Calm After the Cut? Equities Rally as Monetary Policy Divergence Shapes Economic Outlook, Weekly Economic Commentary 3 Nov 2025

Download a PDF copy of the weekly economic commentary here.

Markets

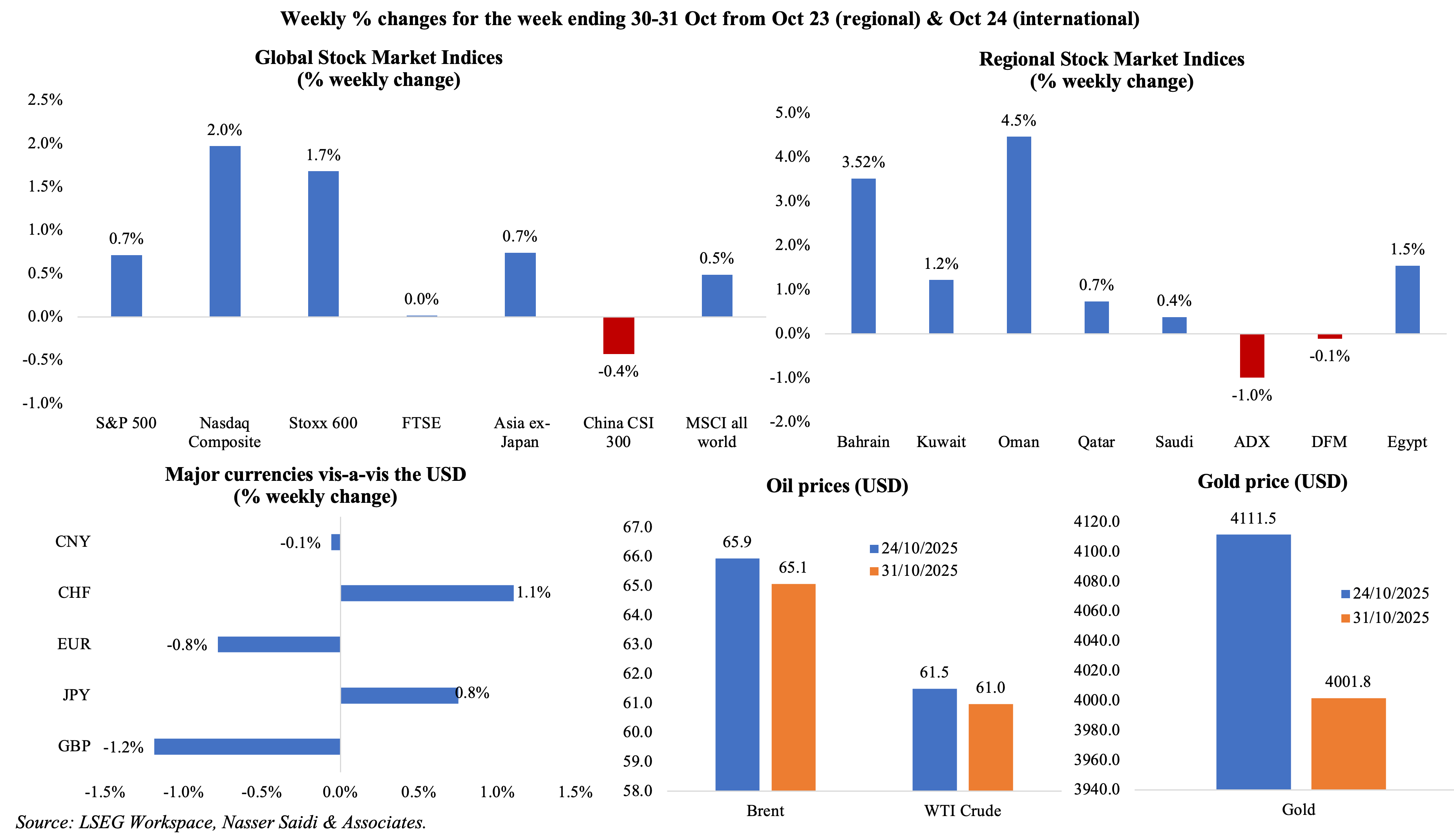

Major equity markets gained last week following the positive outcomes from the Trump-Xi meeting and more generally Trump’s visit to Asia; AI and tech stocks continue their positive run on announcements of continued investments into the sector. The region’s markets were mostly up, thanks to strong corporate earnings and the Fed rate cut. The dollar was supported by comments from Fed officials while the yen fell to a nearly 9-month low vis-à-vis the greenback and the GBP was close to 2.5-year lows versus the euro. Oil prices closed lower ahead of the OPEC+ meeting and gold price slipped closer to the USD 4,000 mark.

Global Developments

US/Americas:

- The Federal Reserve cut their benchmark lending rate by 25 basis points to a range between 3.75% and 4% – the lowest level in three years. The decision was not unanimous, with one official backing a 50bps cut and another preferring to hold rates steady. This was also happening in the backdrop of no government employment data for an entire month due to the shutdown. The Fed Chair stated that a rate cut in Dec was not a “foregone conclusion”, highlighting that “policy is not on a preset course”.

- ADP private payroll data showed a modest increase of 14,250 jobs, weaker than expected, suggesting a gradual cooling in labour demand – with firms more cautious about hiring amid uncertain demand. Going forward, sustained weakness in employment metrics could reinforce the Fed’s dovish tilt and influence rate path expectations into early 2026.

- S&P Case Shiller home price index increased by 1.6% yoy in Aug (Jul: 1.8%), the seventh straight month annual gains have slowed and is the smallest annual increase since Jul 2023.

- Pending home sales was unexpectedly flat in Sep (Aug: 4.2%), probably a result of economic uncertainty, affordability and labour market worries. It may also reflect households deferring purchases in anticipation of lower rates ahead. The average rate on the popular 30-year fixed-rate mortgage declined to a 1-year low of 6.19% after clocking in 6.3% at end-Sep.

- Regional manufacturing sentiment improved. Dallas Fed manufacturing business index rose to -5 in Oct (Sep: -8.7) on an improvement in the employment index (18% of firms reported hiring) alongside easing of price and wage pressures.Richmond Fed manufacturing index increased by 13 points to -4 in Oct, thanks to a rebound in shipments (4 from Sep’s -20) and new orders declined at a softer pace (-6 from -15). Chicago PMI rose to 43.8 in Oct (Sep: 40.6) supported by a rebound in new orders while employment growth was the lowest since Feb.

Europe:

- ECB left interest rates unchanged at 2.0%, after latest data showed modest growth in the eurozone “despite the challenging global environment”. Markets estimate only a 40% chance of another 25bps rate cut by June 2026.

- Preliminary GDP in eurozone rose by 0.2% qoq and 1.3% yoy in Q3 (Q2: 0.1% qoq and 1.5% yoy), with the highest quarterly figures recorded in Sweden (+1.1% qoq) while Germany showed zero growth (following a decline in Q2) and French output expanded at the fastest pace since 2023.

- Flash estimates indicate that inflation in the eurozone eased to 2.1% in Oct (Sep: 2.2%) while core inflation stood pat at 2.4%. Food inflation slowed (2.5% from 3.0%) as did prices of non-energy industrial goods (0.6% from 0.8%) while services prices remained sticky (up 3.4%, the highest since Apr). Inflation (HICP) in Germany eased to 2.3% (Sep: 2.4%).

- Economic sentiment indicator in the eurozone improved modestly to 96.8 in Oct (Sep: 95.6), the highest since Apr 2023. Consumer confidence stood unchanged at -14.2 and business climate rose to -0.46 (Sep: -0.73).

- Retail sales in Germany grew by 0.2% yoy in Sep, the slowest pace in 14 months and slowing sharply from Aug’s 1.4%.In monthly terms, sales were up by 0.2% mom (the first increase since Jun) thanks to an uptick in food sales (0.3% mom) and online and mail-order businesses (0.4%).

- Unemployment rate in Germany was unchanged at 6.3% in Oct, with the number of unemployed declining by 1k to 2.97 million.

- GfK consumer confidence survey in Germany deteriorated further to -24.1 in Nov (Oct: -22.3), as households grew more pessimistic about future incomes (income expectations fell to 2.3 points, lowest since Mar 2025) and) and inflation prospects. This persistent weakness underscores how high living costs and geopolitical uncertainty continue to weigh on sentiment.

Asia Pacific:

- China’s official PMI readings painted a mixed picture in October. The official NBS manufacturing PMI slipped to 49 in Oct (Sep: 49.8), staying below-50 for the seventh month in a row, as output shrank (49.7 from 51.9) and foreign sales plunged (45.9 from 47.8). Non- manufacturing PMI moved up to 50.1 in Oct (Sep: 50), with new orders and employment holding below 50 (at 46 and 45.2 respectively). The slight uptick in non-manufacturing activity suggests that services remain a key growth stabilizer for now.

- The Bank of Japan remains an outlier among major central banks, maintaining its ultra-accommodative stance even as inflation persists above target. The BoJ governor has given clear hints of near-term hike (in Dec or Jan) and the yen fell to a nearly 9-month low vis-à-vis the greenback despite the comments.

- Tokyo consumer price rose to 2.8% yoy in Oct (Sep: 2.5%), with food inflation easing to 6.7% (from 6.9% in Sep) and services inflation holding relatively steady (1.6% from 1.5%). Excluding food and energy prices, inflation rose to 2.8% (from 2.5%). Excluding fresh food, prices were 2.8% (from 2.5%). Tokyo’s inflation metrics strengthened across the board, suggesting underlying price pressures remain broad-based and persistent.

- Unemployment rate in Japan was flat at 2.6% in Sep, with the number of unemployed rising by 20k to a 14-month high of 1.81 million. The jobs-to-applicants ratio held steady at 1.20 for the second month in a row, also the lowest level since Jan 2022.

- Industrial production in Japan grew by 2.2% mom and 3.4% yoy in Sep, marking a solid turnaround from the prior month’s contraction (Aug: -1.5% mom and -1.6% yoy). Gains were driven by production machinery (6.2% from -2.1%) and inorganic & organic chemicals (9.1% from -5.4%).

- Retail sales in Japan rebounded in Sep, up by 0.5% yoy (Aug: -1.1%), indicating that consumer spending is holding up despite lingering price pressures. The recovery was supported by gains in machinery and equipment (5.9%), pharma & cosmetics (5.9%) and other retail (4.4%) while fuel and food & beverages sales fell by 4.9% and 0.3% respectively.

- Industrial output in India grew by 4.0% in Sep (Aug: 4.1%), underpinned by strength in manufacturing output (4.8% vs Aug’s 3.8%). Consumer durables output jumped by 10.2% (vs Aug’s 3.5% growth) while non-consumer durables fell at a slower pace (-2.9% vs Aug’s -6.4%). Cumulative output in Apr-Sep grew by 3.0%. Government infrastructure spending and robust domestic consumption should keep industrial momentum positive, albeit at a moderated pace.

- South Korea’s GDP accelerated by 1.2% qoq and 1.7% yoy in Q3 (Q2: 0.7% qoq and 0.6% yoy), supported by a rebound in exports (+6% yoy, the fastest since Q3 2024) and manufacturing (3.3% yoy) while construction dragged down growth (-8.1% yoy).

Bottom line: Central bank meetings last week resulted in expected outcomes, with the Fed rate cut and the ECB and BoJ holding rates unchanged given the ongoing inflation and trade tariffs challenges. While the Fed was constrained by lack of data due to the data shutdowns, the Bank of England this week has no such limitations – the inflation print will be key in how the BoE decides; for now, the markets are expecting only a 30% chance of a 25bps rate cut. The final PMI readings will also be released this week: though US PMI has been ahead of other developed economies till now, business optimism has been dropping and input prices rising, signalling a decline in headline readings in the months ahead. Meanwhile, global uncertainty has also seen OPEC+ agree to another modest oil output increase of around 137k barrels per day for Dec 2025, while pausing additional increases through Q1 2026. The decision reflects caution amid mounting concerns of an oil supply glut and weak demand growth in some regions.

Regional Developments

- Several GCC central banks followed the Fed’s 25bps rate cut by lowering policy rates. The cuts align with the region’s dollar peg and reflect relatively benign inflation; lower financing costs should help accelerate diversification efforts.

- Bahrain’s sovereign wealth fund Mumtalakat partnered with US-based AI and quant firm SandboxAQ to build biotech assets worth USD 1bn via AI-enabled drug discovery targeting regional health issues. Bahrain will license SandboxAQ’s software and expertise in quantitative AI to identify and develop targets to emerge as a regional biotech centre.

- Egypt’s economic growth rose to 4.4% in fiscal year 2024-25 beating expectations, led by strong non-oil manufacturing, tourism, communications and IT, disclosed the finance minister. Egypt achieved a primary surplus of about 3.6% of GDP and private investment reached its highest level in five years, accounting for 47.5% of total executed investments in 2024-25.

- The Central Bank of Egypt data showed an increase in external debt to USD 161.23bn in Jun 2025 (Mar: USD 156.69bn). Long-term external debt totalled USD 130.32bn and short-term debt stood at USD 30.91bn.

- In Jan-Sep, the total number of new companies in Egypt grew by 7.21% yoy to 32,937, with services sector accounting for 58%+ of total new firms. Capital inflows from newly established companies dropped 79.14% yoy to USD 4.04bn. Egyptian companies’ capital, at USD 3.2bn, contributed 79.2% to total inflows while the largest source of foreign inflows was from Netherlands (4% of total inflows), UAE and Saudi Arabia.

- Egypt plans to raise about USD 7bn over four years by selling 18k+ residential plots to Egyptians living abroad under the “Beit Al Watan” initiative also in a bid to boost foreign-currency inflows. The initiative had generated total receipts of USD 10bn from 25k plots sold since 2012 and will tap into strong remittances (USD 36.5bn in FY 2024-25).If successful, the scheme may become a recurring source of hard-currency inflows, enabling Egypt to stabilise its external position.

- Iraq and Turkey signed an agreement on Iraqi water-infrastructure projects including dams and land-reclamation – to be carried out by Turkish firms and financed via Iraqi oil-sales revenue to Turkey. The deal signals stronger bilateral ties and a strategic pivot by Iraq to address chronic water scarcity, with about 70% of its water resources flowing through Turkey.

- Goldman Sachs in talks for USD 10bn asset-management mandate from the Kuwait Investment Authority, focused on private equity, credit and infrastructure.The move aligns with Goldman’s strategic shift toward alternative assets and its Middle East expansion, as evidenced by its recent Kuwait office opening. For asset-markets and Gulf finance this suggests increasing region-based capital flows into global private markets.

- Oman reported that 74% of Oman Vision 2040 performance indicators have shown measurable progress across sectors including education, healthcare and non-hydrocarbon output.Notably, non-oil sectors contributed 72.8% of output in 2024 and private-sector investment reached 17% of GDP with FDI rising 18%.

- Oman inflation edged up by 1.1% in Sep, the highest since Aug 2024, and averaged 0.8% in Jan-Sep. During the first nine months this year, prices of ‘miscellaneous goods & services’ was up 6.4%, transport 4.5% while food & non-alcoholic beverages declined slightly.

- Value of real-estate transactions in Oman grew by 9.0% yoy to OMR 2.35bn in Jan-Sep 2025, while mortgage-financed purchases rose by 7.0% to OMR 1.4bn (now more than 50% of total transactions) driven by first-time buyers.

- Noatum Logistics (a subsidiary of AD Ports) and Hafeet Rail agreed to create a freight-rail corridor between Sohar (Oman) and Abu Dhabi: seven container trains are being planned per week, with an annual capacity of 193,200 TEUs, targeting general cargo, agri-food, manufactured goods and pharmaceuticals.The deal will enhance logistics integration, lower freight cost, road dependency and strengthen Oman’s connectivity in GCC supply-chains.

- State of Qatar to planning to issue sukuk in the coming weeks, with a goal to manage debt and improve the yield curve. No indication was given as to the size of the issuance.

- Commercial registrations in Qatar surged by 81.5% in Q3: the number of non-Qatari firms was up 59% qoq to 4,631, company setup time was reduced to two days and the number of active commercial licences grew 6.79% yoy. From a structural-economy perspective, this suggests Qatar is actively reducing business-registration barriers, improving infrastructure and signalling a push to broaden private-sector participation.

- MENA region saw 11 IPOs (+120% yoy) raising USD 700mn in Q3 2025: Saudi Arabia contributed eight and raised USD 637mn in proceeds. The largest single listing was Dar Al Majed Real Estate Company in Saudi Arabia at USD 336mn, representing 45.5% of total proceeds. The MENA IPO pipeline also remains strong, with 19 firms and funds intending to list across the region. From a capital-markets angle, this indicates growing depth and investor interest in regional equity and mid-cap segments.

Saudi Arabia Focus

- Saudi Arabia’s preliminary GDP estimates showed an acceleration in Q3, up by 5.0%(Q2: 3.9%), driven by the 8.2% yoy surge in oil sector activity (Q2: 3.8%) and supported by a strong 4.5% increase in non-oil sector activity (Q2: 4.6%). Accelerated unwinding of oil production cuts will support oil sector activity in the rest of the year. The government sector grew at a faster pace of 1.8% (Q2: 0.6%). Government consumption will stay supportive, reflecting ongoing national development priorities.

- The economy minister projected real GDP growth of around 5.1% for 2025, with non‑oil GDP expected to grow about 3.8%, reflecting progress under Vision 2030 toward reducing hydrocarbon‑dependence and promoting non‑oil sectors. The Ministry of Finance forecasts 4.4% growth this year and the IMF estimates it to be 4.0%. Sustaining above‑trend growth will require scaling‑up private‑sector capacity, labour force participation, increased productivity and global competitiveness.

- About 675 international companies opened regional headquarters in Riyadh, surpassing the original target of 500 by 2030, disclosed Saudi Arabia’s investment minister.He also noted that the economy had doubled in size to USD 1.3trn from roughly USD 650bn since the launch of Vision 2030 in 2016, underscoring improvements in the business environment and wider structural reforms. Furthermore, he stated that the contribution of non-oil sectors to GDP rose to 56% (vs 40% before the launch of vision 2030), approximately 40% of the budget and expenditures were now financed by non‑oil revenues, and that around 90% of FDI inflows was going into non‐oil sectors.

- At the FII conference, the investment minister also called on the private sector to take on a greater role in Saudi development, signalling that the PIF may scale back direct spending. He emphasised reducing barriers to doing business and that the government will “own the risk it can neutralise” while allowing private investors to fill more of the value chains and clusters that the sovereign had built.

- Saudi fiscal deficit widened to SAR 88.5bn in Q3 2025(Q3 2024: SAR 30.2bn), tripling the total deficit this year to SAR 181.8bn from SAR 58.0bn in Q1-Q3 2024. Overall revenues fell by 12.7% yoy to SAR 269.9bn in Q3, with oil revenues down by 21.0% (to SAR 150.8bn) given subdued oil prices. Non-oil revenues grew by 0.6% in Q3, with taxes accounting for 75.4% of non-oil revenues. Overall expenditures rose by 5.6% yoy to SAR 358.4bn in Q3, with capex up by 3.7% yoy and 25.1% qoq to SAR 49.9bn and compensation of employees accounted for 45.3% of total spending.

- Consumer spending in Saudi Arabia inched lower for the second consecutive month in Sep, as point of sales transactions fell by a sharp 6.9% month-on-month. In yoy terms, net foreign assets fell for 10th month running. Deposit growth in Saudi Arabia averaged 8.8% in Jan-Sep and credit growth outpaced deposit growth for the 20th straight month in Sep 2025.

- Saudi Aramco acquired a minority share in AI company Humain, aiming to leverage HUMAIN’s AI infrastructure to translate advanced AI capabilities into industrial applications. This demonstrates strategic tech integration for operational efficiency and innovation-led growth while enhancing Aramco’s productivity and lowering emissions.

- The Public Investment Fund (PIF) governor laid out a plan at the FII summit, focusing on six priority sectors between 2026‑2030 – this includes travel, tourism and entertainment; urban development & liveability; advanced manufacturing & innovation; industrial & logistics; clean energy & renewables; and the NEOM project itself. The move follows earlier spending cuts and signals a re‑prioritisation of capital deployment to areas with stronger near‑term yield potential as well as a shift from volume of projects to quality of outcomes.The governor also disclosed that the PIF assets have tripled since 2015 and that it would reach USD 1.0trn by end-2025.

- Saudi Arabia to invite 197 countries for the Expo 2030 Riyadh, anticipating around 42 million visitors during the event and a site footprint of about six million sqm (one of the largest Expo sites ever built). From an economic standpoint, this mega‑event could deliver a significant boost to Riyadh’s international profile as well as act as a catalyst for construction, services and ancillary business growth.

- Saudi Capital Market Authority (CMA) plans to review foreign ownership in Saudi market in 2026. Consultation is open on draft regulatory changes to allow broader foreign investor access to the Main Market – including opening direct access for non‑resident investors. The move is part of deeper capital‑market liberalisation intended to broaden the investor base, increase market liquidity and integrate Saudi markets with global capital flows. Separately, the CMA estimates Saudi Arabia’s asset‑management industry at roughly SAR 1.0trn and private credit (though growing at a fast pace) at only about SAR 5bn – so small it has “almost no impact” on the overall credit quality in the region. The CMA chair however warned of “highest risk” in private credit due to opacity, layering and quality.

- UK unlocked USD 86bn in trade and investment deals with Saudi Arabia, spanning defence, tech, and energy sectors. This is consistent with Saudi Arabia’s strategy of leveraging international partnerships to boost foreign investment.

- Operating revenues in Saudi business sector touched SAR 5.5trn in 2024, up 3.9% yoy, reflecting robust corporate activity and expansion across non-oil industries – including robust growth in manufacturing (7.3%), construction (9.6%), and wholesale & retail trade (8.5%). In terms of operating expenses, manufacturing accounted for the largest share at 41.6%.

- Saudi Arabia aims to double tourism’s share of GDP to 10% by 2030, according to the tourism minister, from about 5% today.The strategy emphasizes improved connectivity, diversified destinations (Riyadh, Jeddah, AlUla, Red Sea) and leveraging new higher‑value international tourism segments (beyond just religious tourism).

- Saudi Arabia welcomed 60.9mn tourists in H1 2025, with total spending up 4% yoy to SAR 161.4bn. Average stays clocked in at 6.7 nights for international tourists and 18.6 nights for domestic travellers. Egypt, Pakistan, and Kuwait were the top three origin countries sending tourists to Saudi, followed by India and Indonesia.

- Saudi awarded five renewable energy projects (with a capacity of 4.5 GW) with capital investment exceeding SAR 9bn, as part of its energy transition plan, reinforcing policy-driven efforts to reduce oil-dependency and stimulate green industrial sectors.

- Saudi startups raised approximately USD 1.3bn in Jan-Sep (from over 170 deals), with Q3 alone attracting USD 466mn (+63% yoy). With several firms hinting at IPOs or mergers, Saudi is fast becoming a maturing ecosystem for early‑stage investment and potential exits.

UAE Focus

- UAE approved its 2026 federal balanced budget with estimated revenues and spending of AED 92.4bn (USD 25.2bn), representing a 29% surge in revenues and spending compared with the 2025 budget. The largest allocations were made towards social development & pensions (37%), government affairs (29%) and financial investments (17%) while infrastructure and economic development received 3%. The budget reflects the country’s pivot from pure oil-revenues toward broad-based development and investment.

- DP World pledged a further USD 5bn investment in India to bolster its integrated supply-chain network, adding to its prior investments of around USD 3bn over the past 30 years. DP World already has a network of more than 200 locations in India, signalling a deepening of Gulf-India strategic ties in logistics and trade infrastructure.

- UAE investments in Africa crossed over USD 110bn between 2019-2023, positioning it as the world’s fourth-largest investor in the continent (after US, China and EU); over USD 70bn of the amount was directed into green, energy and renewable-energy sectors. Meanwhile more than 100 projects worth USD 6bn+ were showcased during the UAE-Africa Tourism Investment Summit 2025; spread across 20 African countries, these projects are expected to create over 70,000 jobs.

- Starting in 2026, UAE will implement a new excise tax mechanism on sugar-sweetened beverages – linking tax per litre to sugar content per 100 ml rather than simply classifying by carbonation status. Carbonated drinks will hence no longer be a separate excise category and will be taxed based on sugar content. Producers and importers must register goods as excise-taxable, provide certified lab reports, and obtain conformity certificates; failure to so will result in automatic classification as “high-sugar” products. From a fiscal and public-health viewpoint, the tiering reflects a move towards more targeted behavioural incentives.

- XRG, the low-carbon energy/chemicals investment arm of ADNOC, is in preliminary discussions to invest in a planned LNG export project by Argentina’s state-owned YPF. The move comes as XRG pursues a strategy to become a global gas & LNG investor, building up upstream and midstream capacity, especially directed toward Asia and emerging markets.

- Foreign real estate investment in Sharjah surged in Jan-Sep, up by 62% yoy to about AED 23bn (USD 6.3bn), with 13,428 properties purchased across 121 different nationalities. UAE nationals invested AED 21bn, while among foreign investors Indians led the purchases, followed by Syrians and Pakistanis.The growth was thanks to the investor-friendly ownership regulations, relative affordability vis-à-vis Dubai/Abu Dhabi and infrastructure upgrades.

- The network of five commercial airports in Abu Dhabi recorded 8.49 million passengers in Q3 2025, up 10.1% yoy – this was the 18th consecutive quarter of double-digit growth in passenger traffic. New destinations, increased connectivity (especially into Asia) and strengthening tourism and business hub credentials of Abu Dhabi contributed to the uptick.

Media Review:

Trump-Xi meeting: tariffs, export controls & fentanyl

https://www.reuters.com/world/us/what-did-trump-xi-agree-tariffs-export-controls-fentanyl-2025-11-01/

The AI Shift: where are all the job losses?

https://www.ft.com/content/3d2669e3-c05e-48c9-8bb3-893c1d66de2e

Why Wall Street won’t see the next crash coming

https://www.economist.com/finance-and-economics/2025/11/02/why-wall-street-wont-see-the-next-crash-coming

Powered by: