Non-Oil Momentum, Industrial Rebound & Tourism Booms Power Growth in GCC, Weekly Insights 15 Aug 2025

Saudi GDP, inflation, industrial production. Bahrain GDP & FDI. Tourism in Dubai, Qatar, Oman.

Download a PDF copy of this week’s insight piece here.

Non-Oil Momentum, Industrial Rebound & Tourism Booms Power Growth in GCC, Weekly Insights 15 Aug 2025

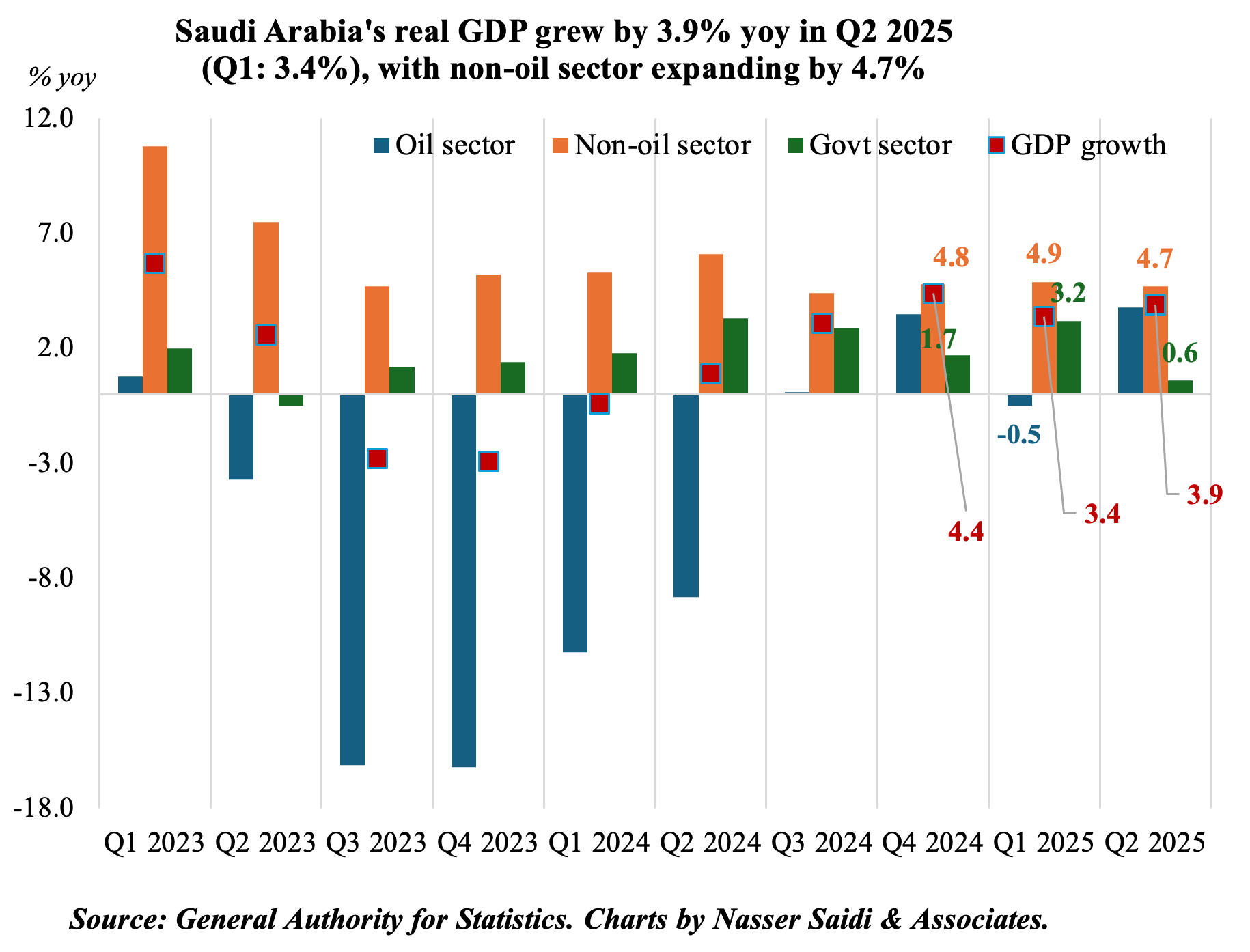

1. Saudi Arabia GDP grew by 3.9% yoy in Q2 2025 (Q1: 3.4%), supported by non-oil activities

- Preliminary data indicates that Saudi Arabia’s real GDP grew by 3.9% in Q2 2025, with non-oil sector activity very resilient (4.7%, following a 4.9% gain in Q1) while the oil sector rebounded (3.8% from Q1’s -0.5%). The government sector grew by 0.6% in Q2 (Q1: 3.2%).

- Non-oil sector’s resilience underscores strong domestic demand, consumer spending, sector specific growth (retail, hospitality, construction) and project pipeline (Vision 2030 projects, 2027 Asian Cup, 2029 Asian Winter Games, Expo 2030 & FIFA World Cup 2034-related etc).

- High-frequency data such as private sector credit growth and non-oil PMIs (with a pipeline of new orders) signal robust underlying economic health. The accelerated unwinding of oil production cuts (548k barrels per day to be returned to the market in Aug-Sep) will also set the stage for stronger growth in H2.

- IMF, in its latest Article IV report, projects overall GDP to accelerate in 2025 (3.6% from 2.0% in 2024), and further by 3.9% in 2026. Non-oil private investment is also forecast to grow at a steady pace, supported also by PIF’s contributions.

- While pushing for greater fiscal consolidation and avoiding pro-cyclical fiscal policy in Saudi Arabia, the IMF also commended the increased non-oil revenue mobilisation: Saudi tax revenues doubled over the past five years & its share of non-oil GDP has remained steady. Top recommendations (in terms of yield) to improve the current fiscal stance were: (a) accelerating energy subsidy reform (would yield 3.5% of GDP); (b) introducing property tax (1.0-1.4% of GDP); and (c) broadening the VAT base / revising existing tax incentives (0.5%-1.0% of GDP).

- Risks to the forecast include geopolitical risks, slower implementation of reforms and weaker oil demand (this could lead to lower oil revenues, and lower government spending that could slow private investment and diversification) among others.

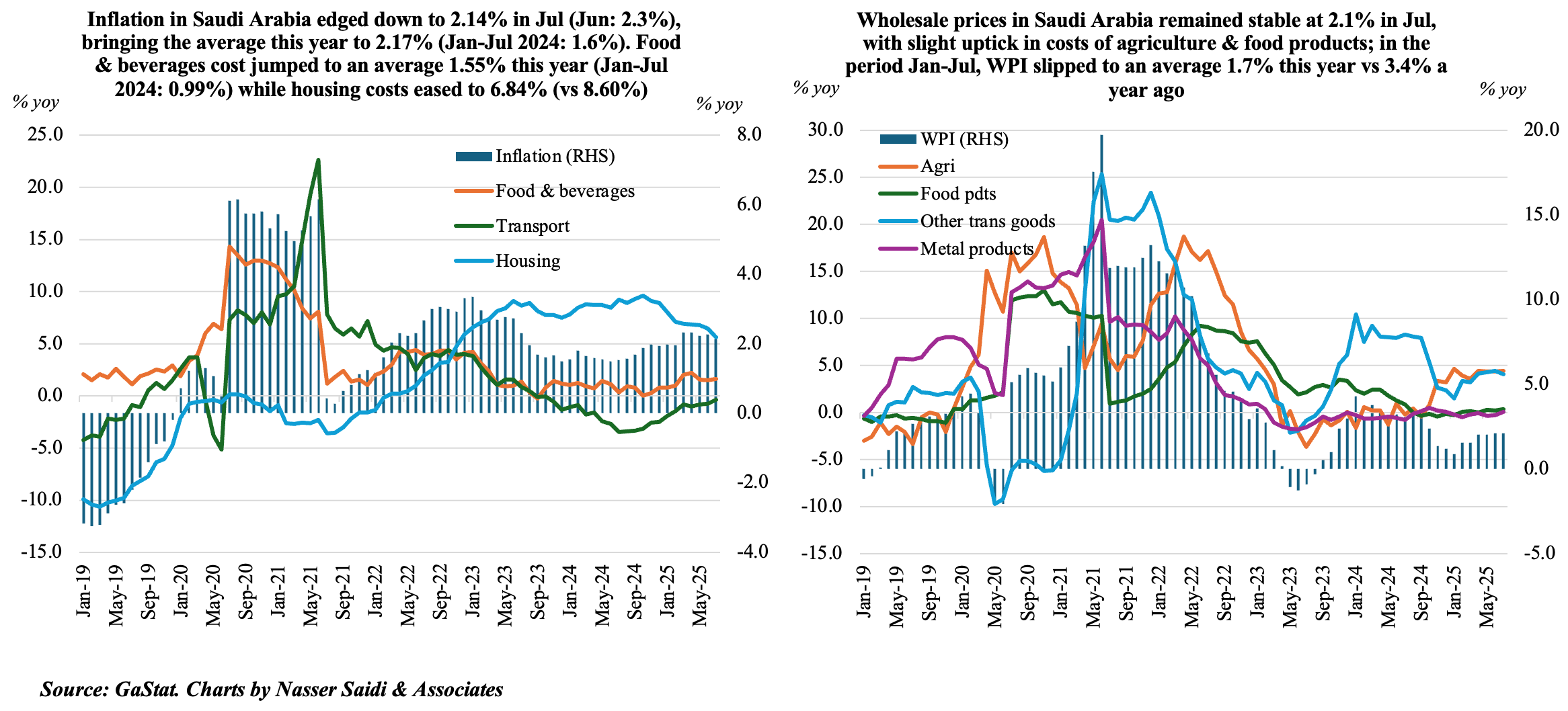

2. CPI in Saudi Arabia edged lower in Jul while producer price inflation almost halved in Jan-Jul (vs a year ago)

- Consumer price inflation in Saudi Arabia edged down to 2.14% in Jul (Jun: 2.3%): as housing & utilities costs eased (5.6% vs 6.5%) as did prices at restaurants & hotels (1.44% from 1.64%) while prices inched up for food & beverages (1.62% from 1.53%), and recreation & culture (0.74% from -0.05%). Rental costs slowed (6.6% from 7.6%).

- Five major categories (of out 12) clocked in deflationary readings; prices dropped further in furnishings & household equipment (-2.0% from -1.74%) while all others saw the pace of decline slow including in transport (-0.33% from -0.72%).

- CPI averaged 2.17% in Jan-Jul 2025 vs 1.6% in the same period in 2024, with the increase stemming from food & beverages (1.55% from 0.99%). Housing & utilities remained the highest across all components but eased to an average 6.84% from 8.6% in Jan-Jul 2024 while miscellaneous goods and services prices accelerated: up by 3.85% in Jan-Jul 2025 vs -0.58% a year ago.

- Wholesale prices in Saudi Arabia held steady at 2.1% in Jul; agriculture & fishery prices inched up slightly (4.43% from 4.38%) as did food products (0.34% from 0.21%); deflation continued in ores & minerals though the pace slowed (-0.85% vs -1.13%).

- Average wholesale prices almost halved to 1.74% in Jan-Jul 2025 (vs Jan-Jul 2024: 3.43%), as prices of “other transportable goods” plunged (3.6% vs 8.5%) while costs of agriculture & fishery surged (4.25% from -0.18%).

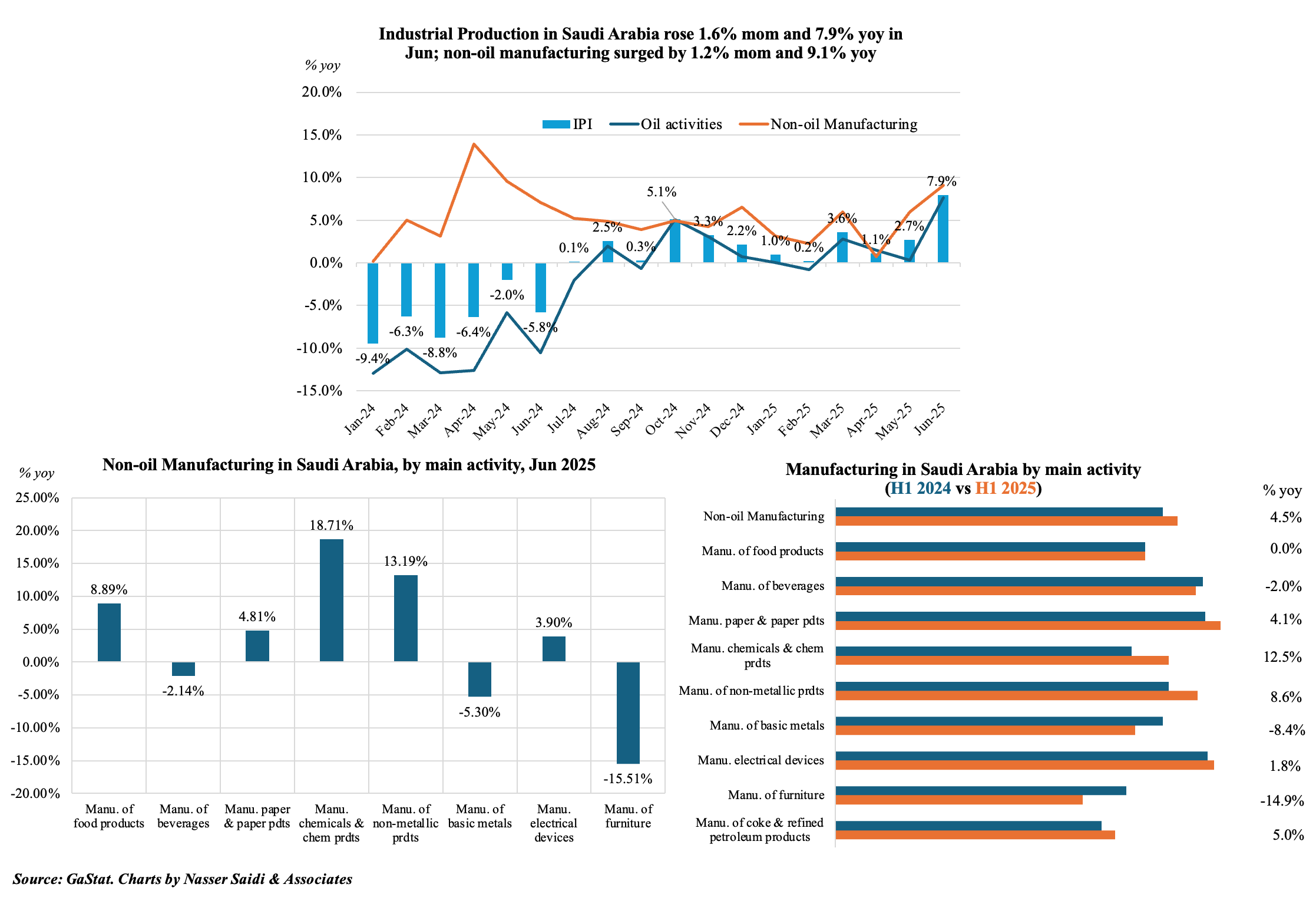

3. Saudi industrial production grew by an average 2.8% in H1 2025, driven by non-oil manufacturing activity (+4.5%)

- Industrial production in Saudi Arabia grew by 1.6% mom and 7.9% yoy in Jun. Oil activities expanded by 1.9% mom and 7.7% yoy, as crude oil production rose. Manufacture of coke & refined petroleum products surged by 15.3% yoy and 1.7% mom. Extraction of crude petroleum & natural gas increased by 6.0%, the third month of upticks (May: 2.1%), and after double digit declines in H1 2024.

- Non-oil manufacturing activities increased by 1.2% mom and 9.1% in Jun. Within this segment, the manufacture of chemicals & chemical products was the fastest growing (18.7% yoy) followed by non-metallic products (13.2%).

- In H1 2025, non-oil manufacturing ticked up by 4.5% alongside a 5.0% gain in the manufacture of coke & refined petroleum products while the extraction of crude petroleum & natural gas ticked up by 1.2%. Under non-oil manufacturing, chemicals & chemical products grew the fastest (12.5%).

- While forward-looking indicators such as PMI & industrial licenses issued have been robust in 2025, a major challenge was highlighted in the IMF’s Article IV report: industrial growth has not translated into durable productivity gains; non-oil total factor productivity has remained stagnant.

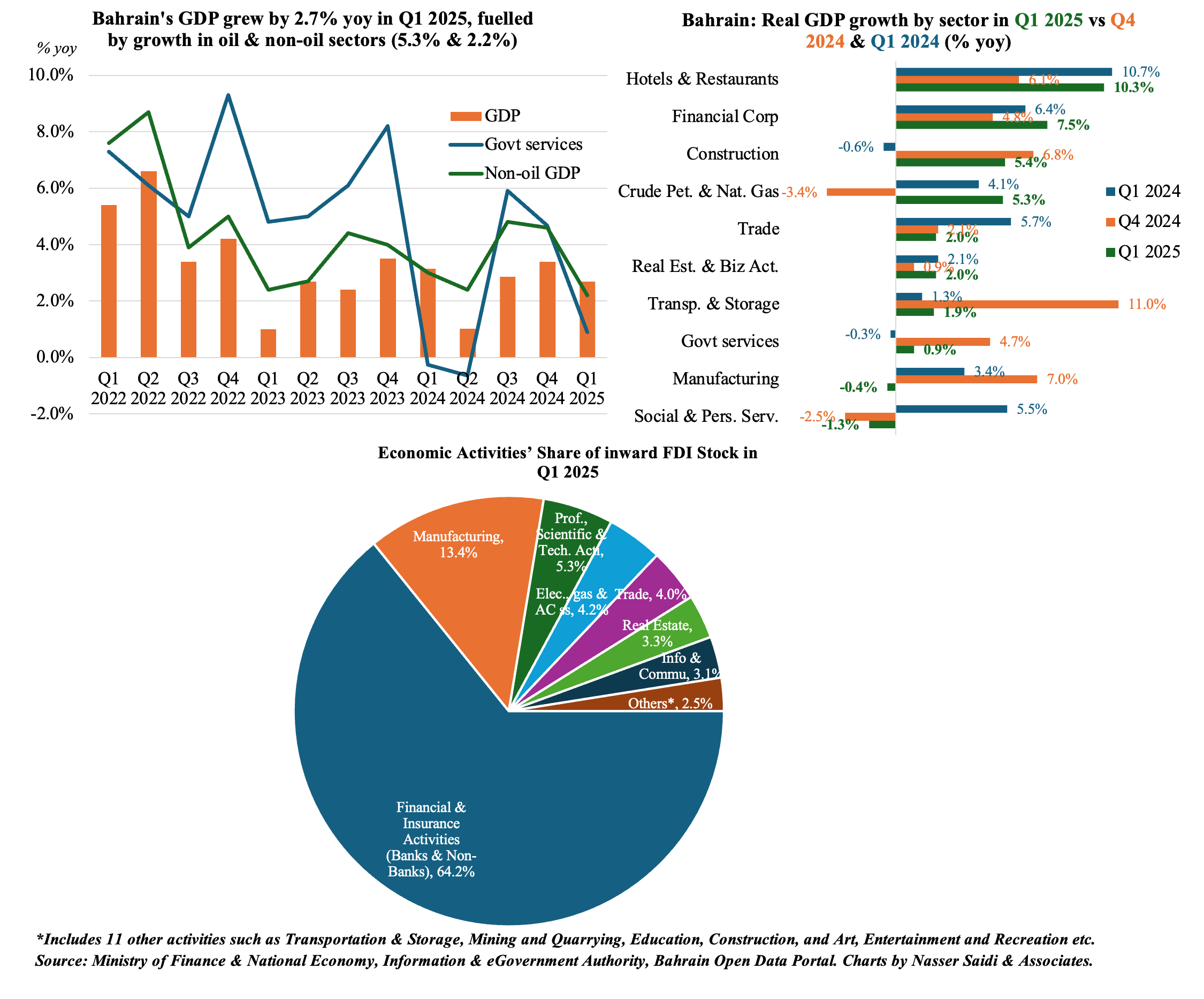

4. Bahrain’s GDP grew by 2.7% yoy in Q1 2025, thanks to a rebound in the oil sector (5.3% vs -3.4% in Q4); FDI into financial sector dominated in Q1 2025

- Real GDP in Bahrain grew by 2.7% in Q1 2025, supported by a 5.3% gain in oil sector activity (rebounding from Q4’s 3.4% drop).

- The non-oil sector contributed 84.8% to real GDP in Q1. Non-oil activity grew by 2.2% (slower than Q4’s 4.6% gain).

- Among the non-oil non-govt sector, hotels and restaurants recorded the highest growth: 10.3% yoy vs 6.1% in Q4; it was reported that average daily spending per tourist rose by 1.1% in Q1 (total overnight tourists: 1.7mn, up 8.6% yoy).

- Financial & insurance activities grew by 7.5% in Q1, rising from 4.8% in Q4. the sector also contributed most to real GDP: 17.4%, followed closely by crude petroleum & natural gas (15.2%) and manufacturing (14.4%).

- Construction activity has been growing for four consecutive quarters: in Q1, growth clocked in at 5.4% (Q4: 6.8%). Preliminary building permits issued surged by 44.7% yoy in Q1 and built-up area grew by 15.6%.

- Separately, total inward FDI stock grew by 3.5% yoy to BHD 17.1bn in Q1 2025. Financial and insurance activities accounted for close to two-thirds of Bahrain’s inward FDI stock in 2024 (64.2%), followed by manufacturing (13.4%); by country of origin of investment, Kuwait, Saudi Arabia and the UAE topped the list – each with a share of 35.0%, 22.1% and 9.8% respectively of total FDI stock.

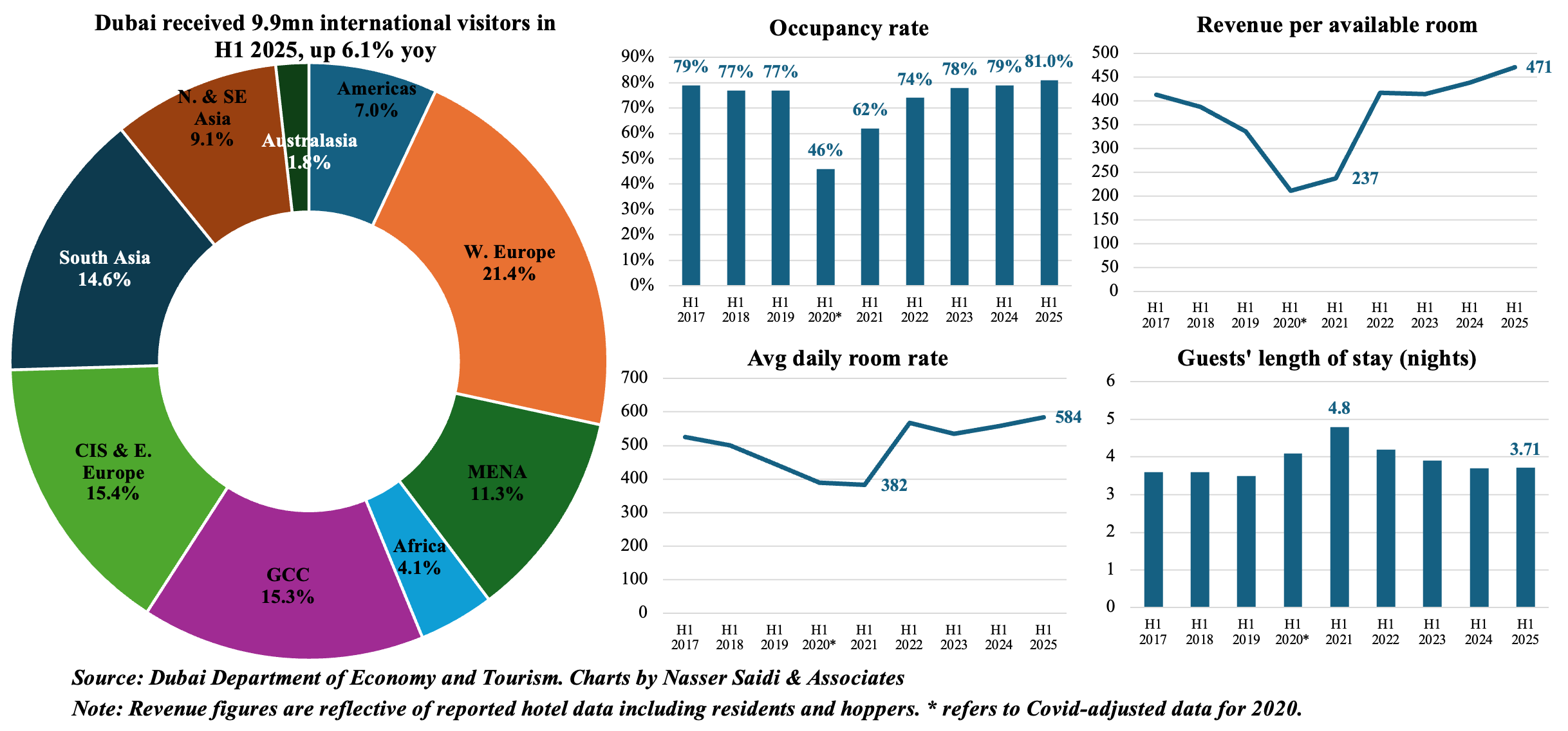

5. International visitors to Dubai grew by 6.1% yoy to 9.9mn in H1 2025

- Dubai welcomed 9.88mn international visitors in H1, up 6.1% yoy, slowly building towards its aim to be one of the top three global destinations “across leisure, business, and specialized services” as part of the D33 economic agenda.

- Dubai is successfully diversifying its visitor base: Western Europe and CIS & Eastern Europe accounted for the largest shares of visitors at 21.4% and 15.4% during the period (2.1mn and 1.5mn respectively) while the GCC & MENA regions together accounted for 2.6mn visitors (or 26.6% of the total). Visitors from South Asia declined by 10.7% yoy to 1.6mn in H1 (only 14.6% of visitors) and so did those from North & South-East Asia (-0.2% yoy to 894k).

- Dubai’s hotel sector metrics (capacity and occupancy) were strong in H1. The rising visitors demand was also met with a one percent increase in the supply of total available hotels rooms (to 152,483 across 822 establishments, supported by multiple high-profile hotel openings). Hotel occupancy rate at a strong 80.6% (slightly higher vs 79% a year ago); revenue per available room rose to AED 471 (+7.3%) and average daily room rates rose by 4.7% to AED 584 (both at record-highs for the first half of the year).

- Dubai International Airport (DXB) handled 46mn passengers in H1 2025 (+2.3% yoy and after handling a record 92.3mn passengers in 2024), despite the air traffic disruptions/ delays during the Iran-Israel war that closed airspaces. GCC’s unified tourist visa (will allow tourists to visit all 6 nations on a single visa) has been approved and is “waiting to be implemented” according to UAE’s economy minister.

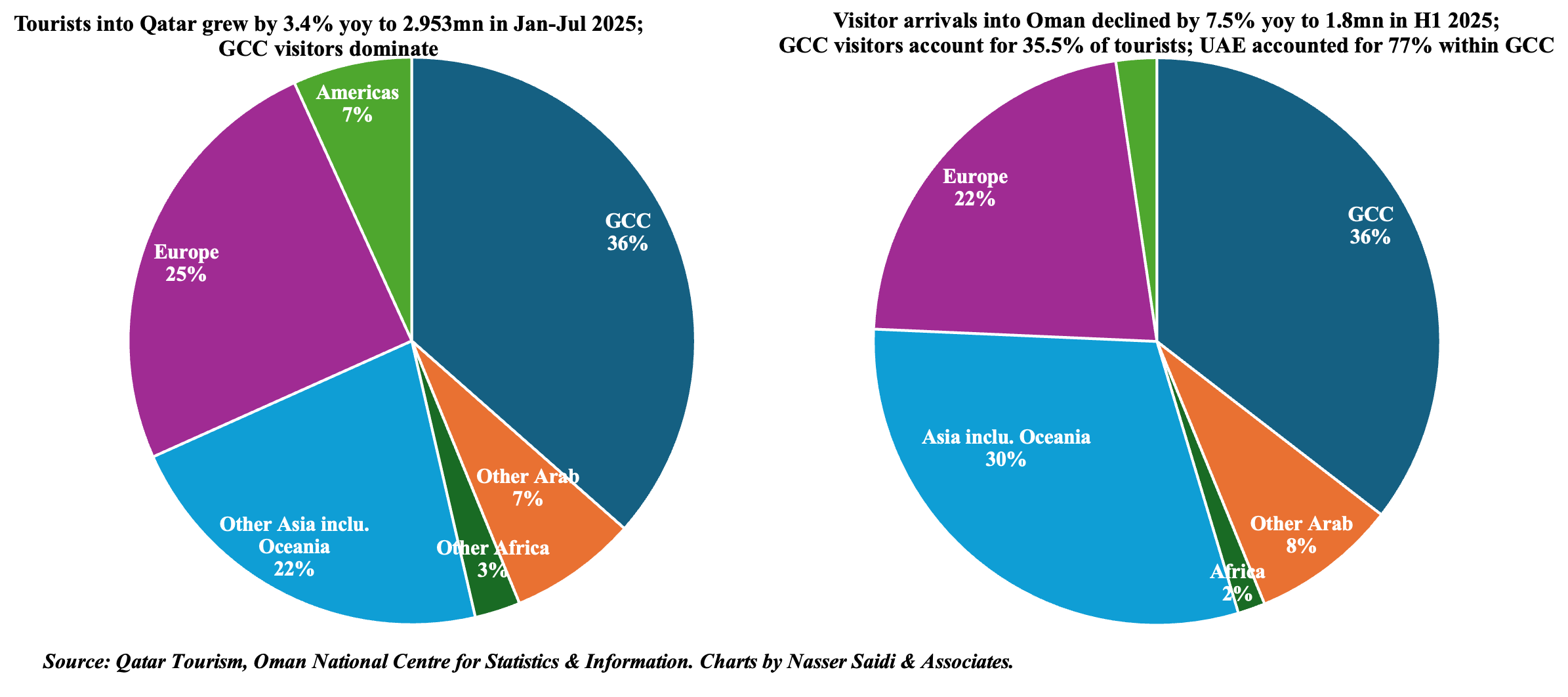

6. Boost from GCC visitors supports tourism in Qatar & Oman

- Tourists into Qatar grew by 3.4% yoy to 2.953mn tourists in Jan-Jul 2025, with visitors from the GCC accounting for 36% of the total, and with Europe and Asia & Oceania accounting for 25% and 22% respectively. Hotel supply increased – there were 41,463 room keys by end-July and full market occupancy was around 69.34% across the year (highest on record).

- Qatar’s tourism strategy 2030 targets raising the sector’s contribution to 10 to 12% of GDP. The sector had contributed QAR 55bn (USD 15bn) to GDP in 2024, an estimated 8 percent of the total economy and up 14 % yoy.

- Oman reported a 7.5% yoy drop in inbound tourists to 1.8mn in H1 2025, with majority of the visitors coming from the GCC (36% of the total) while Europe and Asia & Oceania nations were also significant (at 22% and 30% respectively). UAE accounted for more than three-fourths of visitors from GCC, while Germany and UK were the top source nations from Europe (17.2% and 12.4% of visitors from Europe).

- Oman’s Vision 2040 outlines USD 51bn in investment into the sector by 2040, up to 90% of which is expected to come from the private sector. Interestingly, there has been some regional investment interest into the sector as well: the Abu Dhabi Fund for Development committed to an OMR 80mn (AED 764.5mn) Integrated Tourism Complex in Salalah earlier this month.

Powered by: