Monetary Policy Moves & Renewed Trade Diplomacy Take Centre Stage, Weekly Economic Commentary 27 Oct 2025

Download a PDF copy of the weekly economic commentary here.

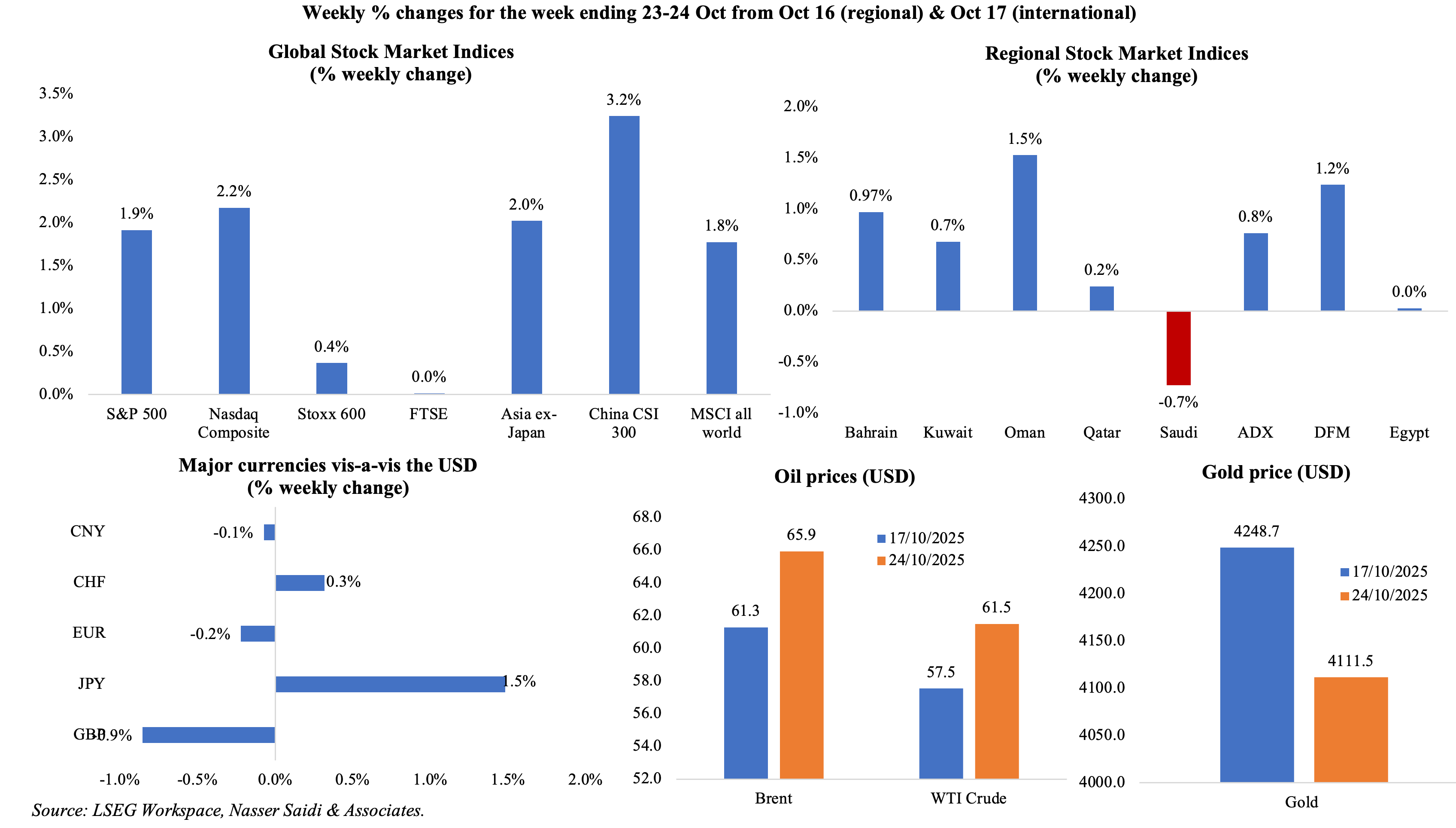

Markets

Major US stock markets posted record highs last week – on lower-than-expected US inflation – as did European markets (including FTSE 100) and the MSCI gauge of global stocks. Regional stocks were mostly up, thanks to expectations of a Fed rate cut, strong corporate earnings and rising oil prices. The dollar was mixed ahead of central bank decisions this week while the yen’s positive performance was influenced by the new PM’s policies including the preparation of a stimulus package to tackle the impact of high prices. Oil prices rose after sanctions were imposed on Russian oil firms – the largest weekly gain since mid-Jun. Gold price touched a record high on Monday but fell weekly after nine weeks of gains.

Global Developments

US/Americas:

- US inflation ticked up to 3.0% in Aug (Jul: 2.9%), but slightly lower than expected as firms have not fully passed along the higher prices to the end consumer. Food and energy prices were up by 3.1% and 2.8% respectively. Core inflation came in at 3%, slightly lower than the previous month’s 3.1%.

- President Trump is on a 5-day trip to Asia. A deal with China is expected, with negotiators confirming that a preliminary consensus and framework had been reached, ahead of President Trump’s meeting with President Xi. Trump also announced trade deals with four countries, including deals with Thailand and Malaysia related to critical minerals, and also oversaw the signing of an expanded Thailand-Cambodia truce.

- An additional 10% tariff hike was imposed on Canada last week “above what they are paying now”, according to President Trump. All bilateral discussions have ended since.

- Existing home sales grew by 1.5% mom to a 7-month high of 4.06mn in Sep (Aug: 4.0mn), thanks to better affordability and lower mortgage rates. Median home prices were up by 2.1% yoy to USD 415,200.

- Kansas Fed manufacturing index jumped to 15.0 in Oct (Sep: 4.0), the highest since Apr 2022, thanks to increases in both durables and non-durables, mainly from positive monthly gains in shipments and production while new export orders were a drag.

- S&P flash manufacturing PMI increased to 55.2 in Oct (Sep: 52.0), thanks to a 20-month high in new orders and increased production while employment growth was at a 3-month low.

- University of Michigan consumer sentiment index declined to 53.6 in Oct (Sep: 55.1), the lowest in five months. The 1-year ahead inflation expectation was unchanged at 4.6% while the 5-year inflation expectation ticked higher to 3.9% (from 3.7% the month before).

Europe:

- Flash manufacturing PMI in the eurozone moved to a neutral reading of 50 in Oct, marking a modest improvement from 49.5 in Sep, reflecting an expansion in output and a recovery in new orders; output prices rose at the fastest pace in seven months.

- The eurozone’s seasonally adjusted current account surplus weakened to EUR 11.9bn in Aug (Jul: EUR 29.8bn), primarily due to a deterioration in the goods surplus (a result of weaker exports amid sluggish global demand) and lower primary income surplus. This underscores the ongoing external pressures facing the euro area, as weaker demand from major trading partners continues to weigh on trade dynamics.

- Consumer confidence in the EU moved to an 8-month high of -14.2 in Oct, better than Sep’s -14.9, reflecting some resilience in household sentiment on lower borrowing costs and easing inflation.

- Producer price index in Germany fell by 0.1% mom and 1.7% yoy in Sep (Aug: -0.5% mom and -2.2% yoy). The yoy drop was seen for the seventh straight month and stemmed from lower energy costs (-7.3%), while increases were recorded in non-durable consumer goods (3.2%), durable consumer goods (1.8%) and capital goods (1.9%).

- German flash manufacturing PMI inched up to 49.6 in Oct (Sep: 49.5), with a marginal decline in export sales and employment declining for the 17th month in a row (longest streak since the 2008 financial crisis). Manufacturing output prices rose for only the second time in the past 29 months.

- UK inflation remained unchanged for the third month in a row, at 3.8% yoy in Sep, while the core inflation eased slightly to 3.5% (from 3.6%). The persistence of headline inflation above target for the 12th straight month underscores the challenge facing policymakers, as services prices remain elevated while food prices eased to 4.5% (Aug: 5.1%). Producer price index for inputs inched up by 0.8% yoy (Aug: 0.2%) and factory gate (output) prices surged by 3.4% for outputs (Aug: 3.1%) suggesting some renewed cost pressures in the production pipeline. Retail price index edged down to 4.5% from 4.6% the month prior.

- The preliminary manufacturing PMI in the UK rose by three points to a 12-month high of 49.6 in Oct, supported by higher levels of output “linked to restocking efforts and, in some cases, a tentative turnaround in domestic demand” and an upturn in new orders. Expectations for the year ahead were the second highest since Oct 2024.

- Retail sales in the UK unexpectedly grew by 0.5% mom and 1.5% yoy in Sep, helped by warm-weather-induced sales of clothing, strong demand for gold and tech sales, amid improving real wage growth and resilient consumer demand.

- GfK consumer confidence in the UK stood at -17 in Oct, the highest level recorded in 2025, and two points higher than the -19 clocked in the previous month.

Asia Pacific:

- At the latest plenum of China’s Communist Party’s Central Committee, it was decided that the new five-year plan would build “a modern industrial system with advanced manufacturing as the backbone” and accelerate its technology push(“high-level scientific and technological self-reliance”). In additional the committee called for supporting domestic demand, boosting consumption and improving livelihoods – no further details were provided.

- China’s GDP grew by 1.1% qoq and 4.8% yoy in Q3 (Q2: 1.1% qoq and 5.2% yoy), the weakest pace in a year, supported by exports as domestic demand waned. This places growth in the Jan-Sep period at 5.2% – on track to meet the almost 5% growth target for the full year. The data suggest that while sequential growth has stabilised, the annual comparison reflects a softer recovery trajectory amid weak confidence in the property sector and subdued demand.

- The People’s Bank of China left benchmark one-year loan prime rate unchanged at 3.0% maintaining its accommodative stance while relying more on targeted liquidity injections and fiscal measures to support growth. The decision reflects a balancing act between sustaining recovery momentum and maintaining the health of the financial sector.

- China’s industrial production increased by 6.5% yoy in Sep (Aug: 5.2%), thanks to manufacturing (7.3% vs Aug’s 5.7%) and mining activity (6.4% vs 5.1%). Retail sales pace slowed to a 10-month low of 3.0% (Aug: 3.4%), pointing to lingering caution among households despite policy efforts to stimulate spending. Fixed asset investment in China fell by 0.5% in Jan-Sep, after clocking in a 0.5% gain in Jan-Aug, signalling persistent weakness in the property sector (-13.9% vs -12.9% in Jan-Aug). Overall, the data depict a mixed picture: industrial momentum is improving, but domestic demand remains uneven.

- Japan’s headline inflation inched up to 2.9% in Sep (Aug: 2.7%). Excluding food and energy, prices eased to 3.0% (from 3.3%) while excluding food, prices ticked up to 2.9% (from 2.7%). The new PM Takaichi has instructed her new cabinet to draft an economic package to fight inflation.

- Exports from Japan rebounded in Sep, up by 4.2% yoy (Aug: -0.1%), after four months of declines, thanks to increased shipments of semiconductor-related goods. Exports to Asia grew (+9.2%) as did that to China (5.8%) while exports to the US tumbled (-13.3%). Imports reported a 3.3% uptick (Aug: -5.2%), taking the trade deficit to JPY 234.6bn.

- Flash manufacturing PMI in Japan slipped to 48.3 in Oct: industrial activity continues to face headwinds from weak global demand and high input costs. Activity contracted in 15 of the 16 past months (posting the steepest decline since Mar 2024) and factory orders dropped the most in 20 months.

- Infrastructure output in India was up by 3.0% yoy in Sep (Aug: 6.3%), with weakness concentrated in energy sectors – output of natural gas and refinery products fell by 3.8% and 3.7% respectively while electric power output slowed (2.1% from 4.1%). Steel production was robust, rising by 14.1% following a 13.6% uptick in Aug.

- India’s flash manufacturing PMI moved up to 58.4 in Oct (Sep: 57.7) reflecting steady domestic demand despite a weak growth in export orders (due to US tariff hikes).

- The Bank of Korea left interest rates on hold at 2.5% maintaining its tightening bias. The central bank continues to navigate a delicate balance between curbing inflation and supporting growth as household debt remains elevated; it also highlighted that the housing market stability was being monitored.

- Inflation in Singapore ticked up to 0.7% yoy in Sep (Aug: 0.5%), driven by a large increase in private transport prices (3.7% vs 2.4%) and prices of retail & other goods (0.3% vs -0.2%). Food and housing costs were unchanged while core inflation ticked up to 0.4% (from 0.3%).

- Singapore’s industrial production surged in Sep, up 16.1% yoy, following Aug’s 9% drop, The rebound was broad-based, led by electronics (+13.2% vs Aug’s -8.5% drop), transport engineering (13.8%) and the volatile biomedical manufacturing (45.9% from Aug’s -37.4%).

Bottom line: It is an activity filled week, with talks of a “framework” for a trade deal with China ahead of US President Trump’s meeting with President Xi Jinping during the former’s visit to Asia. Multiple major central banks are also meeting with week – with the Fed expected to lower interest rates by 25 bps and the ECB and Bank of Japan widely expected to keep interest rates steady. From the region, Saudi Arabia is hosting its flagship investment summit as global finance and business leaders converge in Riyadh this week.

Regional Developments

- The IMF raised its 2025 growth forecast for the Middle East & North Africa (MENA) region to about 3.3%, citing resilience in oil exporters (via higher production and public investment) and improvements in tourism, remittances and financial access for oil importers. However, the IMF emphasised that risks remain “tilted to the downside” with potential triggers including a fall in oil prices and renewed global trade tensions. While the region shows encouraging signs of diversification and resilience, sustaining momentum will require structural reforms (especially in productivity and labour markets) and failure to do so could lead to growth shortfalls or increased fiscal vulnerabilities.

- Bahrain and Saudi Arabia signed a bilateral agreement under Phase Two of the In-Country Value (Takamul) initiative, streamlining certification of origin and customs procedures in a bid to ease movement of goods, reduce operational costs and support industrial exports from Bahrain into Saudi Arabia. The accord aims to strengthen supply-chain linkages within the region and deepen economic integration.

- Egypt’s non-oil exports increased by 21% yoy to USD 36.64bn in Jan-Sep 2025, with growth driven by building materials (+51% to USD 11.69bn), chemicals/fertilizers (+10% to USD 6.8bn), food (+9% to USD 5.2bn) and electronics/engineering goods (+11% to USD 4.7bn).Top export destinations were UAE, Turkiye, Saudi Arabia, Italy and the US that together accounted for a total USD 14.774bn (42% yoy).

- Remittances into Egypt surged by 47.2% yoy to USD 26.6bn in Jan-Aug 2025, according to the central bank. In Aug alone, remittances increased by 32.6% to USD 3.5bn. The increase supports foreign-currency inflows, helps build foreign reserve, relieve external pressures, and underpins household consumption amid structural reform.

- Egypt’s Minister of Investment and Foreign Trade stated that the government has implemented about 60% of a set of 300 investment-climate reforms, while also revealing the creation of a comprehensive database to monitor performance and boost efficiency.

- Egypt recorded a quarterly rise of 1% in natural-gas production to 4.2bn cubic foot per day in Q3, the first in three years, reflecting improved upstream performance. However, Middle East Economic Survey, that reported the data, cautioned against expecting a steady recovery given that the output is expected to decline through the year.

- Saudi Arabia and UAE companies are actively participating in a bid for Egypt’s wind farm on the Red Sea. This move is part of Egypt’s broader strategy to privatize state-owned assets, aiming to attract both domestic and foreign investments – the Gabal El Zeit wind farm is one of the Middle East’s largest and boasts a total installed capacity exceeding 580MW.

- AGBI reported that Egypt plans to sign a EUR 220mn loan agreement with the European Bank for Reconstruction and Development (EBRD) in Nov, to fund its power infrastructure. The funds will be put towards a 500kV transformer station and a 100km ultra high voltage transmission line for the state-backed Egyptian Electricity Transmission Company, with the project to become operational before summer of next year.

- Kuwait’s labour market grew by 2.05% yoy to 2.99 million workers at end-Q2 Indians remained the largest workforce group (about 29.9% of the total), followed by Egyptians (15.7%) while Kuwaitis accounted for only 15%. The private sector employed 58.7% of the total workforce (or 1.75mn) and of this only 4.2% were Kuwaitis.

- The Institute of International Finance (IIF) has proposed that Lebanon could sell part of its gold reserves, estimated at 287 tonnes (or a value of USD 38bn at current prices) to revive the financial sector and help repay the frozen deposits. The proposal outlines selling USD 12bn worth of gold reserves and collateralizing an additional USD 16bn to generate sustainable income. However, any such plan will likely face opposition, as any sale would require parliamentary approval due to constitutional protections of gold reserves.

- Inflation in Oman ticked up to 1.13% yoy in Sep (vs Aug: 0.47%), taking the Jan-Sep average to 0.78% (Jan-Sep 2024: 0.58%). Prices of food & non-alcoholic beverages clocked in negative readings in 7 of the 9 months this year taking the average to -0.59% from 2.98% a year ago. Higher prices this year were seen in health (1.85% from 1.37% in Jan-Sep 2024), transport (3.1% vs -2.8%, largely due to vehicle maintenance and insurance costs), clothing & footwear (0.45% vs 0.09%) and restaurant & hotels (1.6% vs 0.21%).

- Oman initiated a substantial Government Development Bonds issue amounting to OMR 80mn, the 77th such offering. This move is part of Oman’s domestic funding strategy, and the bonds carry a five-year maturity and offer a coupon rate of 4.1% per annum.

- Value-added output of private enterprises in Oman experienced a decline in Q2, down by 0.8% yoy to OMR 8.15bn. Large enterprises continued to hold the largest share of value added at 59.3%, though their contribution declined 2.0%. The number of active private-sector enterprises rose 12.1% yoy to 282,764 in Q2.

- Qatar’s Energy Minister emphasized the importance of gas-producing countries presenting a unified front in opposing trade barriers, highlighting an EU sustainability law. The law states that large companies need to find and fix human rights and environmental issues in their supply chains or faces fines up to 5% of global revenue. The European Parliament agreed to consider further changes to the sustainability rules, given backlash also from the US.

- With the EU approving new sanctions against Russia including ban on its LNG imports, the US and Qatar are collaborating to fill the resulting supply gaps. This partnership highlights the strategic energy alliances forming in the global market. Russia supplies the EU with 21mn tons per year of LNG, of which 15.5 million tons come under long-term contracts.

- Qatar is introducing residency incentives to stimulate its property market: considering the decline in real estate value since the FIFA Cup in 2022, the government is considering new investment tools such as tokenisation and fractional ownership in addition to a fast-track to residency for properties valued at over USD 200k.

- Syria’s central bank has mandated commercial banks to fully provision for losses linked to Lebanon’s financial sector collapse. Affected banks have over USD 1.6bn in exposure to Lebanon (a significant amount given that total deposits in Syria’s commercial banks stands at USD 4.9bn, according to Reuters) and have six months to submit credible restructuring plans.

- A World Bank report projected the cost of Syria’s reconstruction at USD 216bn, saying the figure was a “conservative best estimate”, with the building of houses alone could take six to seven years. Separately, Syria’s Economy Minister expressed optimism that US sanctions could be formally lifted within the coming months.

- The Arab Investment & Export Credit Guarantee Corporation (Dhaman) reported that inter-Arab merchandise trade rose by 16.6% to over USD 250bn in 2024, a 9% share of total Arab merchandise trade. Over trade in the region (USD 2.8trn) was driven by a 0.3% increase in commodity exports (to USD 1.5trn) and an 11% rise in imports (to USD 1.3trn). China was the region’s top trading partner, holding a 16% share of total Arab merchandise trade. Additionally, FDI inflows into Arab countries rose by 53% to USD 122.7bn in 2024.

Saudi Arabia Focus

- Saudi Arabia recorded cumulative growth of 80% since the launch of Vision 2030, disclosed the Minister of Investment, also stating that the private sector’s share of GDP rose to 51% currently from about 40% in 2016 (the 2030 goal stands at 65%). He noted the relocation of 675 regional headquarters of international companies into Riyadh, also stating that investment volume as a share of GDP had grown to 30% from 22%. FDI had leapt to over SAR 120bn (vs SAR 20-30bn p.a.) and the target is to increase it tenfold by 2030. The advanced implementation status is positive for investor sentiment and credibility but monitoring how Saudi Arabia manages execution risk and maintains momentum in sectors where early “easy wins” are already achieved will be key to long-term resilience.

- Non-oil exports (including re-exports) from Saudi Arabia grew by 5.5% yoy to SAR 29.28bn in Aug, given a surge in re-exports (+32.9%). Oil exports grew by 7% yoy, supporting the 6.6% rise in overall exports to SAR 99.09bn. China, UAE and India were the top destinations for Saudi exports. Imports grew by 7.4% yoy to SAR 74.85bn in Aug, supporting a widening of the trade deficit (by 4.1%).

- Saudi Arabia is hosting its flagship Future Investment Initiative from Oct 27-30, focusing on the theme “The Key to Prosperity: Unlocking New Frontiers of Growth” amid rising economic and geopolitical uncertainty. As global finance and business leaders converge in Riyadh this week looking to sign new deals, Saudi will aim to attract FDI into its various projects including in AI, tech and manufacturing.

- The Saudi EXIM Bank extended SAR 23.61bn in credit facilities in H1 2025, up 44% yoy, taking the total to a milestone SAR 100bn since its establishment in 2020.

- Value of Saudi-listed bonds and sukuk grew by 3.0% qoq to SAR 695.8bn at end-Q3 2025, according to Tadawul’s quarterly debt market report, with government sukuk and bonds dominating the market (97.6% of total listed debt). Saudi investors held majority of listed debt instruments, 97.4% of the total or SAR 677.4bn.

- Saudi Railway Company alongside Riyad Capital established a new real-estate fund worth up to SAR 6bn: this targets a 90,000 m² plot in the Al-Rusifah district adjacent to the Haramain High-Speed Railway station in Mecca for a mixed-use transit-oriented development.Though no scope nor expected start date details were provided, the initiative aligns with regulatory shifts allowing foreign investors in real estate in the holy cities, positioning this project as a potential early beneficiary of the reform.

- The AlUla heritage-and-tourism destination in Saudi Arabia is launching SAR 6bn worth investment projects for private-sector participation across 21 initiatives by late-2025 or early-2026. Visitors at the UNESCO World Heritage site stood at 300,000 last year and the target is to reach one million visitors by 2030. The chief tourism officer of the Royal Commission for AlUla revealed that its budget had been secured for the next five years and also disclosed that an IPO is “not yet” planned but under consideration.

- Saudi Arabia’s Tourism Minister stated that the country has not yet decided whether to invest in Egypt’s Red Sea coast near Ras Gamila as the focus is on domestic tourism development for now: the Red Sea Global development plans to open 17 new hotels by May 2026. He also confirmed that Saudi Arabia meets FIFA’s hotel requirements for hosting the 2034 World Cup and is currently working to expand its luxury accommodations.

- Red Sea Global (RSG), backed by the Public Investment Fund of Saudi Arabia, announced it is moving to launch its first international project in Italy, signalling a strategic push beyond domestic Saudi resort. Expanding abroad can diversify RSG’s risk profile and anchor Saudi expertise in global luxury hospitality.

- Saudi Arabia’s ride-hailing sector clocked in 39.04mn trips in Q3, a 78% yoy increase, with Riyadh accounting for 43.9% of all trips (followed by Makkah and Eastern Province at 22.13% and 14.5% respectively).

UAE Focus

- The IMF projects Abu Dhabi to grow by around 6.0% in 2025, while Dubai is expected to expand by roughly 3.4%.The UAE’s overall growth, at 4.8% this year, is underpinned by strong non-oil sectors (tourism, real estate, financial services) and for Abu Dhabi specifically, an uptick in oil production following the easing of OPEC+ cuts. Sustaining the pace will require continued diversification, productivity improvements and resilience to external shocks (e.g., oil price swings or global demand‐slowdown).

- The UAE’s Ministry of Finance launched a “Retail Sukuk” initiative that allows UAE citizens and residents to invest in Shariah-compliant government-backed Treasury Sukuk (T-Sukuk) through participating banks, starting from as low as AED 4,000.The move is explicitly targeted to broaden the investor base beyond institutional players and foster long-term savings behaviour. This could deepen the domestic Sukuk market, reduce funding costs, and anchor savings in government debt.

- Sharjah attracted investments worth USD 1.5bn in H1 2025 (+361% yoy), disclosed the CEO of Invest in Sharjah, supported by a 57% rise in new projects to 74 and resulting in a 45% rise in new jobs (2,578). Earlier reports reveal that sectors driving growth were consumer products (+53% in project count, 188% jump in investment), food & beverages (112% growth in projects) and industrial equipment (project count doubled and investment surged 45%).

- The DIFC is home to over 8,000 active registered companies, with more than 1,000 entities regulated by the Dubai Financial Services Authority. DIFC’s 289 licensed banks and capital markets companies are currently managing around USD 240bn worth banking assets from the DIFC, compared to USD 80bn a decade ago.

- The number of active commercial licences in Ras Al Khaimah rose by 5.7% yoy to 21,575 in Q3 2025. Newer licences (3 years or less) accounted for 24.6% of the total, indicating fresh business formation in addition to legacy renewals (which accounted for 53.5% of the total).

- Dubizzle (the classified advertising website) elected to postpone its planned IPO on the DFM, citing a need to “assess optimal timing” for the offering despite strong investor interest.The UAE accounted for 89% of the company’s H1 revenue and the business is expanding in Saudi Arabia. Given its underlying business fundamentals, the delay likely reflects prudence around market conditions rather than weakness and when the listing proceeds, it could attract strong demand.

- International visitors to Dubai rise 5.1% yoy to 12.54mn in Jan-Aug 2025. Western Europe had the largest shares of visitors at 20.8%, while South Asia and CIS & Eastern Europe accounted for 14.4% each during the period (2.6mn, 1.81mn and 1.8mn respectively); GCC & MENA combined accounted for 3.5mn visitors (or 27.8% of total). At end-Aug 2025, there were 152,284 hotel rooms (+1% yoy) across 818 establishments (-1% yoy) in Dubai.Hotel occupancy rate at a strong 78.5% was higher than 76.2% in Jan-Aug 2024; revenue per available room of AED 413 (+7.6% yoy) remains among the highest recorded during the same period in past years while room rates stood at AED 526 (+4.6% yoy) and length of stay remained steady at 3.6 nights, but higher than 3.4 in Jan-Aug 2019).

- Passengers at the Sharjah International Airport rose by about 16.7% yoy to 5.13mn in Q3 2025.Aircraft movements increased by 10.7% to 30,737, while cargo operations grew by 4.0% (to 48,073 tonnes) and sea-air freight surged 32.8% (to 4,296 tonnes). The strong traffic momentum signals successful execution of Sharjah’s expansion strategy but sustaining this growth will require capacity upgrades (plans are underway to raise passenger capacity to. 20mn by 2026) and further airline partnerships.

- The governments of the US and Abu Dhabi have committed about USD 1.8bn to form a consortium with PE fund Orion Resource Partners aimed at increasing supply of lithium, rare earths and other critical minerals.The investment targets production-ready mining and processing projects globally, marking a strategic shift toward strengthening upstream industrial capacity outside China with an aim to reshape mineral supply-chains.

Media Review:

US government debt burden on track to overtake Italy’s, IMF figures show

https://www.ft.com/content/34194bfa-b8ea-4301-8212-a554ee721aeb

Resilience amid Uncertainty: Will It Last? IMF REO for Middle East & Central Asia

https://www.imf.org/en/Publications/REO/MECA/Issues/2025/10/21/regional-economic-outlook-middle-east-central-asia-october-2025

The ebb and flow of Saudi Arabia’s US Treasury strategy, including comments from Dr. Saidi

https://www.arabnews.com/node/2620246/business-economy

Xi Jinping is at his boldest and brashest. How will Donald Trump fare this week?

https://www.economist.com/china/2025/10/26/xi-jinping-is-at-his-boldest-and-brashest-how-will-donald-trump-fare-this-week

Saudi Arabia’s New Pitch to Wall Street: Less Neom, More AI

https://www.bloomberg.com/news/features/2025-10-23/saudi-arabia-s-new-pitch-to-wall-street-less-neom-more-ai

Powered by: