Abu Dhabi’s Diversification, Saudi’s Fiscal Deficit & Middle East’s Aviation Momentum, Weekly Insights 3 Oct 2025

Abu Dhabi GDP. Saudi monetary stats, unemployment rate, 2026 budget, FDI flows. Middle East airlines.

Download a PDF copy of this week’s insight piece here.

Abu Dhabi’s Diversification, Saudi’s Fiscal Deficit & Middle East’s Aviation Momentum, Weekly Insights 3 Oct 2025

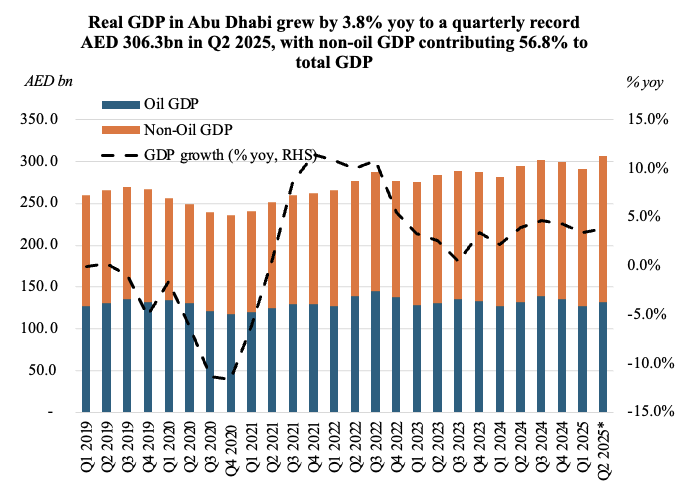

1. Abu Dhabi’s real GDP grew by 3.8% yoy in Q2 (Q1: 3.4%); non-oil GDP clocks in new record contribution of 56.8%

- Real GDP in Abu Dhabi grew by 3.8% yoy to AED 306.3bn in Q2 2025 (Q1: 3.4%), supported by robust non-oil sector activity (a quarterly record AED 174bn, up 6.6% yoy). Contribution of non-oil sector stood at a record high 56.8% of total GDP, highlighting broad-based diversification. Nine of the sixteen economic activities posted the highest-ever quarterly value in Q2, including manufacturing, financial, real estate & construction.

- GDP also expanded by 5.3% qoq, with both oil and non-oil sector growing by a strong 3.7% and 6.4% respectively. The real estate sector posted significant gains in Q2 (+14.2% qoq and 10.2% yoy), as housing projects are fuelled by an increase in population and rising investor demand. The financial sector accelerated by 10.8% qoq and 10.3% yoy, supported by ADGM’s growth as a financial hub (ADGM reported a 42% yoy surge in assets under management in H1 and 47% increase in new entities).

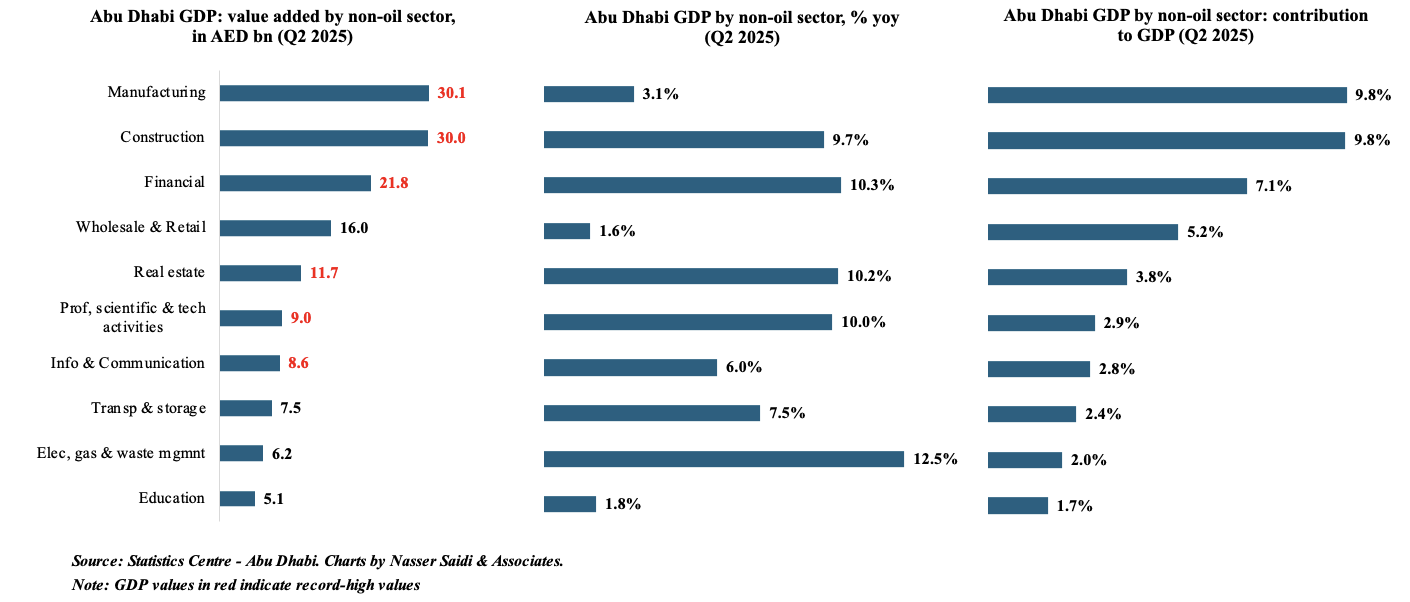

- Manufacturing sector also had the largest contribution to GDP in Q2 (9.8%), followed closely by construction (9.8% share) and financial (7.1% share) sectors. The fastest growing sectors were professional, scientific and technical activities (10.3% yoy), construction (10.2%) and financial & insurance (9.1%).

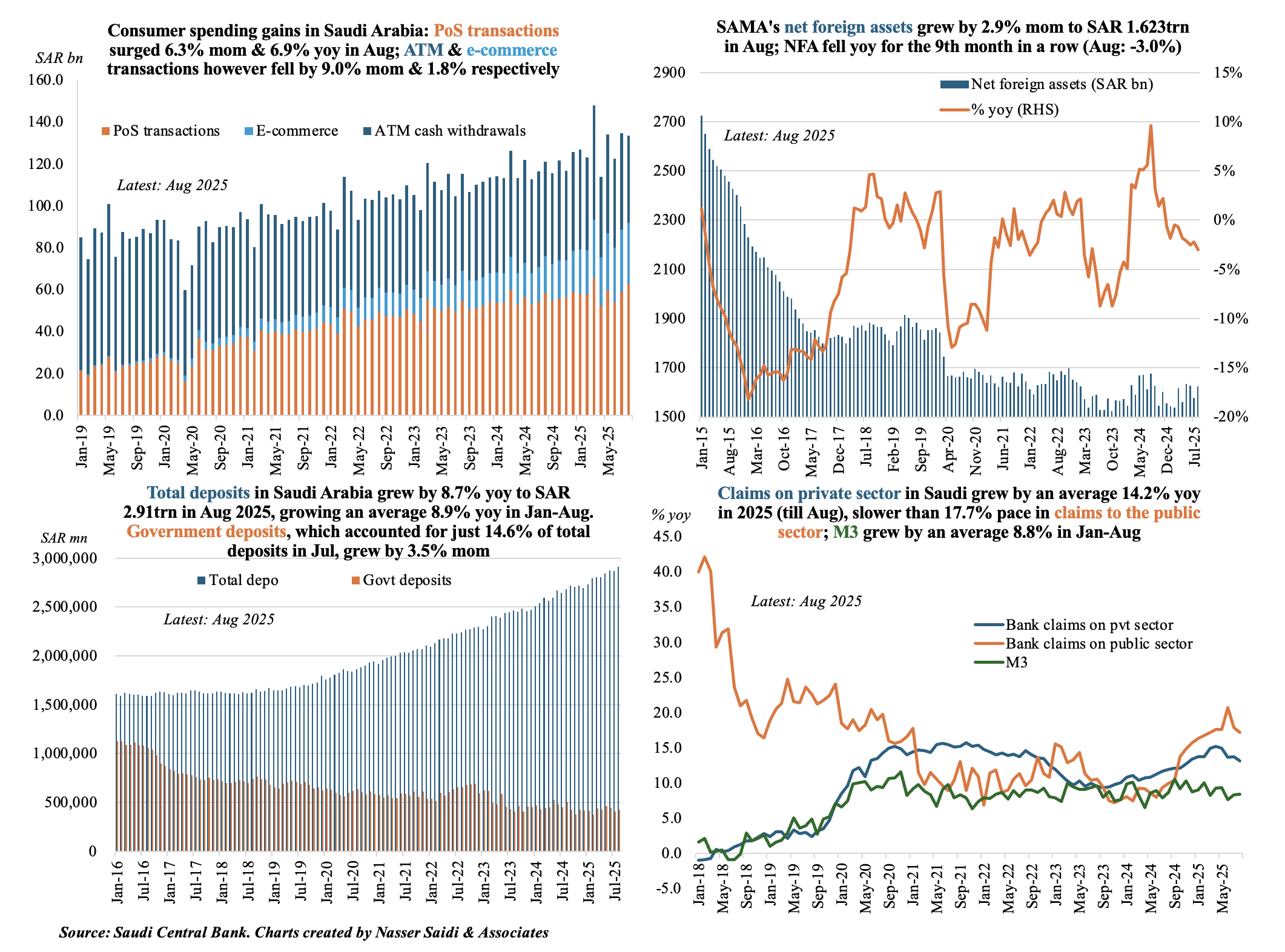

2. Deposit growth in Saudi Arabia averaged 8.9% in Jan-Aug 2025; credit growth outpaced deposit growth for the 19th straight month in Aug. In yoy terms, NFA fell for 9th consecutive month. Consumer spending inched lower, dragged down by ATM & e-commerce transactions

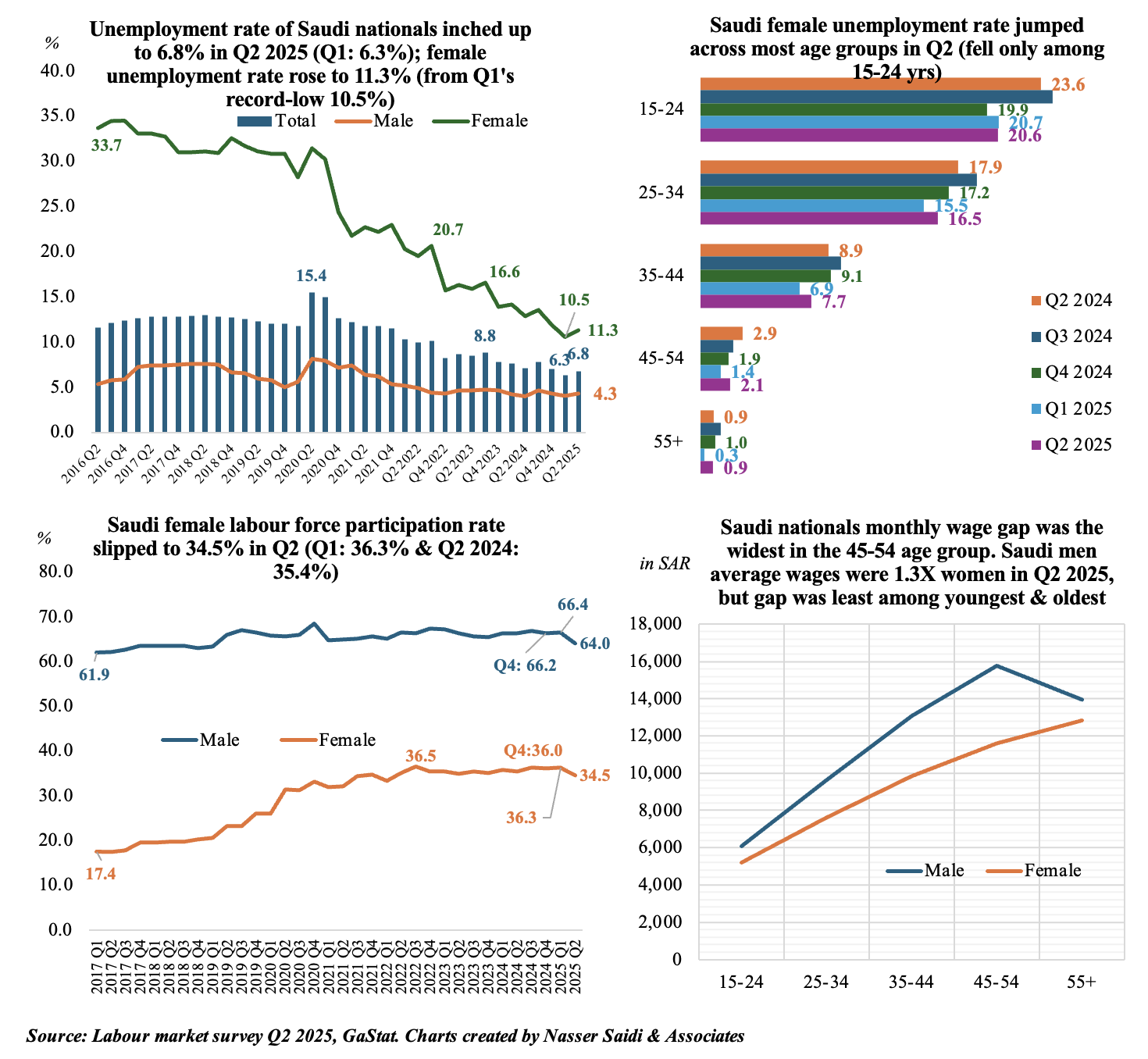

3. Unemployment rate of Saudi citizens rose to 6.8% in Q2

- Unemployment rate of Saudi citizens ticked up to 6.8% in Q2 (vs Q1’s record low 6.3%). Overall unemployment rate including expats also moved up to 3.2% (Q1: 2.8%).

- Saudi female unemployment rate increased to 11.3% (Q1: 10.5%). All groups (except 15-24 age) saw an increase in unemployment rate (vs Q1); readings are lower vs a Q2 ‘24. The improvement in 15-24 age group is promising: hinting at success of the “Early Work” initiative or possibly public-private partnership programs targeting entry-level jobs.

- Saudi FLFPR declined to 34.5% (Q1: 36.3%) – this is the lowest since Q3 ‘22 (36.5 ). Employment to population ratio for Saudi women fell to 30.6 in Q2 (Q1: 32.5); this compares to 61.3 in Saudi men (Q1: 63.8).

- Wage gap remains persistent. Female citizens’ wages averaged SAR 9,108 in Q2 (men: SAR 11,695); wages of women aged 55+ was highest (SAR 12,836, reflecting the seniority of a small pool of employees).

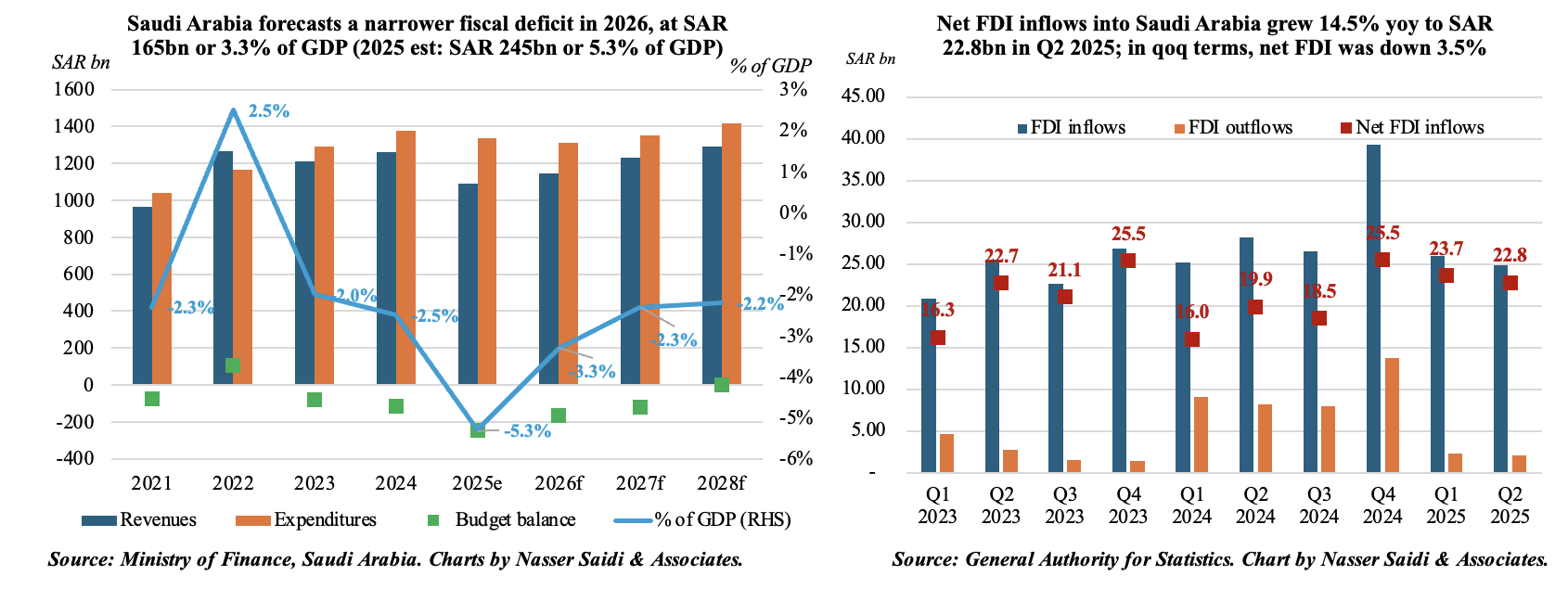

4. Saudi Arabia’s expansionary budget; net FDI inflows rises in H1 as outflows plunge

- Fiscal deficit in Saudi Arabia is forecast to narrow to SAR 165bn in 2026 (or 3.3% of GDP from an estimated 5.3% of GDP in 2025), on higher revenues (+5.1% from 2025 estimate) and lower spending (-1.7% from 2025 estimate).

- Compared to 2025 budget, full year estimate for this year’s revenues was down by 7.9% (to SAR 1.09trn) and spending up 4.0% (to SAR 1.336trn).

- Fiscal deficit in 2025, estimated at SAR 245bn (or 5.3% of GDP), was double the forecast in 2025 budget (SAR 101bn, or 2.3% of GDP).

- The ministry of finance also forecast real GDP growth of 4.4% in 2025 and 4.6% in 2026, supported by expansions in non-oil sector activity (no breakdown was provided).

- Net FDI inflows into Saudi Arabia grew by 14.5% yoy to SAR 22.8bn in Q2; in quarterly terms, however, it was down 3.5% qoq.

- Inflows into Saudi fell by 4.1% qoq and 11.5% yoy to SAR 24.9bn in Q2. Outflows plunged, falling almost 75% yoy to SAR 2.1bn, possibly as KSA reduces investments abroad and retains capital.

- Net inflows of SAR 46.47bn in H1 2025 was higher than the SAR 35.97bn clocked in H1 2024, thanks to the decline in outflows in both Q1 & Q2.

- FDI inflows fell by 5% yoy to SAR 50.9bn in H1, just over one-third of the target of SAR 140bn for 2025 (in the National Investment Strategy), raising questions if the target can be met unless some landmark deals are made in H2 2025.

- FDI inflows are expected including into AI & tech sectors (LEAP 2025 conference had announced USD 14.9bn in investment commitments).

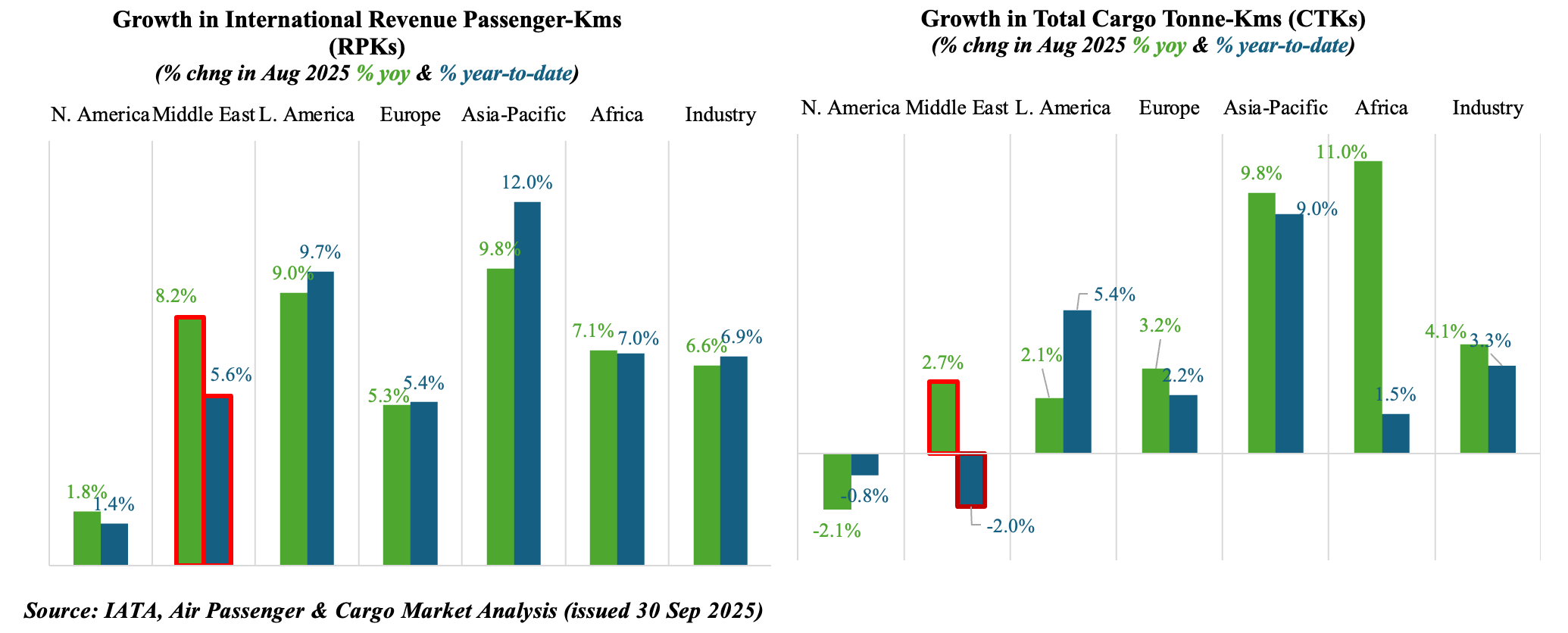

5. Gains in air passenger & cargo in the Middle East, thanks to strong Asia linkages

- International revenue passenger-kilometers (RPKs) growth in Aug (6.6% yoy) was driven by the Asia-Pacific region (9.8%, thanks to China and Japan markets). Middle East airlines experience was also strong, up 8.2% in Aug, with the Middle East-Asia travel corridor posting a gain of 8.5%. Year-to-date gains in the Middle East was slightly muted (5.6% during the year vs industry average of 6.9%), underscoring the impact from ongoing regional conflicts.

- Air cargo demand remained relatively resilient in the backdrop of tariffs uncertainty. Cargo tonne-kms (CTKs) grew by 4.1% yoy in Aug, posting the sixth straight month of growth, and was up 3.3% year-to-date. Demand for air cargo will be impacted by the relative cost of air freight compared to ocean shipping (especially in the backdrop of conflicts in the Middle East) and by tariff-related changes in demand.

- Middle East carriers grew by 2.7% in Aug, slightly higher than the 2.5% clocked in the month before, but was down by 2% so far this year. Interestingly, the Middle East–Asia cargo corridor, which represented 45.8% of Middle East air cargo demand in 2024, saw volumes reach record highs (CTKs at +7.8% yoy in Aug). This is also a sign of cargo from Asia moving away from the US to other regions. Middle East-Europe trade route meanwhile saw a 0.8% decline.

Powered by: