually, citizenship, turning a transient working population into a strong contributor to GDP composed of long-term residents.

Creating permanent economic citizens has many benefits. It is helpful in terms of balance of payments; in building a social security system and long-term investment pools, which goes hand in hand with deepening the capital markets and the insurance and pension segments. It also means the development of a true middle class, which means moving away from a model based on tourism to one that fosters more organic, domestic support of key sectors; but it also means diverging from the country’s existing overreliance on real estate and hospitality, which is unsustainable in its current form.