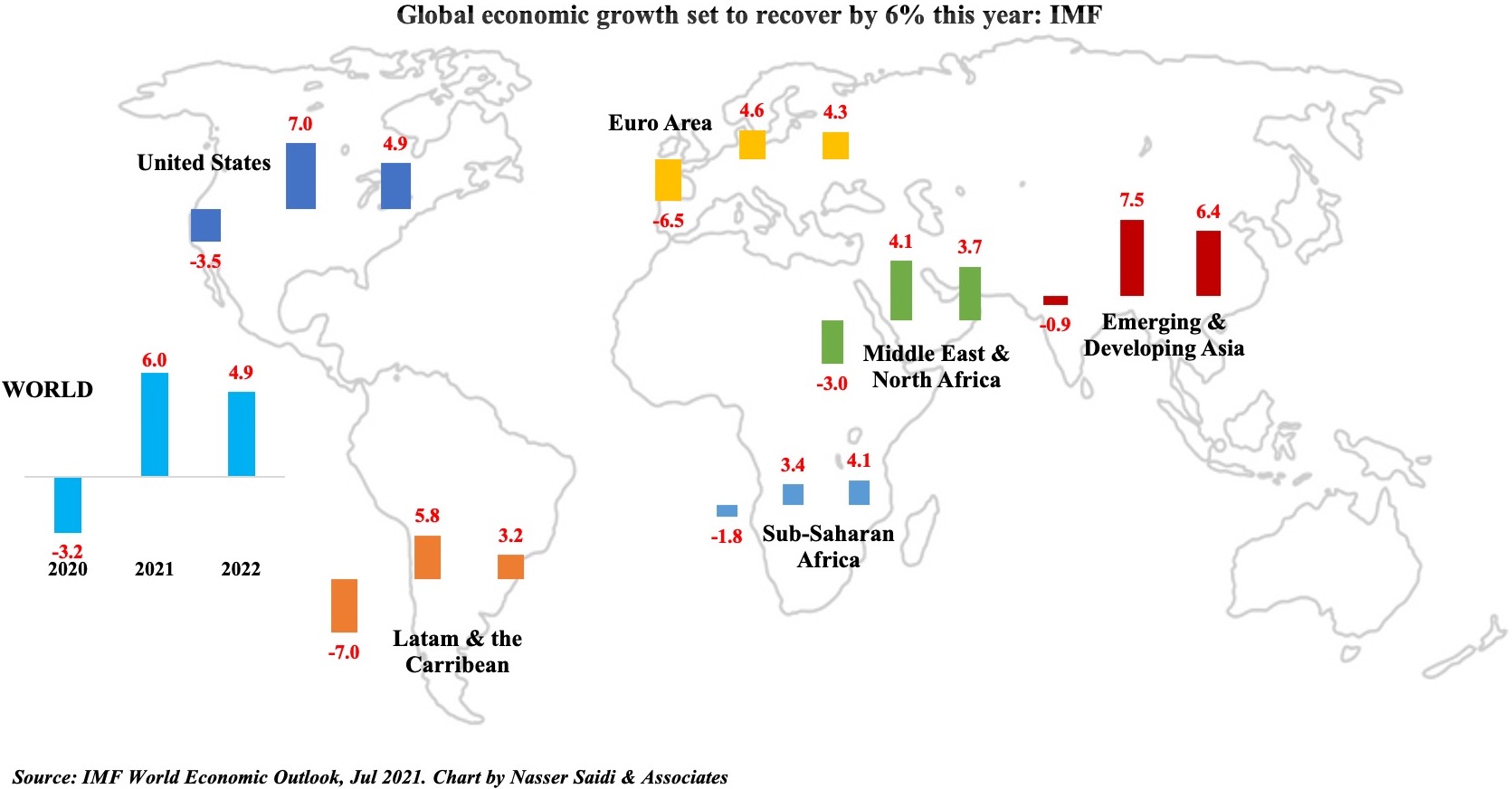

In this interview with Al Arabiya aired on 1st Jan 2023, Dr. Nasser Saidi discusses potential threats to the global economy in 2023. He touches upon slowing global growth/ recessions and divergent growth rates in the back drop of inflation and role of the central banks amid a strong dollar. Also touched upon was growth prospects in China.

Watch the interview at this link as part of the related news article

ناصر السعيدي للعربية: نمو اقتصاد الصين سيتجاوز 5% في 2023

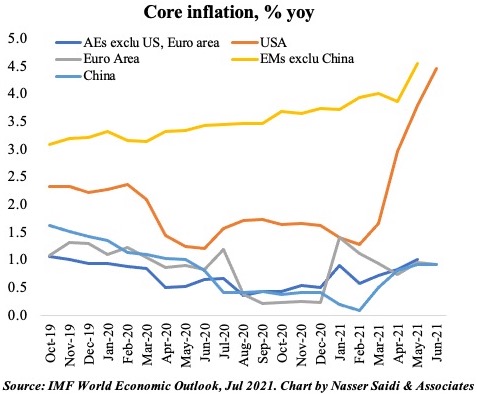

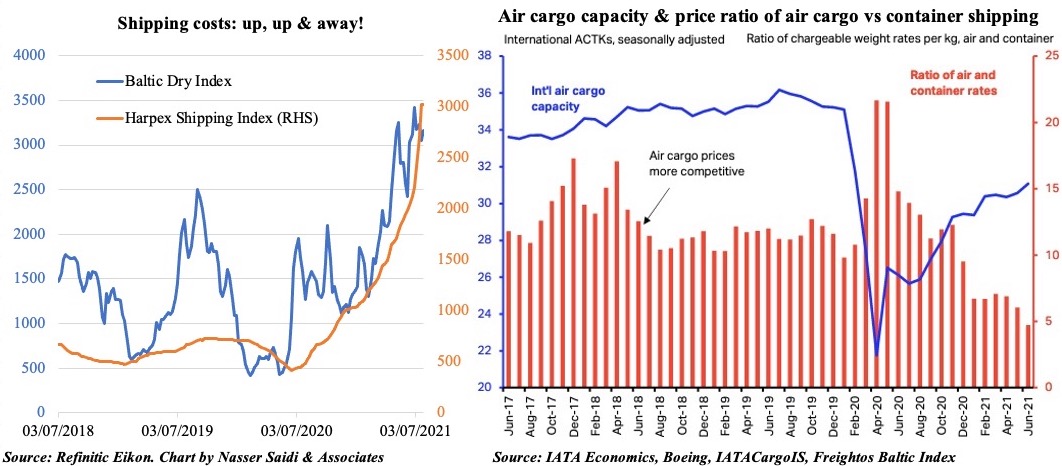

قال رئيس شركة ناصر السعيدي وشركاه، الدكتور ناصر السعيدي، إن هناك 4 عوامل تؤثر في نسب نمو الاقتصاد العالمي خلال 2023، منها العوامل الجيوسياسية المتمثلة في الحرب بين روسيا وأوكرانيا من جهة، والمواجهة والحرب الاقتصادية بين الصين وأميركا من جهة أخرى، وتداعيات حرب أوكرانيا على سوق الطاقة وارتفاع أسعار النفط بما يؤثر على الدول الناشئة والمستوردة للنفط، بالإضافة إلى حالة عدم اليقين بشأن نسب التضخم والسياسات النقدية.

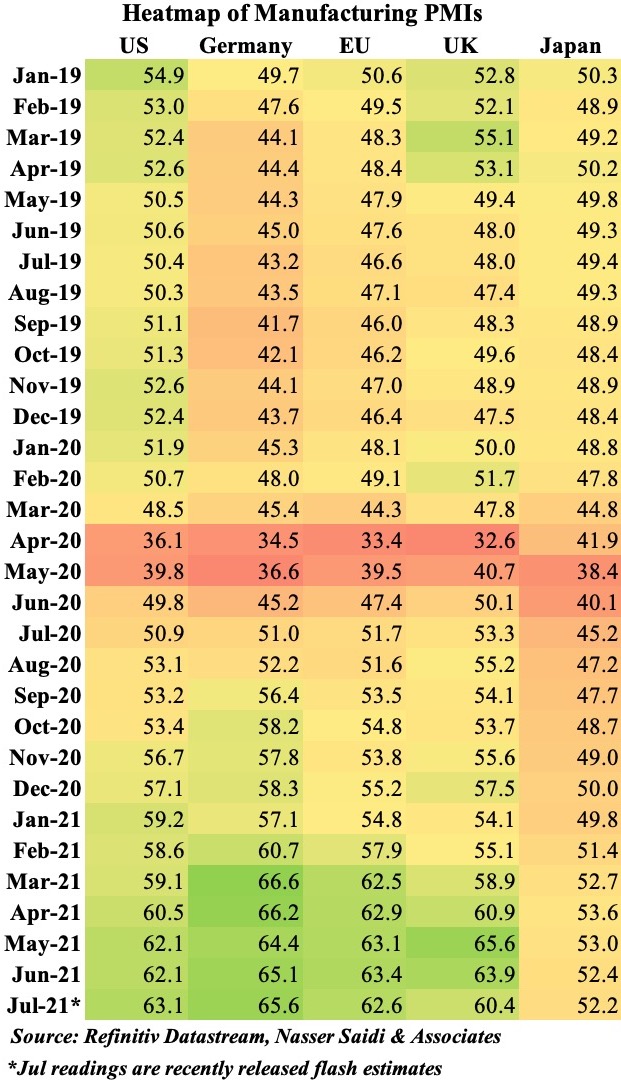

وأضاف السعيدي، في مقابلة مع “العربية”، اليوم الأحد، أن عام 2023 سيشهد تبايناً بين نسب النمو والركود بين دول العالم، وسيحدث ركودا بداية من بريطانيا تلحقها أوروبا خلال الربع الأول من 2023.

وأوضح السعيدي، أن أميركا قد تتجنب الركود العميق مع إمكانية نجاح الفيدرالي الأميركي في رفع الفائدة ولجم التضخم.

وتوقع رئيس شركة ناصر السعيدي وشركاه، أن ترفع الصين نسب النمو لتتجاوز نسبة 5% في 2023 مع ضخ مساعدات لقطاع التكنولوجيا وزيادة الإنفاق على البنية التحتية، وبدعم من قطاع التجزئة الذي مر بفترة توقف بسبب كوفيد-19، ولذلك سترتفع نسب الاستهلاك.

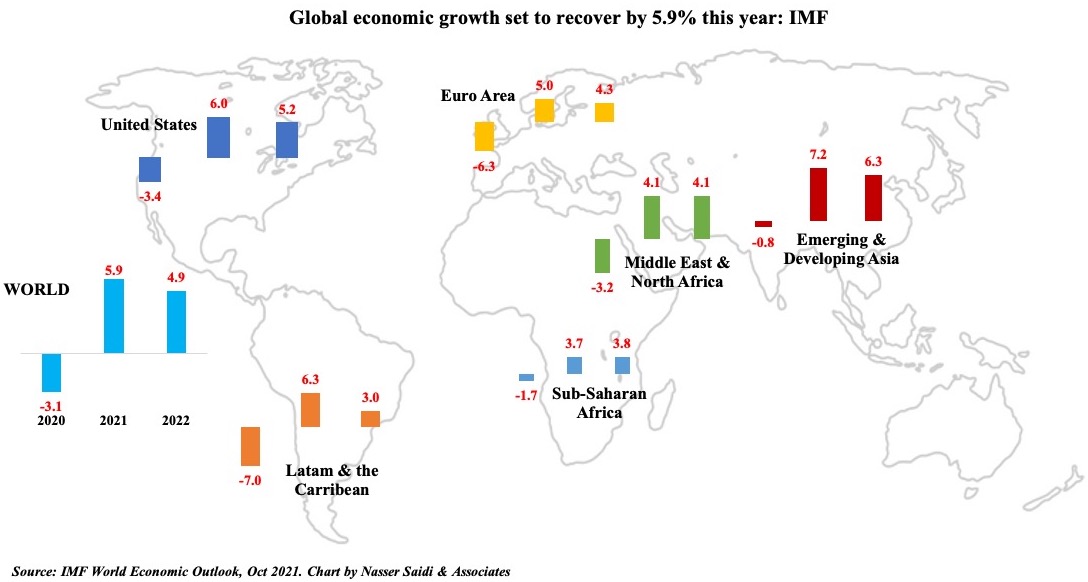

وأوضح أن الصورة عالمياً ستشهد تبايناً كبيراً في النمو بين المناطق.

ورجح السعيدي، أن يستمر البنك المركزي الأميركي في رفع أسعار الفائدة إلى أكثر من 5% وأن تصل النسبة في أوروبا إلى ما بين 4 إلى 4.5% في 2023.

وكشف أن الركود الاقتصادي سينتشر في 2023، وقد يشهد الفصل الأخير من 2023 بداية عودة النمو، مع استمرار الركود في أوروبا لنحو 9 أشهر.

وعن أبرز خطر يهدد الاقتصاد العالمي في 2023، قال رئيس شركة ناصر السعيدي وشركاه، إن العامل المؤثر الأكبر في 2023، سيكون الحرب الاقتصادية بين أميركا والصين وإمكانية وصولها إلى مواجهة عسكرية، وأيضاً التضخم، بعد أن أصبحت مصداقية البنوك المركزية على المحك في لجمه للمستويات المستهدفة، والذي لم يعد خيارا بعد تأخر الفيدرالي الأميركي والمركزي الأوروبي وبنك إنجلترا في رفع الفائدة خلال 2022، وهو ما يستحيل التراجع عنه.

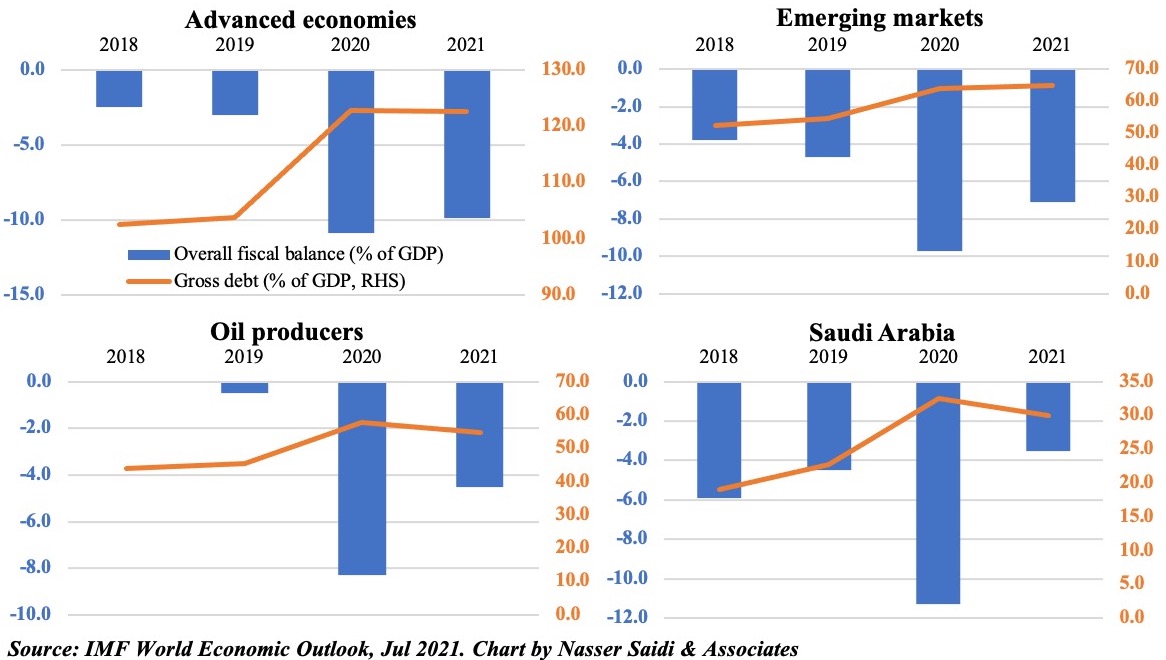

وقال “هذه البنوك المركزية أصبحت مضطرة للمضي في سياسة التشدد النقدي، وهو يضغط على دول لديها حجم ديون مرتفع مثل إيطاليا ومصر، حيث تبلغ نسبة الديون في إيطاليا بالنسبة للناتج القومي 750% ورفع الفوائد إلى 4% سيرفع كلفة الدين، ولذلك فمن أهم الأخطار حدوث أزمة سوق الدين لا سيما في الدول الناشئة”.

وتوقع السعيدي، أن يكون الدولار قوياً في 2023، بسبب ارتفاع الفائدة ولجوء الاستثمارات إلى الأسواق الأميركية، مع حدوث تراجع بسيط في أسعار النفط بنحو 5 إلى 10 دولارات ليصبح في حدود 70 إلى 75 دولارا للبرميل، مع التفاؤل بشأن اقتصادات دول الخليج بدعم من أسعار النفط المرتفعة نسبيا وهو ما يساعد ميزانيات دول الخليج، وكذلك يزيد احتياطي العملات الأجنبية لديها.