Download a PDF copy of this week’s insight piece here.

Weekly Insights 11 Nov 2022: Travel & Tourism Recovery, COP27 Climate Emergency

1. The Climate Urgency, COP27 & Commitments

- A UN report, released ahead of COP27, called for an urgent transformation given “no credible pathway” to keep the rise in global temperatures below 1.5ºC. The report estimates that continuing with current policies, would raise global temperatures by around 2.8ºC this century.

- BloombergNEF: Support for fossil fuels by G-20 Nations reached USD 693bn in 2021, the highest since 2014.

- The IMF’s head called the pace of change “way too slow”, stating that an average USD 75 per ton carbon price was needed by end of this decade for climate goals to succeed.

- The WTO in its World Trade Report 2022 estimates that eliminating tariffs & reducing non-tariff measures on energy-related environmental goods could boost exports by 5% by 2030; resulting rise in energy efficiency & renewable uptake would reduce global emissions by 0.6%.

- Funding: The World Bank provided USD 31.7bn in climate finance in fiscal year 2022, its highest total to date; OECD estimates that member countries contributed USD 83.3bn in climate finance to developing countries in 2020.

- This is but a drop in the ocean: Developing nations need to find a further USD 1.4 trillion annually by 2030 (UN).

- While tensions remained at the COP27 climate negotiations between rich & poorer nations, a few European leaders at COP27 have offered “loss and damage” funds.

Some positive news:

IEA’s Tracking Clean Energy Progress 2022 report shows:

- Record year for renewable electricity capacity additions an increase of ~340GW: roughly equal to the entire installed power capacity of Japan.

- Governments are spending more on clean energy R&D, which could reach USD 35bn in 2022

- Venture capital investments in clean energy start-ups reached an all-time high in 2021.

- From 2019 to 2021, solar generation grew by 47% & wind by 31%.

- Globally, almost half of the buses sold in 2021 were powered by battery electric/ fuel cell electric engine;

- Electric vehicles have doubled from 2020 & accounts for ~9% of new cars.

Major commitments from Middle East during COP 27

- Kuwait commits to reaching carbon neutrality by 2050 in the oil and gas sector

- Saudi Arabia commits USD 2.5bn to Middle East Green Initiative; Saudi presented 66 initiatives as part of its environmental plan (including circular carbon economy)

- UAE & Egypt commit to build one of the world’s largest onshore wind projects in Egypt

2. Global airline passenger recovery continues (with Middle East improving at a good pace); cargo lost some momentum in Sep

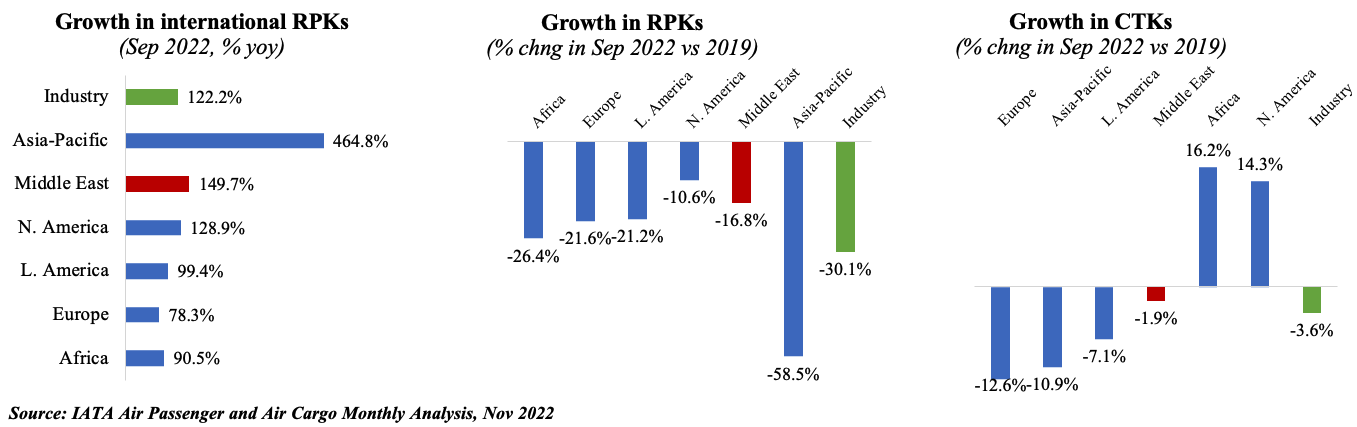

- Middle East airlines international revenue passenger-kilometers (RPKs) grew by 149.7% yoy in Sep, supported by the outperforming ME – N. America & ME – Europe segments: it was the highest rise vs other regions. It stands just 16.8% below its pre-pandemic level.

- Cargo Tonne Kilometers (CTKs) continue to outperform passenger traffic. Cargo traffic from Middle Eastern airlines is down by 1.9% from its 2019 level, but its market share has remained broadly the same as for the past five years (under 15%)

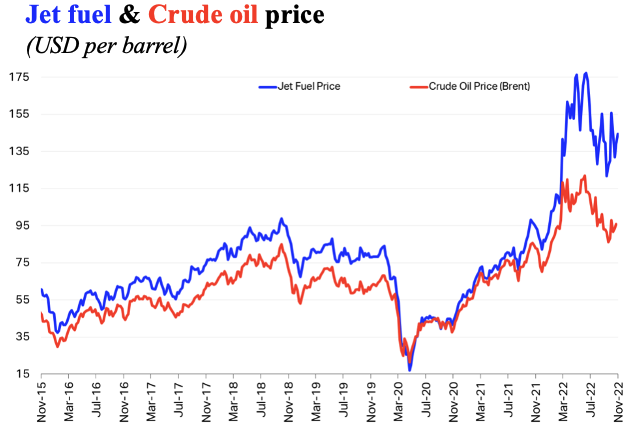

- Oil prices were relatively stable in Sep, and the spread between jet fuel and crude oil (at around USD 42 per barrel) is lower compared to Jun’s peak (of around USD 64 per barrel).

3. Tourism Recovery in the Middle East outpaces other regions.

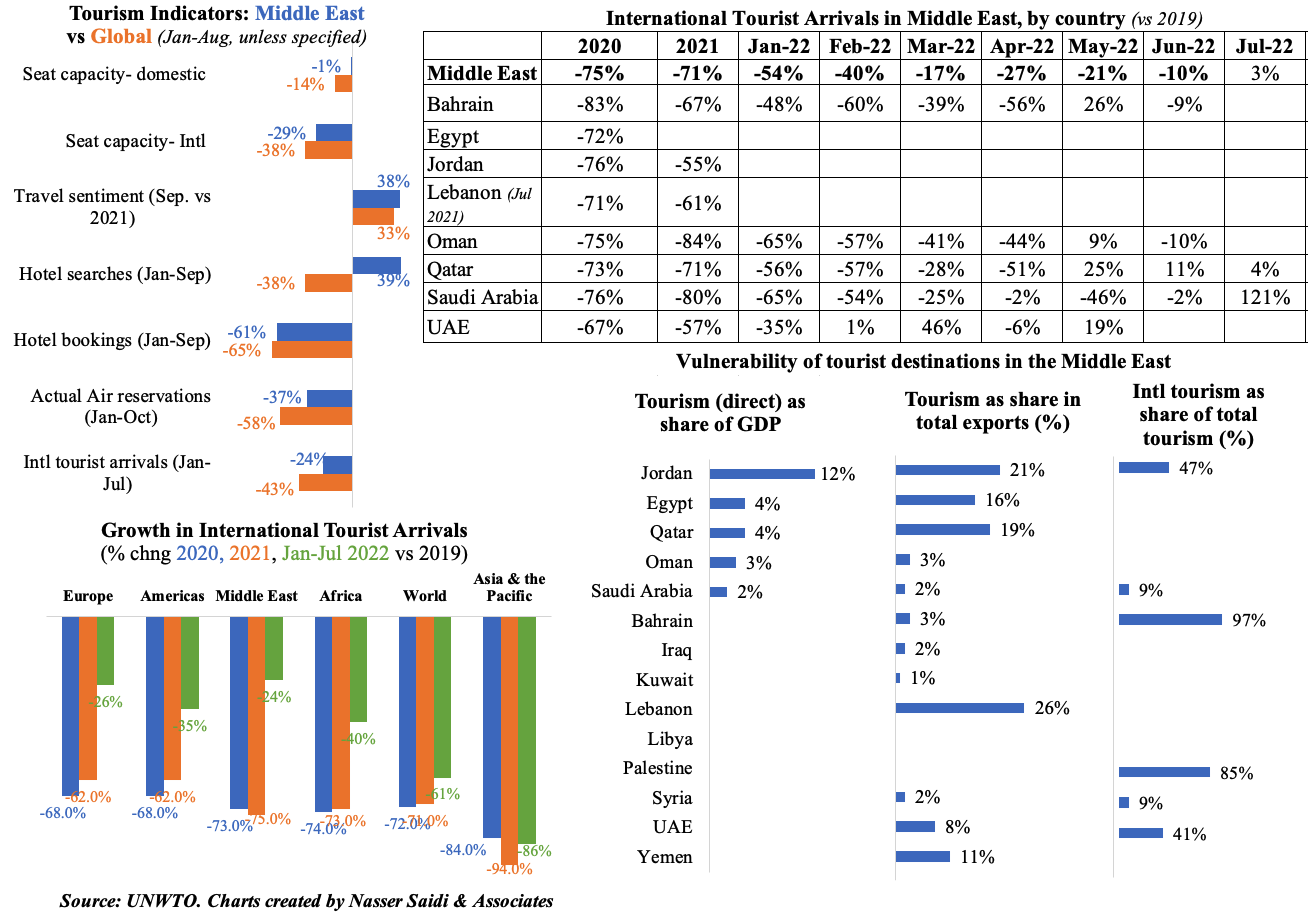

GCC nations breeze past pre-Covid arrivals in few months (UAE’s spike in Mar due to the Expo finale & relatively eased restrictions, May’s +ive readings due to Eid holidays & Saudi’s Jul surge given Haj (1mn+ religious tourists). Some nations are still more vulnerable to tourism than others.

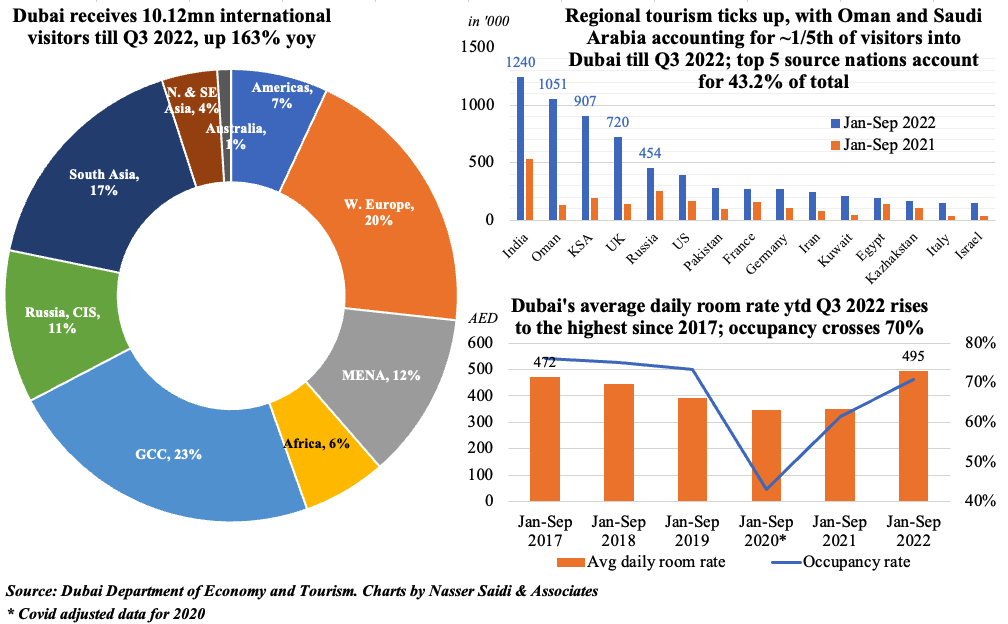

4. Dubai welcomes 10.12mn overnights visitors till end-Q3 2022.

Question is can Q4 inch close to Q1 2022’s 3.94mn arrivals, thereby edging near pre-pandemic levels?

(Jan-Sep 2021: 3.85mn & Jan-Sep 2019: 12.08mn; 2019: 16mn+)

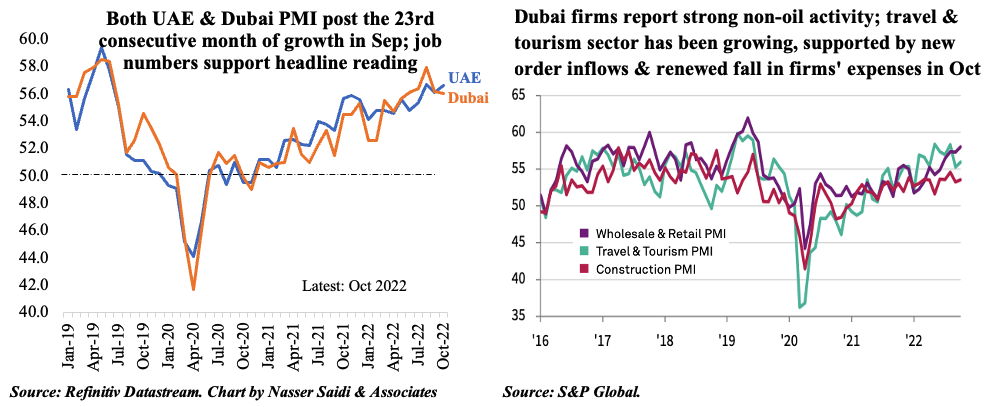

5. Dubai PMI indicates strong expansion in non-oil activity; tourism recovery is well underway & likely to end 2022 well

- Hot on the heels of the UAE PMI for Oct last week, Dubai posted its 23rd consecutive month of expansionary reading. It was slightly lower at 56 in Oct (Sep: 56.2), largely due to a dip in the output sub-index; meanwhile the rate of job creation rose to the highest since Nov 2019.

- Sector-wise readings for Dubai show that wholesale & retail grew at the sharpest rate since Jul 2019, potentially a result of the level of discounting on offer (it was the quickest in more than 2 years, given easing cost pressures). Only construction reported a rise in output prices.

- Nov-Dec months are likely to further support the tourism sector: sports events like the Qatar World Cup, the DP World Tour Championship (golf) and the Formula One race in Abu Dhabi are likely to attract visitors in addition to the New Year celebrations.

6. Concluding comments: time to promote sustainable tourism & travel

- Some of the messages from COP27 are: (a) there is an urgency to address climate change issues given extreme weather events; (b) developing nations need adequate funding & support to implement initiatives to tackle climate change; (c) will it come from the developed nations (keeping in mind that G20 nations continue to account for more than 3/4th of global GHG emissions, and are still financing fossil fuels firms/ coal plants; (d) will challenges of implementation, accountability, transparency etc. be resolved?

- Many GCC nations have committed to Net-Zero Emissions by either 2050 or 60; other Middle Eastern nations have 2030 GHG emissions reduction pledges.

- But, with many of these nations highly reliant on tourism, how can we reconcile the two? According to the World Travel & Tourism Council, the travel industry generates between 8% and 11% of the world’s GHG emissions, the majority from transportation. In the aftermath of Covid, travel activity has soared, offsetting Covid reductions.

- It is time to promote sustainable tourism & travel: offset / reduce emissions from flights (use of sustainable aviation fuel, Etihad’s ‘NetZero’ emissions flight) ; practice more sustainable accommodation (improve energy efficiency, regulate AC temperatures, “green” certifications); and transition to renewable energy use among others

- Will the UAE show the way, at the COP28 conference to be held in Nov 2023?