Markets’ Record Highs Amid Rising Geopolitical Fault Lines: Weekly Economic Commentary 12 Jan 2026

Download a PDF copy of the weekly economic commentary here.

Markets

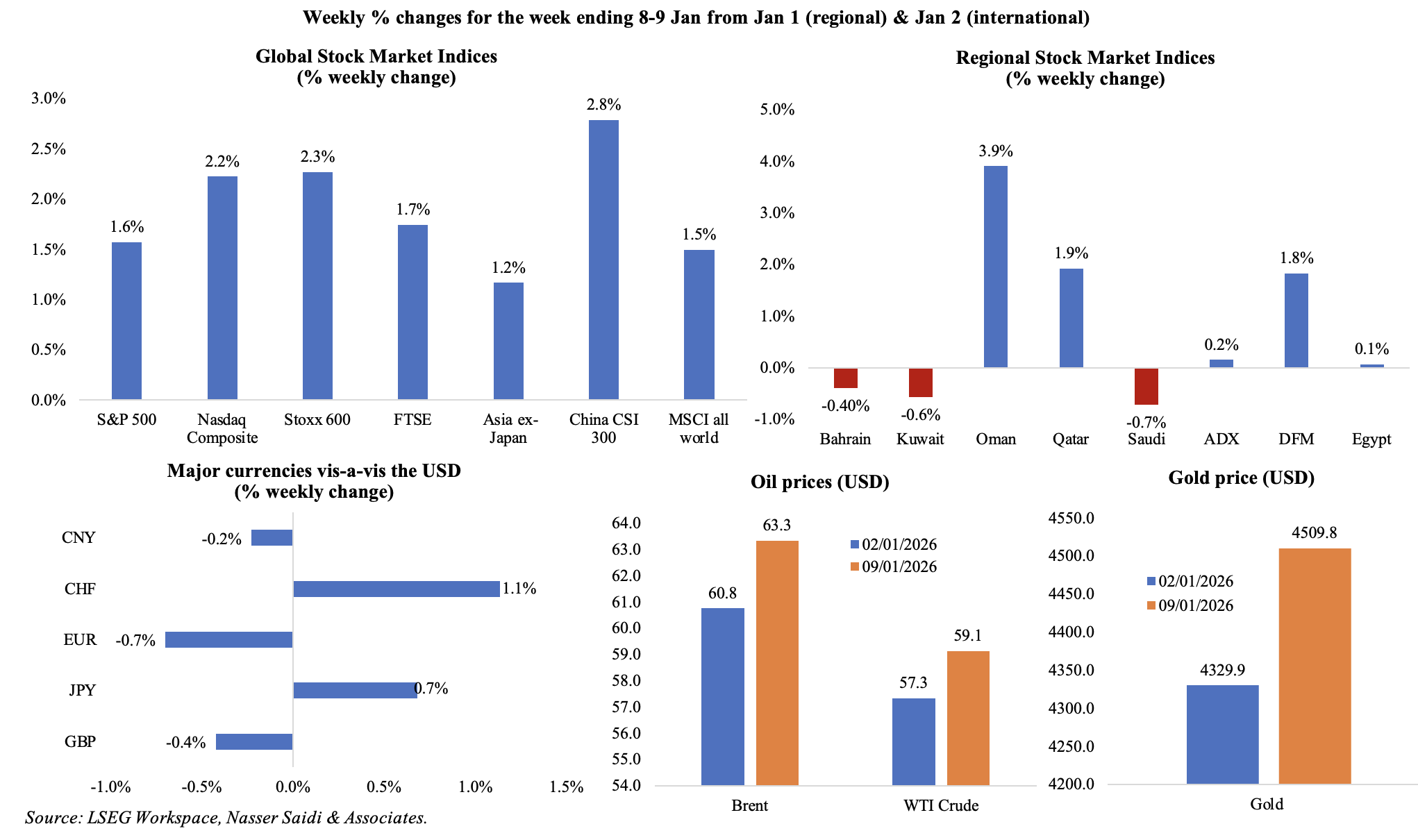

Major equity markets gained last week, many posting gains of more than 2.0%; S&P 500, European stocks as well as the FTSE clocked in record highs while China’s CSI 300 also performed well.Regional markets showed a mixed picture: Saudi markets posted a weekly loss despite the news about opening the markets up to foreign investors while Dubai’s index held near a 2008-high. The USD gained towards end of the week on slower-than-expected jobs growth; it also touched a one-year high vis-à-vis the JPY. Both oil and gold prices closed higher than the week before. Oil supply concerns are rising given the ongoing unrest in Iran and sanctions related to Russia while potential for oil production in Venezuela remains a question mark. Silver price gained almost 10% from the week before, supported partly by underlying industrial demand.

Global Developments

US/Americas:

- Non-farm payrolls in the US stood at 50k in Dec, lower than Nov’s downwardly revised 56k. Federal employment was little changed while gains were from food services and drinking places (27k), healthcare (21k) and social assistance (17k).Unemployment rate slipped to 4.4% (Nov: 4.5%) and labour force participation rate eased to 62.4% (from 64.5%). It was the weakest annual job growth since 2003 for the full year 2025, with just 584k jobs added.

- Non-farm productivity in the US grew by 4.9% qoq in Q3 (Q2: 4.1%), the fastest pace in two years, while unit labour costs fell by 1.9% (Q2: 1.0%). Output accelerated 5.4% (Q2: 5.2%) while hours worked went up 0.5%, following a 1% uptick the previous quarter.

- About 41k private sector jobs were added in the US in Dec, a rebound from Nov’s revised 29k loss. While the rebound is modest, it suggests that hiring conditions have stabilised after a soft patch, particularly in services-related sectors (39k in education and healthcare services and 24k in leisure and hospitality).

- JOLTS job openings fell to 7.146mn in Nov (Oct: 7.449mn), the lowest since Sep 2024. The data supports a soft-landing scenario.

- Initial jobless claims increased by 8k to 208k in the week ended Jan 3, with the 4-week average falling to 211,750 (prev: 219k). Continuing jobless claims also rose by 56k to 1.914mn in the week ended Dec 27.

- Factory orders in the US decreased by 1.3% mom in Oct (Sep: 0.2%), dragged down by airlines category. Shipments of core capital goods rose 0.8% (slightly up from the previously reported 0.7%). This decline underscores ongoing weakness in the manufacturing sector.

- Goods and services trade deficit narrowed to USD 29.4bn in Oct (Sep: USD 48.1bn), with goods trade deficit improved to USD 59.1bn (Sep: USD 78.3bn). The contraction reflects weaker import demand in goods and services (-3.2% to USD 331.4bn) alongside some resilience in exports (2.6% to USD 302bn), contributing positively to near-term GDP growth.

- Housing starts plunged by 4.6% mom to 1.25mn in Oct, with single-family units posting most gains (+5.4% to 874k) while multi-family homes plunged by 26%. Building permits declined by 0.2% mom to 1.412mn: in contrast to housing starts, the gains came from multi-family units (+0.4% to 481k) while single family units fell (-0.2% to 876k). Residential investment remains a drag on growth despite pockets of resilience.

- Michigan consumer sentiment index rose to 54.0 in Jan (Dec: 52.9), with gains concentrated among lower-income households.The one-year inflation expectation was steady at 4.2% (lowest since Jan 2025) and the five-year expectation rose to 3.4% (vs 3.2%).

- ISM manufacturing PMI declined to 47.9 in Dec (Nov: 48.2), the lowest since Oct 2024, despite new orders and employment rising to 47.7 (from 47.4) and 44.9 (from 44) respectively. Prices paid stayed elevated, unchanged at 58.5, suggesting cost pressures remain sticky.

- ISM services PMI increased to 54.4 in Dec (Nov: 52.6), rising for the third month in a row and clocking in the most since Oct 2024, as new orders rose (57.9 from 52.9) and employment expanded (52 from 48.9) while prices paid slowed (64.3 from 65.4).

Europe:

- Inflation in the eurozone eased to 2.0% in Dec (Nov: 2.1%), with services inflation posting the highest annual rate (3.4%) followed by food, alcohol & tobacco (2.6%) while energy prices fell (-1.9%). Core inflation slipped to 2.3% (from 2.4%).

- The eurozone services PMI moved lower to 52.4 in Dec (prelim: 52.6; Nov: 53.6), supported by domestic activity and employment growth while new export orders fell at the sharpest rate since Sep 2025. Composite PMI meanwhile slipped to 51.5 (from 51.9).

- Business climate in the eurozone improved in Dec (-0.56 from -0.66). Consumer confidence dipped to -13.1 (from a revised -12.8) while in the broader EU it held steady at a still negative -12.5. Economic sentiment indicator edged lower to 96.7 in Dec from Nov’s 31-month high reading of 97.1; sentiment fell in Germany (-1.1), France (-0.9) and Italy (-0.6) while Netherlands recorded a gain of 0.5.

- Producer price index in the euro area fell 1.7% yoy in Nov (Oct: -0.5%), the fourth consecutive month of yoy decline. In monthly terms, prices were up 0.5% (from 0.1%).

- Retail sales in the eurozone grew by 0.2% mom and 2.3% yoy in Nov (Oct: 0.3% mom and 1.9% yoy).

- Harmonised index of consumer prices in Germany was 0.2% mom and 2.0% yoy in Dec (Nov: -0.5% mom and 2.6% yoy). This was the lowest yoy reading since Jul.

- Exports from Germany unexpectedly fell by 2.5% mom in Nov (Oct: 0.1%): exports to other EU countries and the US fell by -4.2% mom while non-EU exports fell by 0.2%. Imports into Germany grew by 0.8% (Oct: -1.2%) and trade surplus narrowed (EUR 13.1bn vs Oct’s EUR 16.9bn). German exports to China increased by 3.4% while imports were up 8.0%.

- German factory orders suddenly increased by 5.6% mom and 10.5% yoy in Nov (Oct: 1.6% mom and -0.7% yoy); this was driven by large-scale orders. Industrial production recorded a gain of 0.8% in both monthly and annual terms (Oct: 0.1% mom and -1.2% yoy), rising for the third time in a row in monthly terms.

- German retail sales fell by 0.6% mom in Nov, the first mom dip since Aug and reversing Oct’s 0.3% gain; in annual terms, sales grew by 1.1% in Dec (Nov: 1.6%) while in the full year 2025 sales increased by 2.4%.

- German services PMI eased to 52.7 in Dec (Nov: 53.1) on a slower increase in new business while employment posted a modest increase and input prices rose the quickest in 10 months.

- Unemployment rate in Germany was unchanged at 6.3% in Nov: employment mostly stagnated and hiring demand was subdued. In the eurozone, unemployment rate slipped to 6.3% (from 6.4%).

Asia Pacific:

- Inflation in China rose 0.2% mom and 0.8% yoy in Dec (Nov: -0.1% and 0.7% yoy). The yoy rise was at a 34-month high in Dec while the full year CPI was the lowest since 2009 (on weak domestic demand). Producer price index fell 1.9% yoy (Nov: -2.2%), staying negative for the 39th consecutive month; for the full year 2025, producer prices shrank 2.6%.

- China’s services PMI eased slightly to 52 in Dec (Nov: 52.1), as new orders and business activity rose at their weakest pace in six months and employment fell for the fifth straight month. The rate of inflation was among the highest seen in 2025 while business sentiment rose to a 9-month high.

- Japan’s manufacturing PMI inched up to 50 in Dec (prelim: 49.7 & Nov: 49.7), the highest since Jun, on stable output and higher employment while new orders fell at the softest rate since May 2024 and input prices jumped to an 8-month high.

- Labour cash earnings in Japan grew by 0.5% yoy in Nov (Oct: 2.6%), rising for the 47th month in a row. Real wages fell 2.8% yoy, marking the 11th consecutive month of decline.

- Leading economic index in Japan increased to 110.5 in Nov (Oct: 109.8), the highest since May 2024, while the coincident index slipped to 115.2 (from a 4-month high of 115.9).

- Japan’s consumer confidence index declined to 37.2 in Dec (from Nov’s 19-month high of 37.5). The decline was broad-based: overall livelihood (35.9 from Nov’s 36.2), employment outlook (41.5 from 41.7), and willingness to buy durable goods (30.2 from 30.9).

- Overall household spending in Japan grew by 2.9% yoy in Nov, the largest increase since May and reversing Oct’s 3.0% decline. Spending increased in food (0.9%), furniture & household items (10.6%), transport & communication (20.4%) and culture & recreation (2.2%) while declines slowed in housing (-1.8%) and fuel & utilities (-1.2%).

- India’s services PMI slipped to 58 in Dec (prelim: 59.1; Nov: 59.8), the least since Jan, as both new business and output clocked in 11-month lows and employment fell for the first time since May. Business sentiment dipped to the lowest in almost 3.5 years.

- Singapore retail sales were flat in Nov but grew by 6.3% yoy (Oct: 4.4%), with the recreational goods sector performing best (sales up 13.9% yoy) while food & beverage services rose 2.5%.

Bottom line: On the heel of developments in Venezuela come threats from the US towards Greenland (stating it needs to control the island for national security purposes) and Iran (intervention given the ongoing unrest); the US President also threatened military action against drug cartels (specifically mentioning Mexico, Cuba and Colombia). On the domestic front, a criminal investigation into Fed Chair Powell calls into question (once again) the independence of the Fed in coming months. All these geopolitical concerns are likely to support performance of assets such as gold, silver and US Treasuries, but a further breakdown of relations with the US (if there are more military confrontations) could present trouble for the status of the US dollar. This week’s major data releases are US inflation (key for the next Fed meeting), China’s trade (continued exports growth is widely expected) and UK GDP (relatively low given weak domestic demand in the backdrop of high borrowing costs and taxes).

Regional Developments

- Bahrain’s economy expanded by 4.0% yoy in Q3 2025 (Q2: 2.5%), underpinned by broad-based gains across both oil and non-oil sectors (9.3% and 3.5% respectively), with particularly strong contributions from real estate (5.4%), financial services (5.0%), and transport (4.4%). The data indicate sustained albeit moderate diversification away from hydrocarbon dependence; the recently unveiled targeted fiscal reform package to strengthen public finances will reduce over-reliance on oil revenues and attract / boost investments. Continued non-oil activity, infrastructure investment and financial sector development will support growth.

- Egypt’s PMI clocked in at 50.2 in Dec, a second consecutive month of non-oil private sector expansion, driven by rising output and new orders, though growth eased from Nov’s 61-month high of 51.1. This suggests emerging momentum in the non-oil economy, albeit with ongoing caution in hiring (reduction was sharpest in 13 months) while input cost inflation was subdued.

- The Ministry of Finance forecasts Egypt’s real GDP growth to accelerate to about 5.0% in 2025-26, 5.3% in 2026-27 and 6.2% by fiscal year 2029-30, underpinned by industrial expansion, infrastructure investment, resilient tourism, and enhanced export competitiveness, alongside ongoing macro-stabilization policies and fiscal consolidation. The medium-term strategy emphasises non-oil sectors as key engines of growth, aiming to reduce the debt-to-GDP ratio and attract private and foreign investment.

- Headline inflation in Egypt slowed sharply to 10.3% yoy in Dec, roughly half the rate recorded a year earlier, driven primarily by declining food prices (-0.8% mom). This marked slowdown can ease cost-of-living stresses, bolster real incomes and support consumption.

- Egypt’s five-year sovereign credit default swap (CDS) spreads declined to below 270bps on Jan 6th, the lowest levels since 2020, reflecting improved market perceptions of credit risk amid policy reforms, stabilising macroeconomic indicators, and strengthened external buffers. This decline signals rising investor confidence in Egypt’s debt sustainability, potentially lowering funding costs for government and corporates.

- The Suez Canal Economic Zone in Egypt posted a 55% increase in revenues in the first five months of the 2025-26 fiscal year (Jul-Nov), significantly outpacing budget forecasts (by 43%) and reflecting strong performance in industrial, logistics, and port operations. The zone also secured over USD 5.1bn in investments across 80 new projects during this period and approved ten new industrial projects (with a combined investment of USD 271.1mn).

- Remittance inflows into Egypt recorded a sharp 42.5% yoy increase to USD 37.5bn in the Jan-Nov period, providing a substantial boost to foreign exchange earnings and external account resilience. In Nov alone, remittances surged by 39.9% to USD 3.6bn.

- Egypt signed two MoUs with Syria to supply gas for power generation and meet Syria’s petroleum product needs, leveraging Egypt’s LNG and transmission infrastructure. The agreements highlight Cairo’s strategic role in Eastern Mediterranean energy corridors, although material volumes and commercial terms remain to be clarified.

- Kuwait’s non-oil private sector showed robust momentum at end-2025, with the PMI rising to 54.0 (Nov: 53.4) signalling the fastest output growth in seven months and a strong rise in new orders (35th month in a row) driving business optimism to the highest since survey began in 2018. The sustained expansion and hiring signal resilient domestic demand, though inflationary pressures warrant close monitoring (output prices rose the fastest since Mar 2024).

- Since 2000 Kuwait’s oil production costs have risen more than twelve-fold – to USD 14.6 in 2025-26 from historically low levels of USD 1.2 a barrel in 2000. This has squeezed net revenues (it fell more than KWD 3bn between 2022 and 2025) despite remaining among the lowest oil production costs globally. Rising operating costs, linked to ageing fields and technical challenges could strain fiscal buffers and temper the attractiveness of future upstream investments if not addressed.

- Lebanon’s cabinet announced a gas exploration agreement with a consortium led by QatarEnergy (30% operating stake), TotalEnergies (35%) and ENI (35%) to pursue hydrocarbon prospects in offshore Block 8. While exploration success is far from assured, this represents a strategic attempt to leverage natural resources to ease severe economic pressures and liquidity shortages.

- Lebanon’s central bank announced legal actions to recover misappropriated public funds linked to former officials and intermediaries, aiming to restore depositor confidence amid the ongoing financial crisis.

- Surging global gold prices have resulted in a near USD 10bn increase in Lebanon’s central bank foreign assets (to USD 41.7bn at end-Jun 2025 from USD 31.5bn at end-Jun 2024), reflecting the bulk of the rise while non-gold reserves also posted modest gains. Lebanon’s central bank has pushed back on proposals to sell gold reserves to fund deposit repayment, emphasising it being “fairly asset-rich” and legal constraints on liquidating bullion as part of the recovery plan. This stance, even as gold values have surged, reflects a strategy to preserve confidence in reserves and balance-sheet credibility while negotiating structured repayments with banks and depositors.

- The BLOM Lebanon PMI continued to record expansionary readings for the fifth month in Dec 2025 (51.2 from Nov’s 51.3), underpinned by domestic demand, rising output and new orders; new export orders however slipped back into contraction.

- Oman approved the creation of an independent international financial centre with “legislative, administrative and regulatory independence”, to enhance its attractiveness to global capital and increase diversification efforts. No further details or timing were revealed.

- Over the course of its 10th Five-Year Plan (2021-25), Oman allocated approximately OMR 7.3bn (USD 18.9bn) to subsidies, reflecting sustained fiscal support for energy and essential goods. Of subsidies, electricity, transport fuel and water & sewage subsidies amounted to OMR 2.733bn, OMR 1.464bn and OMR 904mn respectively. The Social Protection System, introduced in the annual budget in 2024, received cumulative allocations of OMR 1.078bn.

- Inflation in Oman stood at an exceptionally low average of 0.94% in Jan-Nov, indicative of subdued domestic price pressures despite global volatility and ongoing subsidy programs.

- At end-Nov 2025, Oman’s luxury hotel revenues were up 21% yoy (to OMR 258mn) and room occupancies rose to 55.4% (vs 48.6% a year ago) as visitor numbers climbed, pointing to a recovery in high-end tourism demand.

- PMI in Qatar eased to a 2-year low of 50 in Dec (Nov: 51.8) as output and new orders edged slightly lower. Employment eased to an eight-month low and inflation pressures were muted despite rising wages.The 12-month business outlook remained firmly positive, approaching its long-run average. PMI in Qatar averaged 51.2 in 2025, the lowest since 2020 and below the long-run average of 52.2.

- Qatar approved amendments to its foreign investment law regulating the investment of non-Qatari capital in economic activity to enhance capital inflows and deepen private sector participation, aligning with its Third National Development Strategy to diversify growth.

- Qatar’s population expanded by about 2.3% yoy to 3.214mn residents at end-2025, supporting domestic demand but placing pressure on infrastructure and public services.

- Qatar’s manufacturing sector contributed more than QAR 69.3bn in 2025, reflecting intensified industrial activity and diversification efforts beyond hydrocarbon exports. The number of factories operating in Qatar rose to 1000+ in 2025 from around 920 in 2023. Similarly, the number of national products rose to over 1,815 in early 2025 from around 1,720 locally produced products in 2023.

- Qatar’s foreign exchange reserves grew by approximately 2.65% yoy to QAR 261.87bn by Dec, reinforcing external liquidity buffers. Official international reserves increased by 3.15% yoy to QAR 202.25bn.

- Qatar and the UAE will join a US-led initiative “Pax Silica” to strengthen technology supply chains, particularly in semiconductors and advanced technologies, reflecting a pivot toward high-value sectors and geopolitical economic cooperation.

Saudi Arabia Focus

- Saudi Arabia’s Capital Market Authority will eliminate the Qualified Foreign Investor regime and open its capital markets to all foreign investors from Feb 1, 2026. This major liberalisation move is aimed at deepening liquidity and attracting global capital into Tadawul. While many institutional investors are already present, the removal of barriers and potential future easing of foreign ownership caps could broaden the investor base and strengthen integration with global financial markets.

- Saudi Arabia’s PMI cooled to 57.4 in Dec (Nov: 58.5): output, employment and new orders remained strong though its pace of growth eased. Saudi Arabia continued to stand out as the region’s major growth engine, with an average PMI of 57.7 in 2025.

- Industrial production in Saudi Arabia accelerated 10.4% yoy in Nov, buoyed by stronger manufacturing (8.1%), mining (12.6%) and oil production (12.9%). While monthly IP dipped slightly (-0.7%), the robust annual gain suggests continued structural industrial expansion.

- Saudi Arabia’s first international bond issuance drew robust investor demand, with orders totalling about USD 31bn(2.7 times oversubscribed), indicating strong appetite for Gulf credit amid stable macro fundamentals and yield pick-up versus developed markets. The tranches were valued at USD 2.5bn, USD 2.75bn, USD 2.75bn and USD 3.5bn, with tenors of three, five, 10 and 30 years, respectively.

- Three Saudi corporates – two banks and one telecom operator – have engaged banks to arrange sukuk issuances, reported AGBI, signalling continued appetite for Sharia-compliant debt refinancing and funding across strategic sectors. The companies have not disclosed the amount to be raised

- Expatriate remittances from Saudi Arabia rose about 5% yoy to SAR 12.6bn in Nov, reflecting sustained income flows from the large migrant workforce.

- Saudi Arabia was ranked first globally for road connectivity and 4th among the G20 for Road Infrastructure Quality Index, according to a report by the World Competitiveness Forum. This infrastructure milestone enhances supply-chain reliability for industry and trade and lowers transaction costs while underpinning economic integration across KSA and GCC.

- New geological surveys have increased Saudi Arabia’s estimated mineral wealth to around SAR 9.375trn (USD 2.4trn), including rare earths, copper, zinc, and gold outside known belts, enhancing the country’s resource diversification narrative. This compares to the previous estimated value of SAR 5trn announced in 2016.

- Over486,000 commercial registries were issued in Saudi Arabia during 2025, pushing the total number of active firms beyond 1.8mn and signalling broad-based entrepreneurial activity across Vision 2030 priority sectors. Registrations in AI technologies rose 34% to 19,042 while virtual and augmented reality technologies recorded a 29% rise to 11,725 registries.

- Saudi Arabia’s Business Confidence Index climbed 2.2% to 62 points in Dec, well above the neutral threshold, indicating rising optimism among firms across non-oil sectors about future performance, sales, and investment.

- Saudi Arabia’s tourism workforce exceeded1 million jobs in Q3, up about 6.4% yoy, reflecting rapid expansion of hospitality infrastructure and visitor activity under Vision 2030. The number of licensed tourism & hospitality establishments also rose 40.6% to 5622 in Q3.

UAE Focus

- UAE PMI eased slightly to 54.2 in Dec (from Nov’s 9-month high of 54.8), with firms reporting strong underlying demand and output growth (among the fastest recorded in 2025). Inflationary pressures are increasing, with input prices rising to the most in 15 months (wages & materials) and selling prices rising for the 6th straight month.

- Official data show nearly a doubling of real GDP in the UAE over the past two decades (to AED 1.77trn in 2024), reflecting sustained diversification, high productivity gains, and rapid expansion of trade and services sectors (non-oil foreign trade surged to AED 3trn in 2024 from AED 415bn in 2006).

- Nearly 250k new companies set up shop in the UAE last year and more than 1.4mn firms are currently operating in the UAE (up 118.7% vs end H1 2021), underscoring the strength of UAE’s private sector and strong entrepreneurial climate (SMEs owned by UAE nationals grew by 63% over the past five years). Recent UAE corporate law amendments are expected to increase company registrations by a further 10-15% this year.

- Tourism sector contributed AED 291bn (USD 79.24bn) to UAE’s GDP (roughly 15% compared to 6% in 2021), revealed the Minister of Economy and Tourism. Tourism is a major growth pillar, reflecting both robust international demand and domestic leisure spending.

- Etihad Rail announced multiple new passenger stations ahead of its phased 2026 launch: national connectivity will increase logistics efficiency and is likely to generate positive supply-chain effects for industrial & tourism sectors while improving people’s mobility.

- The Abu Dhabi Fund for Development (ADFD) announced a USD 2bn global water security initiative to benefit 10 million people worldwide, targeting sustainable water infrastructure in emerging markets and reinforcing the UAE’s role in climate adaptation finance.

Media Review:

Why will Saudi-UAE trade ties remain resilient despite Yemen tensions?

https://www.reuters.com/world/middle-east/why-saudi-uae-trade-ties-remain-resilient-despite-yemen-tensions-2026-01-07/

Dubai’s property boom leans on cash as mortgage lending lags

https://www.agbi.com/real-estate/2026/01/dubai-property-boom-leans-on-cash-as-mortgage-lending-lags/

Wall Street headed for best investment banking year since pandemic

https://www.ft.com/content/f3d79af1-b55a-4c86-b39a-41bf3cec77d1

The “ChatGPT moment” has arrived for manufacturing

https://www.economist.com/interactive/business/2026/01/07/the-chatgpt-moment-has-arrived-for-manufacturing

Powered by: