Will Central Banks move to Reflect (Mixed) Macro Signals? Fed under pressure. Weekly Economic Commentary, 15 Sep 2025

Download a PDF copy of the weekly economic commentary here.

Markets

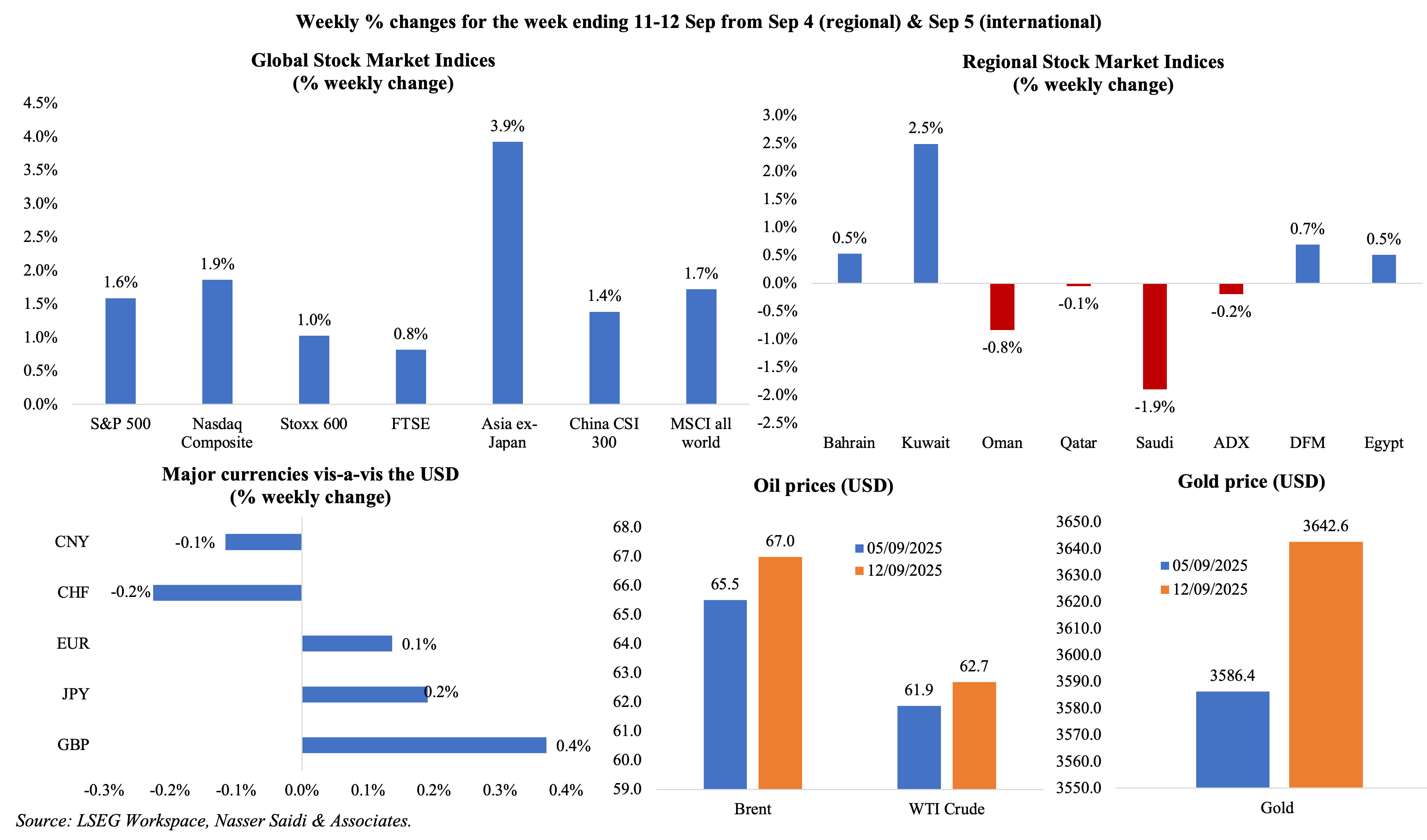

Major global equity indices ended on a positive note last week as expectations for a Fed rate cut increased: the three main US indices closed at record highs last Thursday, following the weaker-than-expected jobs data; markets seemed to have already priced in the rate cut and is looking to statements from the Fed Chair (a dovish tilt is widely expected). Regional markets were affected by tensions in the region (including the bombing in Qatar) and ended the week showing a mixed picture: with Saudi Tadawul was down the most, falling to a near two-year low while on Friday markets in the UAE ticked up on optimism about the rate cut. Among currencies, the GBP and EUR gained ground vis-à-vis the dollar. Oil prices ticked higher on concerns about ongoing conflicts in the Middle East and in Ukraine though oversupply and weak demand woes capped gains. Gold price touched new record highs last week on a weaker dollar and a potentially cooling down US economy.

Global Developments

US/Americas:

- US inflation inched up to a 7-month high of 2.9% yoy in Aug (Jul: 2.7%), reflecting persistent cost pressures in food (3.2% from Jul’s 2.9%), energy (0.2%, the first rise in 7 months) and housing (3.6% from 3.7%). Core inflation stayed unchanged at 3.1% despite the modest uptick in headline inflation. Consumers adjusting spending patterns in response to elevated prices could weigh on economic momentum heading into Q4. Looking ahead, inflation will likely continue to decelerate gradually, but the path to Fed’s 2% target may remain bumpy given resilient labour markets and persistent supply-side constraints. For now, investors are expecting a 25bps Fed cut this week.

- Producer price index in the US eased to 2.6% yoy in Aug (Jul: 3.1%), while excluding food and energy, prices dipped to 2.8% (Jul: 3.4%) indicating that input costs are moderating. This easing could eventually translate into slower consumer price growth though global supply chain uncertainties and energy price volatility remain risks to the outlook.

- Budget deficit in the US widened to USD 345bn in Aug (Jul: USD 291bn) despite the surge in net customs receipts (a new record USD 29.5bn vs USD 7bn a year ago), taking the year-to-date deficit higher by 4.0% to USD 1.973trn; this was the third-largest 11-month deficit after the Covid-years surges in 2020 and 2021. In Aug, both receipts and spending hit record highs of USD344bn (+12% yoy) and USD 689bn respectively.

- NFIB business optimism index inched up to 100.8 in Aug (Jul: 100.3), the highest since Jan, supported by improved expectations for sales and hiring. Nonetheless, firms continued to report labour quality as the top concern (21%) while inflation and regulatory burdens were also mentioned as top concerns by 11% and 9% of owners.

- Michigan consumer sentiment index slipped to 55.4 in Sep (Aug: 58.2), as expectations also slowed (to 51.8 from 55.9). The 1-year inflation expectation held steady at 4.8% while the 5-year ahead expectation ticked up to 3.9% (from 3.5%). The rise in long-term inflation expectations is particularly concerning for policymakers, as it may suggest eroding confidence in the Fed’s ability to maintain price stability.

- Initial jobless claims in the US jumped by 27k to 263k in the week ended Sep 6, the highest reading since Oct 2021, and the 4-week average inched up by 9.75k to 240.5k. Continuing jobless claims remained unchanged at 1.939mn in the week ended Aug 30.

Europe:

- The ECB left interest rates unchanged at 2% for the second meeting in a row. The apex bank appeared to be pausing to assess the effects of past hike as well as the impact of the EU-US trade agreement. Growth indicators across major economies like Germany and Italy have also been underwhelming. Later, the ECB President stated that the disinflationary process is over in the Eurozone, signalling that the ECB is done cutting interest rates.

- Sentix investor confidence in the eurozone tanked to -9.2 in Sep (Aug: -3.7), reflecting growing concerns over stagnation risks and policy uncertainty. The sharp deterioration suggests investors are increasingly pessimistic – the Current Situation Index fell to -18.8 (vs -13) and the Expectations Index declined to 0.8 (vs 6.0).

- German exports declined by 0.6% mom in Jul, as exports to the US fell to the lowest level since 2021 (-7.9% mom) and exports to China declined by 7.3%. Imports also fell by 0.1% in Jul, narrowing trade surplus to EUR 14.7bn from EUR 15.4bn the month before. This shift may also weigh on GDP in H2 2025 if the trend persists.

- Industrial production in Germany grew by 1.3% mom and 1.5% yoy in Jul, a partial rebound as increases in the manufacture of machinery and equipment (9.5% mom) and pharma (8.4%) were offset in part by a drop in energy production (-4.5%). Longer-term outlook looks fragile, with weak forward-looking indicators (e.g. new orders and business sentiment).

- GDP in the UK stagnated in the three months to Jul, with no monthly growth (Q2: 0.4%) and notable contractions in industrial and manufacturing output (by 0.9% mom and 1.3% respectively). Construction output grew by 0.6% (Q2: 1.2%) and services sector was the highest contributor to GDP growth (0.4% in May-Jul).

- UK like-for-like retail sales grew by 2.9% yoy in Aug (Jul: 1.8%), as sales in bricks-and-mortar stores grew by 5.2% (the most since Aug 2023), largely attributed to discount-driven purchases as retailers cleared stock, though high nominal wage growth may also have supported demand in real terms.

Asia Pacific:

- China’s exports grew by 4.4% yoy in Aug, the lowest rate since Feb, while imports by 1.3% (indicating tepid domestic demand), bringing the trade surplus wider to USD 102.33bn. Exports to the US plunged 33% in Aug, while imports from the country fell sharply by 16% yoy. In Jan-Aug, China’s exports to EU, ASEAN and Africa surged by 7.7%, 14.6% an 24.6% and compared to a 15.5% drop in exports to the US.

- Deflationary pressures deepened in China as both consumer and producer prices declined in Aug (-0.4% and -2.9% respectively from the previous month’s 0% and -3.6%). The deflationary CPI reading, the fifth this year, can be traced to food prices (-4.3% vs Jul’s -1.6%) while non-food inflation ticked up (0.5% from 0.3%). If price declines persist, expectations for additional stimulus (including fiscal) will only grow stronger.

- China’s money supply grew by 8.8% yoy in Aug alongside a rebound in new loans, up by CNY 590bn after a CNY 50bn fall in Jul (the first decline in 20 years). Outstanding yuan loans rose by 6.8% yoy, a record low, and slightly lower than Jul’s 6.9% uptick.

- BSI large manufacturing conditions index in Japan surged to 3.8 in Q3 (Q2: -4.8), the highest since Q4 2024, reflecting a sharp increase in exports and the deal reached with the US.

- Japan’s machinery tool orders grew by 8.1% yoy in Aug (Jul: 3.6%), driven by a 12% jump in foreign orders while domestic orders weakened (-1.4%). Rising orders point to future strength in production and renewed investment in high-tech equipment/ automation.

- Industrial production in Japan fell by 1.2% mom and 0.4% yoy in Jul, with global trade uncertainty and weak demand dragging IP. Output fell across the board, including in motor vehicles (-6.7% from 0.5%) and production machinery (-6.3% from 0.5%).

- Unemployment rate in Korea edged up to 2.6% in Aug (Jul: 2.5%), with the number of unemployed up by 4.9% yoy to 592k. Data indicate manufacturing and construction employment continuing to contract amid high youth unemployment (4.9% vs Jul’s 5.0%).

Bottom line: Major central bank decisions – including the Fed, Bank of England (BoE) and Bank of Japan (BoJ) – are on the cards this week. The Fed is widely expected to lower rates; the BoJ is unlikely to decide on interest rates until a PM is appointed (the two frontrunners are poles apart on monetary policy views); unless there is a sharp drop in UK employment data (on Tuesday) or easing services inflation (on Wednesday), the BoE is likely to stay hawkish. Separately, US-China trade talks were underway in Spain; the US Treasury Secretary revealed to the press that the discussions focused on TikTok than trade, and that a deal had been reached regarding the platform (the Chinese Vice Premier did not speak to the press).

Regional Developments

- Bahrain sponsored a deep‐sea mining firm’s (Impossible Metals) application for a mining permit from the International Seabed Authority (the authority has yet to finalise regulations for mining in international waters). The permit application targets part of the Pacific Ocean known as the Clarion‑Clipperton Zone, rich in polymetallic nodules containing metals such as nickel, copper and manganese. The environmental review process is expected to take about five years and cost roughly USD 70mn.

- Egypt and Bahrain signed eight major MoUs, among them a feasibility study for an alumina refinery in Egypt (between Egypt Aluminium and Alba) in addition to agreements on investment, customs divergence, tourism, antiquities, and competition policy. This bilateral cooperation will help diversify industry, improve trade infrastructure and raise non‑oil exports.

- Inflation in Egypt eased to 12% in Aug (Jul: 13.9%), the lowest since Mar 2022, and core inflation also ticked lower to 12% (from 13.9%). Inflation remains in double digits with prices of essentials like transport (26.8%) and housing (16.2%) still high; food inflation, at 2.1% (Jul: 3.4%) fell to the lowest level since May 2021. The PM recently has ruled out any electricity price hikes this month, citing concerns about welfare and inflation.

- Egypt’s National Narrative for Economic Development aims for 7% real GDP growth by 2030 (from a targeted 4.5% in FY 2025-26), raising total investments to 18% of GDP, boosting the share of private investment (both out of total investment and to GDP), creating 1.5 million new jobs annually, and increasing green public investments to 70‑75% of public investment. This ambitious roadmap, which will undergo public consultation for two months before a final version is issued in Dec, signals Egypt’s intention to shift towards investment‑led, private‑sector driven growth, with sustainability at its core.

- Iraq is exploring the construction of a crude export pipeline to Oman that would bypass the Strait of Hormuz, a strategic chokepoint. The route could be overland or undersea, with discussions underway, including for storage of 10mn barrels of crude in Oman’s Ras Markaz port. However, questions remain on funding, the countries involved in transit (if overland), and execution capacity. If the pipeline moves beyond feasibility into construction, it could shift regional energy trade dynamics: Iraq may gain pricing and reliability advantages for delivery to Asian markets.

- Kuwait is expected to delay implementation of the GCC-wide excise tax until the fiscal year ending March 2027, according to Fitch. Implementation of the tax was meant to raise KWD 250mn or 0.5% of GDP. Given the pressure on non-oil fiscal diversification, excise tax may eventually be phased in, perhaps with compensatory measures or exemptions.

- Lebanon’s cabinet approved a licence for Starlink (SpaceX) to provide satellite internet services across the country. The service will initially be limited to companies, with packages starting at USD 100 per month. This is a signal of liberalization and openness to competition in Lebanon’s teleco sector and may help improve internet speed and reliability challenges.

- Oman’s non‑oil exports grew by 9.1% yoy to OMR 3.26bn in H1, driven by growth in plastics, rubber and re‑exports. Overall trade surplus narrowed by 34.3% to OMR 3.09bn, largely due to the 16.1% decline in oil & gas exports (that poses risks to the fiscal balance). The UAE led Oman’s non-oil trade: exports up 29.8% to OMR 593mn and imports at OMR 1.98bn.

- Oman is setting up a USD 250mn special economic zone for artificial intelligence, dedicated to technical business startups. The zone will be developed by a local firm Afouq in partnership with Egypt’s Prime Group, with oversight by the Public Authority for Special/Free Economic Zones and technical advisory support from the Ministry of Transport, Communications & IT. For successful implementation, the project will need complementary policies such as skilled workforce development, intellectual property protection, regulatory clarity, and connectivity.

- The Oman Future Fund (part of the Oman Investment Authority) launched a new SME lending scheme that promises simplified application procedures, quick processing and delivers capital within two weeks along with flexible repayment terms. It is being managed in collaboration with Beehive, a regional fintech specializing in SME finance.

- India is set to finalise the Terms of Reference for a free trade agreement with Qatar in early October, according to an Indian government source. This supports India’s strategy to deepen trade partnerships, especially given the current high US tariffs on Indian exports.

- Qatar’s foreign currency reserves & liquidity increased by 3.2% yoy to QAR 260.3bn in Aug while official reserves rose at a slightly higher pace of 3.8% (to QAR 200.8bn). Within that, gold reserves saw a large increase, but holdings in foreign bonds and treasury bills modestly declined (to QAR 135.2bn).

- The US, Saudi Arabia, the UAE, and Egypt have put forward a peace roadmap for Sudan, following ongoing instability and conflict: this calls for a 3-month humanitarian truce, followed by permanent ceasefire. The proposal is aimed at stabilization and rebuilding, with the participating Arab states playing mediation and reconstruction roles. Stabilizing Sudan would unlock investment opportunities and reduce spillover risk for neighbouring countries.

- Saudi Arabia provided a grant to supply Syria with 1.65mn barrels of crude oil, to help the operation of its refineries and support the country’s post‑war recovery – as part of a broader humanitarian, reconstruction, and diplomatic normalization effort.

- A USD 500mn loan was secured to build the infrastructure that connects the UAE and Oman power grids, via a 400 kV double circuit line between the UAE’s Al‑Silaa station and the Ibri station (that will be built) in Oman. Though terms of the financing were not revealed, this move aims to enhance regional energy security and enable energy trade.

Saudi Arabia Focus

- Saudi Arabia’s real GDP grew by 3.9% in Q2 2025 (in line with preliminary estimates; Q1: 3.4%), supported by non-oil sector activity (4.6%, from Q1’s 4.9% gain) while oil sector rebounded (3.8% from Q1’s -0.4%). Non-oil sector activity accounted for around 55% of real GDP in Q2, while government activities were a relatively high 12% alongside a 21% share in mining and quarrying activity. Among non-oil sectors, manufacturing (excluding petroleum refining), trade and hospitality, and construction together accounted for about 30% of total.

- Industrial production in Saudi Arabia grew by 1.3% mom and 6.5% yoy in Jul. Oil activities expanded by 1.6% mom and 7.8% yoy, as crude oil production rose (given the OPEC+ decision). Non-oil activities increased by 0.6% mom and 3.5% in Jul. Within manufacturing, the manufacture of non-metallic products was the fastest growing (9.0% yoy) followed by chemicals & chemical products (8.88%).

- The “Saudi Summer” 2025 campaign attracted more than 32mn domestic and international tourists, up by 26% compared to the summer season last year, while spending grew by 15% to SAR 53.2bn. The surge in tourist numbers and spending underscores the strong growth momentum in the tourism sector as well as its untapped potential, with coastal, cultural, sports/ events and regional tourism scaling up.

- Aramco raisedUSD 3bn from the sale of sukuk, split into five‑ and ten‑year tranches, with strong investor demand as order books exceeded USD 16.8bn. Spreads tightened, suggesting confidence in both Aramco’s credit and broader investor appetite for Saudi debt, even under regional geopolitical tensions (the deal started a day after Israel’s attack on Qatar).

- Saudi Capital Markets Authority approved new regulations to allow the issuance of sukuk and debt via licensed crowdfunding platforms while also broadening private placements and tightened governance rules for special purpose entities (SPEs). These amendments were rolled out in the backdrop of a near doubling of the number of licensed SPEs (+87.2% yoy) and expansion in sukuk crowdfunding market (to SAR 3.4bn in 2024 from SAR 1.5bn in 2023).

- Sabic postponed plans to list its industrial gases unit (National Industrial Gases Co), calling off meetings with potential investors, reported Bloomberg. This could indicate hesitancy either in valuation, market timing, or both.

- Saudi Arabia posted a 14.7% yoy increase in transshipment volumes handled by its ports (to 189,407 TEUs), and a 9.5% increase overall in container throughput (to around 750,634 TEUs). This strong rise underscores the importance of investing in port capacity, logistics infrastructure and customs facilitation especially as Saudi looks to become an important regional trade and logistics hub.

UAE Focus

- Real GDP in the UAE grew 4.3% yoy to AED 455.30bn in Q1 2025, with non-oil sector activity up by 4.4% (to AED 351.9bn). The contribution of the non-oil sector clocked in a record 77.3% of the total. The fastest growing sectors in the UAE were real estate (7.4%), education (7.3%) and construction (6.8%) – this is not surprising considering the sudden surge in population leading to demand for housing, schools and infrastructure. Among non-oil sectors, wholesale & retail trade (12.1%), financial (11.3%) and manufacturing (10.3%) sectors together contributed one-third of total GDP.

- Bilateral trade between the UAE and Italy bilateral trade grew by 14.6% yoy toUSD 7.9bn in H1 2025. This follows a pattern of expanding trade, with bilateral non-oil trade up 19.7% yoy to USD 14bn in 2024. Key sectors identified for future collaboration include technology, renewable energy, healthcare, and infrastructure.

- UAE telecom operator du launched a secondary share offering, with one of its main investors Mamoura (a Mubadala subsidiary) planning to sell up to 342mn existing shares (roughly 7.55% of du and about 75% of Mamoura’s holding). The offer is priced between AED 9–9.90 per share and is expected to raise AED 3.39bn (USD 923mn) at the top end. The move will increase du’s free float, improve liquidity and broaden its investor base.

- ADNOC moved its majority equity holdings in many of its listed subsidiaries, including ADNOC Distribution, ADNOC Gas, ADNOC Logistics & Services and (pending regulatory approval) ADNOC Drilling, into its international investment arm XRG. The transfers were done via off‑market transactions on ADX, with ADNOC retaining full control through its 100% ownership of XRG; the units’ dividend policies and operational leadership will remain unchanged.

- UAE’s hotel establishments revenues increased by 6.3% yoy to cross AED 26bn (USD 7bn) in H1 2025 and occupancy rates reached 80.5%. High occupancy suggests demand is keeping pace with capacity, and the country looks on track to achieve its tourism goal i.e. for the sector to contribute AED 450bn to the economy by 2031.

- Registered active companies at ADGM increased by 42% yoy to 2972 firms in H1 2025; assets under management grew at a similar pace (+42%) as the financial centre is home to 154 fund and asset managers managing a total of 209 funds.

- Ajman’s Department of Economic Development reported a 37% yoy jump in new professional licences in H1: overall new licences grew by 24%, with industrial and commercial licences up 11% and 9% respectively. Ethiopia and Sudan were part of the top‑ten nationalities of licence holders for the first time, implying a more diverse investor base.

- UK’s fintech firm Revolut obtained in‑principle approvals from the UAE Central Bank for two licences: Stored Value Facilities (i.e. electronic wallets/prepaid accounts) and Retail Payment Services (Category II). These will allow the firm to offer payment‑account services and process retail payments; this could also increase competition with existing payment / remittance firms and could lead to greater fintech innovation in the UAE.

Media Review:

Saudi PIF’s “leaner, meaner, but more profitable” strategy into “2040 and beyond”

https://www.agbi.com/analysis/finance/2025/09/pif-prepares-for-leaner-meaner-but-more-profitable-future/

https://www.agbi.com/finance/2025/09/pif-to-set-out-strategy-for-all-the-way-to-2040-and-beyond/

Cyprus, UAE and the Great Sea Interconnector

https://www.reuters.com/world/middle-east/cyprus-talks-uae-over-european-subsea-cable-project-president-says-2025-09-08/

https://www.agbi.com/telecoms/2025/09/uae-may-take-the-plunge-into-the-great-sea-interconnector/

The US Will Rue Trump’s Trade War on India

https://www.project-syndicate.org/commentary/america-will-regret-trump-tariffs-on-india-by-duvvuri-subbarao-1-2025-09

America’s economy defies gloomy expectations

https://www.economist.com/finance-and-economics/2025/09/14/americas-economy-defies-gloomy-expectations

Powered by: