Price Pressures Ease as Growth Engines Strengthen Across the Gulf: Weekly Insights 16 Jan 2026

Price Pressures Ease as Growth Engines Strengthen Across the Gulf: Weekly Insights 16 Jan 2026

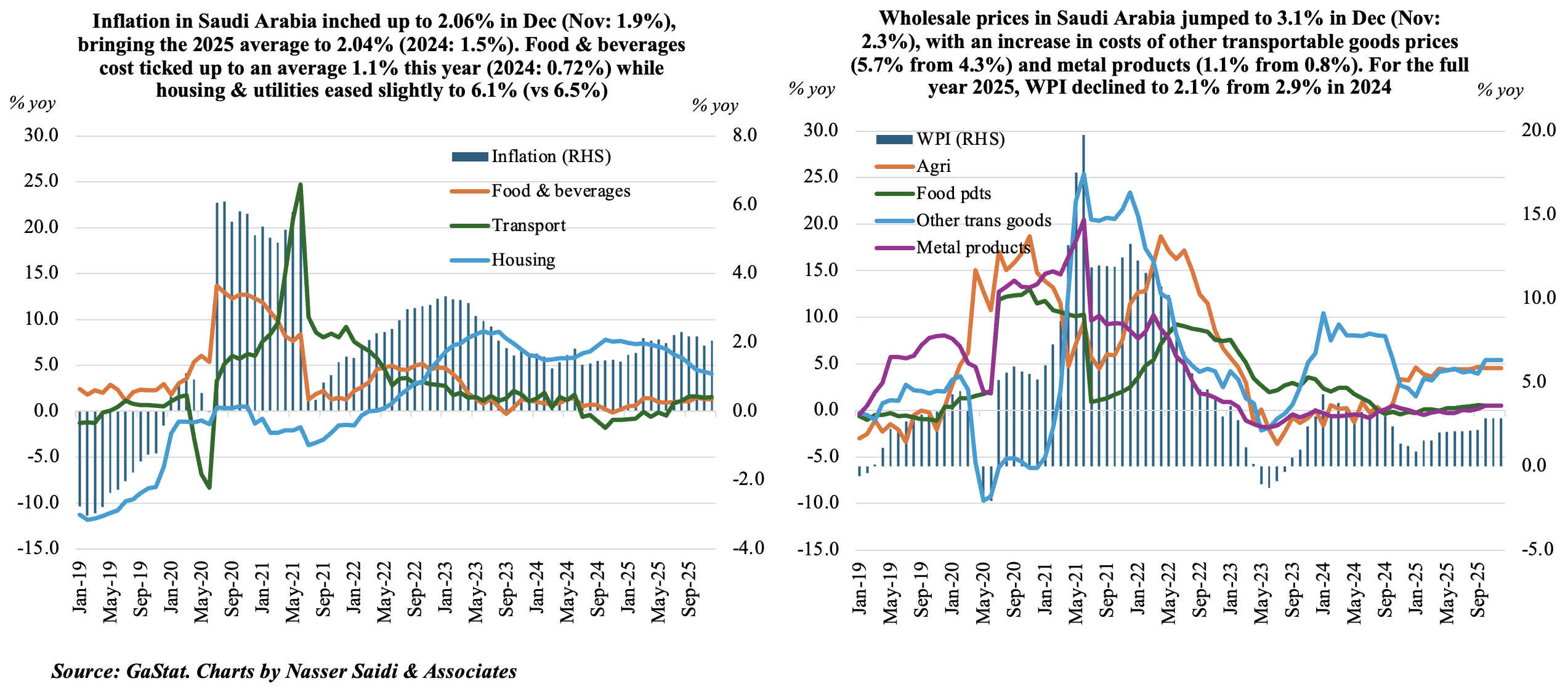

1. Consumer price inflation in Saudi Arabia ticked up to an average 2.0% in 2025 vs 1.5% in 2024; wholesale prices eased to 2.1% in 2025 (vs 2.9%)

- Saudi Arabia’s CPI ended the year posting a gain of 2.1% in Dec (Nov: 1.9%), driven by the high housing & utilities costs (4.1% in Dec) which in turn was due to the 5.3% gain in actual rental costs. Food & beverages inflation stood at a relatively unchanged 1.3% in Dec though upticks were evident in recreation, sport & culture (2.4% vs 1.3% in Nov) as well as personal care, miscellaneous goods & services (7.0% vs 6.6%). These reflect cost pressures in non-tradable sector – including rising wages and administrative costs, as mentioned in the PMI responses.

- CPI averaged 2.04% in 2025 vs 1.5% in 2024, with housing costs continually a major contributor (6.1% in 2025). Increases were noted across food & beverages (1.1% vs 0.7%), transport (0.45% vs 0.22%) and recreation & culture (2.6% vs 0.8%); average prices of personal care, miscellaneous goods & services more than doubled (5.11% from 2.32%).

- Wholesale prices in Saudi Arabia jumped sharply to 3.1% in Dec (Nov: 2.3%), with the monthly gain of 1.0% – the most since Jan 2025. However, the pressure is concentrated in specific sectors – prices of other transportable goods jumped to 5.7% (Nov: 4.3%) as did metal products (1.1% from 0.8%); deflation continued in ores & minerals for the 29th consecutive month. Overall uptick indicates upstream price pressures ahead for retail.

- Average wholesale prices tumbled to 2.1% for the full year 2025 (2024: 2.9%), as prices of “other transportable goods” plunged (4.1% vs 7.2%), in addition to food products (0.3% vs 1.0%); costs of agriculture & fishery surged (4.1% from 0.5%).

- 2026 outlook: Continued fiscal discipline, monetary stability, and gradual cost pass-through of utility & housing adjustments should keep CPI moderate, around or below 2% in 2026. Labour market and wage adjustments could feed into service prices.

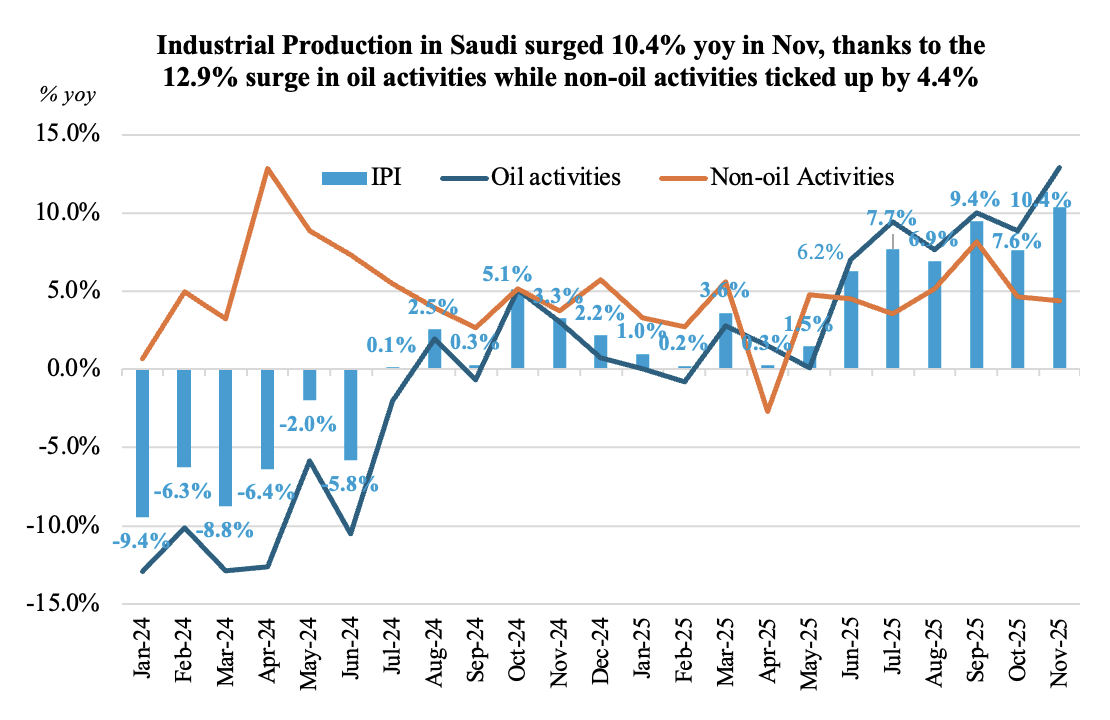

2. Robust industrial momentum: Saudi IP grew 10.4% yoy in Nov 2025

- Industrial production in Saudi Arabia grew by 10.4% yoy in Nov, the fastest annual growth since Oct 2022. Oil activities accelerated by 0.4% mom and 12.9% yoy, as crude oil production rose (around 10.1mn barrels per day in Nov vs 8.9mn bpd a year ago). Extraction of crude petroleum & natural gas grew by 12.6% yoy, the 8th straight month of upticks.

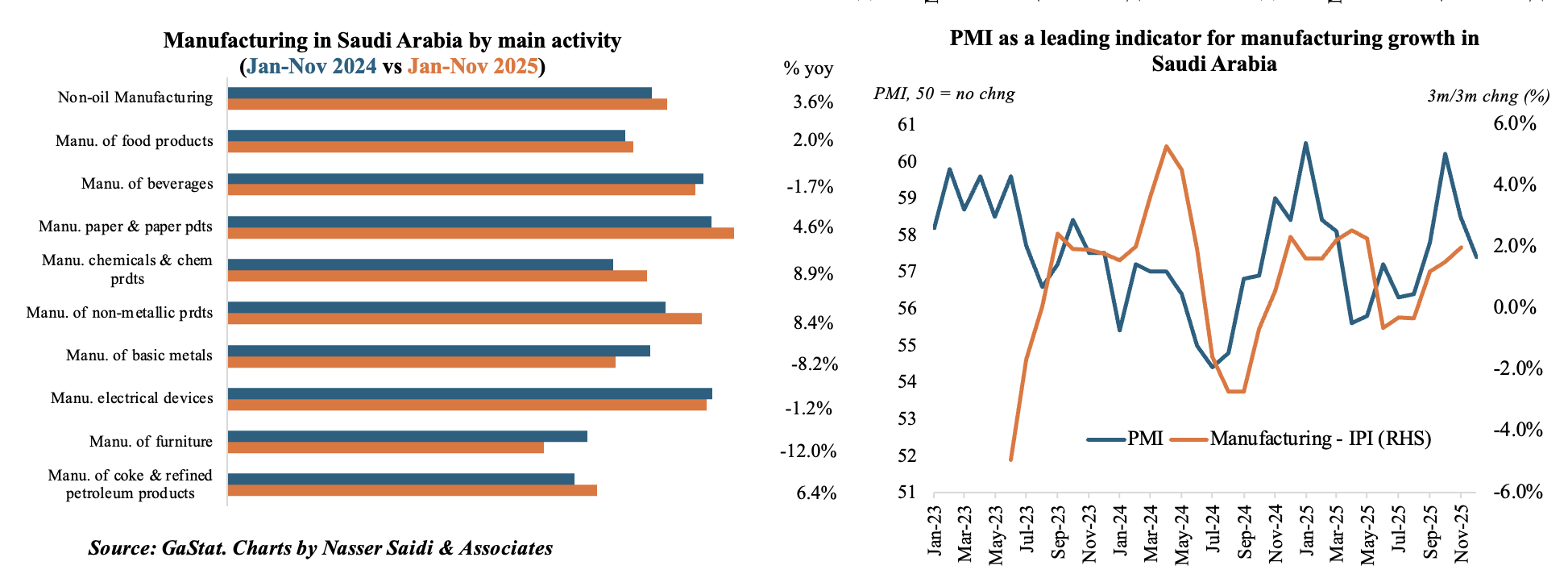

- Non-oil activities increased by 4.4% yoy in Nov (Oct: 4.7%). Within manufacturing, manufacture of chemicals & chemical products was the fastest growing (10.9% yoy) followed by paper & paper products (7.2%). In Jan-Nov, non-oil manufacturing ticked up by 3.6% yoy and manufacture of coke & refined petroleum products gained4%. Under non-oil manufacturing, chemicals & chemical products grew the fastest (8.9%).

- In Nov 2025, Saudi authorities issued 151 new industrial licenses & 93 new factories began production – underscoring ongoing industrial base expansion, a pipeline for growth and capacity increases and job creation in 2026. Non-oil PMI also indicates positive manufacturing sentiment heading into 2026, given increase in activity (upticks in output, new orders and employment).

- Infrastructure, logistics and sectors such as mining and EV-related materials can further nudge manufacturing activity.

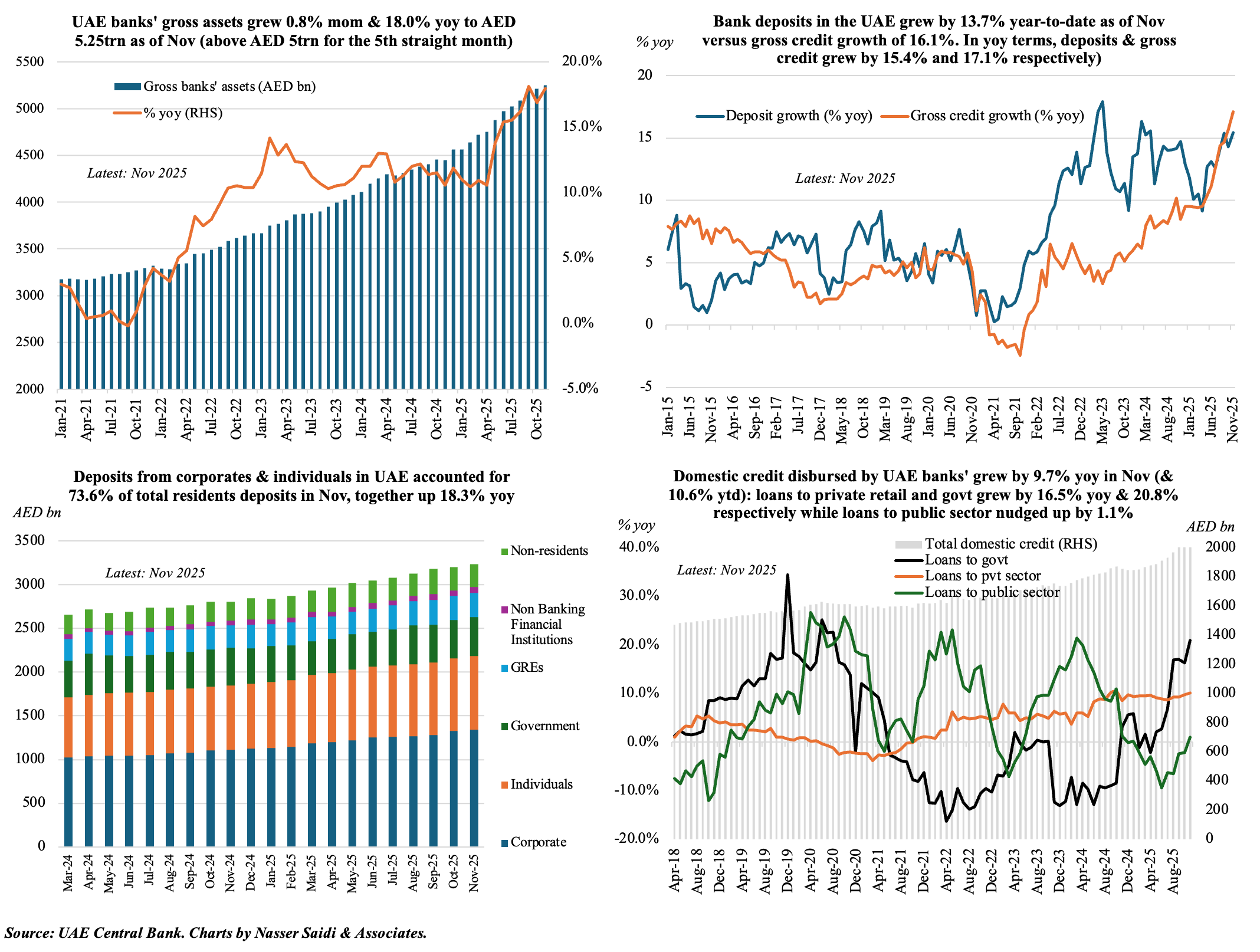

3. UAE deposit growth, at 13.7% year-to-date in Nov, outpaced domestic credit growth (10.6% ytd) but was lower than gross credit (16.1%, which includes foreign credit). Deposits grew thanks to resident private sector (17.4% ytd) while domestic credit was driven by upticks in retail private sector (15.7% ytd) & government (18.9% ytd).

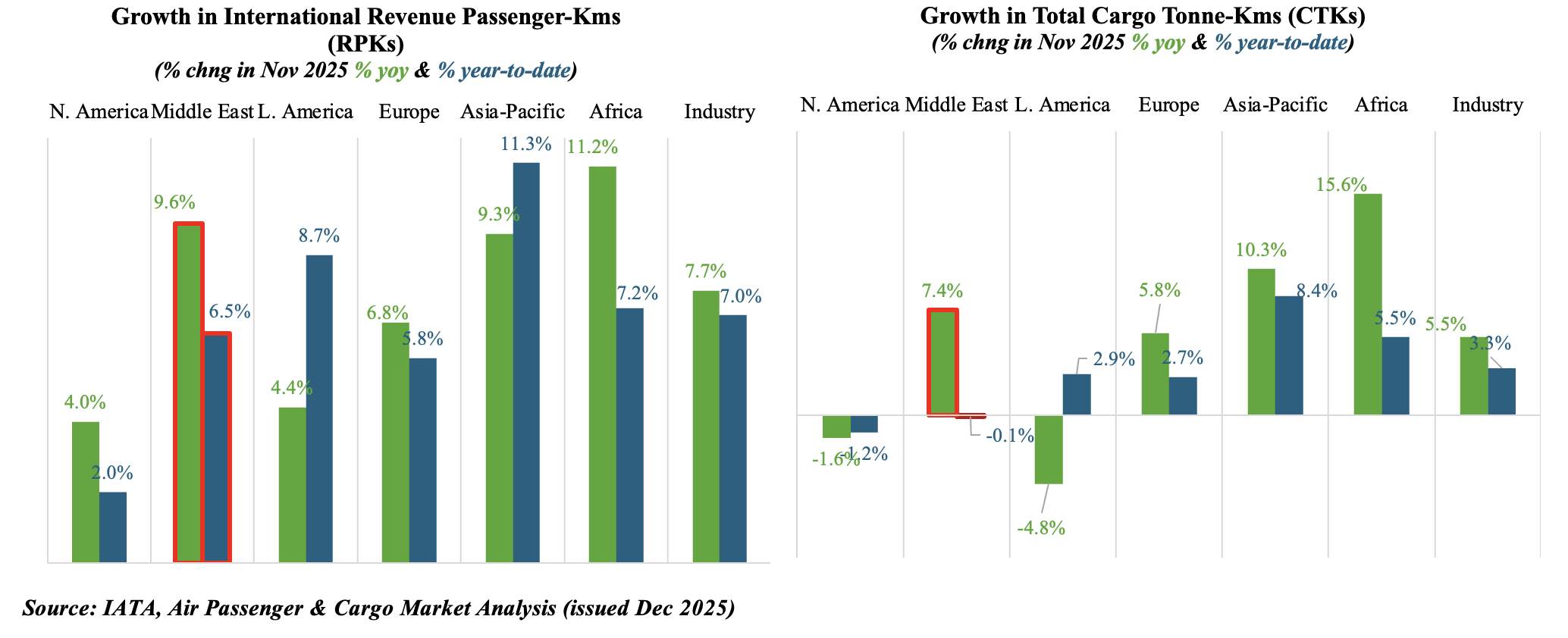

4. Middle East’s strong air passengers & cargo performance continues in Nov; robust growth expected in 2026

- International revenue passenger-kilometers (RPKs) growth in Nov (7.7% yoy) was driven by the Africa, Middle East and Asia-Pacific regions (11.2%, 9.6% and 9.3% respectively). The ME-Asia corridor continued to expand (up 10.5% in Nov, given the connectivity and growing demand) and while the ME-North America route grew by 3.3% (+1% mom) its capacity growth (5.6%) outpaced demand. Year-to-date gains in the Middle East was slightly muted (6.5% ytd vs industry average of 7.0%), underscoring impact from regional conflicts.

- Air cargo tonne-kms (CTKs) posted the second largest increase of this year – 5.5% yoy in Nov – and it is up 3.3% year-to-date. Middle East carriers’ cargo volumes grew by 7.4% in Nov but was down by -0.1% this year. The Middle East–Asia cargo corridor grew for the ninth month in a row (11.1%) and the Middle East-Europe trade route rebounded (5.4% yoy following a 0.7% contraction in Oct; but, ytd traffic remained 3.7% below last year’s level).

- Cargo volumes in 2025 benefitted from the front-loading of shipments ahead of Trump’s tariffs and growth is hence expected to moderate in 2026. IATA expects air cargo traffic to rise by 2.6%, thanks to “growing demand for high-value, time-sensitive goods, and the structural shift toward e-commerce”. IATA also forecasts a 4.9% yoy increase in passenger traffic in 2026, led by Asia-Pacific, which will also benefit the Middle East carriers. Middle East is also the region expected to post the highest profit margins given its hub-based networks and above average passenger growth. Geopolitical uncertainty, trade tensions, and regulatory costs remain key risks.

Powered by: