Growth Engines in Gear: PMIs Rise, Investment Grows, and Non-Oil Sectors Lead, Weekly Insights 12 Sep 2025

Middle East PMIs. Saudi GDP, IP & FDI. UAE GDP.

Download a PDF copy of this week’s insight piece here.

Growth Engines in Gear: PMIs Rise, Investment Grows, and Non-Oil Sectors Lead, Weekly Insights 12 Sep 2025

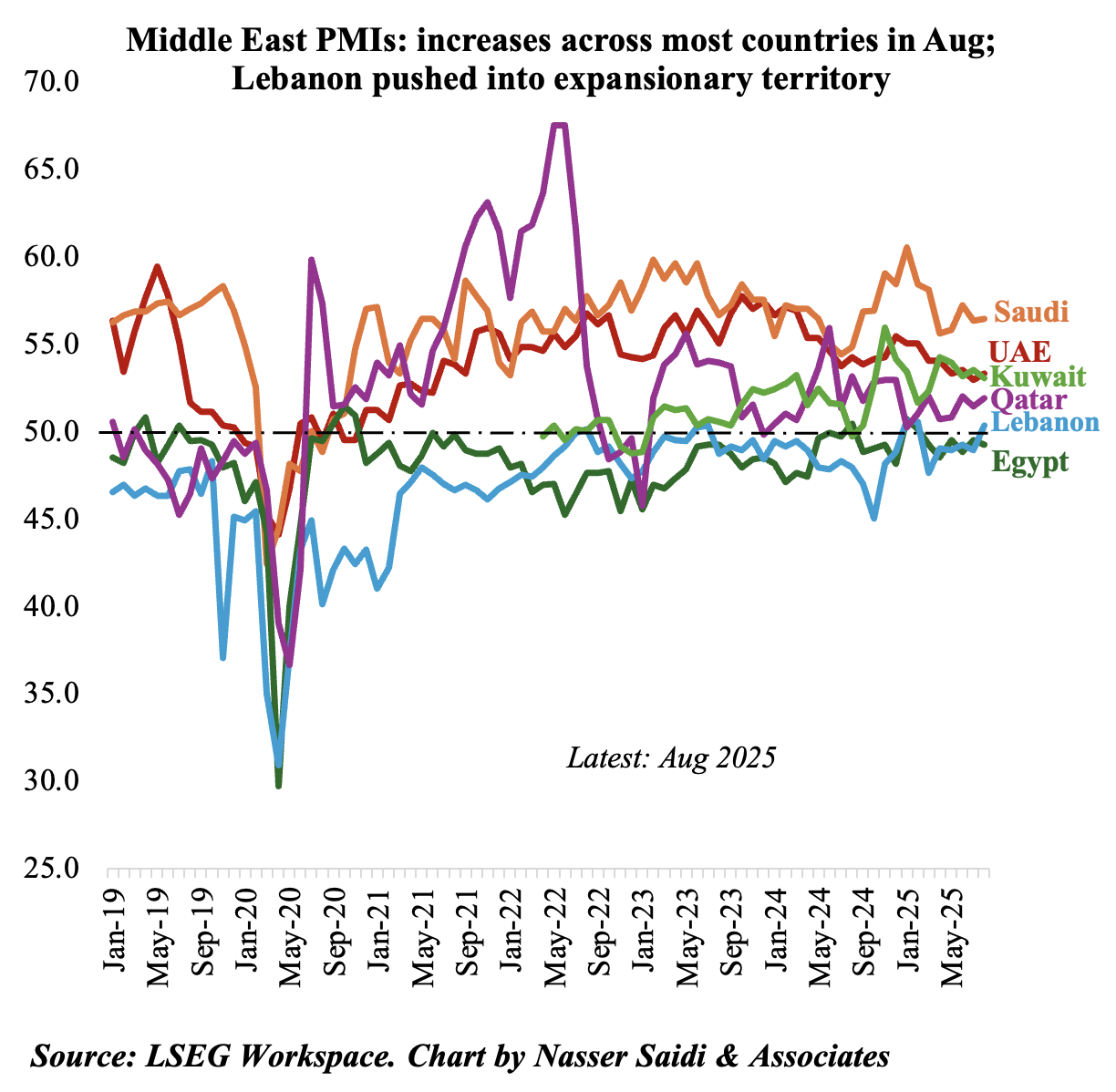

1. Middle East PMIs: Lebanon joins GCC counterparts into expansionary territory in Aug 2025

- Non-oil private sector activity in the GCC captured by PMIs stayed expansionary in Aug. Lebanon moved into expansionary territory, supported by stronger output and new orders (partly a seasonal summer months’ effect and partly confidence in government policy action). Kuwait and Egypt posted slight declines in the headline reading, to a 6-month low of 53.0 in the former & at 49.2 in the latter.

- Output growth touched a 6-month high in the UAE on strong sales and domestic demand, while new order volumes fell to the lowest level since Jun 2021, given competitive pressures & SS chain disruptions. In contrast, KSA saw a slight increase in new orders but driven by rise in export sales.

- With input costs rising with sharp increase in wage costs reported in UAE; Saudi highlighted materials, transport, and technology-related expenses), non-oil firms in UAE and Saudi modestly raised selling prices: in the UAE, the rate of increase was among the highest on record and in Saudi it was up for the third month in a row. However, respondents in Kuwait reported easing inflationary pressure.

- In Qatar, employment growth increased to a record-high and output prices plunged at the fastest rate since Dec 2018, raising questions about profitability.

- Egypt’s decline in PMI resulted from output and new orders declining at a quicker rate while inflation and weak demand dampened sentiment.

- Looking ahead, the GCC policymakers should focus on keeping input cost inflation under control (energy, wages, logistics – this will help firms obtain new orders; in others (EG, LB), macroeconomic stabilisation will be key to future gains – need to stimulate both domestic and external demand.

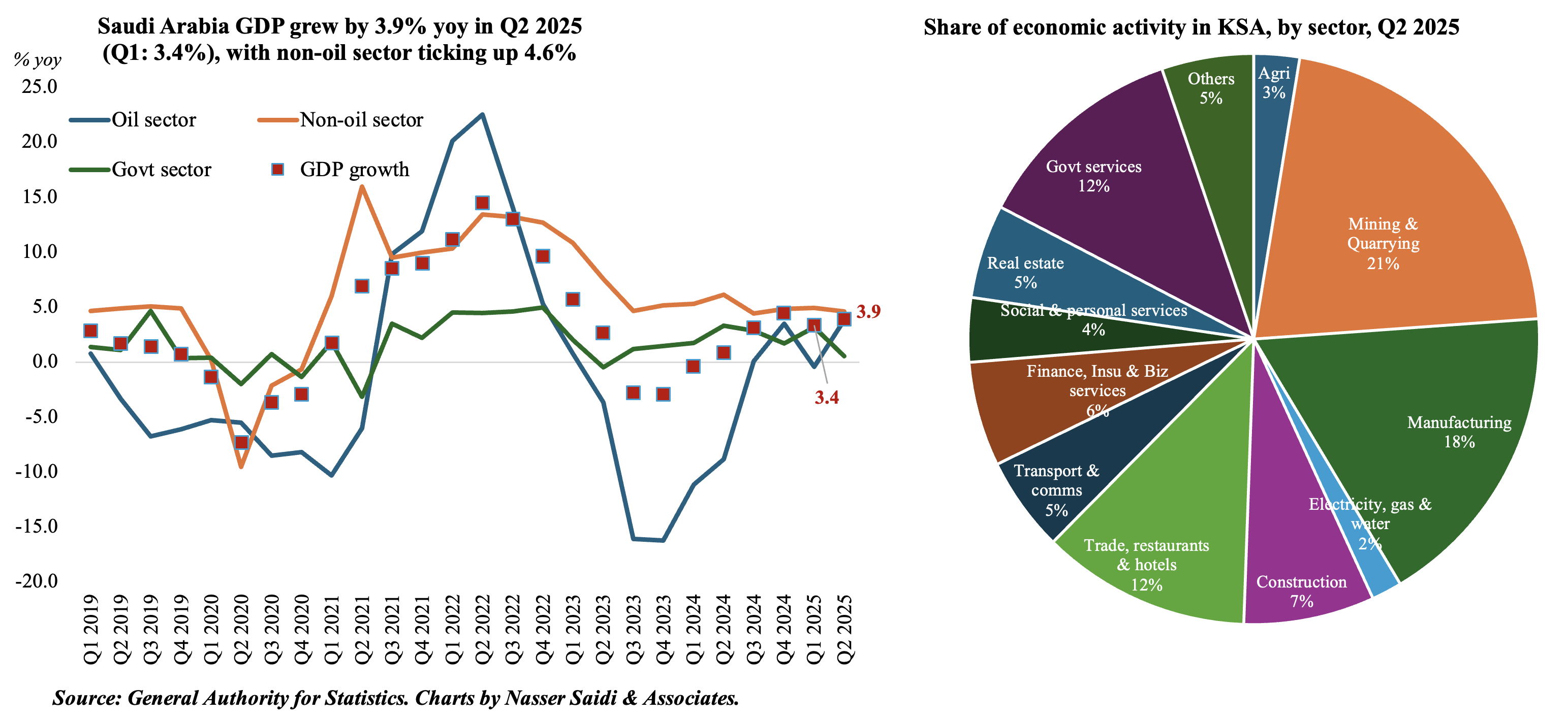

2. Saudi Arabia GDP grew by 3.9% yoy in Q2 2025, supported by non-oil activities; non-oil non-government gross fixed capital formation strong in H1 2025

- Saudi Arabia’s real GDP grew by 3.9% in Q2 2025 (in line with preliminary estimates; Q1: 3.4%), supported by non-oil sector activity (4.6%, from Q1’s 4.9% gain) while oil sector rebounded (3.8% from Q1’s -0.4%). Accelerated unwinding of oil production cuts (548k bpd to be returned to the market in Aug-Sep) will support oil sector activity. The government sector grew by 0.6% in Q2 (Q1: 3.2%).

- Non-oil sector activity accounted for around 55% of real GDP in Q2, while government activities were a relatively high 12% alongside a 21% share in mining and quarrying activity. Among non-oil sectors, manufacturing (excluding petroleum refining), trade and hospitality, and construction together accounted for about 30% of total.

- Nominal GDP grew by 1.1% yoy in H1 2025, supported by private final consumption expenditure (5.8%). Additionally, gross fixed capital formation grew by 5.8% yoy in H1, primarily due to a 6.9% rise in the non-oil non-government sector: this private sector activity bodes well for growth in the coming quarters.

- Looking ahead, non‑oil sectors (manufacturing, tourism, hospitality, trade) are expected to grow further in line with diversification efforts and supportive policy, while public investment in mega‑projects and foreign investment flows are likely to be important levers.

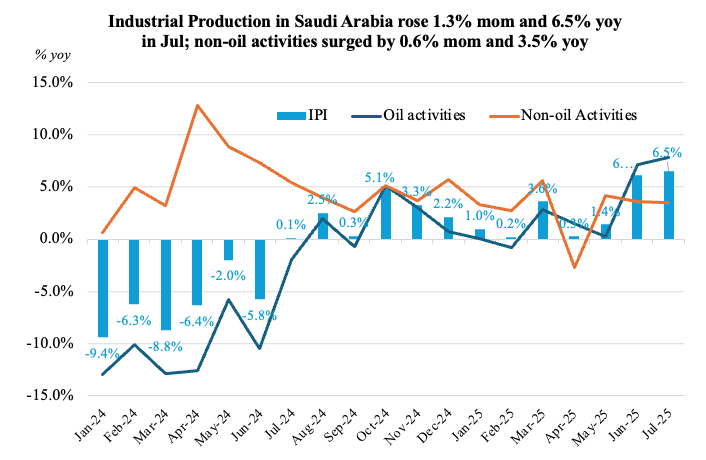

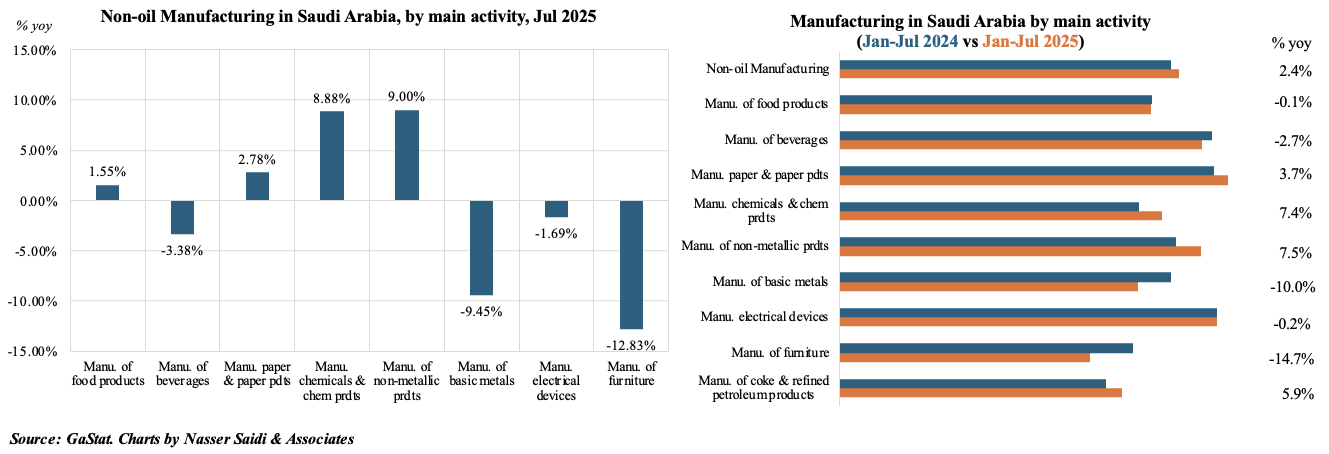

3. Saudi industrial production grew by an average 2.7% in Jan-Jul 2025, driven by non-oil activities

- Industrial production in Saudi Arabia grew by 1.3% mom and 6.5% yoy in Jul. Oil activities expanded by 1.6% mom and 7.8% yoy, as crude oil production rose (given the OPEC+ decision). Manufacture of coke & refined petroleum products surged by 13.8% yoy and 1.0% mom. Extraction of crude petroleum & natural gas increased by 6.5% yoy, the fourth month of upticks, and after double digit declines in H1 2024.

- Non-oil activities increased by 0.6% mom and 3.5% in Jul. Within manufacturing, the manufacture of non-metallic products was the fastest growing (9.0% yoy) followed by chemicals & chemical products (8.88%).

- In Jan-Jul, non-oil manufacturing ticked up by 2.4% alongside a 5.9% gain in the manufacture of coke & refined petroleum products. Under non-oil manufacturing, non-metallic products grew the fastest (7.5%).

- Infrastructure & utilities (energy, water, waste) show rising capacity, highlighting opportunities for sustainable & tech‑enhanced investment (e.g. clean energy, water treatment, recycling). Non‑oil industrial growth is positive but modest; faster growth will require overcoming constraints such as skills shortages, input cost inflation, supply‑chain bottlenecks (all of which could lead to greater efficiency & higher productivity).

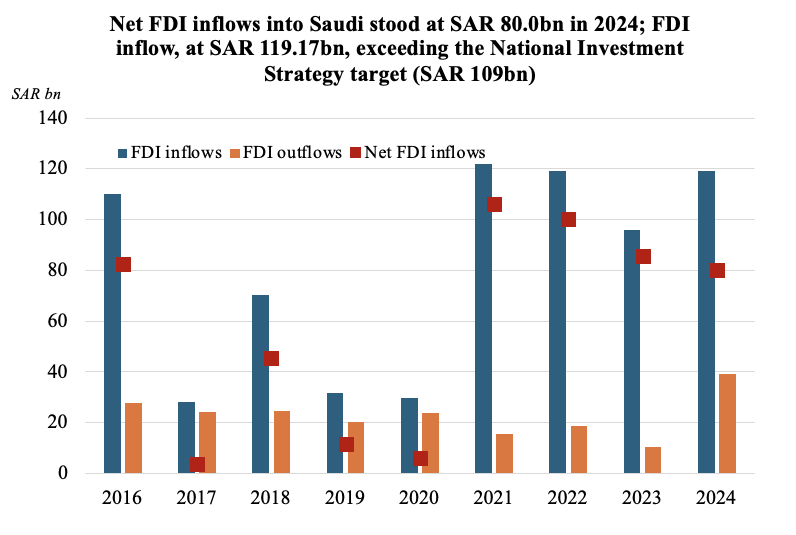

4. Saudi Arabia’s FDI inflows up 24.2% to SAR 119.2bn in 2024

- FDI inflows into Saudi Arabia clocked in at SAR 119.17bn in 2024, up 24.2% yoy, almost matching 2022 and a tad lower than 2021’s record high. As a result of the almost 4-fold increase in outflows to SAR 39.16bn in 2024, net FDI inflows declined to SAR 80.0bn. This was higher than the target of SAR 109bn for 2024, as per the National Investment Strategy.

- The large and growing FDI stock signals a deepening of foreign investor confidence; policy enhancements (ease of doing business, legal & regulatory changes, investor protection) can further amplify this momentum.

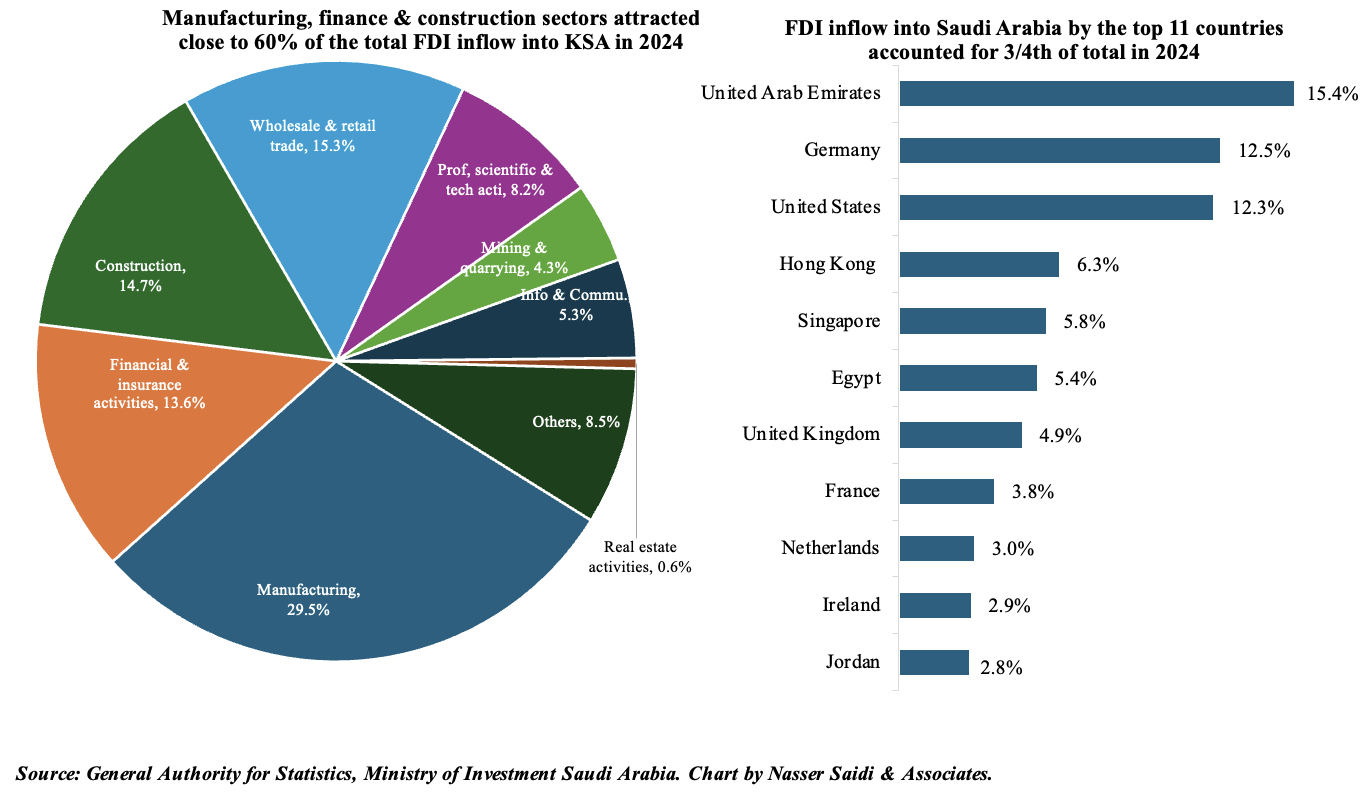

- FDI inflows by economic activities in 2024 showed that three sectors – manufacturing, financial & insurance and construction – accounted for close to about 58% of total FDI inflows.

- UAE topped in terms of FDI inflow into KSA in 2024: 15.4% by direct investor country (Source: GaStat). Germany & US were ranked second and third; FDI from Hong Kong and Singapore were 10 and almost 40 times higher vs 2023.

- The increased FDI outflow to foreign ventures (many regional integration projects) notwithstanding, it is important that domestic investment remains competitive.

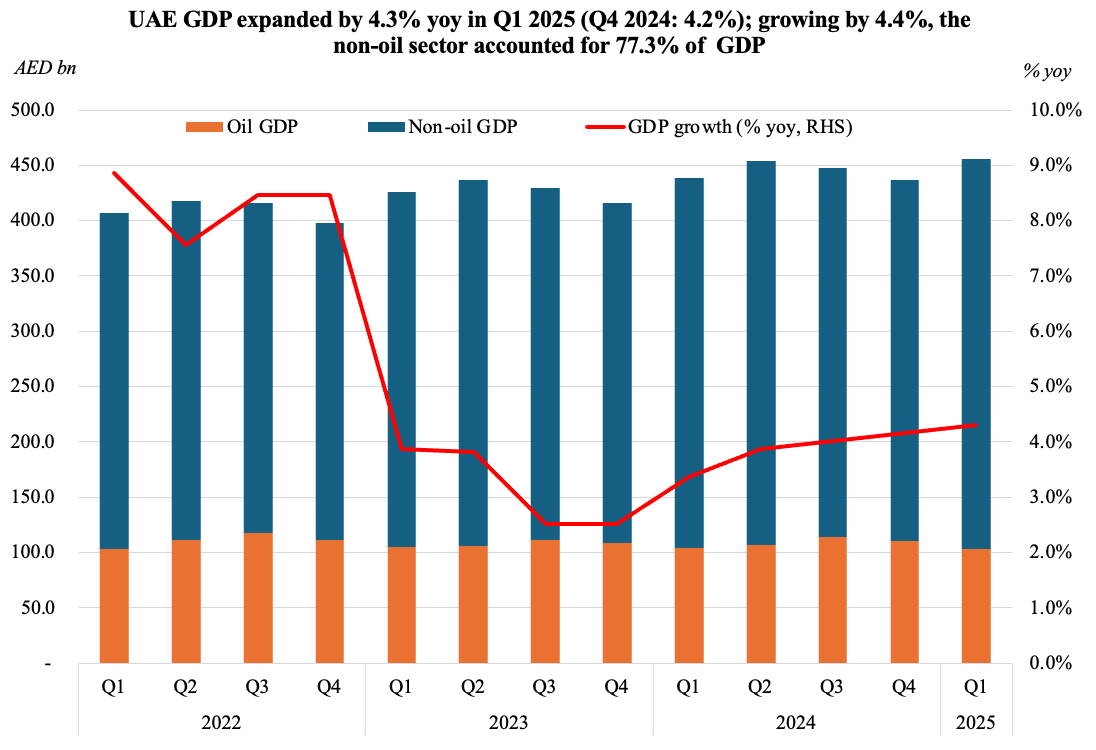

5. UAE GDP expanded by 4.3% yoy in Q1 2025, with non-oil sector accounting for more than three-quarters of overall GDP

- Real GDP in the UAE grew 4.3% yoy to AED 455.30bn in Q1 2025, with non-oil sector activity up by 4.4% (to AED 351.9bn). The contribution of the non-oil sector clocked in a record 77.3% of the total.

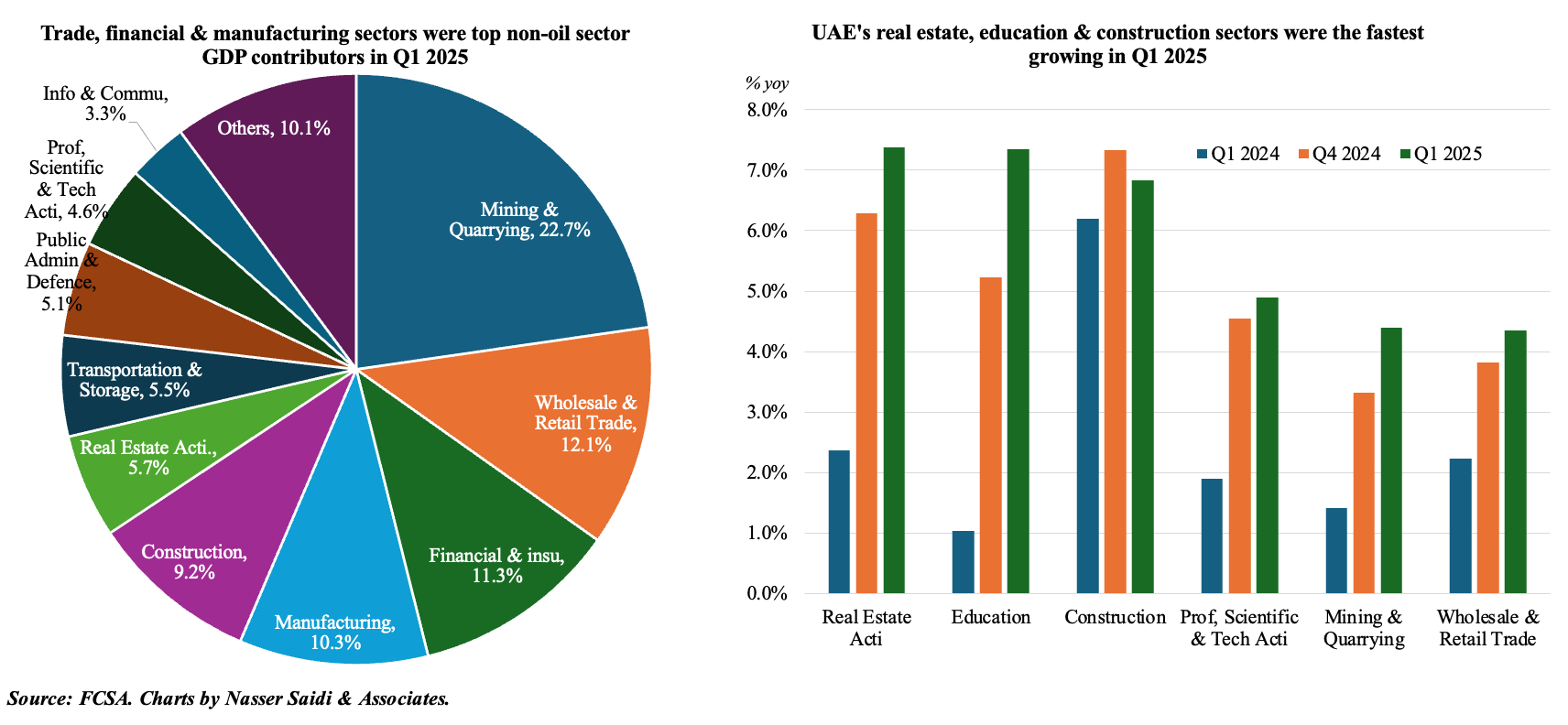

- The fastest growing sectors in the UAE were real estate (7.4%), education (7.3%) and construction (6.8%) – this is not surprising considering the sudden surge in population leading to demand for housing, schools and infrastructure. Others posting high growth rates were professional, scientific & technical activities (4.9%) as well as the oil sector (4.39%) and trade (4.35%).

- Distribution of GDP showed the oil sector accounting for less than 1/4th of GDP (22.7%). Among non-oil sectors, wholesale & retail trade (12.1%), financial (11.3%) and manufacturing (10.3%) sectors were the largest (three together contributed one-third of total GDP).

- The ongoing pace of trade deals and continued FDI inflows will allow for access to new markets, supply chain integration and being part of the global value chain, at times of global trade and investment uncertainty.

- Words of caution: while real estate and construction sectors see an upside from ongoing infrastructure and property demand, the risk of oversupply needs to be monitored closely. Inflation is relatively muted for now, but rise in costs of labour, materials and logistics could affect businesses’ margins (especially in construction and manufacturing).

Powered by: