Broad-Based Growth in Dubai, Industrial Lift in Saudi, Fiscal Deficit in Qatar, Weekly Insights 14 Nov 2025

Dubai GDP. Saudi CPI & WPI. Saudi IP. Qatar fiscal deficit.

Download a PDF copy of this week’s insight piece here.

Broad-Based Growth in Dubai, Industrial Lift in Saudi, Fiscal Deficit in Qatar, Weekly Insights 14 Nov 2025

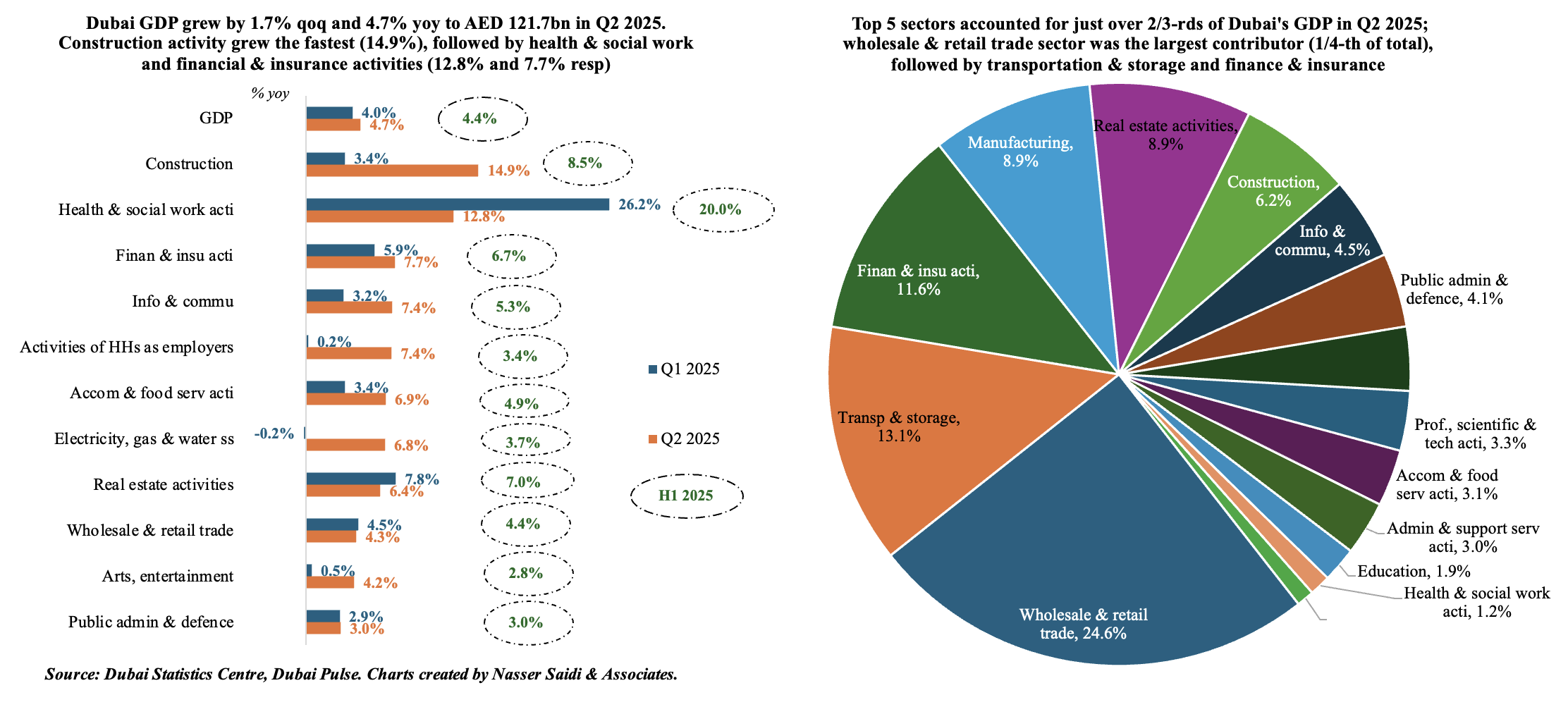

1. Dubai real GDP grew 4.7% yoy in Q2 2025 & 4.4% in H1 2025

- Dubai real GDP grew by 1.7% qoq and 4.7% yoy to AED 121.7bn in Q2, pointing to robust underlying demand and broad‐based sectoral strength . The fastest growing sectors were construction (14.9%), health & social work (12.8%), and finance & insurance (7.7%).

- In H1 2025, GDP grew by 4.4% yoy: growth was not reliant on any single sector, showcasing successful diversification. Robust growth in high-value sectors like finance (6.7% in H1) and health (20%), combined with the foundational strength in real estate (7.0%) and construction (8.5%), suggests that Dubai is well-positioned to maintain its high-growth trajectory.

- Wholesale & retail trade was the largest contributor to GDP in Q2, accounting for ¼-th of total, followed by transportation & storage (13.1%) and financial & insurance activities (11.6%). Along with manufacturing and real estate, these sectors accounted for 65.7% of GDP.

- Dubai’s strength emerges from its role as a global business, tourism and logistics hub – as can be seen from strong trade, real estate and services sectors. Wholesale & retail trade has benefitted from the various UAE CEPAs and Dubai’s inter-linked logistics infrastructure (ports, airports). Furthermore, construction & real estate performance indicate that public & private investment continue to underpin growth.

- Increased tourism arrival numbers, rising FDI & ongoing real estate transaction growth are also positive indicators of future growth.

- To transition to a higher growth path, Dubai needs to record productivity gains, move into higher‐value activities (e.g. digital economy, life sciences, fintech, creative industries, advanced manufacturing/logistics, advanced services) and integrate deeply into global value chains.

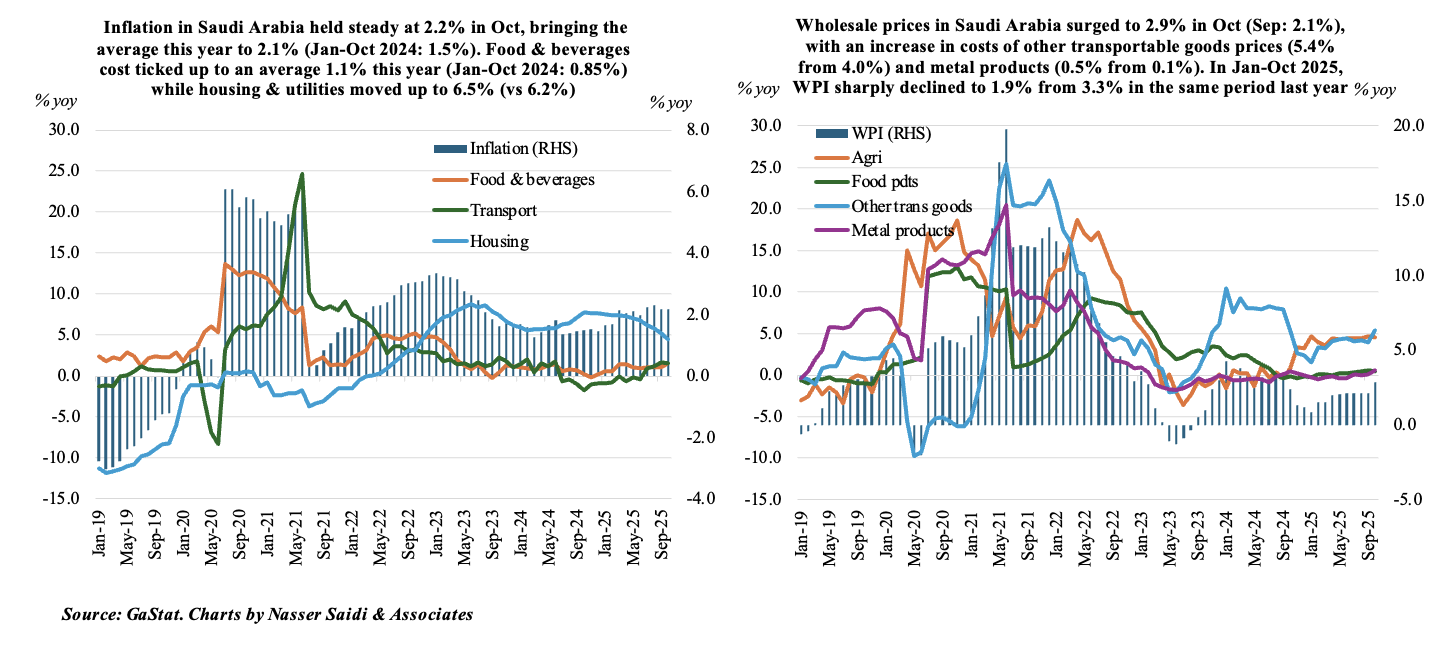

2. Consumer price inflation in Saudi Arabia held steady at 2.2% in Oct; wholesale prices surged to 2.9%

- Saudi Arabia’s consumer price inflation stood unchanged at 2.2% in Oct. Housing costs remain elevated though decelerating (4.5% from 5.2%) – largely due to the sharp decline in rental costs (5.7% from 6.7%) – while food & beverages inflation is ticking up (1.5% from Sep’s 1.1%). Increase in costs of finance & insurance (8.2% from 7.7%) and personal care, miscellaneous goods & services (5.9% from 5.4%) indicate cost pressures in non-tradable sector (including rising wages / administrative costs, that are often cited in the PMI responses).

- CPI averaged 2.05% in Jan-Oct 2025 vs 1.51% in the same period a year ago, with increases across food & beverages (1.06% from 0.85%) and recreation & culture (2.7% from 0.5%) while the average prices of personal care, miscellaneous goods & services more than doubled (4.77% from 2.0%).

- Wholesale prices in Saudi Arabia rose sharply to 2.9% in Oct (Sep: 2.1%), with the monthly gain the most since Jan 2025. However, the pressure is concentrated in specific sectors – prices of other transportable goods jumped to 5.4% (Sep: 4.0%) as did metal products (0.5% from 0.1%); deflation continued in ores & minerals for the 27th month in a row. A consistent increase in wholesale prices could pass through to CPI down the line.

- Average wholesale prices tumbled to 1.9% in Jan-Oct 2025 (vs Jan-Oct 2024: 3.%), as prices of “other transportable goods” plunged (3.9% vs 8.1%), in addition to food products (0.2% vs 1.27%); costs of agriculture & fishery surged (4.3% from -0.1%).

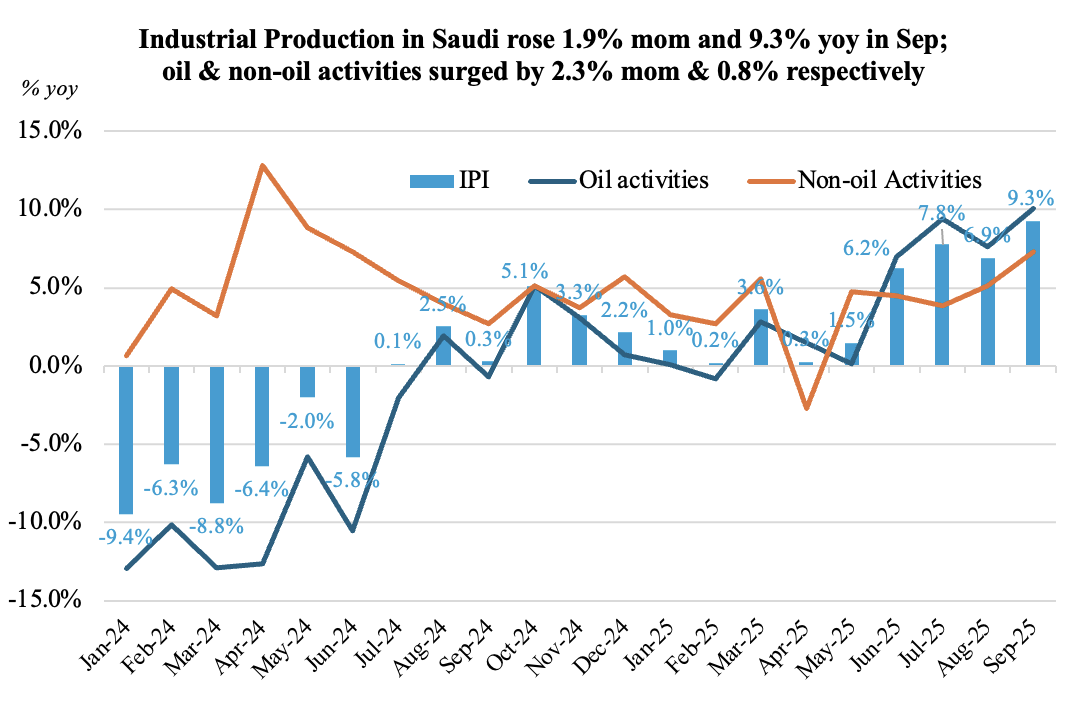

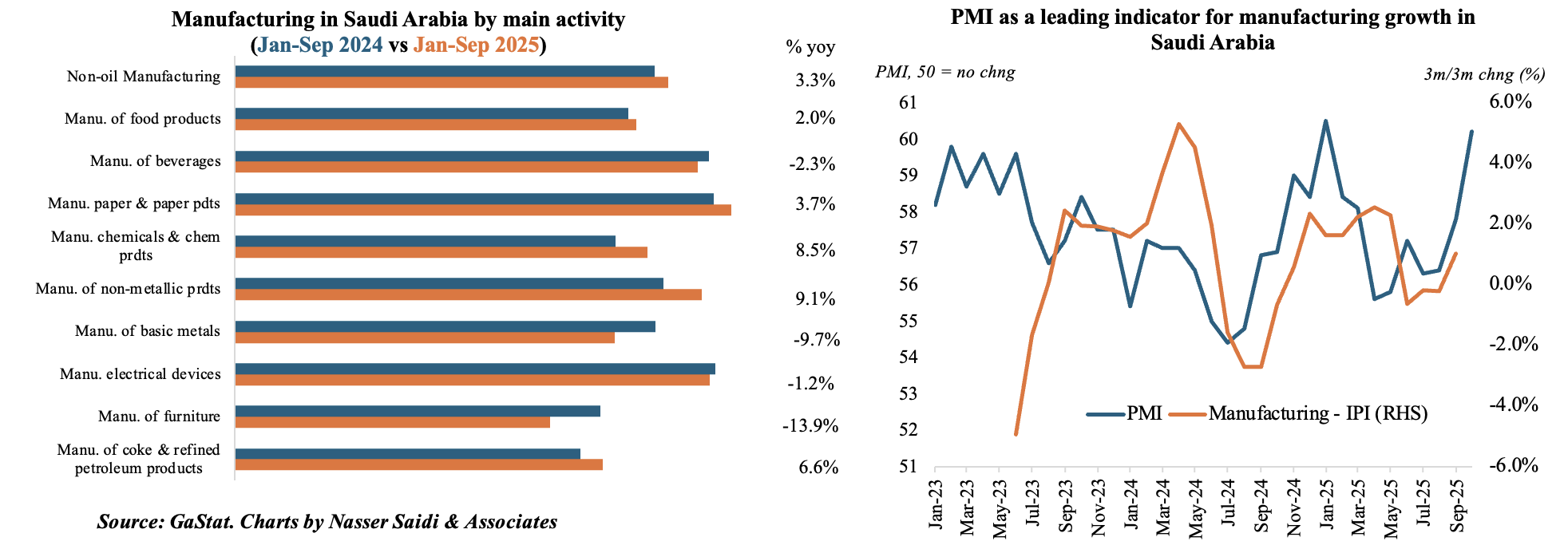

3. Saudi industrial production grew 9.3% yoy in Sep 2025, driven by a surge in hydrocarbons; manufacturing improves

- Industrial production in Saudi Arabia grew by 1.9% mom and 9.3% yoy in Sep. Oil activities expanded by 2.3% mom and 10.1% yoy, as crude oil production rose (given the OPEC+ decision). Extraction of crude petroleum & natural gas grew by 6.5% yoy, the 6th straight month of upticks.

- Non-oil activities increased by 0.8% mom and 7.3% yoy in Sep. Within manufacturing, manufacture of food products was the fastest growing (12.9% yoy) followed by non-metallic products (10.0%) and chemicals & chemical products (9.2%). In Jan-Sep, non-oil manufacturing ticked up by 3.3% and manufacture of coke & refined petroleum products gained6%. Under non-oil manufacturing, non-metallic products grew the fastest (9.1%).

- Infrastructure & utilities (energy, water, waste) show rising capacity, suggesting that industrial capacity and the enabling infrastructure are scaling up. Saudi’s transition to industrial growth driven by non-oil manufacturing and exports will be supported by ongoing industrial and infrastructure projects (chemical plants, refineries etc); non-oil PMI also indicates a further increase in activity (given upticks in output, new orders and employment).

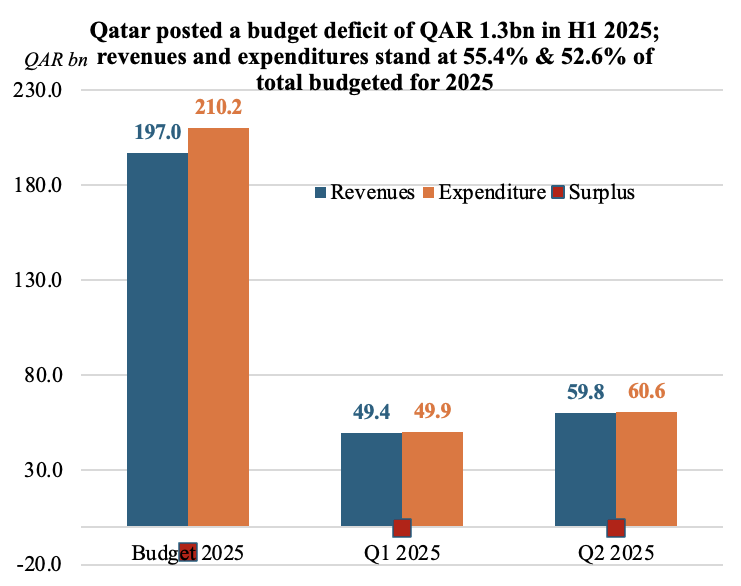

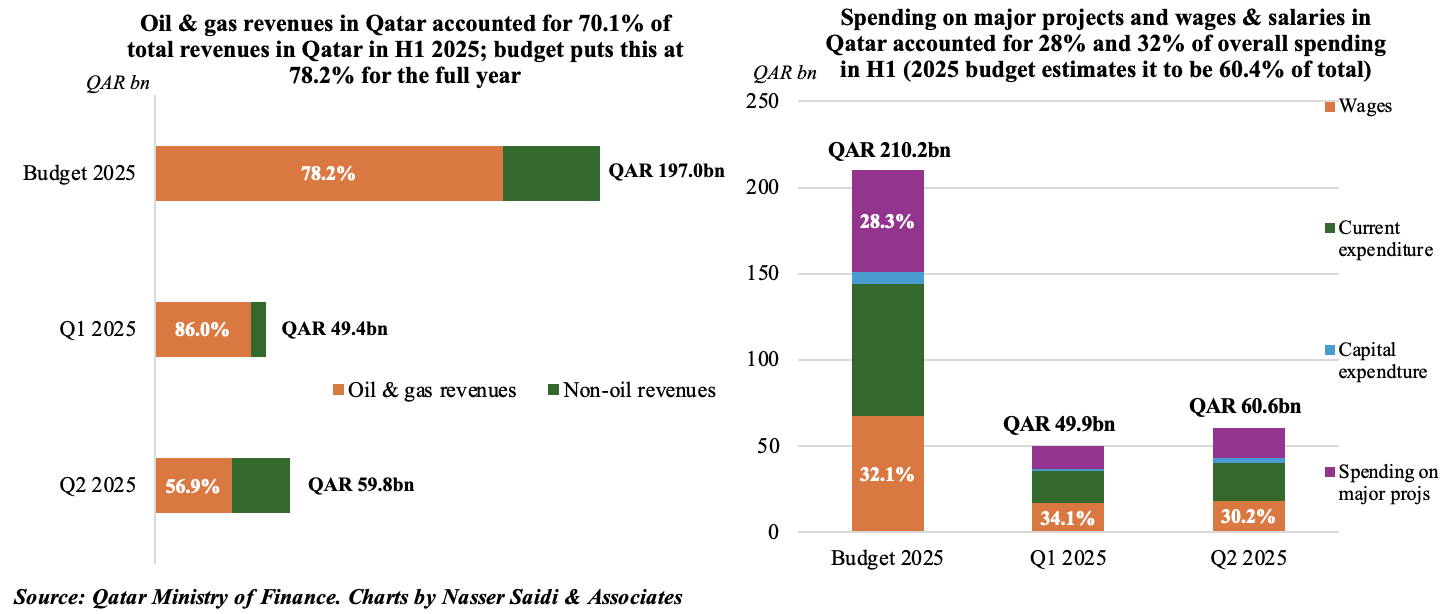

4. Qatar budget deficit stood at QAR 1.3bn in H1 2025 vs QAR 13.2bn in 2025 budget

- Qatar clocked in revenues to the tune of QAR 109.2bn in H1 (55.4% of 2025 budget estimate). With spending at QAR 110.5bn (or 52.5% of budget), the budget deficit stood at QAR 1.3bn.

- Oil and gas revenues, at QAR 76.5bn in H1, accounts for 70.1% of total revenues for the period.

- Total expenditures touched QAR 110.5bn in H1 (52.6% of the amount budgeted for full year 2025), of which 32% was wages and salaries while another 27.7% went towards major projects.

- Qatar continues to benefit from its hydrocarbon‐sector earnings and strong external positions. From a policy-perspective the imperative now is to hold spending growth in check, accelerate non‐hydrocarbon revenue development, and ensure that the ongoing LNG investments and expansion translates into higher government income as planned.

Powered by: