“Syria at the crossroads: From sanctions and collapse to redevelopment and reintegration”, Oped in The National, 18 July 2025

The article titled “Syria at the crossroads: From sanctions and collapse to redevelopment and reintegration” appeared in the print edition of The National on 18th July 2025 and is posted below.

Syria at the crossroads: From sanctions and collapse to redevelopment and reintegration

Nasser Saidi

The pre-2011 Syrian economy, while facing structural challenges, was that of a lower-middle-income country with a functioning industrial base, a significant agricultural sector and nascent potential in tourism and services.

That reality was devastated by 14 years of war, violence and sanctions, emerging into a drug-based Captagon economy. Its gross domestic product contracted by more than 50 per cent from its pre-war peak (by 83 per cent if one uses night-time light estimates) between 2010 and 2024.

Half the pre-war population has been forcibly displaced, representing lost generations of economic output and potential. About two-thirds of the current population lives in poverty (earning less than $3.65 per capita a day), and more than half the population faces food insecurity.

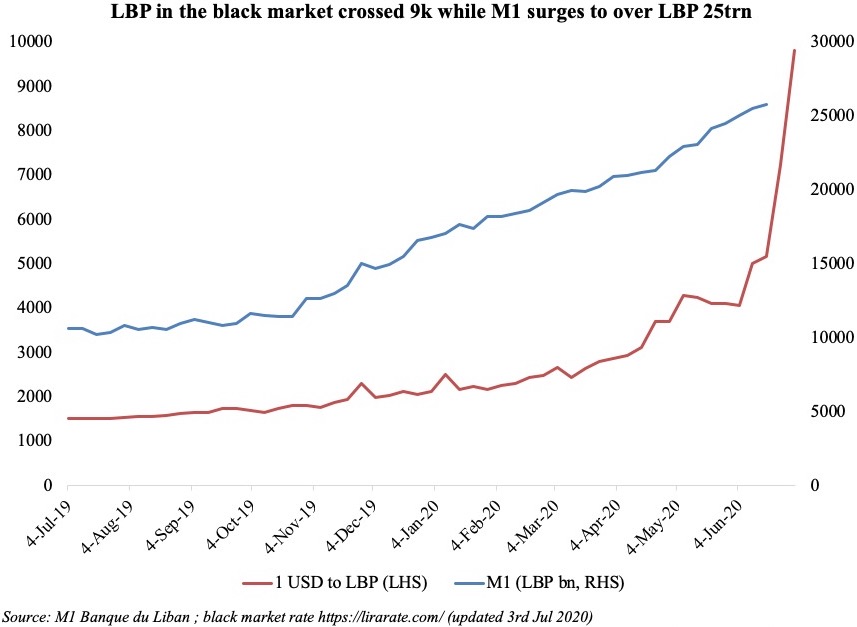

The directly visible indicator of the devastation was the collapse of the local currency (from 47 Syrian pounds per US dollar in 2010 to 14,800 by the end of 2024), as growing budget deficits were financed by the monetary printing press and people shifted into foreign currencies to hedge against near-hyperinflation.

The removal of US sanctions and of Syria’s “designation as a state sponsor of terrorism” is strategically important. The decision was followed by the EU passing legislation to lift all sanctions, thereby enabling Syria’s reintegration into the international economic and financial community.

The Gulf and other Arab countries are steadily bringing Syria back into the fold, restoring long-disrupted economic and financial relations. Saudi Arabia and Qatar have settled Syria’s arrears to the World Bank, pledged to fund public sector restructuring and rebuild energy infrastructure, signed agreements for major infrastructure and power projects, and the resumption of airline services. Iraq has reopened a main border crossing, and DP World has signed an $800 million deal to develop Tartus Port.

Sanctions removal allowed for Syria’s renewed participation in the SWIFT payment system, reactivating formal channels for international trade, remittances and financial flows, delivering a powerful antidote to the scenario of hyperinflation and a dominant illicit sector.

The removal unlocks a multistage recovery process, sequentially addressing the critical deficits in liquidity, capital and strategic infrastructure investment that currently paralyse the country.

Transparent reforms urgent

However, the success of this pathway will be contingent on the implementation of credible and transparent, domestic, structural and institutional reforms.

Syria needs a comprehensive IMF programme and support from the Arab Monetary Fund and Gulf central banks (possibly through central bank swaps and trade financing lines).

The institutions of the central bank, banking supervision and AML/CFT need to be rebuilt. A new monetary and payment system has to be established.

The banking and financial sector has to be restructured, and banks recapitalised, while allowing for private banks (including foreign) to re-emerge. The Syrian pound should stay floating until macroeconomic stability has been restored, including through fiscal reform and access to international finance for trade.

Importantly, the government and central bank need to rebuild the statistical system for evidence-based policymaking; one cannot govern, reform, regulate and manage what one does not know.

Removal of sanctions will allow transfers and remittances through formal channels from the large Syrian expatriate community, a lifeline for returning families, as well as financing reconstruction of housing and businesses.

Restoring the banking system means less reliance on the use of cash – helping to revive the formal economy as compared to the dominant informal economy, and also combating money laundering and terrorist finance associated with the production and trade of drugs. Remittances and capital inflows would allow the Central Bank of Syria to rebuild its foreign currency reserves, stabilise the forex market and restore monetary stability to control inflation.

The removal of sanctions will also lower the prohibitive risk premium associated with Syria and open the country for the much-needed foreign direct investment to stabilise the economy, and for broader reconstruction funding.

The Damascus Securities Exchange, now operational again, could evolve from a symbolic entity into another channel of financing, allowing the government and Syrian businesses to tap into local and international capital for the first time since 2009.

Tapping energy potential

The country’s substantial, largely unexploited, onshore and offshore oil and gas reserves could become an important source of reconstruction finance and job creation. Strategically and importantly, the removal of sanctions would allow oil and gas pipelines to be reopened, and new ones built; pre-civil war, Syria produced up to 400,000 barrels a day of crude versus between 80,000-100,000 bpd this year.

Reactivating existing wells and oil export infrastructure could become a major source of revenue and foreign exchange, dramatically improving Syria’s fiscal position and its ability to reconstruct the devastated country, and bring in international funding.

New pipelines linking oil and gas from the Gulf (notably Qatar, Kuwait and Saudi) and Iraq to the Mediterranean would provide a strategic alternative to maritime routes through the Straits of Hormuz and Red Sea.

Azerbaijan and Syria signed a preliminary agreement on July 12, pledging co-operation in the energy sector – to enable export of gas from Azerbaijan to Syria, through Turkey – and help in rebuilding Syria’s energy infrastructure.

Over the medium and longer term, a new, transformative energy infrastructure and map linking the hydrocarbon-rich regions of the Gulf and Iraq to the Mediterranean coast can be developed: a major building block in stabilising and helping to redevelop Syria.

The lifting of sanctions is a critical initial step supporting Syria in emerging from a vicious cycle of destruction, economic collapse and illicit activity into a virtuous circle of reconstruction, redevelopment, regional and international reintegration.

The realisation of this road map requires a commitment from Syria to undertake essential reforms in governing, the rule of law and institutional transparency. Only then can the country hope to attract and retain the human and financial capital needed to rebuild its economy, regain investor trust, and reclaim its historic role at a vital geostrategic crossroads.

Nasser Saidi is the president of Nasser Saidi and Associates. He was formerly Lebanon’s economy minister and a vice-governor of the Central Bank of Lebanon.

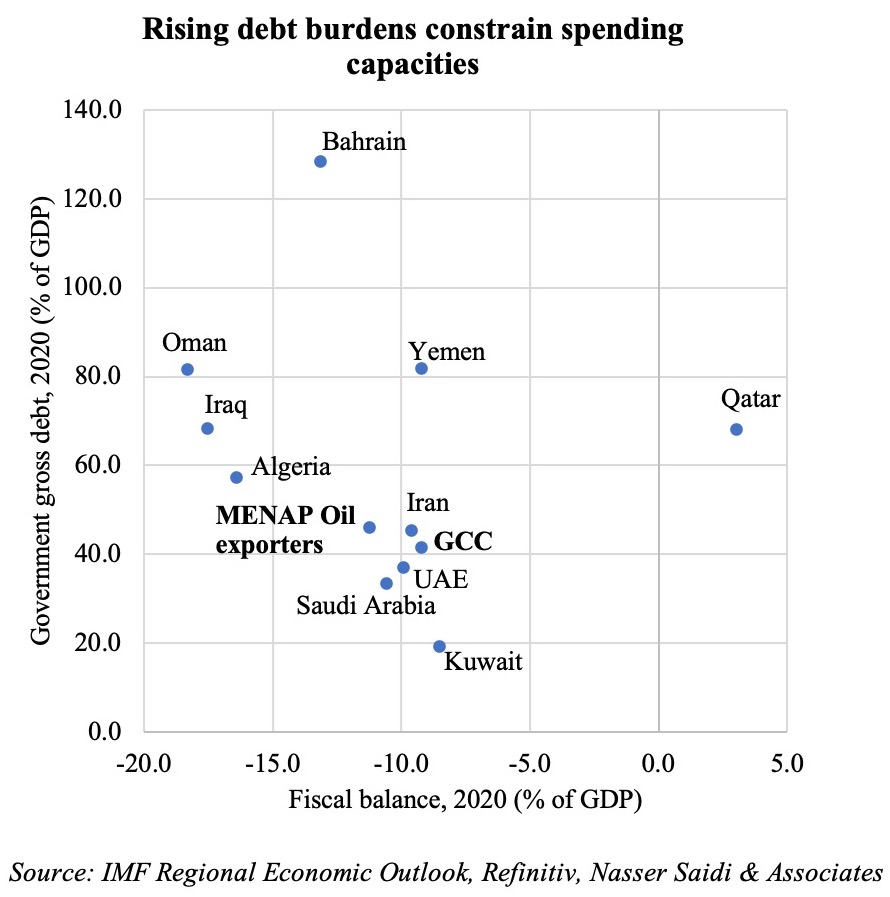

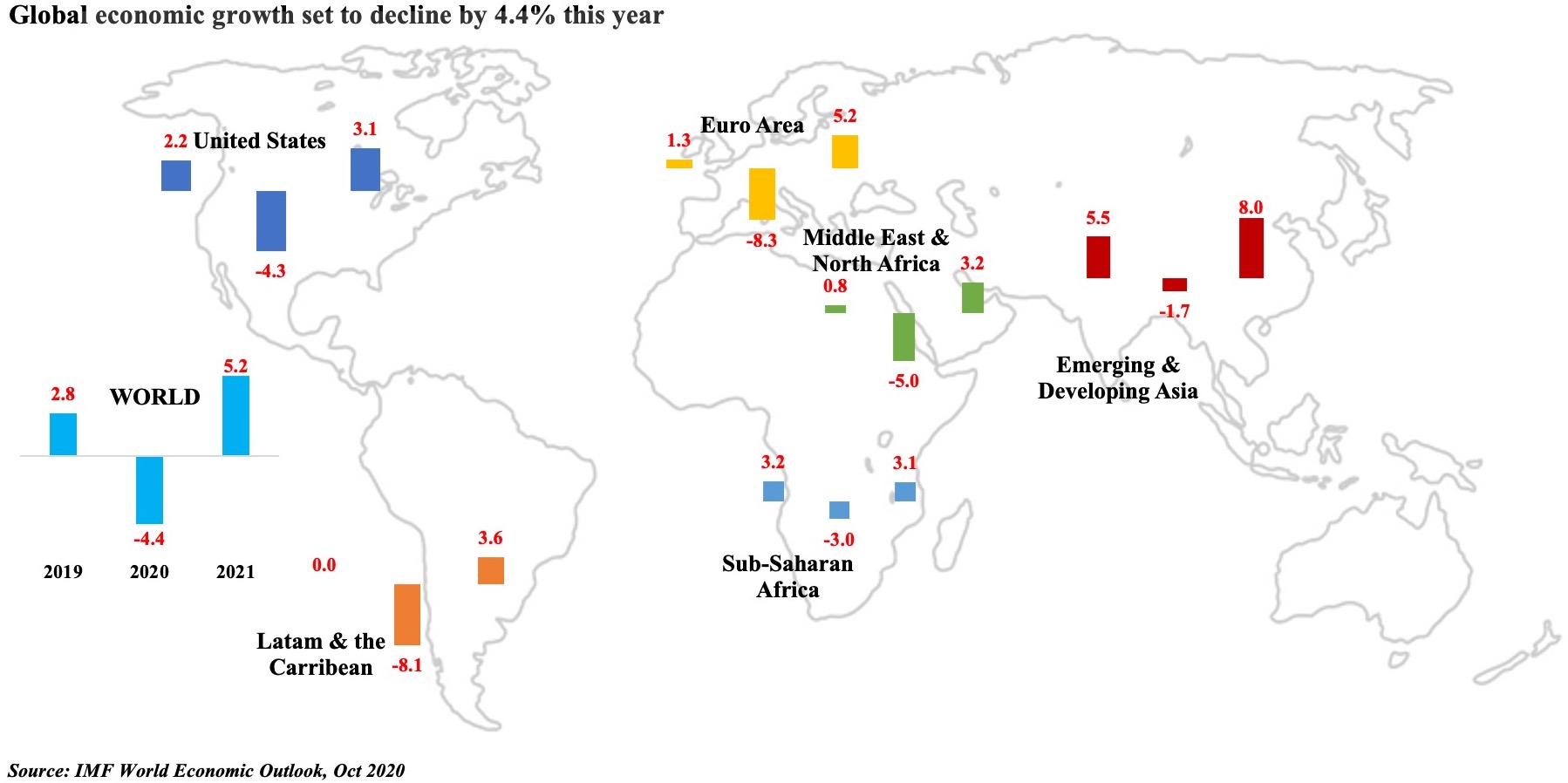

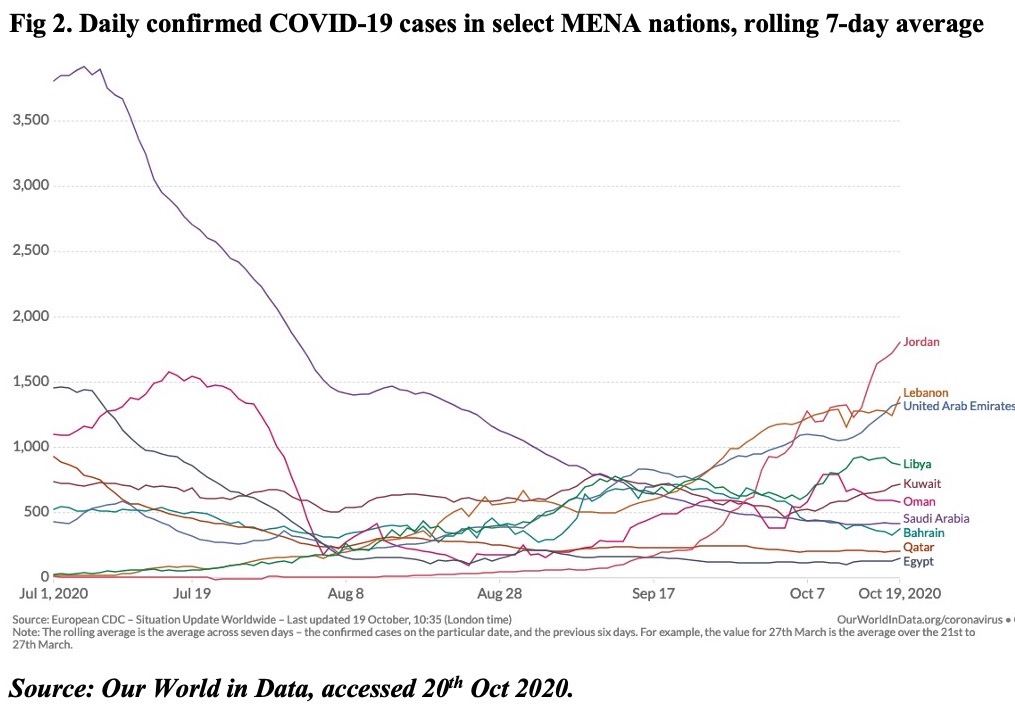

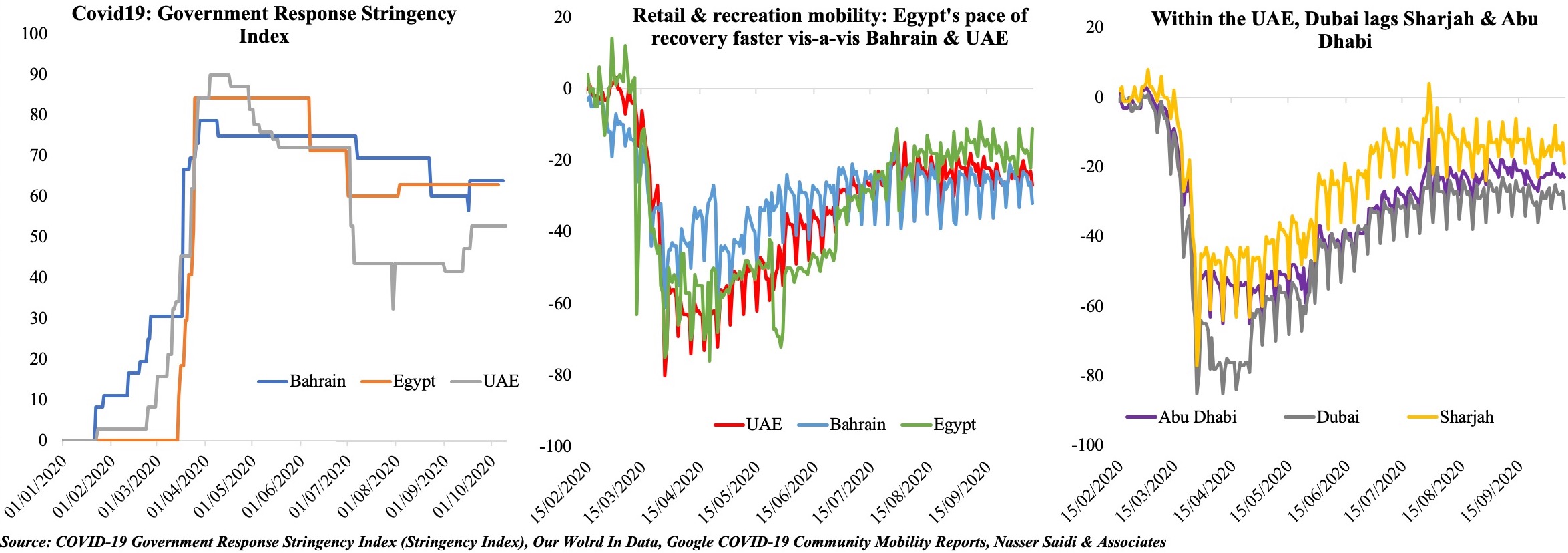

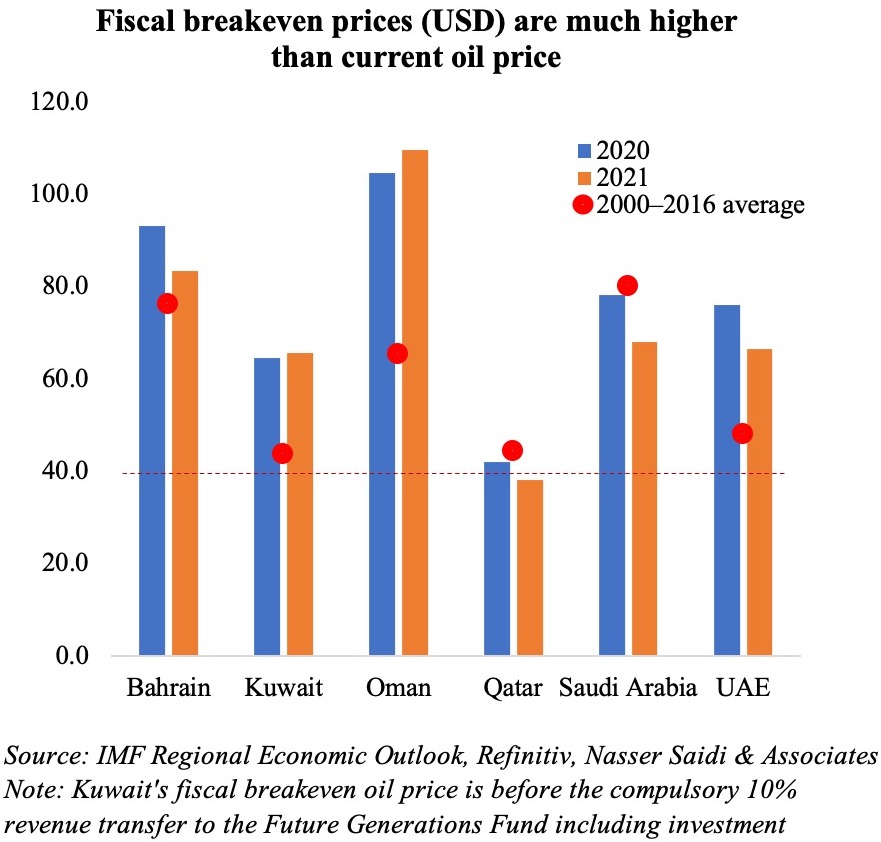

Given the resurgence in Covid19 cases and renewed lockdown measures and the global energy transition away from fossil fuels, it is unlikely that oil prices will revert to the levels seen a few years ago, given weaker demand – the IMF’s latest World Economic Outlook puts oil prices, based on futures markets at USD 41.69 in 2020 and USD 46.70 in 2021 (versus an average price of USD 61.39 last year). Fiscal breakeven oil prices in the GCC range between USD 42 for Qatar to USD 104.5 for Oman this year, exerting additional pressure on most oil producers as they ramp up spending to support the economy (UAE’s emirates Dubai and Sharjah announced USD136Mn and USD139Mn respectively in additional stimulus in the last few days).

Given the resurgence in Covid19 cases and renewed lockdown measures and the global energy transition away from fossil fuels, it is unlikely that oil prices will revert to the levels seen a few years ago, given weaker demand – the IMF’s latest World Economic Outlook puts oil prices, based on futures markets at USD 41.69 in 2020 and USD 46.70 in 2021 (versus an average price of USD 61.39 last year). Fiscal breakeven oil prices in the GCC range between USD 42 for Qatar to USD 104.5 for Oman this year, exerting additional pressure on most oil producers as they ramp up spending to support the economy (UAE’s emirates Dubai and Sharjah announced USD136Mn and USD139Mn respectively in additional stimulus in the last few days).