Interview with CNBC on Fitch Ratings’ decision to withdraw Lebanon ratings, 26 Jul 2024

Interview with CNBC on the potential reform path for Lebanon’s Banque du Liban, 31 Jul 2023

Weekly Insights 23 Sep 2021: UAE’s growth forecasts rebound in 2021 & 2022

Weekly Insights 23 Sep 2021: UAE’s growth forecasts rebound in 2021 & 2022

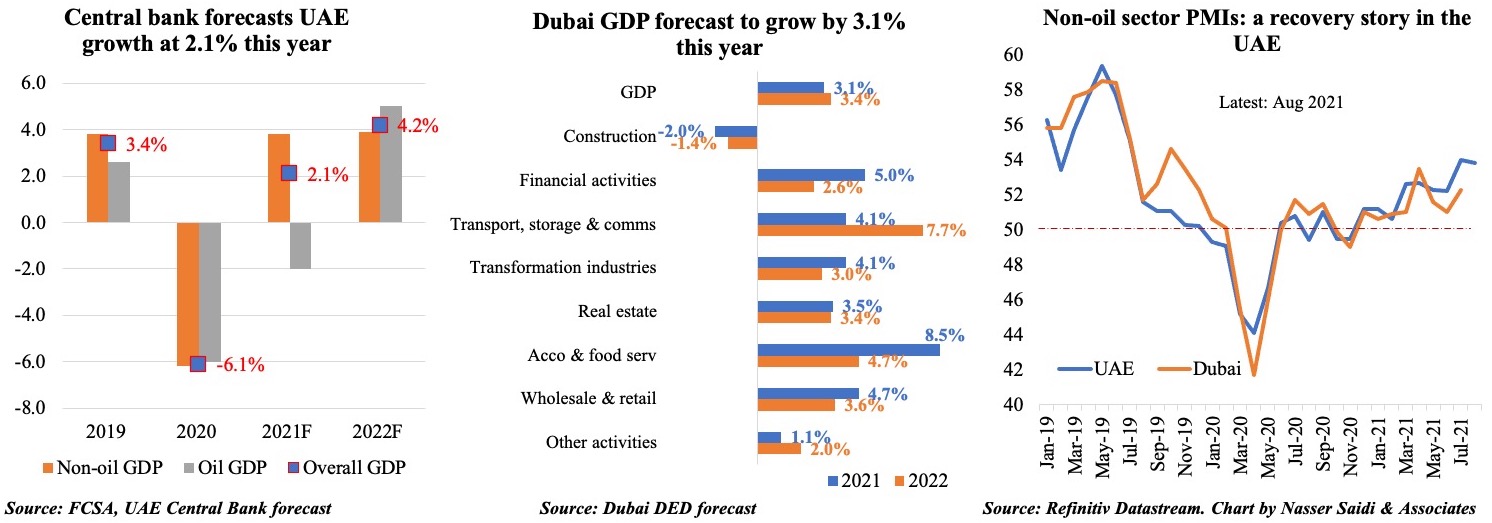

1. UAE expected to grow by 2.1% this year (Central Bank); Dubai by 3.1% (Dubai DED)

- The UAE central bank expects UAE growth to rebound by 2.1% this year (2020: -6.1%), supported by a recovery in the non-oil GDP (+3.8% from -6.2% in 2020)

- Separately, the Dubai Department of Economic Development forecasts Dubai’s GDP to increase by 3.1% yoy in 2021, with recoveries the most among Covid19-affected sectors like accommodation and food services (+8.5%) and wholesale & retail (4.7%). This is underscored by the 5 stimulus packages announced by the emirate’s government since the start of the pandemic that amounted to AED 7.1bn, or 1.6% of Dubai’s GDP. (Dubai Statistics Centre preliminary estimates for GDP growth stood at an estimated 1% qoq in Q1 2021)

- The PMI indicators for both UAE and Dubai remain in expansionary, supported by optimism ahead of the Expo event which begins in Oct, with a drop in daily cases alongside a strong vaccination campaign.

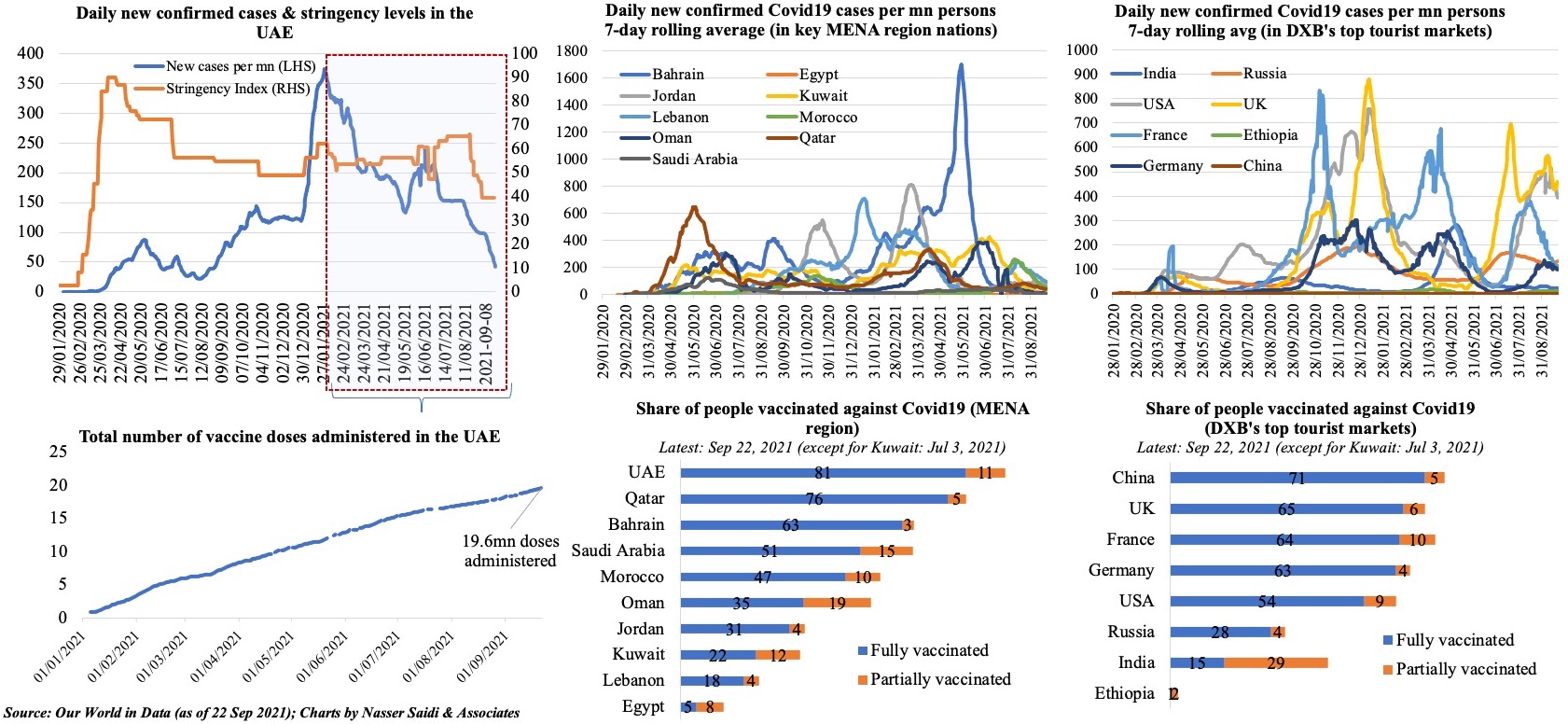

2. An update on Covid19 cases & vaccination campaigns ahead of the start of the Expo

- Daily cases in the UAE have been falling consistently (under 500 for the past few days), and with test positivity rates at just 0.2%, stringency levels have been eased slowly.

- Visitors to the Expo need to be either vaccinated or present a negative PCR: the share of vaccinated people in DXB’s main tourist market all exceed 60%, with daily cases on the decline (except in the UK & US) and vaccination rates are also picking up (especially in Europe & China).

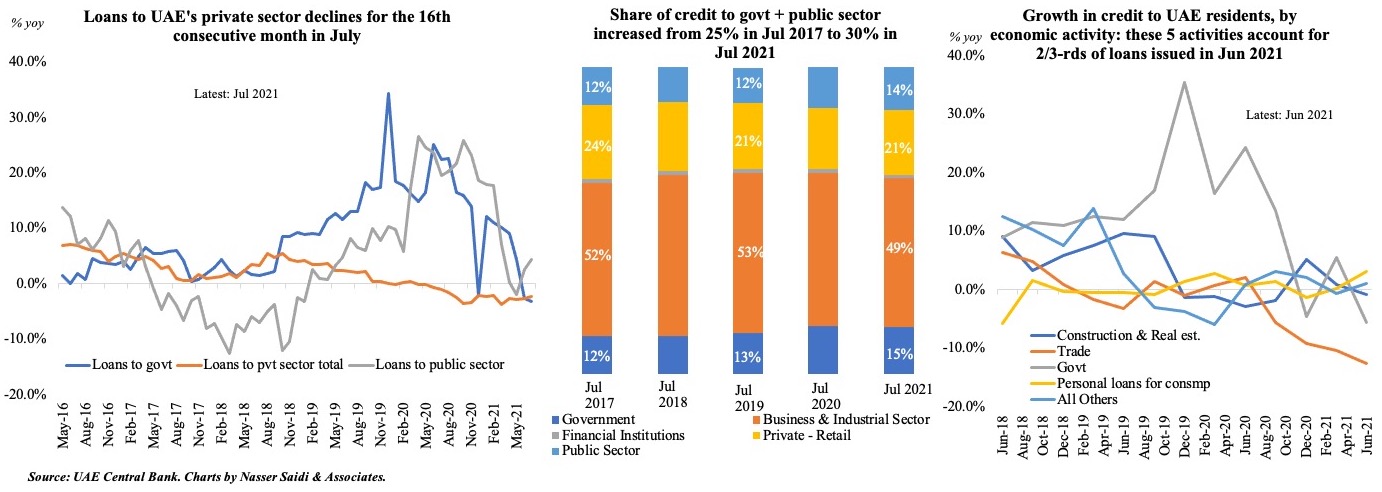

3. The decline in credit disbursed to UAE’s private sector continues past H1 2021

- Overall domestic credit disbursed in UAE fell by 1.6% yoy and 0.1% mom in Jul 2021

- July marks the 16th consecutive month of yoy decline in credit to the private sector and 13th consecutive month of yoy decline in lending to the business sector.

- A breakdown of lending by economic activity shows that the major shares with respect to credit by economic activity remain largely unchanged in Jun 2021: personal loans for consumption (21.3%), construction (20.3%), government (14.6%), others (9.3%) and trade (8.6%) together accounted for 65% of total loans.

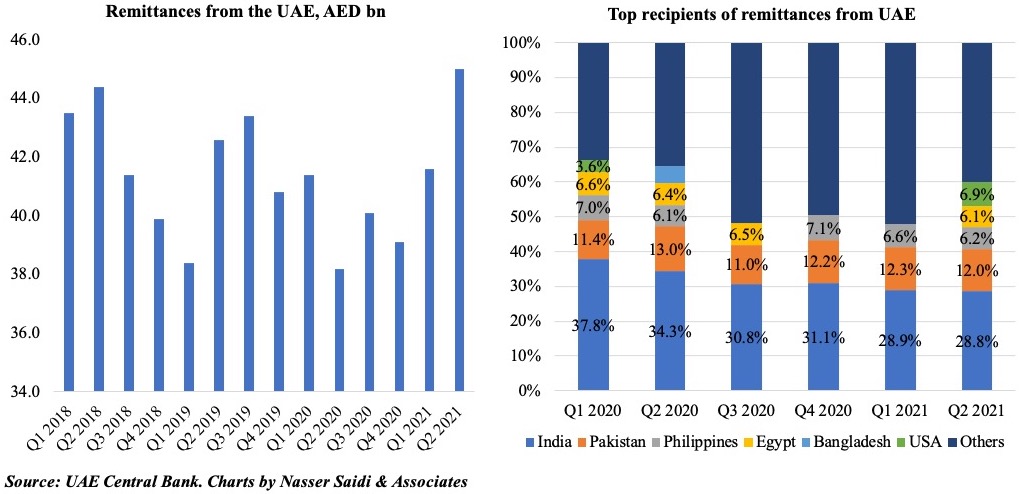

4. Remittances from the UAE surge in Q2 2021

- In Q2 2021, total remittances from the UAE surged by 17.8% yoy and 8.2% qoq to a total of USD 45.0bn. In Q1 2020, given the stringent lockdowns, remittances had dropped by 10.3% yoy to USD 38.2bn.

- Remittance transfers via exchange houses declined in Q2 2021; transfers via banks have gained traction after Covid19, up 31% qoq and 12% qoq in Q1 and Q2 this year respectively.

- India retains its spot as the largest recipient of remittances from the UAE. However, its share in remittances dropped to 28.8% of the total in Q2 this year (vs. 31% at end-Q4 2020 and 37.8% at end-Q1 2020). The decline in share of remittances to India could be due to two factors: one, job losses; two, residents who were affected by the flight ban and stuck in India.

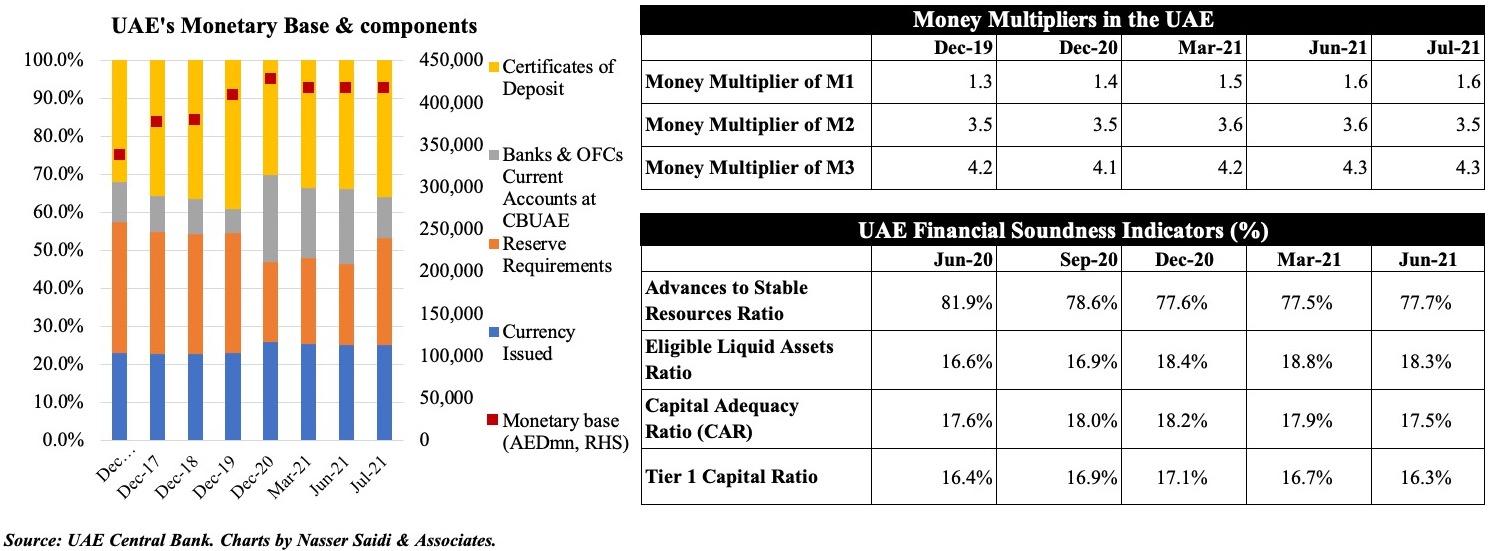

5. UAE banking system remains well capitalized; monetary base contracted in Jul 2021

- UAE’s monetary base contracted by 1.4% mom in Jul, with Banks & OFC’s Excess Reserves (11% of monetary base) declining by almost half (vs a month ago) while Certificates of Deposits purchased by banks (35.9% of monetary base) rose by 4.0% mom.

- Of the monetary aggregates, M1 and M2 declined by 0.8% mom and 0.7% respectively in Jul while M3 inched up by 0.1%, thanks to the 4.5% rise in government deposits. (These values are not seasonally adjusted)

- The increases in the multipliers of M1, M2 and M3 indicate slower decline (/faster uptick) in the monetary aggregates M1, M2 (and M3) compared to the contraction of the monetary base

Powered by:

Weekly Insights 16 Sep 2021: Saudi Arabia’s economic activity picks up pace

Weekly Insights 16 Sep 2021: Saudi Arabia’s economic activity picks up pace

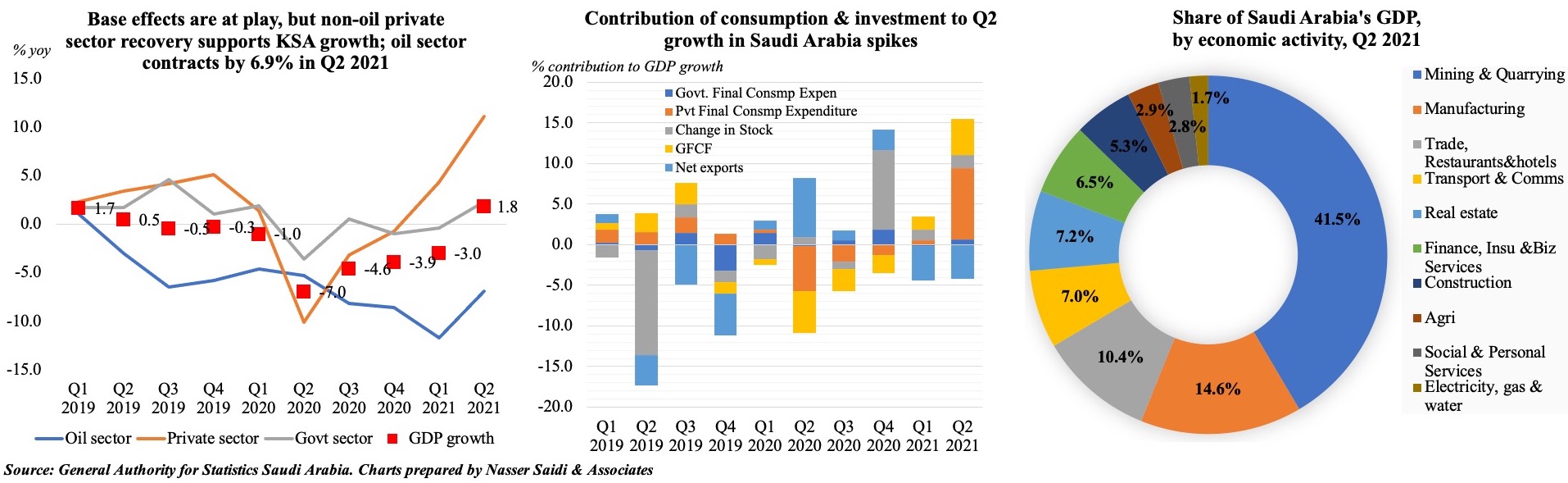

1. Saudi Arabia grows at 1.8% yoy in Q2, with the non-oil sector growing at 8.4%

- Saudi Arabia’s GDP grew by 1.8% yoy in Q2 2021 (Q1: -3.0%), with the non-oil private sector reporting a 11.1% uptick, after rising by 4.4% in Q1.

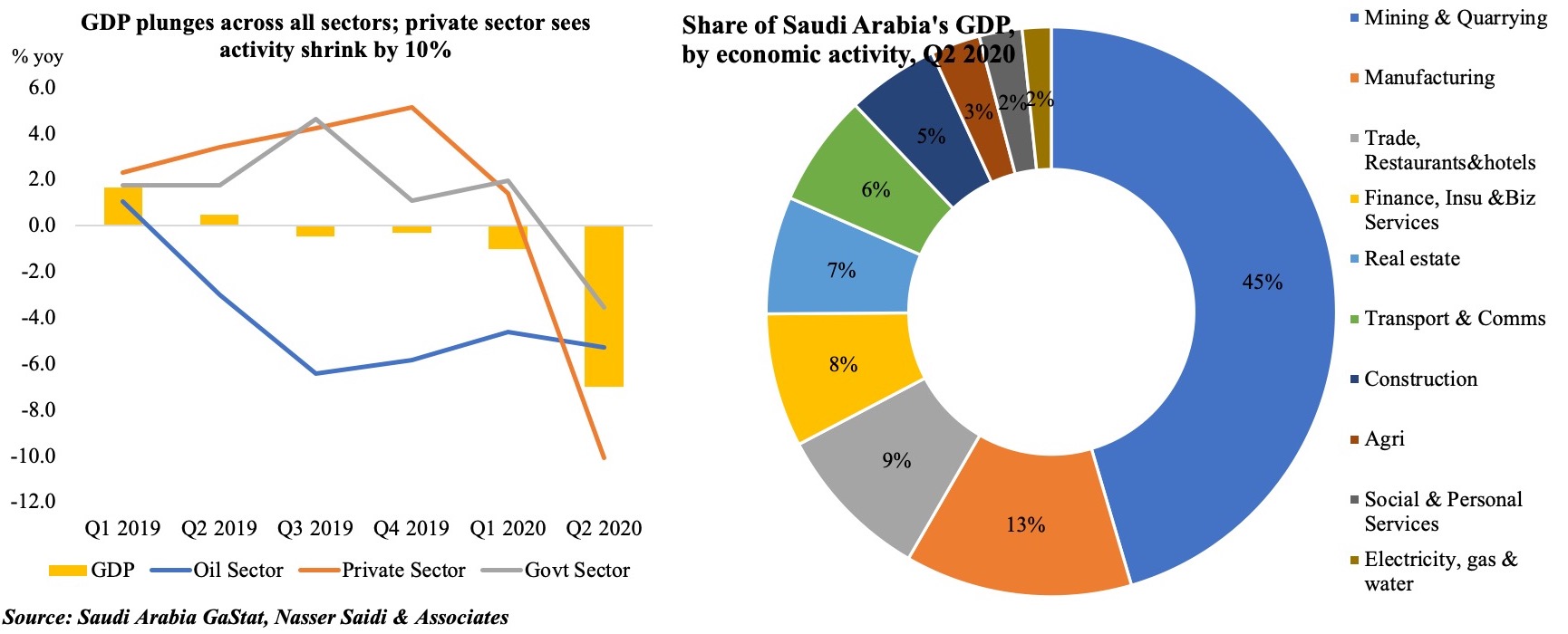

- The major share of activity lies with mining and quarrying (~42%); together with manufacturing and trade, restaurants and hotels, these 3 sectors account for just over two-thirds of the share of GDP in Q2 2021.

- Investment (GFCF) and private consumption expenditure were key drivers contributing to GDP growth in Q2. Given the base effects, both surged in Q2, private consumption by 22.1% and investment by 18.3%.

- With easing of Covid19 restrictions, Saudi is likely to see an increase in recovery pace, supported by both domestic demand and investment as well as its implementation of major projects (in non-oil manufacturing, tourism as well as long-term projects in NEOM among others)

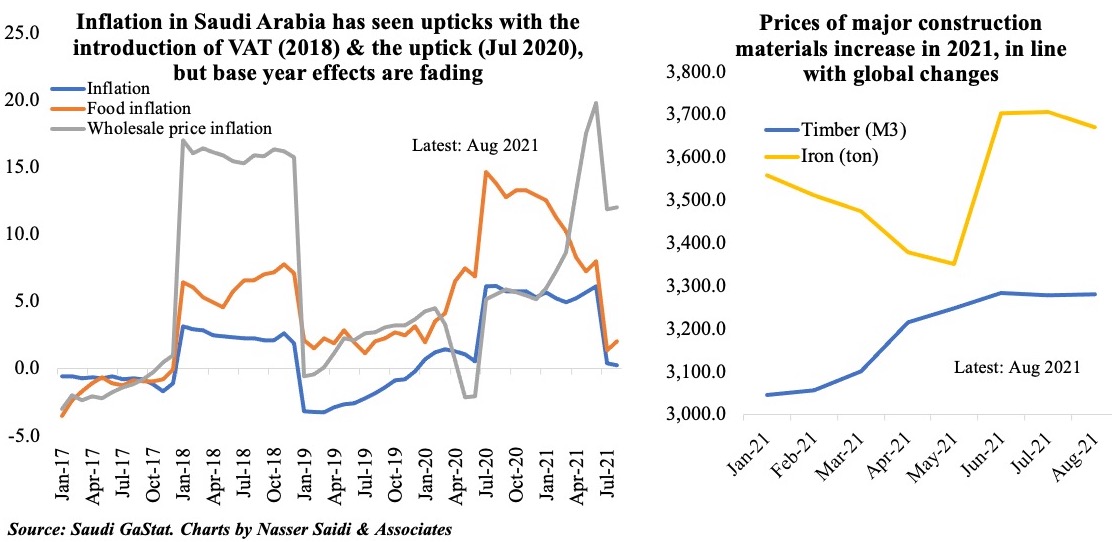

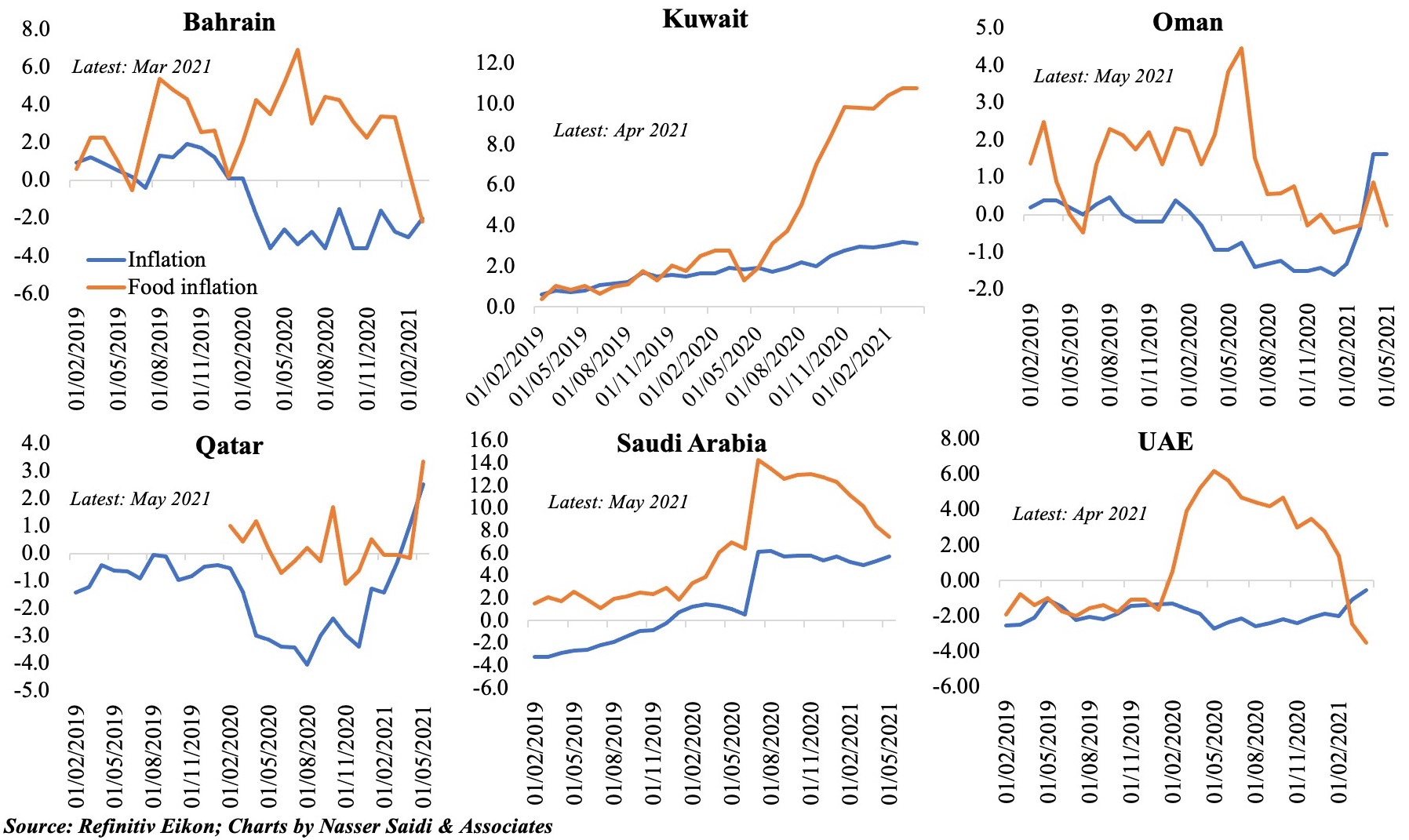

2. Inflation in Saudi Arabia eased for the 2nd month in the row, given base effects; food costs spike

- Inflation in Saudi Arabia eased to 0.3% yoy in Aug (Jul: 0.4%); however, this compares to last year’s surge in the months of Jul-Aug, immediately after the increase in VAT to 15% from 5% before.

- Food inflation however continues to rise, up by 2% yoy and 0.8% mom in Aug (Jul: 1.4% yoy) while sectors like transport and clothing showed weaker inflation.

- Wholesale price index surged by 12% yoy and 0.7% mom in Aug (Jul: 11.9% yoy), with increase in prices of metal products (given the surge in basic metal prices & electrical machinery) and other transportable goods (given hike in refined petroleum products and basic chemicals prices). Prices of major construction materials have also been on the rise, in line with global trends.

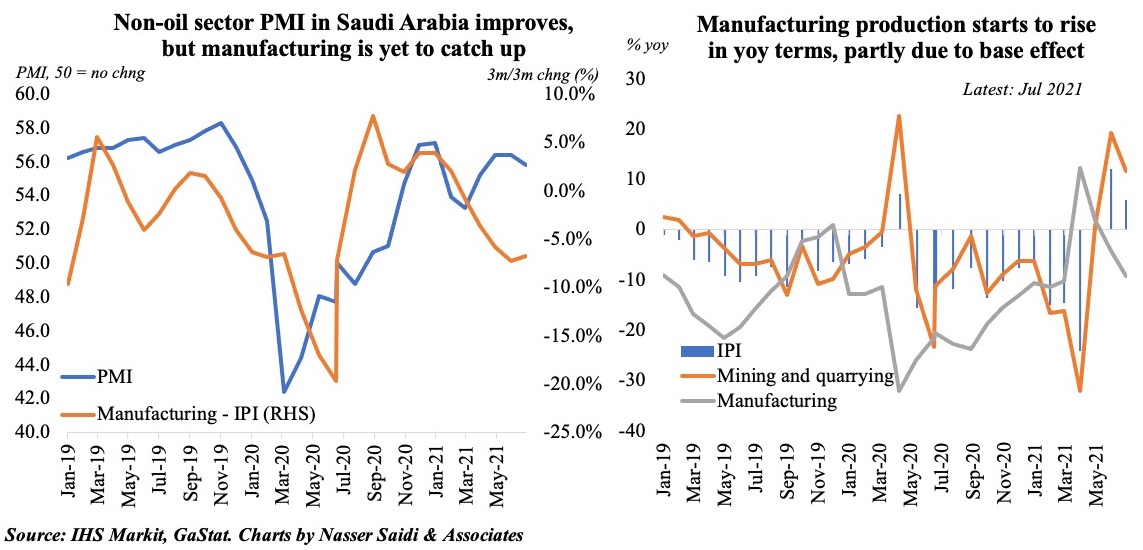

3. Saudi Arabia’s PMI stood at an average 55.3 in Jan-Aug 2021; industrial production is playing catch up

- Saudi non-oil sector PMI declined to 54.1 in Aug, a tad lower than the average so far this year. The month saw new orders growth slowing alonside a softer recovery in export orders as output expanded at the slowest pace in 10 months.

- Official data show that overall industrial production (IP) inched up by 5.9% in Jul while manufacturing dropped by 9.3% as mining/ quarrying sector production improves. The chart tracks three-month-on-three-month changes in the official IP data to remove some volatility. It shows that improvement in non-oil sector is happening faster than in official manufacturing – pointing to the strength in recovery of the non-oil, non-manufacturing sectors.

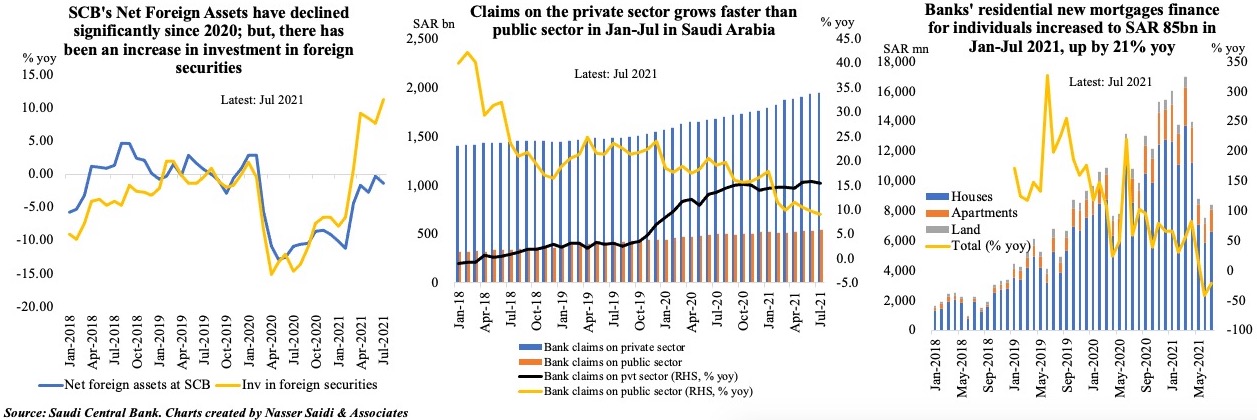

4. Saudi net foreign assets decline in Jul amid upticks in credit disbursed & mortgages

- Saudi net foreign assets posted a 1% mom decline to SAR 1.64trn in Jul. However, the amount of money invested in foreign securities rose by SAR5bn to SAR 1.13trn in Jul, the highest monthly figure since Apr.

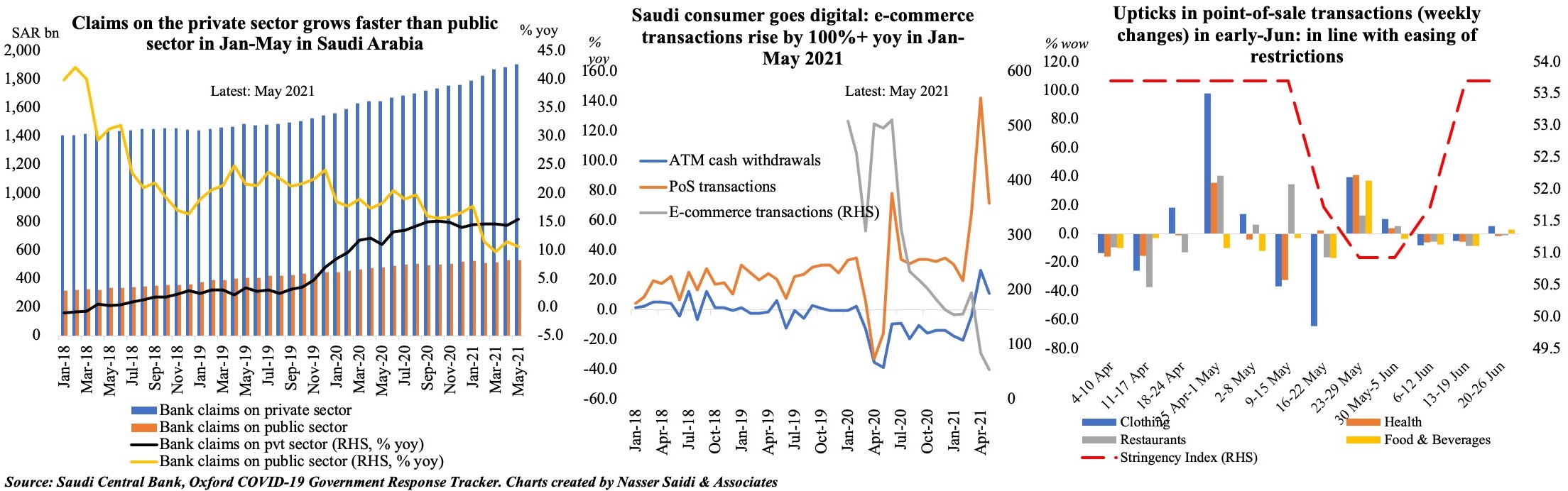

- Credit to the private sector has accelerated by an average of 15% yoy in Jan-Jul 2021 while lending to the public sector was growing at a slightly lower pace of 11.4%. Meanwhile the number of branches have been on the decline considering many consumers’ move online and prominence of digital banking.

- Residential mortgage finance has been one of the fastest growing segments, surging on the back of plans to increase home ownership. The banks have lent SAR 85.4bn for new residential mortgages for individuals during Jan-Jul 2021, up from USD 70bn in the same period a year ago. From the chart a significant decline can be seen in the last few months.

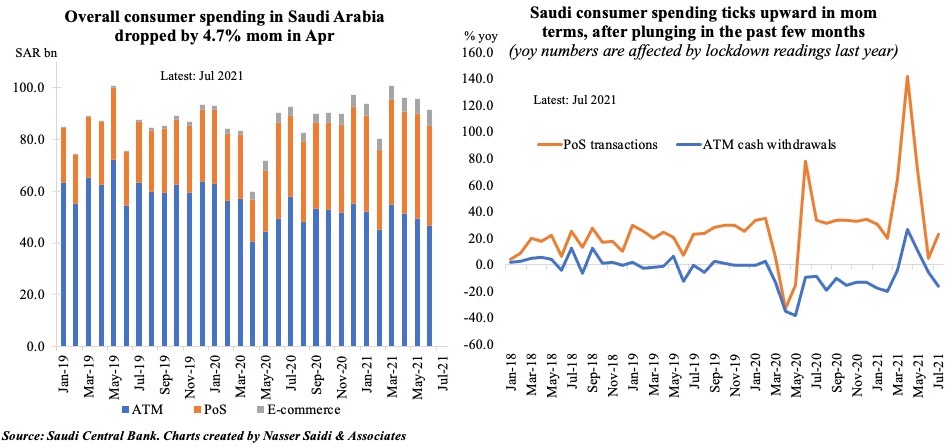

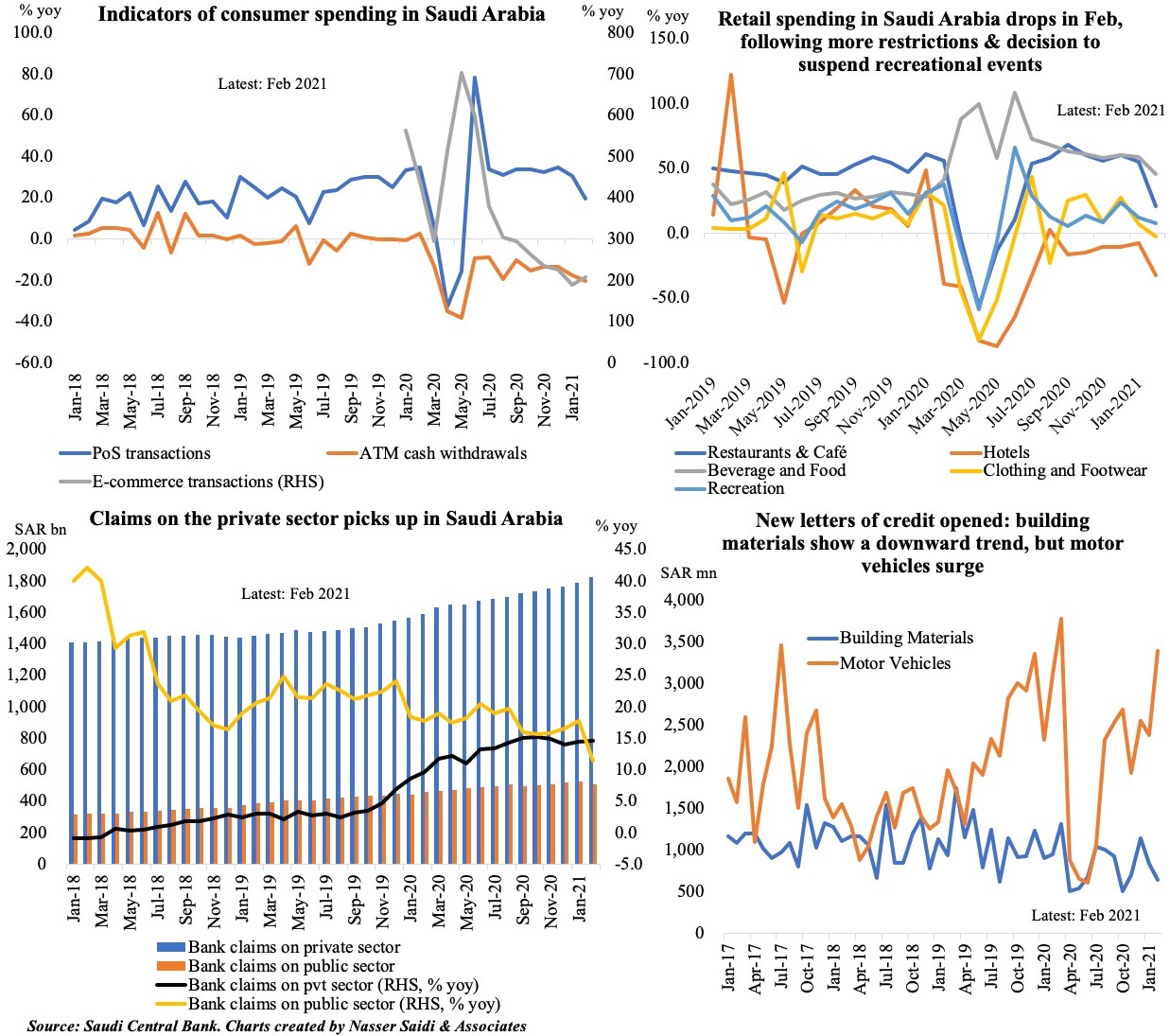

5. Consumer spending in Saudi Arabia is picking up as digital adoption surges

- Overall consumer spending has been rising through 2021, while digital adoption is surging.

- ATM transactions have declined by 6% yoy in Jan-Jul 2021; PoS transactions are up by 42% yoy during the period compared to a year ago while e-commerce transactions have almost doubled!

- Such a pattern is underscored by the results of a recent McKinsey survey about consumer preferences: about 58% of Middle East consumers expressed a strong preference for digital payments, while only 10% strongly preferred cash.

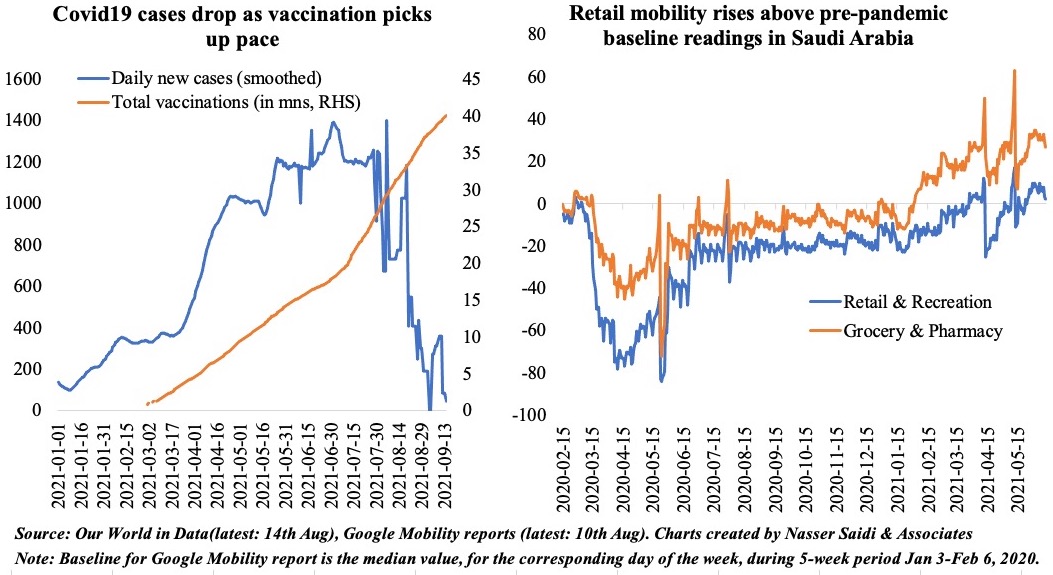

6. Daily cases in Saudi fall & as restrictions are eased; with higher vaccination doses as well, retail mobility returns to pre-pandemic rates

- Daily new cases in Saudi Arabia have fallen to less than 500 in the past few weeks or so as vaccination pace increased significantly. Just under 50% of the population is fully vaccinated and another 16% are partly vaccinated. Stringency levels, as tracked by the Oxford COVID-19 Government Response Tracker, has come also down: at an average 51.3 in Aug (Jul: 53.1).

- In addition to easing restrictions, high levels of vaccination are leading to greater mobility: retail/ recreation/ shopping mobility has risen above pre-pandemic baseline levels in Saudi Arabia as vaccination doses per 100 people touched 113.82 (UAE: 191.8; Bahrain: 144.7).

Powered by:

Weekly Insights 1 Jul 2021: State of the UAE & Saudi Arabia economies

State of the UAE & Saudi Arabia economies: a peek into the latest macroeconomic data

(GDP, Fiscal, Money & Credit, Labour Market, Trade, Inflation)

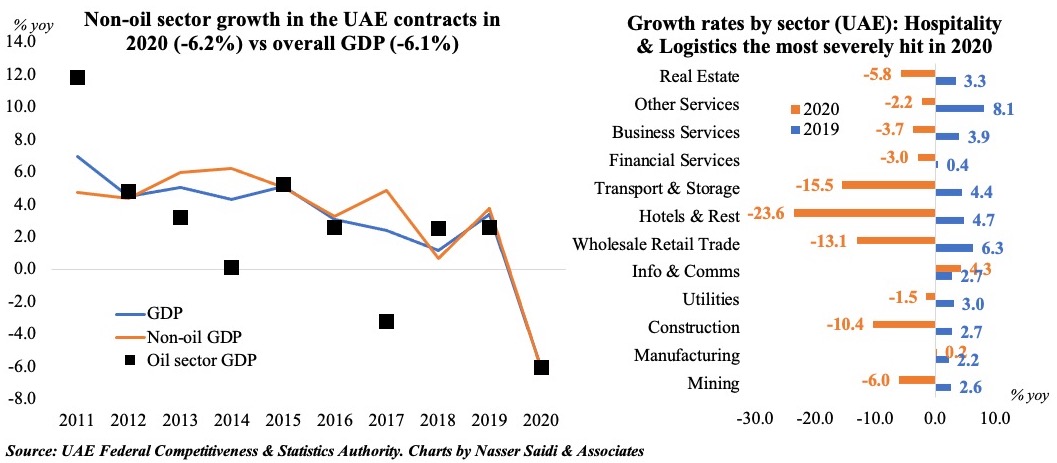

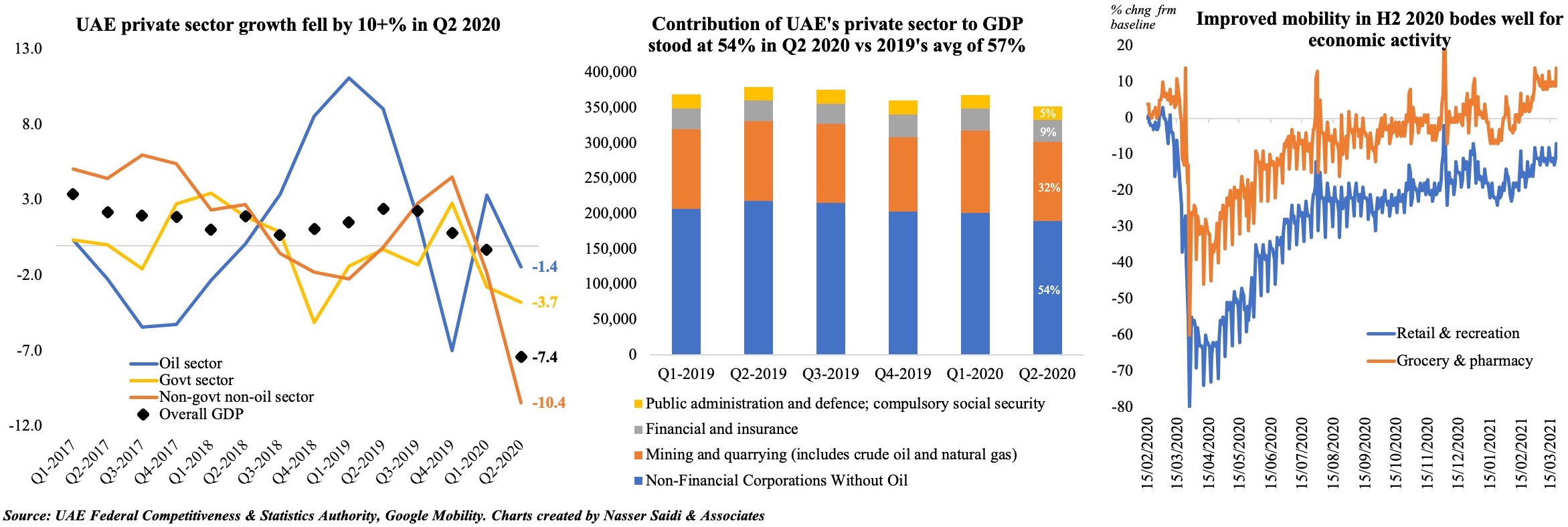

1. UAE’s GDP declined by 6.1% in 2020; hospitality and logistics were the worst affected sectors

- The UAE’s GDP declined by 6.1% in 2020, according to the FCSA, down from an upwardly revised 3.4% growth in 2019. The slump was driven by both oil and non-oil sector, which fell by 6% & 6.2% respectively.

- While the share of oil sector to overall GDP remained unchanged at 29.1%, the sectors that posted a slight increase in overall contribution to GDP include manufacturing (8.8% in 2020 from 2019’s 8.3%), communication (3.3% vs 2.9%), finance and insurance (8.2% from 7.9%) and public sector (5.6% from 5.2%).

- Only a few sectors posted positive growth in 2020; unsurprisingly, the most negatively affected were hospitality (-23.6%), transportation (-15.5%) and trade (-13.1%).

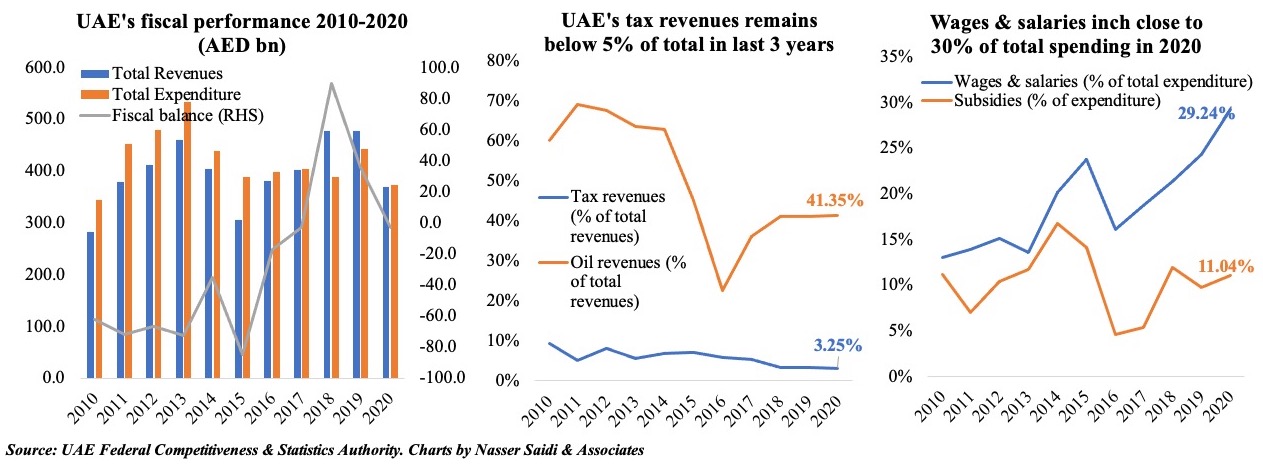

2. UAE fiscal balance moves into deficit in 2020, following two years of surplus

- Both public revenues and expenditures in the UAE declined in 2020, by 22.7% yoy and 15.8% respectively, thereby moving the balance into a deficit of AED 3.04bn. Oil revenues fell by 22.4% yoy

- Oil revenues accounted for 41.35% of overall revenues and 42.7% of non-tax revenues in 2020. Though total tax revenues fell by 22.4% yoy in 2020, its share in total revenues continued to be ~3.25% (similar to 2018 & 2019)

- Wages and salaries continue to represent about 30% of total spending in 2020 but in yoy terms, it declined by 16.7%. Subsidies also fell by 5% yoy, but account for 11% of overall spending

- Fiscal consolidation should be major policy reform for the UAE in the medium- to long-term to reduce dependence on oil & gas revenue. Subsidy reform and reducing public sector wage bills could be reforms on the spending side while new/ higher taxes can support revenues (e.g. carbon tax, property tax)

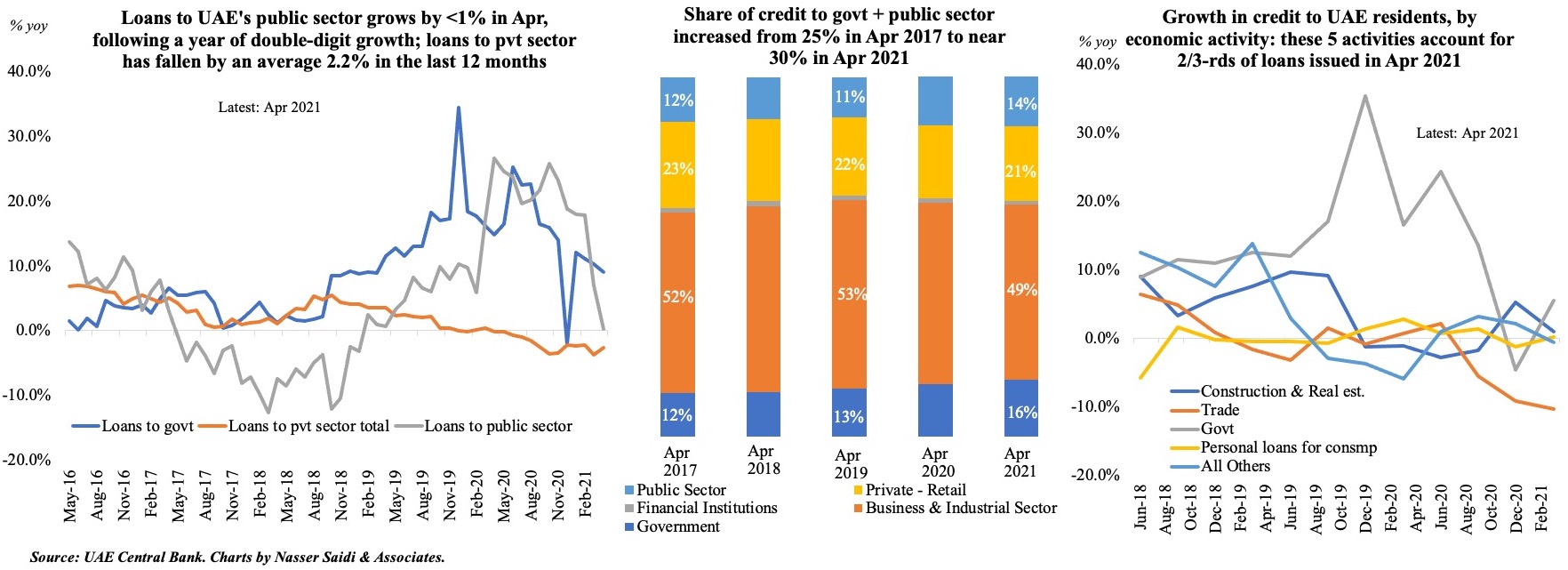

3. Credit to UAE’s private sector continues to decline in 2021; activity-wise differences exist

- Overall domestic credit disbursed in UAE fell by 0.6% yoy in Apr 2021 though rebounding by a marginal 0.52% mom (Mar: -0.9% mom)

- April marks the 13th consecutive month of yoy decline in credit to the private sector and 10th consecutive month of yoy decline in lending to the business sector. Loans to the public sector (which includes government-related enterprises) broke the pattern by ticking up just 0.2% in Apr (Mar: 7.0% and following 12 months of double-digit growth)

- A breakdown of lending by economic activity shows that the major shares with respect to credit by economic activity remain largely unchanged: construction (20.5%), personal loans for consumption (20.4%), government (15%), others (9%) and trade (8.7%) together accounted for 65% of total loans. Sectors with continuous growth for 4 quarters (from Jun 2020) include transport (average 46.7% yoy growth), agriculture (44%) and utilities (29%).

4. Rising credit & changing consumer preference (away from cash) is the story in Saudi Arabia

- Data from the Saudi Central Bank shows claims from the private sector outpacing public sector loans in May 2021 – as seen in most months this year

- A continued preference for PoS/ e-commerce transactions from a previously preferred “cash is king” position. ATM transactions have dropped by 0.7% in the Jan-May period vs a 65.8% and 125.9% hike in PoS & e-commerce transactions

- Weekly PoS transactions show an uptick in early Jun: the distinct rise in PoS transactions in clothing, health, restaurants coincides with when restrictions were eased (tracked by the Oxford COVID-19 Government Response Tracker)

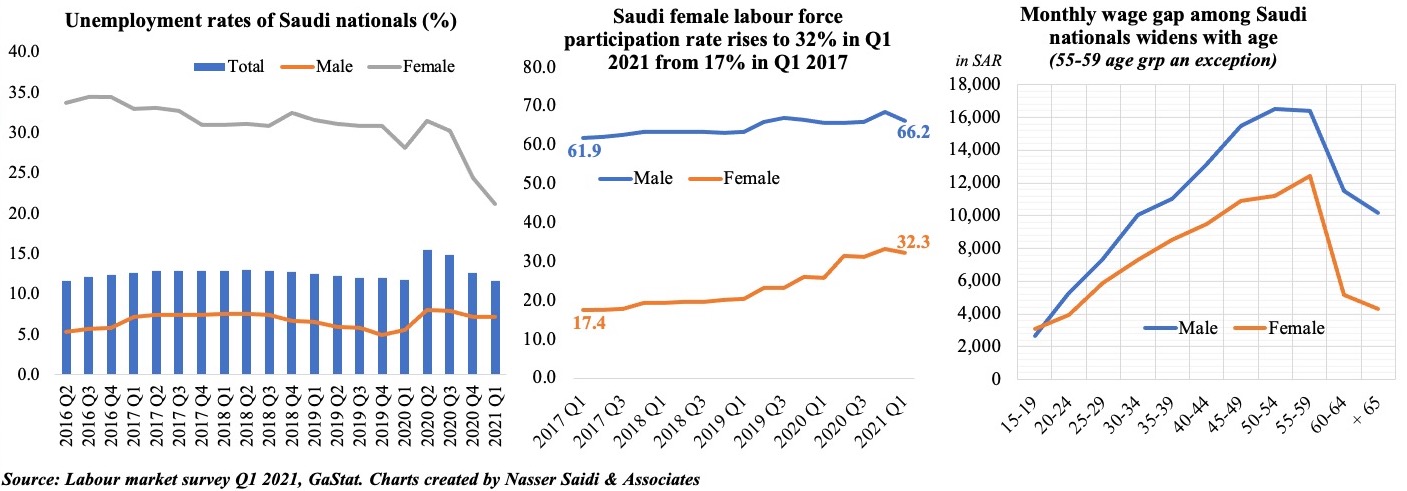

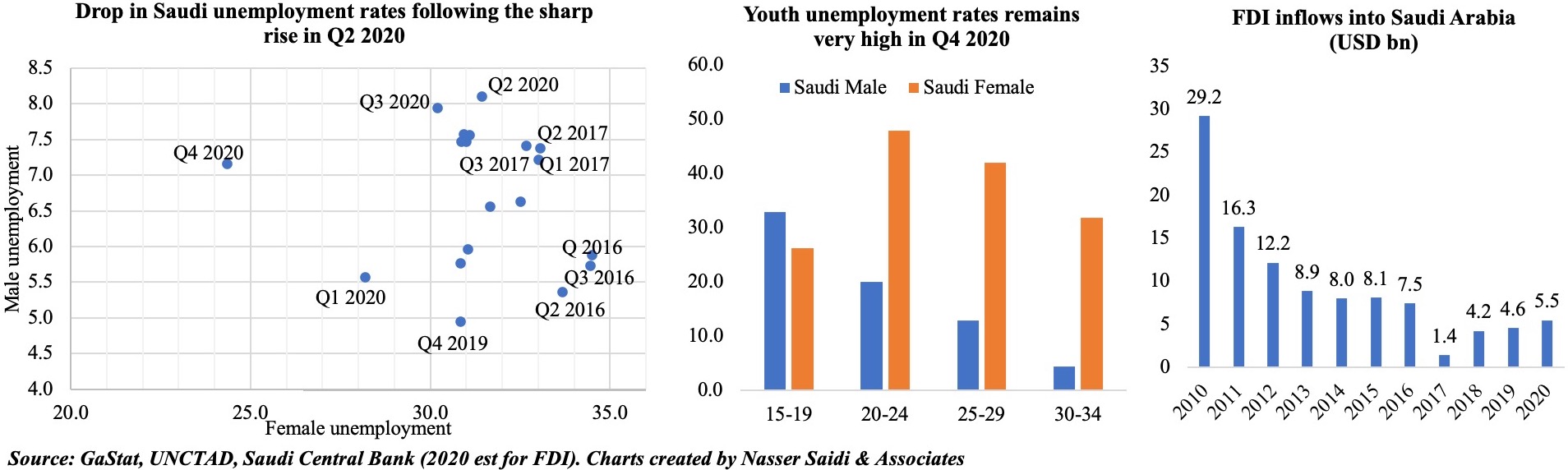

5. Unemployment rate among Saudi nationals (apecially females) dip to a 5 year-low in Q1 2021

- Overall unemployment rate among Saudi nationals fell to 11.7% in Q1 2021 – a 5-year low; more dramatic was the plunge in unemployment rate for Saudi females – 21% in Q1 2021 vs a high 34% at end-2016. By age group, the rate remained highest among females within 25-29 & 20-24 age group (37.9% and 37% respectively).

- Meanwhile, female participation in the workforce increased from 19% in 2016 to 32.3% in Q1 2021. However, both male & female labour force participation rates declined slightly compared to Q4 2020. Though women are joining the workforce in large numbers, many of the job opportunities fall in the lower-paid sectors.

- Women earn slightly more than men in the 15-19 age group, but the pay gap widens after that. On average, in Q1 2021, a Saudi male employee is paid 1.3 times compared to a female national and at the oldest age bracket (65+) it stands at around 2.4 times! The gap has narrowed however compared to previous years.

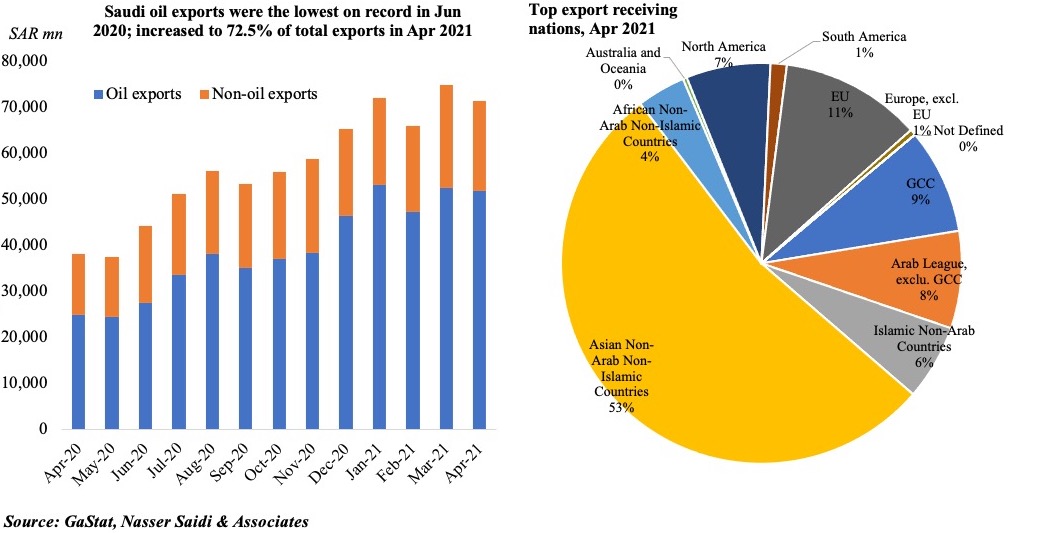

6. Oil exports from Saudi Arabia increase to 72.5% of total exports in Apr; Exports to Asia account for more than half of total exports

- Oil was trading at USD 75 a barrel yesterday (30 Jun), about 40% higher compared to the start of the year, after a report revealed lower US inventories for a 6th straight week. All eyes are on the OPEC+ (set to meet today), who have already warned of “significant uncertainties” ahead: a modest increase in production is likely amid higher demand for oil (summer travel bookings, anecdotal evidence suggests, are picking up in US & Europe)

- Oil exports are rising, accounting for 72.5% of total exports in Apr 2021. The top region for Saudi Arabia’s exports is still Asian nations, and much of the exports is oil. Though many nations – India, Japan and Malaysia – continue to struggle with the pandemic, many others have relatively low levels of cases; as restrictions ease, demand will increase and oil exports will pick up faster.

7. GCC inflation (% yoy): Kuwait’s food inflation is running at 10%+; Saudi’s inflation is influenced by the VAT hike last year; May’s month-on-month readings have food inflation rising at a faster pace than headline

Powered by:

Weekly Insights 15 Apr 2021: Will Middle East’s growth prospects be vulnerable to external debt levels & limited fiscal room?

Download a PDF copy of this week’s insight piece here.

The IMF issued its latest Regional Economic Outlook for the Middle East region this week. Real GDP for the Middle East and North Africa (MENA) region is forecast to grow by 4% this year (up 0.9 percentage points from the projection in Oct 2020) after having slumped by 3.4% in 2020 (vs an estimate of a 5% drop in the Oct 2020 edition). Growth outcomes and prospects will still be centred on how the pandemic progresses in the region amid the pace of vaccination rollouts.

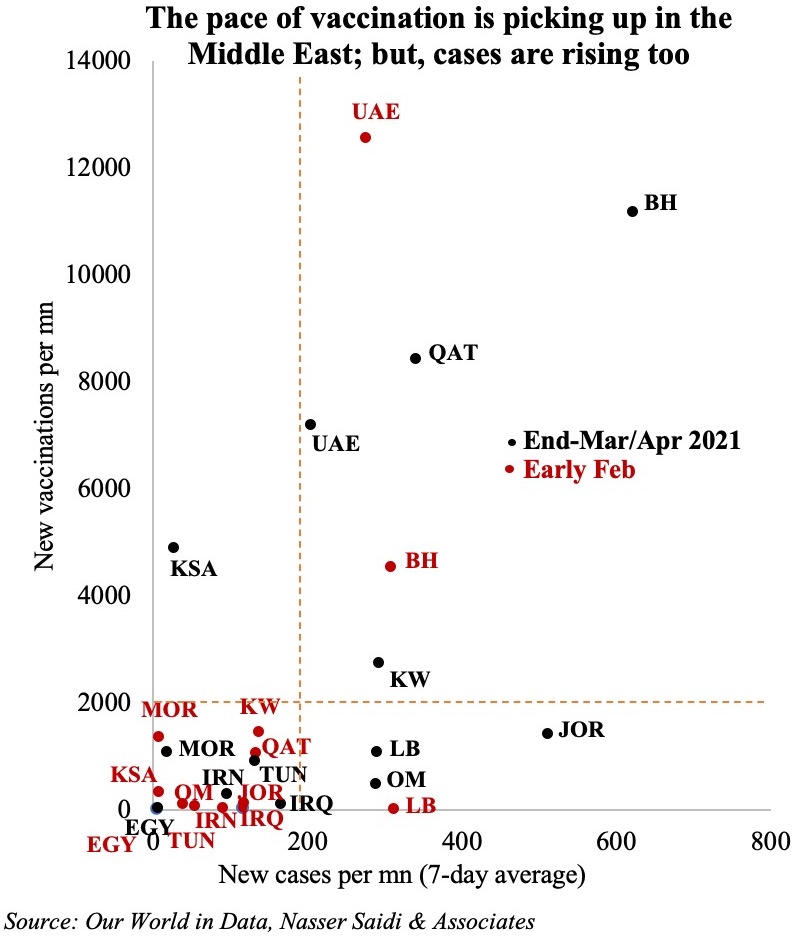

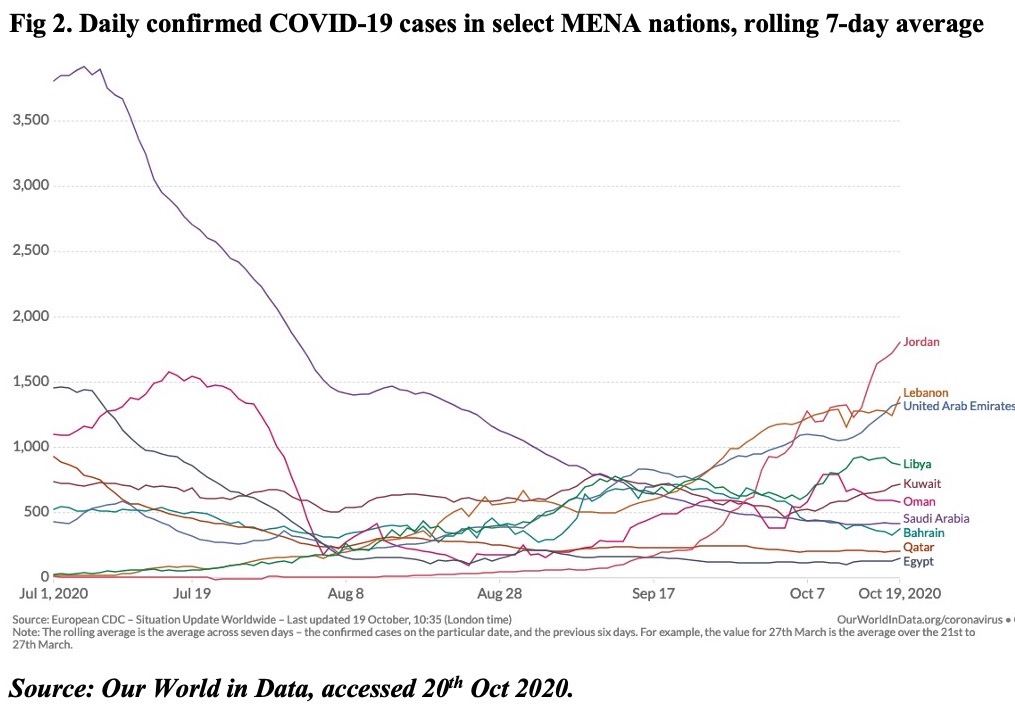

The MENA region is now home to more than 7mn confirmed cases, with Iran the single largest contributor (share of close to 30%) and the GCC accounting for nearly 25%. Infections have been ticking up in the region since the start of this year. This has resulted in increased targeted restrictions and lockdowns in many a nation.

The chart compares the pace of vaccination and new cases. Vaccination pace is picking up in the region: the UAE leads the pack, having disbursed a total of 9.16mn doses as of Apr 13th. With the supply of vaccines increasing (thanks to COVAX facility and donations from the UAE, Russia, China etc.), new vaccinations (black dots in the chart) have improved in most nations (compared to early Feb, marked in red). The production of vaccines domestically in the region will also boost supply later this year: UAE plans to manufacture Hayat-Vax, Egypt has an agreement with Sinovac Biotech, and Algeria will produce Sputnik-V from Sep onwards).

Meanwhile, reported cases are also higher compared to early Feb – many countries are now outside the small quadrant on the bottom-left of the chart. Depending on how fast vaccinations can lead to herd immunity will determine recovery paths – especially so in the more tourism-dependent nations (e.g. Egypt, Jordan, Lebanon).

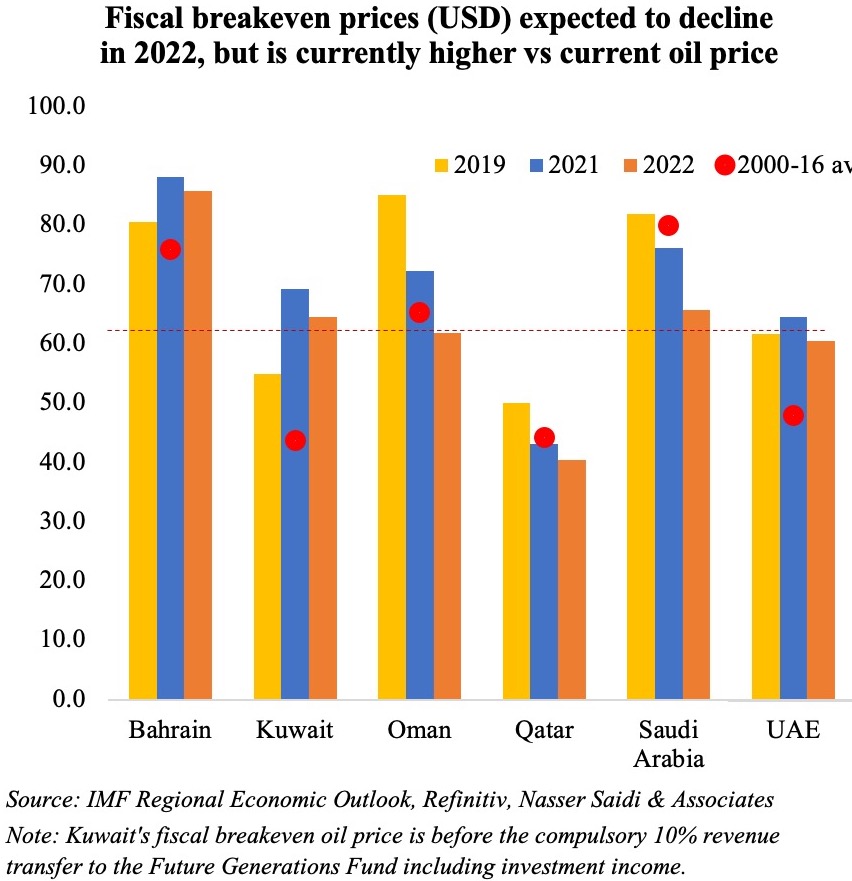

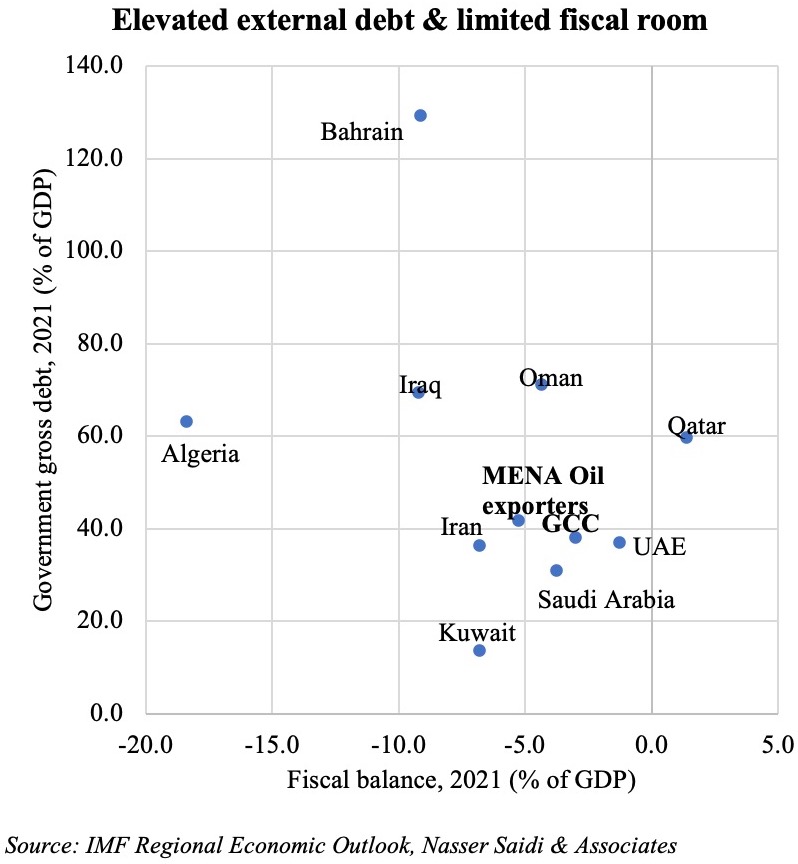

However, policy measures introduced to support the economy during the pandemic is creating immense fiscal strain. Fiscal deficits widened to 10.1% of GDP in 2020 in the MENA region from 3.8% in 2019. It was severe in the GCC as well: fiscal deficit widened to 7.6% of GDP last year (2019: -1.6%), as the impact was from both lower oil and non-oil revenues. The fiscal breakeven price this year ranges from a high USD 88.2 in Bahrain to a low USD 43.1 in Qatar. While, it is expected to decline across the board next year, it still remains higher than the current oil price levels for most nations. Given new rounds of restrictions and with oil demand not yet at pre-pandemic levels, the OPEC+’s recent decision to roll back production cuts are likely to depress oil prices. As real oil prices trend downward, fiscal sustainability becomes increasingly vulnerable.

However, policy measures introduced to support the economy during the pandemic is creating immense fiscal strain. Fiscal deficits widened to 10.1% of GDP in 2020 in the MENA region from 3.8% in 2019. It was severe in the GCC as well: fiscal deficit widened to 7.6% of GDP last year (2019: -1.6%), as the impact was from both lower oil and non-oil revenues. The fiscal breakeven price this year ranges from a high USD 88.2 in Bahrain to a low USD 43.1 in Qatar. While, it is expected to decline across the board next year, it still remains higher than the current oil price levels for most nations. Given new rounds of restrictions and with oil demand not yet at pre-pandemic levels, the OPEC+’s recent decision to roll back production cuts are likely to depress oil prices. As real oil prices trend downward, fiscal sustainability becomes increasingly vulnerable.

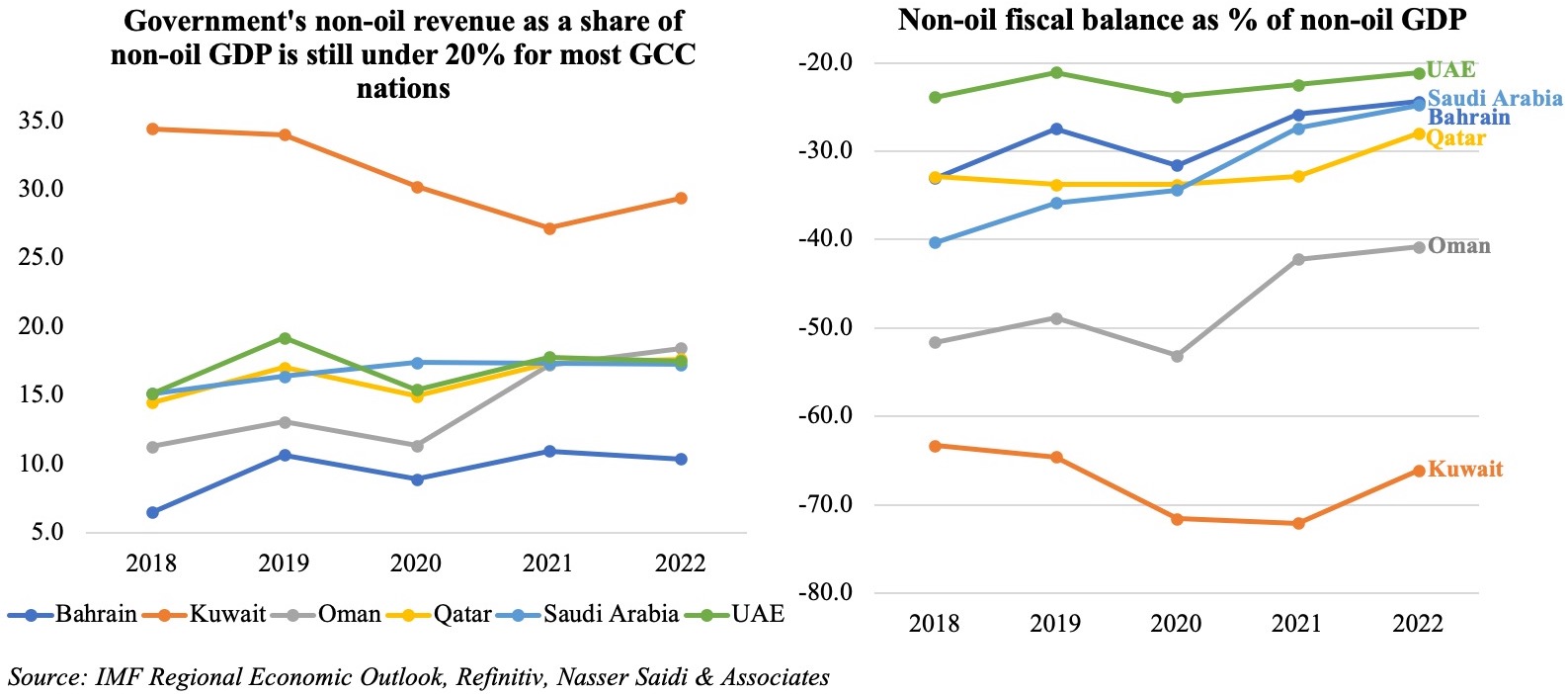

With business operations and revenues affected due to the pandemic alongside weakened domestic demand, non-oil revenues as a share of non-oil GDP declined in 2020: Saudi was the sole exception, given its VAT hike to 15% from Jul 2020. Oman is expected to witness a significant boost in non-oil revenues this year, with the introduction of VAT from Apr 16th. Oil exporters in the region are still highly dependent on oil revenues, as is evident from the large non-oil fiscal deficits in the GCC. In 2021, it is forecast at a high 72% in Kuwait and an average 30.9% and 29.9% in the GCC and MENA oil exporters respectively.

Higher deficits and negative economic growth resulted in governments resorting to multiple financing options: borrowing from commercial banks, tapping international and regional markets (bond issuances, commercial loans) as well as drawing down from international reserves at the central banks/ sovereign wealth funds. Government debt levels increased to 56.4% and 41% in the MENA and GCC regions last year. Though it is forecast to fall slightly this year, it still remains higher than the 2000-17 average of 36.2% and 24.6% respectively. The IMF estimates financing needs in the MENA to touch USD 919bn for this year and next. Public-financing requirements were likely to stay above 15% of GDP in most parts of the region through end-2022.

Higher deficits and negative economic growth resulted in governments resorting to multiple financing options: borrowing from commercial banks, tapping international and regional markets (bond issuances, commercial loans) as well as drawing down from international reserves at the central banks/ sovereign wealth funds. Government debt levels increased to 56.4% and 41% in the MENA and GCC regions last year. Though it is forecast to fall slightly this year, it still remains higher than the 2000-17 average of 36.2% and 24.6% respectively. The IMF estimates financing needs in the MENA to touch USD 919bn for this year and next. Public-financing requirements were likely to stay above 15% of GDP in most parts of the region through end-2022.

This could pose a significant risk in the coming years: (a) sectors affected by the pandemic are being supported by government policy stimulus. When this support is rolled back eventually, this could result in bankruptcies, defaults and job losses, further causing an increase in banks’ non-performing loans; (b) global financial conditions have been quite accommodative and so long as cost of capital remains low, there will be an appetite for borrowing and even refinancing maturing debt. However, a faster-than-expected global recovery could lead to interest rates hikes, push long-term rates and funding costs higher, increase sovereign spreads, thereby tightening financing conditions – affecting countries with large external financing needs (and their indebted corporates). Though GCC’s sovereign debt levels are relatively low, over USD 100bn is expected to mature in 2021-25.

Powered by:

Weekly Insights 8 Apr 2021: Risks to the Rosy Outlook as World Recovery Seemingly Accelerates

Download a PDF copy of this week’s insight piece here.

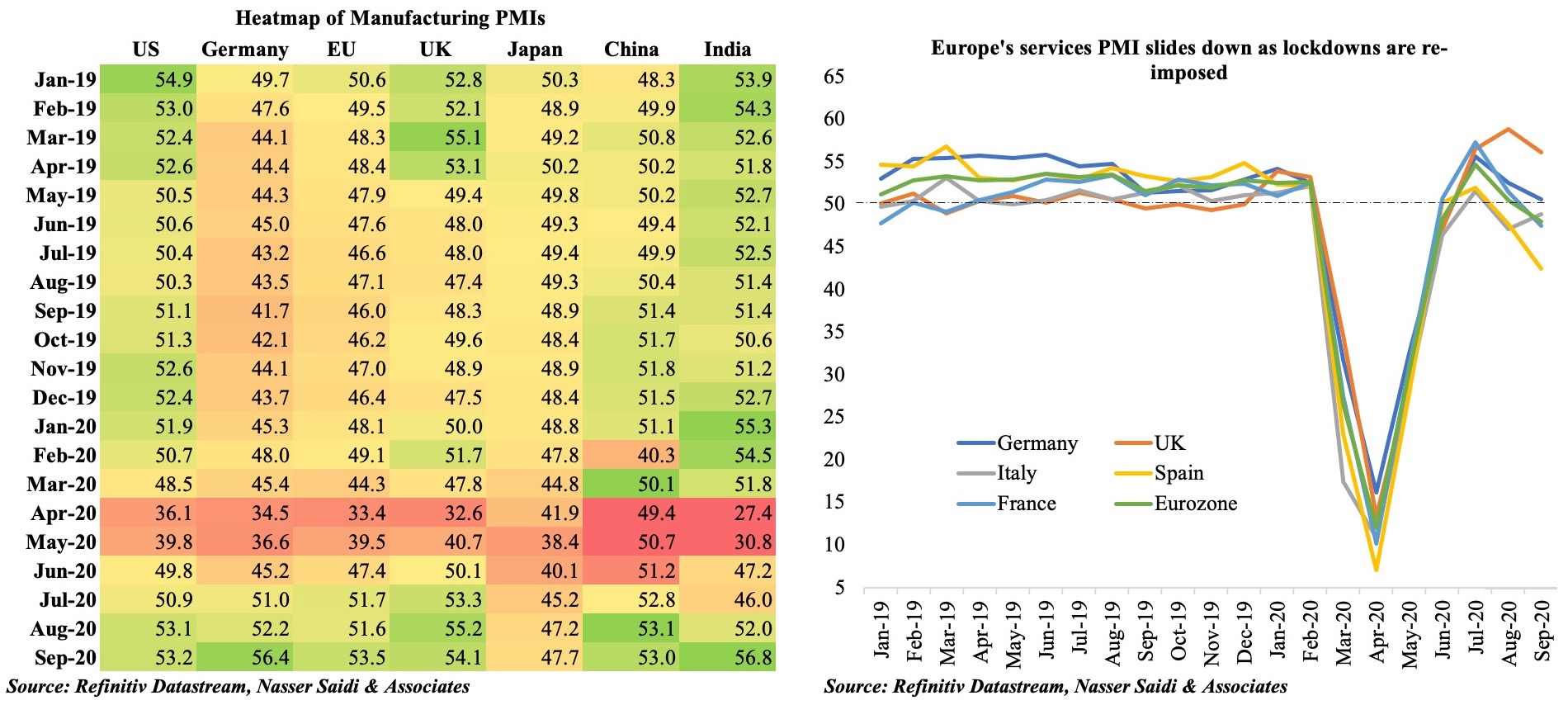

Chart 1. Inspite of battling new Covid19 restrictions, PMIs run high

Chart 1. Inspite of battling new Covid19 restrictions, PMIs run high

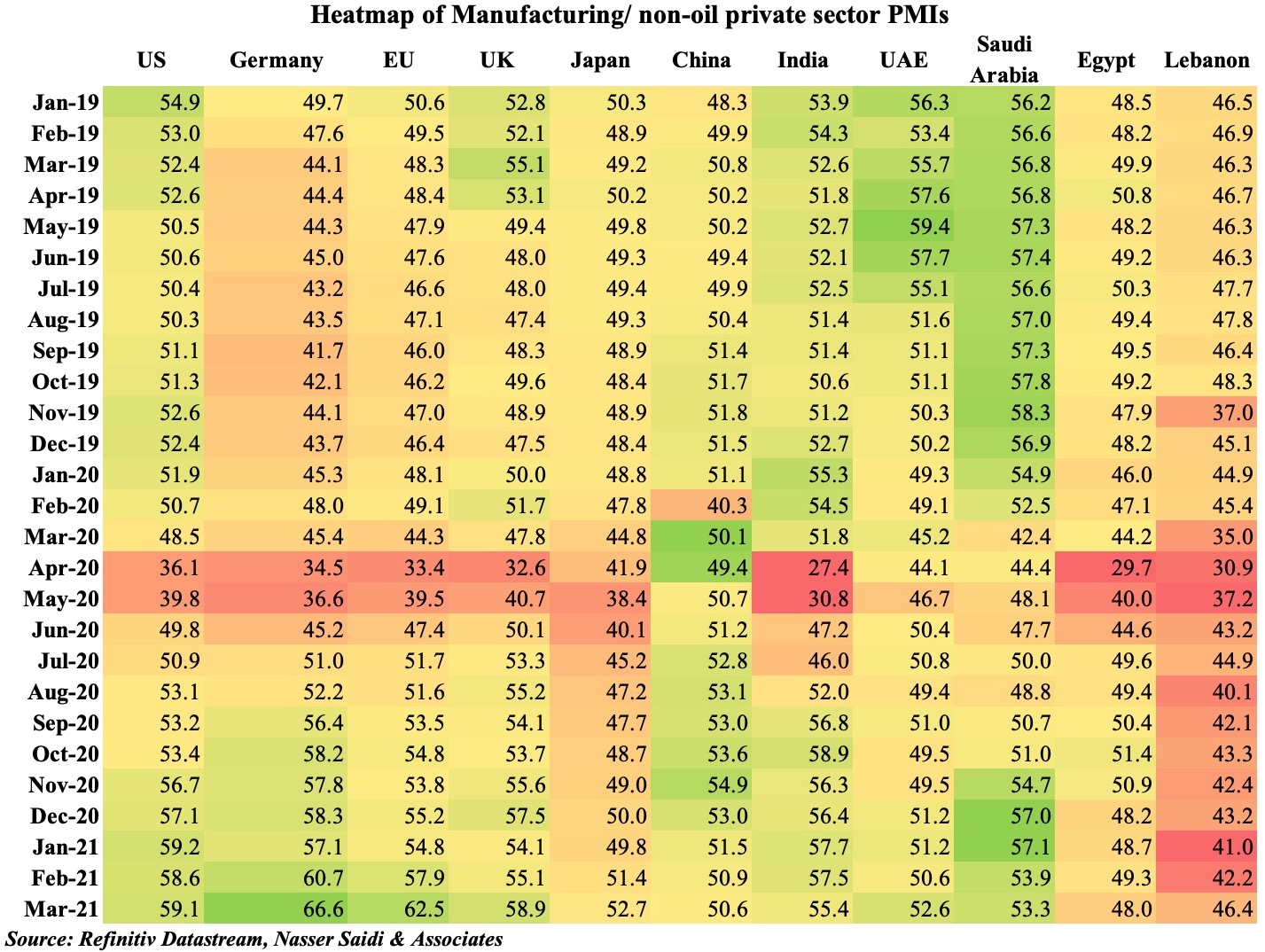

- Global manufacturing PMI touched a 10-year high in Mar: the uptick happened inspite of increased restrictions in late-2020/ early 2021, suggesting less severe impact of the recent lockdowns vs. the one in Apr-May.

- Preparedness for disruptions to production & supply chains as well as online demand & delivery likely improved.

- However, overall conditions are still affected by supply chain disruptions and inflationary pressures.

- Global Services PMI grew to a 33-month high of 54.7 in Mar, supported by inflows of new work.

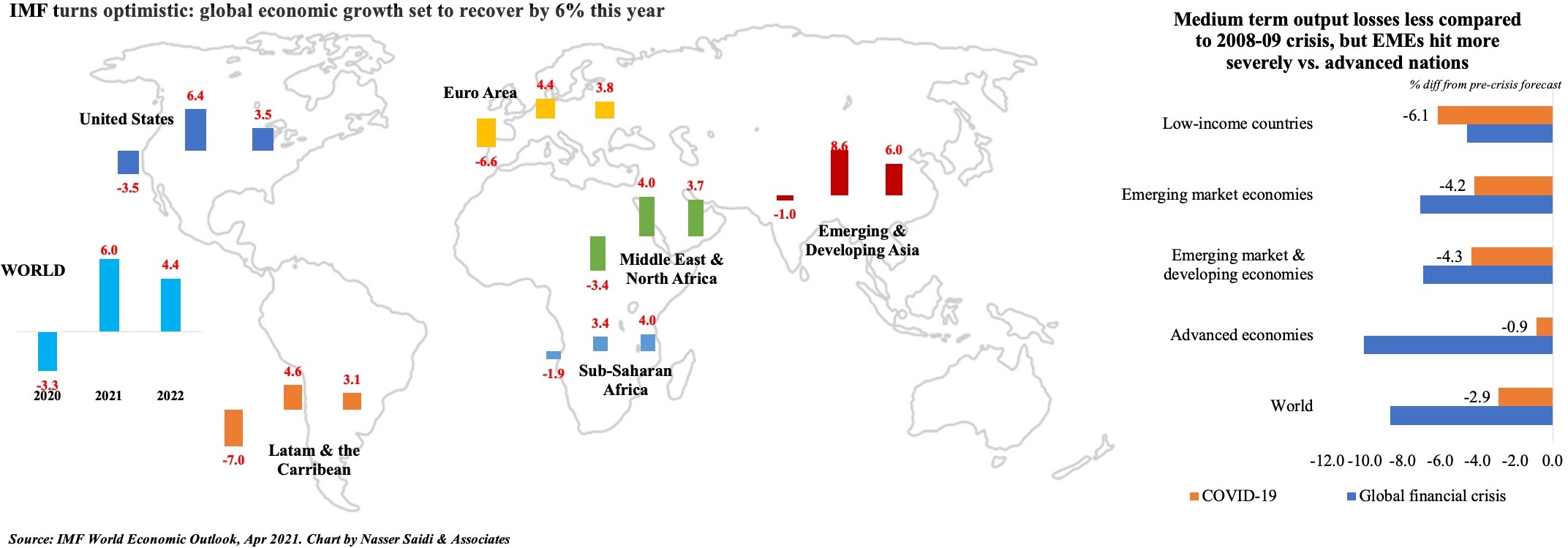

Chart 2. Optimism spills over into IMF’s growth forecasts amid uneven recovery caution

- The IMF projects 6% yoy growth in 2021, up from the 3.3% contraction last year. If the forecast is realized, it would mark the fastest rate of global growth since 1976. While China returned to pre-pandemic GDP levels in 2020 itself (+2.3%), many are unlikely to recover till 2023 – depending on new virus variants, pace of vaccination rollout and extent of fiscal/ monetary stimulus.

- The average medium term output loss over 2020-24, relative to pre-pandemic forecasts, is projected to be 6.1% in low-income countries versus 4.1% and a smaller 0.9% in emerging and advanced nations respectively. This is much lower than the losses seen during the 2008-09 financial crisis (when advanced nations suffered the most).

- The Middle East’s growth forecasts have remained broadly unchanged though recovery prospects of the GCC (where vaccination pace is quite high) are miles apart from many of the war-torn nations.

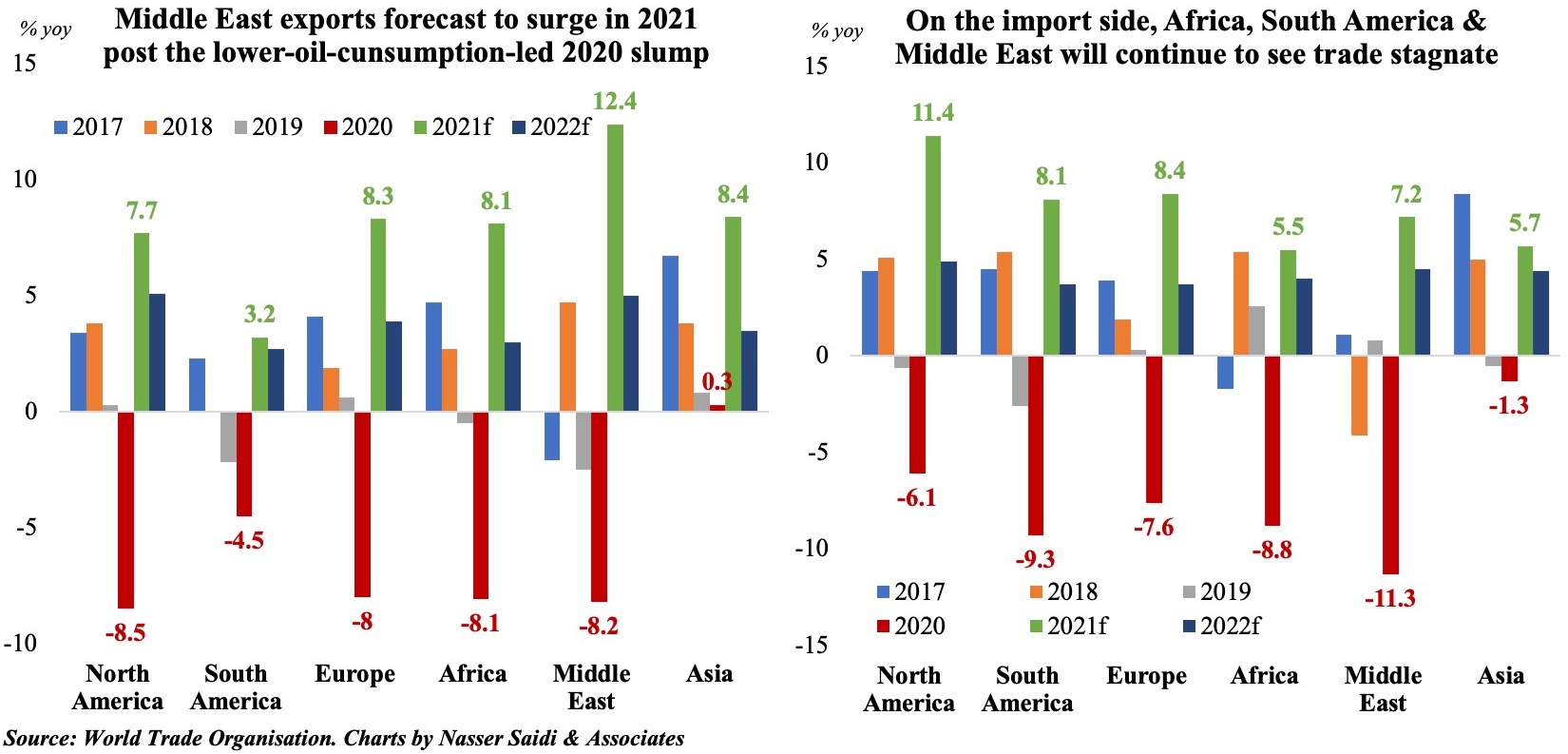

Chart 3. Merchandise trade poised for recovery in 2021, before slowing in 2022: WTO

- Strong, but uneven recovery is the story in merchandise trade volumes as well. Trade volume is projected to increase by 8% this year and then slow to 4% in 2022. Cross-border trade in services remains subdued and new waves of infection could easily reverse course of trade.

- Falling oil prices led to a 35% contraction in trade in fuels in 2020: it had a significant impact on Middle East exports (-8.2% slump in 2020), also resulting in a massive 11.3% plunge in imports. As travel picks up post-vaccine drives, demand for oil will likely strengthen, causing a 12.4% rise in exports in the Middle East this year.

- Asia, the export hub: the region’s limited impact and faster recovery from the virus + supply of medical supplies & consumer goods supported their export growth last year. This will enable the 8.4% rise in exports this year.

Chart 4. Risks to the Rosy Outlook

- Pandemic-related risks:

- New strains of vaccine-resistant Covid19 => prolonged pandemic

- Highly unequal global roll out of vaccines could reverberate on advanced nations, when lockdowns are relaxed

- Supply chain disruptions: one leading COVID-19 vaccine includes 280 components sourced from 19 different countries. Any constraint would impact production and distribution

- Insufficient production of vaccines + vaccine nationalism affecting global rollout of vaccines

- Financial risks:

- Avoid a repeat of 2013 “taper tantrum”. Rise in US rates => repricing of risk + tighter financial conditions => negative impact on highly leveraged nations/ businesses (heavy borrowings in 2020, supported by low interest rates: EMEs borrowed 9.8% of GDP & low-income nations 5.5%)

- Impact of corporate sector when stimulus measures are rolled back: potential bankruptcies/ insolvencies (& job losses), profitability => financial risks & effect on banks’ bottom line

- Long-lasting effects from the pandemic:

- Poverty: an additional 95mn people likely entered the category of “extreme poor” in 2020 versus pre-pandemic projections => rising food prices & social unrest (Lebanon as an example)

- Labour markets: youth, women & low-skilled workers more affected + impact on productivity

- Inequality within nations & across economies: not limited to income. Think education, technology

- Climate change risks: methane & CO2 levels surged to record amounts in 2020 + stranded assets + preparedness for a low-carbon transition

- Geo-political risks: US-China tensions led suppliers to shift away from China (one of the reasons behind the current shortage of computer chips), reshoring and “Made at home” policies

Weekly Insights 1 Apr 2021: Reforms ramping up as GCC nations plan recovery in a post-Covid world

Download a PDF copy of this week’s insight piece here.

Chart 1. Saudi Arabia’s Shareek investment package to jumpstart the economy

- The Shareek strategy (SAR 27trn stimulus over the coming decade) aims to jumpstart and shift expenditure patterns post-Covid by emphasizing investment vs consumption spending (incl.govt current spending), while implementing diversification. As proposed, the plan should be strongly supportive of non-oil growth, increase overall productivity growth and lead to job creation.

- Jobs are one of the biggest concerns for the country: female unemployment was running close to 50% for the 20-24 age group in Q3 & close to 20% for males in the same age group. It has come off highs earlier in 2020, but remains one of the highest in the region

- FDI has improved massively from the fall to USD 1.4bn (0.2% of GDP) in 2017; according to the Saudi Central Bank’s estimates, overall FDI reached USD 5.49bn in 2020 (+20% yoy, still below 1% of GDP).

- Saudi Arabia has been aggressively courting foreign investors: revamped over half of the 400 FDI regulations, introduced new laws (e.g. bankruptcy, PPP) and recently stated that presence of firms’ regional HQs in Saudi would become a necessary condition to bid for government contracts.

- FDI inflows would be directed away from oil & gas into more job creating & higher value-added sectors (e.g. renewable energy and clean tech, ‘clean’ petrochemicals, desert agriculture & AgriTech, digital economy). Potentially, this revival of investment and a successful program could attract back a fraction of Saudi private wealth held offshore (estimated at 56% of GDP).

Chart 2. Monetary indicators in Saudi Arabia: PoS & e-commerce transactions and claims on the private sector rise in Feb

Chart 3. Overall GDP in UAE contracted by 7.4% yoy in Q2 2020; recovery expected in H2

- New data: Non-oil GDP fell by 9.9% in Q2 2020, following a 1.9% decline in the previous quarter. Finance and insurance was the lone sub-sector to post growth in Q2.

- Stringency was the highest and mobility lowest in Q2. Mobility data shows improved activity in H2 of 2020, which bodes well for GDP. UAE’s PMI, which averaged 50.2 in H2 2020 (vs 47.1 in Q2 and 47.5 in H1), also indicates a faster recovery in H2. Faster vaccination rollout and the Expo later this year will result in increased consumer and business confidence.

- With an aim to grow faster in the post-Covid world, the UAE has been proactively announcing reforms: with the latest industrial strategy (“Operation 300bn”), Dubai’s 5-year plan to increase trade to AED 2trn and its 2040 urban development plan alongside various incentives to attract high-skilled professionals (10-year visas, remote working visas, path to citizenship etc.)

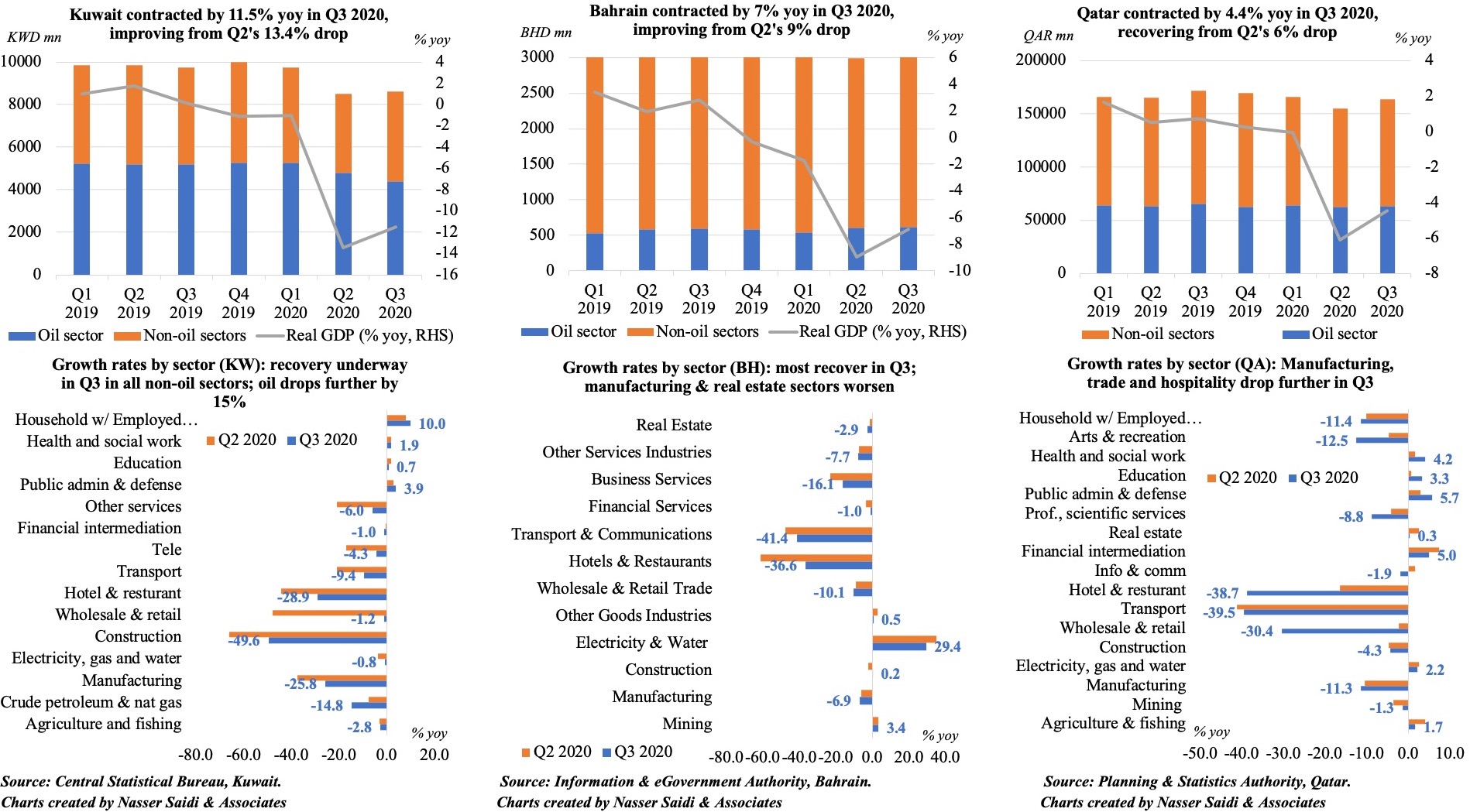

Chart 4. Q3 GDP data from other GCC nations suggest better quarters ahead for the UAE – the least restrictive of all

While overall % yoy GDP improved in Q3, some sectors (including oil, given OPEC+ cuts & others like trade, hospitality) contracted even more

Powered by:

Weekly Insights 7 Jan 2021: UAE’s silver linings – has the country turned a corner?

Download a PDF copy of this week’s insight piece here.

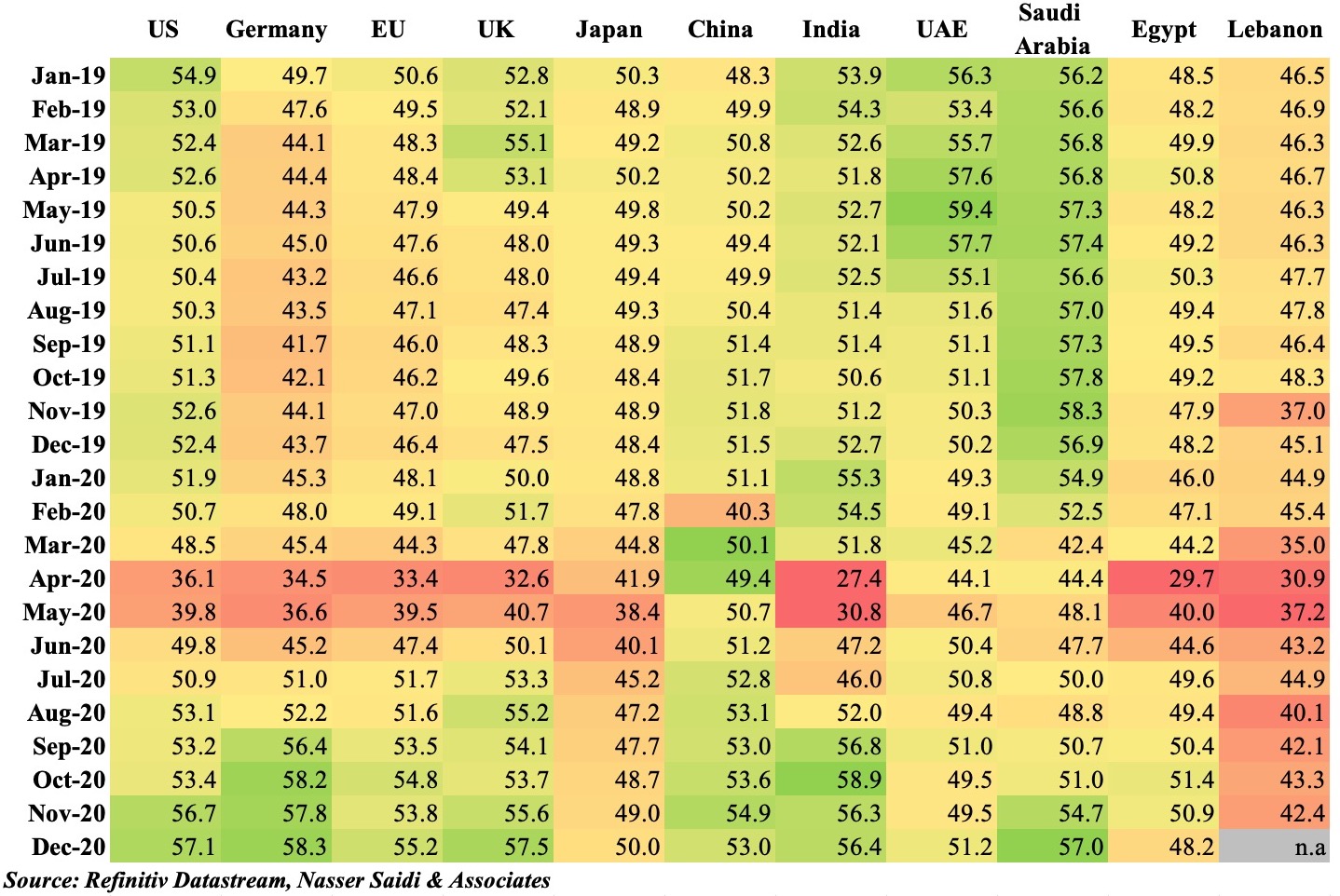

1. Heatmap of Manufacturing/ non-oil private sector PMIs

PMIs across the globe were released this week. Overall, recovery seems to be the keyword with improvements in Dec – in spite of the recent Covid19 surge, the Covid variant and ongoing lockdowns/ restrictions – with new orders and export orders supporting sentiment, with some stability in job creation. However, supply chain issues continue to be a sticking point: the JP Morgan global manufacturing PMI – which remains at a 33-month high of 53.8 in Dec – identifies “marked delays and disruption to raw material deliveries, production schedules and distribution timetables”.

In the Middle East, while UAE and Saudi Arabia PMIs improved (the former recovering from 2 straight months of sub-50 readings), Egypt slipped to below-50 after 3 months in expansionary territory. While Egypt’s sentiment dipped on the recent surge in Covid19 cases, the 12-month outlook improved on optimism around the vaccine rollout. However, the UAE’s announcement of the rollout of Sinopharm vaccine in early-Dec seems to have had little impact on the year-ahead outlook, with business activity expected to remain flat over 2021 (survey responses were collected Dec 4-17) and job losses continuing to fall at an accelerated rate.

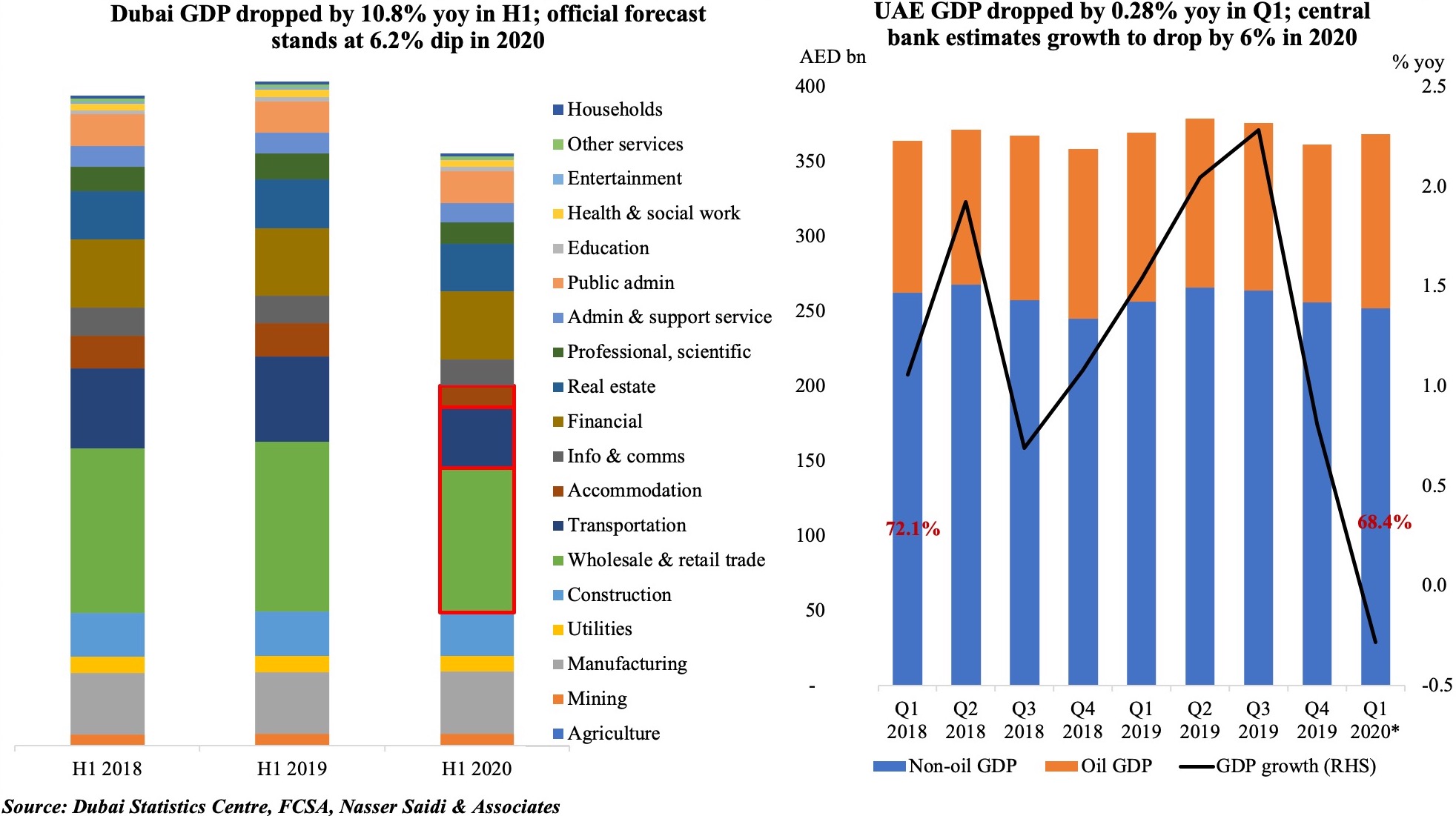

2. Covid19 & impact on Dubai & UAE GDP

The UAE has seen a negative impact from Covid19: the central bank estimates growth this year to contract by 6% yoy, with both oil and non-oil sector expected to contribute to the dip (this is less than the IMF’s estimate of a 6.6% drop in 2020). Oil production fell in Q2 and Q3 by 4.1% and 17.7% yoy respectively, in line with the OPEC+ agreement, and spillover effects on the non-oil economy saw the latter’s growth contract by 1.9% yoy in Q1 (vs oil sector’s growth of 3.3%). The latest GDP numbers from Dubai underscore the emirate’s dependence on trade and tourism to support the non-oil economy: overall GDP dropped by 10.8% yoy in H1 2020; the three sectors (highlighted in red border below) trade, transportation and accommodation (tourism-related) which together accounted for nearly 40% of GDP declined by 15%, 28% and 35% respectively. Dubai forecasts growth to decline by 6.2% this year, before rising to 4% in 2021.

News of a 5th stimulus package worth AED 315mn (announced on 6th Jan) for Dubai – an extension of some incentives till Jun 202, refunds on hotel sales and tourism dirham fees, one-time market fees exemption for establishments that did not benefit from reductions in previous packages and decision to renew licenses without mandatory lease renewal among others – will support growth this year, as well as the uptick from Expo 2021 (based on widespread vaccinations across the globe and potential resumption of air travel by H2 this year). With plans to inoculate 70% of the UAE population by 2021, we remain optimistic about UAE/ Dubai prospects subject to the effective implementation of the recent spate of reforms (including the 100% foreign ownership of businesses, retirement & remote working visas etc.) as well as embracing new and old synergies – Israel and Qatar respectively. Medium-term prospects can be further enhanced by accelerating decarbonization and digitisation – read a related op-ed published in Dec.

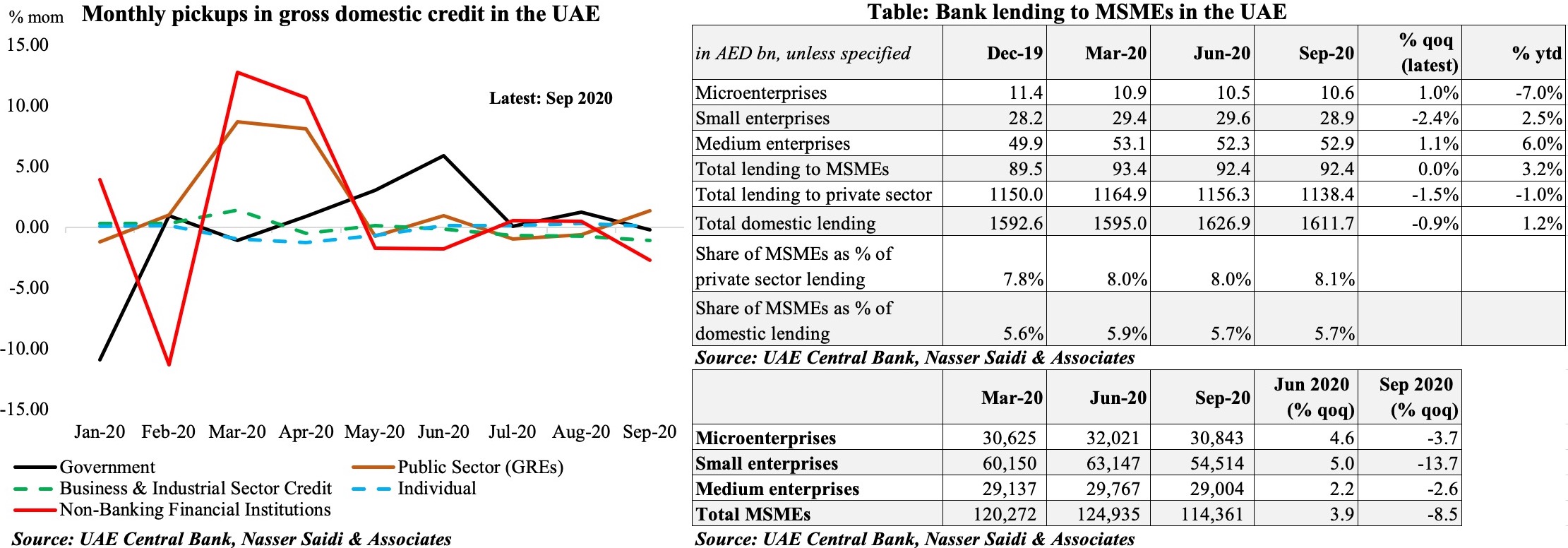

3. UAE credit and SMEs

The UAE central bank has extended support to those persons and businesses affected by Covid19 by launching the Targeted Economic Support Scheme, which is now extended till Jun 2021. Overall credit disbursed till Sep 2020 was up 2.9% yoy and up 1.2% ytd: but during the Apr-Sep 2020, the pace of lending to GREs (+22.7% yoy) and government (+19.6%) have outpaced that to the private sector (-1.0%).

It has been a difficult period for MSMEs (Micro, Small and Medium Enterprises): the number of MSMEs declined by 8.5% qoq in Sep 2020, following an uptick of 3.9% qoq in Jun 2020, signaling deteriorating business conditions that may have forced such firms to close. This also suggests a potential increase in NPLs once the current banks’ support (e.g. deferring loan periods) come to a close. Overall domestic lending also fell by 0.9% qoq as of Sep 2020. The largest share of loans within the MSME sector continues to be to the medium-sized firms (57.3%) and about 1/3-rd to the small enterprises. Considering the amount disbursed per firm, medium enterprises pocketed AED 1.8mn in Q3: this is 3.4 times the amount disbursed per small firm and 5.3 times the amount disbursed to microenterprises.

SMEs also need to think beyond the financial pain point to survive in the post-pandemic era. In addition to reducing/ streamlining operational costs[1], learning digital skills, boosting online profiles and hosting a robust payments and collections platform will also support SMEs to be more bankable in the future.

4. Back to “business as usual” for the GCC

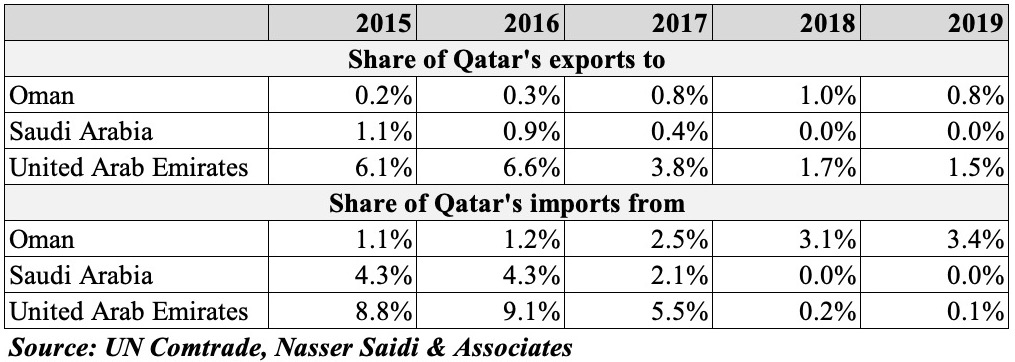

The recent GCC Summit saw Qatar’s blockade (imposed in 2017) being lifted: this improves and will support political stability (a “united GCC” front) and is likely to restore UAE and Saudi businesses direct trade and investment links. Allowing bilateral tourist movements will support upcoming mega-events in the region like the Dubai Expo this year and Qatar’s 2022 World Cup. Trade will be restored among the nations: imports from the UAE had dropped to a negligible 0.1% last year, from close to 10% in the year before the blockade. Oman, meanwhile, had gained – with businesses opting to re-route trade with Qatar through Oman’s ports.

Greater GCC regional stability, implies lower perceived sovereign risk, including credit risk which –other things equal- will lead to an improvement in sovereign credit ratings, lower spreads and CDS rates and encourage foreign portfolio inflows as well as FDI.

[1] Even Mashreq Bank, Dubai’s 3rd largest lender, is planning to reduce operational costs by moving nearly half its jobs to cheaper locations in the emerging markets (to be completed by Oct 2021), according to a Bloomberg report.

Powered by:

Weekly Insights 20 Oct 2020: Expect a Protracted Economic Recovery in Middle East/ GCC

Download a PDF copy of this week’s economic commentary here.

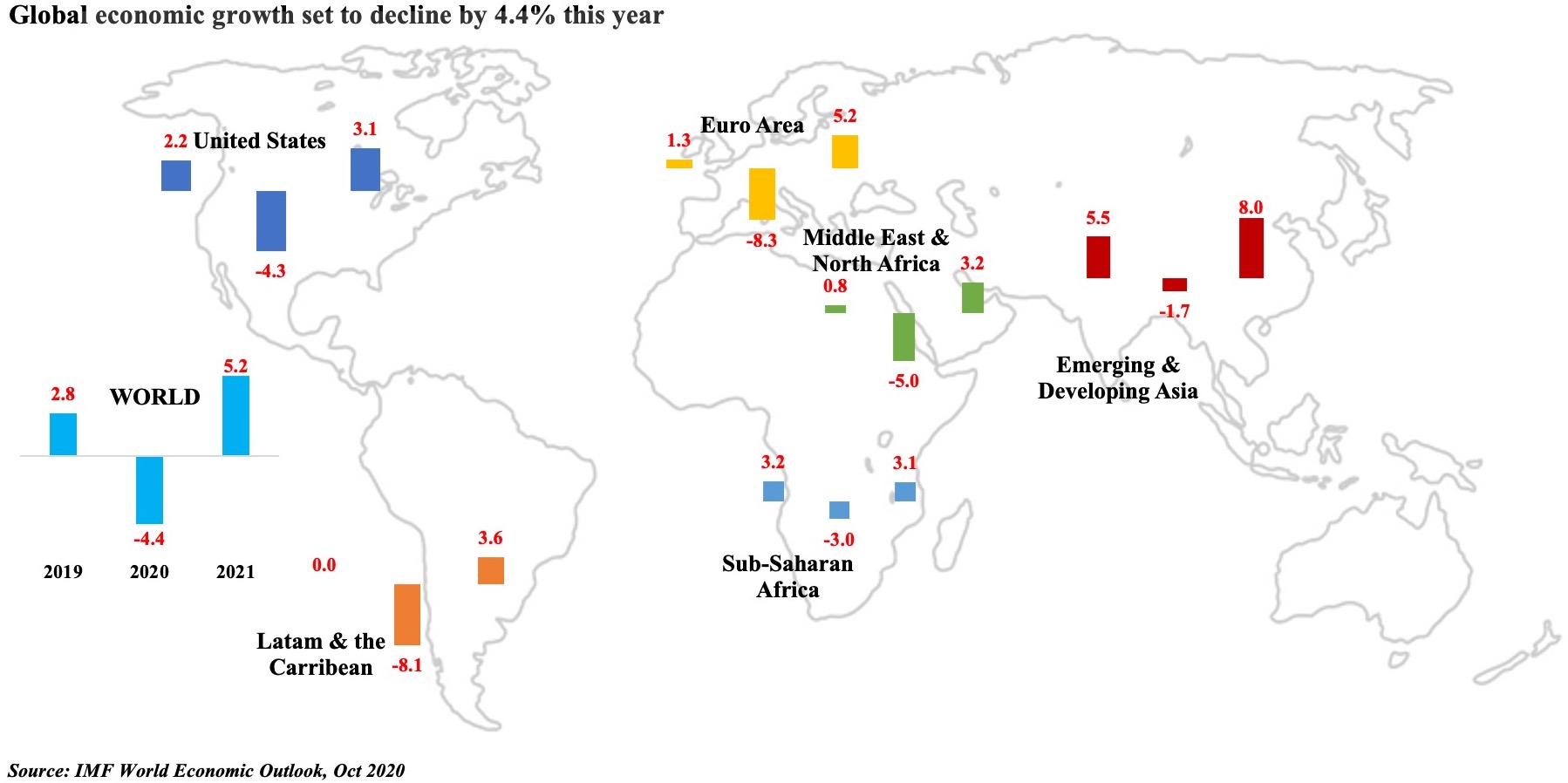

Fig 1. Global Economic Growth to decline by 4.4% this year, before rebounding to 5.2% in 2021

The IMF’s World Economic Outlook, released in October, forecast upwardly revised growth estimates for most country groups this year though stating that the recovery is “long, uneven and uncertain”. The IMF forecasts still seem relatively optimistic with all regional aggregates indicating a wobbly V-shaped recovery. Emerging markets and China are expected to recover much faster than their advanced counterparts while also noting that the plunge in growth was more severe for the advanced nations. A recovery in trade, PMI numbers and consumer spending are cited as supporting global recovery, though the sudden surge in Covid19 confirmed cases across Europe is likely to dampen the rebound, presaging a second wave and extended recovery.

Germany, Italy, Portugal and UK recently reported their highest number of infections since the start of the pandemic and many nations are reimposing restrictions – Belgium’s nationwide curfew, Switzerland making masks compulsory in indoor public areas, a 9pm curfew at many major cities in France – though a full-fledged lockdown is likely to be avoided. While Q3 may show an uptick in growth, Q4 is likely to slide back into negative territory (though not as sharp as Q2’s plunge). Mobility indicators how a decline in footfall across many European cities (https://on.ft.com/2TmvOkZ); PMI data reveals a divergence between manufacturing and services, with the latter reporting a drop in Sep. As we enter the cold winter months, the partial recovery seen in Q3 may be just temporary.

In the Middle East and North Africa (reeling from the effects of the global recession, Covid19 impact and oil exporters facing lower oil prices and demand), growth is expected to recover a tad later and slower compared to the rest, rising to only 3.2% from a 5.0% dip this year (Source: IMF Regional Economic Outlook: Middle East & Central Asia, Oct 2020). Egypt is the only country in the region forecast to grow this year (+3.5% yoy in spite of the massive decline in tourism). GCC growth is forecast to shrink by 6.0% this year – with oil and non-oil GDP contracting by 6.2% and 5.7% respectively.

A recent uptick in Covid19 cases might add to economic uncertainty in the region – Jordan has reimposed some restrictions since the beginning of the month, but none of the nations have gone back to the stringency levels seen during Mar-Apr 2020. The immediate concerns remain on the fiscal side, with most nations rolling out stimulus packages to ease the impact from Covid19. For the GCC, fiscal deficits are projected at 9.2% of GDP this year (2019: -2%) while the fiscal breakeven oil price ranges from USD 42 for Qatar to USD 75.9 for the UAE and as high as USD 104.5 for Oman. Dependence on oil is still pronounced in spite of diversification efforts and the rising fiscal deficits are being met with a combination of debt issuances, tapping domestic markets, reduction of reserves and via sovereign wealth funds.

Though countries in the Middle East emerged from Covid-19 containment in Q2, the economic costs/ impact are likely to be protracted through the year and next given the many spillover risks: debt obligations and financing needs, job losses/ unemployment, potential NPLs affecting banking sectors, business closures leading to insolvency/ bankruptcy, and for the oil importers decline in remittances as well as rising poverty and inequality. IMF estimates foresee that five years from now countries could be 12% below GDP level expected by pre-crisis trends.

Powered by:

Weekly Insights 13 Oct 2020: PMIs, Mobility & Economic Recovery

Download a PDF copy of this week’s economic commentary here.

1.Global PMIs, shipping & trade

PMIs across the globe were released last week. The headline JPMorgan global composite PMI fell for the first time in five months, dipping to 52.1 in Sep (Aug: 52.4). Most manufacturing surveys still indicated an expansion (a reading above 50) though the pace of recovery has slowed as a result of capacity constraints and supply chain delays. Sector-wise, the most significant beneficiary has been the automotive sector, where production capacity increased and new orders posted the most gain since Dec 2019. On the other extreme, tourism and recreation sector continues to be the worst hit – reflecting the glaring divergence between the manufacturing and services sector PMIs (Figure below). September’s PMI readings in the services sector have declined from Aug’s 7-month highs, as many countries witnessed a resurgence in Covid19 cases (and in some, new record daily cases!), leading to restricted lockdowns which added on to the restrictions due to social distancing policies. Employment posted a net increase for the first time since Jan: though jobs growth was faster in the services sector in Aug-Sep, remember that the sector had also seen the steepest job cuts earlier this year.

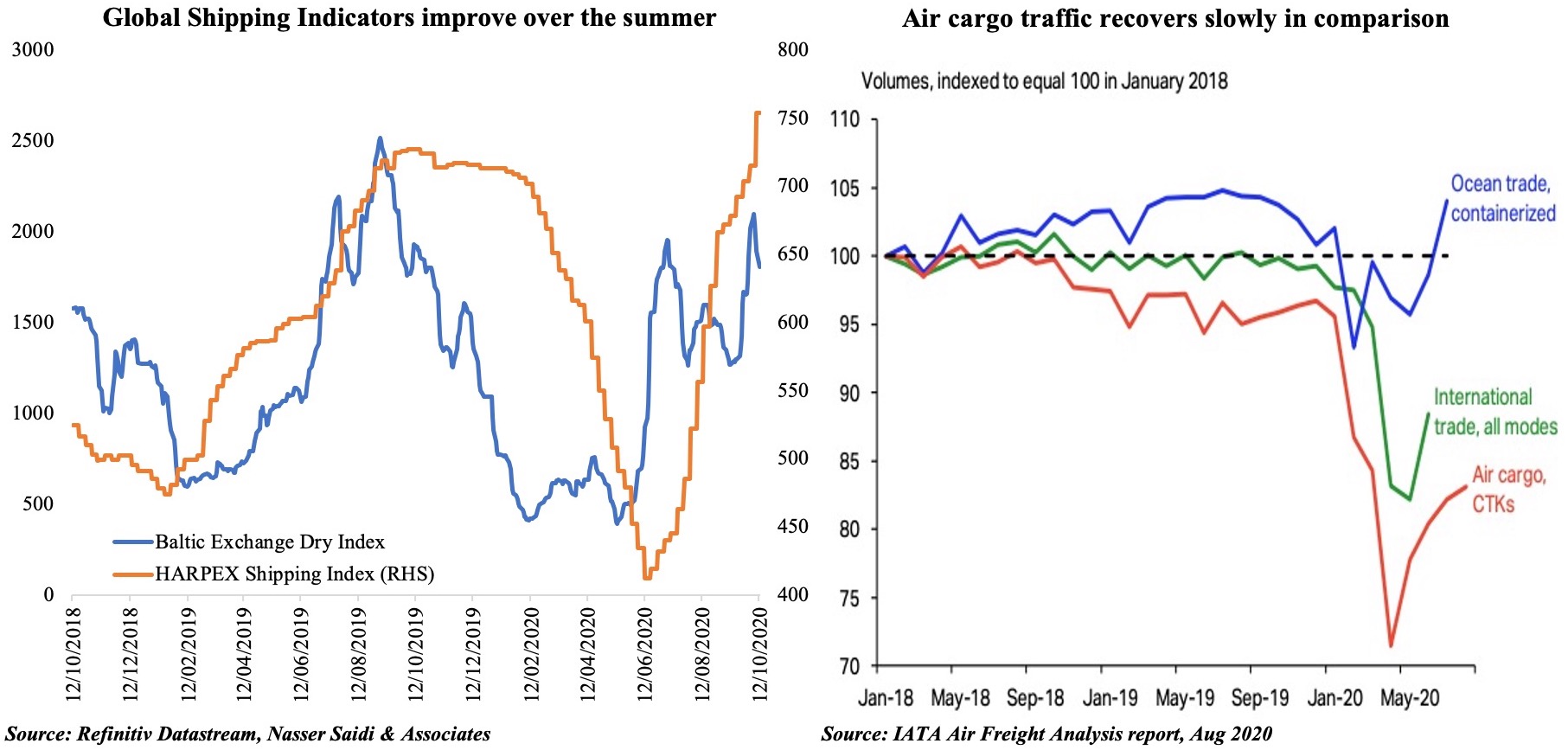

Recent manufacturing PMI readings have shown an increase in new export orders, supported by a pickup in demand. Global shipping indicators have improved during the summer, with both the Baltic Exchange Dry Index (tracks rates for ships carrying dry bulk commodities) and the Harpex shipping index (index created using container shipping rates across different classes of ship) picking up pace. Both indices rose to its highest in more than a year last week, after having touched 3-year highs in mid-2019 and declining sharply during the Feb-Jun period. However, the air freight sector has not recovered in tandem with shipping (Figure below), a result of cheaper ocean trade – a pattern visible during downturns – as well as insufficient air cargo capacity (according to IATA).

2. Regional PMIs

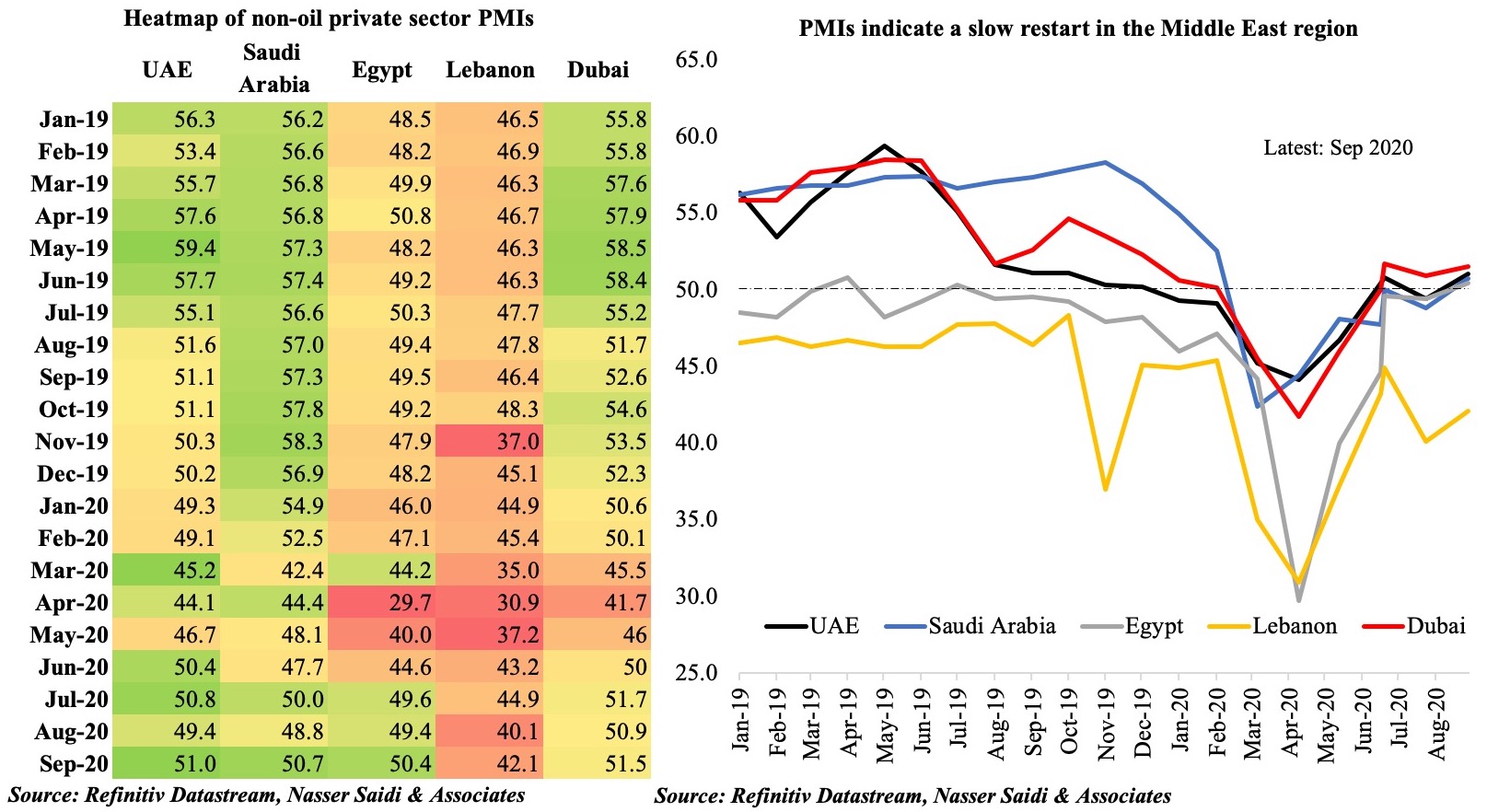

Regional non-oil private sector PMI’s indicate a slow restart: Sep’s modest improvement followed Aug when four of the countries moved into the contractionary territory (i.e. below the 50-mark). Significantly, demand growth has been picking up and the significant price discounting on offer has led to an increase in sales.

Job cuts are still occurring, as businesses adjust to reduce operating costs. The ILO estimates that Arab states witnessed a 2.3% drop in working hour losses in Q1 this year, followed by 16.9% and 12.4% respectively in Q2 and Q3. Job postings are slowly ticking up, though anecdotal evidence suggests that potential employees are willing to accept a significant pay cut to undertake similar work. This will lead to a wider disparity in public-private sector wages, not to mention the impact it would have on wider gender disparities (during Covid19, women are already more likely than men to witness a larger drop in mobility to lose jobs in the informal economy or see a reduction in working time).

Furthermore, with lack of access to finance/ liquidity, not all businesses will recover or survive in the next few months, should uncertainty remain. This could result in a structural change bought about due to Covid19 (e.g. the increase in number of online shopping platforms which are relatively less labour-intensive versus actual physical stores). Being faced with limited financial capabilities (due to job losses or salary cuts and depletion of savings), expatriates could also decide to return to their home countries (negatively affecting consumer spending in the region).

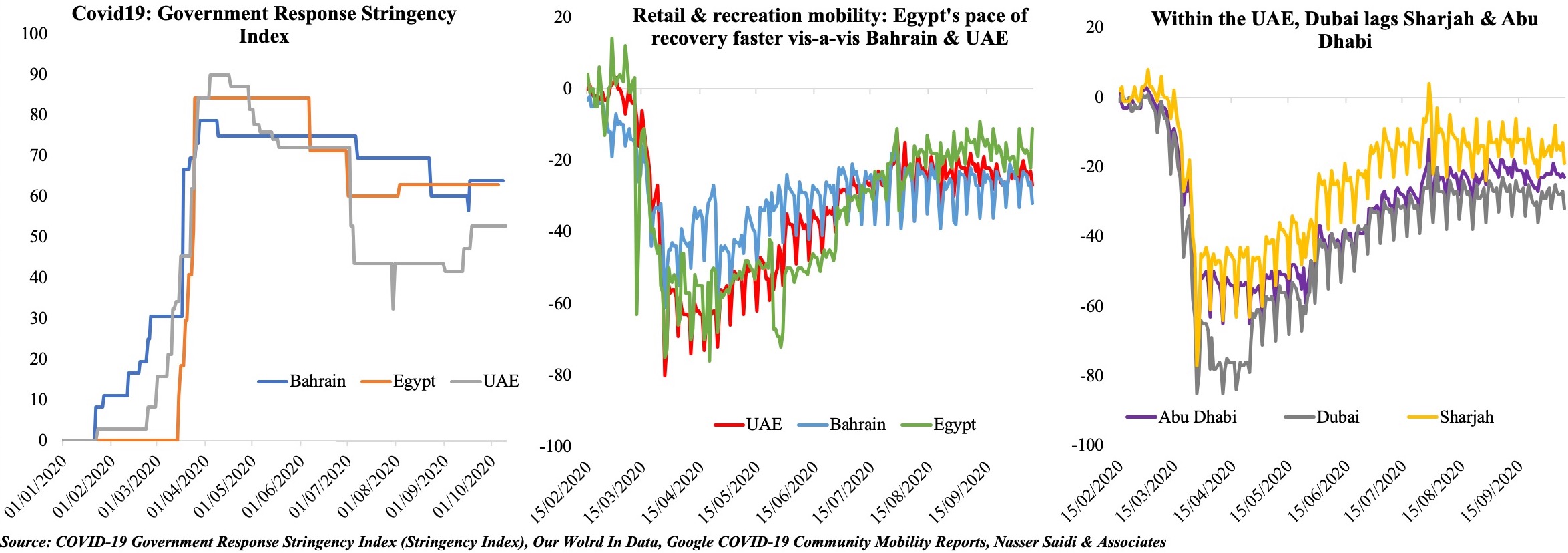

3. Stringency Index vs. Retail and Recreation sector activity

The Middle East has seen a resurgence in Covid19 cases in the recent weeks, and many nations are in the process of reimposing partial lockdowns or shorter nationwide lockdowns: the first panel in the figure below shows that the Government Response Stringency Index[1] has increased for the UAE in the past month (in line with the increase in cases). This is the best way forward, if we are to take into consideration the IMF’s recent World Economic Outlook analysis which found that early adoption of stringent and short-lived lockdowns curbed infections and could be preferable to mild and prolonged measures. The enforcement of lockdowns and social distancing policies was an important factor contributing to a recession: however, such short-term costs of lockdowns may lead to medium-term gains if the virus is contained.

Google Mobility indicator for retail and recreation show that none of the three nations – Bahrain, Egypt, or UAE – have yet returned fully to the pre-Covid19 baseline. Among the three, Egypt, which had declined the most initially, recovered faster in comparison. More interestingly, within the UAE, recovery in retail sector mobility in Sharjah (-14% from baseline in Oct) and Abu Dhabi (-21% from baseline) has outpaced Dubai (-23%). This could potentially be due to higher confidence in these emirates – given mass testing in Sharjah, border controls in Abu Dhabi and a relatively longer lockdown period – compared to Dubai.

What next? Note that a second (or even third) wave of Covid19 is unfolding, as we enter the cold winter months: given the likelihood of resurgence of Covid19, partial recovery – as indicated by PMIs – may be temporary. If further virus containment measures are introduced, though it will dampen economic activity in the short-term, medium-term gains might be achieved. Initial restrictions will likely affect the customer-facing service sectors more than others, but risks to other sectors will increase if further restrictions are imposed. Overall, an air of uncertainty is unlikely to boost confidence among firms, negatively affecting investment decisions and economic activity. Governments need to signal willingness to continue stimulus measures if required and take decisions to introduce “circuit-breakers” if necessary.

[1] The Stringency Index is a composite measure based on nine response indicators that include school closures, workplace closures, and travel bans; the index ranges from 0 to 100 with 100 being the strictest. This index does not track the effectiveness of the response. More: https://www.bsg.ox.ac.uk/research/research-projects/coronavirus-government-response-tracker

Powered by:

Weekly Insights 6 Oct 2020: Economic activity in Bahrain & Saudi Arabia

Charts of the Week: Last week, both Bahrain and Saudi Arabia released Q2 GDP numbers: as expected, overall growth contracted, with private sector activity significantly affected. The initial sections offers a forward-looking perspective on the two nations based on more recent data and proxy indicators. Saudi Arabia also disclosed a medium-term fiscal strategy, which forms the last section of this Insights’ edition.

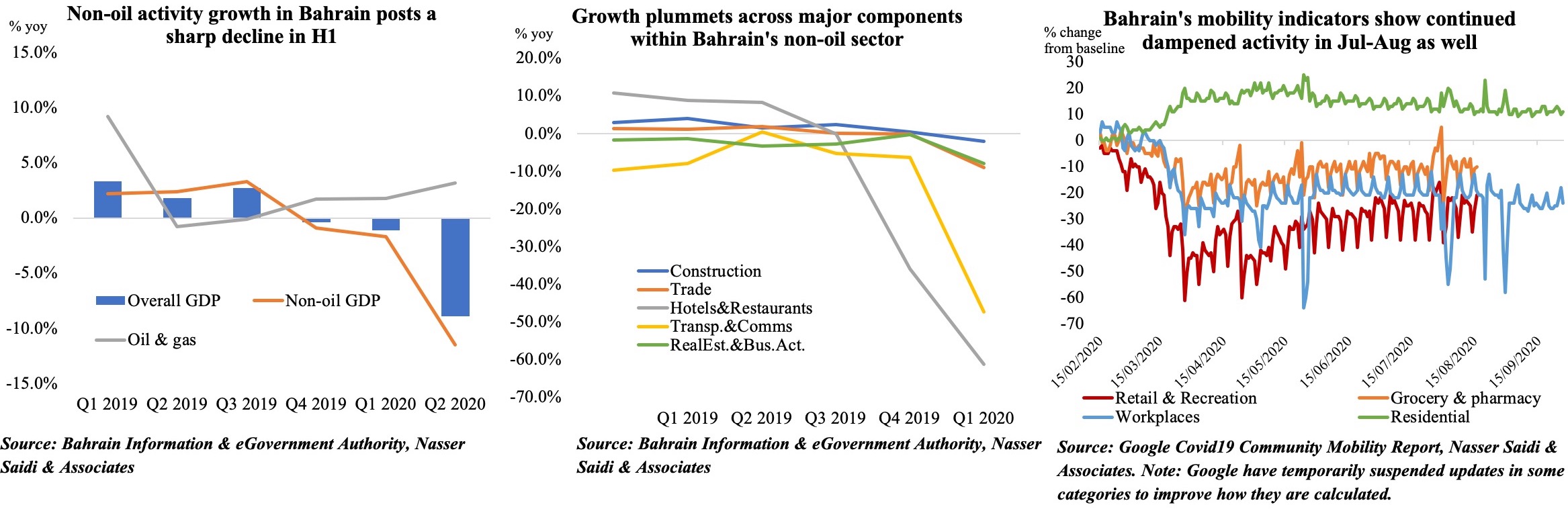

- Bahrain GDP & economic activity

GDP in Bahrain declined by 8.9% yoy in Q2 2020, following a 1.1% drop the previous quarter. This was primarily due to the non-oil sector which plummeted by 11.5%. As expected, the largest dips in GDP came from the hotels and restaurants (-61.3%) and transport & communication (-47.4%) – both directly affected by the Covid19 outbreak. Spillover effects were also visible across the board: the financial sector, which accounts for the largest share of non-oil GDP (16.8% in Q2), posted a 5.8% drop while the sub-sectors real estate and business activities and construction slipped by 7.9% and 2.1% respectively.

With Covid19-related restrictions slowly being phased out in Bahrain, can we expect a resumption of economic activity? The data for Jul-Aug show the pace of recovery has been slow, with readings for retail and recreation still at an average 26% below the baseline data (pre-Covid19). Recent announcements of extended government support – be it the exemption of tourism levies for 3 more months or extended support to KG & nursery teachers, taxi drivers or Bahraini citizens’ payment of utility bills and about 50% of salaries in the private sector (only those affected) – will provide direct support and likely nudge recovery. hotel occupancy rates in four- and five-star hotels increased by 13.3% mom and 17.6% in Jul and Aug respectively. Opening borders with Saudi Arabia will not only increase the number of trucks crossing the King Fahd Causeway (improving transport/ trade) but will also attract visitors from Saudi Arabia (supporting hospitality and retail).

- Saudi Arabia GDP & economic activity

Saudi Arabia’s overall GDP plunged by 7% yoy in Q2 2020, with falls in both the oil and non-oil sectors. The oil sector’s 4.9% drop in H1 is a result of the reduction in oil production in line with the OPEC+ agreement. Within the non-oil sector, all sub-sectors posted declines in Q2 ranging from trade and hospitality (-18.3%) to finance, insurance and real estate (-0.7%). The share of GDP by economic activity shows that the oil sector continues to dominate (45% of overall GDP), closely followed by manufacturing (13%) and trade and hospitality (9%).

To gauge any underlying change in activity during Q3, we refer to the central bank’s data on consumer spending and point-of-sale (PoS) transactions by category. There is a spike before the VAT hike came into place in Jul, as expected, but the Aug data seems to indicate a slight recovery for hotels (+2.6% yoy, following 6 months of double-digit declines) while items like jewelry and clothing continue to register negative growth. The construction and real estate sector look well-placed to improve in H2 this year: not only has letters of credit opened for building materials imports increased by 64% yoy in Aug (following 5 months of double-digit declines), cement sales has also been picking up during Jun-Aug; a temporary boost for the sector will also come from the recent announcement that real estate would be exempt from the 15% VAT (to be replaced instead by a 5% tax on transactions, of which the government would bear the costs for up to SAR 1mn for the purchase of first homes).

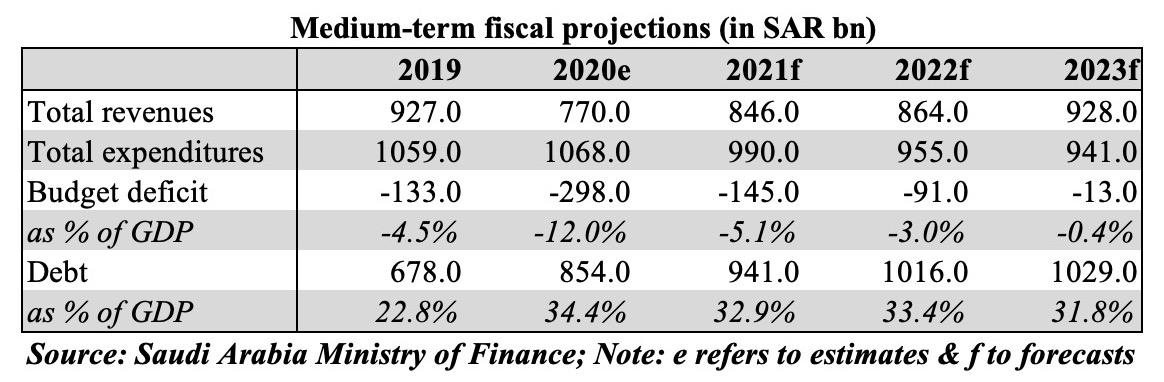

- Saudi Arabia’s fiscal space

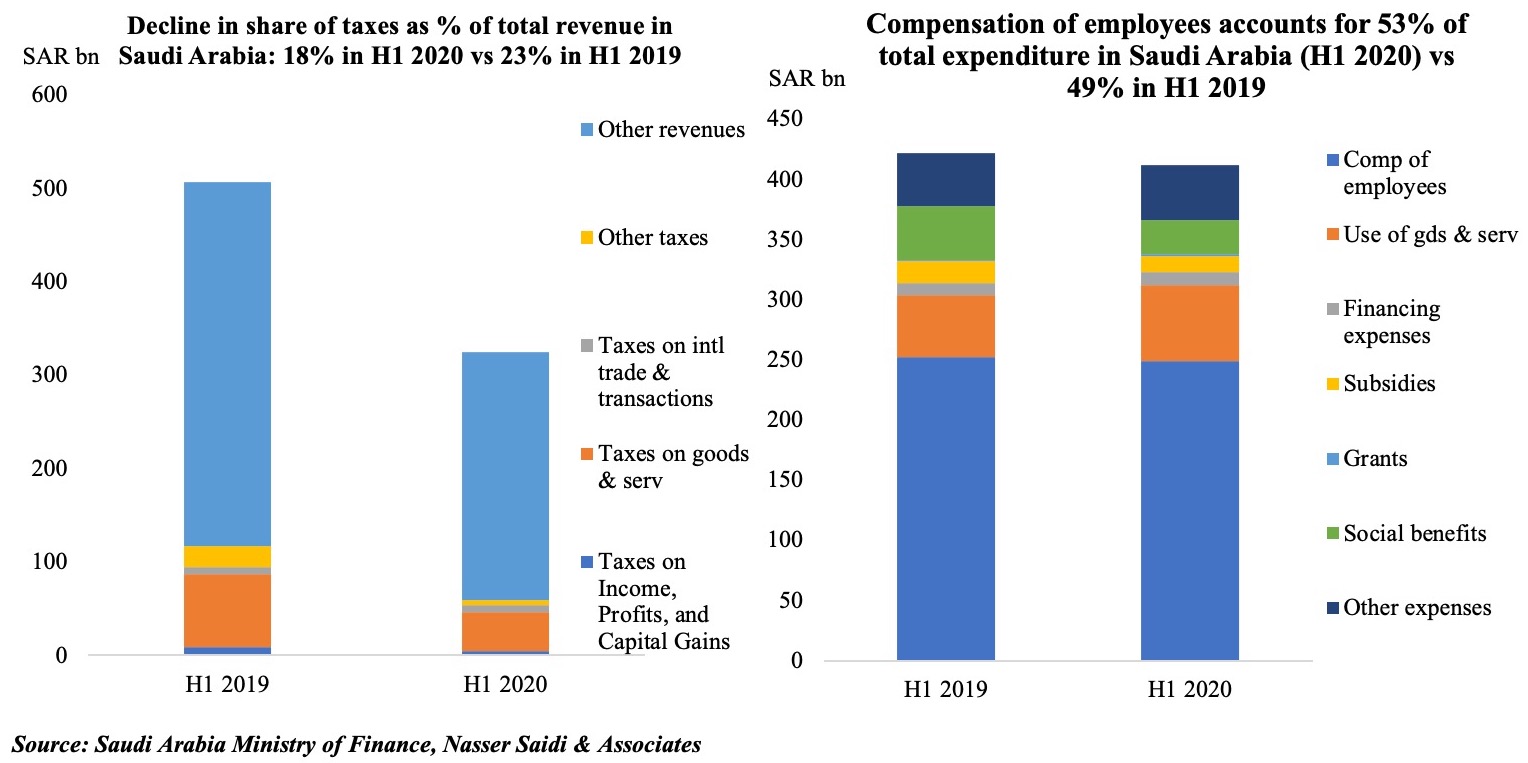

With oil prices around the USD 40-mark, extended government support in Saudi Arabia during the Covid19 outbreak will put a strain on finances. From the H1 2020 estimates disclosed by the Ministry of Finance, it is noticeable that the share of taxes as % of overall revenue has declined to 18% (H1 2019: 23%). Compensation of employees remain the biggest strain on the expenditure side, with the single component accounting for 53% share, though it is commendable that subsidies have declined by 27.8% yoy to SAR 13bn.

If Saudi Arabia’s fiscal consolidation plans are to be met, reforms are required on both revenue and expenditure side. The Kingdom has already increased VAT to 15% from Jul: however, with subdued demand and consumer spending, it seems unlikely that this move will add substantial revenue this year. We have highlighted in previous editions that Saudi Arabia can benefit from the introduction of other more revenue-generating taxes – e.g. carbon taxes, which will also contribute towards a cleaner environment. Additional measures could include energy price reforms (thereby reducing subsidies) as well as a consolidation or removal/ reduction of various small fees and taxes after undertaking an impact exercise (i.e. do these fees raise significant revenues or do they hinder development of the related sector?). The other major route to take is lowering “compensation of employees”: this can be done either by reducing the public sector workforce (and increasing productivity through increased digitalization) or by decreasing wages (and synchronizing public holidays) to be on-par with the private sector – these moves could also support creation of jobs in the private sector, lead to higher productivity levels and growth.

"Lebanon’s crisis needs $20 billion-$25 billion bailout": Reuters interview with Dr. Nasser Saidi, 3 Jan 2020

The interview with Dr. Nasser Saidi was published by Reuters on 3rd Jan, 2020 and was published in several regional newspapers as well as the NYT. The original interview can be accessed here and is pasted below.

Lebanon’s crisis needs $20 billion-$25 billion bailout, former minister says

Lebanon needs a $20 billion-$25 billion bailout including International Monetary Fund support to emerge from its financial crisis, former economy minister Nasser Saidi told Reuters on Friday.

Lebanon’s crisis has shattered confidence in its banking system and raised investors’ concerns that a default could loom for one of the world’s most indebted countries, with a $1.2 billion (917.01 million pounds) Eurobond due in March.

Lebanon’s politicians have failed to come up with a rescue plan since Prime Minister Saad al-Hariri quit in October after protests over state corruption.

Depositors and investors say they have been kept in the dark about the country’s dire financial situation.

President Michel Aoun said on Friday that he hoped a new government would be formed next week. But analysts say the cabinet to be led by Hassan Diab may struggle to win international support because he was nominated by the Iranian-backed Hezbollah group and its allies.

Saidi said time was running short, and that $11 billion in previously pledged support from foreign donors was now roughly half of what was needed to mount a recovery. “The danger of the current situation is we’re approaching economic collapse that can potentially reduce GDP (for 2020) by 10%,” Saidi said in an interview.

Economists have said 2020 is likely to register Lebanon’s first economic contraction in 20 years, with some saying GDP will contract by 2%.

Others have predicted a long depression unseen since independence from France in 1943 or during the 1975-90 civil war.

Lebanese companies have laid off workers and business has ground to a halt. A hard currency crunch has prompted banks to restrict access to dollars and the Lebanese pound trades a third weaker on the parallel market, driving up prices.

“Our policymakers are not wiling to recognise the depth of the problems we have … They need the courage to tell the Lebanese population that difficult times are coming,” said Saidi.

Credit ratings agencies have downgraded Lebanon’s sovereign rating and the ratings of its commercial banks on fears of default.

Saidi said a $20-$25 billion package could guarantee payment on some of the country’s public debt, enabling it to restructure in a way that would extend maturities and reduce interest rates. Saidi said that would need support from the IMF, World Bank, and Western and Gulf states.

Hariri last month discussed the possibility of technical assistance from the IMF and World Bank, but there has been no public mention of a financial package.