Geopolitics key this week as markets remain unperturbed by Trump tariffs (for now!), Weekly Economic Commentary, 11 Aug 2025

Download a PDF copy of the weekly economic commentary here.

Markets

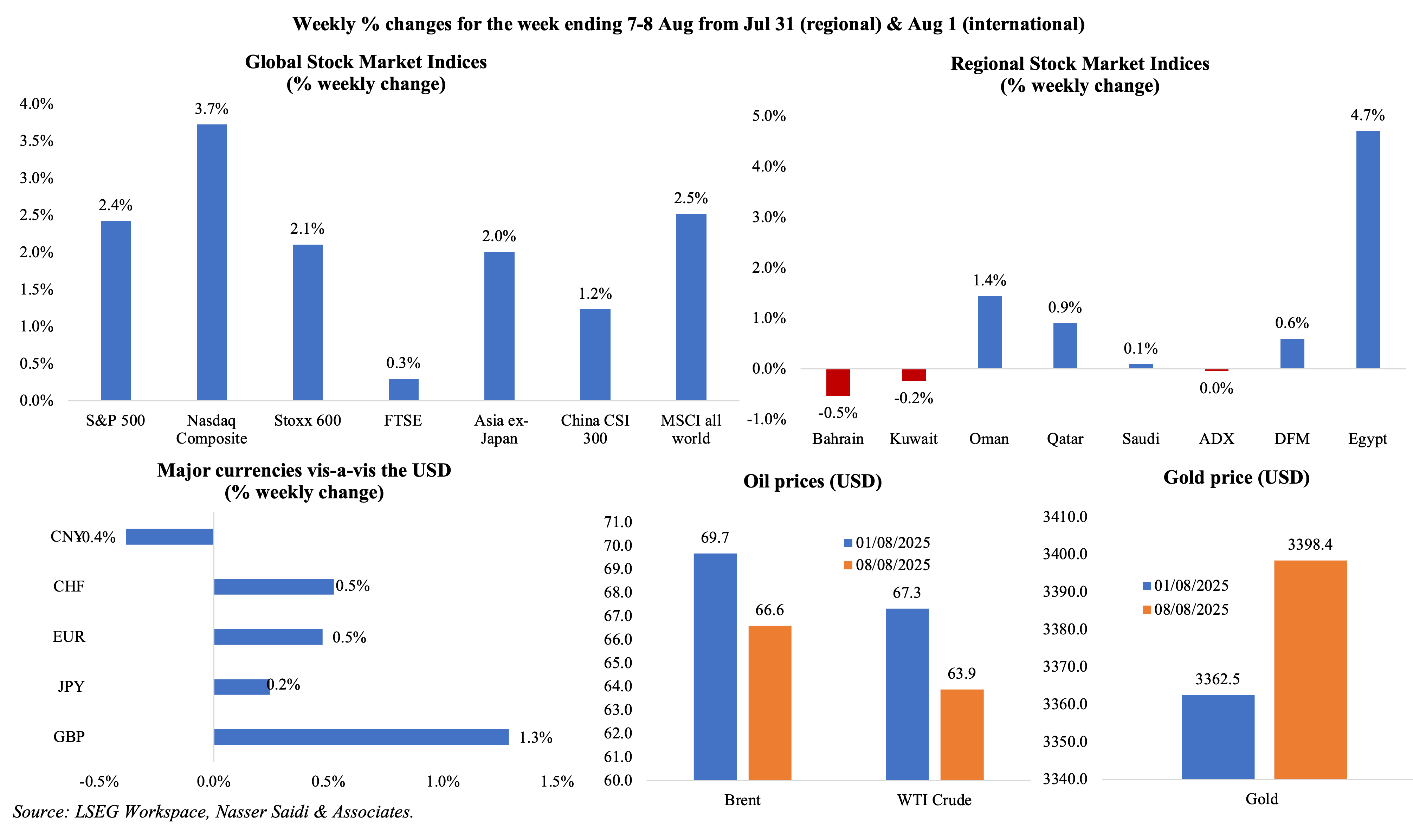

Global stock markets gained last week on upbeat corporate earnings and expectations of US Fed rate cuts: in addition to US stock market gains during the week (Nasdaq surging close to 4%), Stoxx ended gaining more than 2% and the MSCI gauge of global stocks was up by 2.5%. Even the Swiss SMI index gained despite the implementation of the 39% US tariff on Swiss trade. Regional markets were mixed, on Fed moves uncertainty and mixed earnings season; Egypt touched fresh record highs last week, while Qatar’s index climbed to its highest level in more than 2.5 years. Among currencies, the dollar index fell while the GBP-USD settled just below a 2-week high on the Bank of England policy decision to cut rates to a two-year low. Expectations of a Russia-Ukraine truce weighed on oil prices, as did the impact of latest US tariffs on global growth (Brent and WTI were down by 4.4% and 5.1% respectively), while gold futures retreated from record high USD 3,534.10 touched on Friday (reports of gold bullion bars being affected by US country-specific tariffs spooked markets).

Weekly Economic Commentary 11 Aug 2025

Weekly Economic Commentary 11 Aug 2025

Global Developments

US/Americas:

- Trump’s new tariffs came into effect last week, after the Aug 7 deadline passed for negotiation of trade deals: Laos and Myanmar were hit with the highest levies at 40% while Switzerland faces a tariff rate of 39% and Taiwan a 20% tariff. India was hit with a 25% tariff, and that was later doubled to 50% (India’s electronics and pharma exports remain exempt from additional tariffs for now) – and will come into effect on 27 Aug. Trump said he would impose a 100% tariff on foreign-made semiconductors, though chipmakers that have made significant investments in the US appear to be “safe”.

- Non-farm productivity increased by 2.4% qoq in Q2, rebounding from Q1’s drop (-1.8%), as output and hours worked ticked up (by 3.7% and 1.3% respectively). Manufacturing sector labour productivity increased by 1.5% yoy – the largest yoy gain since Q2 2021. Overall unit labour costs grew by 1.6%, weaker than Q1’s 6.9%. If productivity continues to improve, easing the rise in labour costs, it could support a “soft landing” scenario for the US.

- US factory orders fell by 4.8% mom in Jun (May: 8.3%), the steepest monthly drop since Apr 2020, largely tied to the plunge in transportation orders (-22.4%, partly reversing May’s 48.5% surge). Even after adjusting for such swings, the weakness may point to underlying softness in manufacturing demand (affected by the increase in tariffs on imports).

- US goods and services trade balance narrowed to USD 60.2bn in Jun (May: USD 71.7bn), largely attributed to a growing surplus in services (particularly travel and financial services) and a moderation in goods imports. US trade deficit with China tumbled by roughly a third to USD 9.5bn in Jun, the narrowest since Feb 2004, as imports plunged to USD 18.9bn (the lowest since 2009). The current pause on China’s tariffs is set to expire on Aug 12.

- S&P Global Composite PMI in the US rose to 55.1 in Jul (prelim: 54.6; Jun: 52.9), thanks to support from services PMI (55.7 vs projected 55.2) as well as upticks in new orders and employment. For now, services are acting as a buffer against manufacturing weakness.

- ISM services PMI in the US slipped to 50.1 in Jul (Jun: 50.8), with the decline in new orders (50.3 from 51.3) and employment (46.4 from 47.2) signalling potential weakness ahead. The jump in prices paid (69.9 vs 67.5) could revive inflationary worries in services – traditionally a stickier inflation component.

- Initial jobless claims in the US increased for the second week in a row, up by 8k to 226k in the week ended Aug 2 and the 4-week average slipped by 500 to 220.75k. Continuing jobless claims moved up to 1.974mn in the week ended Jul 26, the highest level since Nov 2021, and up from 1.936mn the week prior. Overall, the labour market remains tight.

Europe:

- Composite PMI in the EU edged down to 50.9 in Jul from the preliminary reading of 51 (but slightly higher than Jun’s 50.6), as services PMI moved to 51 (prelim: 51.2; Jun: 50.5) amid persistent industrial weakness (49.8 in Jul vs 49.5 in Jun). The report highlights new orders “down by a fraction”, export sales (including intra-eurozone trade) declining for the 41st month in a row and “growth expectations fell further below their long-term average”.

- Producer price index in the eurozone ticked up by 0.8% mom and 0.6% yoy in Jun (May: -0.6% mom and 0.3% yoy). The uptick marks a reversal from recent disinflationary trends, as prices of durable and non-durable consumer goods rose by 1.5% yoy and 2.0% respectively while energy prices declined at a slower rate (-0.1%).

- Retail sales in the eurozone recovered in Jun, growing by 0.3% mom and 3.1% yoy (May: -0.3% mom and 1.9% yoy), supported by easing inflation. The improvement is broad-based, with food (1.7% yoy), non-food products (4.3%), and car fuel sales (4.0%) driving gains; however, real wages and high borrowing costs remain key constraints.

- Sentix investor confidence in the eurozone slipped to -3.7 in Aug (Jul: 4.5%) suggesting renewed concerns over the growth outlook, driven by trade uncertainty, sluggish industrial data, and tightening financial conditions. A breakdown shows sharp declines in investor confidence in Germany and Switzerland after the EU reached an agreement with Trump.

- Exports from Germany rebounded in Jun, up 0.8% mom (May: -1.4%) and imports were also up by 4.2% (May: -3.9%), resulting in a narrower trade surplus (of EUR 14.9bn, the smallest since Oct 2024, and down from May’s EUR 18.5bn).

- German factory orders fell by 1.0% mom in Jun, following a 0.8% drop in May. In yoy terms, orders grew by 0.8%, slower than the previous month’s 6.1% gain. This results from a plunge in foreign orders (-3.0% mom) especially orders from outside the euro area (-7.8%).

- Services PMI in Germany returned to an expansionary 50.6 reading in Jul (Jun: 49.7), supported by an increase in new businesses while the pace of job creation slowed, and inflationary pressures eased sharply to weakest since Feb 2021.

- The Bank of England lowered interest rates by 25 bps to 4.0% at the latest meeting, the lowest level in two years, with five voting for a cut and four opting to keep rates unchanged (it also involved an unprecedented second vote). This highlights a delicate balancing act: addressing cooling growth in the face of lingering inflation risks (still above the target of 2%). While the BoE governor acknowledged that the path of rates will continue to move downwards, he also highlighted “genuine uncertainty”.

Asia Pacific:

- The risk of deflation remains a challenge in China: inflation was flat in Jul (Jun: 0.1%) as non-food prices ticked up (0.3% from Jun’s 0.1%) alongside a steeper decline in food prices (-1.6% from -0.3%). Core inflation, at 0.8% yoy, was the highest in 17 months. While the flat CPI avoids outright deflation, it reflects tepid domestic demand despite policy stimulus. PPI fell by 3.6% in Jul, matching Jun’s reading; persistent decline underscores weak industrial demand and overcapacity in key industries (e.g. manufacturing and construction).

- China Caixin services PMI increased to 52.6 in Jul, from Jun’s 50.6 reading: this was supported by new business (strongest pace in a year) and external demand (thanks to rebound in tourism) while employment rose (most since Jul 2024).

- Exports from China accelerated by 7.2% yoy in Jul (Jun: 5.8%) alongside a1% rise in imports (Jun: 1.1%), leading to a narrower trade surplus of USD 98.24bn (Jun: USD 114.77bn). Higher tariffs meant that exports to the US plunged by 21.7% in Jul, but was more than offset by increase in exports to ASEAN (+16.6%), EU (9.2%), Africa (42.4%) and Latin America (7.7%).

- The BoJ meeting minutes revealed that some members were ready to raise rates “depending on US policy developments” and if “trade friction de-escalates” (referring to the US tariffs-related uncertainty, resolved for now given the recent trade deal); higher growth and inflation could push the apex bank to resume rate hikes later this year.

- Japan’s leading economic index rose to 106.1 in Jun (May: 104.8, the lowest since Aug 2020), supported by a surge in household spending, while the coincident index also ticked up to 116.8 (from 116.0).

- Labour cash earnings in Japan grew by 2.5% yoy in Jun (May: 1.4%), reflecting tight labour markets and strong Shunto wage negotiations earlier this year. However, real wages remained under pressure, falling for the sixth consecutive month (-1.3% in Jun and -2.6% in May), constraining household purchasing power. Separately, overall household spending in Jun grew by 1.3% yoy (May: 4.7%), led by spending on housing (11.6%), transportation and communication (8.6%) costs though spending on food fell (-2.1%).

- Japan’s current account surplus narrowed to JPY 1,348.2bn in Jun (May: JPY 3,436.4bn) reflecting a narrower goods surplus (exports fell by 2.4%, higher than imports’ 1.3% drop) alongside a primary income surplus (JPY 1,500.7bn). In H1 2025, surplus grew by 9.1% yoy to JPY 14.6trn, thanks to smaller trade deficit and higher returns on foreign investments.

- The Reserve Bank of India held interest rates unchanged at the latest meeting, a cautious pause amid stable inflation (RBI projection was lowered to 3.1% for the current fiscal year) and robust growth (RBI forecast at 6.5%), and with the threat of US tariff hikes looming large. The rates – repo rate at 5.5% and reverse repo at 3.35% – are above pre-pandemic levels, while the real interest level adjusted for inflation is 2-3%.

- India composite PMI inched up to 61.1 in Jul (flash estimate: 60.7), the highest since Apr 2024, supported by services PMI that rose to 60.5 (fastest in 11 months) and a near 18-month high manufacturing PMI score.

- Retail sales in Singapore grew by 2.3% yoy (May: 1.3%), supported by gains in motor vehicles (14.6%) and sales of computer & telecommunications equipment (7.3%) while declines were posted in petrol service stations (-5.9%) and retailers of food & alcohol (-5.2%).

Bottom line: US-China trade negotiations are reaching the Aug 12 deadline, with no indication of either side being close to signing; despite the trade uncertainty, Chinese stock markets are at near a 10-month high. With Presidents Trump and Putin meeting this week, it remains to be seen whether a ceasefire deal will be brokered in the absence of Europe and/ or Ukraine. If there is no agreement, it remains to be seen if additional tariffs are imposed on Russia’s trade partners – China is the top Russian oil importer (India is already looking at a hiked US 50% tariff from Aug 27th if a bilateral trade deal is not agreed with the US) and Brazil has been one of the largest buyers of Russian diesel and fertiliser (for its agricultural goods). Finally, the US inflation print this week is important – it could influence Fed interest rate policy especially if higher import duties have filtered through the prices (anecdotal evidence indicated that businesses have been absorbing the additional costs so far).

Regional Developments

- Bahrain’s sovereign wealth fund Mumtalakat (with assets under management around USD 18bn) announced a minority stake in Abu Dhabi-based private equity firm BlueFive Capital (AuM of USD 2.6bn), adding to the recent moves among sovereign investors to increase exposure to smaller and regional alternative asset managers.

- Egypt’s non-oil PMI rose to a 5-month high of 49.5 in Jul (Jun: 48.8), on softer declines in output and new orders alongside the first rise in employment since Oct 2024. While wholesale and retail sector remained the largest drag on demand, firms cited slowing inflation and diminishing regional conflicts as signs of optimism for future activity.

- The central bank of Egypt forecasts GDP growth of 4.8% for the fiscal year 2025–26, signalling a cautiously optimistic outlook amid ongoing reforms, external financing and macroeconomic stabilization (Suez Canal recovery, private sector credit growth, high demand and investment across sectors). Overall fiscal deficit is projected to drop by 3.4 percentage points over the upcoming four years to hit 4.2% of GDP by FY 2028-29.

- Egypt and Vietnam signed a deal to deepen economic and trade cooperation, setting the stage for enhanced cooperation in areas such as the digital economy, climate change, sustainable development, renewable energy, and the localisation of industry.

- Net international reserves in Egypt climbed to a record USD 49.036bn in Jul, reflecting steady accumulation since the launch of its flexible-exchange-rate policy in Mar 2024. Separately, net foreign assets touched EGP 741.8bn (roughly USD 15bn) by end-Jun, continuing a rebound from past negative territory as it restores external balances through remittances, tourism inflows, and structural reforms (attracting external financing).

- Egypt’s trade deficit narrowed to USD 3.41bn in May (-17.8% yoy), stemming from higher exports (+4.6%) – led by petroleum products (53.5%), garments (32.8%), and food prep (21.7%) – alongside a decline in imports (-6.7%), notably in petroleum products (-20.3%) and raw materials (-34%).

- Exports to the EU from Egypt amounted to USD 14bn annually, according to an official at the General Authority for Investment and Free Zones, driven by a surge in agricultural and processed food shipments. Amid rising global trade restrictions, Egypt’s aims to further diversify its export portfolio and strengthen trade with EU nations will be beneficial.

- Independent Chinese oil companies are increasingly investing in Iraq’s oil sector and seem on track to double their production to 500,000 barrels per day by 2030. This shift comes as major Western oil firms scale back operations in the region, and Iraq’s move towards more lucrative profit-sharing contracts (from fixed-fee agreements) has attracted these firms.

- Kuwait’s PMI edged up to 53.5 in Jul (Jun: 53.1), thanks to growth in new orders, output, and steady employment.While purchase prices and staff costs rose at the slowest rates in six and four months respectively, output price inflation was at a 4-month low.

- Kuwait successfully raised KWD 150mn (USD 491mn) through a domestic debt issuance, with strong demand from banks; the issuance was oversubscribed 10 times. The funds will support government spending and infrastructure projects while also allowing it to diversify its funding sources and manage public debt more effectively.

- Lebanon’s PMI declined for the fifth month in a row, to 48.9 in Jul (Jun: 49.2), on subdued demand conditions while the drop in new export business was the steepest since Nov 2024. Purchasing prices rose, with higher import and transportation fees often cited.

- The Oman Investment Authority has allocated over OMR 7bn (USD 1.8bn) to support the state budget since 2016, disclosed OIA’s Chairman in an interview. He also revealed that the OIA also cut debt by more than OMR 2.5bn by end-2024 while the National Development Fund (established by the OIA in 2021) attracted OMR 3.3bn in foreign investments in 2024.

- Oman reported a 5.5% yoy increase in vehicle registrations to nearly 1.8mn as of end-Jun 2025, with private vehicles accounting for 79% of the total.

- The Ministry of Labour in Oman noted the creation of more than 12k new jobs in H1 2025, roughly 38% of its employment target for 2025. Of this, 82.1% of jobs were created in the private sector.

- China’s Sungrow Hydrogen is partnering with Oman’s United Engineering Services (UES) to construct the Oman’s first plant specialising in green energy equipment in Duqm. The site will produce electrolysers, liquefied-gas equipment, purification and power systems in Duqm.

- Qatar PMI slipped to 51.4 in Jul (Jun: 52), as new business fell at the fastest rate since Feb though private sector employment rose at the third-strongest rate on record (also accompanied by higher wages). New work rose in manufacturing and wholesale & retail, but declined in services and construction, according to the report.

- The banking sector in Qatar reported a 5.2% increase in domestic credit issuance to QAR 1.33trn in Jun, alongside a 1.9% rise in domestic deposits (to QAR 850.5bn). Additionally, total assets of commercial banks grew by 6.3% to reach QAR 2.13trn. All supportive for business investments and domestic consumption, facilitating economic expansion.

- Syria signed 12 investment agreements worth USD 14bn, including a USD 4bn deal with Qatar’s UCC Holding to construct a new airport, a USD 2bn deal with the UAE’s National Investment Corporation to develop a subway system in Damascus, and plans to develop a USD 2bn “mega city” in Damascus, featuring 20,000 residential units across 60 high-rise buildings (a collaboration between Italy’s Ubako and local company Yobaco) – all part of Syria’s broader reconstruction efforts following over a decade of conflict.

- OPEC’s oil production increased to 27.38mn barrels per day (bpd) in Jul, up by 270k bpd from Jun, with the UAE and Saudi Arabia contributing the most to this rise while Iraq lowered output due to additional compensation cuts and disruptions due to drone attacks. This reflects OPEC+’s strategy to gradually unwind production cuts while managing member compliance.

- Maersk CEO highlighted during an earnings call that the Red Sea crisis continues to cause significant disruptions to global shipping routes, leading to costly detours: this was also reinforced by other shipping companies. These disruptions are expected to last through 2025, impacting supply chains and raising transportation costs, reshaping global trade dynamics.

Saudi Arabia Focus

- Saudi Arabia PMI declined to 56.3 in Jul (Jun: 57.2): though business activity expansion slowed to its weakest since Jan 2022, employment surged (one of the steepest increases in 14 years). Domestic demand remains high, thanks to existing projects and incoming new orders, alongside positive business sentiment (though it was at the lowest since Jul 2024).

- In its 2025 Article IV consultation, the IMF commended Saudi Arabia’s robust non‑oil growth (4.5% in 2024), stable low inflation, and record‑low unemployment levels (doubling of female labour force participation rates, halving of youth & female unemployment and a 12% increase in private sector employment for citizens). The IMF underscored the importance of countercyclical policies, gradual fiscal consolidation, and structural reforms. Public debt to GDP is projected to rise to 32.6% next year from an estimated 29.8% this year, but remaining within normal levels given sound fiscal management and borrowing strategies. More: https://www.imf.org/en/News/Articles/2025/08/03/pr25275-saudi-arabia-imf-executive-board-concludes-2025-article-iv-consultation

- Saudi Aramco revenues fell to USD 22.67bn in Q2 2025, reflecting lower average realised oil prices (to USD 66.7 per barrel), and net profits fell for the 10th consecutive quarter (-22% yoy to SAR 85.02bn). Aramco maintained full upstream reliability, delivered robust free cash flow (SAR 57bn for Q2; SAR 129bn for H1), and remained committed to gas expansion.

- SABIC posted a net loss of SAR 5.3bn in H1 2025 but plans to distribute a SAR 4.5bn dividend, equivalent to SAR 1.5 per share (15%). Capital investment is projected to be steady at USD 3.0 to 3.5bn in 2025, reinforcing long‑term expansion commitments.

- Supply of housing in Saudi Arabia lags demand, affecting residential prices: price growth slowed to 0.4% qoq in Q2 (Q1: 5.1%), according to GaStat. Transaction volumes dropped 1.5% yoy in Q2, as per JLL – who also estimate that bout 18,900 units are currently under construction in Riyadh. The recent law allowing foreigners to purchase property from 2026 in restricted areas will add further pressure on prices.

- The active oil rig count in Saudi Arabia plunged to 20 rigs in Jul 2025, the lowest since Feb 2005, and down from 46 in early 2024, reported Bloomberg. This highlights Aramco’s strategic shift away from upstream expansion and reinforcing gas-related investments (including infrastructure).

- Saudi Arabia’s Yanbu port is planning a SAR 500mn expansion in the form of a bunkering hub to enhance marine fuel and oil storage services/ strategic logistics capacity. The port currently handles up to 210mn tonnes annually.

UAE Focus

- UAE’s PMI slipped to 52.9 in Jul (Jun: 53.5), the lowest reading since Jul 2021, as demand softened and export orders dropped to the slowest pace in nearly 4 years. In contrast, Dubai PMI rose to 53.5 (from Jun’s 45-month low of 51.8), supported by increased sales / new orders.

- UAE and Russia signed a bilateral Trade in Services and Investment Agreement, building on the broader Economic Partnership Agreement between UAE and the Eurasian Economic Union. Bilateral non-oil trade between the nations stood at around USD 6.65bn in H1 2025 (+75.3% yoy) and USD 11.5bn in 2024 (+4.9% yoy), and UAE aims for this to double at both the bilateral level and with Eurasian countries in five years’ time.

- Non-oil foreign trade in Abu Dhabi grew by 34.7% yoy to AED 195.4bn in H1 2025, with exports, re-exports and imports registering double-digit growth rates (64%, 35% and 15% respectively).

- Dubai welcomed 9.88mn international visitors in H1 2025, up 6.0% yoy, with visitors from GCC and MENA accounting for 26% of total arrivals. Average occupancy in the emirate rose to 80.6% (vs 79% a year ago), average daily rate grew by 5% to AED 584 (or USD 159) and revenue per available room rose to AED 471 (+7%).

- Building permits applications processed in Dubai surged to over 30k in H1 2025, up 20% yoy, and covering 5.5mn+ sqm of built-up area. New permissions were almost evenly split between commercial/investment buildings (~45%) and residential villas (~40%), with industrial and public structures comprising the rest. Currently, 726 developments are underway across the emirate, according to the Dubai Land Department.

- Summer temperatures in the UAE are soaring: on Aug 1, it was reported to be 51.8°C in the town of Sweihan: this was close to the all-time peak of 52.1 °C (recorded in July 2002). Aug temperatures are projected to remain 0.25–0.5 °C above average this year.

- ADNOC Gas signed a decade-long LNG supply agreement with India’s Hindustan Petroleum, committing to deliver 500,000 metric tonnes of LNG annually. This is the third such agreement with Indian oil firms; supplies will be sourced from the Das Island liquefaction facility, with a capacity of 6mn tonnes per year.

Media Review:

An updated System of National Accounts to capture digitalisation & intangible assets

https://www.imf.org/en/Blogs/Articles/2025/07/31/new-standards-for-economic-data-aim-to-sharpen-view-of-global-economy

Six months after DeepSeek’s breakthrough, China speeds on with AI

https://www.economist.com/china/2025/08/05/six-months-after-deepseeks-breakthrough-china-speeds-on-with-ai

Can Democracy survive AI?

https://www.project-syndicate.org/commentary/can-democracy-survive-ai-by-ian-bremmer-2025-08

Why the oil market is tight despite big OPEC+ output hikes

https://www.reuters.com/business/energy/why-oil-market-is-tight-despite-big-opec-output-hikes-2025-08-07/

Chinese tourists flock to Gulf again – and not only to Dubai

https://www.agbi.com/analysis/tourism/2025/08/chinese-tourists-flock-to-gulf-again-and-not-only-to-dubai/

Powered by: