Markets Steady Amid Tariff Tensions and Diverging Global Policy Paths, Weekly Economic Commentary, 14 Jul 2025

Download a PDF copy of the weekly economic commentary here.

Markets

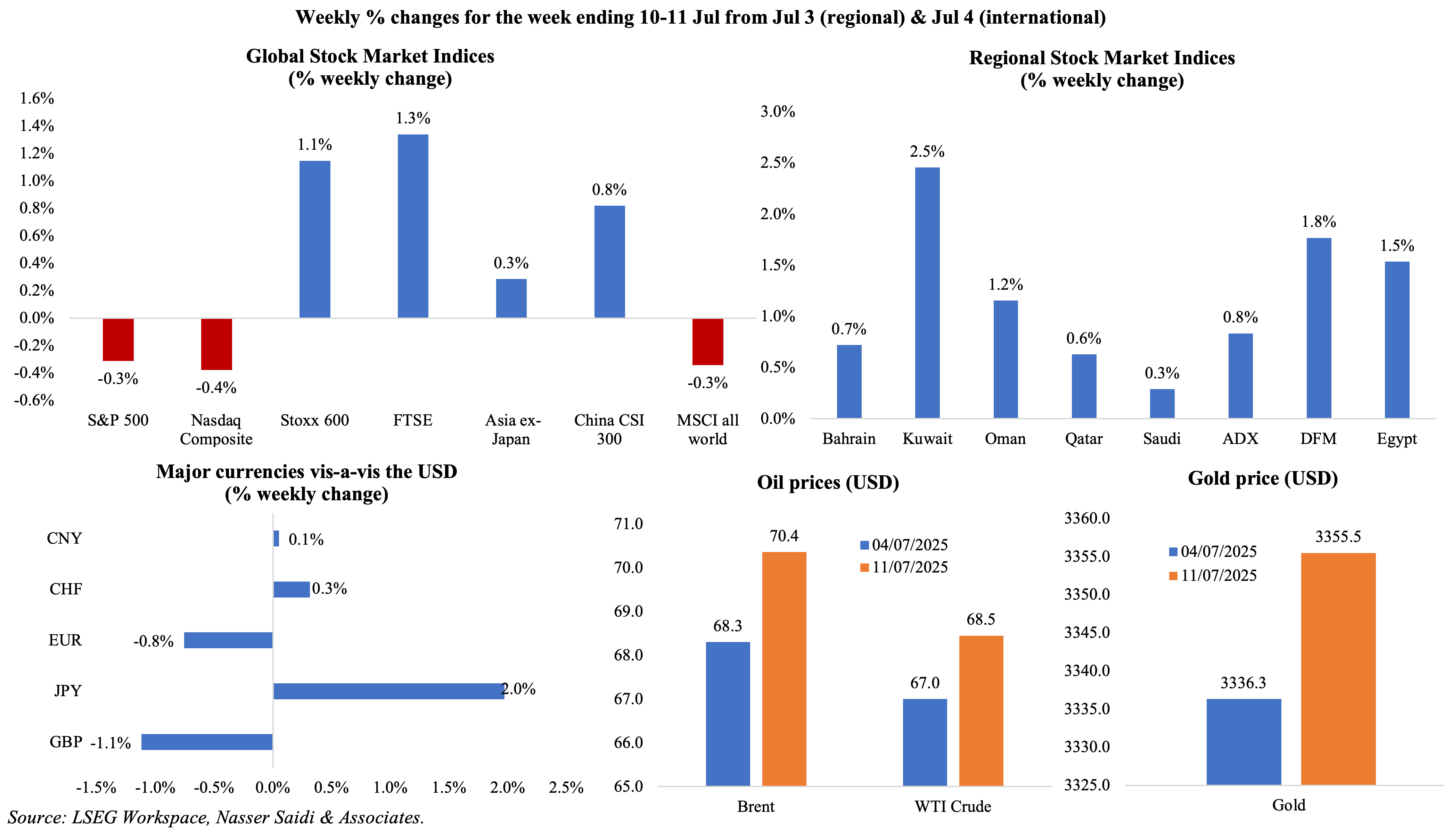

US equity markets closed the week a tad lower after hitting record highs on Thursday despite letters with new tariff rates being sent to 14 trade partners; as of now, the new tariff rates are to be imposed from Aug 1st onwards, unless there is a reprieve or “deal” announced. Stoxx600 and FTSE gained as did major Asian markets. The region’s equity markets posted gains, brushing aside news of tariff hikes thanks to gains in the oil price and IEA’s report that global oil markets may be tighter than previously indicated. With the trade tariff “war” resuming, USD rose vis-à-vis its peers: USD gained nearly 2.0% versus JPY while the euro slipped by 0.8% (on expectations of a letter with new tariff rates). Oil prices rose, with Brent and WTI up by 3% and 2.2% from a week ago. Metal prices climbed: gold (with its safe-haven status) saw prices edge up by 0.6%; silver price reached its highest in over 13 years and copper futures hit an all-time high, riding on the announced 50% tariff on copper.

Global Developments

US/Americas:

- President Trump & tariffs: letters detailing the new, higher tariff rates was sent to 14 trade partners initially, including Japan and South Korea with whom negotiations were ongoing. Canada was added later, and over the weekend, additional hikes were announced for both Mexico and the EU. Brazil was hit with duties of 50% (despite running a surplus with the US) and a 50% tariff announced on copper, with a further threat of 200% on pharmaceuticals.

- Though the Fed left rates unchanged at its latest meeting, the FOMC minutes highlighted a growing divide with most officials calling for one or two rate cuts by end of the year while the minority want to hold given persistent inflation (a September cut seems likely if inflation cools further in the coming months). Discussion also centred around balance sheet reduction (seen as appropriate and likely sustainable), whether tariffs-related price hikes would be transitory or longer-lasting, and the Fed emphasised a data-driven approach to decide policy.

- NFIB business optimism in the US slipped to 98.6 in Jun (May: 98.8), signalling a subdued sentiment among small business owners. Inflation remains the main concern and persistent labour shortage was another – together this points to slower hiring and/ or investment in H2, especially if borrowing costs remain at current levels.

- Budget balance in the US moved to a surplus USD 27bn in Jun, in contrast to May’s deficit of USD 316bn, driven by strong receipts (+13% to USD 526bn) and a surge in customs duties (up 301% yoy to a record USD 27.2bn). Net interest on the USD 36trn national debt totalled USD 84bn in Jun. The federal government posted a surplus in Jun last in 2017, but the overall fiscal year deficit remains large (USD 1.34trn, up 5% yoy).

- Initial jobless claims in the US declined by 6k to 227k in the week ended Jul 4 and the 4-week average slipped by 5.75k to 235.5k. Continuing jobless claims moved up to 1.965mn in the week ended Jun 27, from 1.955mn the week prior.

Europe:

- Euro area retail sales weakened in May, down by 0.7% mom (Apr: 0.3%) as sales decreased for food, drinks & tobacco (-0.7%), non-food products (-0.6%) and automotive fuel (-1.3%). In yoy terms, sales were up by 1.8%, slowing from Apr’s 2.7% gain.

- Sentix investor confidence in the eurozone increased to 4.5 in Jul (Jun: 0.2), the highest level since Feb 2022, as all sub-components increased for the third time in a row. Expectations rose for the third month in a row (+2.3 points to +19.8) while current assessment rose for the fifth time (+8 points to -18.8).

- German industrial production rebounded by 1.2% mom and 1.0% yoy in May (Apr: -1.6% mom and -2.1% yoy). The monthly gain resulted from gains in energy production (10.8%), pharmaceuticals (10%) and automotive (4.9%) sectors.

- Despite the promising IP data, a mixed picture emerged as exports from Germany fell by 1.4% mom in May, alongside a steeper 3.8% drop in imports (to a 5-month low of EUR 111.1bn), causing trade surplus to increase to EUR 18.4bn (Apr: EUR 15.8bn). Exports to the US plunged by 7.7% to the lowest level since Mar 2022, while exports to China and EU fell by 2.9% and 2.2% respectively.

- Current account surplus in Germany shrank to EUR 9.6bn in May (Apr: EUR 23.5bn) as primary income surplus plunged (EUR 2.7bn vs EUR 14.4bn, partly due to higher dividend payments to non-residents) and services deficit narrowed (EUR 5.2bn vs EUR 6.3bn).

- German wholesale price index rose to 0.9% yoy in Jun (May: 0.4%), as prices rose for food, beverages & tobacco (4.2%) while other segments posted declines such as solid fuels & mineral oil products (-5.9%) and computers & related equipment (-5.0%).

- GDP in the UK fell by 0.1% mom in the three months to May, an improvement from the previous three-month period contraction by 0.3%. Industrial production fell (-0.9% mom) dragged down by manufacturing (-1% mom), reflecting weak external demand and sluggish domestic investment.

Asia Pacific:

- China’s inflation rose to positive in Jun, up 0.1% yoy (vs May’s -0.1%) though food prices remained deflationary for the fifth month in a row (-0.3% yoy). Producer price index remained deflationary for the 33rd month in Jun: at -3.6% yoy (May: -3.3%), it was the steepest decline since Jul 2023. In H1 2025, factory prices fell by 2.6%.

- Foreign exchange reserves in China rose to USD 3.317trn in Jun (May: USD 3.285trn), the highest since Dec 2015, because of the exchange rate conversions (given the depreciation of the USD) and rising asset prices. Gold holdings also increased, for the eighth month in a row (June: 73.83mn ounces, valued at around USD 242.93bn).

- Current account surplus in Japan widened to JPY 3.436trn in May (Apr: JPY 2.258trn) as services account posted a surplus (JPY 201.bn from a deficit JPY 51.6bn a year ago) alongside smaller trade deficit (USD 522.3bn from USD 1.098bn a year ago).

- Japan’s preliminary leading economic index reading ticked up to 105.3 in May (Apr: 104.2) while the coincident index edged down to 115.9 from 116.

- The Bank of Korea left interest rates unchanged at 2.5%: the apex bank highlighted a “significant acceleration” in household debt and housing prices in Seoul (19%+ in Jun on an annualised basis) and is expected to lower rates after assessing measures undertaken to cool the housing market.

Bottom line: Notwithstanding the new tariff hike announcements, markets (and investors) remained calm, showing no signs of a dramatic sell-off (as seen following the Liberation Day announcement) – viewing this as a negotiating tactic and expecting either delayed implementation or roll-back of the hikes, a Trump Always Chickens Out (TACO). As Q2 earnings releases get underway, there will be greater visibility regarding the consequences of tariff-related uncertainty (especially from a business costs and future investments perspective). US inflation for the month of June is likely to show a pass-through of tariff hikes, and will be critical in Fed’s next move in Sep. Furthermore, China’s Q2 GDP release (on Tuesday) will be critical, especially the private consumption component: if data shows demand weakness, expect more stimulus measures in coming quarters.

Regional Developments

- Bahrain attractedUSD 250mn+ in British investments across multiple sectors such as financial services, ICT, education, and tourism over the period 2022–2024, according to the Economic Development Board.

- Urban inflation in Egypt eased to 14.9% in Jun (May: 16.8 %), driven by a slower rise in food & beverages (6.9% yoy vs 11.2% in May) while core inflation also slowed to 11.4%. In monthly terms, CPI slipped by 0.1%, the first deflationary reading since May 2024 as food prices dropped (-1.2%).

- Egypt’s Central Bank held interest rates steady, retaining both the 24% overnight deposit, 24.5% discount and 25% lending rates, after two consecutive cuts. With inflation falling and growth holding steady (close to 4.8%), policy moves will be predicated on the impact of recent VAT and subsidy reforms amidst external risks (such as currency volatility).

- Egypt’s net foreign assets increased by 8.1% mom to USD 14.7bn in May, driven by NFAs of commercial banks’ (rising by USD 3.2bn to USD 4.8bn, the highest since Feb 2021).

- Egypt and China signed three MoUs focused on strengthening financial linkages, promote use of the CNY and payment systems. Especially important in the context of greater geopolitical fragmentation and increased weaponisation of the dollar, discussions centred around a local currency swap agreement, settling payments in local currencies, linking payment systems and issuance of Panda bonds.

- Kuwait’s recent capital market reforms (as part of the second stage of Phase Three of the Market Development Program) includes the introduction of a central counterparty clearing framework, upgraded brokerage standards, and streamlined settlement systems among others in addition to upgrading IT infrastructure to support future listings of ETFs and fixed income instruments.

- Inflation in Oman eased to 0.5% in Jun (May: 0.6%), dragged down by negative readings in food & beverages (-2.0% from -0.8% in May) and furnishings (-0.2%) while costs hiked for transport (2.6% from 2.4%) and housing & utilities (0.5% vs flat in May). Inflation clocked in an average 0.7% in H1 2025, with prices of transport and health the highest (averages of 2.7% and 2.4% respectively).

- Oman’s trade surplus narrowed 40.4% to OMR 1.849bn by end-Apr, as exports fell by 9.3 % (mainly a 15% drop in oil & gas shipments) while non‑oil exports grew 9.0 % and imports rose 9.2 %. UAE remained Oman’s top non-oil trading partner: exports to UAE was up 24.9% to OMR 390mn, and the UAE was the largest source of imports at OMR 1.283bn.

- Tourism revenues in Oman touched OMR 2.12bn in 2024, reflecting a CAGR of 3.2%. The sector’s contribution to GDP rose to OMR 2.7bn in 2024 (vs OMR 2.3bn in 2018). The Minister of Heritage and Tourism also highlighted the strong local and regional demand as well as appeal from European tourists as key drivers of growth.

- Moody’s upgraded Oman’s long-term issuer and senior unsecured ratings to “Baa3” from “Ba1”, citing expectations of continued improvement in debt ratios irrespective of oil price movements. Public spending had reduced to less than 29% of GDP in 2024 from an average of more than 41% of GDP during 2016-2020. However, Moody’s changed its outlook to “stable” from “positive” citing the continued high reliance on the hydrocarbon sector (output and fiscal).

- Qatar central bank’s international reserves and foreign currency liquidity grew by 3.51% yoy and 0.29% mom to QAR 258.9bn in Jun. International official reserves were up 4.5% yoy and 0.47% mom to QAR 199.6bn, with the increase driven by higher gold reserves (holdings rose to OMR 44.5bn, from QAR 44.3bn) and improved IMF reserve position (up QAR 81mn to QAR 5.25bn).

- Qatar and China signed an MoU to increase transport rights for passenger and cargo flights between the two countries and cooperate in code-sharing that will enhance cooperation and increase efficiency.

- The World Bank forecasts Syria’s GDP to grow modestly by 1% in 2025, with the easing of sanctions providing “upside potential, and following a contraction of 1.5% last year. GDP had cumulatively contracted by more than 50% since the conflict started in 2010 and the gross national income, at just USD 830 last year, is lower than the threshold for low-income nations.

- Bahrain is identified as having a 48% cost advantage in EY’s “Cost of Doing Business in the GCC” financial services sector report. Annual labour costs for a financial services tech hub in Bahrain is up to 24% more competitive, businesses can save 85% on annual business & licensing fees and get 60% better value for office space rental.

- M&A deals in the MENA region surged by 149% yoy to USD 115.5bn in H1 2025, with equity and equity-related issuance totalling USD 7.6bn (-57% yoy) and bond issuance rising by 17% yoy to USD 86.8bn (the highest H1 reading since 1980). Investment banking fees in the MENA fell by 2% yoy to USD 773.7mn in H1 2025, the third highest H1 total since 2000, according to the LSEG Deals Intelligence report. Debt capital markets’ underwriting fees jumped by 20% yoy to an all-time high of USD 278.9mn in H1 2025, hitting an all-time high while equity capital markets were most impacted (underwriting fees fell sharply by 18% to a two-year low of USD 169.6mn).

- Telco operators in Oman and the UAE began operating a submarine fibre optic cable connecting the two countries – a backup for the land and satellite-based channels.

Saudi Arabia Focus

- Industrial production in Saudi Arabia grew by 2.5% mom and 1.5% yoy in May. Oil activities expanded by 0.5% mom and 2.0% yoy, as crude oil production rose to 9.184mn barrels per day (bpd), up from 8.99mn bpd a year ago. Manufacture of coke & refined petroleum products surged by 2.1% yoy and 2.0% mom. Non-oil manufacturing activities increased by 2.5% mom and 4.8% in May. Within this segment, manufacture of chemicals & chemical products was the fastest growing (14.0% yoy) followed by non-metallic products (10.5%).

- Riyadh’s KAFD will announce a “huge expansion” this year – this could double the area (from the current 1.6 sq km). With multiple development projects underway in the district, the KAFD aims to attract 40k visitors a day by end-2025.

- SABIC, in line with its portfolio optimisation exercise and focusing on core businesses, is planning a potential IPO for National Industrial Gases (74 % owned by SABIC, generating revenues of SAR 1.6bn last year). The feasibility study is ongoing, and this potential listing comes on the heels of SABIC posting a Q1 net loss partly due to rising operating costs.

- GCC residents can now directly invest in Saudi stock market, promoting market openness, and removing prior restrictions that was limited to investments in the parallel market, debt and the derivatives market. This was part of a wider set of regulatory changes from the CMA including stronger governance measures (safeguards for fund manager transitions), greater flexibility for REITs listed on the parallel market, and allowing investment fund units to be distributed through licensed digital platforms and SCB-approved fintech firmsamong others.

- Saudi investors traded SAR 164.3bn (USD 43.8bn) in US stock markets in Q1 2025 (+164% yoy), accounting for nearly 99% of total foreign market trades (at SAR 144.2bn), according to the CMA. GCC and European markets garnered SAR 953mn and SAR 254mn in trades respectively.

- Saudi Arabia issued 80,000+ new commercial licenses in Q2 2025, leading to a total of nearly 1.72mn active registrations. Riyadh accounted for the largest share of new registrations (28k+), and women entrepreneurs share was a high 49 %, while sectors with largest upticks included cloud data storage & analytics (+48% to 5,894), AI (+34% to 14,409), and franchise (+64% to 2863 driven largely by the food and beverage, retail, and services segments) sectors.

- Saudi Arabia’s updated property law will allow foreign nationals to buy property in the country starting Jan 2026 in specific areas (expected to be around major urban centres). Related regulations and provisions (including property rights) are yet to be disclosed.

- Saudi Arabia’s crude oil exports to China are expected to rise to about 51mn barrels in Aug, up 4mn barrels versus Jul’s volume and the highest since Apr 2023, reported Reuters.

- Construction output in Saudi Arabia grew by 4.6% yoy to USD 148bn in H1 2024, according to Knight Frank. The firm also forecasts a steady growth in this value to USD 191bn by 2029. Riyadh accounted for 63% of total, while giga projects (such as NEOM, Riyadh Metro and Red Sea), mega-contracts and state-backed infrastructure contribute to a robust pipeline. This aligns with diversification goals and growing public investment will raise non-oil GDP.

- Population in Saudi Arabia touched 35.3mn in 2024, as per GASTAT data, with 55.6% Saudi nationals and males accounting for 62.1%. Working age population (15-64 years) accounted for 74.7% of the population.

- Saudi Aid Platform revealed that total external aid disbursements by Saudi Arabia totalled SAR 528.4bn (USD 140.9bn), with top beneficiaries including Egypt (USD 32.49bn), Yemen (USD 27.69bn), and Pakistan (USD 13.19bn). These allocations reinforce Saudi Arabia’s humanitarian assistance and strategic geopolitical positioning.

UAE Focus

- UAE and Azerbaijan signed a Comprehensive Economic Partnership Agreement (CEPA) to strengthen trade and investment linkages. The deal will contribute USD 680mn to UAE’s GDP and USD 300mn to Azerbaijan by 2031. Bilateral non-oil trade stood at USD 2.4bn in 2024 (+43% yoy) and UAE is Azerbaijan’s leading investor from the region (USD 1bn+ in cumulative terms).

- The EU officially removed the UAE from its AML “grey list”, recognizing its recent measures to restrict illicit financial flows including the establishment of an Executive Office for Anti-Money Laundering and Counter Terrorism Financing, imposing AML/CFT fines and responding to international enforcement actions. This change is expected to lower compliance costs and reduce due diligence friction while also boosting investor confidence in the UAE’s governance quality.

- DP World signed a 30-year concession agreement with Syria’s General Authority for Land and Sea Ports to develop and operate the Port of Tartus. As part of the agreement, DP World will invest USD 800mn over the duration of the concession to upgrade the port’s infrastructure and position it as a critical regional trade hub connecting Southern Europe and MENA.

- The UAE targets oil production capacity of 5mn barrels per day (bpd) by 2027, with an option to scale it up to 6mn bpd if markets require so, according to the energy minister. This latter option would cover just under 6% of global demand and reinforces the UAE’s role as a major oil and liquids producer.

- Membership in the Abu Dhabi Chamber of Commerce and Industry increased by 4.9% to 157,207 companies during the period Sep 2024 to Jun 2025, reflecting strong business confidence.

- Dubai’s state entities are exploring digital payment solutions as part of a broader cashless strategy. Emirates airline signed an MoU with Crypto.com to study the potential of including cryptocurrency as a payment method by next year. Dubai Duty Free will also explore such payments for its in-store and online purchases. This marks an important shift toward enabling stablecoin transactions in regular payment operations.

- UAE’s G42, in partnership with Microsoft and local partners (FPT, VinaCapital, and Viet Thai Group), proposed the development of a USD 2bn hyperscale data centre in Ho Chi Minh City aimed at driving AI and cloud capabilities regionally. No timeframe was given for its development, but the project could attract FDI, lead to job creation, and skill development.

- Masdar and Iberdrola will invest EUR 5.2bn an offshore wind farm in the UK (a 1.4 GW project), with operations expected to start by end‑2026 and power 1.3mn homes. This deal enhances Masdar’s global renewable footprint and follows the completion of an offshore wind farm project in Germany recently and other renewable energy projects in the UK.

Media Review:

The return of ‘tariff man’: the week Donald Trump revived the global trade war

https://www.ft.com/content/a4078c2b-3f59-4711-95b6-f20bfd69bc91

When Ideology Trumps Economic Interests: Dani Rodrik

https://www.project-syndicate.org/commentary/why-people-vote-against-their-economic-interests-by-dani-rodrik-2025-07

Can Nvidia persuade governments to pay for “sovereign” AI?

https://www.economist.com/business/2025/07/13/can-nvidia-persuade-governments-to-pay-for-sovereign-ai

Currency FOMO may yet draw US investors overseas

https://www.reuters.com/markets/europe/currency-fomo-may-yet-draw-us-investors-overseas-2025-07-14/

Powered by: