Download a PDF copy of this week’s insight piece here.

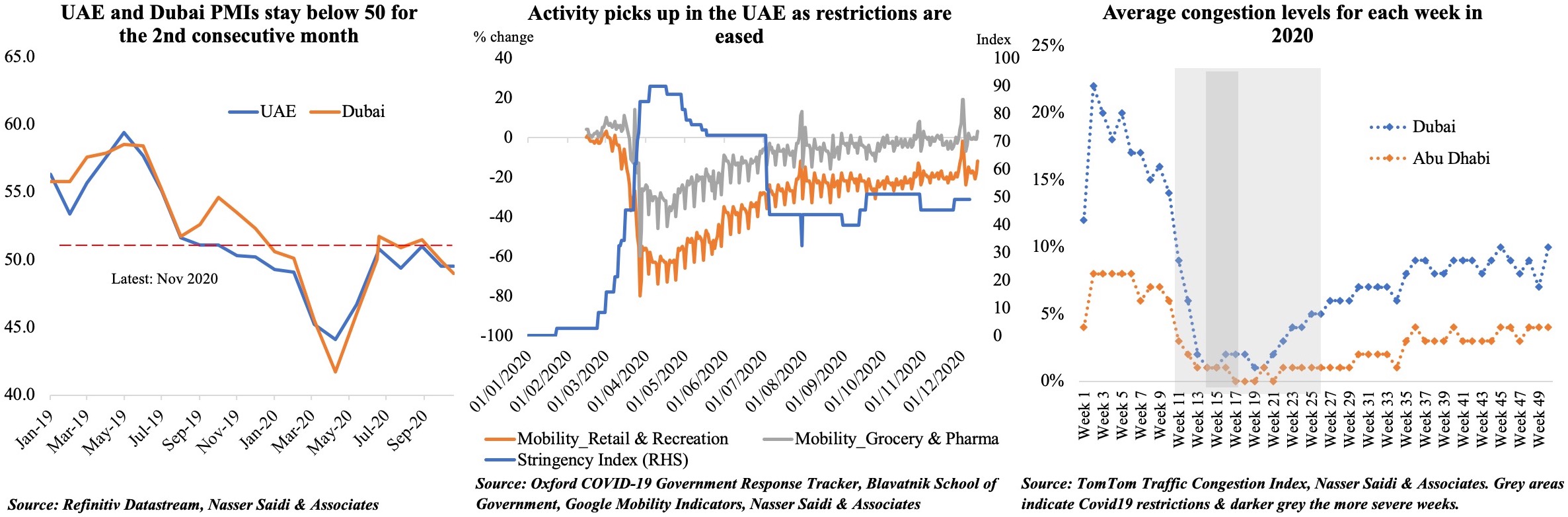

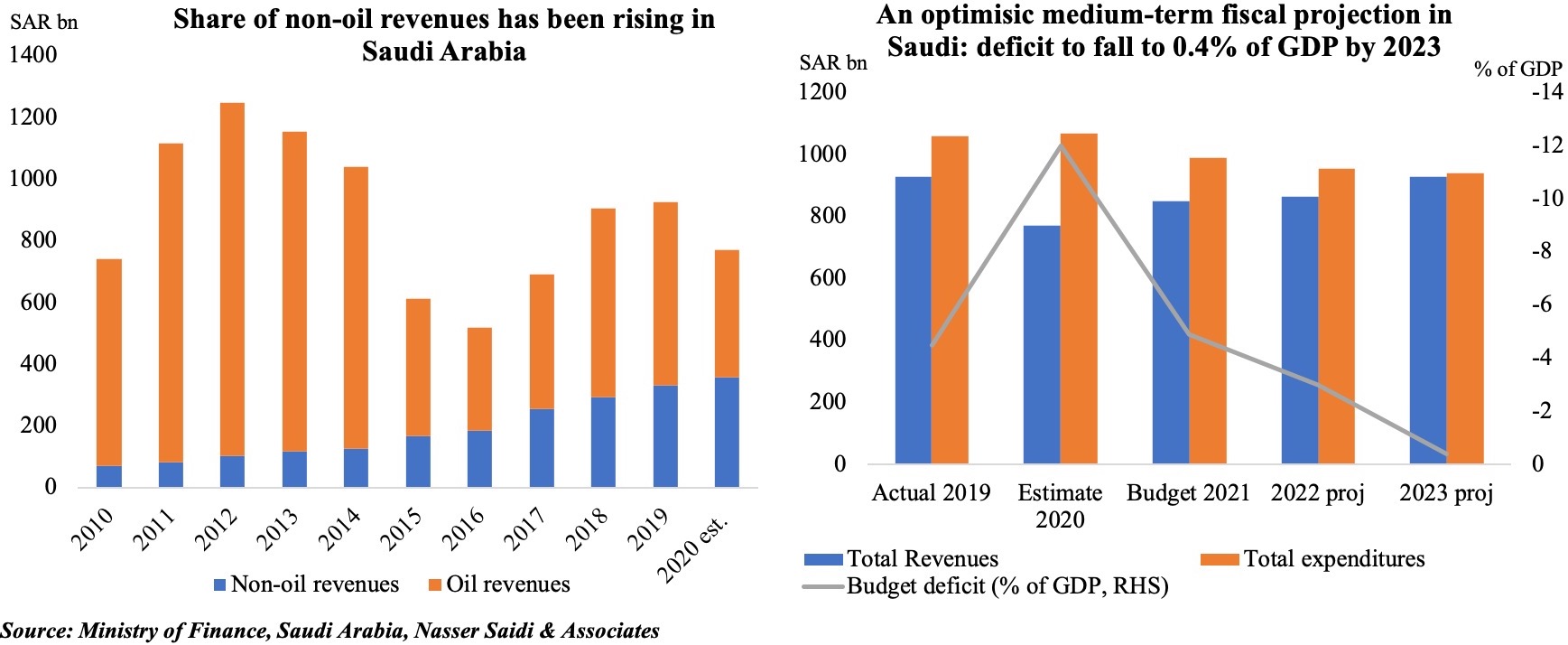

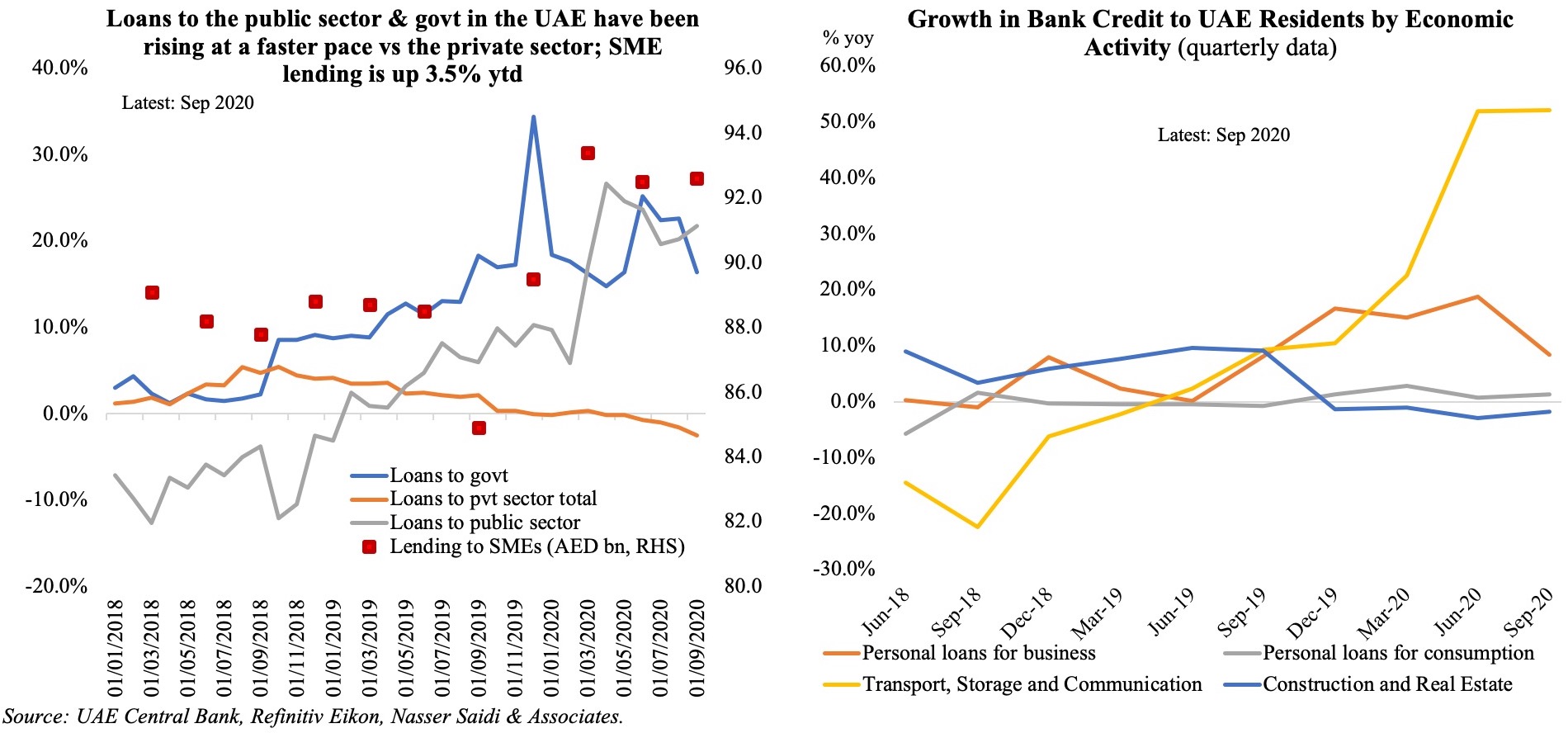

Chart 1: PMIs in the Middle East/ GCC have had a slow restart compared to US/ Europe/ Asia post-lockdown, even during the latest wave

Manufacturing PMI readings have picked up in Nov across the globe, thanks to increases in export orders; global manufacturing PMI also showed employment rising for the first time in 12 months & business confidence at a 69-month high. Vaccine announcements in early-Nov probably added to the mostly positive outlook.

There is a distinct divergence in the Middle East, with UAE and Lebanon still below the 50-mark in Nov. Lebanon’s reading is a clear reflection of its domestic economic meltdown while UAE’s is pegged to subdued demand in spite of the nation being the least stringent (i.e. more “open”, including for tourists) in the region.

The announcement of the efficacy of the Sinopharm vaccine in UAE and planned deployment, in addition to the recent spate of announced reforms – rights of establishment, long-term residency, remote working & retirement visas – should support business and consumer confidence in the months ahead.

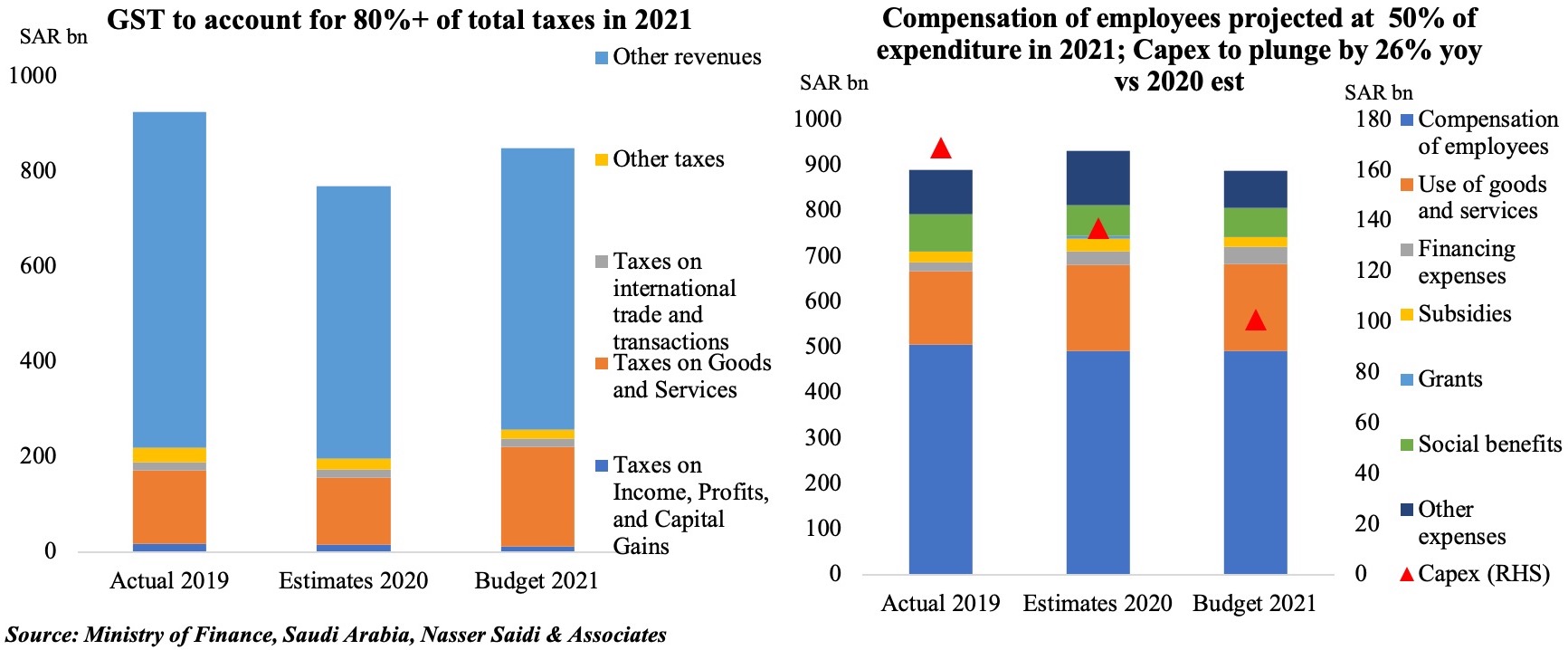

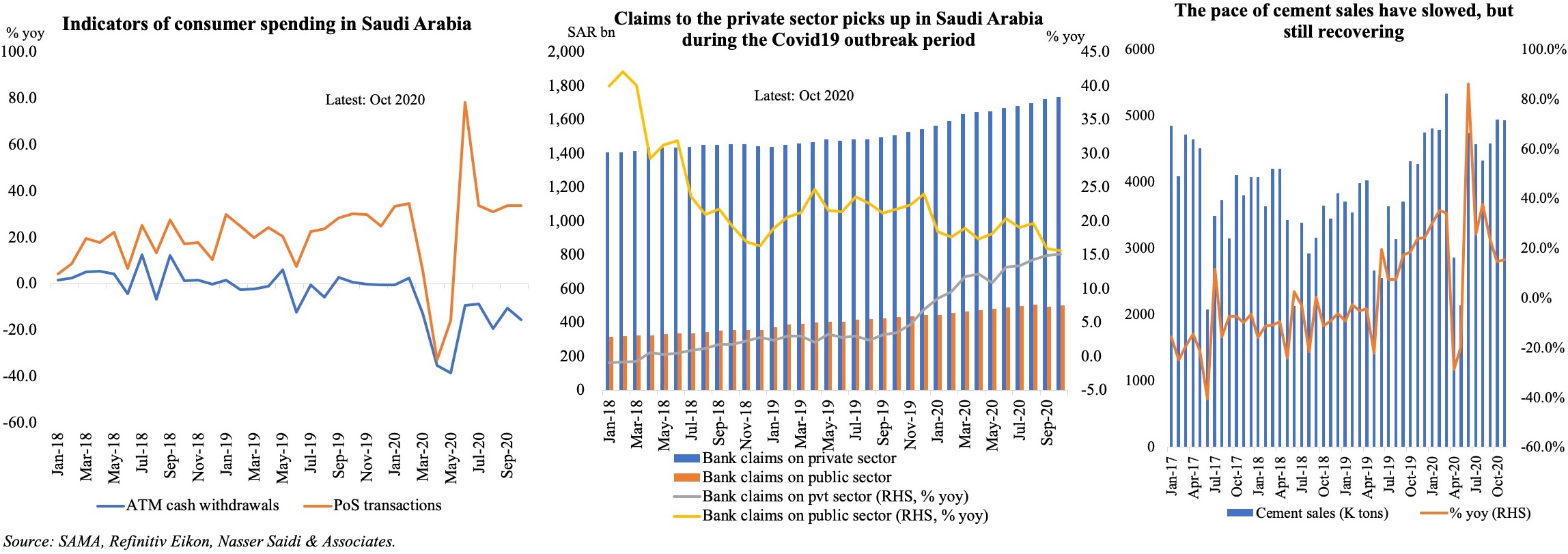

Chart 2: Will vaccines signal a recovery and rescue the airline industry?

Vaccines have been in the news since early-Nov, with the latest announcement from the UAE on the Sinopharm vaccine. As the vaccines are rolled out next year, the hope is that nations recover to the pre-Covid19 phase.

International travel markets remain weak: Middle East airlines revenue passenger-kilometres (RPKs) were down by 86.7% and 88.2% for international connectivity and long-haul traffic in Oct. This should benefit the airline industry in 2 ways: (a) in the near-term, the industry will support distribution of vaccines across the globe: being well-connected to global hubs and given its fleet size, UAE’s Emirates and Etihad are well-placed to gain. Emirates SkyCargo transported more than 75mn kilograms of pharmaceuticals on its aircraft last year; (b) as more people get vaccinated, demand for and willingness to travel will increase probably by H2 next year along with ‘travel bubbles’.

However, the success of the vaccine distribution is also dependent on the last mile delivery hurdles and vaccine storage facilities.

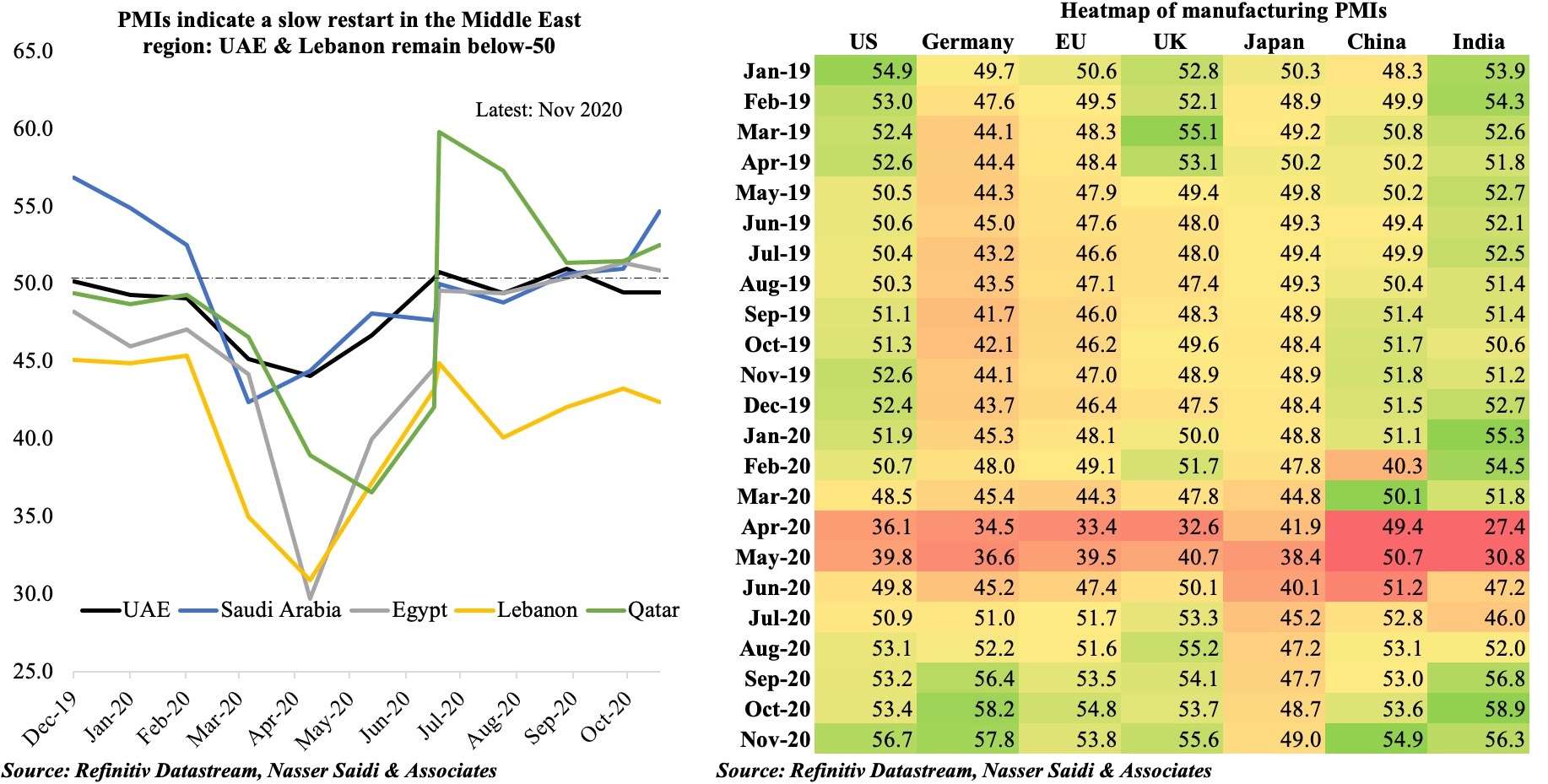

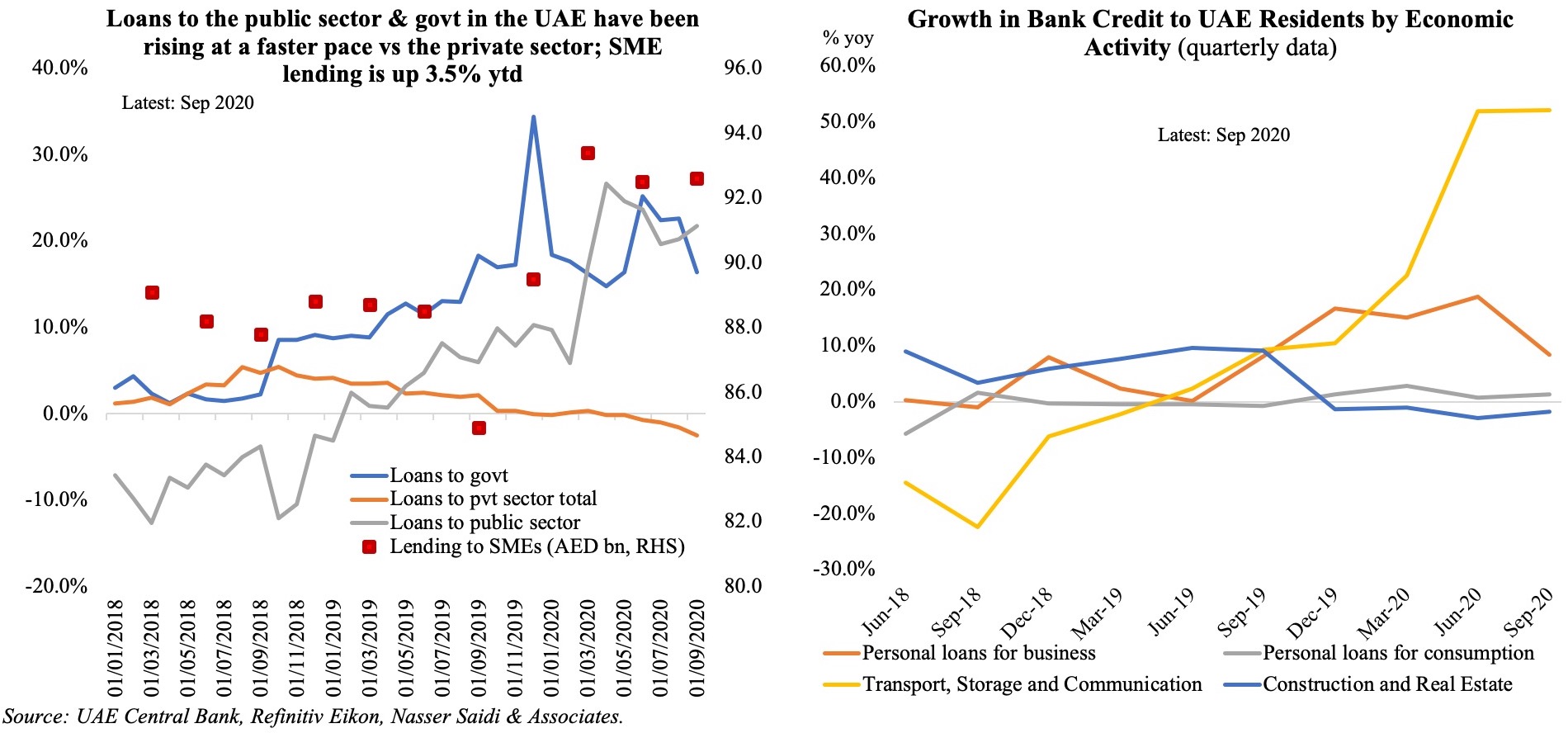

Chart 3: Bank credit in the UAE

The UAE central bank extended its Targeted Economic Support Scheme (Tess) for another six months until June 30, 2021

During Apr-Sep 2020, the overall pace of lending to GREs (+22.7% yoy) and government (+19.6%) have outpaced lending to the private sector (-1.0%). The pace of SME lending has been slow as well, but up 3.5% year-to-date.

Breaking down lending by sector, there has been upticks in credit to both transport, storage and communication (+52.1% yoy as of end-Sep) as well as government (13.6% yoy); mining & quarrying and construction sectors saw declines of -14.4% and -1.9% respectively.

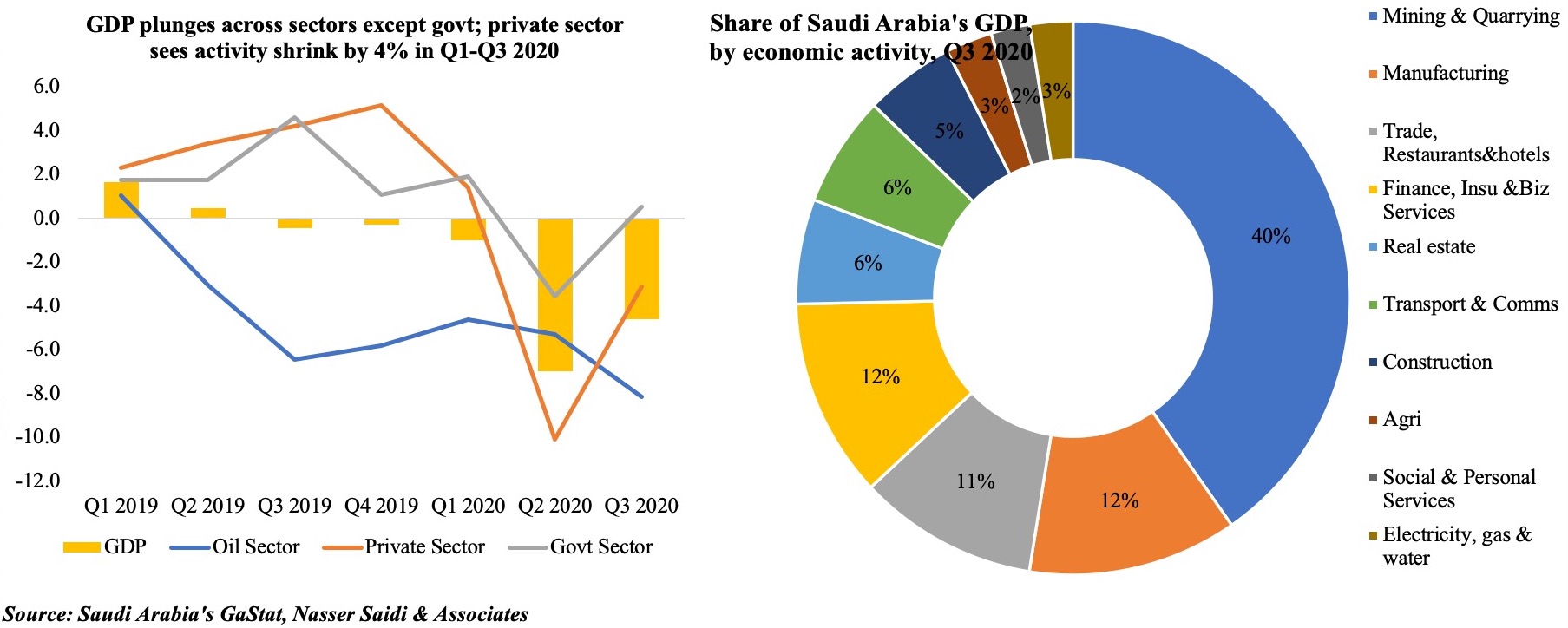

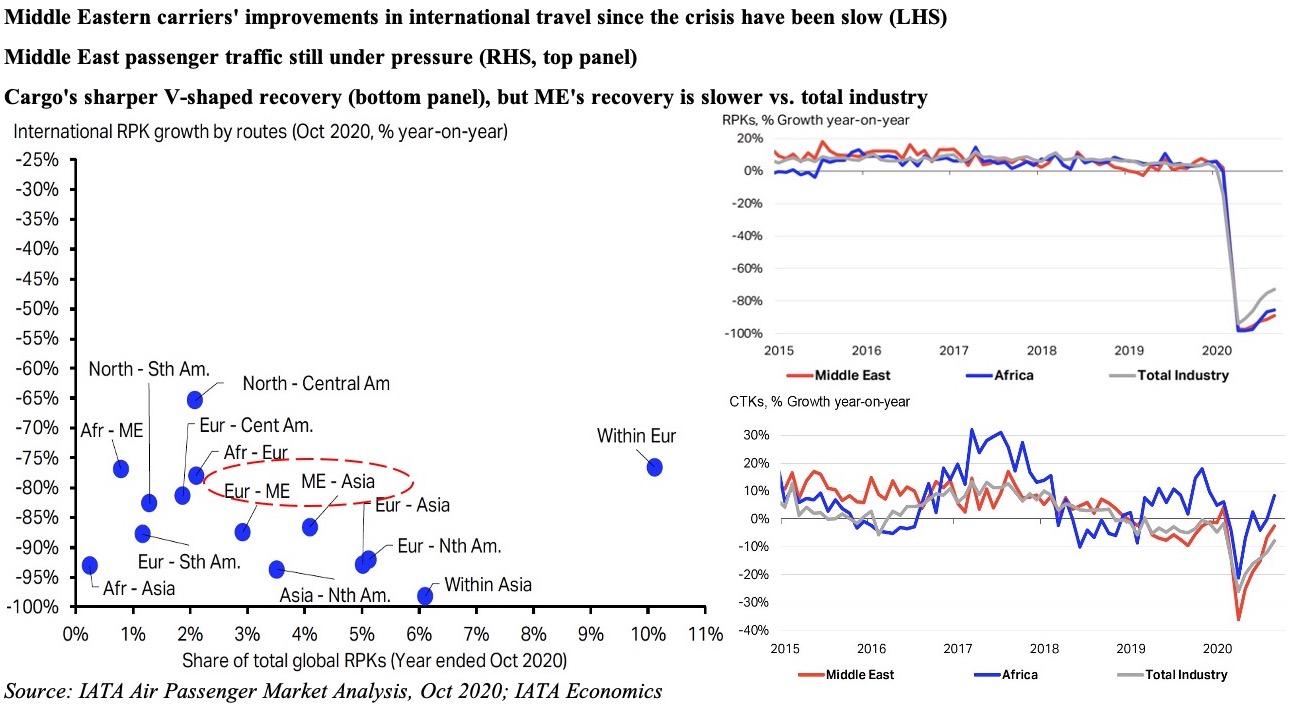

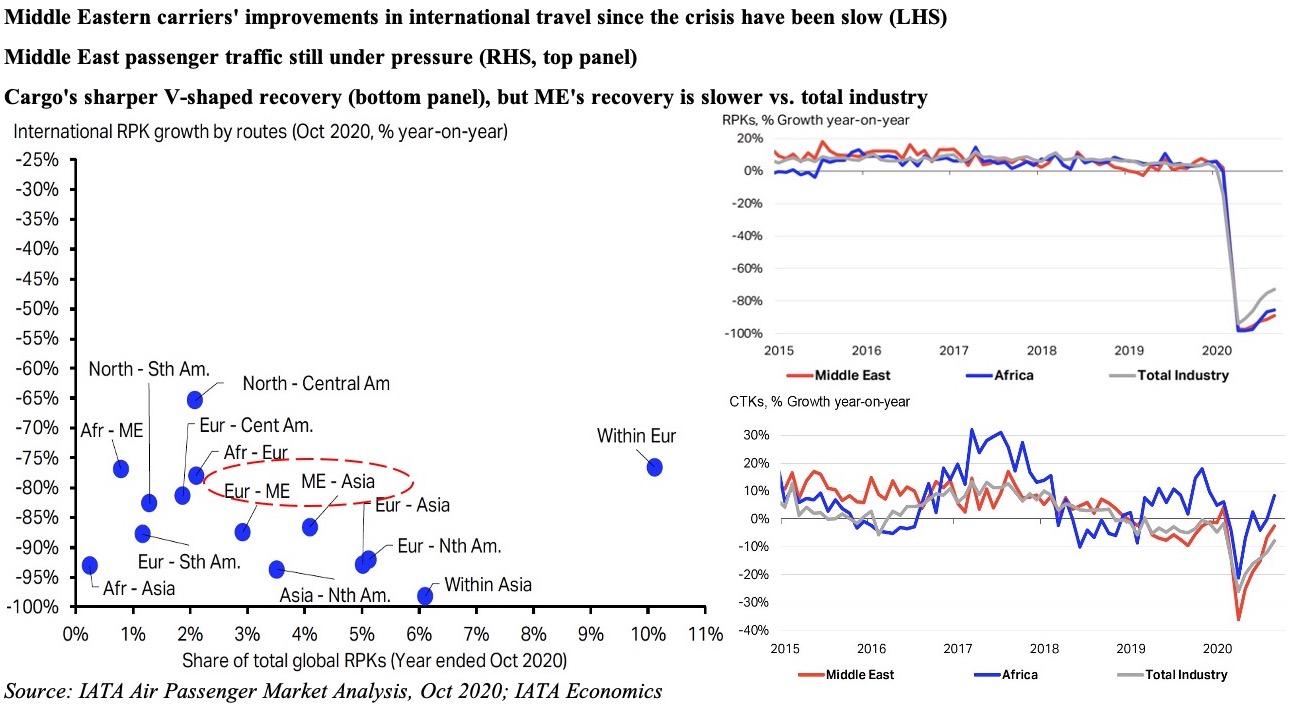

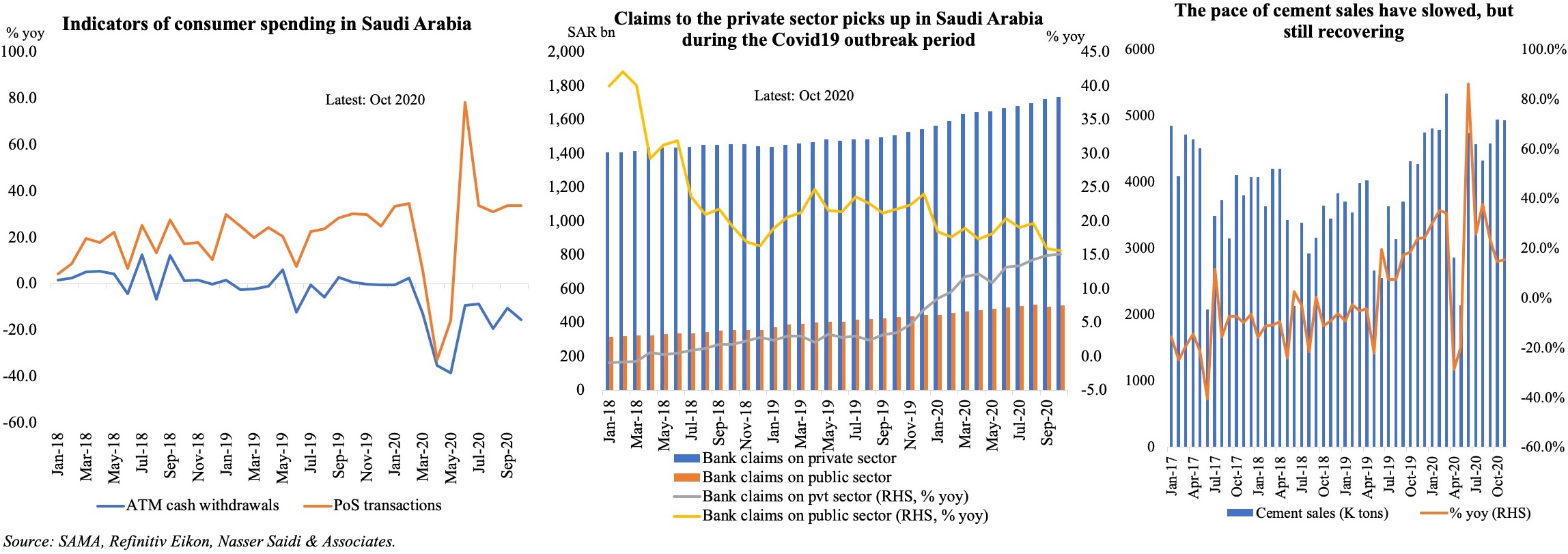

Chart 4: Indicators of economic activity in Saudi Arabia

Among the proxy indicators for consumer spending – ATM withdrawals and PoS transactions – the latter is picking up faster, supported by transactions in food and beverage (+28.9% during Jan-Oct 2020) and restaurants and cafes (+68.9%); in comparison, transactions at hotels are down by 33%. ATM transactions dropped by one-fourth to SAR 499.87bn in Jan-Oct.

Loans to the private sector in KSA has been growing at a double-digit pace since Mar this year, with the year-to-date growth at 12.4% yoy.

Cement sales have been on the uptick, supported by the number of ongoing mega-projects (like the Red Sea development) as well as residential demand: real estate loans by banks are up 38% till Q3 this year, outpacing growth in both 2018 & 2019 while PoS transactions in the construction and building materials is up 44.2% this year (a large 247.4% uptick in Jun, ahead of the VAT hike).

Powered by: