Rising GCC Debt Levels, Weekly Insights 19 Sep 2025

Debt in the GCC. UAE H1 monetary stats. Saudi inflation. GCC Treasury holdings & gold.

Download a PDF copy of this week’s insight piece here.

Rising GCC Debt Levels, Weekly Insights 19 Sep 2025

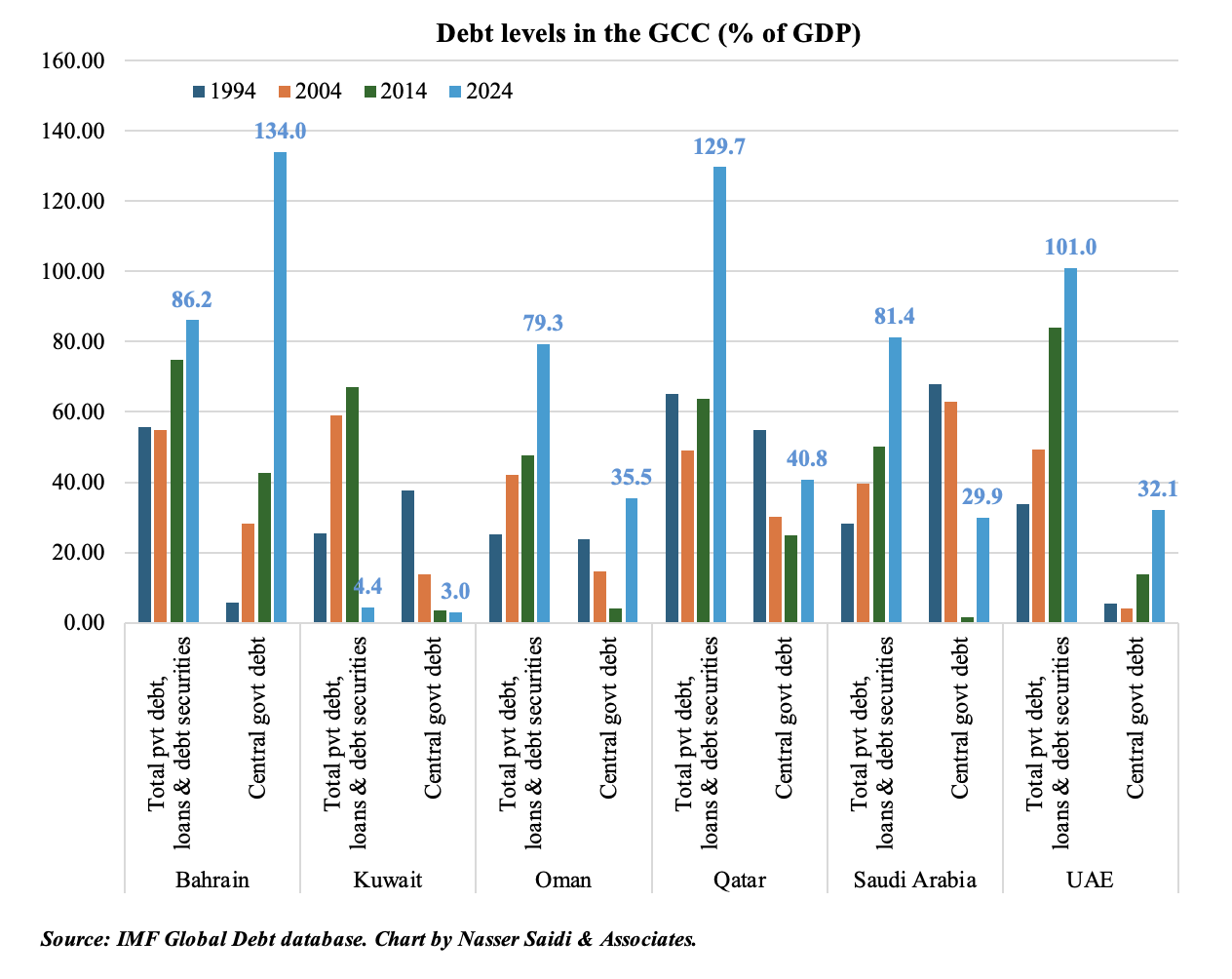

1. Private & government debt have been rapidly rising in GCC. Global debt rose to just over 235% of global GDP in 2024.

- In the GCC, Bahrain has the highest central government debt in 2024 (134% of GDP vs 5.6% in 1994) followed by Qatar (40.8%) and Oman (35.5%). Bahrain the most indebted in relative terms: amplifies risks – vulnerability to shocks, interest burden & refinancing risk => so, diversification matters.

- Total private debt, loans and securities as % of GDP was most in Qatar (129.7% of GDP vs 65.2% in 1994), followed by the UAE (101.0% of GDP), Bahrain (86.2%) and Saudi Arabia (81.4%). Remember that debt-fueled growth can be productive: if private debt funds infrastructure, energy projects, export capacity & such. Also key is routine monitoring of corporate leverage and bank exposure.

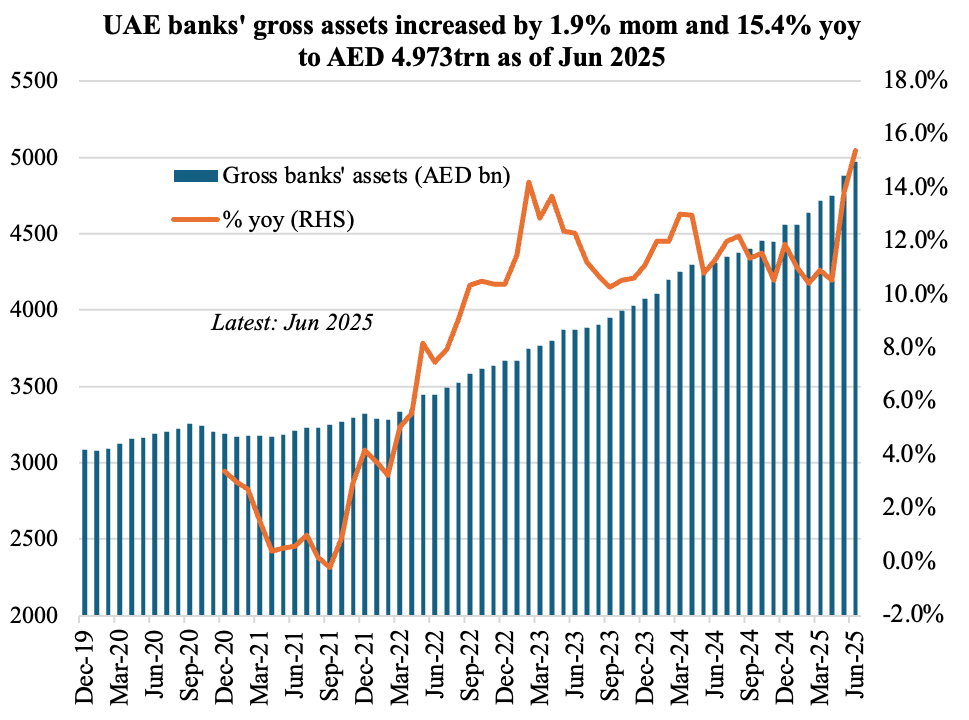

2. UAE deposits grow at an average 11.2% pace in H1; credit growth trails in comparison

- UAE’s gross bank assets continue to grow at a fast pace: it increased by 9.1% year-to-date (ytd) to a record AED 4.973trn in Jun. The central bank’s total assets crossed AED 1.0trn in Jun, up 24.6% yoy and 3.1% mom.

- While the central bank’s net international reserves jumped 2.8% mom to AED 956.9bn, its gold holdings have climbed to AED 28.9bn (25.7% ytd) – a reflection of the global trend, thanks to its safe-haven status, a hedge amid geopolitical risk and allowing for dollar diversification.

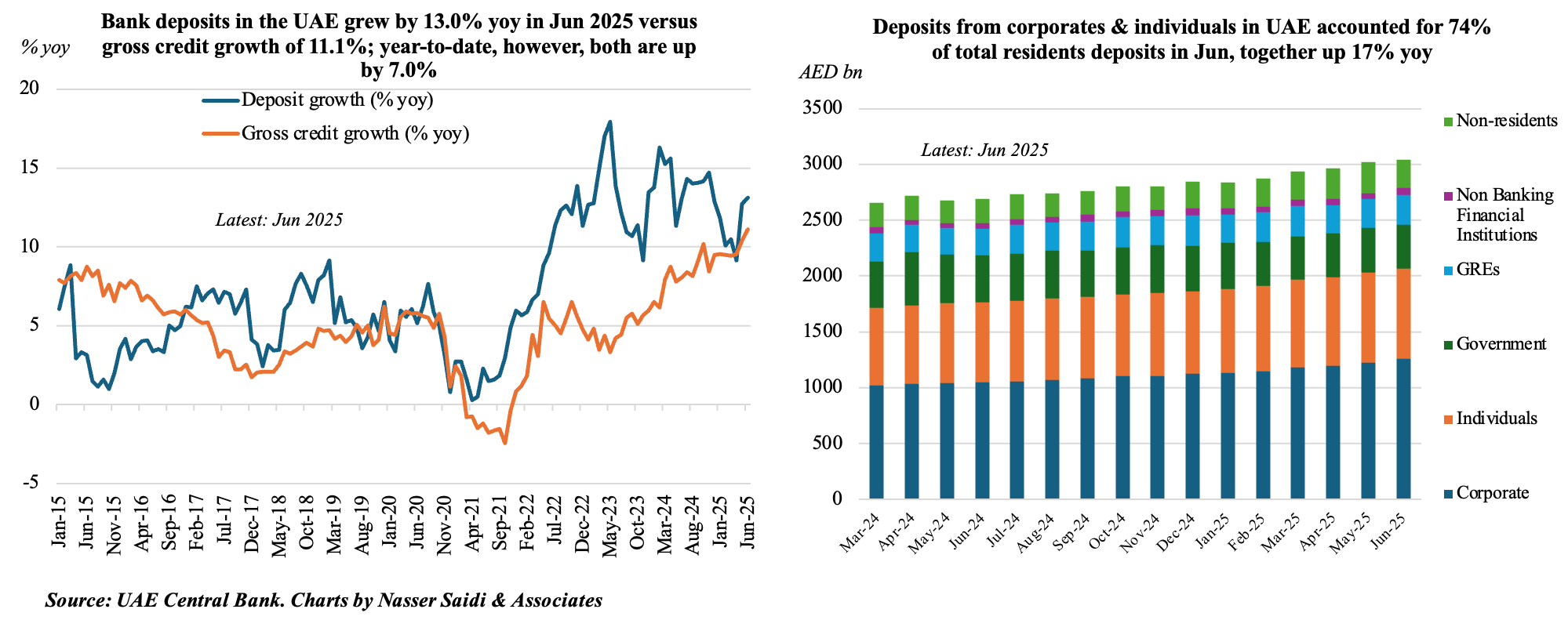

- UAE banks’ deposits grew at an average 11.2% pace in H1 2025. It grew 13.1% yoy in Jun, thanks to a 12.9% yoy rise in resident deposits (to AED 2.8trn) and 16.0% growth in non-resident deposits (8.3% of total deposits).

- Private sector deposits (at AED 2.06trn) accounted for 74% of residents’ deposits (17.0% yoy). Government & GREs, accounted for 23.7% of residents’ deposits, with the latter up 11.8% yoy while former fell by 5.6%.

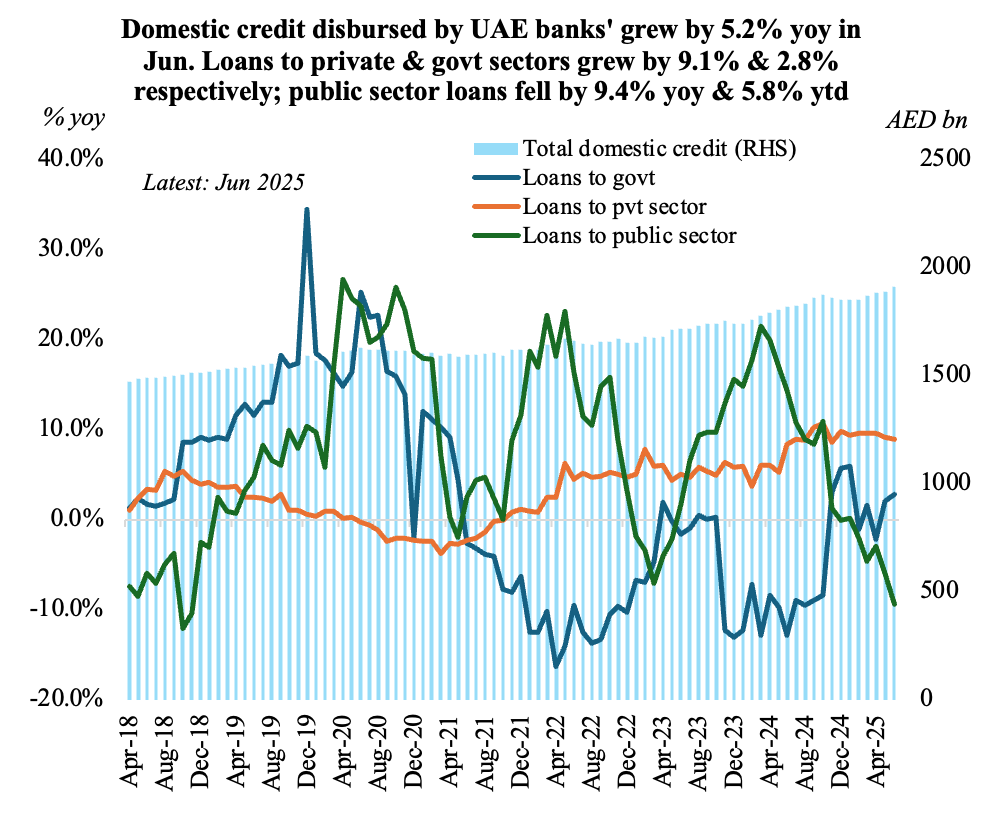

3. UAE gross credit & domestic credit grew by an average 9.9% & 5.3% in H1 ‘25

- Average growth in H1 2025 of gross credit (9.9% yoy) and domestic credit (5.3% yoy) lagged overall deposit (11.2%) in the UAE. However, year-to-date, both gross credit & bank deposits are up by 7.0%.

- Gross credit in the UAE grew by 1.8% mom and 11.1% yoy to AED 2.334trn in Jun. This was driven by growth in domestic credit (5.2% yoy to AED 1.91trn) and a surge in foreign credit (48.9% yoy to AED 423.6bn). Foreign credit also includes loans and advances to non-residents, which grew by 57.9% yoy to AED 33.8bn.

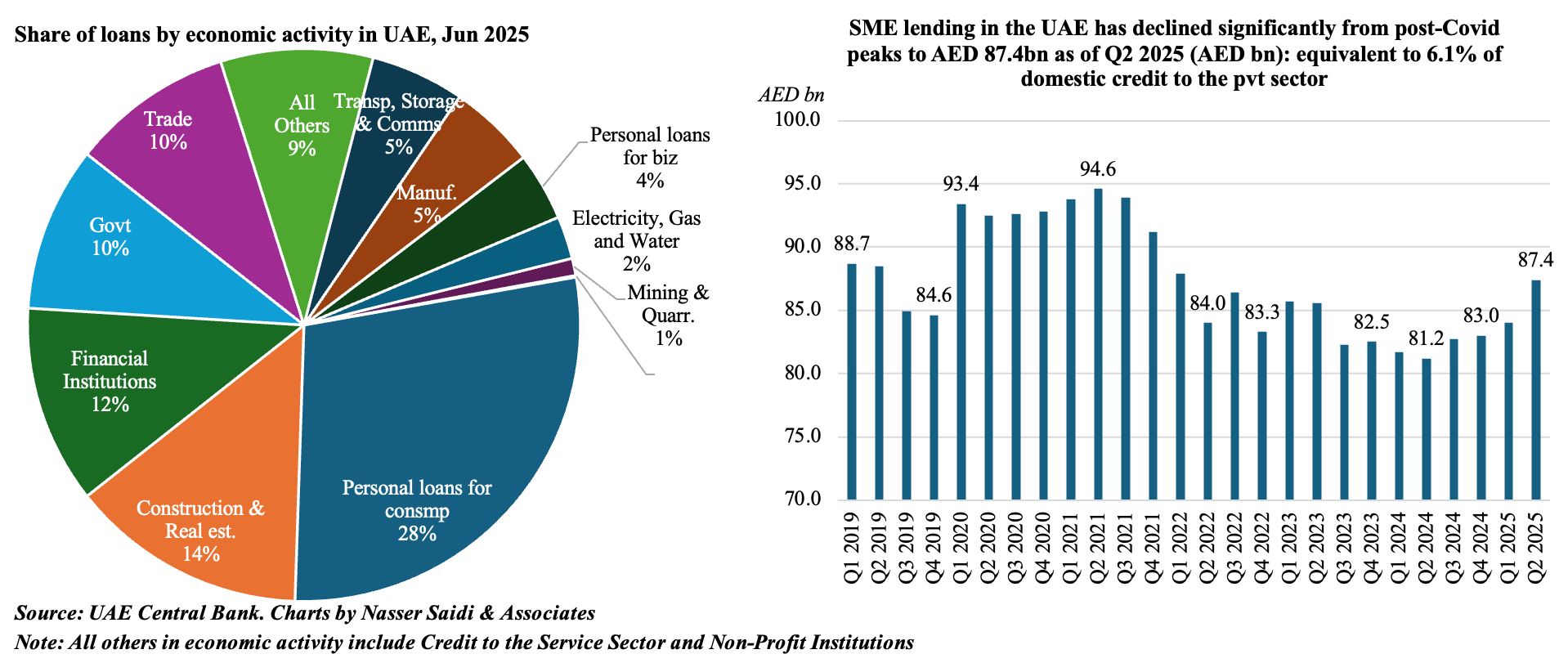

- Loans to the private sector accounted for three-fourths of domestic credit. Loans to the government increased by 2.8% yoy to AED 195.9bn while growth of loans to GREs fell 9.4% to AED 274.0bn.

- Lending to SMEs increased to AED 87.4bn, up 7.6% yoy (the fastest growth since Q4 2020) and 4.0% qoq (the sharpest gain since Q1 2020).

- When classifying bank credit to residents by economic activity, construction & real estate (14%), financial institutions (12%) and government (10%) were among the top.

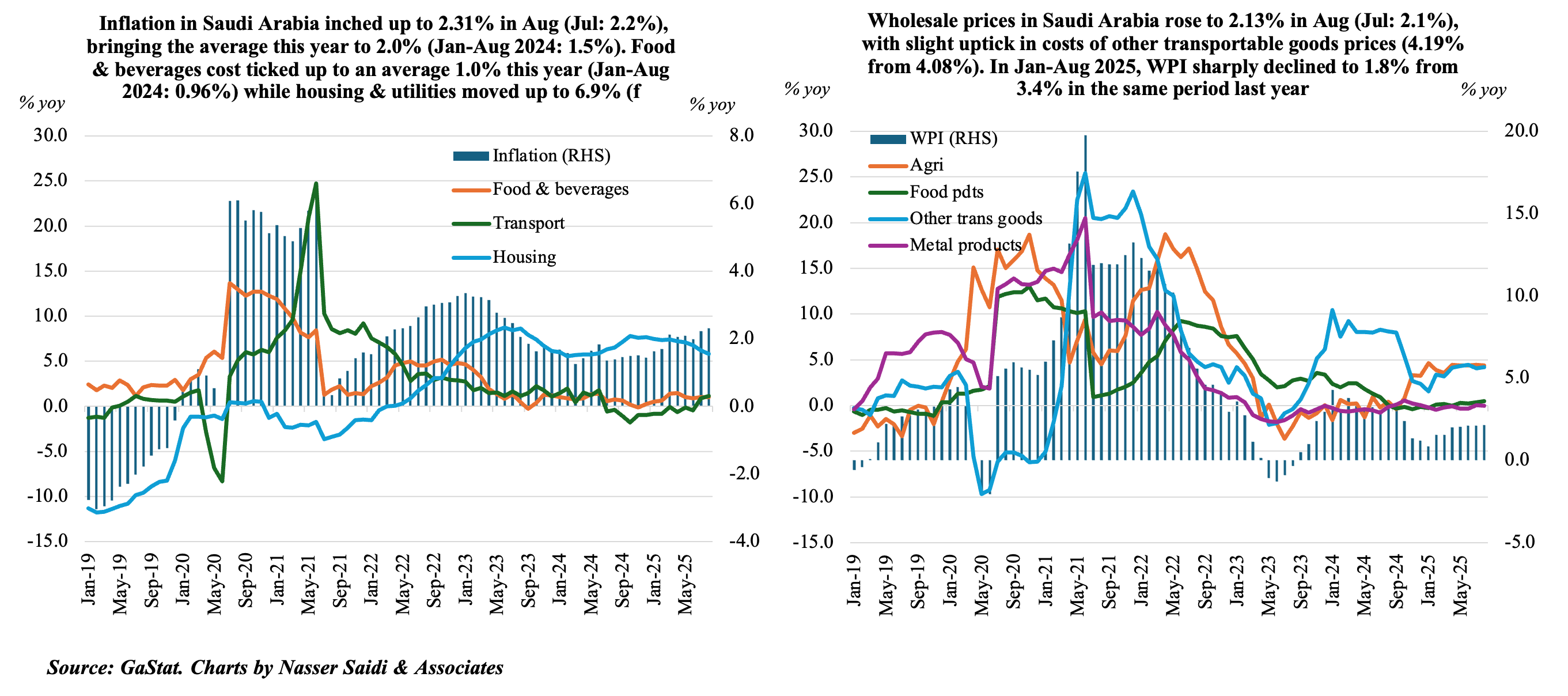

4. Consumer price inflation in Saudi Arabia inched up to 2.3% in Aug, the highest since Jul 2023; producer prices rose for the fifth straight month

- Saudi Arabia updated its methodology for calculating inflation. As per the latest data, consumer price inflation inched up to 2.3% in Aug (Jul: 2.1%), the highest reading since Jul 2023.

- Prices increased in most categories, with the sharpest upticks being in restaurants & accommodation (3.0% from 1.9% in Jul) and transport (1.2% from 0.9%). Prices did ease in housing & utilities (5.8% vs 6.2%) and recreation, sports & culture prices edged up (2.7% from 3.5%). A slow easing in housing costs stems from rental costs slowing to 7.6% (from 8.2%).

- CPI averaged 2.01% in Jan-Aug 2025 vs 1.51% in the same period a year ago, with the increase stemming from housing & utilities (6.9% from 5.9%) as well as recreation & culture costs (2.7% from 0.1%) while prices of personal care, miscellaneous goods & services accelerated (4.56% from 1.56%).

- Wholesale prices in Saudi Arabia moved up for the fifth consecutive month in Aug, to 2.13% in Aug (Jul: 2.10%), due to modest upticks in food products and other transportable goods; deflation continued in ores & minerals for the 25th month in a row (-0.84% from -0.85%).

- Average wholesale prices almost halved to 1.8% in Jan-Aug 2025 (vs Jan-Aug 2024: 3.4%), as prices of “other transportable goods” plunged (3.7% vs 8.4%), in addition to food products (0.1% vs 1.65%); costs of agriculture & fishery surged (4.3% from -0.1%).

5. Foreign US Treasury holdings reach a peak USD 9.159trn in Jul even as China lowered its holdings to the lowest since 2008. Kuwait jumped to another record-high & Saudi stayed 17th largest holder. Many central banks’ gold reserves rise in the region.

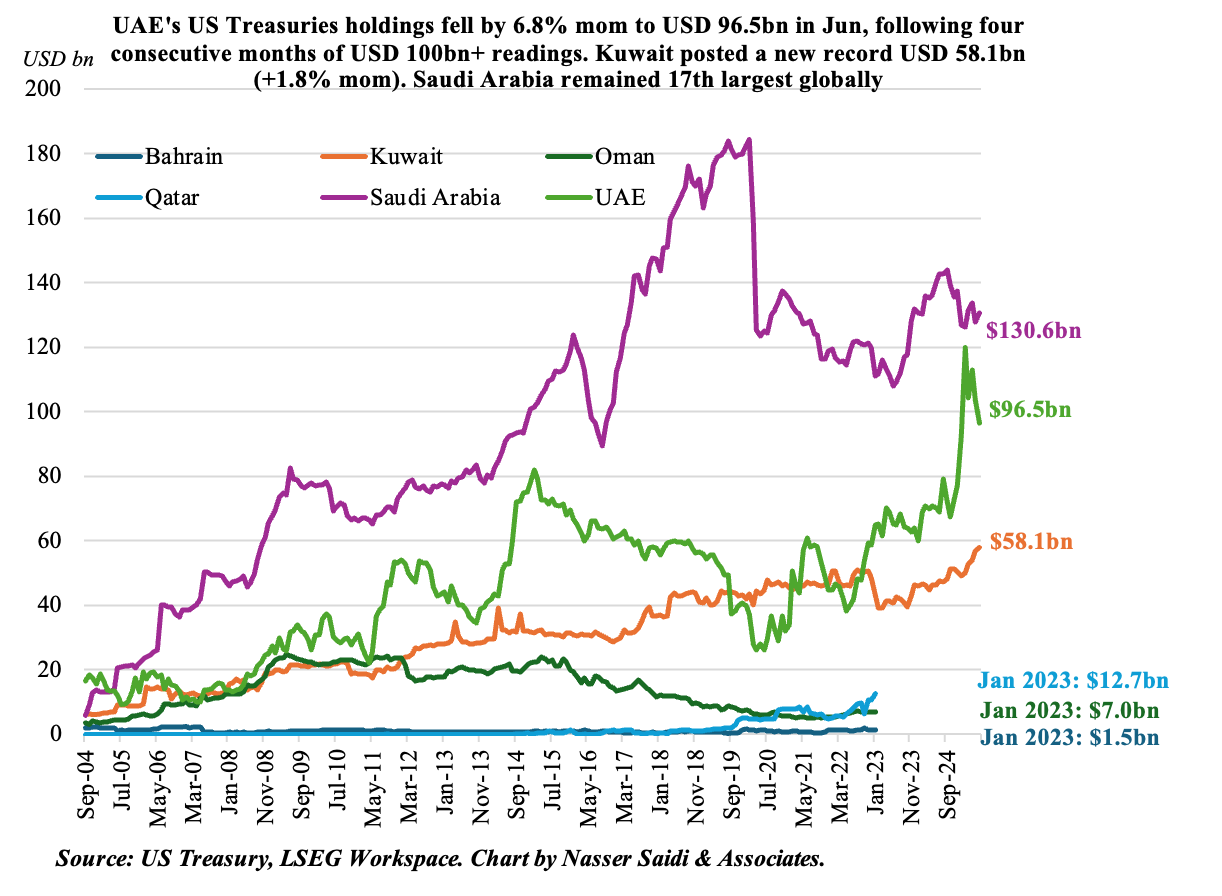

- Foreign holdings of Treasuries edged up by 0.4% mom and almost 9% yoy to USD 9.159trn in Jul: despite a decline in China’s holdings to USD 730.7bn (lowest since Dec 2008)

- Japan and UK were the largest two nations holding US Treasuries (at USD 1.15trn and USD 899.3bn respectively).

- Saudi Arabia remained the 17th largest global investor in Jul: though its holdings inched up 2.2% mom to USD 130.6bn; in yoy terms, it was down 6.9%.

- UAE holdings declined by 6.9% mom to USD 96.5bn. In yoy terms, it surged by 37.6%.

- Kuwait gained to a new all-time peak of USD 58.05bn, up 1.8% mom & 25.0% yoy (previous high: USD 57.0bn May 2025).

- Many central banks in the region have also been increasing their gold holdings – this includes Qatar (+4.8% ytd to 116.12 tonnes in Jun), Egypt (1.3% ytd to 128.54 in Jun), Jordan (1.6% ytd to 72.83 in Jun), UAE (0.2% ytd to 74.56 in Mar). Top holders of gold reserves at the central bank are Saudi Arabia, Lebanon and Algeria, with holdings of 323.07 tonnes (Mar 2025), 286.83 (Mar), 173.56 (Jun, no change from Mar). Source: World Gold Council.

Powered by: