Weekly Insights 7 Oct 2021: Moving Towards Gradual Economic Recovery in the GCC

1. UAE’s debut federal debt to support and accelerate the development of a government debt market

- UAE’s Federal government raised USD 4bn in its debut bond sale, after having received orders upwards of USD 22.5bn. This underscores investors confidence in the country’s fundamentals and its recovery story

- The individual emirates have tapped markets multiple times, but this is the first Federal issuance

- With USD 2bn raised in 40-year notes, the UAE has successfully secured cheap and long-term funding for the government. The funds are to be used for financing of long-term projects like infrastructure and to also support investments by the Emirates Investment Authority (UAE’s SWF)

- This will support and accelerate the development of a government debt market, which can be used to finance budget deficits (will not be necessary to maintain a balanced budget, but it would be prudent to introduce fiscal rules)

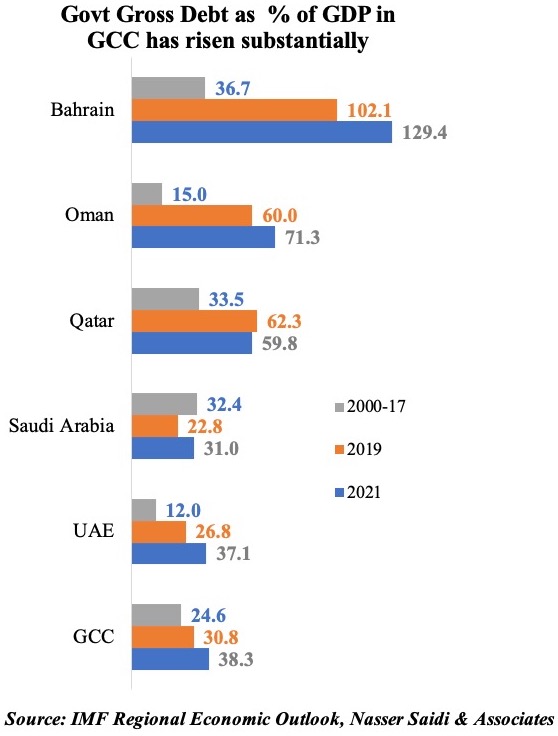

- Government gross debt for UAE stands at an estimated 38% of GDP in 2020 – slightly lower than the 40% average for the GCC and much lower than Bahrain’s 130%+ and Oman’s 80%+

- The next step is to create a local currency bond market: a steady pipeline of issuances would result in stable access to capital that can be tapped when needed; furthermore, given UAE’s peg to the dollar, the central bank can also use this to conduct open market operations (support liquidity)

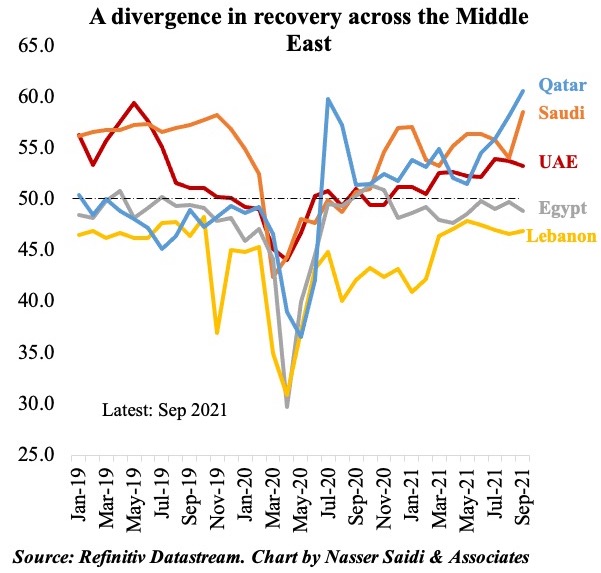

2. PMIs indicate a divergent recovery in the Middle East

- PMIs of fuel exporters Saudi Arabia, UAE and Qatar continue to expand in 2021, supported by strong domestic demand thanks to high vaccination rates and ease of restrictions

- Higher raw material prices & rising fuel costs are hurting businesses bottomline; however, full costs are not being passed on to consumers (yet!) amid concerns of strong competition

- Meanwhile among oil importers, both Egypt and Lebanon remain in contractionary territory

- The political deadlock had been a major factor in Lebanon’s plunge in addition to the growth freefall; the formation of the government has not changed businesses sceptical viewpoint

- Optimism of a recovery in the next 12-months reached an all-time high in Egypt in Sep, on indications of rising pace of vaccination and slow easing of travel/ tourism restrictions

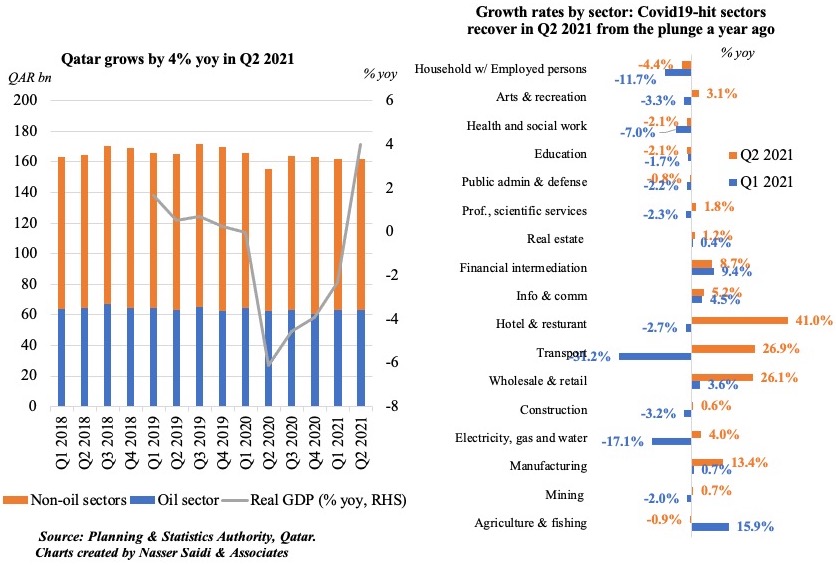

3. Qatar’s GDP grows by 4% in Q2 2021, thanks to a 6% surge in non-oil sector activity

- GDP in Qatar grew by 4% yoy in Q2 2021, supported by a 6% surge in non-oil sector growth alongside a 0.7% increase in mining & quarrying

- Restoring trade and travel links with Saudi, UAE, Bahrain and Egypt after the embargo was lifted in early 2021 has also benefitted the economy

- Compared to a year ago, hospitality sector posted the largest increase (41%) in Q2 as did transport (26.9%) and trade (26.1%) – not surprising, since these sectors were most affected by the Covid19 outbreak.

- Manufacturing picked up by 13.4% yoy in Q2, after a slight 0.7% gain in Q1

- Another interesting point is the growth in activity in agriculture & fishing – possibly a result of policies introduced to support local agricultural products & improve food security

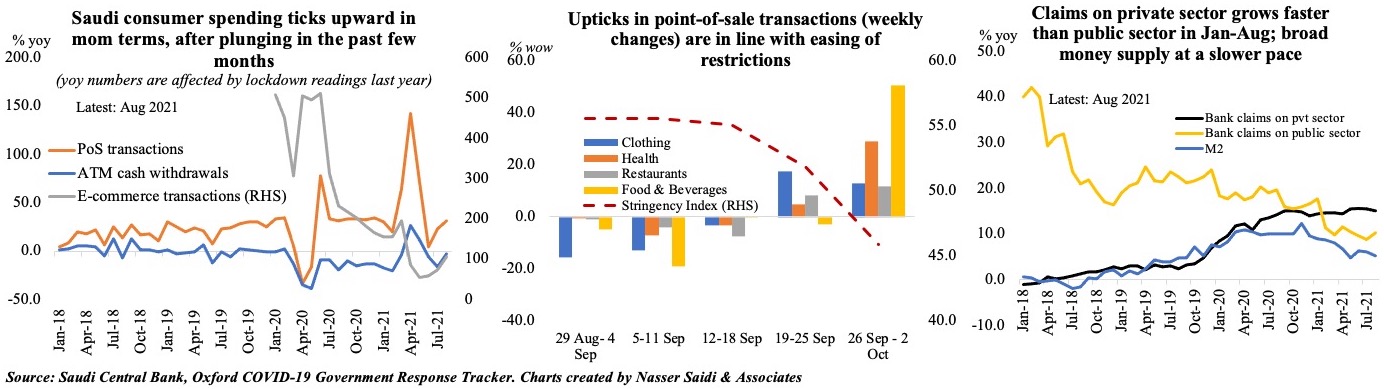

4. Broad money in Saudi Arabia grows at a slower pace than credit growth; e-commerce transaction gains continue

- Consumer spending in Saudi Arabia has been rising gradually in month-on-month terms, with e-commerce transactions doubling in Aug (SAR 6.9bn from SAR 3.3bn in Aug 2020)

- Weekly PoS transactions in clothing, health, restaurants & food are rising with the easing of restrictions (tracked by the Oxford COVID-19 Government Response Tracker/ stringency index)

- Credit growth has been rising at a faster pace than broad money supply (M2)

- Claims on the private sector continues to outpace public sector loans in Aug 2021 – as seen in most months this year. Separately, residential new mortgages increased in Aug, after two consecutive months of declines in Jun & Jul

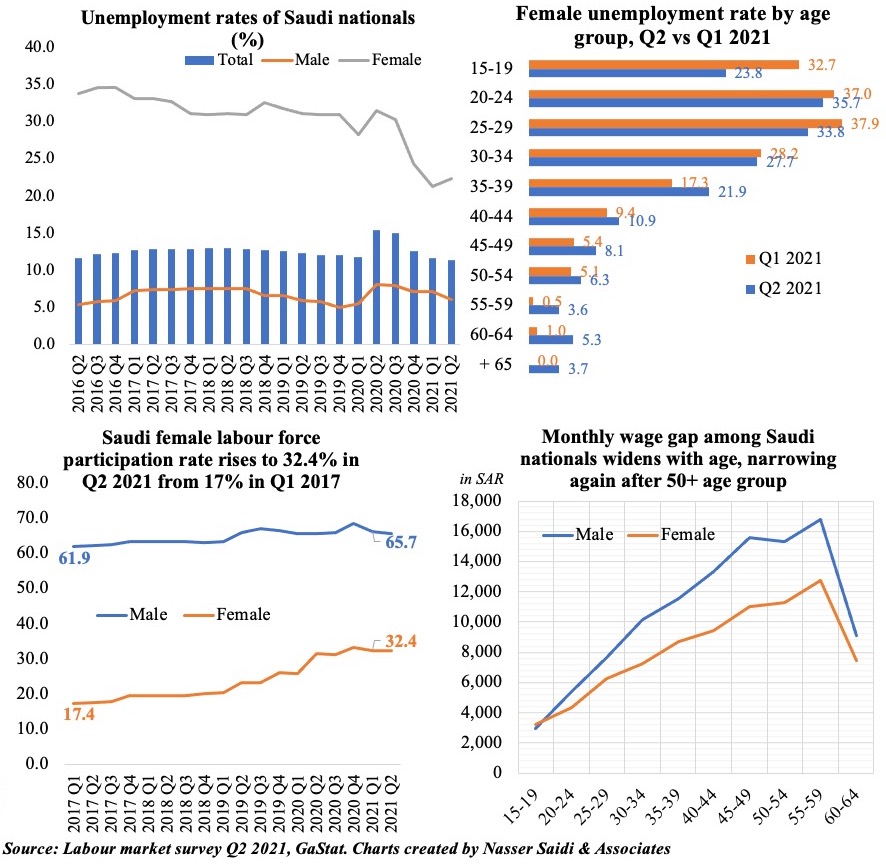

5. Unemployment rate among Saudi females ticks up to 22.3% in Q2 2021

- Overall unemployment rate among Saudi nationals fell to 11.3% in Q2 2021, down from Q1’s 11.7%. Youth unemployment (20-24) dropped to 22.2% in Q2 (Q1: 23.6%)

- Unemployment rates among Saudi males dipped to 6.1% in Q2 from 7.2% in Q1

- Unemployment rate among female Saudi citizens inched up to 22.3% from 21.2% in Q1 – a result of a jump in unemployment rates in all age brackets above 35+

- Female participation in the workforce inched up to 32.4% in Q2 2021 (Q1: 32.3%; 2016: 19%)

- Women earn slightly more than men in the 15-19 age group, but the pay gap widens after that. On average, in Q2 2021, a Saudi male employee is paid 1.3 times compared to a female national though the gap has narrowed significantly over time

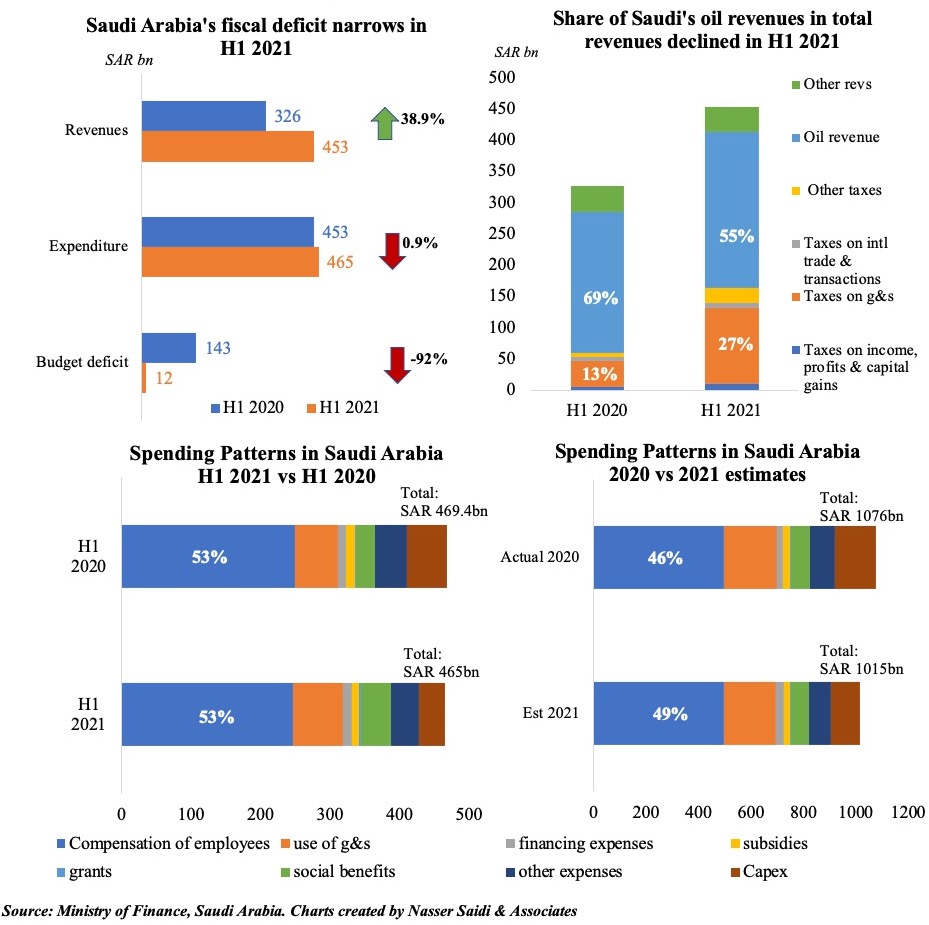

6. Saudi fiscal deficit has been revised down to an estimated 2.7% of GDP in 2021

- Fiscal deficit in Saudi Arabia narrowed to SAR 12bn in H1 2021 compared to SAR 143bn in H1 2020

- Revenues increased by close to 40% yoy in H1 2021 – a result of a surge in tax revenue (+171.7% yoy) and 11% rise in oil revenues. Share of oil revenue declined to 55% (H1 2020: 69%) while taxes on goods & services rose to 27% (given the VAT hike)

- Total expenditure declined by 0.9% yoy to SAR 465bn in H1 2021; private investment indicators improved by 12.3%: finance ministry.

- Saudi Arabia revised down its 2021 budget deficit to SAR 85bn (equivalent to 2.7% of GDP) from the previous SAR 141bn (or 4.9%) estimate

- Deficit is estimated to narrow to 1.6% of GDP next year, and surpluses are forecast from 2023 onwards.

Powered by: