As the GCC nations roll out various economic, financial, health and travel-related initiatives, the latest country-by-country measures is compiled below. Scroll down to see a map of the confirmed Covid-19 cases in the Middle East & North Africa region.

The list is update as of 3:00pm on 21st June, 2020.

Table: GCC responses to tackle the Covid19 outbreak

|

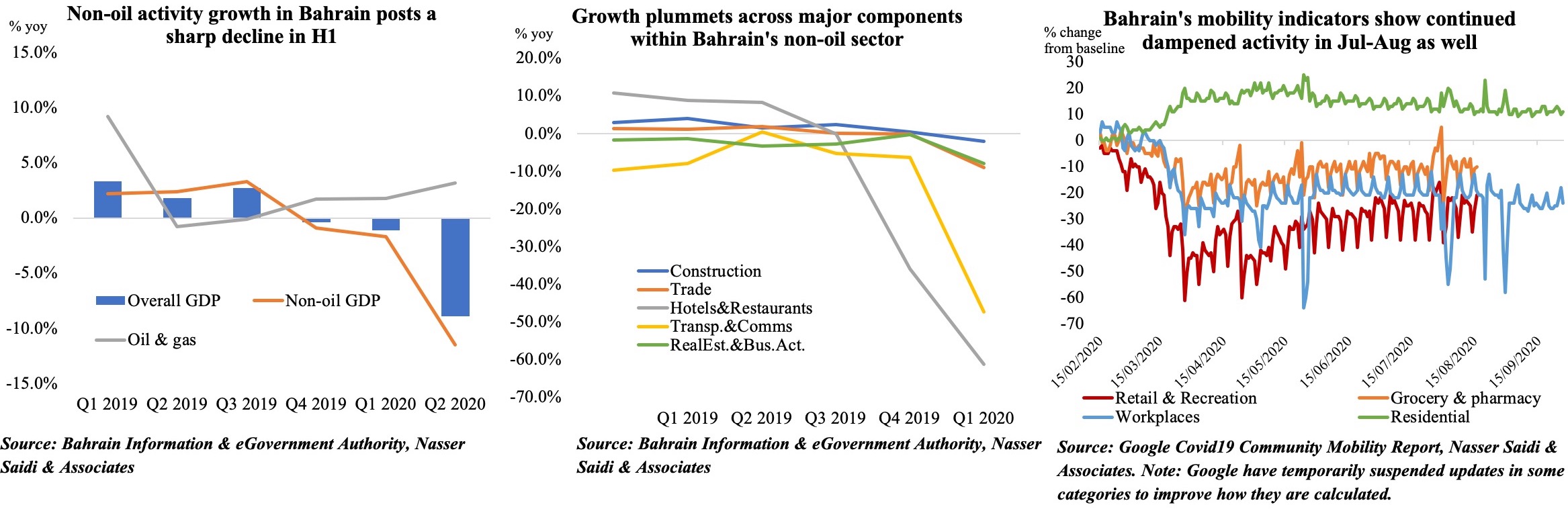

Bahrain

|

| Economic & Financial |

Health & travel-related |

|

Will slash spending by ministries and government agencies by 30%

BHD 4.3bn stimulus package: Doubling the Liquidity Fund to BHD 200mn + Waiver on utilities bills for 3 months + Delay in loans installments for 6 months + Supporting wages of citizens in pvt sector

BHD 5m allocated to Bahraini families in need & individuals affected by Covid-19

BHD 177mn (USD 470mn) will be added to this year’s budget to tackle emergency expenses related to the Covid19 outbreak

Central bank moves:

– Banned lenders from freezing customers’ accounts in case of lost jobs or retirement

– Cut overnight lending rate to 2.45% from 4% to ensure “smooth functioning of the money markets” (before Fed moves)

Parliament:

– Approved measures like reduction of commercial registration fees as well as labour & utility charges for 6 months

Cabinet authorised the finance minister to directly withdraw funds with a 5% ceiling from the public account

Bahrain will not collect rents and allowance from all tenants of municipal properties for three months starting from Apr

|

– All non-essential medical services resume operations

– Shops and industrial enterprises opened on May 7; restaurants remain closed still for dine-in customers

– Plans to resume Friday prayers postponed

– Schools scheduled to reopen in Sep

– Bans public gatherings of more than 5 individuals

– Bahrain will allow passengers to transit through the international airport; entry into the country will be limited to only citizens; mandatory 14-day self-isolation

|

|

Kuwait

|

| Economic & Financial |

Health & travel-related |

|

Central bank:

– Reduced the discount rate to 1.5% (from 2.5%) a record-low

– Reduced liquidity and capital adequacy requirements for banks & cut risk weighting for SMEs (estimated to raise bank lending by USD 16bn)

– Domestic banks will defer payment of consumer & SME loans and financing, credit card instalments for six months

Set up a KWD 10mn (USD 33mn) fund, to be financed by Kuwaiti banks

Government authorized additional funding of KWD 500mn (USD 1.5bn) to ministries and state agencies for fight against Covid19

Suspended fees on point of sales devices and ATM withdrawals + increased the limit for contactless payments to KWD 25 from KWD 10

The Kuwait Fund for Arab Economic Development pledged almost USD 95mn to support government efforts

|

– Kuwait eases “total curfew” to between 7pm to 5am; lockdown on Hawally area has been lifted

– Parliament suspended for 2 weeks (from Jun 18); public sector employees not be allowed to return to offices from this week (starting Jun 21)

– Expiring residence permits/ visas expiring in Jun extended for 3 months

– Closed schools, shopping centres, cinemas, wedding halls & children’s entertainment

– Halted ALL commercial passenger flights

– All educational institutions in Kuwait will reopen on 4th Aug

|

|

Oman

|

| Economic & Financial |

Health & travel-related |

|

CB announces a $20bn incentive package

– Repo rate cut by 75bps to 0.5%;

– Reduce Capital Conservation Buffers for banks to 1.25% from 2.5%;

– Lending Ratio / Financing Ratio for lenders increased to 92.5% up from 87.5%

– banks and financial institutions to freeze repayments of personal and housing loans for three months, effective from May

– Reduce existing fees related to banking services + avoid introducing new fees

Finance ministry slashed approved budgets of civil, military and security agencies by 5%

All government companies have to reduce approved expenditures for 2020 by 10% + no execution of new projects or capital expenditures for the year; all exceptional bonuses for state employees would be halted

Other measures include tourism & municipality tax breaks, free government storage facilities and postponement of credit instalment payments

|

– Lockdown in Muscat ended; Dhofar Governorate in Oman closed from 12 noon of June 13 until July 3 for tourism

– At least 50% of employees in government entities will work from the offices starting May 31

– Oman has closed its borders; all domestic and international flights to and from airports suspended from 12 noon of Mar 29

– Covid-19 tests and treatments will be done for free for all communities

– Suspend issuance of tourist visas; will not allow cruise ships to dock at its ports during this period

– Schools closed; all public parks closed, public gathering prohibited, Friday prayers at mosques suspended; limited staffing at estate entities

– Few shops in Oman (consulting, law, audit firms, flower shops, boutiques etc) to reopen

– Restrictions are still in place on gatherings (of more than 5 individuals) on beaches and other public places

|

|

Qatar

|

| Economic & Financial |

Health & travel-related |

|

A $23.3bn stimulus package

– QAR 75bn ($20.6bn) to provide financial + economic incentives for private sector

– CB to put in place an appropriate mechanism to encourage banks to postpone loan installments and obligations of the private sector with a grace period of 6 months

– Qatar Development Bank to postpone installments for all borrowers for 6 months

– Qatar’s government entities directed to reduce costs for non-Qatari employees by 30% as of Jun 1 (either pay cuts or layoffs)

– Directing govt funds to increase investments in the stock exchange by QAR 10bn ($2.75bn)

– Exempting food & medical goods from customs duties for 6 months

– Utilities bill exemption for SMEs, affected sectors; rent exemption for 6 months

|

– Four-phased recovery programme planned: Mosques to reopen Jun 15th, restaurants to partially reopen (Jul 1)

– All international flights suspended from Mar 18; cargo aircraft, transit flights exempt; travel ban on all travelers except Qatari nationals

– Qatar Airways grounds its A380 fleet; to temporarily reduce 40% of staff (in food and beverage, retail & ground staff) at Hamad Airport

– Educational institutions closed; parks and public beaches closed

– Bans social gatherings; introduces enforcement measures: checkpoints and mobile police patrols

– Private sector companies instructed to have 80% of their staff work from home, effective Thurs (Apr 2) for an initial 2 weeks

– Public transport modes have been stopped

– 6 tonnes of aid sent to Iran (medical equipment & supplies); donating $150mn in aid to Gaza

|

|

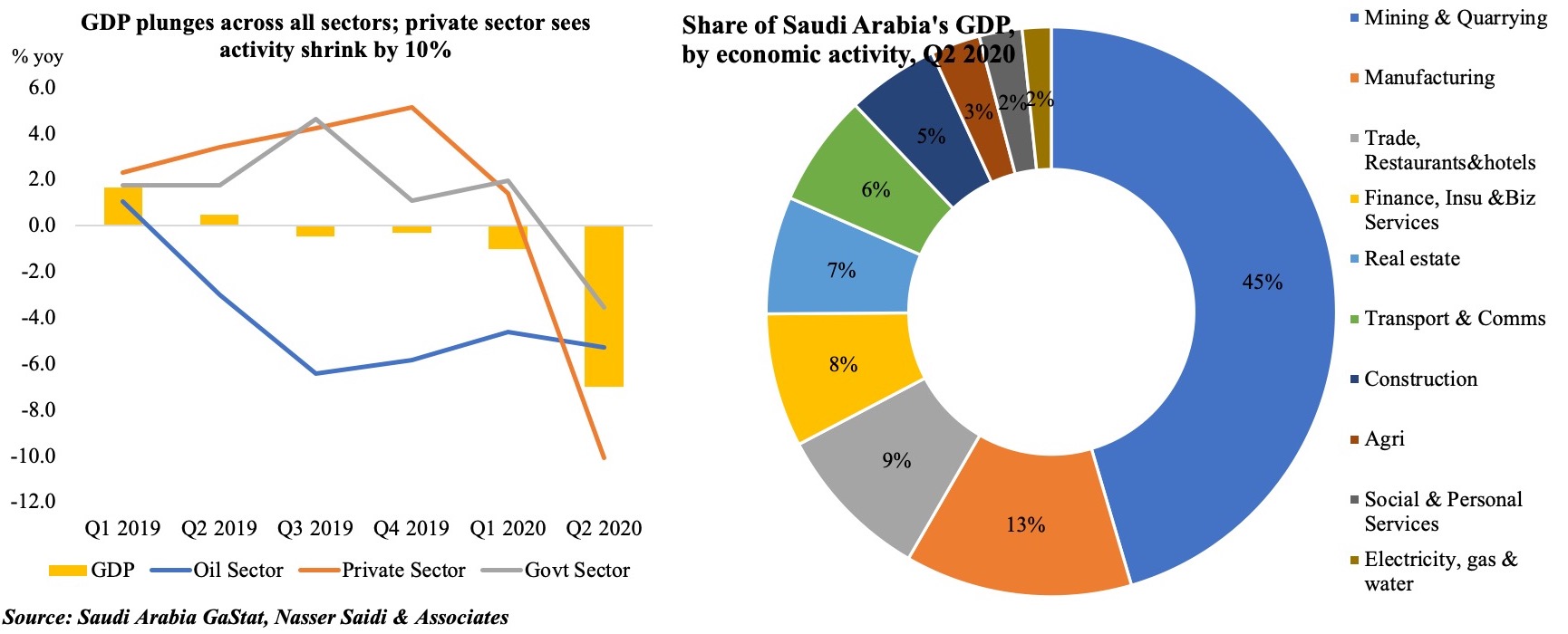

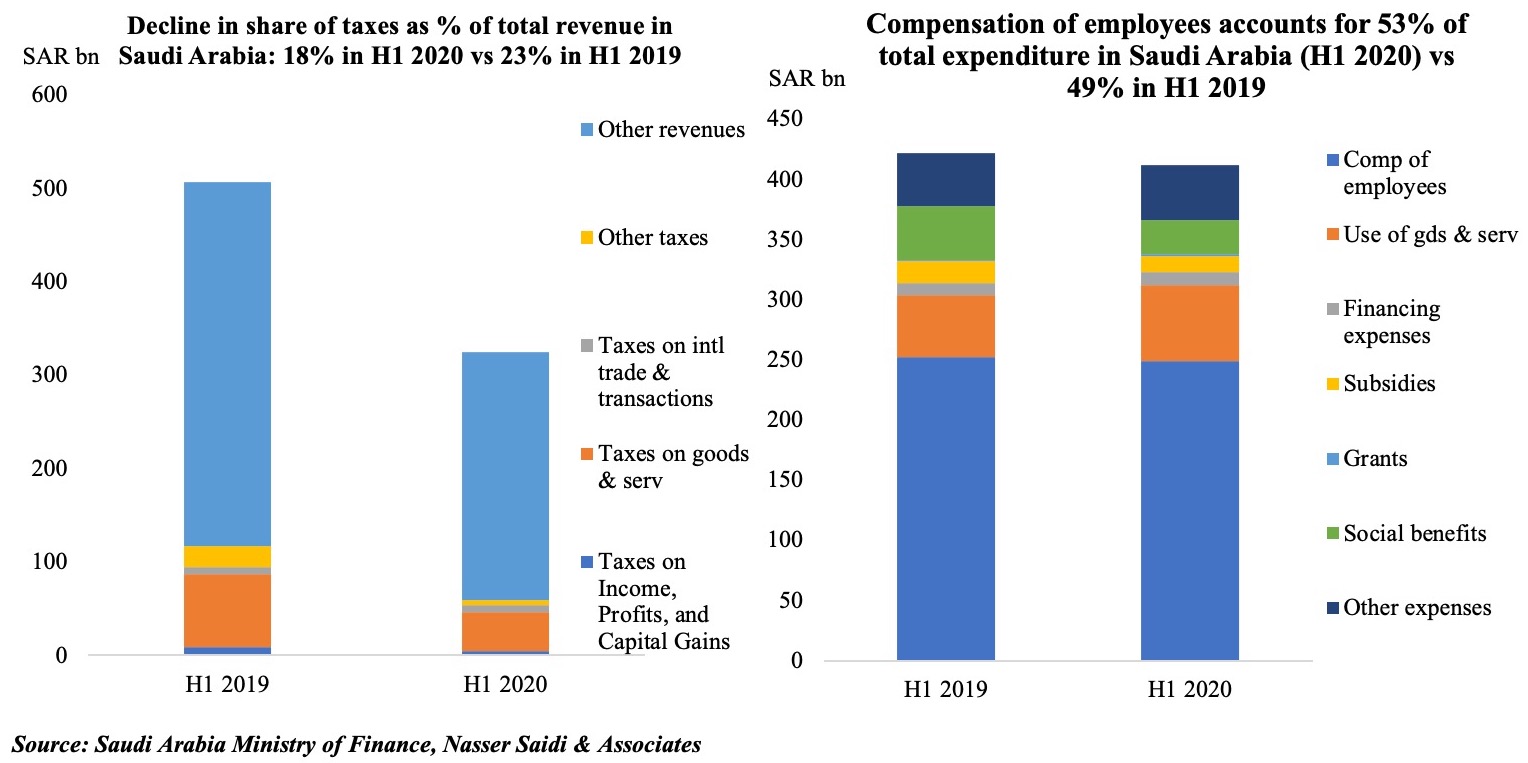

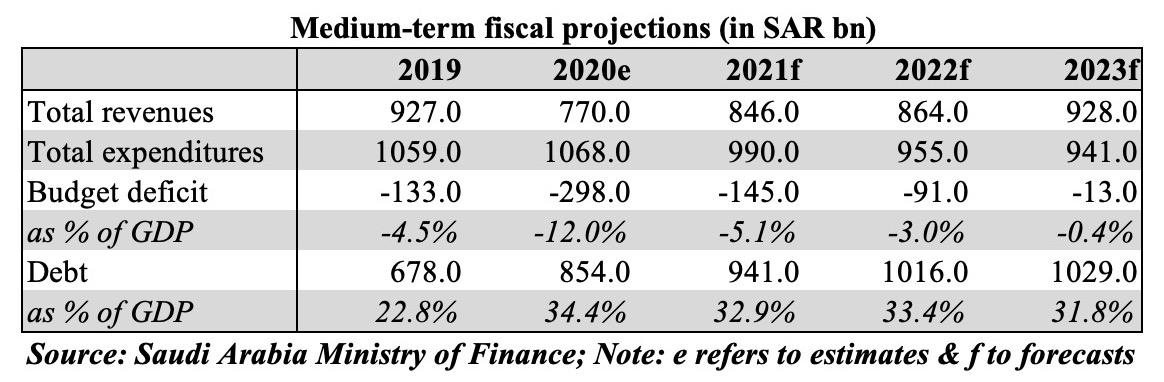

Saudi Arabia

|

| Economic & Financial |

Health & travel-related |

|

– SAR 120bn worth measures to support the pvt sector including postponement of VAT/ excise/ income tax/ Zakat payments, exemptions of govt dues etc

– SAMA’s SAR 50bn stimulus package: financing support for SMEs (including deferred loan payments, concessional loans) and coverage of points of sale & e-commerce fees

– SAMA’s measures for supporting & financing the private sector: adjusting or restructuring the current funds without any additional costs or fees + reviewing reassessment of interest rates and other fees on credit cards + refunding travel-related forex transfer fees

– SAR 7bn allocated to Health Ministry in addition to the SAR 8bn package earlier + SAR 32bn approved for healthcare facilities

– Government will cover 60% of private sector salaries (of Saudi citizens) hit by Covid-19; first payment to be send on May 3.

– Will allow private businesses (affected by Covid19) to reduce working hours and permit wages to be reduced by not more than 40%

– Additional set of measures announced: SAR 50bn to accelerate payment of private sector dues & provide liquidity to several sectors while a further SAR 47bn was set aside for the health sector

– Saudi Industrial Development Fund revealed a SAR 3.7bn (USD 3.62bn) stimulus package for industrial sector companies

– Initiatives to reduce private sector’s burdens related to manpower: e.g. lifting halts on non-payment of fines, fines related to workers recruitment etc.

– Saudi Arabia will cut SAR 50bn (USD 13.32bn or less than 5%) of the 2020 budget; cost of living allowance scrapped

– VAT to be tripled to 15% starting 1st Jul

– Land borders with UAE, KW, Bahrain closed except for commercial trucks; shipping services suspended from 50 countries; cargo traffic not affected

|

– Restrictions eased across the nation: Saudi Arabia initiates the 3rd phase of its recovery plan by opening most commercial activities from Jun 20. Mosques in Makkah are also set to reopen with social distancing measures in place.

– Domestic flights resume; intl passenger flights still suspended + workplace attendance in both public and private sectors

– Malls reopen with multiple safety measures

– Mosques reopened with restrictions; Umrah pilgrimages to Mecca & Medina under a temporary ban

– Capital Markets Authority urged shareholders & invested in listed companies to vote electronically in upcoming meetings; Tadawul reduces trading hours

|

|

United Arab Emirates

|

| Economic & Financial |

Health & travel-related |

|

UAE announces a 2-phase recovery plan: short-term gradual re-opening (includ the AED 282.5bn stimulus) + focus on sectors “with high potential” in the long-term (AI, 5G, IoT, Blockchain, RE, EVs, 3D printing, robotics…)

Central bank:

– AED100bn stimulus to facilitate temporary relief on private sector loans & promote SME lending; support also the real estate sector

– 50% reduction in reserve requirements for demand deposits to 7% (releasing ~ USD 16.6bn in liquidity)

– Banks to reschedule loans contracts + grant deferrals on monthly loan payments (till end-2020) + reduce fees and commissions

UAE Cabinet: additional AED 16bn stimulus to reduce cost of doing business, support small business, accelerate implementation of govt infrastructure projects

Ministry of Economy reduced fees of 94 services

Dubai: AED 1.5bn stimulus package to support businesses affected by Covid19 including 10% reduction in utilities bills

Abu Dhabi: AED 5bn in utilities subsidies; free road tolls till end-2020, 20% rebate on rental values for restaurants + tourism & entertainment sectors (+ faster implementation of Ghadan-21 initiatives)

Dubai Freezones launch stimulus package: rents postponed for six months; cancellation of fines; free movement of labour with temporary contracts

Federal Tax Authority extends the Excise Tax return submission deadline for March and April 2020 to May 17, 2020

|

– Varied restriction across emirates: Abu Dhabi imposes movement ban from/to the emirate till Jun 23rd;

– Easing of restrictions: mall capacity increased; restaurants, gyms, beaches, museums reopen.

– Dubai permits shopping malls and private businesses to operate at full capacity

– Metro services re-open; buses and taxis are operational

– 30% of federal employees return to work from May 31; full capacity in Dubai’s govt offices & 30% in Sharjah’s govt offices from Jun 14

– Curfews reduced to between 10pm-6am; in Dubai from 11pm to 6am

– Entry for residents overseas to start from Jun 1; temporary ban to issue new visas

– All inbound, outbound and transit flights suspended from Mar 25; Emirates bookings are open from Jul 1 for 12 Arab nations; UAE airports welcome transit passengers.

– Schools to be closed till end-Jun; distance learning extended. Schools will reopen in Sep, though discussions ongoing regarding the method of learning in the 2020-21 academic year.

– Mosques, churches and other places of worship remain closed

– Opened, with social distancing measures: public parks, beaches, cinemas, gyms

– Supporting others: Sends 2 batches critical medical aid to Iran in Mar + flew 215 people from different countries out of Wuhan to Abu Dhabi’s Emirates Humanitarian City

|

Map: Number of Confirmed Covid19 cases by country (Source: Johns Hopkins University)

google.charts.load('current', {

'packages':['geochart'],

// Note: you will need to get a mapsApiKey for your project.

// See: https://developers.google.com/chart/interactive/docs/basic_load_libs#load-settings

'mapsApiKey': 'AIzaSyA4Q3e-hV2dI5w-sv8d4jG0V2jS1dXidTM'

});

google.charts.setOnLoadCallback(drawRegionsMap);

function drawRegionsMap() {

var data = google.visualization.arrayToDataTable([

['Country', 'Confirmed cases'],

['Bahrain', 21331],

['Kuwait', 39145],

['Oman', 29471],

['Qatar', 86488],

['Saudi Arabia', 154233],

['Lebanon', 1536],

['Iraq', 29222],

['Jordan', 1015],

['United Arab Emirates', 44533],

['Syria', 204],

['Iran', 202584],

['West Bank & Gaza', 448]

]); var options = {

region: '145', // Middle East

colorAxis: {colors: ['#00853f', 'black', '#e31b23']},

};

var chart = new google.visualization.GeoChart(document.getElementById('regions_div')); chart.draw(data, options);

}

google.charts.load('current', {

'packages':['geochart'],

// Note: you will need to get a mapsApiKey for your project.

// See: https://developers.google.com/chart/interactive/docs/basic_load_libs#load-settings

'mapsApiKey': 'AIzaSyA4Q3e-hV2dI5w-sv8d4jG0V2jS1dXidTM'

});

google.charts.setOnLoadCallback(drawRegionsMap); function drawRegionsMap() {

var data = google.visualization.arrayToDataTable([

['Country', 'Confirmed cases'],

['Algeria', 11631],

['Morocco', 9957],

['Tunisia', 1156],

['Djibouti', 4565],

['Libya', 544],

['Sudan', 7007],

['South Sudan', 1882],

['Iran', 202584],

['Egypt', 53758],

['Syria', 204],

['Yemen', 922]

]); var options = {

region: '015', // North Africa

colorAxis: {colors: ['#00853f', 'black', '#e31b23']},

};

var chart = new google.visualization.GeoChart(document.getElementById('regions_div2')); chart.draw(data, options);

}

google.charts.load('current', {

'packages':['geochart'],

// Note: you will need to get a mapsApiKey for your project.

// See: https://developers.google.com/chart/interactive/docs/basic_load_libs#load-settings

'mapsApiKey': 'AIzaSyA4Q3e-hV2dI5w-sv8d4jG0V2jS1dXidTM'

});

google.charts.setOnLoadCallback(drawRegionsMap); function drawRegionsMap() {

var data = google.visualization.arrayToDataTable([

['Country', 'Confirmed cases'],

['Iran', 202584],

['Syria', 204],

['Afghanistan', 28833]

]); var options = {

region: '034', // SAsia

colorAxis: {colors: ['#00853f', 'black', '#e31b23']},

};

var chart = new google.visualization.GeoChart(document.getElementById('regions_div3')); chart.draw(data, options);

}

Middle East

North Africa

Iran & Afghanistan