Fed Whispers, Market Reactions & Geopolitical Rebalancing, Weekly Economic Commentary, 25 Aug 2025

Download a PDF copy of the weekly economic commentary here.

Markets

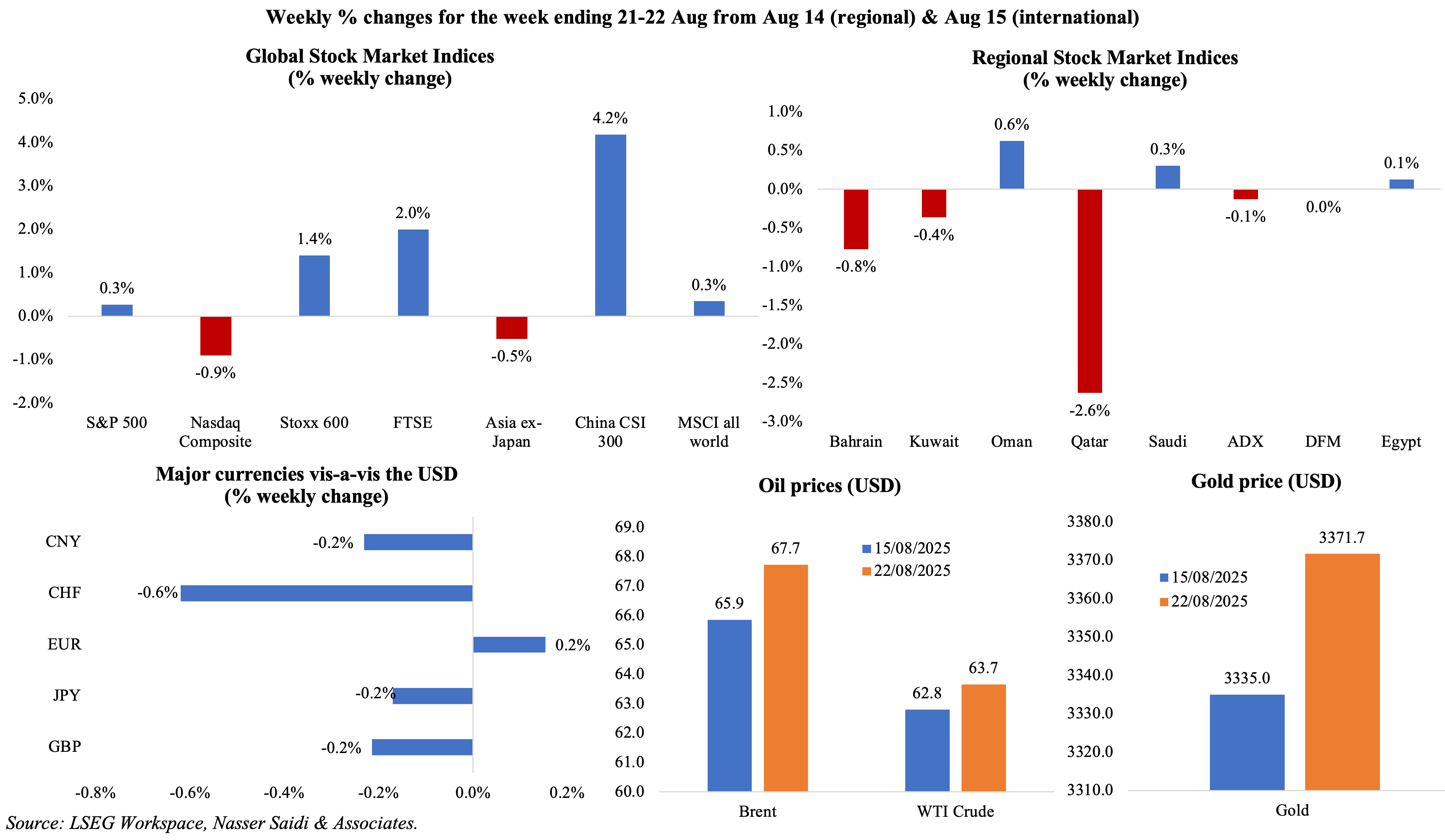

Global equities jumped following Fed Chair Powell’s speech after he hinted at a possible rate cut at the Sep meeting; US markets ticked up by more than 1.5% on Friday but closed lower for the week (US tech stocks had stumbled during the week following concerns about AI valuations). Regional markets were mixed with Qatar posting the sharpest decline from a week ago (after eight weeks of gains); Abu Dhabi gained on Friday after a 12-session losing streak but closed slightly lower compared to a week before. Concerns about the independence of the Fed affected dollar performance, and the euro climbed to a 4-week high vis-à-vis the dollar. Both oil and gold prices increased compared to a week ago, with the former gaining as hopes decreased for the Russia-Ukraine peace deal.

Global Developments

US/Americas:

- Fed Chair Powell’s speech at the Jackson Hole symposium hinted at potential rate cuts, stating that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance”. Post-speech, trading in fed funds futures pointed to an 81% chance of a quarter-point rate cut in Sep, up from 75% the day prior, according to CME Group data.

- The FOMC minutes revealed a cautious but divided committee: “a majority of participants judged the upside risk to inflation” was larger than that posed by a potential slowdown in the labour market (remember that this meeting was held prior to the sharp downward revision in the July jobs report). With two Fed governors backing a 25bps cut, this meeting was the first instance when two governors disagreed with the Fed chair since 1993.

- Building permits in the US fell by 2.8% mom to 1.354mn in Jul, the lowest since Jun 2020, with permits for building with more than five units plunged by 9.9%. The drop in building permits suggests a moderation in future construction activity, likely reflecting elevated mortgage rates and cost pressures. Housing starts increased by 5.2% mom to 1.428mn, led by single family housing starts (+2.8% to 939k units). Existing home sales grew by 2% mom to 4.01mn; with 1.55mn homes available for sale at end-Jul, this represents a 4.6-month supply. The rise in housing starts and existing home sales points to residual demand, and the average rate on a 30-year US mortgage being at its lowest level in nearly 10 months (last week, according to Freddie Mac) bodes well for prospective home buyers.

- Philadelphia Fed manufacturing index weakened in Aug, falling to -0.3 (Jul: 15.9), with new orders index down 20 points to -1.9 and shipments index fell (to 4.5). Additionally, prices remain elevated: prices paid index rose 8 points to 66.8, the highest reading since May 2022.

- S&P Global manufacturing PMI unexpectedly rose to 53.3 in Aug (Jul: 49.8), thanks to an increase in production (highest since May 2022) and new orders (most since Feb 2024) alongside a rebound in employment. Services PMI moderated to 55.4 (Jul: 55.7), on strong sales growth and new businesses amid rising price pressures – input costs rose at the second-highest pace in over two years resulting in output charges rising the most in three years.

- Initial jobless claims in the US increased by 11k to 235k in the week ended Aug 16 and the 4-week average inched up by 4.5k to 226.25k. Continuing jobless claims rose to 1.972mn in the week ended Aug 9, the highest since Nov 2021, and up from 1.942mn the week prior. A continued upward trend in jobless claims could prompt a more dovish tone from the Fed, especially if paired with slower wage growth.

Europe:

- Flash manufacturing PMI in the euro area rose to 50.5 in Aug (Jul: 49.8), the highest in 38 months and the first expansionary reading since 2022. Even as new orders rose for the first time since 2022, employment continued to fall and input costs rose. Though the manufacturing rebound offers some growth stability, business confidence still weakened. Services PMI eased to 50.7 from 51, and the composite PMI moved up to 51.1 (from 50.9).

- Consumer confidence in the euro area fell to -15.5 in Aug (Jul: -14.7), well below the historical average, reflecting persistent concerns over inflation, interest rates, and economic uncertainty.

- German GDP shrank by 0.3% qoq in Q2, worse than the flash estimate (-0.1%), on a sharper decline in manufacturing and investment. In yoy terms, growth was up by 0.2%, following the 0.4% gain a quarter prior. With sluggish industrial output and stumbling demand, Germany remains one of the euro area’s weakest links and faces a risk of entering a technical recession unless fiscal or external support materializes.

- Producer price index in Germany fell by 0.1% mom and 1.5% yoy in Jul (Jun: +0.1% mom and -1.3% yoy). The yoy drop was the most since Jun 2024, and marked the 5th straight month of decline, driven by lower energy costs (-6.8%).

- Germany’s manufacturing PMI increased to 49.9 in Aug (Jul: 49.1), the highest since Jun 2022, supported by output and new orders (fastest growth since Mar 2022) alongside a decline in employment.

- Inflation in the UK ticked up to 3.8% yoy in Jul (Jun: 3.6%) as core CPI also moved to 3.8% (from 3.7%) and retail inflation moved higher to 4.8% from 4.4% a month before. UK is showing signs of stickier inflation, driven by resilient services inflation (5% in Jul vs 4.7% in Jun) and food prices (4.9%). If inflation remains sticky into Q4, BoE may delay rate cuts.

- UK preliminary manufacturing PMI declined to 47.3 in Aug (Jul: 48), reflecting lower output, weak domestic orders, subdued investment and further employment cuts.

- GfK consumer confidence in the UK inched up to -17 in Aug (Jul: -19), as personal finances improved following the interest rate cut (to 4% from 4.25%). The measure for general economic situation over the next 12 months fell by one point to -30, highlighting still high living costs and cautious job market outlooks.

Asia Pacific:

- China’s central bank left interest rate unchanged for the third month in a row, signalling a cautious approach despite sluggish domestic demand and deflationary pressures. This suggests a preference for targeted fiscal/ structural support for specific sectors. Without aggressive policy stimulus, China’s recovery may remain uneven.

- FDI into China fell by 13.4% in the seven months to Jul (H1: -15.2%), with the actual use of FDI in high-tech industries at CNY 137.36bn (of a total CNY 467.34bn). Investments from ASEAN grew by 1.1% while that from Japan and UK surged 53.7% and 19.5% respectively. The modest improvement from H1 indicates some stabilization, but levels remain below trend.

- Japan’s inflation eased to 3.1% in Jul (Jun: 3.3%), staying higher than the BoJ’s target 2% for the 40th month in a row. Excluding food and energy, prices held steady at 3.4% while excluding just fresh food, prices eased to 3.1% (from 3.3%). Sticky core-core inflation suggests that wage pass-through is gradually taking hold.

- Exports from Japan fell by 2.6% yoy in Jul, the largest decline since Feb 2021, while imports declined at a faster pace of 7.5%. Trade balance moved to a deficit JPY 117.58bn from a surplus JPY 152.1bn the month before. Japan’s exports to the top trade partners US and China declined sharply – by 10.1% and 3.54% respectively.

- Japan’s core machinery orders grew by 3% mom and 7.6% yoy in Jun, with the monthly gain following two months of declines; however, manufacturing sector orders fell by 8.1%.

- Japan manufacturing PMI rose to 49.9 in Aug (Jul: 48.9), supported by resilient domestic orders while overall sales declined and foreign sales fell for the fifth month in a row.

- Flash manufacturing PMI in India ticked up to 59.8 in Aug (Jul: 59.1), the highest reading since Jan 2008, supported by new orders and growth in new export orders. Services PMI increased to a record high 65.6 (Jul: 60.5), backed by strong domestic demand and a jump in new orders (domestic and export) alongside increased hiring (to meet rising workloads).

- Infrastructure output in India grew by 2% yoy in Jul (Jun: 2.2%), with growth in steel and cement production (12.8% and 11.7% respectively) alongside a decline in refineries production (-1% vs 3.4% in Jun).

Bottom line: Flash headline PMI readings for Aug had some unexpected upticks, including in the US and Europe. S&P highlighted that some of this improvement could be related to inventory building (ahead of the tariff hikes implementation). In the US, average prices charged were reportedly at the steepest rate for three years, with firms citing the need to pass along higher costs to the end-consumer. Trump policies are inflationary, as emphasized by recent Fed research that the tariff’s effects on inflation are usually delayed (by over a year). With the Fed’s independence under threat under the Trump Presidency, there is greater monetary policy uncertainty and the threats of USD weaponisation is encouraging de-dollarisation and a shift in the global economic/ political order – a case in point is India. The country stepped up diplomatic discussions with both Russia (meeting confirmed plans to boost bilateral trade, increase energy and defence ties) and China (Chinese Foreign Minister Wang Yi’s visit to India) last week.

Regional Developments

- Egypt posted a record primary surplus of EGP 629bn in fiscal year 2024-25, up 80% yoy and roughly 3.6% of GDP, and despite the 60% drop in Suez Canal receipts (versus the budget target). The increase was supported by the 35.5% surge in tax revenues (to EGP 2.2trn), thanks to the widening tax base and efficiency in revenue collection.

- Natural gas production in Egypt fell by 3.64% mom and nearly 16% yoy to 3.416bn cubic metres in Jun, according to JODI data. Output fell by 18.9% yoy to 26bn cubic metres in H1.

- Egypt’s trade with Saudi Arabia led to a USD 2.9bn deficit in H1, according to the statistics agency. However, Saudi investments into Egypt (of USD 532mn in H1) and rising remittances from Saudi to Egypt (USD 8bn in 2023-24 fiscal year) deepen economic linkages.

- Tourism revenues in Egypt grew by 22% yoy to USD 8bn in H1 2025, supported by the addition of around 6k new rooms. Hotel occupancy also crossed 80%, thanks to a 23% uptick in tourist arrivals since the starts of the year.

- Egypt plans to build a 2 GW subsea electricity cable to Jordan, slated for completion by 2029. While the countries are currently linked by a 500MW-capacity subsea cable (that was built in 1999), this project is expected to quadruple the present power supply to Jordan and enable the supply of electricity to Syria, Iraq, and Lebanon.

- Egypt and Japan inked 12 investment agreements covering strategic sectors such as education, renewable energy, industry, tourism, infrastructure, and technology among others. These pacts highlight Egypt’s push to attract high‑value, tech‑intensive FDI that can support job creation and promote sustainable growth.

- Egypt aims to attract over USD 2bn in FDI from India over the next 18 months focusing on sectors such as chemicals, fertilisers, pharma, renewables, IT, textiles, and garments. India ranks among Egypt’s top five trade partners and there are 55 Indian firms are present in Egypt, having invested more than USD 3.7bn.

- Kuwait’s trade surplus with Japan narrowed by 15.2% yoy to JPY 49bn in Jul, as exports to Japan fell for the sixth month in a row (by 5.9% to JPY 77.5bn) and imports grew by 15.8%. Middle East’s exports to Japan fell by 18.1% yoy resulting in a narrower trade surplus (JPY 550.4bn, down by 25.1%).

- Inflation in Kuwait ticked up to 2.39% in Jul (Jun: 2.32%), the highest reading since March, as prices increased across food (5.3% from 5.1%) while transportation costs dropped at a slower pace (-1.75% from -1.81%) and priced moderated in others such as health (2.85% from 2.94%) and clothing (3.7% from 3.93%).

- Kuwait-based Gulf Bank and Warba Bank have initiated formal merger discussions, backed by appointed advisors, with the aim of forming one of Kuwait’s largest Islamic banks. Gulf Bank received preliminary approval to convert into a sharia-compliant institution ahead of the merger, with a one-year window to complete regulatory and operational restructuring.

- Oman announced plans to launch a Golden Visa programme on Aug 31, in a bid to attract foreign investors by offering long-term residency and facilitating easier business ownership. Mirroring similar initiatives across the UAE and Saudi Arabia, the program builds on reforms under Oman’s Foreign Capital Investment Law (that allows 100% foreign ownership).

- Fiscal balance in Oman moved to a deficit of OMR 259mn in H1 2025, from a surplus OMR 391mn in H1 2024. Fiscal revenues fell by 5.8% to OMR 5.8bn, partly driven by reduced hydrocarbon receipts. Net oil and gas revenues fell by 10.2% & 6.3% to OMR 3.0bn and OMR 884mn. Non-hydrocarbon revenues rose by 2.4% to OMR 1.9mn (one-third of total), reflecting moderate strengthening in non-oil revenue sources. Spending increased by 5.0% to OMR 6.1bn: current expenditure ticked up (1.3% to OMR 4.1bn). Public debt stood at USD 14.1bn by end-Q2. Continued fiscal prudence and targeted reinvestment could strengthen economic diversification and improve creditworthiness, further bolstered by any upside in oil prices or non‑oil revenue performance.

- Oman’s exports fell by 9.5% yoy to OMR 11.5bn as of end-Jun alongside a 5.1% uptick in imports (to OMR 8.4bn), resulting in a narrower trade surplus (OMR 3.1bn vs OMR 4.7bn in H1 2024). The decline in exports resulted from the 16.1% drop in oil & gas exports (to OMR 7.4bn). Oil and gas exports accounted for 64.6% of Oman’s overall exports in H1 2025 (lower than 69.7% in H1 2024). Total non-oil exports grew by 9.1% to OMR 3.260bn in H1, with UAE Oman’s largest non-oil trade partner: non-oil exports to UAE grew by 29.8% yoy to OMR 593mn in H1 2025 and re-exports held steady at OMR 348mn.

- Rising activity at Oman’s ports in H1: there was an 11% increase in vessel traffic, total volume of cargo handled by the ports was up by 5.2% to 70mn tonnes while container handling rose by 12% to 2.4mn TEU (20-foot equivalent units). This bodes well for future trade activity and will help Oman’s aim of becoming a regional maritime hub.

- Bank lending in Oman climbed by 8.4% yoy to OMR 34.1bn in H1, largely due to an increase in credit disbursed to corporates (46% of total). Total deposits grew 7.6% to OMR 33bn, with private sector accounting for around 50%, followed by corporates (31%) and SMEs (19.6%). Islamic banking also expanded notably: assets grew by 17.4% yoy to OMR 9.2bn, while financing climbed 13.1% (to OMR 7.2bn), and deposits rose 19.6%.

- Al Mansour Holdings, a firm owned by a member of Qatar’s royal family, pledged to invest USD 12bn in Botswana and USD 19bn in Zambia across multiple sectors (the latter is one of the largest bilateral investment deals). These commitments reflect Qatar’s strategic engagement with Africa’s emerging economies, in line with a broader GCC policy for greater regional integration and linkages.

- Qatar Financial Centre reported a 64% yoy surge in new company registrations (828 additions) in H1 2025 alongside a 19% jump in assets under management, thanks to a recent slew of pro-business reforms including simplified incorporation, instant licensing for non-regulated activities, and a sharp 90% reduction in registration fees.

- Digital payments in Qatar touched QAR 16.133bn across 51.7mn transactions in Jul, with card payments dominating (78% of the total), according to the central bank, underscoring the rapid adoption and maturing of digital payments.

- Syria plans to revalue the Syrian Pound by removing two zeros, and rolling out new banknotes by Dec 8th, in a bid to curb informal cash circulation (an estimated SYP 40trn) and restore public confidence in the devalued currency. For now, there is no clarity if such a move needs legislative approval (first elections are scheduled for Sep), and banks were informed that there would be a one-year transition period when both currencies would “coexist”.

- Saudi Arabia remained the 17th largest global investor in US Treasury holdings in June: its holdings increased by 2.3% mom to USD 130.6bn in Jun, but in yearly terms, holdings were down by 6.9%. Meanwhile, Kuwait posted a gain of 1.8% mom & 25.0% yoy to a new record USD 58.05bn in Jun (previous high: USD 57.0bn May 2025). The UAE downsized their holdings, down by 6.9% mom (or USD 7bn+) to USD 96.5bn, thereby moving out of the top 20 holders of US Treasuries; UAE holdings were however up by 37.6% yoy.

Saudi Arabia Focus

- Saudi Arabia and Syria boost cooperation. The two countries are exploring industrial cooperation within a wider gambit of advancing economic integration amid evolving regional dynamics. A bilateral investment protection agreement was also signed, with Saudi Arabia offering legal and financial safeguards that pave the way for increased cross-border private-sector activity.

- Saudi Arabia raised SAR 5.31bn via local currency sukuk issuance this month, up 5.8% mom. Separately, Saudi Arabia led emerging markets (excluding China) in dollar‑denominated debt issuances in H1 2025, according to Fitch Ratings. Saudi accounted for 18.9% of the USD 250bn debt issuance in emerging markets, followed by Brazil and the UAE (10.6% and 8.7% of total issuances).

- The Saudi Fund for Development signed 17 loan agreements worth SAR 3.7bn with 13 countries in 2024, according to the annual report. Over the past decade, the fund disbursed over SAR 81bn worth of loans financing nearly 800 projects across over 100 countries.

- FDI from China into Saudi Arabia surged, with FDI stock up by 28.8% yoy to SAR 31.1bn in 2024. Investment inflows surged 164% yoy to SAR 8.6bn, while net inflows more than tripled to SAR 7bn.

- Saudi Arabia is preparing to launch a new voluntary pension and savings scheme for its citizens and foreign employees, as per the IMF’s latest Article IV report. As of Q1 2025, Saudi Arabia had 12.8mn subscribers in the social insurance system, of whom 77% (nearly 10 million) were expats. The IMF report also highlighted the strong growth in the tourism sector: international tourism spending grew by 19% yoy to SAR 169bn.

- Construction costs in Saudi Arabia inched up by 0.7% yoy in Jul, attributed largely to elevated diesel (27.3%) and equipment & machinery rental (1.8%) costs, reflecting cost pressures in infrastructure projects.

- Dar AlMajed’s retail IPO order book was 278% oversubscribed, with orders touching SAR 701mn. Saudi also listed two additional football clubs for private investment, aligning with broader diversification and privatization goals. Jamjoom Fashion confirmed its share listing on the Nomu parallel market and plans a broader IPO in the future.

- Lenovo will establish a regional headquarters in Riyadh as part of its USD 10bn Saudi strategy. The company plans to invest in a flagship retail outlet, a VIP customer centre, research and development facilities and partnerships across the Kingdom.

- Saudi Capital Markets Authority tweaked rules expanding foreign investor access: six classifications of foreign investors were permitted to enter the market, the most important being qualified foreign investors and strategic foreign investors.

UAE Focus

- The Central Bank of the UAE’s gold reserves climbed to AED 28.933bn in Jan-May, up 25.9% year-to-date. UAE’s monetary base grewby 2.2% mom to AED 836.7bn in May, with key contributors’ reserve accounts (+29.2% mom) & monetary bills & Islamic Certificate of Deposits (+6.7%). Moderate expansion of money aggregates suggests steady demand within the economy and buoyant liquidity growth.

- UAE banks’ gross assets increased by 2.7% mom to a new high of AED 4.88trn as of May Year-to-date, bank deposits and gross credit grew by 6% and 5.2% respectively. Domestic credit disbursed by banks grew by 4.8% yoy (and 2.5% ytd) in May though loans to the public sector reported a 5.9% drop.

- The UAE central bank reported that it had imposed penalties of AED 381mn on violations by financial institutions. This was issued as part of the bank’s oversight and regulatory functions, after 19 inspections were conducted since the start of the year, with penalties across exchange houses, banks and insurance firms.

- Dubai’s Mohammed Bin Rashid Housing Establishment provided housing support packages worth more than AED 1.725bn to 3,027 beneficiaries in H1 this year.

- Sharjah government plans to spend AED 4bn to upgrade and expand its water networks: work is underway on multiple projects including the Al Hamriyah independent water desalination plant, pumping stations and water storage reservoirs among others.

Media Review:

The Fed’s September dilemma

https://www.piie.com/blogs/realtime-economics/2025/feds-september-dilemma

The twilight of the central banking elite

https://www.ft.com/content/3b5a3fde-6110-4e40-88b1-04f71ed5b0f1

The New Economic Geography

https://www.foreignaffairs.com/united-states/new-economic-geography-posen

Dr. Nasser Saidi’s Al Arabiya interview on the Fed, Powell’s speech & way forward (Arabic)

https://www.alarabiya.net/aswaq/videos/closing-bell/2025/08/24/

The ‘capital of capital’: Abu Dhabi’s pitch to become a global financial centre

https://www.ft.com/content/5fceb665-c75a-4328-b28a-e8c684425060

Powered by: