"Will the UAE’s accelerated vaccine campaign help fuel economic growth?", Oped in The National, 16 Feb 2021

The article titled “Will the UAE’s accelerated vaccine campaign help fuel economic growth?” appeared in the print edition of The National on 16th February 2021 and is posted below.

Will the UAE’s accelerated vaccine campaign help fuel economic growth?

Nasser Saidi & Aathira Prasad

The drive could help improve herd immunity and gradually return business activity to pre-pandemic levels

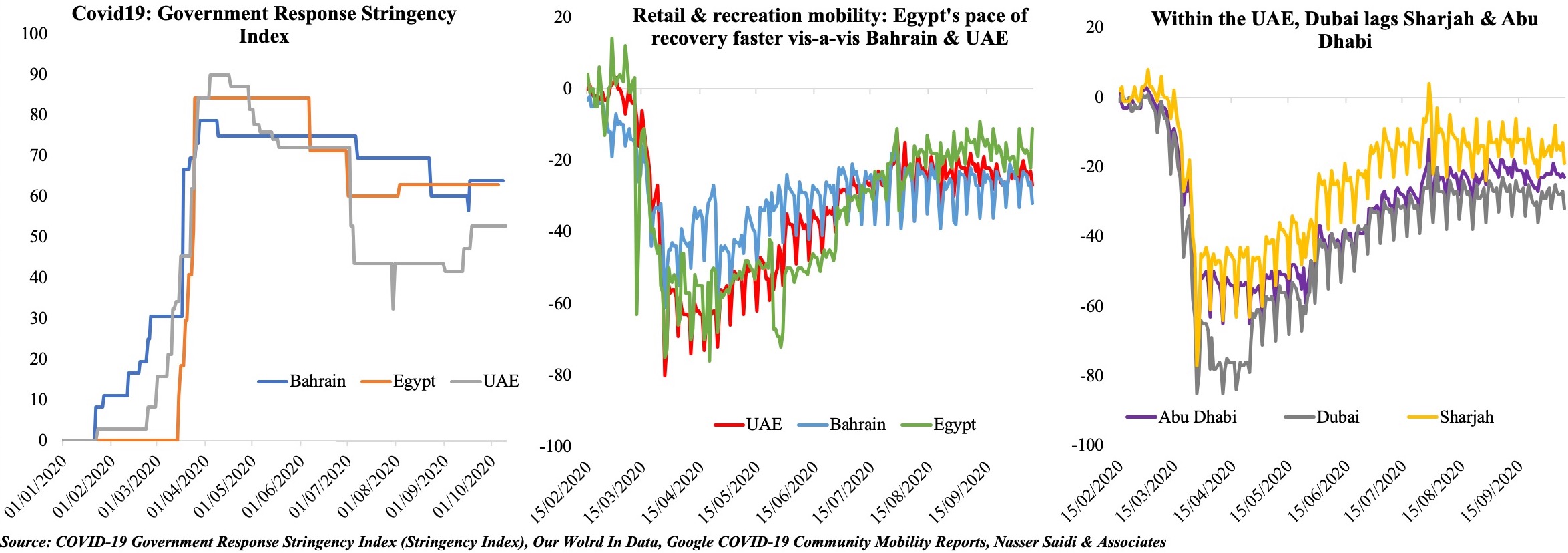

Countries around the world, including in the Gulf region, have registered a sharp increase in Covid-19 cases amid a rise in new virus strains.

As the number cases grows, the UAE has reintroduced more stringent restrictions and penalties for non-compliance to ensure the safety of residents and stem the pandemic’s spread.

In tandem with safety measures, the country has also hastened its vaccination drive since December and is currently a global leader, having administered 51.11 vaccine doses for every 100 people as of Sunday, making it second only to Israel.

With four vaccines being expended currently – Sinopharm, Pfizer-BioNTech, AstraZeneca and Sputnik V – the government is on track to vaccinate more than half the population by the end of the first quarter of this year.

Is this sufficient to support economic recovery?

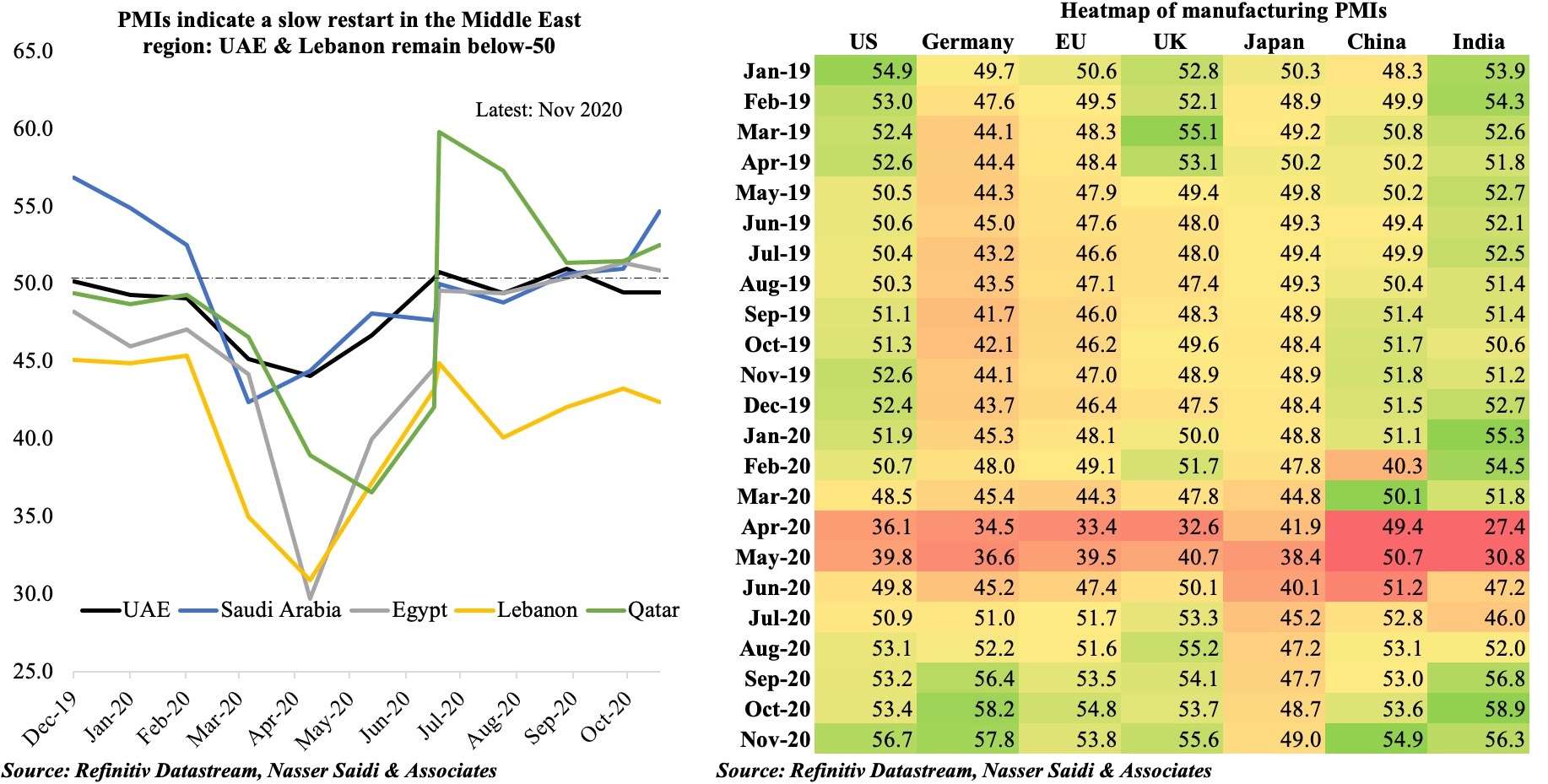

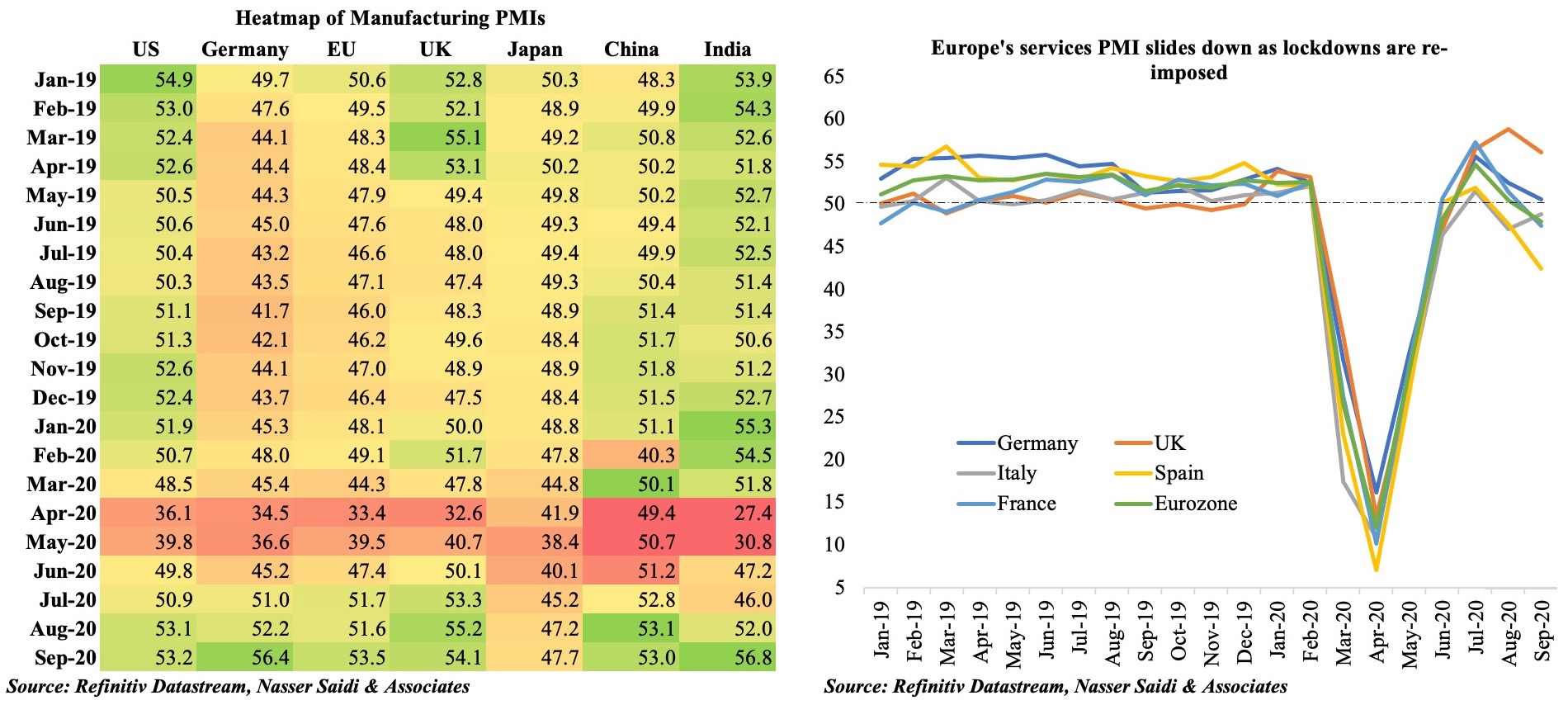

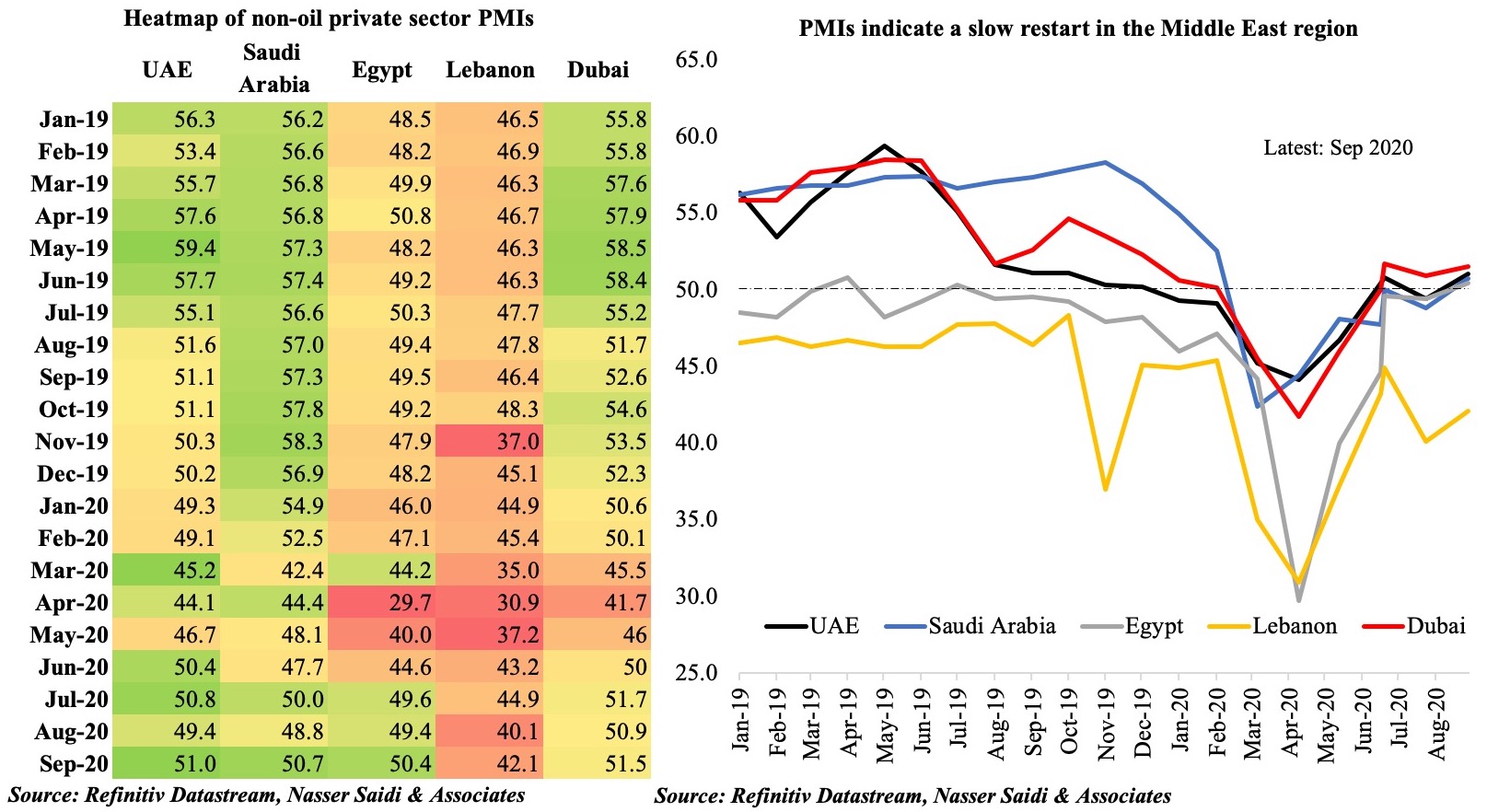

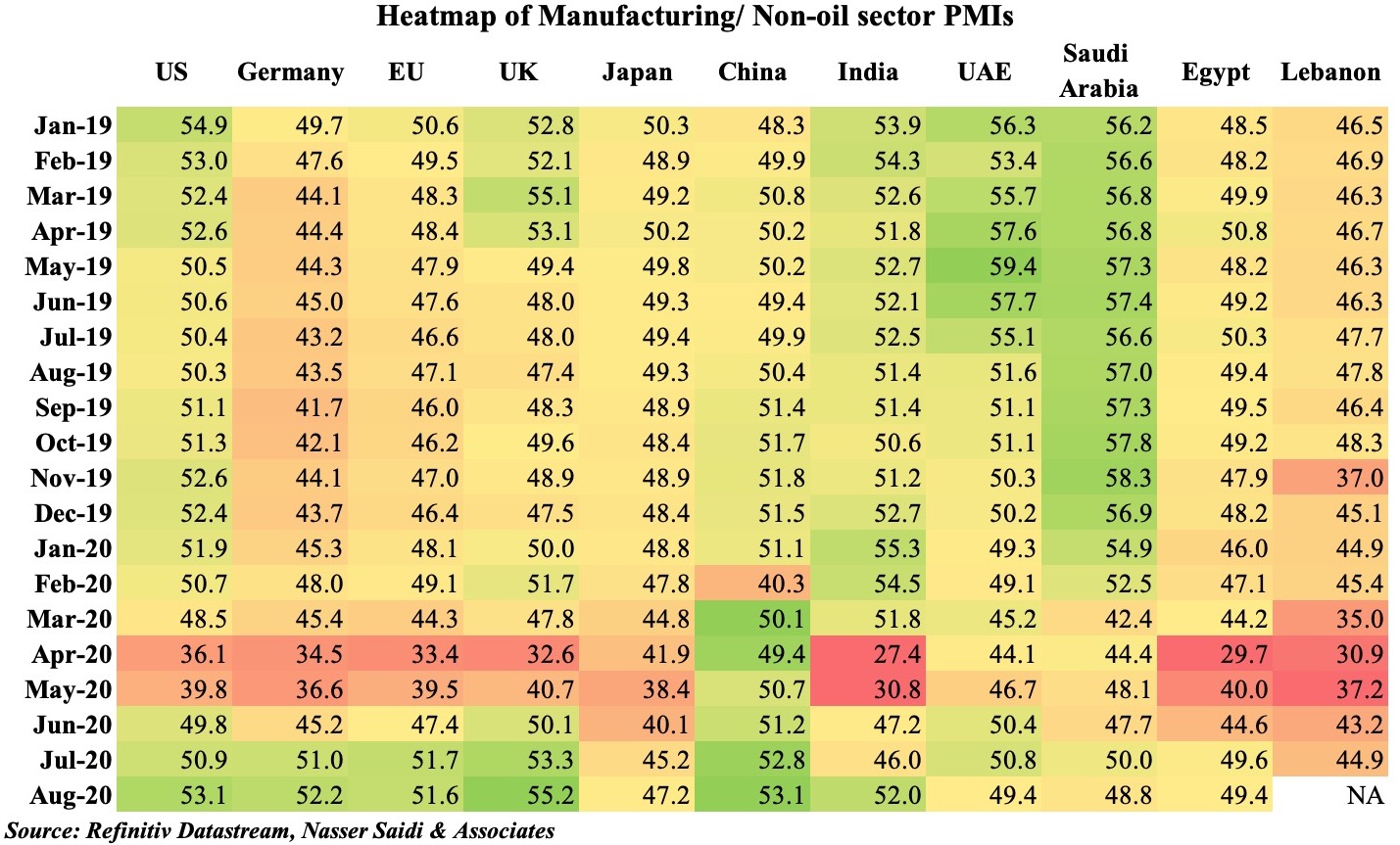

Given the paucity of monthly indicators or data from official sources, we use purchasing managers’ index numbers released by IHS Markit to gauge the level of business activity in the UAE and Dubai.

Both PMIs have stayed quite close to the neutral 50-mark from December to January after having spent two consecutive months in contractionary territory. Job prospects seem to be improving in Dubai and across the country.

However, Dubai’s tourism sector, which recorded a sharp increase in activity in December, returned to sub-50 levels as tourists returned after the New Year holidays and travel restrictions were tightened.

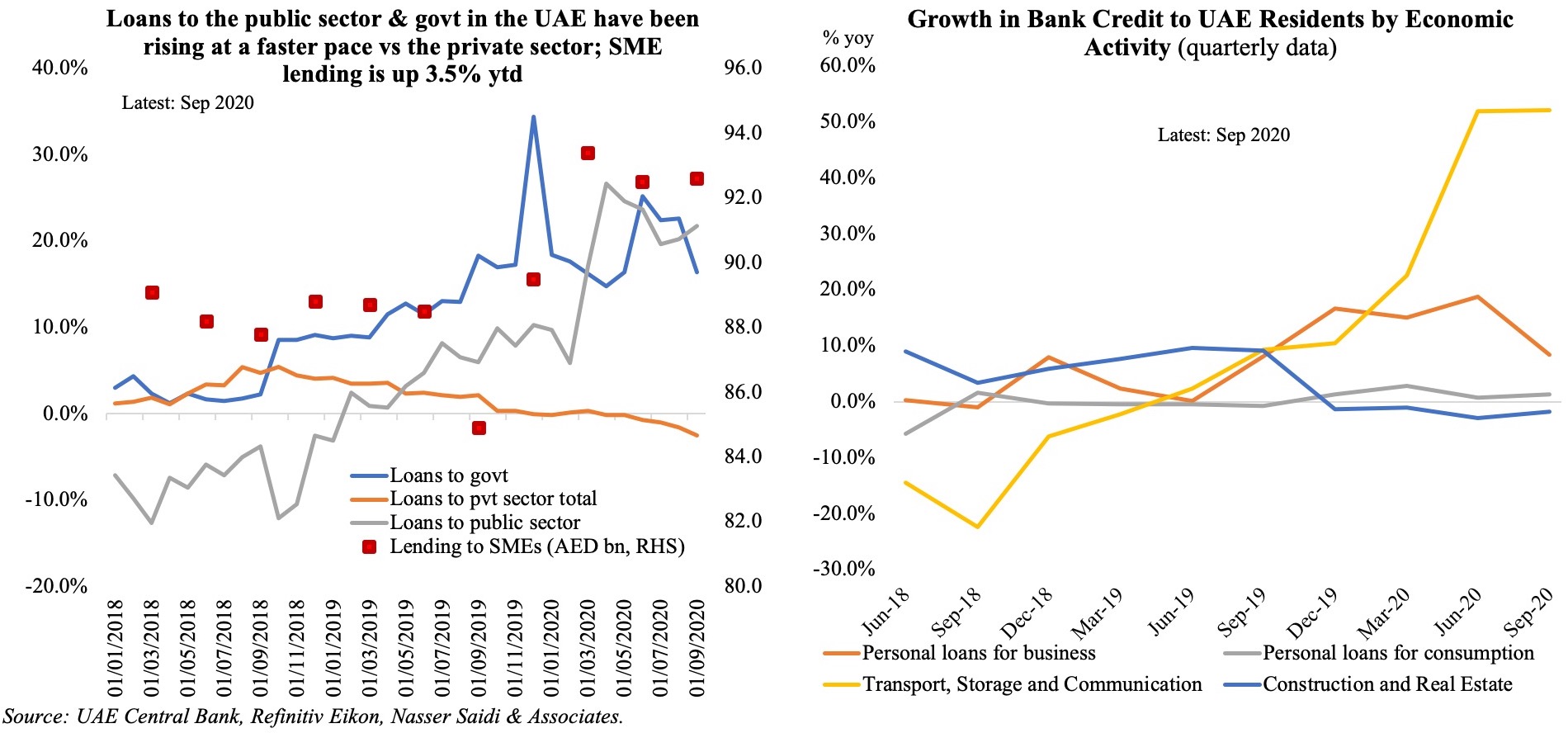

With the vaccination drive, it is evident that as the nation inches closer to achieving herd immunity, domestic activity and business and consumer levels will gradually build up to pre-pandemic levels.

Investor and business-friendly reforms to convince skilled professionals to take up residence in the country will help spur economic activity. While the success of these structural reforms will not be immediate, their steady and effective application is expected to support economic growth in the medium and long term.

How can the UAE step up its recovery?

It is in the best interests of the UAE and Dubai, which is hosting the Expo later this year, for the wider region and the rest of the world to achieve high vaccination levels.

The longer countries remain unvaccinated, the greater the risk of newer strains emerging that could potentially result in another cycle of infections and subsequent movement restrictions.

There are two potential ways to support this.

First, it is crucial to increase the production of vaccines. A recent paper by the University of Chicago said “increasing the total supply of vaccine capacity available in January 2021 from two to three billion courses per year generated $1.75 trillion in social value, while additional firm revenue was closer to $30bn”, far outweighing the investment required to do so.

Vaccination is a public social good that has several private benefits while the coronavirus remains a global threat. So, the UAE’s plans to manufacture the Sinopharm Covid-19 vaccine later this year would be a win-win situation that would cater to both domestic and global demand – especially if the vaccine is to be administered on an annual basis – and boost growth.

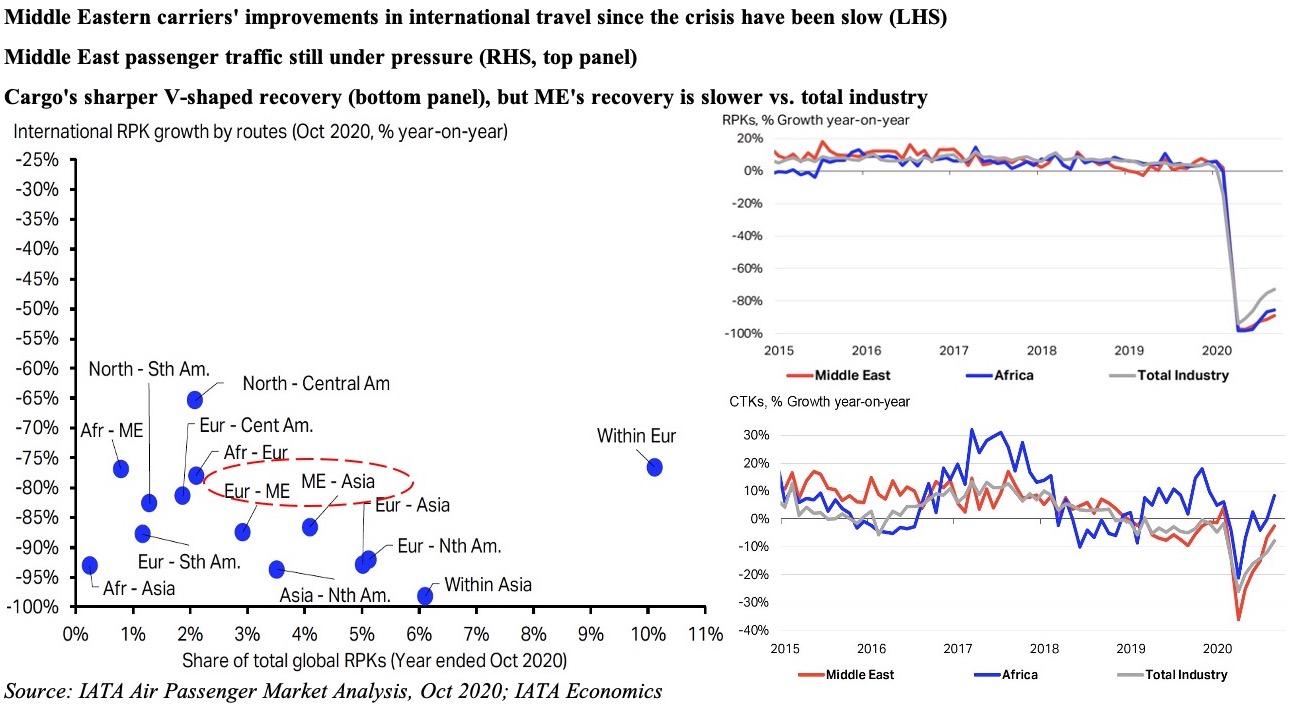

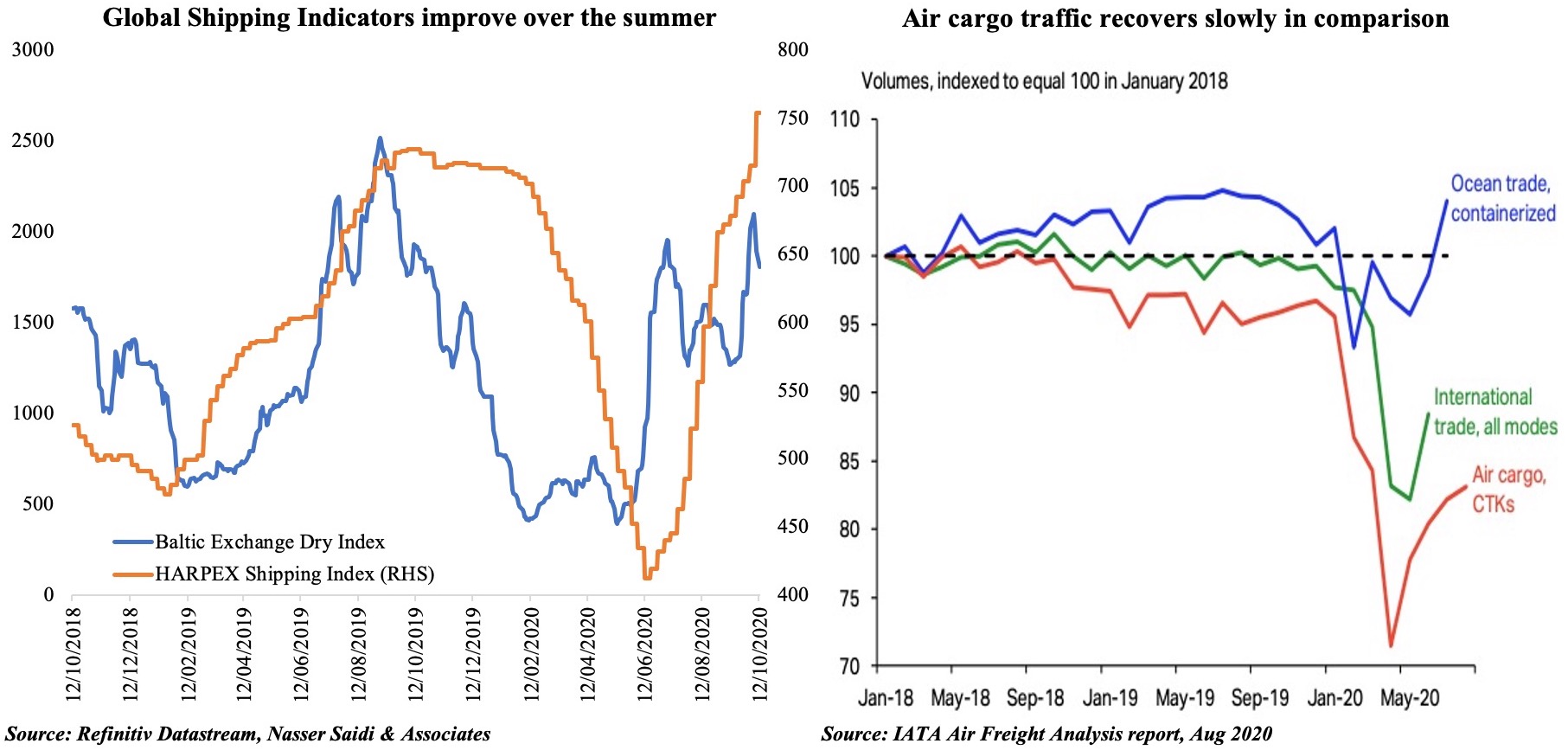

Secondly, the manufactured vaccines need to be distributed faster to reach those in need. To this end, the UAE is well-positioned as a global logistics and transport hub – both for delivering vaccines to smaller nations in the region and using its vast cargo network to transport Covid-19 shots around the world.

Abu Dhabi’s Hope Consortium was set up for vaccine storage and distribution while Dubai’s Vaccine Logistics Alliance will support the World Health Organisation’s effort to deliver two billion doses of vaccines this year.

This could be supported by vaccine aid – either in its contribution to global alliances such as Covax, which plans to deliver 2.3 billion doses this year, or through the free delivery of vaccines to smaller and poor nations, for example, India’s campaign to distribute free vaccines in Nepal, Bhutan and Bangladesh.

A global recovery is essential to the UAE’s overall growth prospects. As a country that relies on trade and tourism, which accounted for about 15 per cent of national gross domestic product and about 30 per cent of Dubai’s GDP in 2019, the impact of Covid-19 has been significant.

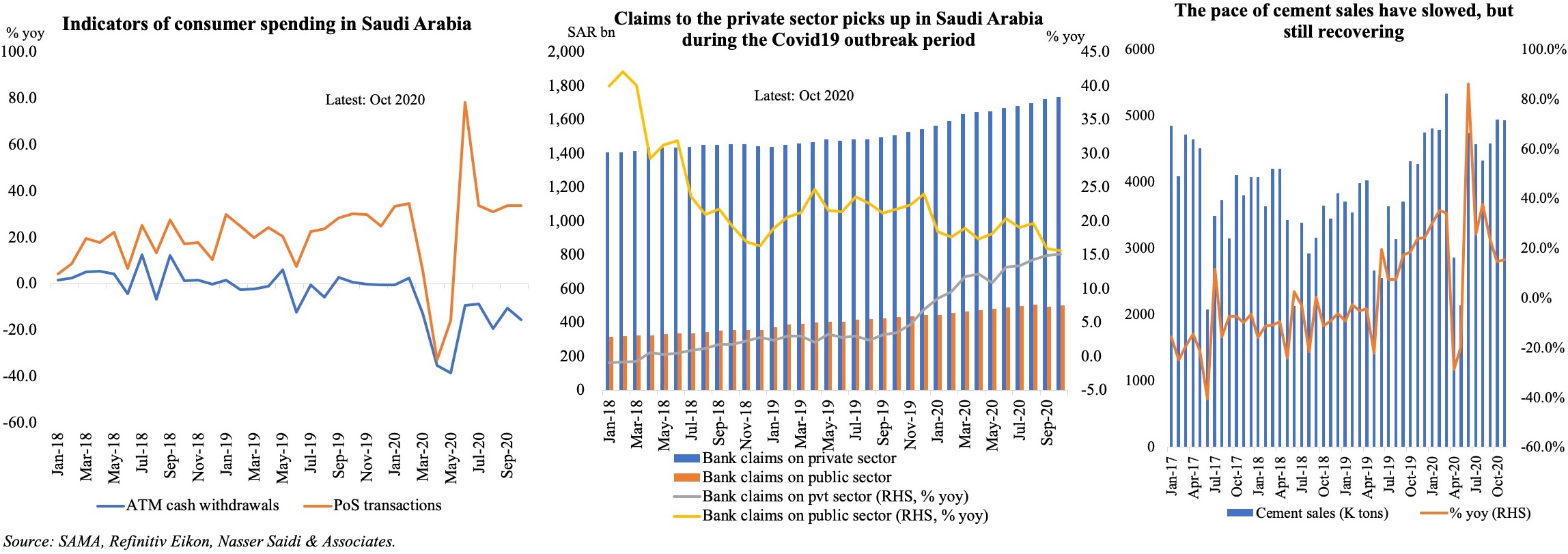

Despite Opec+ production cuts and a subdued demand for crude, signs of a recovery in oil demand (declining oil inventories in China and India) and higher oil prices (about $60 now) will be beneficial to trade and growth.

The UAE’s oil and related product exports are about 40 per cent of total exports and the main export destinations include India, China and Japan, which together account for more than 25 per cent of overall exports and are recovering faster than European markets and the US – to the UAE’s benefit.

Lastly, no outlook is complete without risks. Long-term diversification away from oil is an overarching imperative, as is decarbonisation and debt sustainability, especially in the context of another potential taper tantrum or a faster-than-expected increase in interest rates that leads to tighter financing conditions.

The UAE should continue to press forward with its clean energy initiatives and energy efficiency policies. As the success of the Mars Hope probe has demonstrated, the country has the will, leadership and access to technology and resources to turn the challenge posed by the pandemic into a lever that can help its economy and activities become green, clean, innovative and resilient to climate change.