Markets

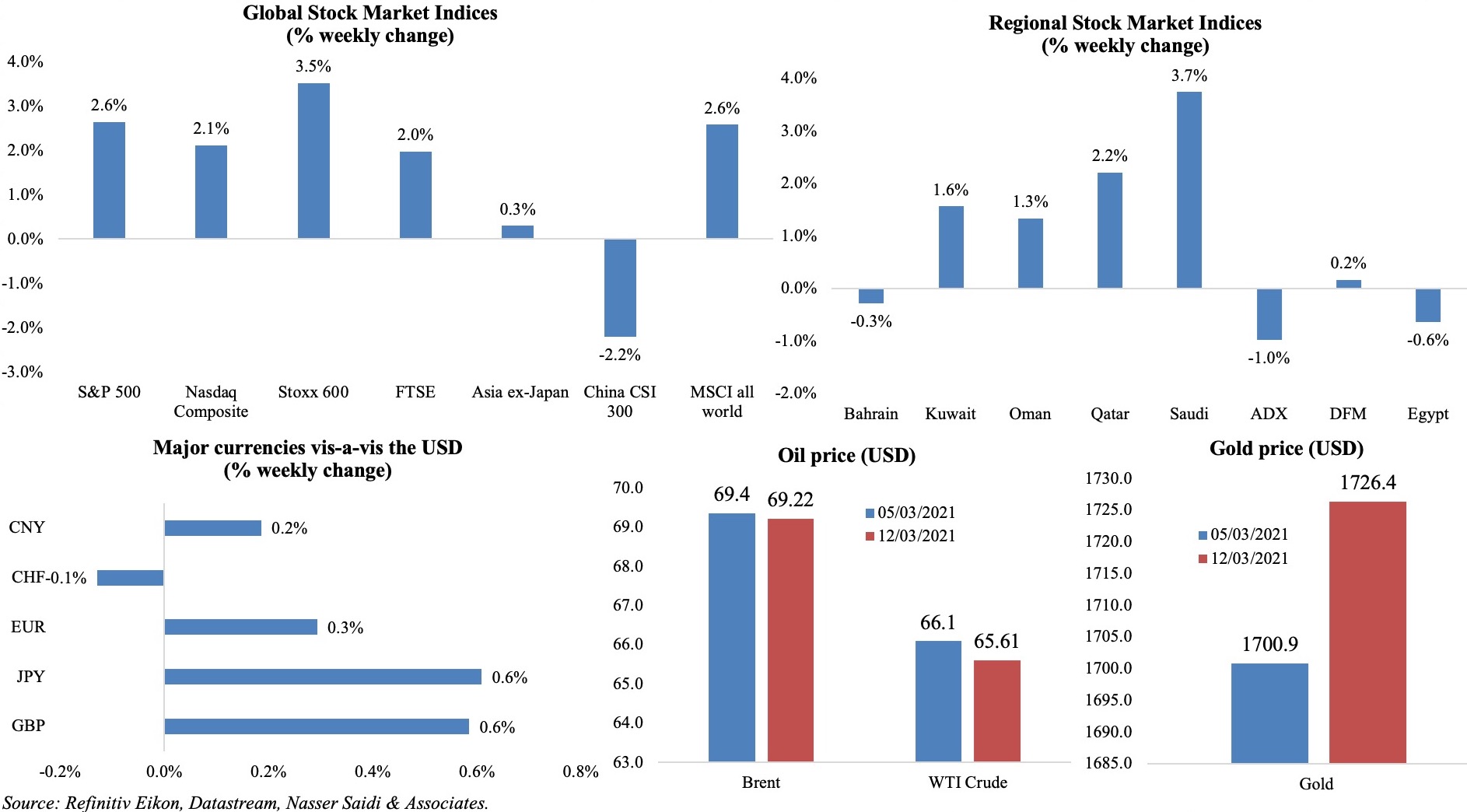

Weekly gains were posted across equity markets last week – thanks to the US stimulus bill and ECB’s dovish tones – with the Dow hitting a record high (as inflation worries eased), the MSCI World index posting a strong gain and the Stoxx600 closing at its highest level since Feb 21st, 2020. Among regional markets, Saudi was the best performer, recording its fifth consecutive weekly gain. The dollar closed lower last week, posting its biggest drop in 4 weeks. Oil prices fell slightly after gaining more than 10% over the past 2 weeks while gold price grew by 1.5%, its best week in 11. Bitcoin surpassed $60k while talks of its environmental impact gains speed.

Weekly % changes for last week (11-12 Mar) from 4 Mar (regional) and 5 Mar (international).

Global Developments

US/Americas:

- Inflation in the US increased to a 1-year high of 1.7% yoy in Feb (Jan: 1.4%), thanks to the rising costs of gasoline (+6.4% following Jan’s 7.4% gain). But core prices, excluding both food and energy, eased: recording 1.3% yoy in Feb retreating from Jan’s 1.4% print.

- US producer price rose by a series-high gain of 0.5% mom in Feb (Jan: +1.3%) due to a 6% rise in energy costs and 1.3% uptick in food prices. In yoy terms, it increased by 2.8%, the largest increase since Oct 2018.

- Initial jobless claims declined to 712k in the week ended Mar 6, rising from an upwardly revised 754k the prior week, with the 4-week average slowing to 759k. Continuing claims fell by 193k to 4.1mn in the week ended Feb 27, psoting another pandemic-era low.

Europe:

- GDP in the Eurozone contracted by 0.7% qoq and 4.9% yoy in Q4 (Q3: -0.6% qoq and -5% yoy), given the effect of the lockdowns and plunge in household consumption (-3%). For the full year, growth plummeted by 6.6% yoy. Separately, employment growth in the region slowed to 0.3% in Q4 (Q3: 1.0%).

- The ECB left policy rates unchanged, while promising that bond purchases would be “conducted at a significantly higher pace” in the next 3 months (The ECB has about EUR 1trn of pandemic emergency purchase programme (PEPP) left to spend). ECB projects real GDP in the Eurozone as likely to contract in Q1, but overall growth forecast was revised up to 4% for the full year (from 3.9% earlier). Inflation has been rising due to “transitory factors and higher energy prices” but will remain under the ECB’s 2% target.

- Industrial production in the Eurozone increased by 0.8% mom in Jan, rebounding from Dec’s 0.1% dip. Also, IP ticked up by 0.1% yoy, following 26 straight months of contraction.

- Germany’s industrial production unexpectedly declined by 2.5% mom in Jan (Dec: 1.9%), as production of both capital and consumer goods fell by 0.8% and 3% respectively. Excluding energy and construction, industrial output was down 0.5%.

- Inflation in Germany increased by 0.7% in Feb (Jan: 0.8%), in line with preliminary estimates. Energy prices ticked up by 0.3% after Jan’s 2.3% drop while food costs were higher by 1.4% (Jan: 2.2%). Meanwhile, the harmonized index for consumer prices fell by 0.1% yoy.

- Exports from Germany inched up by 1.4% mom in Jan (Dec: 0.4%), on robust trade with China as exports to EU nations plunged by 6% yoy and to the UK collapsed by 29%. As consumer demand slowed, imports slumped by 4.7%, helping trade surplus to widen to EUR 22.2bn from EUR 16.4bn the month before. Current account surplus meanwhile declined to EUR 16.9bn (Dec: EUR 25.9bn).

- UK GDP shrank by 2.9% in Jan compared with Dec, with the lockdown affecting retail trade, restaurants and education: this was the largest drop in monthly GDP since spring 2020. The economy was 9% smaller than before the start of the pandemic and 4.0% below Oct 2020 (the initial recovery peak).

- Industrial output in the UK fell by 1.5% mom in Jan, with manufacturing falling for the first time since Apr (-2.3%), with car production severely down.

- After the new trading rules came into effect post-Brexit, shipments dropped by 40% in Jan, as UK’s exports to the EU plunged by 40.7%, while imports from the bloc fell by 28.8% – the biggest drops since records began in 1997. The largest decline in exports to the EU was in food products (-63.6%) alongside a 56.6% decline in exports in the chemicals sector.

Asia Pacific:

- China’s exports surged by 60.6% yoy in Jan-Feb – the highest in over 2 decades – with electronics and textiles exports rising by 54.1% and 50.2% respectively. Imports meanwhile grew by 22.2%, widening the surplus to USD 103.25bn. In 2020, China’s exports and imports fell by 17% and 4% respectively.

- Inflation in China declined by 0.2% yoy in Feb (Jan: -0.3%) as food costs declined (-0.2%). Producer price index increased sharply to 1.7% yoy (Jan: 0.3%), the highest reading since Nov 2018, as fuel and metal commodity prices increased internationally alongside an increase in domestic demand for industrial raw materials.

- Broad money supply in China grew by 10.1% yoy in Feb, after rising by 9.4% in Jan while new loans declined to CNY 1360bn (USD 208.86bn) from Jan’s CNY 3580bn. Outstanding yuan loans grew 12.9% yoy compared with 12.7% growth in Jan. FDI surged by 31.5% yoy to CNY 176.76bn (USD 27.21bn) in Jan-Feb this year, from a low base last year.

- Foreign exchange reserves in China edged down to USD 3.205trn in Feb from the previous month’s USD 3.211trn.

- Japan’s Q4 GDP grew by a downwardly revised 2.8% qoq in Q4, as capital expenditure grew by 4.3% and household consumption by 2.2%. On an annualized basis, GDP grew 11.7%.

- The preliminary reading of Japan’s leading economic index increased to 99.1 in Jan (Dec: 97.7), the highest since Sep 2018. The coincident index also ticked up to 91.7 from Dec’s 88.2.

- Overall household spending in Japan declined by 6.1% yoy in Jan, following a 0.6% drop in Dec. With lockdown measures in place, spending on traveling and eating out suffered most.

- Japan’s current account balance narrowed by 2.3% yoy to JPY 646.8bn in Jan, declining for the first time in 5 months as the travel surplus continued to plunge.

- India’s industrial output declined by 1.6% yoy in Jan (Dec: +1.5%), as both mining and manufacturing sectors contracted (by 3.7% and 2% respectively). Production of consumer durables declined by 0.2% while capital goods fell by 9.6%. In Apr 2020-Jan 2021, factory output shrank by 12.2% yoy.

- India attracted FDI inflow of USD 67.54bn during Apr-Dec 2020: the highest ever for the first nine months of a financial year and up 22% compared to the same period a year ago.

- Retail inflation in India accelerated to a 3-month high of 5.03% in Feb, following Jan’s 16-month low reading.

Bottom line: India posted the highest single-day spike in Covid19 cases this year as Italy prepares for an Easter lockdown, calling into question the pace of global recovery. While the US President accelerated vaccine plans and set July 4th as a return to near-normal, in Europe the vaccine rollout has been varied (UK’s high 36.5 doses per 100 persons to 10.3 in Germany, France and Italy). Major central banks are set to meet this week: investors are likely to be on the lookout for talk about asset bubbles, yields (US treasuries 10Y yields were above 1.6% last week- the highest in a year) and inflation rates rising. Emerging markets are likely to embark on rate hikes (even as economies are still reeling under the effects of the Covid19 epidemic), on inflationary pressures and as borrowing costs rise.

Regional Developments

- Bahrain’s borrowing stood at BHD 13bn at end-2020, accounting for about 118% of GDP. The finance ministry is proposing to raise the ceiling of borrowing to BHD 15bn, especially given repayment schedules: BHD 37bn is due this year with BHD 708mn interest and BHD 1.269bn with interest of BHD 757mn next year.

- Egypt’s GDP grew at an annualized 2% rate in Q2 of the fiscal year 2020-21 and by 1.3% in H1 of the fiscal year, disclosed the planning minister. The economy is estimated to grow by 2.8% in Q3 and by 5.3% in Q4.

- Annual urban consumer price inflation increased to 4.5% yoy in Feb (Jan: 4.3%), largely due to higher prices of tobacco products and utilities as food prices fell by 0.5%. Core inflation stood at 3.645% in Feb, almost steady compared to Jan’s 3.637%.

- The central bank revealed that Egypt’s foreign debt increased to USD 125.3bn in Sep 2020: partly due to an increase in the net disbursements of loans and facilities by about USD 400mn and about USD 1.3bn increase due to exchange rate changes in the borrowed currencies.

- Egypt will launch foreign exchange trading with instant settlement system between banks operating in the country on 22 March. Not only would this reduce the cost of payment orders but also reduce the time required to settle.

- The Egyptian pound appreciated and settled at EGP 15.7 in Feb 2021 – the strongest since Oct 2016 – according to the planning minister. Separately, net international reserves grew for the 8th consecutive month, rising to USD 40.2bn in Feb (Jan: USD 40.1bn) while gold reserves fell by USD 144mn to USD 4.14bn.

- Egypt received USD 3.3bn in funds to support women and this would be used to implement 34 projects across various sectors (e.g. health, education and agriculture among others), disclosed the ministry of international cooperation.

- Unemployment in Jordan increased by 5.7% yoy to 24.7% in Q4 2020. Male unemployment rate stood at 22.6% while among females it stood at 32.8%. Youth unemployment continues to be the highest: the rate stood at 62.1% in the age group 15-19 and 47.9% in the 20-24 range.

- Renewable energy in Jordan accounted for around 20% of total energy consumption in the country last year, revealed the energy minister. This is expected to rise to 31% in 2030.

- Kuwait’s finance minister stated that the nation’s fiscal breakeven oil price is around USD 90 while calling for “radical economic and financial reforms”.

- Lebanon could “go into total darkness” by end of this month and face “disastrous consequences” if fuel subsidy is not approved, warned the energy minister. A bill for the funding of Electricite du Liban was not included in Friday’s Parliament discussion.

- The Lebanese pound hit a record low in value on Saturday, trading for as high as LBP 12,400 against the dollar on the black market.

- Oman’s new stimulus package covered 5 main areas: exemptions related to taxes and fees (for SMEs, hotels, and companies that began operations in 2021), incentives to support the business and investment environment (including long-term residency for foreign investors), plans to support SMEs, incentives for the labour market (reduction in recruitment fees, setting aside OMR 20mn to train jobseekers) and banking incentives (postponement of loan repayments). Rent at the Duqm Special Economic Zone and industrial areas will also be reduced until end of 2022.

- Occupancy rate at Oman’s hotels reached 27% in Jan 2021, with guests down by 49.5% to 78451 and revenues down 70% to OMR 6.231mn.

- The Tourism Sector Economic Stimulus Plan in Oman covers income tax exemption for hotel establishments for 2020 & 2021, as well as an exemption from the tourism tax payable by tourism establishments in 2021 and the postponement of the settlement of the tourism tax.

- Qatar restarted condensate exports to the UAE after lifting of the 3-year blockade, sending 80,000 tonnes of condensate to Jebel Ali port.

Saudi Arabia Focus

- Saudi Arabia replaced a few ministers and senior officials including the Minister of Hajj and Umrah.

- The Public Investment Fund in Saudi Arabia signed a USD 15bn multi-currency revolving credit facility with a group of 17 banks, with the loan to be used for general corporate purposes.

- Saudi Arabia approved the establishment of Digital Government Authority: the authority will prepare a national e-government strategy and organize the work of digital government in addition to increasing the efficiency of e-services. Separately, authorities launched a digital version of the Muqeem (or resident) ID for foreign workers.

- Following the OPEC+ decision to extend supply cuts into Apr, Saudi Arabia cut the supply of Apr-loading crude to at least 4 north Asian buyers by up to 15% while keeping average monthly supplies to India unchanged (rejecting Indian refiners requests for additional supplies).

- New labour rules will be rolled out in Saudi Arabia from today (Mar 14) promising major reforms : this includes expats being able to change jobs without the approval of current employer and also travel outside the country without employers’ approval (exit and re-entry visa reform).

- Saudi announced incentives to support individuals and firms in the Hajj and Umrah sector: includes fees exemption for expats working with these firms for a period of 6 months, license fee exemptions and postponement of collection of customs duties among others.

- Saudi Arabia committed to investing USD 3bn in a joint fund for investments in Sudan; the country also recommitted to a USD 1.5bn grant first announced in Apr 2019.

UAE Focus![]()

- Dubai announced details of its 2040 Urban Master Plan for an estimated 5.8mn residents: this includes ensuring that 55% of the population stay within 800 metres of a public transport station, increasing the length of its beaches by 400% over the next 20 years, as well as growing the areas for economic and recreational activities, with a significant focus on nature (60% of the city is to be dedicated to nature reserves). (More: https://www.thenationalnews.com/uae/dubai-2040-everything-you-need-to-know-about-the-urban-master-plan-1.1183432)

- Markit’s Dubai PMI edged up to 50.9 in Feb (Jan: 50.6), though new business inflows in the non-oil sector fell for the first time since May 2020 as restrictions increased. Output growth was strongest in the construction sector followed by wholesale and retail.

- The freeze on Dubai government fees, announced for 3 years in Mar 2018, will continue till early 2023 to support the economy. This will not be applicable in case of new vital services.

- Dubai Economy issued 4,796 new licenses in Feb, up 3.4% yoy; of these, 57% were professional licenses, followed by commercial (41.5%).

- The DIFC reported a 20% yoy increase in the number of companies registered at the centre to 2,919 firms. FinTech firms more than doubles to 303 last year.

- A resolution issued in Dubai to regulate the collection and management of public revenue stipulated that all payments to the suppliers need to be made within 90 working days from the date of the final handover or as per what is specified in the contract.

- UAE’s non-oil foreign trade amounted to AED1.03trn in Jan-Sep 2020.

- Female citizens in the UAE account for 33.7% of the population, according to data from the FCSA. Women also account for 50% of the Federal National Council and there are 9 women ministers (among a total 33) in the most recent Cabinet reshuffle.

- Dubai’s residential property market saw 7,019 transactions worth AED 14.16bn in Jan-Feb this year. Feb registered 3,814 transactions (+15.6% mom) worth AED 7.34bn (+10.2%).

- The BCG’s “Decoding Global Talent” for 2021 report (that consolidated the feedback of 209k persons across 190 nations) ranked Dubai as the 3rd most preferred city to move into (up 3 places from 2018) while Abu Dhabi climbed 9 places to 5th ranking. London and Amsterdam were the top 2 nations, and Berlin the 4th.

Media Review

The “Non-Fungible Token mania” & digital art

https://www.nytimes.com/2021/03/11/arts/design/nft-auction-christies-beeple.html

https://www.ft.com/content/7df21f05-1365-4e31-bac5-5987658f9f7e

NFTs primer: https://www.theverge.com/22310188/nft-explainer-what-is-blockchain-crypto-art-faq

Can you tokenise yourself, as a valuable asset? https://www.ft.com/content/83a59275-9a85-464b-af45-aad0e8bd6311

IMF’s Chart of the Week: How Countries Are Helping Small Businesses Survive Covid19

https://blogs.imf.org/2021/03/09/how-countries-are-helping-small-businesses-survive-covid-19/

Are vaccine passports a good idea?

https://www.economist.com/science-and-technology/2021/03/13/are-vaccine-passports-a-good-idea

UAE’s economy shows remarkable ability to overcome repercussions of Covid19 pandemic

https://www.wam.ae/en/details/1395302917282

Prolonged crisis of governance leaves Lebanon adrift and isolated

https://www.arabnews.com/node/1823816/middle-east