From Trade to Treasuries: Growth Resilience in the GCC, Weekly Insights 22 Aug 2025

Dubai GDP. UAE monetary stats. Oman fiscal stance, foreign trade. GCC’s US Treasury holdings.

Download a PDF copy of this week’s insight piece here.

From Trade to Treasuries: Growth Resilience in the GCC, Weekly Insights 22 August 2025

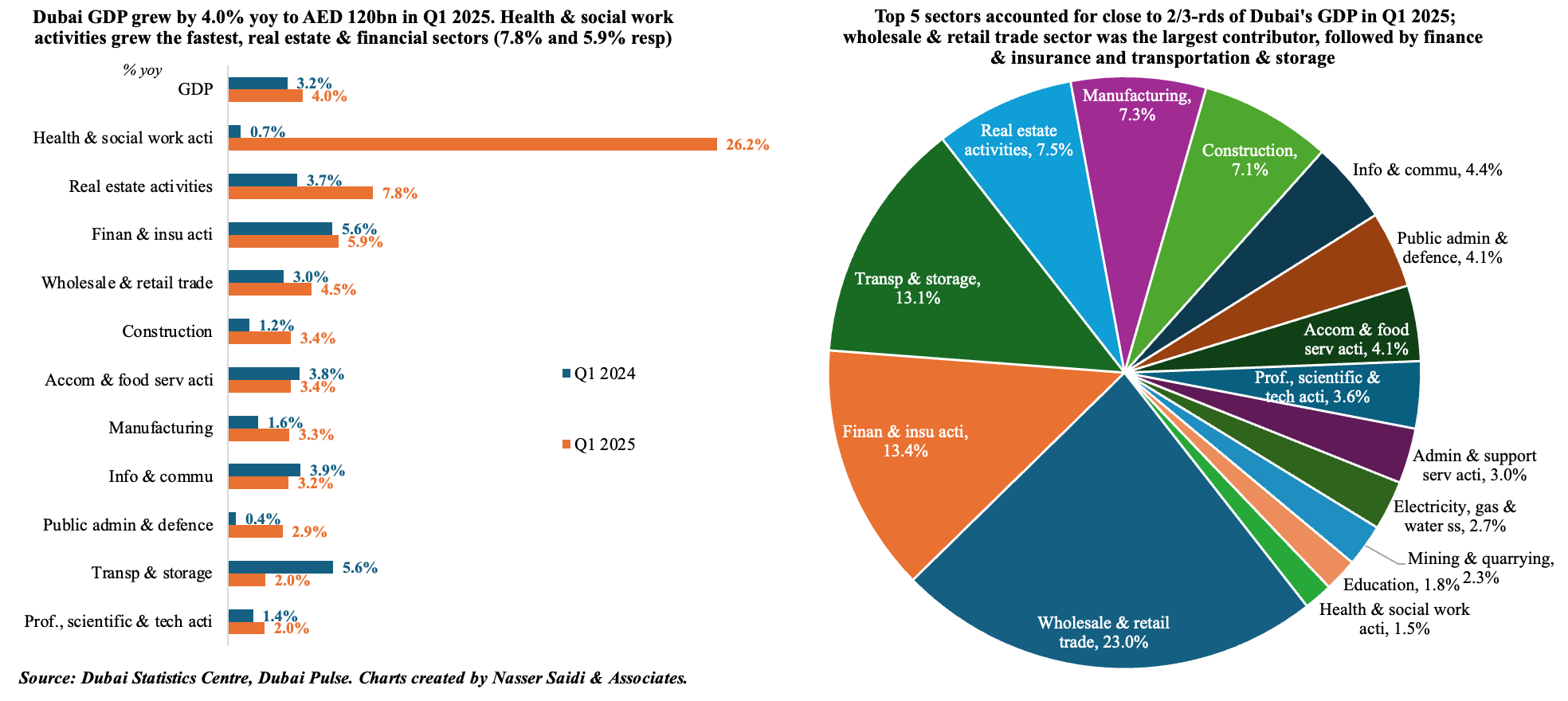

1. Dubai real GDP grew 4.0% yoy in Q1 2025: Trade major contributor

- Dubai real GDP grew by 4.0% yoy to AED 119.7bn in Q1 2025: fastest growing sectors were health & social work (26.2%), real estate activity (7.8%) and finance & insurance (5.9%). Wholesale & retail trade (4.5%), and construction (3.4%) round up the fastest growing sectors.

- Wholesale & retail trade was the largest contributor to GDP (23% of total in Q1), followed by financial & insurance activities (13.4%) and transportation & storage (13.1%). Along with real estate and manufacturing, these five sectors together accounted for 64.3% of overall GDP.

- Post-Covid, Dubai has successfully diversified into multiple sectors, thereby reducing over-dependency.

- Wholesale & retail trade has benefitted from the various UAE CEPAs and Dubai’s inter-linked logistics infrastructure (ports, airports): the opening of the Etihad Rail and new Al Maktoum International Airport will accelerate growth further.

- Financial & insurance sector has benefitted from the presence of the DIFC (home to 7700 firms & 48k professionals), with rising interest from fintech firms & wealth & asset management firms; plans for infrastructure & regulatory updates will further raise the DIFC’s contribution to Dubai’s GDP. The removal of UAE from the FATF grey list has also benefitted the sector.

- Real estate activities & construction on the rise: Real estate transactions crossed AED 431bn in H1 (+25% yoy), with transaction volumes exceeding 125k deals (+26%). With the influx of expat population and more tourists (9.9mn visitors in H1), there has been a surge in urban planning & infrastructure development (roads, bridges, rainwater drainage network development), housing & logistics solutions.

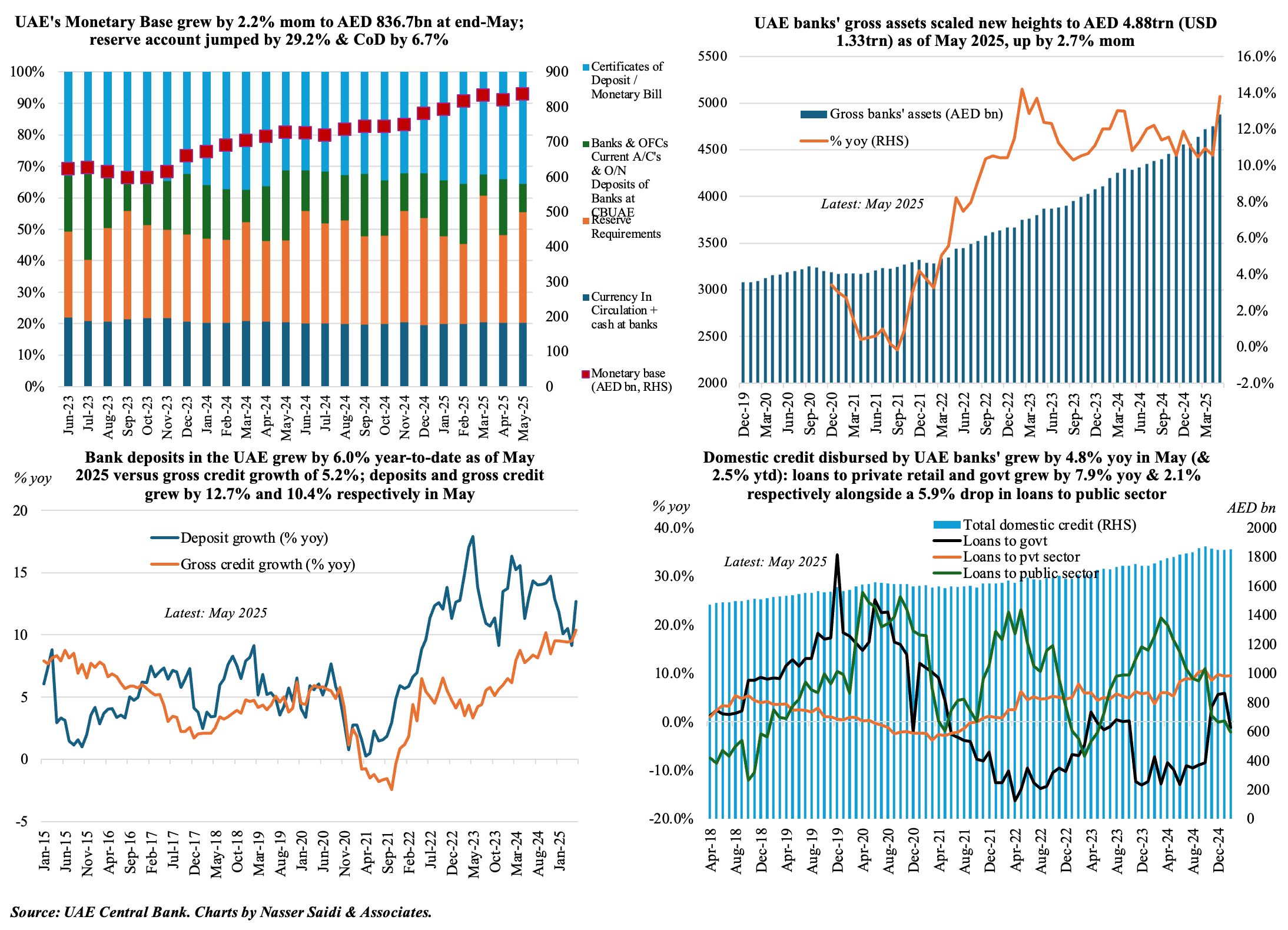

2. UAE deposit growth continues outpacing credit growth

- UAE’s monetary base grew by 2.2% mom to AED 836.7bn in May, with key contributors’ reserve accounts & monetary bills & Islamic Certificate of Deposits. Moderate expansion of money aggregates suggests steady demand within the economy and buoyant liquidity growth.

- Gross bank assets took to new record high of AED 4.88trn. Banks’ deposits grew by 6.0% year-to-date (private sector & non-residents deposits grew fastest by 8.9% & 12.8% ytd) alongside gross credit growth, up 5.2% ytd (credit to individuals grew fastest, 6.7% ytd).

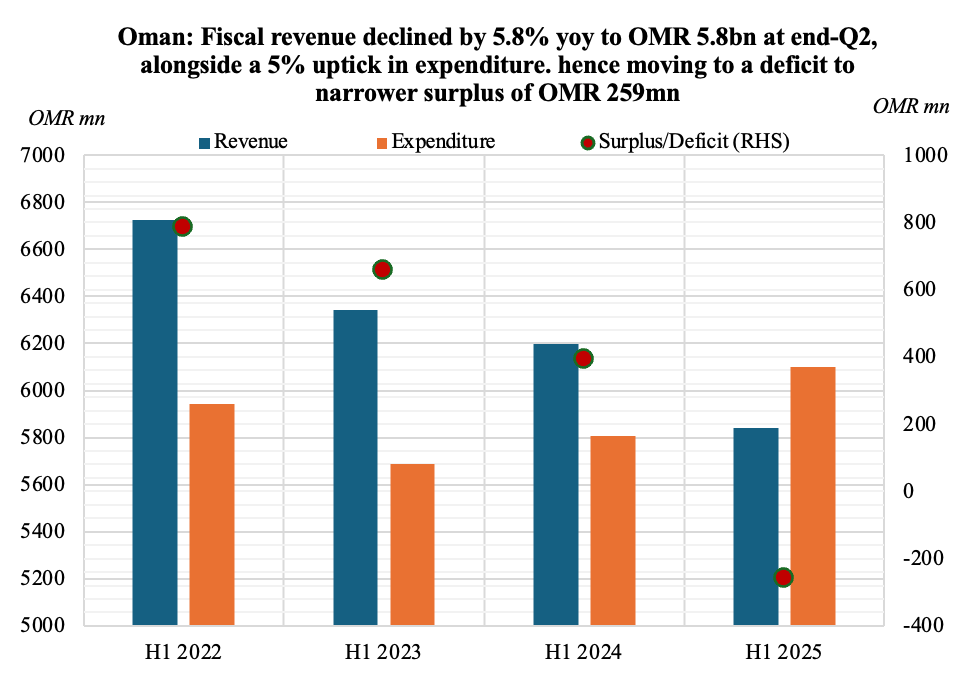

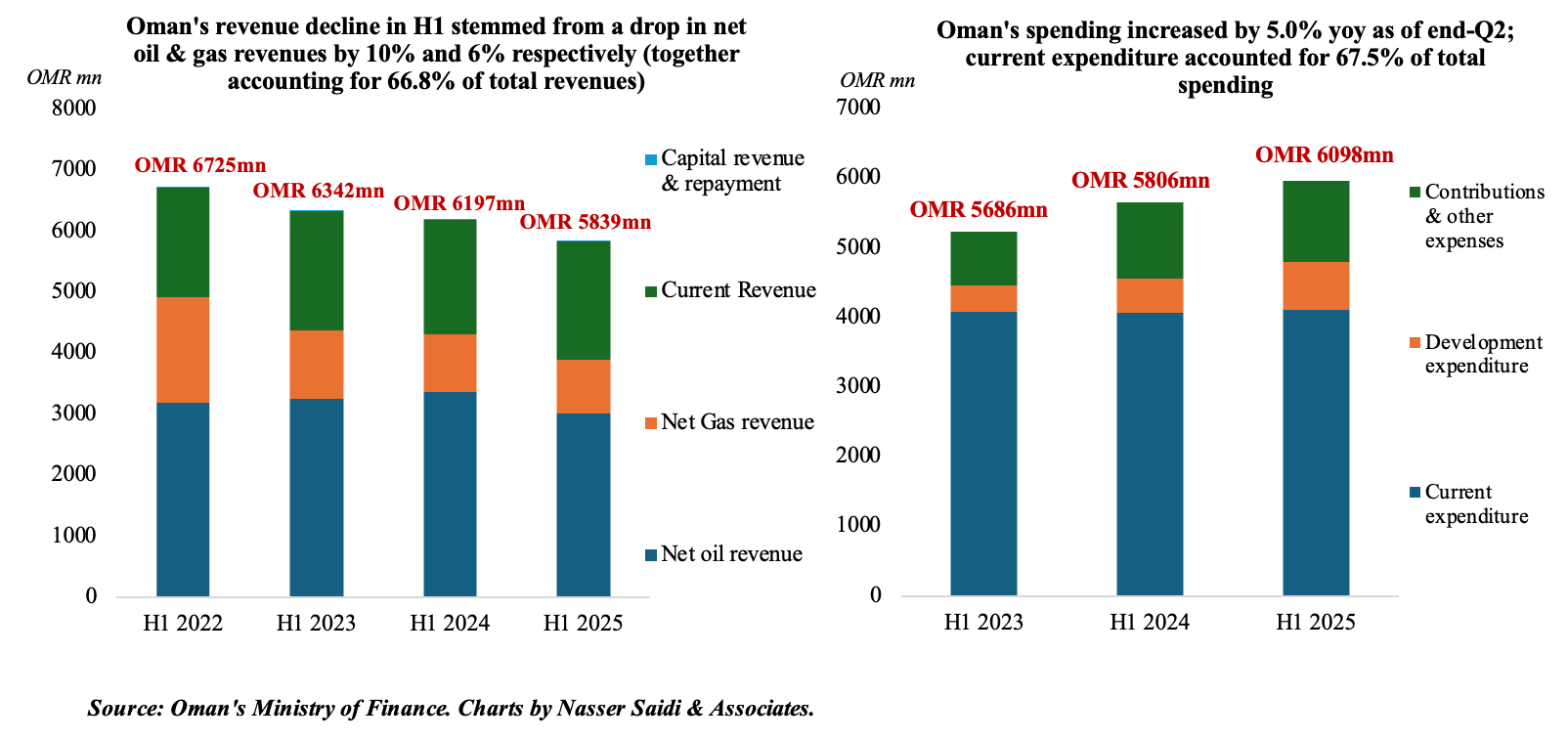

3. Oman clocked in a fiscal deficit of OMR 259mn in H1 2025; revenues fell by 5.8% yoy on weak O&G income

- Fiscal balance in Oman moved to a deficit of OMR 259mn in H1 2025, from a surplus OMR 391mn in H1 2024.

- Oman’s fiscal revenues fell by 5.8% to OMR 5.8bn, partly driven by reduced hydrocarbon receipts. Net oil and gas revenues fell by 10.2% & 6.3% to OMR 3.0bn and OMR 884mn. Net O&G together accounted for 66.8% of revenues. Average oil price fell by 8.5% yoy to USD 75and average daily oil production fell by 1.5% to 988k barrels per day. Non-hydrocarbon revenues rose by 2.4% to OMR 1.9mn (one-third of total), reflecting moderate strengthening in non-oil revenue sources.

- Spending increased by 5.0% to OMR 6.1bn: current expenditure ticked up (1.3% to OMR 4.1bn) alongside a 37% surge in development spend (to OMR 688mn, or 76% of devt spending allocated for 2025) while contributions & other expenses edged up by 6.7% yoy to OMR 1.2bn.

- Debt trajectory is encouraging: public debt stood at USD 14.1bn by end-Q2 (Q2 ‘24: OMR 14.4bn), a notable reduction through proactive debt repayments; OMR 749mn was disbursed in arrears as payments to the private sector, boosting liquidity and confidence.

- Rising non-oil revenues and continued development outlays while managing deficits and a solid reduction in debt will ensure resilience and maintain investor trust. The IMF projects a narrower surplus of 0.5% of GDP in 2025-26 (vs 3.3% of GDP).

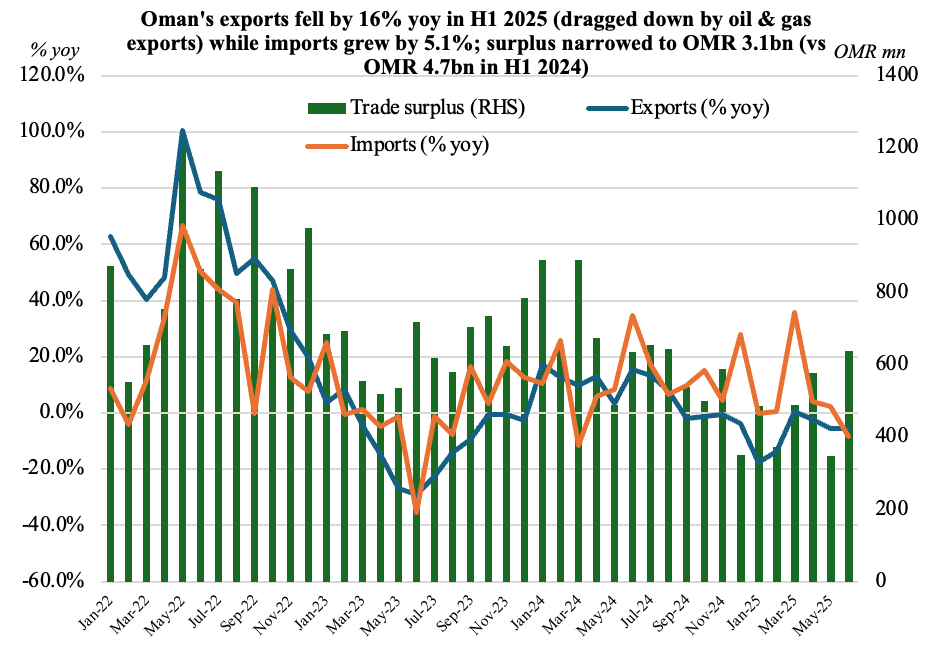

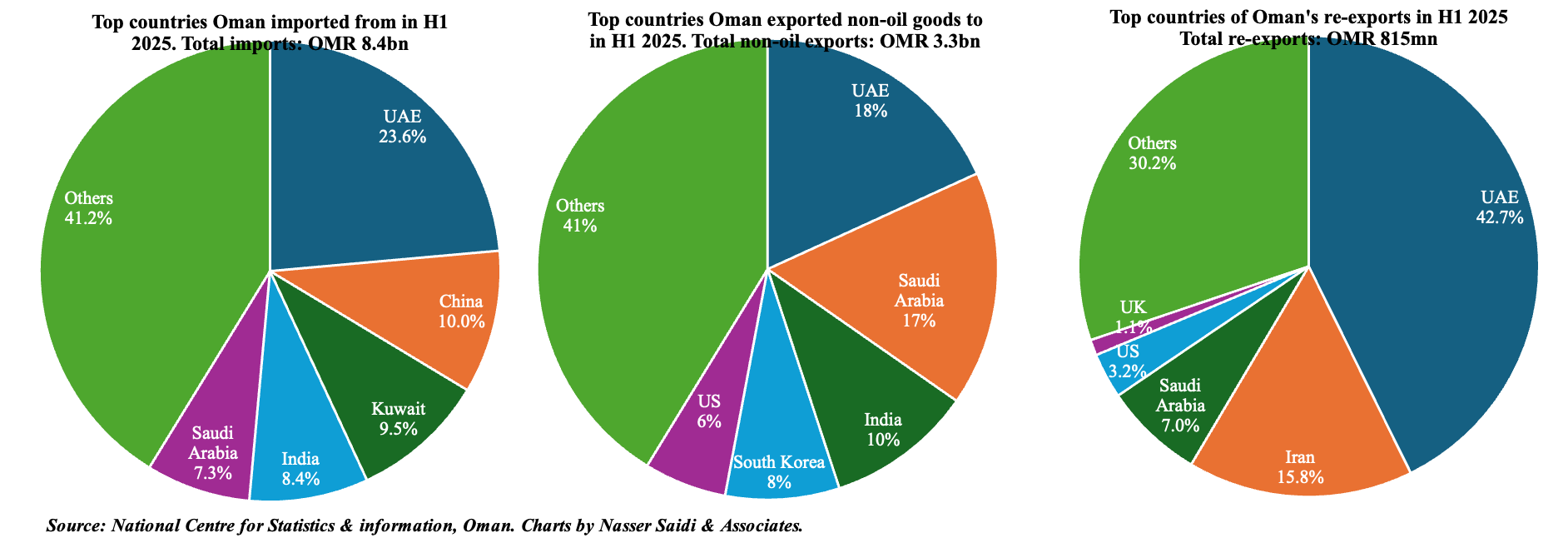

4. Oman’s sustained growth in non-oil exports in H1; growing regional integration, with the UAE top trade partner

- Oman’s exports fell by 9.5% yoy to OMR 11.5bn as of end-Jun alongside a 5.1% uptick in imports (to OMR 8.4bn), resulting in a narrower trade surplus (OMR 3.1bn vs OMR 4.7bn in H1 2024).

- The decline in exports resulted from the 16.1% drop in oil & gas exports (to OMR 7.4bn). Oil and gas exports accounted for 64.6% of Oman’s overall exports in H1 2025 (lower than 69.7% in H1 2024).

- Non-oil exports grew by 9.1% yoy to OMR 3.3bn, anchored by mineral products (OMR 886mn, up by 4.0% yoy, but accounting for 27.2% share of non-oil exports) and base metals & articles (OMR 674mn). Re-exports fell by 5.9% to OMR 815mn, with transport equipment and electrical machinery & equipment accounting for 28.3% and 26.3% of total re-exports respectively.

- UAE was Oman’s largest non-oil trade partner: non-oil exports to UAE grew by 29.8% yoy to OMR 593mn in H1 2025 and re-exports held steady at OMR 348mn. Oman’s imports originated mainly from GCC: UAE was Oman’s largest source of imports (OMR 1.98bn, or 23.6% of total); along with Kuwait and Saudi, the 3 countries accounted for 40.4% of imports.

- Strengthened port & logistics infrastructure will increase Oman’s regional attractiveness. Rising activity at Oman’s ports in H1 – number of containers, ships, and volume of goods – bodes well for future trade activity and will help Oman’s aim of becoming a regional maritime hub.

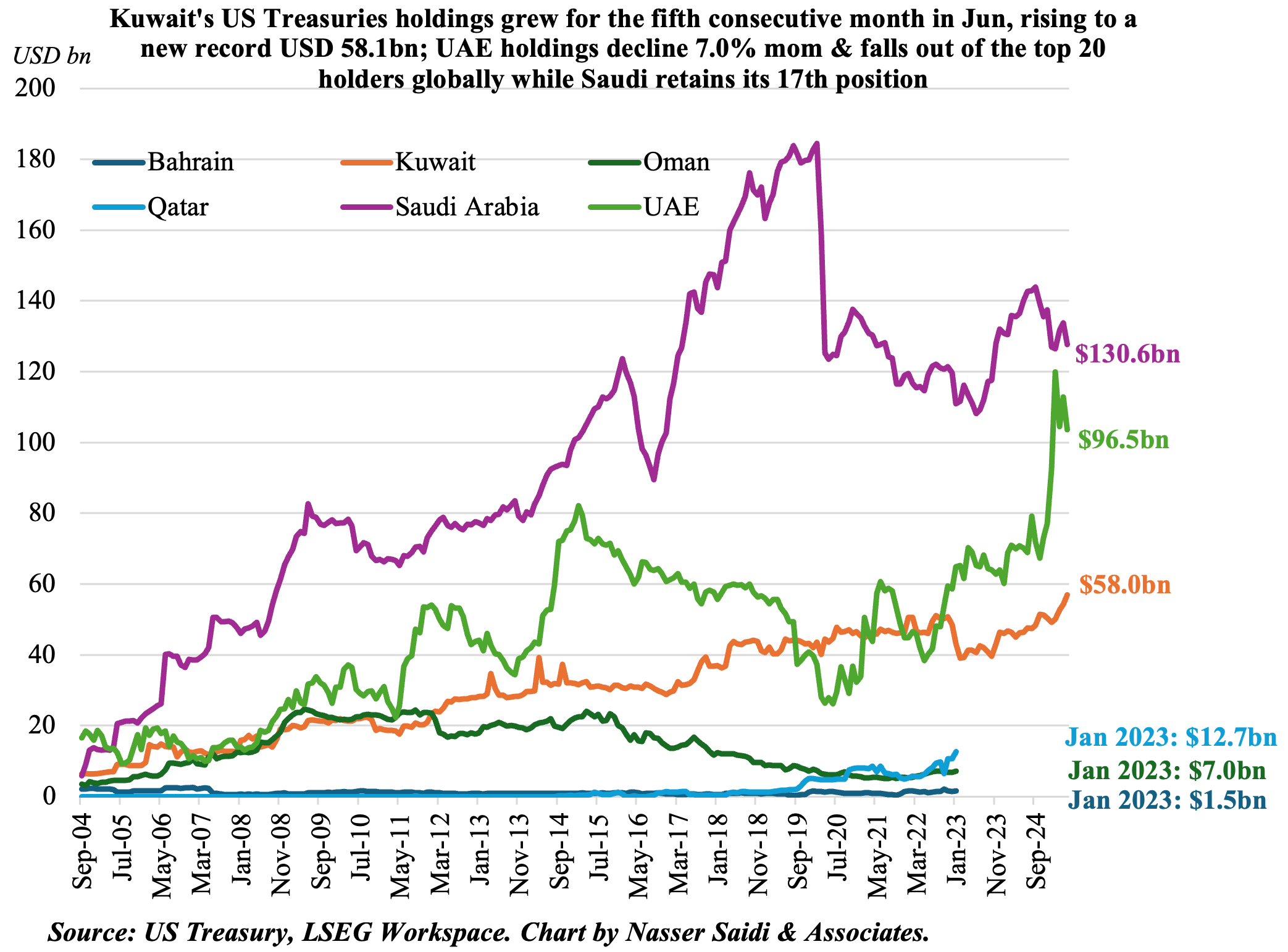

5. Foreign US Treasury holdings stayed above USD 9.0trn for the 4th straight month in June. Kuwait soared to another record-high; UAE moved out of top 20 holders

- Foreign holdings of US Treasuries accelerated by 0.9% mom & 10% yoy to a new record USD 9.13trn in Jun, staying above USD 9trn for the 4th straight month.

- Japan and UK were the largest two nations holding US Treasuries (at USD 1.147trn and a record USD 858.1bn respectively), while China’s holdings was little changed at USD 756.4bn, the lowest since Feb 2009.

- Saudi Arabia remained the 17th largest global investor in Jun: its holdings increased by 2.3% mom to USD 130.6bn, but in yearly terms, holdings were down by 6.9%.

- UAE downsized their Treasury holdings: it fell by 6.9% mom (or USD 7bn+) to USD 96.5bn, thereby moving out of the top 20 holders of US Treasuries. However, in yoy terms, UAE holdings were up by 37.6%.

- Kuwait posted a gain of 1.8% mom & 25.0% yoy to a new record-high USD 58.05bn in Jun (previous high: USD 57.0bn May 2025).

Powered by: